Fiber Optics Testing Market Size, Share, Statistics and Industry Growth Analysis with COVID-19 impact Analysis by Service Type (Testing, Inspection, Certification), Offering Type (In-House, Outsourced), Fiber Mode (Single Mode, Multimode), Application, Region - Global Forecast to 2025

Updated on : April 03, 2024

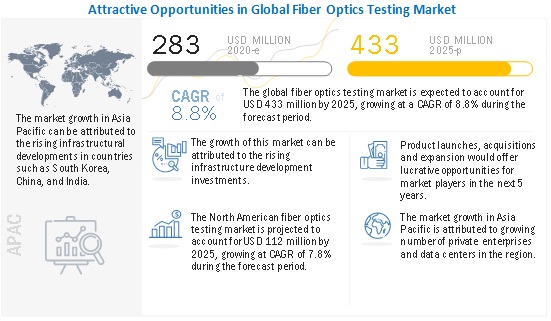

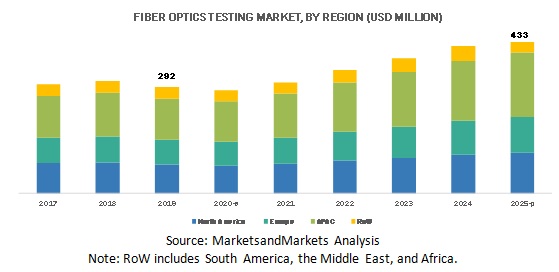

The global fiber optics testing market is expected to grow from USD 283 million in 2020 to USD 433 million by 2025, at a CAGR of 8.8% during the forecast period.

Post-COVID-19, manufacturers are gradually realizing the importance of fiber optics testing more than ever. But due to the lockdown across countries, companies are facing severe cash flow issues and are deferring new projects related to the implementation of fiber optics testing in their factories. The ongoing COVID-19 pandemic has caused disruptions in economies and supply chains, thereby causing companies operating in different industries to adopt a global supply chain model. A number of manufacturing companies have halted their production, which has collaterally damaged the supply chain and negatively impacted the fiber optics testing market.

Fiber Optic Test Equipment Market Dynamics

Drivers :

Increasing investments in infrastructure development

Major telecommunication operators and government authorities have delayed the installation of fiber optic cables on account of the spread of the COVID-19 pandemic, leading to the postponement of testing services. COVID-19 will lead to a sharp decrease in wire and cable demand globally throughout 2020 owing to the reduction in fixed investments, industrial activities, and private consumption. The US, China, and Europe have announced delays in 5G rollouts, with optical fiber cabling demand is likely to fall in 2020. Hence, this is going to impact the installation of fiber optic cables, leading to a decrease in their demand across the world.

Surging demand for FTTX

In terms of optical fibers and fiber optic cables, over 50% of the global R&D and supply is done in Wuhan, China. Products related to optical fibers include optical communication components, optical transceivers, and 5G components. Most of the key component suppliers of 5G base stations are located in Wuhan (Hubei). Thus, the pandemic’s impact on the optical communications industry is likely to have serious repercussions for the development of 5G infrastructure and the rollout of 5G services in 2020.

The construction of 5G base stations places a high demand on the quality and quantity of fiber optic cables. For instance, the deployment of UDN, or ultra-dense networks, has galvanized a corresponding demand on fiber optic cables. The 5G transition requires more than double the total of fiber optic cables used in the 4G infrastructure. This will require a huge quantity of fiber optic cables to bring other changes,

Restraints:

High cost of installation and training

The fiber optics testing industry is considered to be a labor-intensive industry, and there are growing issues with keeping a minimum workforce. Labor cost is ~ 50% of the installation cost and mostly involves repetitive work. Communication companies are making a proactive effort in manufacturing resumption. However, transportation and logistics remain key aspects of the production of optical communications equipment. With many interprovincial and intercity roads still blocked and international flights canceled, the industry is witnessing greatly reduced logistical capacity and shipment. Because of this, fiber optics installation costs are significantly high in the current scenarios.

Inspection services to grow at the fastest rate in the fiber optics testing market during the forecast period

The market for inspection services is expected to grow at the highest CAGR during the forecast period owing to the need for repetitive inspections of fiber cables after installation because they are prone to damages. Inspection services ensure that the products meet the customer expectations and adhere to the industry and government regulations, thereby reducing the risk of defective products.

In-house services to hold a major market share in the fiber optics testing market during the forecast period

The in-house services are attributed to hold around major share of the testing, inspection, and certification services in coming years. These services are carried out in-house and are particularly evident, especially in telecommunication, data center, and public sector applications.

Multimode to witness highest CAGR in the fiber optics testing market during the forecast period.

Multimode fibers are expected to register a higher CAGR in the fiber optics testing market from 2020 to 2025 owing to the rising demand for increased bandwidth for cloud computing applications. Multimode fiber optical interconnects are used for short-distance data transmissions in data centers and high-performance computing applications. Cloud computing offers a large number of benefits, such as reduced infrastructure costs and improved connectivity, thereby leading to its increased adoption rate globally. The increasing use of cloud computing has created the requirement for high-efficiency processing in datacenters. All these factors are expected to boost the demand for multimode fibers, which, in turn, would create an increased requirement for fiber optics testing.

Telecommunication is expected to hold the largest market share of the fiber optics testing market during the forecast period.

Telecommunication is expected to hold the largest market share in the fiber optics testing market during the forecast period. Fiber optics cabling is the core element of the telecommunications industry. As the demand for improved network speed and bandwidth increases, it is necessary to minimize the limitation of throughput drop and bandwidth loss.

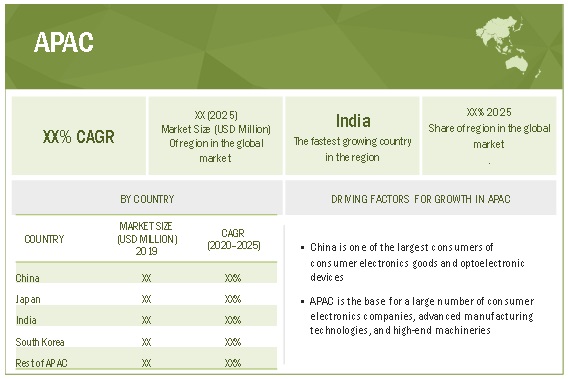

APAC held the largest market share in the fiber optics testing market between 2020 and 2025.

APAC is expected to hold a major market share during the forecast period as it is a base for several consumer electronics companies, advanced manufacturing technologies, and the other high-end machinery, due to which it is one of the most significant users of a wide range of optoelectronics equipment. However, the outbreak of COVID-19 has significantly affected the manufacturing sector of APAC which will have a significant impact on the said market in this region for the forecast period.

Top Fiber Optic Test Equipment Companies - Key Market Players:

The key market players in the market are UL LLC (US), Element Materials Technology (UK), Intertek (UK), NTS (US), TÜV Rheinland (Germany), VIAVI Solutions (US), Eurofins Scientific (Luxembourg), EXFO (Canada), Fujikura (Japan), L3Harris (US), and Fluke Corporation (US).

UL LLC

UL LLC is the dominant player regarding the fiber optics testing market in the US and globally. UL LLC certifies, validates, inspects, tests, audits, advises, and trains clients from various industries, such as automotive, food & beverage, life safety and security, lighting, and personal care and beauty. It has five distinct business units, namely, Product Safety, Environment, Life & Health, Verification, and Knowledge Services. It operates in more than 143 countries

The company has published more than 1,500 standards for safety and sustainability and has conducted over 97,000 product evaluations. The company operates in 46 countries of major regions such as Europe, the Middle East, Africa, Latin America, Asia Pacific (APAC), and North America.

Fiber Optic Test Equipment Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 283 million |

| Projected Market Size | USD 433 million |

| Growth Rate | 8.8% CAGR |

|

Market size available for years |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units |

Value, USD |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

UL LLC (US), Element Materials Technology (UK), Intertek (UK), NTS (US), TÜV Rheinland (Germany), VIAVI Solutions (US), Eurofins Scientific (Luxembourg), EXFO (Canada), Fujikura (Japan), L3Harris (US), and Fluke Corporation (US). |

This report categorizes the Fiber Optics Testing Market based on service type, offering type, fiber mode, application, and region.

Fiber Optics Testing Market , by Service type:

- Testing services

- Inspetion services

- Certification services

- Other services

Fiber Optics Testing Market , by Offering type:

- In-House services

- Outsourced services

Fiber Optics Testing Market , by Fiber mode:

- Single mode

- Multimode

Fiber Optics Testing Market, by Testing Services:

- Continuity test

- End-to-end insertion loss test

- Optical power measurement test

- Optical radiation test

- Mechanical test

- Environmental test

- Others

Fiber Optics Testing Market, by Testing Standards:

- International Organization For Standardization (ISO)

- Building Industry Consulting Services International (BICSI)

- Telecommunications Industry Association (TIA)

- International Electrotechnical Commission (IEC)

- International Telecommunication Union (ITU)

Fiber Optics Testing Market , by Application:

- Telecommunication

- Private Enterprise

- Cable Television

- Military and Aerospace

- Manufacturing

- Oil and Gas

- Energy and Power

- Railway

- Medical

- Others

Fiber Optics Testing Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- South America

- Middle East

- Africa

Recent Developments in Fiber Optic Test Equipment Industry :

- In January 2020, Element Materials Technology acquired an industry-leading connected technologies business, PCTEST Engineering Laboratory (PCTEST), which will strengthen Element’s position in the testing and certification services segment in the connected technologies market.

- In January 2020, Viavi Solutions signed an alliance agreement with Ingram Micro (US) to distribute VIAVI test instruments in the US, which are used for fiber and cable networks, and performance management solutions for enterprise networks.

- In April 2020, AFL launched the ROGUE OLTS Certifier designed for both enterprise network operators and telecom service providers working in environments ranging from data centers to LANs, access, metro, and core networks. The unique optical design features a test port on each of the paired units that measures insertion loss, return loss, and length bi-directionally to industry standards on multimode or single-mode networks. This allows certification of both enterprise networks, and single-fiber circuits often found in optical access networks connecting homes and businesses.

- In January 2020, AFL launched two new Fujikura splicer models, the 90S single fiber fusion splicer and 90R ribbon fusion splicer. The splicers feature ergonomic improvements, combined with enhancements to automate operation, and are designed to maximize productivity and minimize downtime for routine maintenance.

- In March 2020, Fluke Networks unveiled the FI-3000 FiberInspector Ultra, the industry’s most efficient, complete end-face inspection camera. This solution allows fiber optic technicians to find contamination, the most common cause of fiber failure in nearly any fiber connection. Technicians using the FI-3000 can get a live view of the fiber end-face instantly on their phone or Versiv Cabling Certification System and then use a gesture-based interface to zoom in on individual fibers or perform a pass/fail test in seconds.

Frequently Asked Questions (FAQ):

Which are the major applications of the fiber optics testing market? How big is the opportunity for their growth in the developing economies in the next five years?

The major applications of fiber optics testing market includes telecommunication, private enterprise, cable television, military and aerospace, manufacturing, among others. It is expected to boost the demand for fiber optics testing in this industries leading to USD 433 million opportunity till 2025.

Which are the major companies in the fiber optics testing market? What are their major strategies to strengthen their market presence?

The major companies in fiber optics testing includes UL LLC (US), Element Materials Technology (UK), Intertek (UK), NTS (US), TÜV Rheinland (Germany). UL LLC is the dominant player regarding the fiber optics testing market in the US and globally. UL LLC certifies, validates, inspects, tests, audits, advises, and trains clients from various industries, such as automotive, food & beverage, life safety and security, lighting, and personal care and beauty. It has five distinct business units, namely, Product Safety, Environment, Life & Health, Verification, and Knowledge Services. The major strategies adopted by these players are product launches, expansions and acquisitions strategies.

Which are the leading countries in the fiber optics testing market?

Fiber optics testing market is expected to grow at the highest CAGR in APAC region during the forecast period. The countries in APAC such as China, Japan, India, and South Korea have witnessed rising infrastructural developments owing to growth of private enterprises and data centres in the region.

Which type of fiber mode is expected to witness significant demand for fiber optics testing in the coming years?

Single mode fibers are expected to have substantial demand in the fiber optics testing market in the next few years due to their high-speed data rates, low attenuation and external interference.

How will COVID-19 impact on the penetration of fiber optics testing services, segment wise (by application and region)?

The spread of COVID-19 is anticipated to have a light effect on the Construction Services subdivision during 2019-20. However, firms installing fibre optic cable are likely to endure disruptions in the supply chain for building materials, tools and electrical equipment as well as the supply of skilled labor. These disruptions include the supply of imported cabling, couplings and other electrical components and equipment sourced from countries most adversely affected by the coronavirus, including imports sourced from China, the United States, the United Kingdom and the European Union. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 FIBER OPTICS TESTING MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 FIBER OPTICS TESTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 FIBER OPTICS TESTING MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 FIBER OPTICS TESTING MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 TESTING SERVICES TO CAPTURE LARGEST SHARE OF FIBER OPTICS TESTING MARKET IN 2025

FIGURE 8 OUTSOURCED SERVICES TO EXHIBIT HIGHER CAGR THAN IN-HOUSE SERVICES IN FIBER OPTICS TESTING MARKET FROM 2020 TO 2025

FIGURE 9 SINGLE MODE SEGMENT TO CONTINUE TO HOLD LARGER SHARE OF FIBER OPTICS TESTING MARKET DURING FORECAST PERIOD

FIGURE 10 PRIVATE ENTERPRISE WOULD BE FASTEST-GROWING APPLICATION IN FIBER OPTICS TESTING MARKET DURING FORECAST PERIOD

FIGURE 11 APAC ACCOUNTED FOR LARGEST SHARE OF FIBER OPTICS TESTING MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 FIBER OPTICS TESTING MARKET, 2020–2025 (USD MILLION)

FIGURE 12 INCREASING INFRASTRUCTURE DEVELOPMENT INVESTMENTS TO DRIVE GROWTH OF FIBER OPTICS TESTING MARKET IN COMING YEARS

4.2 MARKET, BY SERVICE TYPE

FIGURE 13 TESTING SERVICES TO ACCOUNT FOR LARGEST SIZE OF FIBER OPTICS TESTING MARKET IN 2025

4.3 MARKET, BY OFFERING TYPE

FIGURE 14 OUTSOURCED SERVICES TO WITNESS HIGHER CAGR IN FIBER OPTICS TESTING MARKET DURING FORECAST PERIOD

4.4 FIBER OPTICS TESTING MARKET, BY FIBER MODE

FIGURE 15 SINGLE MODE SEGMENT TO HOLD LARGER SIZE OF FIBER OPTICS TESTING MARKET IN 2025

4.5 FIBER OPTICS TESTING MARKET, BY APPLICATION

FIGURE 16 FIBER OPTICS TESTING MARKET FOR PRIVATE ENTERPRISES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.6 MARKET IN APAC, BY APPLICATION AND COUNTRY

FIGURE 17 CHINA AND TELECOMMUNICATION APPLICATION TO BE LARGEST SHAREHOLDERS OF FIBER OPTICS TESTING MARKET IN APAC IN 2020

4.7 MARKET, BY REGION

FIGURE 18 APAC TO WITNESS HIGHEST CAGR IN FIBER OPTICS TESTING MARKET DURING FORECAST PERIOD

5 COVID-19 IMPACT ON FIBER OPTICS TESTING (Page No. - 54)

FIGURE 19 FIBER OPTICS TESTING MARKET SIZE DURING PRE- AND POST-COVID-19 SCENARIO

5.1 POST COVID-19

5.2 INDUSTRIAL IMPACT

5.3 REGIONAL IMPACT

6 MARKET OVERVIEW (Page No. - 56)

6.1 INTRODUCTION

6.2 MARKET DYNAMICS

FIGURE 20 FIBER OPTICS TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

6.2.1 DRIVERS

FIGURE 21 MARKET DRIVERS AND THEIR IMPACT

6.2.1.1 Increasing investments in infrastructure development

6.2.1.2 Surging demand for FTTx

FIGURE 22 PENETRATION RATE OF FTTH/B, BY COUNTRY, 2019

6.2.2 RESTRAINTS

FIGURE MARKET RESTRAINT AND ITS IMPACT

6.2.2.1 High cost of installation and training

6.2.3 OPPORTUNITIES

FIGURE 24 MARKET OPPORTUNITIES AND THEIR IMPACT

6.2.3.1 Growing telecommunications industry

FIGURE 25 GROWING NUMBER OF INTERNET USERS, 2012–2018

6.2.3.2 Rising adoption of 5G networks

6.2.3.3 Increasing need to modify existing fiber optic networks

6.2.4 CHALLENGES

FIGURE 26 MARKET CHALLENGES AND THEIR IMPACT

6.2.4.1 Rise in adoption of Wi-Fi and WiMAX

6.3 IMPACT OF COVID-19: DRIVING FACTORS

6.3.1 INCREASING INVESTMENTS IN INFRASTRUCTURE DEVELOPMENT

6.3.2 SURGING DEMAND FOR FTTX

6.4 IMPACT OF COVID-19: RESTRAINING FACTORS

6.4.1 HIGH COST OF INSTALLATION AND TRAINING

6.5 VALUE CHAIN ANALYSIS

FIGURE 27 FIBER OPTICS TESTING VALUE CHAIN

6.5.1 KEY PARTICIPANTS IN FIBER OPTICS TESTING VALUE CHAIN

6.5.1.1 Fiber optics testing standards and regulatory bodies

6.5.1.2 Companies offering fiber optics testing services

6.5.1.3 End users

6.6 PRICING ANALYSIS

6.6.1 PRICING ANALYSIS FOR FIBER OPTICS EQUIPMENT (ACCORDING TO MARKET DEMAND)

TABLE 1 AVERAGE PRICING ANALYSIS FOR FIBER OPTICS EQUIPMENT

7 FIBER OPTICS TESTING MARKET, BY SERVICE TYPE (Page No. - 65)

7.1 INTRODUCTION

FIGURE 28 INSPECTION SERVICES TO WITNESS HIGHEST CAGR IN FIBER OPTICS MARKET DURING 2020–2025

TABLE 2 PRE-COVID-19: MARKET, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 3 POST-COVID-19: MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

7.2 TESTING SERVICES

7.2.1 FIBER OPTIC CABLES ARE TESTED TO VERIFY QUALITY OF COMPONENTS

TABLE 4 FIBER OPTICS TESTING METHODS

7.3 INSPECTION SERVICES

7.3.1 INSPECTION SERVICES ELIMINATE SAFETY-RELATED RISKS AND ENSURE THAT ALL REGULATORY STANDARDS ARE ADHERED

7.4 CERTIFICATION SERVICES

7.4.1 CERTIFICATION SERVICES HELP MANUFACTURERS TO IMPROVE MARKETABILITY OF THEIR PRODUCTS

TABLE 5 CERTIFICATION STANDARDS

7.5 OTHER SERVICES

8 FIBER OPTICS TESTING MARKET, BY OFFERING TYPE (Page No. - 71)

8.1 INTRODUCTION

FIGURE 29 IN-HOUSE SERVICES TO CONTINUE TO ACCOUNT FOR LARGER SIZE OF FIBER OPTICS MARKET DURING 2020–2025

TABLE 6 PRE-COVID-19: MARKET, BY OFFERING TYPE, 2017–2019 (USD MILLION)

TABLE 7 POST-COVID-19: MARKET, BY OFFERING TYPE, 2020–2025 (USD MILLION)

8.2 IN-HOUSE SERVICES

8.2.1 MAJORITY OF TESTING, INSPECTION, AND CERTIFICATION SERVICES ARE CONDUCTED IN-HOUSE

TABLE 8 PRE-COVID-19: MARKET FOR IN-HOUSE SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 9 POST-COVID-19: MARKET FOR IN-HOUSE SERVICES, BY REGION, 2020–2025 (USD MILLION)

8.3 OUTSOURCED SERVICES

8.3.1 GROWTH OF MARKET FOR OUTSOURCED SERVICES DEPENDS ON COUNTRY’S FEDERAL STRUCTURE AND ADMINISTRATIVE RULES

TABLE 10 PRE-COVID-19: MARKET FOR OUTSOURCED SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 11 POST-COVID-19: MARKET FOR OUTSOURCED SERVICES, BY REGION, 2020–2025 (USD MILLION)

9 FIBER OPTICS TESTING MARKET, BY FIBER MODE (Page No. - 76)

9.1 INTRODUCTION

FIGURE 30 MULTIMODE FIBERS TO RECORD HIGHER CAGR IN FIBER OPTICS TESTING MARKET FROM 2020 TO 2025

TABLE 12 PRE-COVID-19: MARKET, BY FIBER MODE, 2017–2019 (USD MILLION)

TABLE 13 POST-COVID-19:MARKET, BY FIBER MODE, 2020–2025 (USD MILLION)

9.2 SINGLE MODE

9.2.1 SINGLE MODE FIBERS OFFER UNMATCHED SPEED BECAUSE OF THEIR HIGH BANDWIDTH AND LOW ATTENUATION

TABLE 14 PRE-COVID-19: SINGLE MODE FIBER OPTICS TESTING MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 15 POST-COVID-19: SINGLE MODE FIBER OPTICS TESTING MARKET, BY REGION, 2020–2025 (USD MILLION)

9.3 MULTIMODE

9.3.1 MULTIMODE FIBER OPTIC CABLES MAKE COUPLING OF LIGHT SOURCES EASY

TABLE 16 PRE-COVID-19: MULTIMODE FIBER OPTICS TESTING MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 17 POST-COVID-19:MARKET, BY REGION, 2020–2025 (USD MILLION)

10 DIFFERENT SERVICES RELATED TO FIBER OPTICS TESTING (Page No. - 81)

10.1 INTRODUCTION

10.2 CONTINUITY TEST

10.2.1 CONTINUITY TEST CHECKS CONTINUITY OF FIBER OPTIC CABLE LINK

10.3 END-TO-END INSERTION LOSS TEST

10.3.1 END-TO-END INSERTION LOSS TEST IS ESSENTIAL TO ENSURE RELIABLE FIBER CONNECTIONS

10.4 OPTICAL POWER MEASUREMENT TEST

10.4.1 OPTICAL POWER MEASUREMENT TEST CHECKS SIGNAL STRENGTH FROM TRANSMITTER WHEN SYSTEM IS ACTIVATED

10.5 OPTICAL RADIATION TEST

10.5.1 OPTICAL RADIATION TEST IS PERFORMED TO EXAMINE EFFECTS OF RADIATION EXPOSURE ON OPTOELECTRONIC COMPONENTS

10.6 MECHANICAL TEST

10.6.1 MECHANICAL TESTING IS VITAL FOR CHECKING RELIABILITY OF FIBER-BASED SYSTEM

10.7 ENVIRONMENTAL TEST

10.7.1 ENVIRONMENTAL TEST CHECKS SUITABILITY OF FIBER OPTIC CABLES FOR DEPLOYMENT IN TOUGHEST ENVIRONMENTAL CONDITIONS

10.8 OTHERS

11 TESTING STANDARDS OF FIBER OPTICS TESTING (Page No. - 83)

11.1 INTRODUCTION

11.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

TABLE 18 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO): FIBER OPTICS TESTING CERTIFICATION

11.3 BUILDING INDUSTRY CONSULTING SERVICES INTERNATIONAL (BICSI)

TABLE 19 BUILDING INDUSTRY CONSULTING SERVICES INTERNATIONAL (BICSI): FIBER OPTICS TESTING CERTIFICATION

11.4 TELECOMMUNICATIONS INDUSTRY ASSOCIATION (TIA)

TABLE 20 TELECOMMUNICATIONS INDUSTRY ASSOCIATION (TIA): FIBER OPTICS TESTING CERTIFICATION

11.5 INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC)

TABLE 21 INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC): FIBER OPTICS TESTING CERTIFICATION

11.6 INTERNATIONAL TELECOMMUNICATION UNION (ITU)

TABLE 22 INTERNATIONAL TELECOMMUNICATION UNION (ITU): FIBER OPTICS TESTING CERTIFICATION

12 FIBER OPTICS TESTING MARKET, BY APPLICATION (Page No. - 87)

12.1 INTRODUCTION

12.2 COVID-19 IMPACT ON APPLICATIONS

FIGURE 31 TELECOMMUNICATION APPLICATION TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF FIBER OPTICS TESTING MARKET DURING 2020–2022

TABLE 23 PRE-COVID-19: FIBER OPTICS TESTING MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 24 POST-COVID-19: FIBER OPTICS TESTING MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

12.3 TELECOMMUNICATION

12.3.1 DESIRED TRANSMISSION CAPABILITY OF INSTALLED CABLING LINK CAN BE ASSURED BY NETWORK CABLE TESTING

12.3.2 COVID-19 IMPACT

TABLE 25 PRE-COVID-19: MARKET FOR TELECOMMUNICATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 POST-COVID-19: MARKET FOR TELECOMMUNICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 27 PRE-COVID-19: MARKET FOR TELECOMMUNICATION IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 28 POST-COVID-19: MARKET FOR TELECOMMUNICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 29 PRE-COVID-19: MARKET FOR TELECOMMUNICATION IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 30 POST-COVID-19: MARKET FOR TELECOMMUNICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 31 PRE-COVID-19: MARKET FOR TELECOMMUNICATION IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 32 POST-COVID-19: MARKET FOR TELECOMMUNICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 33 PRE-COVID-19: MARKET FOR TELECOMMUNICATION IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 POST-COVID-19: MARKET FOR TELECOMMUNICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.4 CABLE TELEVISION

12.4.1 FIBER OPTICS IS IDEAL COMMUNICATION MEDIUM FOR HIGH-DEFINITION TELEVISION (HDTV)

12.4.2 COVID-19 IMPACT

TABLE 35 PRE-COVID-19: MARKET FOR CABLE TV, BY REGION, 2017–2019 (USD MILLION)

TABLE 36 POST-COVID-19: MARKET FOR CABLE TV, BY REGION, 2020–2025 (USD MILLION)

TABLE 37 PRE-COVID-19: MARKET FOR CABLE TV IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 38 POST-COVID-19: MARKET FOR CABLE TV IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 39 PRE-COVID-19: MARKET FOR CABLE TV IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 40 POST-COVID-19: MARKET FOR CABLE TV IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 41 PRE-COVID-19: MARKET FOR CABLE TV IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 42 POST-COVID-19: MARKET FOR CABLE TV IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 43 PRE-COVID-19: MARKET FOR CABLE TV IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 44 POST-COVID-19: FIBER OPTICS TESTING MARKET FOR CABLE TV IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.5 OIL & GAS

12.5.1 FIBER OPTICS IS USED IN MONITORING SYSTEMS TO PROVIDE HIGH BANDWIDTH AND ERROR-FREE PERFORMANCE

12.5.2 COVID-19 IMPACT

TABLE 45 PRE-COVID-19: MARKET FOR OIL AND GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 POST-COVID-19: MARKET FOR OIL AND GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 PRE-COVID-19: MARKET FOR OIL AND GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 48 POST-COVID-19: MARKET FOR OIL AND GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 49 PRE-COVID-19: MARKET FOR OIL AND GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 50 POST-COVID-19: MARKET FOR OIL AND GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 51 PRE-COVID-19: MARKET FOR OIL AND GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 52 POST-COVID-19: MARKET FOR OIL AND GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 53 PRE-COVID-19: MARKET FOR OIL AND GAS IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 54 POST-COVID-19: FIBER OPTICS TESTING MARKET FOR OIL AND GAS IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.6 ENERGY & POWER

12.6.1 FIBER OPTICAL COMPONENTS AND SOLUTIONS ARE USED FOR POWER GENERATION, TRANSMISSION, AND DISTRIBUTION

12.6.2 COVID-19 IMPACT

TABLE 55 PRE-COVID-19: MARKET FOR ENERGY AND POWER, BY REGION, 2017–2019 (USD MILLION)

TABLE 56 POST-COVID-19: MARKET FOR ENERGY AND POWER, BY REGION, 2020–2025 (USD MILLION)

TABLE 57 PRE-COVID-19: FIBER OPTICS TESTING MARKET FOR ENERGY AND POWER IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 58 POST-COVID-19: MARKET FOR ENERGY AND POWER IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 59 PRE-COVID-19: MARKET FOR ENERGY AND POWER IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 60 POST-COVID-19: MARKET FOR ENERGY AND POWER IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 61 PRE-COVID-19: MARKET FOR ENERGY AND POWER IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 62 POST-COVID-19: MARKET FOR ENERGY AND POWER IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 63 PRE-COVID-19: MARKET FOR ENERGY AND POWER IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 64 POST-COVID-19: MARKET FOR ENERGY AND POWER IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.7 MILITARY & AEROSPACE

12.7.1 EQUIPMENT ARE TESTED TO CHECK IF THEY SUSTAIN IN HARSH ENVIRONMENTAL CONDITIONS AND MEET STRINGENT MIL STANDARDS

12.7.2 COVID-19 IMPACT

TABLE 65 PRE-COVID-19: FIBER OPTICS TESTING MARKET FOR MILITARY AND AEROSPACE, BY REGION, 2017–2019 (USD MILLION)

TABLE 66 POST-COVID-19: MARKET FOR MILITARY AND AEROSPACE, BY REGION, 2020–2025 (USD MILLION)

TABLE 67 PRE-COVID-19: MARKET FOR MILITARY AND AEROSPACE IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 68 POST-COVID-19: MARKET FOR MILITARY AND AEROSPACE IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 69 PRE-COVID-19: MARKET FOR MILITARY AND AEROSPACE IN EUROPE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 70 POST-COVID-19: MARKET FOR MILITARY & AEROSPACE IN EUROPE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 71 PRE-COVID-19: MARKET FOR MILITARY AND AEROSPACE IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 72 POST-COVID-19: APAC MARKET FOR MILITARY AND AEROSPACE IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 73 PRE-COVID-19: MARKET FOR MILITARY AND AEROSPACE IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 74 POST-COVID-19: MARKET FOR MILITARY & AEROSPACE IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.8 PRIVATE ENTERPRISE

12.8.1 PRIVATE ENTERPRISES PREFER FIBER OPTICS FOR THEIR HIGH-SPEED COMMUNICATION NEEDS

12.8.2 COVID-19 IMPACT

TABLE 75 PRE-COVID-19: FIBER OPTICS TESTING MARKET FOR PRIVATE ENTERPRISE, BY REGION, 2017–2019 (USD MILLION)

TABLE 76 POST-COVID-19:MARKET FOR PRIVATE ENTERPRISE, BY REGION, 2020–2025 (USD MILLION)

TABLE 77 PRE-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 78 POST-COVID-19: FIBER OPTICS TESTING MARKET FOR PRIVATE ENTERPRISE IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 79 PRE-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 80 POST-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 81 PRE-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 82 POST-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 83 PRE-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 84 POST-COVID-19: MARKET FOR PRIVATE ENTERPRISE IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.9 MANUFACTURING

12.9.1 MANUFACTURERS ADOPT FIBER OPTICS FOR HIGH-SPEED AND NOISE-FREE COMMUNICATION APPLICATIONS

12.9.2 COVID-19 IMPACT

TABLE 85 PRE-COVID-19: MARKET FOR MANUFACTURING, BY REGION, 2017–2019 (USD MILLION)

TABLE 86 POST-COVID-19: MARKET FOR MANUFACTURING, BY REGION, 2020–2025 (USD MILLION)

TABLE 87 PRE-COVID-19: MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 88 POST-COVID-19: NORTH AMERICA FIBER OPTICS TESTING MARKET FOR MANUFACTURING IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 89 PRE-COVID-19: MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 90 POST-COVID-19: MARKET FOR MANUFACTURING IN EUROPE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 91 PRE-COVID-19: MARKET FOR MANUFACTURING IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 92 POST-COVID-19: MARKET FOR MANUFACTURING IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 93 PRE-COVID-19: MARKET FOR MANUFACTURING IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 94 POST-COVID-19: FIBER OPTICS TESTING MARKET FOR MANUFACTURING IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.10 RAILWAY

12.10.1 OPTICAL FIBER SENSORS ARE GAINING TRACTION FOR MONITORING RAILWAYS

12.10.2 COVID-19 IMPACT

TABLE 95 PRE-COVID-19: FIBER OPTICS TESTING MARKET FOR RAILWAY, BY REGION, 2017–2019 (USD MILLION)

TABLE 96 POST-COVID-19: FIBER OPTICS TESTING MARKET FOR RAILWAY, BY REGION, 2020–2025 (USD MILLION)

TABLE 97 PRE-COVID-19: MARKET FOR RAILWAY IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 98 POST-COVID-19: MARKET FOR RAILWAY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 99 PRE-COVID-19: MARKET FOR RAILWAY IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 100 POST-COVID-19: MARKET FOR RAILWAY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 101 PRE-COVID-19: MARKET FOR RAILWAY IN APAC, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 102 POST-COVID-19: MARKET FOR RAILWAY IN APAC, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 103 PRE-COVID-19: MARKET FOR RAILWAY IN ROW, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 104 POST-COVID-19: MARKET FOR RAILWAY IN ROW, BY REGION, 2020–2025 (USD THOUSAND)

12.11 MEDICAL

12.11.1 IMAGING AND ILLUMINATION COMPONENTS OF ENDOSCOPES ARE MOST SIGNIFICANT APPLICATIONS OF FIBER OPTICS IN MEDICINE

12.11.2 COVID-19 IMPACT

TABLE 105 PRE-COVID-19: MARKET FOR MEDICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 106 POST-COVID-19: MARKET FOR MEDICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 107 PRE-COVID-19: MARKET FOR MEDICAL IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 108 POST-COVID-19: MARKET FOR MEDICAL IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 109 PRE-COVID-19: FIBER OPTICS TESTING MARKET FOR MEDICAL IN EUROPE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 110 POST-COVID-19: MARKET FOR MEDICAL IN EUROPE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 111 PRE-COVID-19: MARKET FOR MEDICAL IN APAC, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 112 POST-COVID-19: MARKET FOR MEDICAL IN APAC, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 113 PRE-COVID-19: FMARKET FOR MEDICAL IN ROW, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 114 POST-COVID-19: MARKET FOR MEDICAL IN ROW, BY REGION, 2020–2025 (USD THOUSAND)

12.12 OTHERS

TABLE 115 PRE-COVID-19: FIBER OPTICS TESTING MARKET FOR OTHERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 116 POST-COVID-19: MARKET FOR OTHERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 117 PRE-COVID-19: MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 118 POST-COVID-19: MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 119 PRE-COVID-19: MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 120 POST-COVID-19: FMARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 121 PRE-COVID-19: MARKET FOR OTHERS IN APAC, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 122 POST-COVID-19: MARKET FOR OTHERS IN APAC, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE 123 PRE-COVID-19: MARKET FOR OTHERS IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 124 POST-COVID-19: FMARKET FOR OTHERS IN ROW, BY REGION, 2020–2025 (USD MILLION)

13 GEOGRAPHIC ANALYSIS (Page No. - 130)

13.1 INTRODUCTION

FIGURE 32 INDIA TO WITNESS HIGHEST CAGR IN FIBER OPTICS TESTING MARKET DURING FORECAST PERIOD

TABLE 125 PRE-COVID-19: FIBER OPTICS TESTING MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 126 POST-COVID-19: FIBER OPTICS TESTING MARKET, BY REGION, 2020–2025 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 IMPACT OF COVID-19

FIGURE 33 NORTH AMERICA: SNAPSHOT OF FIBER OPTICS TESTING MARKET

TABLE 127 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 128 POST-COVID-19: MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 129 PRE-COVID-19: MARKET IN NORTH AMERICA, BY FIBER MODE, 2017–2019 (USD MILLION)

TABLE 130 POST-COVID-19: MARKET IN NORTH AMERICA, BY FIBER MODE, 2020–2025 (USD MILLION)

TABLE 131 PRE-COVID-19: MARKET IN NORTH AMERICA, BY OFFERING TYPE, 2017–2019 (USD MILLION)

TABLE 132 POST-COVID-19: FIBER OPTICS TESTING MARKET IN NORTH AMERICA, BY OFFERING TYPE, 2020–2025 (USD MILLION)

TABLE 133 PRE-COVID-19: MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 134 POST-COVID-19: FMARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.2 US

13.2.2.1 US to continue to hold largest share of fiber optics testing market in coming years

TABLE 135 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN US, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 136 POST-COVID-19: MARKET IN US, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.3 CANADA

13.2.3.1 High growth of telecommunications sector to drive Canadian market growth

TABLE 137 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN CANADA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 138 POST-COVID-19: MARKET IN CANADA, BY APPLICATION, 2020–2025 (USD MILLION)

13.2.4 MEXICO

13.2.4.1 Mexico to exhibit highest growth rate in North American market

TABLE 139 PRE-COVID-19: MARKET IN MEXICO, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 140 POST-COVID-19: MARKET IN MEXICO, BY APPLICATION, 2020–2025 (USD MILLION)

13.3 EUROPE

13.3.1 IMPACT OF COVID-19

FIGURE 34 EUROPE: SNAPSHOT OF FIBER OPTICS TESTING MARKET

TABLE 141 PRE-COVID-19: MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 142 POST-COVID-19: MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 143 PRE-COVID-19: MARKET IN EUROPE, BY FIBER MODE, 2017–2019 (USD MILLION)

TABLE 144 POST-COVID-19: MARKET IN EUROPE, BY FIBER MODE, 2020–2025 (USD MILLION)

TABLE 145 PRE-COVID-19: MARKET IN EUROPE, BY OFFERING TYPE, 2017–2019 (USD MILLION)

TABLE 146 POST-COVID-19: MARKET IN EUROPE, BY OFFERING TYPE, 2020–2025 (USD MILLION)

TABLE 147 PRE-COVID-19: MARKET IN EUROPE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 148 POST-COVID-19: MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.2 GERMANY

13.3.2.1 Increasing use of FTTH in country to boost fiber optics testing market growth

TABLE 149 PRE-COVID-19: MARKET IN GERMANY, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 150 POST-COVID-19: MARKET IN GERMANY, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.3 UK

13.3.3.1 CityFibre, UK’s largest alternative digital infrastructure provider, planning to roll out full fiber in 5 million homes in country

TABLE 151 PRE-COVID-19: MARKET IN UK, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 152 POST-COVID-19: MARKET IN UK, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.4 FRANCE

13.3.4.1 National broadband plan—France Très Haut Débit— to accelerate fiber optics market growth

TABLE 153 PRE-COVID-19: MARKET IN FRANCE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 154 POST-COVID-19: MARKET IN FRANCE, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Government programs aimed at developing fiber broadband infrastructure to fuel demand for fiber optics testing solutions

TABLE 155 PRE-COVID-19: MARKET IN ITALY, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 156 POST-COVID-19: MARKET IN ITALY, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.6 SPAIN

13.3.6.1 Spain is key ICT market, by volume, in Europe

TABLE 157 PRE-COVID-19: MARKET IN SPAIN, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 158 POST-COVID-19: MARKET IN SPAIN, BY APPLICATION, 2020–2025 (USD MILLION)

13.3.7 REST OF EUROPE

TABLE 159 PRE-COVID-19: MARKET IN REST OF EUROPE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 160 POST-COVID-19: MARKET IN REST OF EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

13.4 APAC

13.4.1 IMPACT OF COVID-19

FIGURE 35 APAC: SNAPSHOT OF FIBER OPTICS TESTING MARKET

TABLE 161 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 162 POST-COVID-19: MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 163 PRE-COVID-19: MARKET IN APAC, BY FIBER MODE, 2017–2019 (USD MILLION)

TABLE 164 POST-COVID-19: MARKET IN APAC, BY FIBER MODE, 2020–2025 (USD MILLION)

TABLE 165 PRE-COVID-19: MARKET IN APAC, BY OFFERING TYPE, 2017–2019 (USD MILLION)

TABLE 166 POST-COVID-19: MARKET IN APAC, BY OFFERING TYPE, 2020–2025 (USD MILLION)

TABLE 167 PRE-COVID-19: MARKET IN APAC, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 168 POST-COVID-19: MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.2 CHINA

13.4.2.1 China accounts for more than half of global demand for optical cables

TABLE 169 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN CHINA, BY APPLICATION, 2017–2019 USD MILLION)

TABLE 170 POST-COVID-19: MARKET IN CHINA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Government initiatives are expected to foster fiber optics testing market growth in Japan

TABLE 171 PRE-COVID-19: MARKET IN JAPAN, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 172 POST-COVID-19: MARKET IN JAPAN, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.4 SOUTH KOREA

13.4.4.1 South Korea is among countries having numerous broadband users

TABLE 173 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN SOUTH KOREA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 174 POST-COVID-19: MARKET IN SOUTH KOREA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.5 INDIA

13.4.5.1 Government initiatives such as Smart Cities Vision and Digital India to create growth opportunities for fiber optics testing market

TABLE 175 PRE-COVID-19: MARKET IN INDIA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 176 POST-COVID-19: MARKET IN INDIA, BY APPLICATION, 2020–2025 (USD MILLION)

13.4.6 REST OF APAC

TABLE 177 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN REST OF APAC, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 178 POST-COVID-19: FIBER OPTICS TESTING MARKET IN REST OF APAC, BY APPLICATION, 2020–2025 (USD MILLION)

13.5 ROW

13.5.1 IMPACT OF COVID-19

FIGURE 36 ROW: SNAPSHOT OF FIBER OPTICS TESTING MARKET

TABLE 179 PRE-COVID-19: MARKET IN ROW, BY REGION, 2017–2019 (USD MILLION)

TABLE 180 POST-COVID-19: MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 181 PRE-COVID-19: MARKET IN ROW, BY FIBER MODE, 2017–2019 (USD MILLION)

TABLE 182 POST-COVID-19:MARKET IN ROW, BY FIBER MODE, 2020–2025 (USD MILLION)

TABLE 183 PRE-COVID-19: MARKET IN ROW, BY OFFERING TYPE, 2017–2019 (USD MILLION)

TABLE 184 POST-COVID-19: MARKET IN ROW, BY OFFERING TYPE, 2020–2025 (USD MILLION)

TABLE 185 PRE-COVID-19: MARKET IN ROW, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 186 POST-COVID-19: MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.2 SOUTH AMERICA

13.5.2.1 Massive projects in fiber optics technology are set to increase demand for fiber optics testing

TABLE 187 PRE-COVID-19: FIBER OPTICS TESTING MARKET IN SOUTH AMERICA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 188 POST-COVID-19: MARKET IN SOUTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.3 MIDDLE EAST

13.5.3.1 Countries such as Saudi Arabia, UAE, Kuwait, and Qatar are hotspots for OEMs of fiber optics testing

13.5.3.2 Saudi Arabia

13.5.3.3 Qatar

13.5.3.4 United Arab Emirates (UAE)

13.5.3.5 Kuwait

13.5.3.6 Bahrain

13.5.3.7 Oman

TABLE 189 PRE-COVID-19: MARKET IN MIDDLE EAST, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 190 POST-COVID-19: MARKET IN MIDDLE EAST, BY APPLICATION, 2020–2025 (USD MILLION)

13.5.4 AFRICA

13.5.4.1 Telecom sector in Africa is growing owing to increasing demand for broadband services

TABLE 191 PRE-COVID-19:MARKET IN AFRICA, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 192 POST-COVID-19: MARKET IN AFRICA, BY APPLICATION, 2020–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 177)

14.1 OVERVIEW

FIGURE 37 COMPANIES ADOPTED PRODUCT LAUNCHES/DEVELOPMENTS, EXPANSIONS, AND ACQUISITIONS AS KEY GROWTH STRATEGIES FROM 2017 TO 2020

14.2 MARKET SHARE ANALYSIS, 2019

FIGURE 38 SHARE OF MAJOR PLAYERS IN FIBER OPTICS TESTING MARKET, 2019

14.3 COMPETITIVE LEADERSHIP MAPPING

14.3.1 VISIONARY LEADERS

14.3.2 INNOVATORS

14.3.3 DYNAMIC DIFFERENTIATORS

14.3.4 EMERGING COMPANIES

FIGURE 39 FIBER OPTIC TESTING MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

14.4 COMPETITIVE SCENARIO

FIGURE 40 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES/DEVELOPMENTS, EXPANSIONS, ACQUISITIONS, AND PARTNERSHIPS HAVE BEEN KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM 2017 TO 2020

14.5 COMPETITIVE SITUATIONS AND TRENDS

14.5.1 PARTNERSHIPS, CONTRACTS, AND AGREEMENTS

TABLE 193 ACQUISITIONS, CONTRACTS, AND AGREEMENTS, 2017–2020

14.5.2 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 194 PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2020

14.5.3 EXPANSIONS

TABLE 195 EXPANSIONS, 2017–2020

14.5.4 ACQUISITIONS

TABLE 196 PARTNERSHIPS, 2017–2020

15 COMPANY PROFILES (Page No. - 187)

15.1 KEY PLAYERS

(Business Overview, Products, Solutions, and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

15.1.1 UL LLC

15.1.2 ELEMENT MATERIALS TECHNOLOGY

15.1.3 INTERTEK

FIGURE 41 INTERTEK: COMPANY SNAPSHOT

15.1.4 NTS

15.1.5 TÜV RHEINLAND

FIGURE 42 TÜV RHEINLAND: COMPANY SNAPSHOT

15.1.6 VIAVI SOLUTIONS

FIGURE 43 VIAVI SOLUTIONS: COMPANY SNAPSHOT

15.1.7 EUROFINS SCIENTIFIC

FIGURE 44 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

15.1.8 EXFO

FIGURE 45 EXFO: COMPANY SNAPSHOT

15.1.9 FUJIKURA

FIGURE 46 FUJIKURA: COMPANY SNAPSHOT

15.1.10 L3HARRIS TECHNOLOGIES

FIGURE 47 L3HARRIS: COMPANY SNAPSHOT

15.2 RIGHT-TO-WIN

15.3 OTHER PLAYERS

15.3.1 FLUKE NETWORKS

15.3.2 FIBERTECHS

15.3.3 ADTELL INTEGRATION

15.3.4 MERCANTILE INFORMATION & TELECOMMUNICATION TECHNOLOGY CO.

15.3.5 AL DAHIYA GROUP

15.3.6 MIDDLE EAST FIBER CABLE MANUFACTURING (MEFC)

15.3.7 NOUR COMMUNICATIONS

15.3.8 OPTOKON

15.3.9 GLOBAL EMIRATES CABLES & SYSTEMS INDUSTRIES

15.3.10 AL BAUD TECHNOLOGY CO.

* Business Overview, Products, Solutions, and Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 224)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORT

16.5 AUTHOR DETAILS

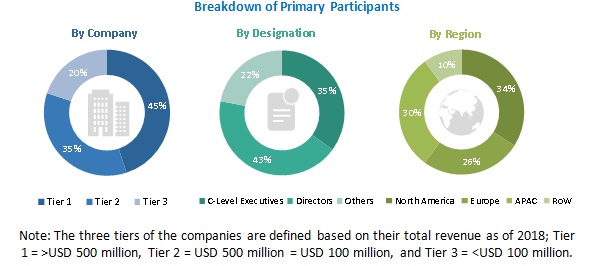

The study involved the estimation of the current size of the Fiber Optics Testing Market. Exhaustive secondary research was conducted to collect information about the market, the peer market, and the parent market, the impact of COVID-19 outbreak in the said market. This was followed by the validation of these findings, assumptions, and sizing with industry experts identified across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. It was followed by market breakdown and data triangulation procedures which were used to estimate the market size of segments and sub-segments.

Secondary Research

The research methodology used to estimate and forecast the Fiber Optics Testing Market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the Fiber Optics Testing Market. Each Industry wise COVID-19 impact was estimated from various secondary sources. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the Fiber Optics Testing Market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, service providers, and related executives from various key companies and organizations operating in the ecosystem of the Fiber Optics Testing Market.

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the Fiber Optics Testing Market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in significant applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, analyze, and forecast the fiber optics testing market, in terms of value based on deployment, component, product, application, end-user industry and region

- To forecast the market size, in terms of value for various segments with regard to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the fiber optics testing market, globally

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the fiber optics testing market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies

- To provide a detailed competitive landscape for the market leaders

- To analyze competitive developments such as product launches, acquisitions, and expansions in the Fiber Optics Testing Market

- To analyze the market penetration of the fiber optics testing market through secondary and primary research, for both pre- and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Fiber Optics Testing Market