Event Stream Processing Market by Application (Fraud Detection, Predictive Maintenance, Algorithmic Trading, and Network Monitoring), Component, Deployment Mode, Type (Data Integration and Analytics), Vertical, and Region - Global Forecast to 2023

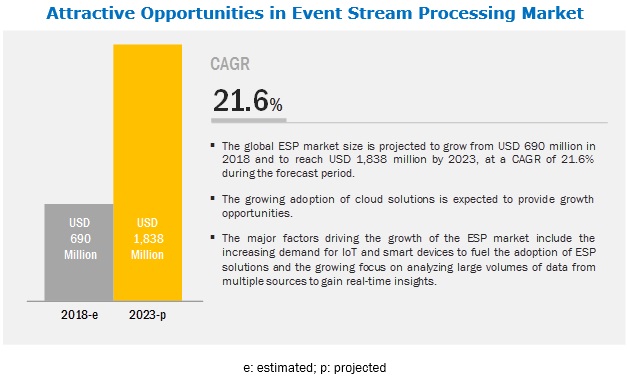

[168 Pages Report] The event stream processing market is expected to grow from USD 690 million in 2018 to USD 1,838 million by 2023, at a Compound Annual Growth Rate (CAGR) of 21.6% during the forecast period. The major growth factors expected to drive the growth of the event stream processing market include the increasing demand for Internet of Things (IoT) and smart devices driving the adoption of event stream processing solutions, and the growing focus on analyzing large volumes of data from multiple sources to gain real-time insights the adoption of the event stream processing solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

The solutions segment is expected to grow at a higher CAGR during the forecast period

Based on the components, the event stream processing market has been classified into solutions and services. Among these components, the solutions segment is expected to account for a larger market size CAGR during the forecast period. The solutions segment is further broken into software tools and platforms, and various verticals would expect to be leveraging event stream processing solutions to meet the changing industry requirements. Moreover, the services segment is expected to be growing at a faster pace during the forecast period.

BFSI vertical is expected to account for the largest market size during the forecast period

The BFSI vertical is expected to account for the largest market size, as various financial institutions and banks are focusing on unlocking insights from a large pool of data generated from various transactions. This vertical by deploying event stream processing solutions can achieve competitive advantage by analyzing real-time streaming data to perform various activities. There are various applications in BFSI where event stream processing solutions can prove beneficial.

Asia Pacific is expected to grow at the highest CAGR during the forecast period

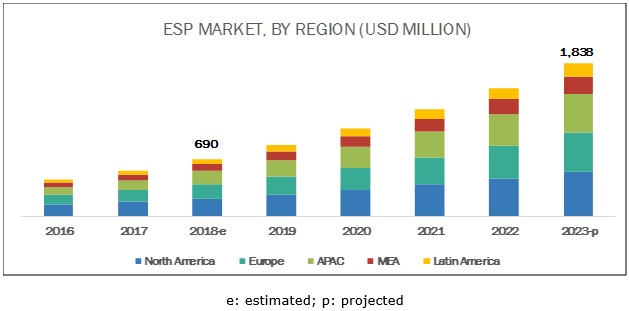

On the basis of regions, the global event stream processing market has been segmented into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. Among regions, North America is expected to hold the largest market size, whereas APAC is projected to grow at the highest rate during the forecast period. APAC shows the highest growth rate during the forecast period, owing to various factors, including technological advancements, growing adoption of Internet of Things (IoT) and connected devices, and various government initiatives supporting the adoption of event stream processing solutions which would help the region grow at the highest rate during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Event Stream Processing Market Players

The major vendors in the event stream processing market include IBM (US), Microsoft (US), Google (US), Oracle (US), SAS (US), SAP (Germany), TIBCO (US), Informatica (US), Hitachi Vantara (US), AWS (US), Software AG (Germany), Salesforce (US), Redhat (US), FICO (US), Impetus Technologies (US), data Artisans (Germany), Radicalbit (Italy), Streamlio (US), Equalum (Israel), Striim (US), Confluent (US), EVAM (US), Databricks (US), SQL Stream (US), and EsperTech (US).

IBM is a leading provider of event stream processing platform provider to the market. The company is focusing on scaling its platforms, delivering productivity through automation, infusing Artificial Intelligence (AI) into its offerings, and investing to expand its cloud infrastructure. The company uses organic and inorganic growth strategies to improve its market share and increase the annual revenue. As a part of its organic growth strategies, in April 2017, IBM announced new capabilities to Bluemix OpenWhisk, a serverless computing platform. Bluemix OpenWhisk assists developers to securely connect event-driven programming into outside data streams. Apart from new product launches, partnership is another significant strategy that the company is focusing on. In October 2018, IBM announced the acquisition of Red Hat, a prominent player in open source companies for USD 34 billion. Post this acquisition, IBM would be the worlds biggest hybrid cloud provider.

Microsoft is one of the key industry players that has a strong product portfolio in the event stream processing market. Microsoft spends significantly on R&D to enhance its event-based offerings. Its product portfolio contains powerful tools and services that offer event streaming capabilities. Microsofts event stream processing portfolio includes Azure Stream Analytics and Event Hubs. The company is focusing on organic, as well as inorganic growth strategies. In line with organic growth strategies, in September 2018, Microsoft enhanced Microsoft Quantum Development Kit, a new chemical simulation library. The kit enables quantum solutions and enable researchers and developers to tackle real-time computationally complex chemistry problems. In line with inorganic growth strategies, in June 2016, Microsoft acquired Event Zero, an Australian-based company. With Event Zeros technology, Microsoft improves its business voice and video conferencing software to offer a more streamlined experience to Skype users.

Scope of the report

|

Report Metrics |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Application, Component, Deployment Mode, Type, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Google (US), Oracle (US), SAS (US), SAP (Germany), TIBCO (US), Informatica (US), Hitachi Vantara (US), AWS (US), Software AG (Germany), Salesforce (US), Redhat (US), FICO (US), Impetus Technologies (US), data Artisans (Germany), Radicalbit (Italy), Streamlio (US), Equalum (Israel), Striim (US), Confluent (US), EVAM (US), Databricks (US), SQL Stream (US), and EsperTech (US) |

This research report categorizes the market based on application, component, deployment mode, type, vertical, and region.

Based on Application, the event stream processing market has been segmented as follows:

- Fraud Detection

- Predictive Maintenance

- Algorithmic Trading

- Network Monitoring

- Sales and Marketing Management

- Others (Location Intelligence, Operations Management, and Smart Grid Stabilization)

Based on Components, the market has been segmented as follows:

- Solutions

- Software Tools

- Platforms

- Services

- Professional Services

- Managed Services

Based on Deployment Mode, the market has been segmented as follows:

- Cloud

- On-premises

Based on Type, the market has been segmented as follows:

- Data Integration

- Analytics

Based on Regions, the market has been segmented as follows:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- SAS partnered with a smart energy communication solutions provider company named Trilliant. Here, the latter would take advantage of SAS streaming analytics software. With this partnership, both the companies would work to analyze abnormal consumption behavior patterns of meters and devices to get information about faulty installations, thefts, failures, and many others.

Critical Questions the report answers

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming industry trends in the event stream processing market?

- What are the growth strategies undertaken by key vendors in the market?

- What are the use cases, where ESP solutions have deployed to achieve various benefits?

- What are the region wise trends in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Segmentation

1.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary

2.1.2.2 Key Industry Insights

2.2 Market Breakdown and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Event Stream Processing Market

4.2 Top 4 Applications

4.3 Top 3 Applications and Regions

4.4 Market Potential, By Vertical

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for IoT and Smart Devices to Drive the Adoption of ESP Solutions

5.2.1.2 Growing Focus on Analyzing Large Volumes of Data From Multiple Sources to Gain Real-Time Insights

5.2.2 Restraints

5.2.2.1 Lack of Integration With the Legacy Architecture

5.2.2.2 Intensifying Market Competition

5.2.3 Opportunities

5.2.3.1 Growing Adoption of Cloud Solutions

5.2.4 Challenges

5.2.4.1 Data Security and Privacy Concerns

5.2.4.2 Lack of Skilled Personnel

5.3 Regulatory Implications

5.3.1 Introduction

5.3.2 General Data Protection Regulation

5.3.3 Health Insurance Portability and Accountability Act

5.3.4 Payment Card Industry Data Security Standard

5.3.5 SOC 2 Type II Compliance

5.3.6 ISO/IEC 27001

5.3.7 The Gramm-Leach-Bliley Act

5.4 Use Cases

5.4.1 Introduction

5.4.1.1 Use Case: Scenario 1

5.4.1.2 Use Case: Scenario 2

5.4.1.3 Use Case: Scenario 3

5.4.1.4 Use Case: Scenario 4

5.4.1.5 Use Case: Scenario 5

6 Event Stream Processing Market, By Application (Page No. - 45)

6.1 Introduction

6.2 Fraud Detection

6.2.1 Need for Reducing Operational Risks and Financial Losses to Increase Adoption of Fraud Detection Application

6.3 Predictive Maintenance

6.3.1 Demand for Higher Asset Utilization and Reliability to Accelerate Adoption of Predictive Maintenance Application

6.4 Algorithmic Trading

6.4.1 Fast and Reliable Processing of Trade Requests to Boost Growth of Algorithmic Trading Application

6.5 Network Monitoring

6.5.1 Need for Reducing Cost Associated With Network Failures and Outages to Create Opportunities for ESP Solution Providers

6.6 Sales and Marketing

6.6.1 Huge Data Generated From Marketing and Retail Activities to Create Opportunities for Sales and Marketing Application Providers

6.7 Others

7 Market, By Component (Page No. - 55)

7.1 Introduction

7.2 Solutions

7.2.1 Software Tools

7.2.1.1 Software Tools Enable Easy Integration of Event Stream Processing Capabilities With Developers Applications

7.2.2 Platforms

7.2.2.1 ESP Platforms Offer A Complete Infrastructure to Enterprises for Processing Millions of Events in A Minimal Time

7.3 Services

7.3.1 Professional Services

7.3.1.1 Consulting Services to Assist Organizations in Implementing ESP Solutions

7.3.2 Managed Services

7.3.2.1 Managed Services to Gain Traction in Coming Years

8 Market, By Deployment Mode (Page No. - 63)

8.1 Introduction

8.2 Cloud

8.2.1 Cloud Benefits to Boost the Growth of Cloud Deployment Mode

8.3 On-Premises

8.3.1 Data-Sensitive Organizations to Continue to Adopt On-Premises Deployment Mode

9 Event Stream Processing Market, By Type (Page No. - 67)

9.1 Introduction

9.2 Data Integration

9.2.1 Demand for Data-Driven Decisions to Accelerate the Growth of ESP Solutions

9.3 Analytics

9.3.1 Analytics Solutions to Assist Enterprises Unleash the Value of Streaming Data

10 Market, By Vertical (Page No. - 71)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.2.1 Banking, Financial Services, and Insurance Vertical to Be the Largest Adopter of ESP Solutions

10.3 It and Telecommunications

10.3.1 Telecommunications Vertical to Deploy ESP Solutions for Optimizing Network Performance, Detecting Frauds, and Boosting Network Functioning

10.4 Retail and Ecommerce

10.4.1 Increasing Digital Transformation to Drive the Adoption of ESP Solutions in Retail Vertical

10.5 Manufacturing

10.5.1 Increasing Focus of Manufacturers Toward Enhancement of Asset Life to Boost the Adoption of ESP Solutions in Manufacturing Vertical

10.6 Energy and Utilities

10.6.1 Increasing Focus on Reducing Equipment Failures to Help Grow Adoption of ESP Solutions

10.7 Transportation and Logistics

10.7.1 Transportation and Logistics Vertical to Grow at the Highest CAGR During the Forecast Period

10.8 Others

11 Event Stream Processing Market, By Region (Page No. - 80)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Increasing Investments in Start-Ups to Boost the Event Stream Processing Market Growth

11.2.2 Canada

11.2.2.1 Increasing Investments and Continuous Research to Drive the Market in the Region

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Increasing Adoption of IoT Technology to Provide Opportunities for ESP Solutions Across the Region

11.3.2 Germany

11.3.2.1 Growing Investments By Tech-Giants to Provide Opportunities for Development of ESP Solutions

11.3.3 France

11.3.3.1 Growing Need to Analyze Real-Time Data to Boost the Adoption of ESP Solutions

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Growing Initiatives Supporting Digitalization to Boost the Adoption of ESP Solutions

11.4.2 Japan

11.4.2.1 Rapid Technological Advancements to Accelerate the Growth of ESP Solutions

11.4.3 India

11.4.3.1 Growing Infrastructure Developments and Adoption of Connected Devices to Act as A Driving Factor for This Market

11.4.4 Rest of APAC

11.5 Middle East and Africa

11.5.1 United Arab Emirates

11.5.1.1 Demand for Connected Devices to Increase the Adoption of ESP Solutions

11.5.2 Israel

11.5.2.1 Rise in the Adoption of AI and Real-Time Analytics to Provide Opportunities for ESP Solutions

11.5.3 South Africa

11.5.3.1 Increase in the Adoption of Advanced Digital Technologies to Provide Opportunities for ESP Solutions

11.5.4 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Emerging Technology Trends in Brazil to Help the Event Stream Processing Market Growth in the Coming Years

11.6.2 Mexico

11.6.2.1 Growing Steps Toward Revolution of Various Technologies in Mexico May Create Demand for ESP Solutions in the Coming Years

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 110)

12.1 Overview

12.2 Ranking of Key Players

12.3 Competitive Scenario

12.3.1 New Product Launches and Product Enhancements

12.3.2 Partnerships and Collaborations

12.3.3 Mergers and Acquisitions

12.3.4 Expansions

13 Company Profiles (Page No. - 116)

13.1 IBM

(Business Overview, Products & Services, Platforms Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Microsoft

13.3 Oracle

13.4 AWS

13.5 SAP

13.6 SAS Institute

13.7 Google

13.8 Fico

13.9 Software AG

13.10 Red Hat

13.11 Hitachi Vantara

13.12 Tibco

13.13 Informatica

13.14 Salesforce

13.15 Striim

13.16 Confluent

13.17 Sqlstream

13.18 Streamanalytix

13.19 Dataartisans

13.20 Streamlio

13.21 Equalum

13.22 Databricks

13.23 ESPertech

13.24 EVAM

13.25 Radicalbit

*Details on Business Overview, Products & Services, Platforms, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 159)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Knowledge Store: MarketsandMarkets Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (79 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Global Event Stream Processing Market Size and Growth Rate, 20162023

Table 3 Connected Devices, 20172023 (Billion)

Table 4 ESP Applications Across Verticals

Table 5 Market Size, By Application, 20162023 (USD Million)

Table 6 Fraud Detection: Market Size, By Region, 20162023 (USD Million)

Table 7 Predictive Maintenance: Market Size, By Region, 20162023 (USD Million)

Table 8 Algorithmic Trading: Market Size, By Region, 20162023 (USD Million)

Table 9 Network Monitoring: Market Size, By Region, 20162023 (USD Million)

Table 10 Sales and Marketing: Market Size, By Region, 20162023 (USD Million)

Table 11 Others: Market Size, By Region, 20162023 (USD Million)

Table 12 Market Size, By Component, 20162023 (USD Million)

Table 13 Market Size, By Solution, 20162023 (USD Million)

Table 14 Solutions: Market Size, By Region, 20162023 (USD Million)

Table 15 Software Tools: Market Size, By Region, 20162023 (USD Million)

Table 16 Platforms: Market Size, By Region, 20162023 (USD Million)

Table 17 Event Stream Processing Market Size, By Service, 20162023 (USD Million)

Table 18 Services: Market Size, By Region, 20162023 (USD Million)

Table 19 Professional Services: Market Size, By Region, 20162023 (USD Million)

Table 20 Managed Services: Market Size, By Region, 20162023 (USD Million)

Table 21 Market Size, By Deployment Mode, 20162023 (USD Million)

Table 22 Cloud: Market Size, By Region, 20162023 (USD Million)

Table 23 On-Premises: Market Size, By Region, 20162023 (USD Million)

Table 24 Market Size, By Type, 20162023 (USD Million)

Table 25 Data Integration: Market Size, By Region, 20162023 (USD Million)

Table 26 Analytics: Market Size, By Region, 20162023 (USD Million)

Table 27 Event Stream Processing Market Size, By Vertical, 20162023 (USD Million)

Table 28 Banking, Financial Services, and Insurance: Market Size, By Region, 20162023 (USD Million)

Table 29 IT and Telecommunications: Market Size, By Region, 20162023 (USD Million)

Table 30 Retail and Ecommerce: Market Size, By Region, 20162023 (USD Million)

Table 31 Manufacturing: Market Size, By Region, 20162023 (USD Million)

Table 32 Energy and Utilities : Market Size, By Region, 20162023 (USD Million)

Table 33 Transportation and Logistics: Market Size, By Region, 20162023 (USD Million)

Table 34 Others: Market Size, By Region, 20162023 (USD Million)

Table 35 Event Stream Processing Market Size, By Region, 20162023 (USD Million)

Table 36 North America: Event Stream Processing Market Size, By Application, 20162023 (USD Million)

Table 37 North America: Market Size, By Component, 20162023 (USD Million)

Table 38 North America: Market Size, By Solution, 20162023 (USD Million)

Table 39 North America: Market Size, By Service, 20162023 (USD Million)

Table 40 North America: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 41 North America: Market Size, By Type, 20162023 (USD Million)

Table 42 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 43 North America: Market Size, By Country, 20162023 (USD Million)

Table 44 Europe: Event Stream Processing Market Size, By Application, 20162023 (USD Million)

Table 45 Europe: Market Size, By Component, 20162023 (USD Million)

Table 46 Europe: Market Size, By Solution, 20162023 (USD Million)

Table 47 Europe: Market Size, By Service, 20162023 (USD Million)

Table 48 Europe: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 49 Europe: Market Size, By Type, 20162023 (USD Million)

Table 50 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 51 Europe: Market Size, By Country, 20162023 (USD Million)

Table 52 Asia Pacific: Event Stream Processing Market Size, By Application, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size, By Component, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size, By Solution, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 57 Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 58 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 59 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 60 Middle East and Africa: Event Stream Processing Market Size, By Application, 20162023 (USD Million)

Table 61 Middle East and Africa: Market Size, By Component, 20162023 (USD Million)

Table 62 Middle East and Africa: Market Size, By Solution, 20162023 (USD Million)

Table 63 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 64 Middle East and Africa: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 65 Middle East and Africa: Market Size, By Type, 20162023 (USD Million)

Table 66 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 67 Middle East and Africa: Market Size, By Country, 20162023 (USD Million)

Table 68 Latin America: Event Stream Processing Market Size, By Application, 20162023 (USD Million)

Table 69 Latin America: Market Size, By Component, 20162023 (USD Million)

Table 70 Latin America: Market Size, By Solution, 20162023 (USD Million)

Table 71 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 72 Latin America: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 73 Latin America: Market Size, By Type, 20162023 (USD Million)

Table 74 Latin America: Market Size, By Vertical, 20162023 (USD Million)

Table 75 Latin America: Market Size, By Country, 20162023 (USD Million)

Table 76 New Product Launches and Product Enhancements, 20162018

Table 77 Partnerships and Collaborations, 20162018

Table 78 Mergers and Acquisitions, 20162018

Table 79 Expansions, 20162017

List of Figures (53 Figures)

Figure 1 Regions Covered

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Market Size Estimation Methodology Top-Down Approach

Figure 5 Factor Analysis

Figure 6 North America to Account for the Highest Market Share in 2018

Figure 7 Event Stream Processing Market Snapshot, By Application

Figure 8 Market Snapshot, By Component, 2018

Figure 9 Market Snapshot, By Solution, 2018

Figure 10 Market Snapshot, By Service, 2018

Figure 11 Market Snapshot, By Deployment Mode

Figure 12 Market Snapshot, By Type, 2023

Figure 13 Market Snapshot, By Vertical

Figure 14 Global Event Stream Processing Market to Witness Significant Growth During the Forecast Period

Figure 15 Predictive Maintenance Segment to Grow at the Highest CAGR During the Forecast Period

Figure 16 Fraud Detection Segment and the North America to Account for the Highest Market Shares in the Event Stream Processing Market in 2018

Figure 17 Retail and Ecommerce Vertical to Register the Highest Market Share in 2018

Figure 18 Event Stream Processing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Predictive Maintenance Segment to Witness the Highest CAGR During the Forecast Period

Figure 20 Services Segment to Register A Higher CAGR During the Forecast Period

Figure 21 Software Tools Segment to Register A Higher CAGR During the Forecast Period

Figure 22 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 23 Cloud Segment to Exhibit A Higher CAGR During the Forecast Period

Figure 24 Analytics Segment to Grow at A Higher CAGR During the Forecast Period

Figure 25 Transportation and Logistics Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 26 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 27 India to Register the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific to Grow at Highest Rate During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 North America: Market, By Application

Figure 31 Europe: Market, By Application

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Asia Pacific: Market, By Application

Figure 34 Event Stream Processing Market in Middle East and Africa, By Application

Figure 35 Latin America: Market, By Application

Figure 36 Key Developments By Leading Players in the Global Market

Figure 37 IBM Led the Event Stream Processing Market in 2018

Figure 38 IBM: Company Snapshot

Figure 39 SWOT Analysis: IBM

Figure 40 Microsoft: Company Snapshot

Figure 41 SWOT Analysis: Microsoft

Figure 42 Oracle: Company Snapshot

Figure 43 SWOT Analysis: Oracle

Figure 44 AWS: Company Snapshot

Figure 45 SWOT Analysis: AWS

Figure 46 SAP: Company Snapshot

Figure 47 SWOT Analysis: SAP

Figure 48 SAS: Company Snapshot

Figure 49 Google: Company Snapshot

Figure 50 Fico: Company Snapshot

Figure 51 Software AG: Company Snapshot

Figure 52 Red Hat: Company Snapshot

Figure 53 Salesforce: Company Snapshot

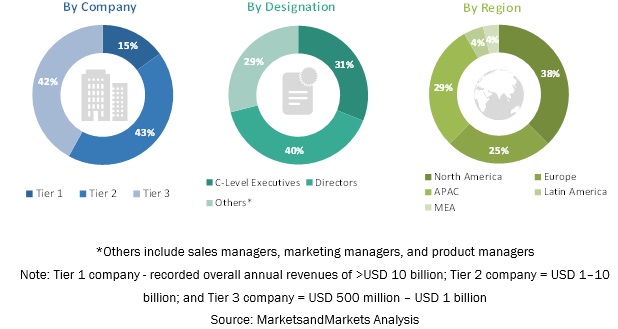

The study consists of 4 major activities to estimate the current market size of the Event Stream Processing market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to, for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles by recognized authors; gold standard and silver standard websites; real-time payments technology Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary research

Various primary sources from both supply and demand sides of the event stream processing market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the ESP solutions and associated service providers and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of the primary respondents profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the event stream processing market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the event stream processing market by application (fraud detection, predictive maintenance, algorithmic trading, network monitoring, sales and marketing management, and others comprising location intelligence, operations management, and smart grid stabilization), component (solutions and services), deployment mode ( cloud and on-premises), type (data integration and analytics) and region (North America, Asia Pacific [APAC], Europe, Latin America, and Middle East and Africa [MEA])

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the ESP ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Event Stream Processing Market

- Further breakup of the European Market

- Further breakup of the APAC Market

- Further breakup of the MEA Market

- Further breakup of the Latin American Market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Event Stream Processing Market