Explosion-proof Lighting Market Size, Share, Statistics and Industry Growth Analysis Report by Type (High Bay & Low Bay, Linear, Flood), Light Source (LED, Fluorescent), Safety Rating, Hazardous Location, End-user Industry, and Region (2021-2026)

Updated on : October 23, 2024

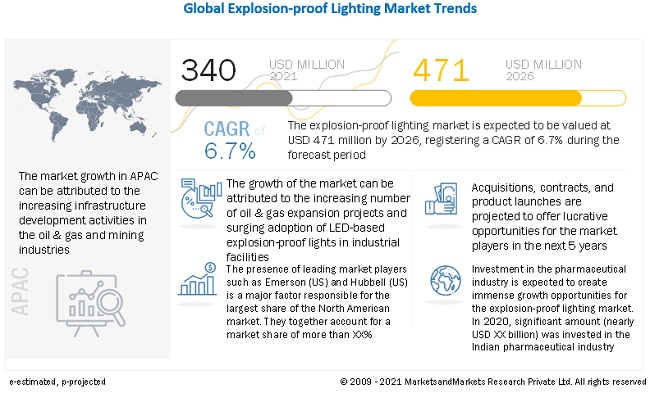

The Explosion-proof Lighting Market Report Share is estimated to be USD 340 million in 2021 and expected to reach USD 471 million by 2026, growing at a CAGR of 6.7% during the forecast period from 2021 to 2026.

The growth of the explosion-proof lighting market is fueled by increasing investments in oil & gas exploration and expansion projects, government regulations regarding employee safety in hazardous environments, rapid transition from traditional light systems to connected lighting solutions, and surging adoption of LED based explosion-proof light fixtures in industrial facilities.

Impact of AI on Explosion-proof Lighting Market

Artificial Intelligence (AI) is making a significant impact on the explosion-proof lighting market by enhancing safety, operational efficiency, and predictive maintenance in hazardous environments. AI-integrated explosion-proof lighting systems can automatically adjust brightness, detect environmental changes such as gas leaks or temperature fluctuations, and respond in real-time to potential threats, improving worker safety in industries like oil & gas, mining, and chemical processing. AI also enables remote monitoring and diagnostics, allowing facility managers to track lighting performance and identify faults before they lead to failures. By leveraging machine learning algorithms, these smart systems can predict maintenance needs and optimize energy consumption, reducing downtime and operational costs. As the demand for intelligent and reliable safety lighting grows, AI is driving innovation and shaping the future of the explosion-proof lighting market.

To know about the assumptions considered for the study, Request for Free Sample Report

Explosion-proof Lighting Market Dynamics

Driver: Increasing investments in major end-user industries—oil & gas and chemical & pharmaceutical

Oil & gas is the major end-user industry of explosion-proof lighting since any loss or damage to assets due to an explosion can lead to increased costs. With several upcoming oil & gas projects across the globe, the demand for new explosion-proof lighting in the oil & gas industry is expected to increase, which will drive the explosion proof lighting market growth during the forecast period. Some of these projects include the Johan Castberg Field in Norway, Corpus Christi LNG in US, and Petronas Floating LNG 2 in Malaysia. In the chemical & pharmaceutical industry, the presence of flammable substances is high, and any reaction of the substances with sparks within the luminaire could lead to an explosion. Therefore, lights encased within thick glass covers and an explosion-proof box are used in the industry. Additionally, the industry in emerging economies such as India and China is growing rapidly and attracting high investments. For instance, according to Invest India, the chemical & petrochemical industry in India is expected to reach to USD 300 Billion by 2025.

Restraint: High initial cost associated with deployment of explosion-proof LED light fixtur

The average cost of an explosion-proof LED light fixture is USD 500, which is considerably higher as compared to fluorescent light fixtures, whose prices are approximately USD 300 for similar form factor. An efficient lighting solution—LED lights—can save costs in the long run. However, the initial cost associated with the implementation and equipment is very high. LED lamps are approximately 10 times costlier than conventional lamps. However, the mass production of LED lamps and evolving lighting technologies are expected to reduce the price of LEDs significantly in the near future. With lighting control systems, the lighting costs can be reduced by 30–60 percent while enhancing lighting quality and reducing environmental impact. Efforts need to be taken by the manufacturers, facility managers, and the governments to make customers aware of the long-term benefits of installing LED lighting solutions.

Opportunity: Rapid transition from traditional lighting systems to connected lighting solutions

In recent years, there has been a rapid shift in the adoption of connected lighting solutions from traditional lighting systems due to various advantages offered by connected lighting solutions, such as increased energy efficiency, improved luminance, and cost savings in the long run. Connected lighting enables users to remotely regulate the lights according to their requirements and hence, minimize energy costs. As industries such as oil & gas, chemical & pharmaceutical, and food & beverage highly rely on cost optimization, the demand for IoT-enabled explosion-proof lighting is expected to increase during the forecast period. Additionally, several developments are taking place in the connected lighting market space. BACnet, a communication protocol for building automation, has added wireless networking options by adding the ZigBee profile to the lighting system. ZigBee is a wireless technology designed to address the requirements of the low-cost, low-power wireless sensors and control networks in LED lighting solutions. This integration between BACnet and ZigBee would help to create an efficient and connected LED lighting network.

Challenges: Difficulties in generating high revenue attributed to COVID-19 pandemic

The outbreak of COVID-19 has negatively impacted the explosion-proof lighting market. Leading explosion-proof lighting providers, such as Eaton (Ireland) and Emerson (US), have incurred significant losses owing to the pandemic. Both companies have reported a decline of approximately 10% and 8%, respectively, in their FY 2020 revenue as compared to the previous year. Governments worldwide have cut down their spending on various areas to focus on improving healthcare infrastructure, and therefore, the demand for explosion-proof LED lighting from national lighting projects is expected to shrink. Also, as industrial facilities in most parts of the world would run at a significantly low capacity in 2021, companies might delay a potential upgrade of their lighting solutions. Though for the past few months, the industrial facilities have increased their capacity, the investment in retrofitting and upgrading light fixtures is significantly impacted.

To know about the assumptions considered for the study, download the pdf brochure

LEDs accounted for the largest market share of the explosion-proof lighting market in 2020

LEDs are the most energy-efficient lighting options having a long lifespan of nearly 50,000–100,000 working hours. Growing focus of governments worldwide on energy conservation is a major factor contributing to the market growth of explosion proof lighting. The governments in countries such as Thailand, China, Brazil, and the US have implemented stringent regulations mandating LEDs for lighting applications. These regulations also direct manufacturers of thrusting fixtures to comply with minimum standards of lighting efficiency. This is creating the demand for explosion-proof LED light fixtures and therefore contributing to the high market growth for these fixtures.

Zone 2 expected to be the fastest growing segment of the explosion-proof lighting market, by hazardous location between 2021 and 2026

Zone 2 has a high-risk atmosphere consisting of a mixture of air with flammable substances in the form of gas, vapor, or mist. These flammable gases or vapors can potentially lead to ignition or fire when reacting with electrical sources, including lighting. Notable locations include petroleum refineries, gasoline storage areas, cold storage, and chemical plants. In hazardous locations, lighting protocols such as NFPA 101, IBC mandate, and National Electrical Code (NEC) must be followed to maintain safe illumination levels across facilities of the oil & gas, chemical & pharmaceutical, and food & beverage industries. Also, hazardous location lighting or explosion-proof lights should be compliant with Occupational Safety and Health Administration (OSHA) Safety Standards for use in areas where flammable petrochemical vapors and/or dust exist or have the potential to exist. Thus, the presence of the above-mentioned regulations is supporting the growth of the explosion-proof lighting market for Zone 2 applications.

Oil & Gas: The largest segment of explosion-proof lighting market, by end-user industry

The environment in the oil & gas industry is highly prone to explosives, and the use of lighting solutions in this environment needs to be explosive-protected with all the necessary built-in safety standards. Ongoing developments in the industry is expected to increase the demand for explosion-proof light fixtures during the forecast period. For instance, a large number of companies are focusing on the exploration and production of oil & gas assets across the world. Moscow, the capital city of Russia, is taking new measures to spur the oil & gas industry development, with a target of doubling production of petrochemicals to approximately 20 million metric tons per year by 2030. In July 2019, Kuwait signed a USD 600 million offshore exploration contract with Halliburton (US), which can increase Kuwait’s production capacity of oil by approximately 100,000 barrels of oil per day. Additionally, upcoming oil & gas projects such as Basra Gas Gathering Project in Iraq and Abu Dhabi North West Development Project in UAE with investments of approximately USD 17.2 billion and USD 15 billion, respectively, will boost the demand for explosion-proof luminaires across downstream, upstream, and midstream operational units in the oil & gas industry.

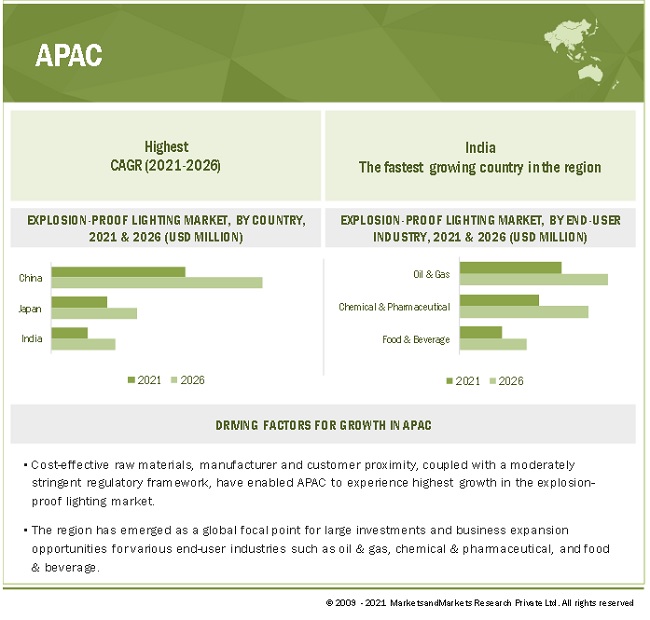

APAC is projected to be the fastest growing regional market between 2021 and 2026

APAC is expected to exhibit the highest CAGR in the explosion-proof lighting market during the forecast period. The region has witnessed significant investments in the oil & gas, chemical & pharmaceutical, mining, and marine & shipbuilding industries. For instance, according to Invest India, the chemical & petrochemical industry in India is expected to grow to USD 300 billion by 2025. Furthermore, the increase in mining infrastructure development activities in India is driving the demand for explosion-proof light fixtures. Also, according to International Energy Statistics, China is the fifth-largest oil producer globally with a market share of 5%. In the APAC region, the number of industrial facilities is increasing significantly as raw materials are easily available in Asian countries such as India and China. Also, being one of the fastest-growing innovation centers in the world, companies around the globe are looking to invest and expand their industrial bases in the APAC region. All these factors are placing explosion-proof lighting market in APAC towards a positive growth trajectory.

The outbreak of the COVID-19 pandemic has affected the global supply chain of the lighting industry, owing to the lockdowns imposed across many countries during the first and second quarters of 2020. The supply chain of lighting devices is complex and depends on several suppliers from disparate locations to be in synchronization with each other. The shortage of even a single component can hold up an entire production line, resulting in inventory and cashflow backlogs. Unless the entire supply chain of the lighting device market is operational and functioning smoothly, their production is challenged and constrained. Thus, most of the lighting OEMs and integrators are witnessing a shortage of electronic components such as chips and LED drivers. This has created an imbalance, resulting in a demand–supply gap and an increase in the prices of lighting products. Disruption in the supply chain would create an imbalance in the demand–supply equation and create pressure across entities in the explosion-proof lighting ecosystem.

Key Market Players

The Explosion-proof Lighting Companies is dominated by key globally established players such as Eaton (Ireland), Hubbell (US), Emerson (US), ABB (Switzerland), and GE Current (US).

These companies focus on adopting both organic and inorganic growth strategies, such as product launches and developments, contracts, and acquisitions to strengthen their position in the explosion proof lighting market.

Explosion-proof Lighting Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 340 Million |

| Revenue Forecast in 2026 | USD 471 Million |

| Growth Rate | 6.7% |

|

Historical Data Available for Years |

2017–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Increasing investments in major end-user industries—oil & gas and chemical & pharmaceutical |

| Key Market Opportunity | Rapid transition from traditional lighting systems to connected lighting solutions |

| Largest Growing Region | Asia Pacific |

This report categorizes the explosion-proof lighting market based on type, light source, safety rating, hazardous location, end-user industry, and region

By Type:

- High Bay & Low Bay

- Linear

- Flood

By Light Source:

- LED

- Fluorescent

- Others

By Safety Rating:

- Class 1

- Class 2

- Class 3

By End-user Industry:

- Oil & Gas

- Chemical & Pharmaceutical

- Food & Beverage

- Mining

- Energy & Power

- Others

By Hazardous Location:

- Zone 1

- Zone 2

- Others

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In March 2021, Larson Electronics launched the EPL-EMG-LB-50LED-RT-CM, an explosion-proof high bay LED light fixture for use in Class I, Division 1 hazardous locations. This LED fixture comes with an emergency battery backup and provides 7,000 lumens of light output while drawing only 50 watts.

- In November 2020, Eaton launched HPLN Ex LED explosion-proof lighting, designed to deliver reliable performance in harsh operating conditions in Zone 1 and 2 hazardous areas. The HPLN features a compact, high-efficacy design with custom optics to ensure maximum efficiency.

- In November 2020, GE Current launched the GE Filtr-Gard to its existing portfolio of LED HID replacement lamps for hazardous locations. The hazardous lamp portfolio is offered in 21-, 35-, and 45-watt configurations and comes in 3000K, 4000K, or 5000K color temperatures, offering 2.5x times longer life as compared to standard HID lamps.

- In October 2020, Hubbell launched its new Luna LED Temporary Floodlight. This new Luna LED Floodlight, being IP66 and IP67 rated, is dust-tight and protected against powerful jets of water and immersion. The product is certified for use in Zones 1, 2, 21, and 22, making it ideal for use in oil refineries, chemical plants, and offshore platforms, as well as many other hazardous areas.

- In May 2020, Eaton launched the latest LED explosion-proof lighting, HRL series, which has excellent luminous efficacy with over 50% cost-saving and energy consumption than traditional ones and can powerfully boost the safety of working conditions.

Frequently Asked Questions (FAQ):

What is the current size of the global explosion-proof lighting market?

The global explosion-proof lighting market is estimated to be USD 340 million in 2021 and is projected to reach 471 million by 2026, growing at a CAGR of 6.7% during the forecast period. Factors attributing to the growth of the market include increasing investments in the oil & gas and chemical & pharmaceutical industries for infrastructure development and project expansion plans and surging adoption of LED based explosion-proof light fixtures owing to several advantages over conventional light sources.

Who are the winners in the global explosion-proof lighting market?

Companies such as Eaton (Ireland), Hubbell (US), Emerson (US), ABB (Switzerland), and GE Current (US) fall under the winner’s category. These companies cater to the requirements of their customers by providing technologically advanced explosion-proof luminaires with a presence in majority of countries. Moreover, these companies have a strong and reliable distribution network which gives them an edge over other industry players.

What are the opportunities for the existing players and for those who are planning to enter various stages of the explosion-proof lighting value chain?

There are various opportunities for the existing players to enter the value chain of the explosion-proof lighting industry. Some of these include the rapid transition from traditional light systems to connected lighting solutions and government regulations regarding employee safety in hazardous environments.

What is the COVID-19 impact on explosion-proof lighting market?

COVID-19 sent both demand side and supply side shocks across the global economy. Leading explosion-proof lighting product providers, such as Eaton (Ireland) and Hubbell (US), have incurred significant losses owing to the pandemic. Both companies have reported a decline of approximately 10% and 12%, respectively, in their 2020 full-year revenue compared to the previous year. The impact of COVID-19 may last until 2021. The situation is almost similar in both emerging and developed economies. As of April 2021, India and the US became the worst COVID-hit countries. Several oil & gas projects in the above-mentioned countries were delayed because of the decline in fuel and energy demand from various end-user industries. With the decrease in fuel and energy demand, it is estimated that there would be negligible investments from the oil & gas players toward updating industrial facilities with energy-efficient explosion-proof lights.

What are some of the regulatory changes in the explosion-proof lighting market?

The European Commission has been working on tightening the energy efficiency regulation for the past few years. This includes that all new types of light sources have to fulfill the energy-efficiency requirements that fall within the framework of the European Ecodesign Directive. For instance, the minimum lumen maintenance requirement for a light source with a life claim of 10,000 hours is 89.9%, after undergoing the endurance test. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 GENERAL INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT TYPE LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT LIGHT SOURCE LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT HAZARDOUS LOCATION LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT SAFETY RATING LEVEL

1.2.7 INCLUSIONS AND EXCLUSIONS AT END-USER INDUSTRY LEVEL

1.2.8 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 EXPLOSION-PROOF LIGHTING MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 EXPLOSION-PROOF LIGHTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key participants in primary processes across value chain of market

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM KEY MARKET PLAYERS IN MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYERS IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE)—BOTTOM-UP ESTIMATION OF EXPLOSION PROOF LIGHTING MARKET, BY LIGHT SOURCE

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET SHARE ESTIMATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

3.1 SCENARIO ANALYSIS

FIGURE 9 COMPARISON OF PRE- AND POST-COVID-19 SIZE OF EXPLOSION-PROOF LIGHTING MARKET, BY SCENARIO, 2017–2026

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.4 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 10 HIGH BAY & LOW BAY SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2021

FIGURE 11 MARKET, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

FIGURE 12 MARKET IN CANADA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 13 OIL & GAS INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 14 APAC TO REGISTER HIGHEST CAGR IN EXPLOSION PROOF LIGHTING MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN EXPLOSION-PROOF LIGHTING MARKET

FIGURE 15 LED-BASED EXPLOSION-PROOF LIGHTS TO WITNESS HIGH ADOPTION DURING FORECAST PERIOD

4.2 MARKET, BY END-USER INDUSTRY

FIGURE 16 OIL & GAS INDUSTRY TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2021 TO 2026

4.3 MARKET, BY TYPE

FIGURE 17 LARGEST MARKET SHARE WILL BE CAPTURED BY HIGH BAY & LOW BAY LIGHTS THROUGHOUT FORECAST PERIOD

4.4 MARKET, BY HAZARDOUS LOCATION

FIGURE 18 ZONE 2 SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.5 EXPLOSION-PROOF LIGHTING MARKET, BY LIGHT SOURCE AND REGION

FIGURE 19 NORTH AMERICA AND LED TO BE MOST FAVORABLE MARKETS IN 2026

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 EXPLOSION PROOF LIGHTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in major end-user industries—oil & gas and chemical & pharmaceutical

TABLE 2 LIST OF UPCOMING OIL & GAS PROJECTS

5.2.1.2 Growing adoption of explosion-proof LED light fixtures owing to several advantages over conventional light sources

TABLE 3 FACTORS SUPPORTING ADOPTION OF LED LIGHTING SOLUTION

FIGURE 21 TOTAL COST OF OWNERSHIP FOR DIFFERENT LIGHT SOURCES IN 2015 VS. 2020

5.2.1.3 Government regulations regarding employee safety in hazardous environments

FIGURE 22 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 High initial cost associated with deployment of explosion-proof LED light fixtures

5.2.2.2 Lack of common open standards

TABLE 4 NORMS, LABELS, AND STANDARDS FOR LED LIGHTING TO BE FOLLOWED ACROSS INDUSTRIES

FIGURE 23 MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid transition from traditional lighting systems to connected lighting solutions

5.2.3.2 Growing focus of governments worldwide on energy conservation

FIGURE 24 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Difficulties in generating high revenue attributed to COVID-19 pandemic

5.2.4.2 Supply chain disruptions caused due to outbreak of COVID-19

FIGURE 25 EXPLOSION-PROOF LIGHTING MARKET CHALLENGES: IMPACT ANALYSIS

5.3 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 26 REVENUE SHIFT IN MARKET

5.4 PRICE TREND ANALYSIS

FIGURE 27 AVERAGE SELLING PRICES OF EXPLOSION-PROOF LIGHTING FIXTURES USING DIFFERENT LIGHT SOURCES, 2017–2026

5.5 REGULATORY LANDSCAPE

TABLE 5 RECENT REGULATORY NORMS

5.6 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: INPUT SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS ADD MAJOR VALUE TO EXPLOSION-PROOF LIGHTING CHAIN

5.7 ECOSYSTEM ANALYSIS

FIGURE 29 KEY PLAYERS IN EXPLOSION-PROOF LIGHTING ECOSYSTEM

TABLE 6 EXPLOSION-PROOF LIGHTING MARKET: ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 INTENSITY OF COMPETITIVE RIVALRY

FIGURE 31 INTENSITY OF COMPETITIVE RIVALRY TO BE HIGH DUE TO PRESENCE OF SEVERAL GIANT PLAYERS

5.8.2 THREAT OF SUBSTITUTES

FIGURE 32 THREAT OF SUBSTITUTES TO HAVE LOW IMPACT DURING FORECAST PERIOD DUE TO LOW QUALITY OF SUBSTITUTE PRODUCTS

5.8.3 BARGAINING POWER OF BUYERS

FIGURE 33 BARGAINING POWER OF BUYERS TO BE LOW DUE TO LIMITED NUMBER OF SUBSTITUTES

5.8.4 BARGAINING POWER OF SUPPLIERS

FIGURE 34 BARGAINING POWER OF SUPPLIERS TO BE MODERATE DUE TO LIMITED PRODUCT DIFFERENTIATION

5.8.5 THREAT OF NEW ENTRANTS

FIGURE 35 THREAT OF NEW ENTRANTS TO HAVE LOW IMPACT ON MARKET DUE TO REQUIREMENT FOR HIGH CAPITAL

5.9 TECHNOLOGY ANALYSIS

TABLE 8 COMMON PROTOCOLS FOR LIGHTING CONTROL APPLICATIONS

5.10 TRADE ANALYSIS

FIGURE 36 EXPORT SCENARIO FOR HS CODE: 940540-BASED PRODUCTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

FIGURE 37 IMPORT SCENARIO FOR HS CODE: 940540-BASED PRODUCTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

5.11 CASE STUDY ANALYSIS

5.11.1 HUBBELL LIGHTS UP NORTH SEA OPERATOR WITH ITS LATEST PROTECTA X LED

5.11.2 PHOENIX SUPPLIES EXPLOSION-PROOF LIGHTS FOR RESEARCH VESSEL RV VIRGINIA

5.11.3 DIALIGHT REDUCES PEPSICO’S ENERGY CONSUMPTION AND COSTS

6 EXPLOSION-PROOF LIGHTING MARKET, BY TYPE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 38 LINEAR LIGHT FIXTURES TO EXPERIENCE FASTEST GROWTH RATE IN MARKET BETWEEN 2021 AND 2026

TABLE 9 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 HIGH BAY & LOW BAY

6.2.1 EXCELLENT LUMEN OUTPUT AND HIGHLY DIRECTIONAL LIGHTING FOR HIGH CEILING APPLICATIONS FUEL DEMAND FOR HIGH BAY & LOW BAY LIGHT FIXTURES

TABLE 11 MARKET FOR HIGH BAY & LOW BAY LIGHTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 MARKET FOR HIGH BAY & LOW BAY LIGHTS, BY REGION, 2021–2026 (USD MILLION)

6.3 LINEAR

6.3.1 RECENT DEVELOPMENTS IN EXPLOSION-PROOF LINEAR LIGHTING TECHNOLOGY TO DRIVE MARKET GROWTH

TABLE 13 EXPLOSION PROOF LIGHTING MARKET FOR LINEAR LIGHTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 MARKET FOR LINEAR LIGHTS, BY REGION, 2021–2026 (USD MILLION)

6.4 FLOOD

6.4.1 STRONG FOCUS OF END-USER INDUSTRIES ON ADOPTION OF ENERGY-EFFICIENT AND STURDY LIGHTING SOLUTIONS IN OUTDOOR ENVIRONMENTS TO PROMOTE MARKET GROWTH

TABLE 15 MARKET FOR FLOODLIGHTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 MARKET FOR FLOODLIGHTS, BY REGION, 2021–2026 (USD MILLION)

7 EXPLOSION-PROOF LIGHTING MARKET, BY LIGHT SOURCE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 39 MARKET, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

TABLE 17 MARKET, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 18 MARKET, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

TABLE 19 MARKET, BY LIGHT SOURCE, 2017–2020 (THOUSAND UNITS)

TABLE 20 MARKET, BY LIGHT SOURCE, 2021–2026 (THOUSAND UNITS)

7.2 LED

7.2.1 LED LIGHTING IS MOST ENERGY-EFFICIENT OPTION ADOPTED BY INDUSTRIAL FACILITIES TO REDUCE OVERALL OPERATING COST

TABLE 21 EXPLOSION PROOF LIGHTING MARKET FOR LED LIGHTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR LED LIGHTS, BY REGION, 2021–2026 (USD MILLION)

7.3 FLUORESCENT

7.3.1 LOW COST OF FLUORESCENT LIGHT FIXTURES ACCELERATES THEIR DEPLOYMENT IN HAZARDOUS LOCATIONS

TABLE 23 MARKET FOR FLUORESCENT LIGHTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR FLUORESCENT LIGHTS, BY REGION, 2021–2026 (USD MILLION)

7.4 OTHERS

TABLE 25 MARKET FOR OTHER LIGHT SOURCES, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR OTHER LIGHT SOURCES, BY REGION, 2021–2026 (USD MILLION)

8 EXPLOSION-PROOF LIGHTING MARKET, BY SAFETY RATING (Page No. - 87)

8.1 INTRODUCTION

FIGURE 40 EXPLOSION PROOF LIGHTING MARKET, BY SAFETY RATING

8.2 CLASS 1

8.2.1 PRESENCE OF FLAMMABLE GASES OR VAPORS IN AIR ACT AS SOURCE OF IGNITION

8.3 CLASS 2

8.3.1 PRESENCE OF COMBUSTIBLE DUST IN AIR ACT AS SOURCE OF IGNITION

8.4 CLASS 3

8.4.1 PRESENCE OF IGNITABLE FIBERS IN AIR ACT AS SOURCE OF IGNITION

9 EXPLOSION-PROOF LIGHTING MARKET, BY HAZARDOUS LOCATION (Page No. - 89)

9.1 INTRODUCTION

FIGURE 41 ZONE 2 HAZARDOUS LOCATION TO ACCOUNT FOR LARGEST MARKET SIZE BETWEEN 2021 AND 2026

TABLE 27 MARKET, BY HAZARDOUS LOCATION, 2017–2020 (USD MILLION)

TABLE 28 MARKET, BY HAZARDOUS LOCATION, 2021–2026 (USD MILLION)

9.2 ZONE 1

9.2.1 NOTABLE INDUSTRIAL FACILITIES IN ZONE 1 HAZARDOUS LOCATION INCLUDE PETROLEUM REFINERIES, GASOLINE STORAGE AREAS, PAINT SPRAY BOOTHS, UTILITY GAS PLANTS, AND CHEMICAL PLANTS

TABLE 29 MARKET FOR ZONE 1 HAZARDOUS LOCATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR ZONE 1 HAZARDOUS LOCATION, BY REGION, 2021–2026 (USD MILLION)

9.3 ZONE 2

9.3.1 ZONE 2 DEMANDS EXPLOSION-PROOF LIGHTS BECAUSE OF PRESENCE OF FLAMMABLE SUBSTANCES IN FORM OF GAS, VAPOR, OR MIST WITHIN ATMOSPHERE

TABLE 31 EXPLOSION-PROOF LIGHTING MARKET FOR ZONE 2 HAZARDOUS LOCATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR ZONE 2 HAZARDOUS LOCATION, BY REGION, 2021–2026 (USD MILLION)

9.4 OTHERS

TABLE 33 MARKET FOR OTHER HAZARDOUS LOCATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR OTHER HAZARDOUS LOCATIONS, BY REGION, 2021–2026 (USD MILLION)

10 EXPLOSION-PROOF LIGHTING MARKET, BY END-USER INDUSTRY (Page No. - 95)

10.1 INTRODUCTION

FIGURE 42 CHEMICAL & PHARMACEUTICAL INDUSTRY TO BE FASTEST-GROWING MARKET FOR EXPLOSION-PROOF LIGHTING BETWEEN 2021 AND 2026

TABLE 35 MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 36 MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

10.2 OIL & GAS

10.2.1 INCREASING INVESTMENTS IN OIL & GAS INDUSTRY TO FUEL DEMAND FOR ENERGY-EFFICIENT EXPLOSION-PROOF LIGHTING

TABLE 37 EXPLOSION-PROOF LIGHTING MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.3 CHEMICAL & PHARMACEUTICAL

10.3.1 EXPANDING CHEMICAL & PHARMACEUTICAL MARKET IN EMERGING ECONOMIES TO INCREASE REQUIREMENT FOR EXPLOSION-PROOF LIGHTING

TABLE 39 MARKET FOR CHEMICAL & PHARMACEUTICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR CHEMICAL & PHARMACEUTICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.4 ENERGY & POWER

10.4.1 REGULATORY STANDARDS DEFINING MINIMUM BRIGHTNESS LEVELS IN INDUSTRIAL PLANTS TO PROMOTE MARKET GROWTH

TABLE 41 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.5 MINING

10.5.1 SURGING DEMAND FOR ATEX-CERTIFIED EXPLOSION-PROOF LUMINAIRES TO SUPPORT MARKET GROWTH

TABLE 43 MARKET FOR MINING INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR MINING INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.6 FOOD & BEVERAGE

10.6.1 RISING ADOPTION OF EXPLOSION-PROOF LIGHTING FIXTURES MADE FROM FOOD-GRADE STAINLESS STEEL AND OTHER FOOD-SAFE MATERIALS TO BOOST MARKET GROWTH

TABLE 45 EXPLOSION PROOF LIGHTING MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.7 OTHERS

TABLE 47 ILLUMINATION LEVELS TO BE MAINTAINED WITHIN MARINE & SHIPBUILDING INDUSTRY IN DIFFERENT INSTANCES

TABLE 48 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

11 EXPLOSION-PROOF LIGHTING MARKET, BY REGION (Page No. - 105)

11.1 INTRODUCTION

FIGURE 43 GEOGRAPHIC SNAPSHOT OF MARKET, 2021–2026

FIGURE 44 APAC TO BE FASTEST-GROWING MARKET FOR EXPLOSION-PROOF LIGHTING DURING FORECAST PERIOD

TABLE 50 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: SNAPSHOT OF EXPLOSION PROOF LIGHTING MARKET

FIGURE 46 US TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 52 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 56 EXPLOSION-PROOF LIGHTING MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

TABLE 60 MARKET IN NORTH AMERICA, BY HAZARDOUS LOCATION, 2017–2020 (USD MILLION)

TABLE 61 MARKET IN NORTH AMERICA, BY HAZARDOUS LOCATION, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Significant presence of leading oil & gas companies in US to drive demand for explosion-proof lighting

TABLE 62 EXPLOSION-PROOF LIGHTING MARKET IN US, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 63 MARKET IN US, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Thriving chemical & pharmaceutical industry in Canada to boost market growth

TABLE 64 MARKET IN CANADA, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 65 MARKET IN CANADA, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increasing investments in chemical industry to fuel market growth

TABLE 66 MARKET IN MEXICO, BY LIGHT SOURCE, 2017–2020 (USD THOUSAND)

TABLE 67 MARKET IN MEXICO, BY LIGHT SOURCE, 2021–2026 (USD THOUSAND)

11.2.4 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

11.3 EUROPE

FIGURE 47 EUROPE: SNAPSHOT OF EXPLOSION-PROOF LIGHTING MARKET

FIGURE 48 MARKET IN GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 68 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 71 MARKET IN EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 72 MARKET IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 73 MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

TABLE 76 MARKET IN EUROPE, BY HAZARDOUS LOCATION, 2017–2020 (USD MILLION)

TABLE 77 MARKET IN EUROPE, BY HAZARDOUS LOCATION, 2021–2026 (USD MILLION)

11.3.1 UK

11.3.1.1 Rapid infrastructure development with growing investment by several industries to fuel market growth

TABLE 78 EXPLOSION-PROOF LIGHTING MARKET IN UK, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 79 MARKET IN UK, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Robust presence of renowned chemical and pharmaceutical companies to drive market growth

TABLE 80 MARKET IN GERMANY, BY LIGHT SOURCE, 2017–2020 (USD THOUSAND)

TABLE 81 MARKET IN GERMANY, BY LIGHT SOURCE, 2021–2026 (USD THOUSAND)

11.3.3 RUSSIA

11.3.3.1 High investments in oil & gas industry to fuel demand for explosion-proof lighting fixtures

TABLE 82 MARKET IN RUSSIA, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 83 MARKET IN RUSSIA, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.3.4 REST OF EUROPE

TABLE 84 MARKET IN REST OF EUROPE, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 85 EXPLOSION-PROOF LIGHTING MARKET IN REST OF EUROPE, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.3.5 IMPACT OF COVID-19 ON MARKET IN EUROPE

11.4 APAC

FIGURE 49 APAC: SNAPSHOT OF MARKET

FIGURE 50 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 86 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 MARKET IN APAC, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN APAC, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 90 MARKET IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 92 MARKET IN APAC, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 93 MARKET IN APAC, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

TABLE 94 MARKET IN APAC, BY HAZARDOUS LOCATION, 2017–2020 (USD MILLION)

TABLE 95 MARKET IN APAC, BY HAZARDOUS LOCATION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Availability of cost-effective raw materials allows China to capture leading position in explosion-proof lighting market

TABLE 96 MARKET IN CHINA, BY LIGHT SOURCE, 2017–2020 (USD THOUSAND)

TABLE 97 MARKET IN CHINA, BY LIGHT SOURCE, 2021–2026 (USD THOUSAND)

11.4.2 JAPAN

11.4.2.1 Japan being third-largest shipbuilding nation to witness significant demand for explosion-proof lights

TABLE 98 MARKET IN JAPAN, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN JAPAN, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Prominent presence of leading pharmaceutical companies such as Cipla (India) and Sun Pharma (India) to strengthen country’s position in explosion-proof lighting market

TABLE 100 MARKET IN INDIA, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN INDIA, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Strong focus on modification of manufacturing facilities with adoption of next-generation lighting technologies to fuel market growth

TABLE 102 MARKET IN SOUTH KOREA, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN SOUTH KOREA, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.4.5 REST OF APAC

TABLE 104 LIST OF UPCOMING OIL & GAS PROJECTS IN REST OF APAC

TABLE 105 MARKET IN REST OF APAC, BY LIGHT SOURCE, 2017–2020 (USD THOUSAND)

TABLE 106 MARKET IN REST OF APAC, BY LIGHT SOURCE, 2021–2026 (USD THOUSAND)

11.4.6 IMPACT OF COVID-19 ON EXPLOSION-PROOF LIGHTING MARKET IN APAC

11.5 ROW

TABLE 107 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 109 MARKET IN ROW, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN ROW, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

TABLE 111 EXPLOSION PROOF LIGHTING MARKET IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 MARKET IN ROW, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN ROW, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN ROW, BY HAZARDOUS LOCATION, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN ROW, BY HAZARDOUS LOCATION, 2021–2026 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Recent contracts related to oil & gas project expansions to fuel demand for explosion-proof lights

TABLE 117 EXPLOSION PROOF LIGHTING MARKET IN MIDDLE EAST & AFRICA, BY LIGHT SOURCE, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN MIDDLE EAST & AFRICA, BY LIGHT SOURCE, 2021–2026 (USD MILLION)

11.5.2 SOUTH AMERICA

11.5.2.1 Surging investments in offshore & onshore rigs to create growth prospects for explosion-proof lighting manufacturers

TABLE 119 MARKET IN SOUTH AMERICA, BY LIGHT SOURCE, 2017–2020 (USD THOUSAND)

TABLE 120 MARKET IN SOUTH AMERICA, BY LIGHT SOURCE, 2021–2026 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 142)

12.1 INTRODUCTION

FIGURE 51 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY BETWEEN JANUARY 2018 AND MARCH 2021

12.2 MARKET EVALUATION FRAMEWORK

TABLE 121 OVERVIEW OF STRATEGIES DEPLOYED BY KEY EXPLOSION-PROOF LIGHTING OEMS

12.2.1 PRODUCT PORTFOLIO

12.2.2 REGIONAL FOCUS

12.2.3 MANUFACTURING FOOTPRINT

12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

12.3 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2020

TABLE 122 EXPLOSION-PROOF LIGHTING MARKET: DEGREE OF COMPETITION

TABLE 123 SHARE OF LEADING PLAYERS IN MARKET, 2020

TABLE 124 MARKET RANKING ANALYSIS: MARKET, 2020

12.4 HISTORICAL REVENUE ANALYSIS OF MAJOR PLAYERS IN MARKET

FIGURE 52 REVENUE ANALYSIS FOR KEY COMPANIES FROM 2016 TO 2020 (USD BILLION)

12.5 COMPETITIVE SITUATIONS & TRENDS

12.5.1 PRODUCT LAUNCHES

TABLE 125 MARKET: PRODUCT LAUNCHES, JANUARY 2018–MARCH 2021

12.5.2 DEALS

TABLE 126 EXPLOSION-PROOF LIGHTING MARKET: DEALS, JANUARY 2018–MARCH 2021

12.6 COMPANY EVALUATION MATRIX, 2020

12.6.1 STAR

12.6.2 PERVASIVE

12.6.3 PARTICIPANT

12.6.4 EMERGING LEADER

FIGURE 53 MARKET (GLOBAL), COMPANY EVALUATION MATRIX (2020)

12.7 STARTUP/SME EVALUATION MATRIX, 2020

12.7.1 PROGRESSIVE COMPANY

12.7.2 RESPONSIVE COMPANY

12.7.3 DYNAMIC COMPANY

12.7.4 STARTING BLOCK

FIGURE 54 EXPLOSION-PROOF LIGHTING MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX (2020)

12.8 COMPETITIVE BENCHMARKING

TABLE 127 COMPANY INDUSTRY FOOTPRINT

TABLE 128 COMPANY REGION FOOTPRINT

TABLE 129 COMPANY FOOTPRINT

13 COMPANY PROFILES (Page No. - 158)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

13.2.1 EATON

TABLE 130 EATON: BUSINESS OVERVIEW

FIGURE 55 EATON: COMPANY SNAPSHOT

13.2.2 ABB

TABLE 131 ABB: BUSINESS OVERVIEW

FIGURE 56 ABB: COMPANY SNAPSHOT

13.2.3 HUBBELL

TABLE 132 HUBBELL: BUSINESS OVERVIEW

FIGURE 57 HUBBELL: COMPANY SNAPSHOT

13.2.4 EMERSON

TABLE 133 EMERSON: BUSINESS OVERVIEW

FIGURE 58 EMERSON: COMPANY SNAPSHOT

13.2.5 SIGNIFY

TABLE 134 SIGNIFY: BUSINESS OVERVIEW

FIGURE 59 SIGNIFY: COMPANY SNAPSHOT

13.2.6 GE CURRENT

TABLE 135 GE CURRENT: BUSINESS OVERVIEW

13.2.7 GLAMOX

TABLE 136 GLAMOX: BUSINESS OVERVIEW

FIGURE 60 GLAMOX: COMPANY SNAPSHOT

13.2.8 AIRFAL INTERNATIONAL

TABLE 137 AIRFAL INTERNATIONAL: BUSINESS OVERVIEW

13.2.9 PHOENIX LIGHTING

TABLE 138 PHOENIX LIGHTING: BUSINESS OVERVIEW

13.2.10 WORKSITE LIGHTING

TABLE 139 WORKSITE LIGHTING: BUSINESS OVERVIEW

13.2.11 LARSON ELECTRONICS

TABLE 140 LARSON ELECTRONICS: BUSINESS OVERVIEW

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.3 OTHER IMPORTANT PLAYERS

13.3.1 R. STAHL

13.3.2 RAYTEC

13.3.3 CESP

13.3.4 TORMIN ELECTRICAL

13.3.5 LDPI

13.3.6 IWASAKI ELECTRIC

13.3.7 NORDLAND LIGHTING

13.3.8 NORKA

13.3.9 UNIMAR

13.3.10 SCHUCH

13.3.11 CORTEM

13.3.12 ABTECH

13.3.13 NUOVA ASP

13.3.14 TREVOS

14 APPENDIX (Page No. - 198)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

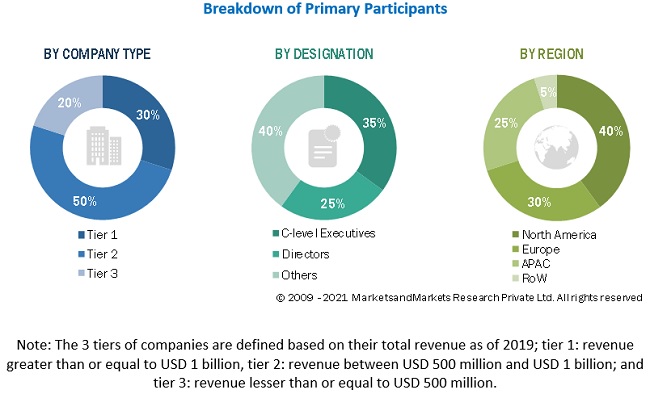

The study involved four major activities in estimating the size of the explosion-proof lighting market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market’s size. After that, market breakdown and data triangulation were used to estimate the market sizes of segments and sub-segments.

Secondary Research

In the explosion-proof lighting market report, both top-down and bottom-up approaches have been used to estimate and validate the size of the explosion-proof lighting market, along with other dependent submarkets. The key players in the explosion-proof lighting market have been identified through secondary research, and their market ranks have been determined through primary and secondary research. This entire research methodology involved studying annual and financial reports of the top players and interviewing experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that may affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Primary Research

The explosion-proof lighting market supply chain comprises several stakeholders, such as input suppliers, OEMs, system integrators, design consultants, distribution channels, and end-users. The demand side of this market is characterized by industries such as oil & gas, chemical & pharmaceutical, food & beverage, and mining, among others; while the supply side is characterized by input suppliers, OEMs, system integrators, design consultants, and distribution channels. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of explosion-proof lighting market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the explosion-proof lighting market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to explosion-proof lighting supply chain, including input suppliers, OEMs, lighting associations, and end-users.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the explosion-proof lighting market.

Report Objectives

- To describe and forecast the explosion-proof lighting market size, by type, light source, hazardous location, end-user industry, and region, in terms of value

- To describe and forecast the explosion-proof lighting market size, by light source, in terms of volume

- To describe and forecast the market size for various segments of the explosion-proof lighting market with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the explosion-proof lighting market

- To provide a value chain analysis of the global explosion proof lighting ecosystem, along with critical information about price and technology trends, market ecosystem, Porter’s five forces analysis, regulatory landscape, trade analysis, and case studies

- To describe the impact of COVID-19 on the explosion-proof lighting market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze growth opportunities for stakeholders in the explosion-proof lighting market

- To strategically profile key players and comprehensively analyze their position in the explosion-proof lighting market in terms of their market share and core competencies and provide details of the competitive landscape for market leaders

- To analyze various developments such as contracts, acquisitions, and product launches, along with research and development activities, in the global explosion-proof lighting market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Information

- Additional country-level analysis of explosion-proof lighting market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Explosion-proof Lighting Market