Database Encryption Market by Types (Transparent Encryption, File-system Encryption, Application-level Encryption, Column-level Encryption, Hashing and Key Management), by End User, by Deployment Types, by region - Global Forecast to 2020

[125 Pages Report] The global Database Encryption Market size was USD 261.8 Million in 2015 and is projected to reach USD 968.3 Million by 2020, growing at a Compound Annual Growth Rate (CAGR) of 29.9% during the forecast period.

The database encryption market is witnessing tremendous growth and presents many opportunities, making it a lucrative market. The increasing volume of business and customer data generated among organizations has led to the threats of theft or being hacked, which are driving the adoption of database encryption solutions. The major area of opportunities for database encryption is the increasing demand for cloud-based database and cloud-based database encryption solutions. The need to comply with regulatory mandates by the government and other regulatory authorities and the increasing digitalization among the organizations and the economies are some of the major factors boosting the growth in the market. The growing demand for database encryption solutions owes to the availability of flexible encryption solutions is supporting the growth of this market. The overall market has been segmented by type, deployment type, end user, and industry vertical. This study has been done on a global level, covering five regions broadly, namely, North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. The research methodology used to estimate and forecast the database encryption market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

The breakdown of profiles of primary is depicted in the below figure:

Key Target Audience

- Encryption Solution Providers

- Open Source Providers (ODBC & JDBC)

- Internet Service Providers (ISPs)

- Third-Party Providers

- Cloud Service Providers

- System Integrators

- Technology Infrastructure

- Networking Companies

- Application Design and Development Providers

Scope of the Report

The research report segments the Database Encryption market to following sub-markets:

Database Encryption Business Model

By Database Encryption Type

- Transparent Encryption

- Column-level Encryption

- File-system Encryption

- Application- Level Encryption

- Key Management

Database Operational Models

- Data-at-Rest

- Data-in-Motion

By Deployment Type

- On-Premises

- Cloud

By End User

- SMBs

- Enterprises

By Vertical:

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail and E-commerce

- Government & Public sectors

- Aerospace & Defense

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The database encryption market is expected to grow from USD 261.8 Million in 2015 to USD 968.3 Million by 2020, at a Compound Annual Growth Rate (CAGR) of 29.9%. In 1961, a computer based login and password was developed to allow more users to work on a single machine. This increased the risk of data leakage due to which, in 1979, the Data Encryption Standard was launched. In 1996, another standard was launched called the Advanced Encryption Standard (AES), to reduce the risk of security breach. Moreover, in 2012, personal data lockers were launched so that organizations can secure their financial and personal information. Furthermore, the rising need for organizations to comply with regulatory standards, the growing demand for cloud-based database, and the availability of flexible encryption software are some factors which are driving the growth in the adoption of the database encryption software.

The extensive usage of mobile devices, social media, and virtual storage among organizations and consumers has generated huge data which is vulnerable to loss. Such sensitive information is stored in the form of database and is warehoused in data centers or in virtual storages. Furthermore, companies store these databases in heterogeneous environments, ranging from business networks to diverse type of clouds. However, this vast and sensitive information is vulnerable to loss and breaches with the rising number of cyber-attacks. Thus, this encourages organizations to adopt robust database encryption software that offers multilevel encryption, regardless of the heterogeneous environment.

Small- and medium-sized businesses are estimated to exhibit the highest adoption rate; the wide adoption of cloud-based database will present the new opportunities and growth prospects to drive the database encryption market in future. Various database encryption types such as transparent/external encryption, column level encryption, file system encryption, application level encryption, and key management features allow users to encrypt the confidential business and private data according to their needs. Some of the major players offering database encryption solutions with these features include IBM, Symantec Corporation, HP, Microsoft Corporation, Sophos, Vormetric, McAfee (Intel Security), and Net App.

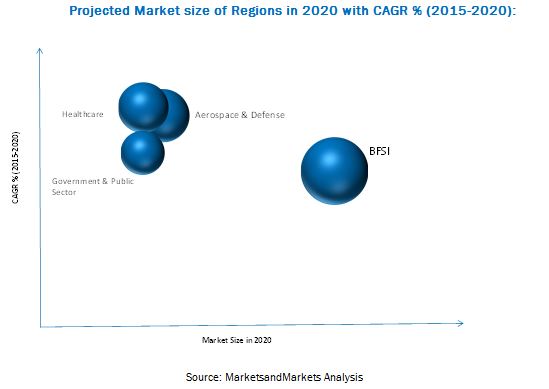

These database encryption features comply with various standards such as AES, RSA, Blowfish, and others that are prevalent among various industries. Various regulatory mandates such as PCIDSS, HIPPA, GLB, and FIPS have to be adhered to mandatorily by various industries such as BFSI, healthcare, IT & telecom, government & public sector, retail & e-commerce, and aerospace & defense. The BFSI, healthcare, and IT & telecom verticals are expected to have the largest database encryption market share. Database encryption solutions can be deployed both on-premises and cloud.

Factors such as high cost of encryption solutions and lack of proper key management are some of the factors restraining the growth of the market. However, the increasing demand for cloud-based encryption solutions is expected to drive the growth of the market in the future. The companies have also adopted various organic and inorganic growth strategies to increase their share in the market. New product/service launch is the major key strategy followed by companies such as IBM, Symantec, McAfee, and Oracle. This strategy accounted for 46% of the total strategic developments in the market. Furthermore, companies such as McAfee and Vormetric have also adopted strategic partnerships and collaborations as an important strategy to enhance their product offerings and distribution networks in the local market. This strategy accounted for 14% of the total strategic developments in the database encryption market. The mergers and acquisitions strategy accounted for 29% of the total strategic developments and is adopted by top database encryption companies such as IBM and Gemalto.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.3.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Database Encryption Market

4.2 Market Snapshot, By Vertical

4.3 Market Size of Top Three Verticals and Regions

4.4 Global Database Encryption Lifecycle Analysis, 2015

5 Database Encryption Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Database Encryption Type

5.3.2 By Deployment Type

5.3.3 By End User

5.3.4 By Vertical

5.3.5 By Region

5.4 Database Encryption Market Dynamics

5.4.1 Drivers

5.4.1.1 Need of Organizations to Comply With Regulatory Standards

5.4.1.2 Growing Demand for Cloud-Based Database

5.4.1.3 Availability of Flexible Encryption Software

5.4.2 Restraints

5.4.2.1 High Cost Encryption Solutions

5.4.2.2 Lack of Proper Key Management

5.4.3 Opportunities

5.4.3.1 Increasing Demand for Cloud Based Encryption Solutions

5.4.4 Challenges: Impact Analysis

5.4.4.1 Heterogeneous IT Environment

5.5 Regulatory Impact

5.5.1 GLB

5.5.2 FIPS

5.5.3 PCI Dss

5.5.4 HIPAA

6 Database Encryption Market: Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.4 Encryption Algorithms

6.4.1 Des and Triple Des

6.4.2 Advanced Encryption Standard

6.4.2.1 Aes 256 Bit Encryption

6.4.2.2 Aes-128 Bit Encryption

6.4.2.3 Xxtea-128 Bit Encryption

6.4.2.4 RSA

6.4.2.5 Blowfish

6.4.2.6 Twofish

6.4.2.7 Conclusion

7 Database Encryption Market Analysis, By Type (Page No. - 50)

7.1 Introduction

7.2 Database Encryption Types

7.2.1 Transparent/External Database Encryption

7.2.2 Column Level Encryption

7.2.3 File-System Encryption

7.2.4 Application-Level Encryption

7.2.5 Key Management

7.3 Database Operational Models

7.3.1 Data-At-Rest

7.3.2 Data-In-Motion

8 Database Encryption Market Analysis, By Deployment Type (Page No. - 53)

8.1 Introduction

8.2 On-Premises

8.3 Cloud Deployment

9 Database Encryption Market Analysis, By Organization Size (Page No. - 58)

9.1 Introduction

9.2 Small and Medium Enterprises

9.3 Enterprises

10 Database Encryption Market Analysis, By Vertical (Page No. - 62)

10.1 Introduction

10.2 BFSI

10.3 Healthcare

10.4 Government and Public Sector

10.5 Retail and E-Commerce

10.6 IT and Telecom

10.7 Aerospace and Defense

10.8 Others

11 Geographic Analysis (Page No. - 70)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.5 Middle East and Africa

11.5.1 Kingdom of Saudi Arabia

11.6 Latin America

11.6.1 Mexico

11.6.2 Brazil

12 Competitive Landscape (Page No. - 89)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 Agreements, Partnerships, Collaborations, and Joint Ventures

12.2.3 Mergers and Acquisitions

12.2.4 Expansions

13 Company Profiles (Page No. - 95)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 International Business Machines Corporation

13.3 Symantec Corporation

13.4 Intel Security (Mcafee)

13.5 Microsoft Corporation

13.6 Oracle Corporation

13.7 Netapp, Inc.

13.8 Hewlett-Packard Company

13.9 Vormetric

13.10 Sophos Ltd

13.11 Gemalto

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 119)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (53 Tables)

Table 1 Global Database Encryption Market Size and Growth, 20132020 (USD Million, Y-O-Y %)

Table 2 Drivers: Impact Analysis

Table 3 Restraints: Impact Analysis

Table 4 Opportunities: Impact Analysis

Table 5 Challenges: Impact Analysis

Table 6 Database Encryption Market Size, By Deployment Type, 20132020 (USD Million)

Table 7 On-Premises: Market Size, By Region, 20132020 (USD Million)

Table 8 On-Premises: Market Size, By Organization Size, 20132020 (USD Million)

Table 9 Cloud: Market Size, By Region, 20132020 (USD Million)

Table 10 Cloud: Market Size, By Organization Size, 20132020 (USD Million)

Table 11 Database Encryption Market Size, By Organization Size, 20132020 (USD Million)

Table 12 SMES: Market Size, By Region, 20132020 (USD Million)

Table 13 SMES: Market Size, By Deployment Type, 20132020 (USD Million)

Table 14 Enterprises: Market Size, By Region, 20132020 (USD Million)

Table 15 Enterprises: Market Size, By Deployment Type, 20132020 (USD Million)

Table 16 Global Database Encryption Market Size, By Vertical, 20132020 (USD Million)

Table 17 BFSI: Market Size, By Region, 20132020 (USD Million)

Table 18 Healthcare: Market Size, By Region, 20132020 (USD Million)

Table 19 Government and Public Sector: Market Size, By Region, 20132020 (USD Million)

Table 20 Retail and E-Commerce: Market Size, By Region, 20132020 (USD Million)

Table 21 IT and Telecom: Market Size, By Region, 20132020 (USD Million)

Table 22 Aerospace and Defense: Market Size, By Region, 20132020 (USD Million)

Table 23 Others : Market Size, By Region, 20132020 (USD Million)

Table 24 Database Encryption Market Size, By Region, 20132020 (USD Million)

Table 25 North America: Market Size, By Country, 20132020 (USD Million)

Table 26 U.S.: Market Size, By Vertical, 20132020 (USD Million)

Table 27 U.S.: Market Size, By Organzation Size, 20132020 (USD Million)

Table 28 Canada: Market Size, By Vertical, 20132020 (USD Million)

Table 29 Canada: Market Size, By Organzation Size, 20132020 (USD Million)

Table 30 Europe: Database Encryption Market Size, By Country, 20132020 (USD Million)

Table 31 U.K.: Market Size, By Vertical, 20132020 (USD Million)

Table 32 U.K.: Market Size, By Organzation Size, 20132020 (USD Million)

Table 33 Germany: Market Size, By Industry Vertical, 20132020 (USD Million)

Table 34 Germany: Market Size, By Organnization Size, 20132020 (USD Million)

Table 35 France: Database Encryption Market Size, By Vertical, 20132020 (USD Million)

Table 36 France: Market Size, By Organnization Size, 20132020 (USD Million)

Table 37 Asia-Pacific: Market Size, By Country, 20132020 (USD Million)

Table 38 China: Market Size, By Vertical, 20132020 (USD Million)

Table 39 China: Market Size, By Organnization Size, 20132020 (USD Million)

Table 40 Japan: Market Size, By Vertical, 20132020 (USD Million)

Table 41 Japan: Market Size, By Organnization Size, 20132020 (USD Million)

Table 42 Middle East and Africa: Database Encryption Market Size, By Country, 20132020 (USD Million)

Table 43 Kingdom of Saudi Arabia: Market Size, By Vertical, 20132020 (USD Million)

Table 44 Kingdom of Saudi Arabia: Market Size, By Organnization Size, 20132020 (USD Million)

Table 45 Latin America: Market Size, By Country, 20132020 (USD Million)

Table 46 Mexico: Market Size, By Vertical, 20132020 (USD Million)

Table 47 Mexico: Market Size, By Organization Size, 20132020 (USD Million)

Table 48 Brazil: Database Encryption Market Size, By Vertical, 20132020 (USD Million)

Table 49 Brazil: Market Size, By Organization Size, 20132020 (USD Million)

Table 50 New Product Launches, 20122015

Table 51 Agreements, Partnerships, Collaborations, and Joint Ventures, 20122015

Table 52 Mergers and Acquisitions, 20122015

Table 53 Expansions, 20132015

List of Figures (45 Figures)

Figure 1 Market Segmentation

Figure 2 Database Encryption Market: Research Design

Figure 3 Breakdown of Primary Interview: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Database Encryption Market Size, By Vertical, 2015-2020 (USD Million)

Figure 8 Cloud Deployments are Expected to Exhibit the Highest Growth During the Forecast Period

Figure 9 Regional Market Snapshot: Asia-Pacific Expected to Present Opportunities to Drive the Market

Figure 10 Lucrative Growth Prospects in the Market

Figure 11 Lucrative Growth Prospects in Market

Figure 12 North America Expected to Hold the Largest Share in the Database Encryption Market in 2015

Figure 13 Asia-Pacific is Expected to Soon Enter the High Growth Phase

Figure 14 Evolution of Database Encryption

Figure 15 Database Encryption Market Segmentation: By Type

Figure 16 Market Segmentation: By Deployment Type

Figure 17 Market Segmentation: By End User

Figure 18 Market Segmentation: By Vertical

Figure 19 Market Segmentation: By Region

Figure 20 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Value Chain Analysis (2015): Major Role Played By Database Encryption Service Providers

Figure 22 Cloud-Based Database Encryption Software is Expected to Grow at the Highest Rate From 2015 to 2020

Figure 23 North America is Expected to Contribute Substantially Toward On-Premises Database Encryption Market

Figure 24 SMES are Growing Substantially in the Market

Figure 25 BFSI is Growing Substantially Among Industry Verticals in the Database Encryption Market

Figure 26 Asia-Pacific is Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 27 APAC is Expected to Grow at the Highest CAGR During the Forecast Period 2015-2020

Figure 28 North America Market Snapshot: On-Premises Deployment to Contribute Maximum to the Market

Figure 29 Asia-Pacific Market Snapshot: IT and Telecom Industry is Expected to Gain Popularity Among the Users

Figure 30 Companies Adopted New Product Launch as the Key Growth Strategy During 20122015

Figure 31 Database Encryption Market Evaluation Framework

Figure 32 Battle for Market Share: New Product Launch Was the Key Strategy

Figure 33 Geographic Revenue Mix of Top 4 Market Players

Figure 34 IBM: Company Snapshot

Figure 35 IBM: SWOT Analysis

Figure 36 Symantec Corporation: Company Snapshot

Figure 37 Symantec: SWOT Analysis

Figure 38 Intel Security: SWOT Analysis

Figure 39 Microsoft Corporation: Company Snapshot

Figure 40 Microsoft Corporation: SWOT Analysis

Figure 41 Oracle Corporation: Company Snapshot

Figure 42 Oracle: SWOT Analysis

Figure 43 Netapp, Inc: Company Snapshot

Figure 44 Hewlett-Packard Company: Company Snapshot

Figure 45 Gemalto : Company Snapshot

Growth opportunities and latent adjacency in Database Encryption Market