Algorithmic Trading Market by Trading Type (FOREX, Stock Markets, ETF, Bonds, Cryptocurrencies), Component (Solutions and Services), Deployment Mode (Cloud and On-premises), Enterprise Size, and Region - Global Forecast to 2024

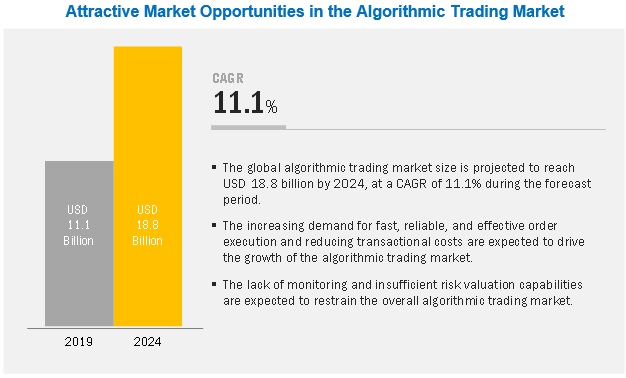

[143 Pages Report] The global algorithmic trading market size to grow from USD 11.1 billion in 2019 to USD 18.8 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period. The major growth drivers of the market include the rising demand for fast, reliable, and effective order execution, reducing transactional costs, increasing government regulations, and growing demand for market surveillance.

Among trading types, the Exchange-Traded Fund (ETF) segment to grow at the highest CAGR during the forecast period

Algorithmic trading is segmented on the basis of trading types. The trading types include Foreign Exchange (FOREX), stock markets, ETF, bonds, cryptocurrencies, and others (assets, commodities, collateral mortgage, Credit Default Swap (CDS) and Interest Rate Swap (IRS)). The ETF segment is the fastest growing segment in the algorithmic trading market, due to the increasing demand for automated trading across the globe. ETFs provide low average costs to traders so that they can gain maximum profits out of the ETFs.

The cloud deployment mode to grow at a rapid pace during the forecast period

Most of the vendors in the algorithmic trading market offer cloud-based trading solutions to gain maximum profits and effectively automate the trading process. The adoption of cloud-based algorithmic trading solutions is expected to grow, mainly due to their benefits such as easy trade data maintenance, cost-effectiveness, scalability, and effective management.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global algorithmic trading market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. In APAC, the highest growth rate can be attributed to the heavy investments made by private and public sectors for enhancing their trading technologies, resulting in an increased demand for algorithmic trading solutions used for automating the trading process. North America is expected to be the leading region in terms of adopting and developing algorithmic trading. The rising investments in trading technologies such as blockchain, increasing presence of algorithmic trading vendors, and growing government support for global trading are the major factors expected to contribute to the market growth during the forecast period.

Key Algorithmic Trading Market Players

Major vendors in the global market include Thomson Reuters (US), 63 moons (India), Virtu Financial (US), Software AG (Germany), MetaQuotes Software (Cyprus), Symphony Fintech (India), InfoReach (US), Argo SE (US), Kuberre Systems (US), Tata Consulting Services (India), QuantCore Capital Management (China), iRageCapital (India), Automated Trading SoftTech (India), Tethys (US), Trading Technologies (US), uTrade (India), Vela (US), and AlgoTrader (Switzerland). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to further expand their presence in the global algorithmic trading market.

Thomson Reuters is one of the leading providers of algorithmic trading solutions. The company offers trading solutions to facilitate clients to easily integrate their solutions with ERP systems from Oracle and SAP. Its solutions offer several advantages, such as improving performance through accelerating workflows, increasing margins through reduction in logistics costs, and efficiently managing risks and compliances. It enables its clients to make efficient and quick business decisions by providing them with professional expertise, technology, and intelligence. Moreover, it drives its growth through a renewed focus on organic product development, yielding a robust product pipeline in the market.

Scope of the report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Trading Types, Components, Solutions, Services, Deployment Modes, Enterprise Size, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Thomson Reuters (US), 63 moons (India), Virtu Financial (US), Software AG (Germany), MetaQuotes Software (Cyprus), Symphony Fintech (India), InfoReach (US), Argo SE (US), Kuberre Systems (US), Tata Consultancy Services (India), QuantCore Capital Management (China), iRageCapital (India), Automated Trading SoftTech (India), Tethys(US), Trading Technologies (US), uTrade (India), Vela (US), and AlgoTrader (Switzerland) |

This research report categorizes the market based on trading types, components, solutions, services, deployment modes, enterprise size, and region.

Based on Trading Types, the Algorithmic trading market is divided into the following segments:

- Foreign Exchange (FOREX)

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Cryptocurrencies

- Others (commodities, assets, Credit Default Swaps, (CDS), Interest Rate Swaps (IRS), and collateral mortgage)

Based on Components, the market is divided into the following segments:

-

Solutions

- Platforms

- Software Tools

-

Services

- Professional Services

- Managed Services

Based on Deployment modes, the Algorithmic trading market is divided into the following segments:

- On-premises

- Cloud

Based on enterprise size, the market is divided into the following segments:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Regions, the Algorithmic trading market is divided into the following segments:

- North America

- Europe

- APAC

- Latin America

- MEA

Recent developments

- In March 2019, Virtu Financial acquired Investment Technology Group, a global financial technology company that helps top brokers and asset managers improve returns for investors across the globe. The acquisition would implement a Client Information Security Program (CISP) for Virtu Financial’s broker-neutral client offerings.

Critical questions the report answers

- What are the current trends that are driving the algorithmic trading market?

- In which trading type most of the financial institutions are deploying algorithmic trading?

- Where will all these developments take the industry in the mid- to long-term?

- Who are the top vendors in the market and what is their competitive analysis?

- What are the drivers and challenges of the algorithmic trading market?

Frequently Asked Questions (FAQ):

What is the Algorithmic Trading Market Growth?

What is the estimated growth rate (CAGR) of the global Algorithmic Trading Market?

What are the major revenue pockets in the global Algorithmic Trading Market currently?

Which are Leading Companies in Algorithmic Trading Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Algorithmic Trading Market

4.2 Market: Top 3 Trading Types

4.3 Market: Top 3 Trading Types and Regions

4.4 Market, By Trading Type

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Fast, Reliable, and Effective Order Execution and Reduced Transaction Costs

5.2.1.2 Increasing Government Regulations and Growing Demand for Market Surveillance

5.2.1.3 Growing Adoption of Cloud-Based Solutions

5.2.2 Restraints

5.2.2.1 Lack of Monitoring and Insufficient Risk Valuation Capabilities

5.2.3 Opportunities

5.2.3.1 Algorithmic Trading to Have No Impact of Human Emotions

5.2.3.2 Emergence of Ai and Algorithms in Financial Services Sector

5.2.4 Challenges

5.2.4.1 Lack of Accuracy and Consistency in Algorithms

5.3 Use Cases

5.3.1 Introduction

5.3.1.1 Use Case: Scenario 1

5.3.1.2 Use Case: Scenario 2

5.3.1.3 Use Case: Scenario 3

5.3.1.4 Use Case: Scenario 4

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 General Data Protection Regulation

5.4.3 Markets in Financial Instruments Directive Ii

5.4.4 Markets in Financial Instruments Regulation

5.4.5 Securities and Exchange Commission

5.4.6 Commodity Futures Trading Commission

5.5 Algorithmic Trading Architecture

6 Algorithmic Trading Market, By Trading Type (Page No. - 46)

6.1 Introduction

6.2 Foreign Exchange

6.2.1 Need for Automated Trading to Drive Market in Forex Segment

6.3 Stock Markets

6.3.1 Stock Markets to Gain Traction in Coming Years

6.4 Exchange-Traded Funds

6.4.1 Exchange-Traded Funds Provide Lower Average Costs for Trading Process to Drive Market

6.5 Bonds

6.5.1 Increasing Demand for Financing Projects and Operations to Drive Adoption of Bonds in the Market

6.6 Cryptocurrencies

6.6.1 Cryptocurrencies Assist Traders in Performing Secure Trading Payments

6.7 Others

7 Market, By Component (Page No. - 54)

7.1 Introduction

7.2 Solutions

7.2.1 Platforms

7.2.1.1 Growing Demand for Algorithmic Trading Platform to Effectively Automate Trading Process and Maximize Profit

7.2.2 Software Tools

7.2.2.1 Rising Demand for Algorithmic Trading Tools to Automate Trading Strategies

7.3 Services

7.3.1 Professional Services

7.3.1.1 Increasing Demand for Consulting Services to Effectively Implement Algorithmic Trading Solutions

7.3.2 Managed Services

7.3.2.1 Organizations’ Need to Focus More on Core Tasks to Drive Demand for Managed Services in Coming Years

8 Algorithmic Trading Market, By Deployment Mode (Page No. - 62)

8.1 Introduction

8.2 Cloud

8.2.1 Cost-Effectiveness and Scalability Benefits to Boost Growth of Cloud Deployment Models

8.3 On-Premises

8.3.1 Data-Sensitive Organizations to Continue to Adopt On-Premises Deployment Models

9 Market, By Organization Size (Page No. - 66)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Growing Potential of Algorithmic Trading to Drive Adoption of Algorithmic Trading Among Small and Medium-Sized Enterprises

9.3 Large Enterprises

9.3.1 Large Enterprises to Deploy Algorithmic Trading Solutions for Effectively Executing Trading Strategies

10 Market, By Region (Page No. - 70)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Growing Implementation of Ai- and Ml-Based Solutions to Fuel the Demand for Algorithmic Trading in the US

10.2.2 Canada

10.2.2.1 Increase in Ai-Based Investments and Research Activities to Drive the Growth of the Market in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Growing Governance From Regulators to Fuel the Adoption of Algorithmic Trading Solutions in the UK

10.3.2 Germany

10.3.2.1 Increasing Adoption of Algorithmic Trading Solutions to Drive the Market in Germany

10.3.3 France

10.3.3.1 Heavy Inflow of Capital From Various Investors to Drive the Market in France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Growing Investments By Tech Giants to Expand and Provide Opportunities for the Development of Algorithmic Trading Market Solutions

10.4.2 Japan

10.4.2.1 Growing Government Regulations Helps Algorithmic Trading Solution Providers Improve Risk Management Practices in Japan

10.4.3 India

10.4.3.1 Lower Cost of Technology and Availability of Skilled Resources to Help the Market Grow

10.4.4 Australia

10.4.4.1 Increasing Investments in Technologies to Help the Market to Grow

10.4.5 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 United Arab Emirates

10.5.1.1 Complex Legal, Regulatory, and Economic Resolutions to Compel Organizations to Adopt Algorithmic Trading Solutions in UAE

10.5.2 Israel

10.5.2.1 Regulatory Compliance Backed By the Presence of Algorithmic Trading Vendors to Lead the Adoption of Algorithmic Trading Solutions in Israel

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Brazil to Witness the Highest Growth Rate in the Coming Years

10.6.2 Mexico

10.6.2.1 Mexico to Account for the Largest Market Size in the Algorithmic Trading Market in the Region

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 100)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.3 Strength of Product Portfolio

11.4 Business Strategy Excellence

12 Company Profiles (Page No. - 104)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Thomson Reuters

12.3 63 Moons

12.4 Virtu Financial

12.5 Software AG

12.6 MetaQuotes Software

12.7 Symphony

12.8 InfoReach

12.9 Argo SE

12.10 Kuberre Systems

12.11 Tata Consultancy Services

12.12 QuantCore Capital Management

12.13 iRageCapital

12.14 Automated Trading SoftTech

12.15 Tethys

12.16 Trading Technologies

12.17 uTrade

12.18 Vela

12.19 Algo Trader

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (64 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Global Market Size and Growth, 2017–2024 (USD Million, Y-O-Y %)

Table 4 Algorithmic Trading Market Size, By Trading Type, 2017–2024 (USD Million)

Table 5 Forex: Market Size, By Region, 2017–2024 (USD Million)

Table 6 Stock Markets: Market Size, By Region, 2017–2024 (USD Million)

Table 7 Exchange-Traded Funds: Market Size, By Region, 2017–2024 (USD Million)

Table 8 Bonds: Market Size, By Region, 2017–2024 (USD Million)

Table 9 Cryptocurrencies: Market Size, By Region, 2017–2024 (USD Million)

Table 10 Others: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Algorithmic Trading Market Size, By Component, 2017–2024 (USD Million)

Table 12 Market Size, By Solution , 2017–2024 (USD Million)

Table 13 Platforms: Market Size, By Region, 2017–2024 (USD Million)

Table 14 Software Tools: Market Size, By Region, 2017–2024 (USD Million)

Table 15 Market Size, By Service, 2017–2024 (USD Million)

Table 16 Professional Services: Market Size, By Region, 2017–2024 (USD Million)

Table 17 Managed Services: Algorithmic Trading Market Size, By Region, 2017–2024 (USD Million)

Table 18 Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 19 Cloud: Market Size, By Region, 2017–2024 (USD Million)

Table 20 On-Premises: Market Size, By Region, 2017–2024 (USD Million)

Table 21 Algorithmic Trading Market Size, By Organization Size, 2017–2024 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 23 Large Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 24 Market Size, By Region, 2017–2024 (USD Million)

Table 25 North America: Algorithmic Trading Market Size, By Trading Type, 2017–2024 (USD Million)

Table 26 North America: Market Size, By Component, 2017–2024 (USD Million)

Table 27 North America: Market Size, By Solution, 2017–2024 (USD Million)

Table 28 North America: Market Size, By Service, 2017–2024 (USD Million)

Table 29 North America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 30 North America: Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 31 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 32 North America: Major Fintech Companies

Table 33 Europe: Algorithmic Trading Market Size, By Trading Type, 2017–2024 (USD Million)

Table 34 Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 35 Europe: Market Size, By Solution, 2017–2024 (USD Million)

Table 36 Europe: Market Size, By Service, 2017–2024 (USD Million)

Table 37 Europe: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 38 Europe: Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 39 Europe: Market Size, By Country, 2017–2024 (USD Million)

Table 40 Europe: Major Fintech Companies

Table 41 Asia Pacific: Algorithmic Trading Market Size, By Trading Type, 2017–2024 (USD Million)

Table 42 Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 43 Asia Pacific: Market Size, By Solution, 2017–2024 (USD Million)

Table 44 Asia Pacific: Market Size, By Service, 2017–2024 (USD Million)

Table 45 Asia Pacific: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 46 Asia Pacific: Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 47 Asia Pacific: Market Size, By Country, 2017–2024 (USD Million)

Table 48 Asia Pacific: Major Fintech Companies

Table 49 Middle East and Africa: Algorithmic Trading Market Size, By Trading Type, 2017–2024 (USD Million)

Table 50 Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 51 Middle East and Africa: Market Size, By Solution, 2017–2024 (USD Million)

Table 52 Middle East and Africa: Market Size, By Service, 2017–2024 (USD Million)

Table 53 Middle East and Africa: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 54 Middle East and Africa: Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 55 Middle East and Africa: Market Size, By Country, 2017–2024 (USD Million)

Table 56 Middle East and Africa: Major Fintech Companies

Table 57 Latin America: Algorithmic Trading Market Size, By Trading Type, 2017–2024 (USD Million)

Table 58 Latin America: Market Size, By Component, 2017–2024 (USD Million)

Table 59 Latin America: Market Size, By Solution, 2017–2024 (USD Million)

Table 60 Latin America: Market Size, By Service, 2017–2024 (USD Million)

Table 61 Latin America: Market Size, By Deployment Mode, 2017–2024 (USD Million)

Table 62 Latin America: Market Size, By Enterprise Size, 2017–2024 (USD Million)

Table 63 Latin America: Market Size, By Country, 2017–2024 (USD Million)

Table 64 Latin America: Major Fintech Companies

List of Figures (40 Figures)

Figure 1 Global Algorithmic Trading Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 North America to Account for the Highest Market Share in 2019

Figure 4 Market Snapshot, By Component, 2019

Figure 5 Market Snapshot, By Solution, 2019

Figure 6 Market Snapshot, By Service, 2019

Figure 7 Market Snapshot, By Deployment Mode, 2019

Figure 8 Market Snapshot, By Enterprise Size, 2019

Figure 9 Increasing Demand for Fast, Reliable, and Effective Order Execution and Reduced Transactional Cost to Drive the Adoption of Algorithmic Trading

Figure 10 Exchange-Traded Fund Segment to Grow at the Highest CAGR During the Forecast Period

Figure 11 Stock Markets Segment and North America to Account for the Highest Market Shares in the Algorithmic Trading Market in 2019

Figure 12 Stock Markets Segment to Register the Highest Market Share in 2019

Figure 13 Asia Pacific to Be the Best Market for Investments During the Forecast Period

Figure 14 Drivers, Restraints, Opportunities, and Challenges

Figure 15 Architecture and Development: Algorithmic Trading Market

Figure 16 Exchange-Traded Fund Segment to Grow at the Highest CAGR During the Forecast Period

Figure 17 Services Segment to Record A Higher CAGR During the Forecast Period

Figure 18 Platforms Segment to Record A Higher CAGR During the Forecast Period

Figure 19 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 20 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 21 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 22 North America to Hold the Largest Market Size During the Forecast Period

Figure 23 India to Register the Highest CAGR During the Forecast Period

Figure 24 Asia Pacific to Account for the Highest CAGR in 2019

Figure 25 North America: Algorithmic Trading Market Snapshot

Figure 26 ETF Trading Type to Grow at the Highest CAGR During the Forecast Period

Figure 27 ETF Trading Type to Grow at the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific: Market Snapshot

Figure 29 ETF Trading Type to Grow at the Highest CAGR During the Forecast Period

Figure 30 ETF Trading Type to Grow at the Highest CAGR During the Forecast Period

Figure 31 ETF Trading Type to Grow at the Highest CAGR During the Forecast Period

Figure 32 Algorithmic Trading Market (Global) Competitive Leadership Mapping, 2019

Figure 33 Thomson Reuters: Company Snapshot

Figure 34 Thomson Reuters: SWOT Analysis

Figure 35 63 Moons: Company Snapshot

Figure 36 63 Moons: SWOT Analysis

Figure 37 Virtu Financial: Company Snapshot

Figure 38 Virtu Financial: SWOT Analysis

Figure 39 Software AG: Company Snapshot

Figure 40 Software AG: SWOT Analysis

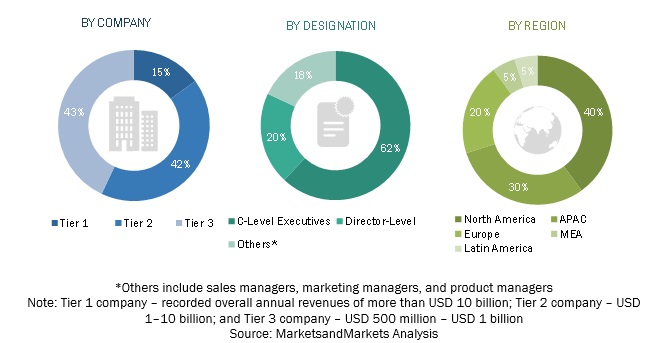

The study consists of 4 major activities to estimate the current market size of the algorithmic trading market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the algorithmic trading market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary research

Various primary sources from both the supply and demand sides of the algorithmic trading market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), technology and innovation directors, hedge fund managers, and related key executives from various vendors offering algorithmic trading solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the algorithmic trading market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the algorithmic trading market by component (platforms and software tools), service (professional services and managed services), trading type (Foreign Exchange [FOREX], stock markets, Exchange-Traded Fund [ETF], bonds, cryptocurrencies, and others [commodities, assets, Credit Default Swaps {CDS}, Interest Rate Swaps {IRS}, and collateral mortgage), deployment mode (cloud and on-premises), organization size (Small and Medium-sized Enterprises [SMEs] and large enterprises), and region (North America, Europe, Asia Pacific [APAC], Latin America, and Middle East and Africa [MEA]).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the algorithmic trading market

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the algorithmic trading ecosystem

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with the detailed competitive landscape of market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American algorithmic trading market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA algorithmic trading market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Algorithmic Trading Market