Enterprise WLAN Market by Component, Hardware (Wireless access points, AP Antennas, Wireless LAN controllers, Multigigabit Switching, Wireless Location Appliance), Software, Service, Vertical, and Region - Global Forecast to 2021

[165 Pages Report] Enterprise WLAN Market is expected to grow from USD 5.53 billion in 2016 to USD 21.10 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 30.7%. Moreover, technological advancements is expected to increase WLAN applications in numerous industry sectors. The growing demand of mobility and cloud applications and the emergence of Internet of Things (IoT) is driving the deployment of market and upgrades of enterprise networks. This market is witnessing a surge in deployment due to high demand of WLANs in different verticals, as it supports numerous business-critical mobility applications. Deployment of WLAN through cloud reduces cost and enables the companies to enjoy more security and flexibility.

Enterprise WLAN Market Dynamics

Drivers

- Rapid adoption of enterprise WLAN trends, such as BYOD

- Transition of enterprises and consumers from wired to wireless networks

- Increase in business and vertical-specific applications

Restraints

- Lack of standardization in enterprise WLAN technology for internetwork interoperability and portability

- Limited investment owing to high prices of WLAN products

Opportunities

- Advent of IoT along with the deployment of WLAN through cloud

- Rise in demand for the 802.11 ac Wave 2 standards

- Shift toward carrier Wi-Fi

Challenges

- Bandwidth and latency issues

- Increasing WLAN hardware cost affects the demand

Objectives of the Study

The main objective of this report is to define, describe, and forecast the global market on the basis of component, hardware, service, software, vertical, and regions. The report provides detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market. The report aims to strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global market. The report also attempts to forecast the market size of the 5 main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, new developments, and Research and Development (R&D) activities, in the market.

Research Methodology

The research methodology used to estimate and forecast the market begins with capturing data on key vendor revenues through secondary research such as the Crunchbase. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global enterprise WLAN market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

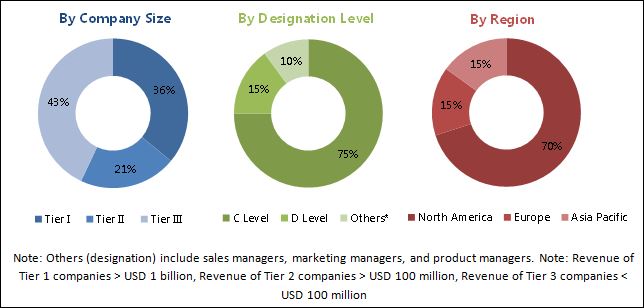

The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The enterprise WLAN market ecosystem comprises solution and service providers such as Cisco Systems (U.S.), Juniper Networks (U.S.), Alcatel Lucent Enterprises (U.S.), Aruba Networks (U.S.), Ruckus Wireless (U.S.), Aerohive Networks (U.S.), Allied Telesis (U.S.), Avaya Corporation (U.S.), Dell (U.S.), Huawei (Japan), Extreme Networks (U.S.), ZTE Corporation (China), Fortinet (U.S.), Wi-Fi Spark (U.K.), and Boingo Wireless (U.S.).

Key Target Audience for Enterprise WLAN Market

- Mobile network operators

- SDN solution providers

- Wireless infrastructure providers

- Cloud and virtualized datacenters

- Network infrastructure providers

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

20162021 |

|

Base year considered |

2016 |

|

Forecast period |

20162021 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Hardware, Software, Service, Vertical and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Cisco Systems (U.S.), Juniper Networks (U.S.), Alcatel Lucent Enterprises (U.S.), Aruba Networks (U.S.), Ruckus Wireless (U.S.), Aerohive Networks (U.S.), Allied Telesis (U.S.), Avaya Corporation (U.S.), Dell (U.S.), Huawei (Japan), Extreme Networks (U.S.), ZTE Corporation (China), Fortinet (U.S.), Wi-Fi Spark (U.K.), and Boingo Wireless (U.S.). |

The report scope covers the following submarkets of the enterprise WLAN market:

Enterprise WLAN Market By Component

- WLAN Hardware

- WLAN Software

- WLAN Services

Enterprise WLAN Market By Hardware

- Wireless Access Points

- AP Antennas

- Wireless LAN Controllers

- Multigigabit Switching

- Wireless Location Appliance

Enterprise WLAN Market By Software

- WLAN Analytics

- WLAN Security

- WLAN Management Software

Enterprise WLAN Market By Services

- Professional Services

- Managed Services

Enterprise WLAN Market By Vertical

- It and Telecommunication

- Municipality and Public Infrastructure

- Logistics

- BFSI

- Education

- Healthcare

- Transport and Logistics

- Retail

- Others

Enterprise WLAN Market By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Among enterprise WLAN hardware, the access points segment has the fastest growing market during the forecast period. The introduction of wireless access point technologies in the industrial environment is a challenging goal, with high potential benefits on increasing flexibility and reduced costs; this is basically true for industrial automation and robotics. In the automation scenario, there are several solutions available, and IEEE 802.11n is a standard that overcomes most of the constraints on the part of automation. In enterprise WLAN, an access point is a device that allows wireless devices such as smartphones and tablets to connect with a wired network using Wi-Fi. The WLAN access point is forecast to be one of the highest growth segments in the enterprise WLAN market.

Among enterprise WLAN market by service, the professional services segment is the largest contributor during the forecast period, whereas the managed services segment is expected to grow at the highest CAGR. With increase in the number of mobile devices connecting to the wireless network, users have started using an increasing number of bandwidth-intensive applications, which in turn has led to decrease in the efficiency of networks. To maintain bandwidth and latency of the network to provide efficient and effective services to end-users, it becomes very important to manage and optimize the services of enterprise WLAN.

The municipality and public infrastructure vertical is the fastest growing vertical in the enterprise WLAN market. The municipality and public agencies have the incomparable challenge of protecting operational information as a matter of national security. These mission-critical environments cannot afford to have downtime in networks. Through the solutions in enterprise WLAN, the agencies can keep track of the issues before a problem arises. The dashboards available in enterprise WLAN solutions such as traffic analyzer, configuration management, and performance monitoring can be used as automated network tools for solving such problems.

The increasing mobility in businesses due to the rapid adoption of many WLAN trends, such as Bring Your Own Device (BYOD) is driving the evolution of the enterprise WLAN market.

Hospitality

Enterprise WLAN has recorded for the largest market share by municipality

Hospitality companies require insights into factors such as number of users, media duration, and Quality of Experience (QoE). This has considerably resulted in robust growth of hospitality vertical by enterprise WLAN

Education

The organizations in the education segment need a reliable network environment. These networks must be stable to provide users access to mission- critical applications and regulate the usage of network for personal content.

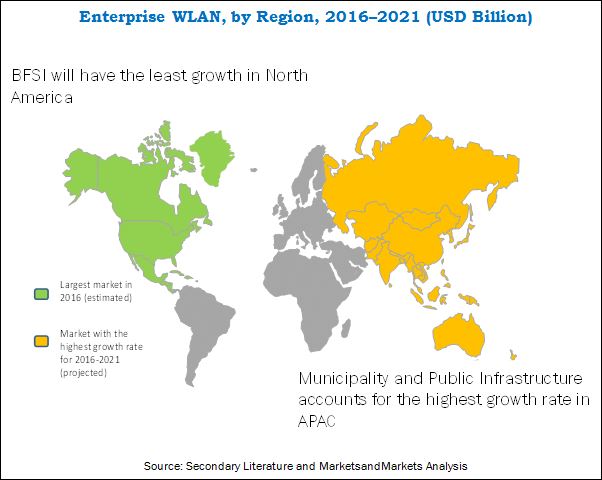

Among regions, North America is projected to have the largest market share and is expected to dominate the enterprise WLAN market from 2016 to 2021. Correspondingly, during the same period, APAC is expected to showcase a significant growth potential and is projected to grow at the highest CAGR for the market. This is backed by the existence of a large population, increasing customer awareness, developing technology hubs, and affluent countries such as South Korea, Singapore, and Hong Kong.

However, due to lack of awareness, expertise, and other operational challenges, most of the organizations struggle to optimally utilize the full potential of enterprise WLAN technologies. This has been significantly hindering the growth of the market. Technological giants such as Huawei, Juniper, and Cisco Systems have adopted various growth strategies such as new product launches, partnerships, contracts, collaborations, acquisitions, and expansions to expand their global presence and increase their market shares in the global Enterprise WLAN market.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry trends for Enterprise WLAN?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Vendor Dive: Criteria Weightage

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Attractive Market Opportunities in the Global Market

4.2 Enterprise WLAN Market

4.3 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 41)

5.1 Market Segmentation

5.2 Market Dynamics

6 Enterprise WLAN: Industry Trends (Page No. - 43)

6.1 Enterprise WLAN Market Ecosystem

6.2 Market Evolution

7 Geographic Analysis (Page No. - 46)

7.1 Introduction

7.2 North America

7.2.1 North America: Enterprise WLAN Market Size, By Component

7.2.2 North America: Market Size, By Hardware

7.2.3 North America: Market Size, By Software

7.2.4 North America: Market Size, By Service

7.2.5 North America: Enterprise WLAN Market Size, By Vertical

7.2.4.1 North America: Telecom and IT Market Size, By Component

7.2.4.2 North America: Banking, Financial Services, and Insurance Market Size, By Component

7.2.4.3 North America: Healthcare Market Size, By Component

7.2.4.4 North America: Education Market Size, By Component

7.2.4.5 North America: Municipality and Public Infrastructure Market Size, By Component

7.2.4.6 North America: Hospitality Market Size, By Component

7.2.4.7 North America: Retail Market Size, By Component

7.2.4.8 North America: Logistics Market Size, By Component

7.2.4.9 North America: Others Market Size, By Component

7.2.4.10 North America: Telecom and IT Market Size, By Component

7.3 Europe

7.3.1 Europe: Enterprise WLAN Market Size, By Component

7.3.2 Europe: Market Size By Hardware

7.3.3 Europe: Market Size, By Software

7.3.4 Europe: Market Size, By Service

7.3.5 Europe: Enterprise WLAN Market Size, By Vertical

7.3.5.1 Europe: Telecom and IT Market Size, By Component

7.3.5.2 Europe: Banking, Financial Services, and Insurance By Component

7.3.5.3 Europe: Education Market Size, By Component

7.3.5.4 Europe: Healthcare Market Size, By Component

7.3.5.5 Europe: Hospitality Market Size, By Component, 2016 vs 2021

7.3.5.6 Europe: Municipality and Public Infrastructure Market Size, By Component

7.3.5.7 Europe: Logistics Market Size, By Component

7.3.5.8 Europe: Retail Market Size, By Component

7.3.5.9 Europe: Others Market Size, By Component

7.4 Asia-Pacific

7.4.1 Asia-Pacific: Enterprise WLAN Market Size, By Component

7.4.2 Asia-Pacific: Market Size By Hardware

7.4.3 Asia-Pacific: Market Size, By Software

7.4.4 Asia-Pacific: Market Size, By Service

7.4.5 Asia-Pacific: Enterprise WLAN Market Size, By Vertical

7.4.5.1 Asia-Pacific: Telecom and IT Market Size, By Component

7.4.5.2 Asia-Pacific: Banking, Financial Services, and Insurance, By Component

7.4.5.3 Asia-Pacific: Education Market Size, By Component

7.4.5.4 Asia-Pacific: Healthcare Market Size, By Component

7.4.5.5 Asia-Pacific: Hospitality Market Size, By Component

7.4.5.6 Asia-Pacific: Municipality and Public Infrastructure Market Size, By Component

7.4.5.7 Asia-Pacific: Logistics Market Size, By Component

7.4.5.8 Asia-Pacific: Retail Market Size, By Component

7.4.5.9 Asia-Pacific: Others Market Size, By Component

7.5 Middle East and Africa

7.5.1 Middle East and Africa: Enterprise WLAN Market Size, By Component

7.5.2 Middle East and Africa: Market Size By Hardware

7.5.3 Middle East and Africa: Market Size, By Software

7.5.4 Middle East and Africa: Market Size, By Service

7.5.5 Middle East and Africa: Enterprise WLAN Market Size, By Vertical

7.5.5.1 Middle East and Africa: Telecom and IT Market Size, By Component

7.5.5.2 Middle East and Africa: Banking, Financial Services, and Insurance, By Component

7.5.5.3 Middle East and Africa: Education Market Size, By Component

7.5.5.4 Middle East and Africa: Healthcare, By Component

7.5.5.5 Middle East and Africa: Hospitality Market Size, By Component

7.5.5.6 Middle East and Africa: Municipality and Public Infrastructure Market Size, By Component

7.5.5.7 Middle East and Africa: Logistics Market Size, By Component

7.5.5.8 Middle East and Africa: Retail Market Size, By Component

7.5.5.9 Middle East and Africa: Others Market Size, By Component

7.6 Latin America

7.6.1 Latin America: Enterprise WLAN Market Size, By Component

7.6.2 Latin America: Market Size By Hardware

7.6.3 Latin America: Market Size, By Software

7.6.4 Latin America: Market Size, By Service

7.6.5 Latin America: Market Size, By Vertical

7.6.5.1 Latin America: Telecom and IT Market Size, By Component

7.6.5.2 Latin America: Banking, Financial Services, and Insurance market Size, By Component

7.6.5.3 Latin America: Education Market Size, By Component

7.6.5.4 Latin America: Healthcare Market Size, By Component

7.6.5.5 Latin America: Hospitality Market Size, By Component

7.6.5.6 Latin America: Municipality and Public Infrastructure Market Size, By Component

7.6.5.7 Latin America: Logistics Market Size, By Component

7.6.5.8 Latin America: Retail Market Size, By Component

7.6.5.9 Latin America: Others Market Size, By Component

8 Competitive Landscape (Page No. - 101)

8.1 Enterprise WLAN: Market Vendor Analysis

9 Company Profiles (Page No. - 108)

9.1 Introduction

9.2 Cisco Systems Inc.

9.3 Juniper Networks

9.4 Huawei Technologies Co. Ltd.

9.5 Alcatel Lucent Enterprises

9.6 Aruba Networks

9.7 Ruckus Wireless, Inc.

9.8 Aerohive Networks

9.9 Dell Inc.

9.10 Extreme Networks

9.11 ZTE Corporation

9.12 Fortinet

9.13 Avaya

9.14 WiFi Spark

9.15 Boingo Wireless

9.16 Allied Telesis

10 Appendix (Page No. - 155)

10.1 Key Industry Insights

10.2 Discussion Guide

10.3 Knowledge Store: MarketsandMarkets Subscription Portal

10.4 Introducing RT: Real-Time Market Intelligence

10.5 Available Customizations

10.6 Related Reports

List of Tables (72 Tables)

Table 1 Enterprise WLAN Market Size, By Region, 20142021 (USD Million)

Table 2 North America: Market Size By Component, 20142021 (USD Million)

Table 3 North America: Market Size, By Hardware, 20142021 (USD Million)

Table 4 North America: Market Size, By Software, 20142021 (USD Million)

Table 5 North America: Market Size, By Service, 20142021 (USD Million)

Table 6 North America: Enterprise WLAN Market Size By Vertical, 20142021 (USD Million)

Table 7 North America: Telecom and IT Market Size, By Component, 20142021 (USD Million)

Table 8 North America: Banking, Financial Services, and Insurance Market Size, By Component, 20142021 (USD Million)

Table 9 North America: Healthcare Market Size, By Component, 20142021 (USD Million)

Table 10 North America: Education Market Size, By Component, 20142021 (USD Million)

Table 11 North America: Municipality and Public Infrastructure Market Size, By Component, 20142021 (USD Million)

Table 12 North America: Hospitality Market Size, By Component, 20142021 (USD Million)

Table 13 North America: Retail Market Size, By Component, 20142021 (USD Million)

Table 14 North America: Logistics Market Size, By Component, 20142021 (USD Million)

Table 15 North America: Others Market Size, By Component, 20142021 (USD Million)

Table 16 Europe: Enterprise WLAN Market Size, By Component, 20142021 (USD Million)

Table 17 Europe: Market Size, By Hardware, 20142021 (USD Million)

Table 18 Europe: Market Size, By Software, 20142021 (USD Million)

Table 19 Europe: Market Size, By Service, 20142021 (USD Million)

Table 20 Europe: Enterprise WLAN Market Size, By Vertical, 20142021 (USD Million)

Table 21 Europe: Banking, Financial Services, and Insurance Market Size, By Component, 20142021 (USD Million)

Table 22 Europe: Telecom and IT Market Size, By Component, 20142021 (USD Million)

Table 23 Europe: Healthcare Market Size, By Component, 20142021 (USD Million)

Table 24 Europe: Education Market Size, By Component, 20142021 (USD Million)

Table 25 Europe: Municipality and Public Infrastructure Market Size, By Component, 20142021 (USD Million)

Table 26 Europe: Hospitality Market Size, By Component, 20142021 (USD Million)

Table 27 Europe: Retail Market Size, By Component, 20142021 (USD Million)

Table 28 Europe: Logistics Market Size, By Component, 20142021 (USD Million)

Table 29 Europe: Others Market Size, By Component, 20142021 (USD Million)

Table 30 Asia-Pacific: Enterprise WLAN Market Size, By Component, 20142021 (USD Million)

Table 31 Asia-Pacific: Market Size, By Hardware, 20142021 (USD Million)

Table 32 Asia-Pacific: Market Size, By Software, 20142021 (USD Million)

Table 33 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 34 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Million)

Table 35 Asia-Pacific: Telecom and IT Market Size, By Component, 20142021 (USD Million)

Table 36 Asia-Pacific: Banking, Financial Services, and Insurance Market Size, By Component, 20142021 (USD Million)

Table 37 Asia-Pacific: Healthcare Market Size, By Component, 20142021 (USD Million)

Table 38 Europe: Enterprise WLAN Market Size By Vertical, 20142021 (USD Million)

Table 39 Asia-Pacific: Education Market Size, By Component, 20142021 (USD Million)

Table 40 Asia-Pacific: Municipality and Public Infrastructure Market Size, By Component, 20142021 (USD Million)

Table 41 Asia-Pacific: Hospitality Market Size, By Component, 20142021 (USD Million)

Table 42 Asia-Pacific: Retail Market Size, By Component, 20142021 (USD Million)

Table 43 Asia-Pacific: Logistics Market Size, By Component, 20142021 (USD Million)

Table 44 Asia-Pacific: Others Market Size, By Component, 20142021 (USD Million)

Table 45 Middle East and Africa: Enterprise WLAN Market Size, By Component, 20142021 (USD Million)

Table 46 Middle East and Africa: Market Size, By Hardware, 20142021 (USD Million)

Table 47 Middle East and Africa: Market Size, By Software, 20142021 (USD Million)

Table 48 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 49 Middle East and Africa: Enterprise WLAN Market Size, By Vertical, 20142021 (USD Million)

Table 50 Middle East and Africa: Banking, Financial Services, and Insurance Market Size, By Component, 20142021 (USD Million)

Table 51 Middle East and Africa: Telecom and IT Market Size, By Component, 20142021 (USD Million)

Table 52 Middle East and Africa: Health Care Market Size, By Component, 20142021 (USD Million)

Table 53 Middle East and Africa: Education Market Size, By Component, 20142021 (USD Million)

Table 54 Middle East and Africa: Municipality and Public Infrastructure Market Size, By Component, 20142021 (USD Million)

Table 55 Middle East and Africa: Hospitality Market Size, By Component, 20142021 (USD Million)

Table 56 Middle East and Africa: Retail Market Size, By Component, 20142021 (USD Million)

Table 57 Middle East and Africa: Logistics Market Size, By Component, 20142021 (USD Million)

Table 58 Middle East and Africa: Others Market Size, By Component, 20142021 (USD Million)

Table 59 Latin America: Enterprise WLAN Market Size, By Component, 20142021 (USD Million)

Table 60 Latin America: Market Size, By Hardware, 20142021 (USD Million)

Table 61 Latin America: Market Size, By Software, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 63 Latin America: Enterprise WLAN Market Size, By Vertical, 20142021 (USD Million)

Table 64 Latin America: Banking, Financial Services, and Insurance Market Size, By Component, 20142021 (USD Million)

Table 65 Latin America: Telecom and IT Market Size, By Component, 20142021 (USD Million

Table 66 Latin America: Healthcare Market Size, By Component, 20142021 (USD Million)

Table 67 Latin America: Education Market Size, By Component, 20142021 (USD Million)

Table 68 Latin America: Municipality and Public Infrastructure Market Size, By Component, 20142021 (USD Million)

Table 69 Latin America: Hospitality Market Size, By Component, 20142021 (USD Million)

Table 70 Latin America: Retail Market Size, By Component, 20142021 (USD Million)

Table 71 Latin America: Logistics Market Size, By Component, 20142021 (USD Million)

Table 72 Latin America: Others Market Size, By Component, 20142021 (USD Million)

List of Figures (110 Figures)

Figure 1 Enterprise WLAN: Markets Covered

Figure 2 Enterprise WLAN Market: Research Design

Figure 3 Market Breakdown and Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Enterprise WLAN Market: Research Assumptions

Figure 7 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 8 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 WLAN Analytics Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 WLAN Software Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 Municipality & Public Infrastructure Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 North America is Estimated to Hold the Largest Share of the Enterprise WLAN Market in 2016

Figure 13 Increase in Business and Vertical-Specific Applications is Expected to Drive the Market

Figure 14 Wireless Location Appliance Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Municipality and Public Infrastructure Vertical and North America to Hold the Highest CAGR of the Enterprise WLAN Market for 2016

Figure 16 North America is Expected to Be in the High Growth Phase in 2016

Figure 17 Drivers, Restraints, Opportunities, and Challenges

Figure 18 Enterprise WLAN Market Ecosystem

Figure 19 Enterprise WLAN: Market Evolution

Figure 20 Asia-Pacific Region is Expected to Grow at the Highest CAGR, During the Forecast Period

Figure 21 Regional Snapshot: Asia-Pacific is the Emerging Region in the Enterprise WLAN Market Analysis

Figure 22 North America: Enterprise WLAN Market Snapshot

Figure 23 North America: Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 24 North America: Market Size By Hardware, 2016 vs 2021 (USD Million)

Figure 25 North America: Market Size, By Software, 2016 vs 2021 (USD Million)

Figure 26 North America: Market Size, By Service, 2016 vs 2021 (USD Million))

Figure 27 North America: Enterprise WLAN Market Size, By Vertical, 2016 vs 2021 (USD Million)

Figure 28 North America: Telecom and IT Market Size, By Component, 2016 vs 2021 (USD Million))

Figure 29 North America: Banking, Financial Services, and Insurance Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 30 North America: Healthcare Market Size, By Component, 2016 vs 2021 (USD Million

Figure 31 North America: Education Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 32 North America: Municipality and Public Infrastructure Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 33 North America: Hospitality Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 34 North America: Retail Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 35 North America: Logistics Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 36 North America: Others Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 37 Europe: Enterprise WLAN Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 38 Europe: Market Size, By Hardware, 2016 vs 2021 (USD Million)

Figure 39 Europe: Market Size, By Software, 2016 vs 2021 (USD Million)

Figure 40 Europe: Market Size, By Service, 2016 vs 2021 (USD Million)

Figure 41 Europe: Enterprise WLAN Market Size, By Vertical, 2016 vs 2021 (USD Million)

Figure 42 Europe: Banking, Financial Services, and Insurance Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 43 North America: Hospitality Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 44 Europe: Healthcare Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 45 Europe: Education Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 46 Europe: Municipality and Public Infrastructure Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 47 Europe: Hospitality Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 48 Europe: Retail Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 49 Europe: Logistics Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 50 Europe: Others Market Size, By Component, 2016 vs 2021 (USD Million)

Figure 51 WLAN Hardware in Asia-Pacific to Hold the Largest Market Size in 2016 and 2021

Figure 52 Wireless Access Points in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 53 WLAN Management Software in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 54 Professional Services in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 55 Education in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 56 WLAN Hardware for Telecom and IT Vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 57 WLAN Hardware for BFSI Vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 58 WLAN Hardware for Healthcare vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 59 WLAN Hardware for Education Vertical in Asia-Pacific to Hold the Largest Enterprise WLAN Market Share, 2016 vs 2021 (USD Million)

Figure 60 WLAN Hardware for Municipality and Public Infrastructure Vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 61 WLAN Hardware for Hospitality Vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 62 WLAN Hardware for Retail Vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 63 WLAN Hardware for Logistics Vertical in Asia-Pacific to Hold the Largest Market Share , 2016 vs 2021 (USD Million)

Figure 64 WLAN Hardware for Others Vertical in Asia-Pacific to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 65 WLAN Hardware in Middle East and Africa to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 66 Access Points In Middle East and Africa to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 67 WLAN Management Software in Middle East and Africa to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 68 Professional Services in Middle East and Africa to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 69 Municipality and Infrastructure in Middle East and Africa to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 70 WLAN Hardware to Hold the Largest Market Share of BFSI Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 71 WLAN Hardware to Hold the Largest Market Share of Telecom and IT Vertical in Middle East and Africa , 2016 vs 2021 (USD Million)

Figure 72 WLAN Hardware to Hold the Largest Market Share of Healthcare Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 73 WLAN Hardware to Hold the Largest Enterprise WLAN Market Share of Education Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 74 WLAN Hardware to Hold the Largest Market Share of Municipality and Public Infrastructure Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 75 WLAN Hardware to Hold the Largest Market Share of Hospitality Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 76 WLAN Hardware to Hold the Largest Market Share of Retail Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 77 WLAN Hardware to Hold the Largest Market Share of Logistics Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 78 WLAN Hardware to Hold the Largest Market Share of Others Vertical in Middle East and Africa, 2016 vs 2021 (USD Million)

Figure 79 WLAN Hardware in Latin America to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 80 Wireless Access Points in Latin America to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 81 WLAN Management Software in Latin America to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 82 Professional Services in Latin America to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 83 Municipality and Public Infrastructure in Latin America to Hold the Largest Market Share, 2016 vs 2021 (USD Million)

Figure 84 WLAN Hardware to Hold the Largest Market Share of BFSI Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 85 WLAN Hardware to Hold the Largest Market Share of Telecom and IT Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 86 WLAN Hardware to Hold the Largest Market Share of Healthcare Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 87 WLAN Hardware to Hold the Largest Market Share of Education Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 88 WLAN Hardware to Hold the Largest Market Share of Municipality and Public Infrastructure Vertical I Latin America, 2016 vs 2021 (USD Million)

Figure 89 WLAN Hardware to Hold the Largest Market Share of Hospitality Vertical in Latin America, 2016 vs 2021 (USD Million) in Enterprise WLAN Market

Figure 90 WLAN Hardware to Hold the Largest Market Share of Retail Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 91 WLAN Hardware to Hold the Largest Market Share of Logistics Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 92 WLAN Hardware to Hold the Largest Market Share of Others Vertical in Latin America, 2016 vs 2021 (USD Million)

Figure 93 DIVE Quadrant Representation

Figure 94 Moon Chart: Product Offering

Figure 95 Moon Chart: Business Strategy

Figure 96 Moon Chart for Cisco Systems, Inc.

Figure 97 Moon Chart for Juniper Networks

Figure 98 Moon Chart for Huawei Technologies Co. Ltd.

Figure 99 Moon Chart for Alcatel-Lucent Enterprise

Figure 100 Moon Chart for Aruba Networks

Figure 101 Moon Chart for Ruckus Wireless, Inc.

Figure 102 Moon Chart for Aerohive Networks

Figure 103 Moon Chart for Dell Inc.

Figure 104 Moon Chart for Extreme Networks

Figure 105 Moon Chart for ZTE Corporation

Figure 106 Moon Chart for Fortinet

Figure 107 Moon Chart for Avaya Inc

Figure 108 Moon Chart for WiFi Spark

Figure 109 Moon Chart for Boingo Wireless

Figure 110 Moon Chart for Allied Telesis

Growth opportunities and latent adjacency in Enterprise WLAN Market