Electronic Load Market by Voltage (Low, High), Current Type (AC, DC), Application (Aerospace, Defense & Government Services, Automotive, Energy, Wireless Communication and Infrastructure, and Others), Region- Global Trends and Forecast to 2024

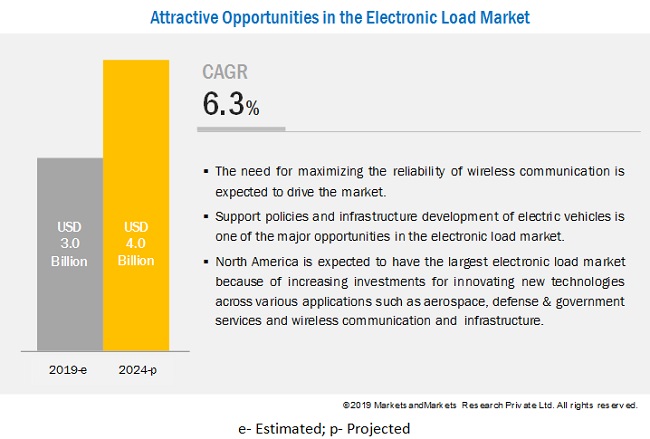

[146 Pages Report] The global electronic load market size is projected to reach USD 4.0 billion by 2024, from an estimated value of USD 3.0 billion in 2019, growing at a CAGR of 6.3 % during the forecast period. The growth is attributed to the increasing investments in wireless communication for the deployment of a 5G network.

Low voltage is expected to be the largest contributor to the electronic load market, by voltage, during the forecast period

The market is segmented into low and high voltage electronic load. Low voltage electronic load accounted for the highest share of electronic load industry in 2018. Growing demand for testing and measuring of equipment at the early stage of development to avoid malfunctioning at a later stage is expected to drive the market.

The DC segment is expected to lead the electronic load market, by current type, during the forecast period

The market is segmented into DC and AC electronic load. The DC segment is expected to be the fastest-growing market during 2019 to 2024. DC electronic loads are used for testing power devices such as power supplies, power converter and inverter testing, batteries, automotive charging stations, solar panels, fuel-cells, and other power electronics components. Thus, the increase in demand for these devices is likely to drive the DC electronic load market during the forecast period.

Wireless communication & infrastructure is expected to be the largest market, by application, during the forecast period

Wireless communication and infrastructure accounted for the largest share of the electronic load market during the forecast period. Wireless infrastructure is the support system for communication and an essential component for any countrys economy. It is used across various industries such as aerospace, automotive, and consumer electronics, among others, as it provides reliable control system and improves productivity. Thus, increasing dependency on wireless communication has raised the demand for electronic load for various wireless and power supply testing to ensure efficient operation of the electronic components.

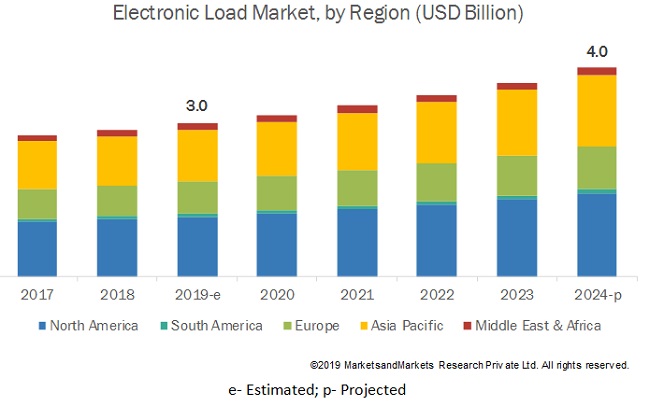

North America is expected to be the largest market for electronic load market during the forecast period

In this report, electronic load industry has been analyzed for five regions, namely, North America, South America, Europe, Asia Pacific, Middle East & Africa. North America is estimated to be the largest market from 2019 to 2024 and is expected to see a high demand for electronic load due to the increased investment in R&D across various end-use sectors. Also, the adoption of 5G technology is expected to boost the electronic load market in the region.

Key Market Players

The major players in the global electronic load market such as Keysight Technologies (US), AMETEK (US), National Instruments (US), Chroma ATE (Taiwan), and Teledyne Technologies (US).

Keysight Technologies provides electronic design and test solutions to communications, networking, and electronics industries. It operates through four main business segments, namely, communications solutions group, electronic industrial solutions group, Ixia solutions group, and services solutions group. The electronic industrial solutions group offer electronic load for testing solutions. It has an extensive sales strategy that uses direct sales force, distributors, resellers and manufacturer's representatives. It specializes in electronic design and test software, instruments, and systems used in the simulation, design, validation, manufacturing, installation, and optimization of electronic equipment. Keysight Technologies operates in various global region such as North America, Asia Pacific, and Europe.

Another major player in the market is AMETEK. The company offers electronic instruments and electromechanical devices. Its key strategy is to focus on growing investment and strategic acquisition. It has two business segments namely, electronic instruments and electromechanical devices. The electronic instruments business segment designs and manufactures advanced analytical, test, and measurement instrumentation for the energy, aerospace, power, research, medical, and industrial markets. The company operates in North America, Europe, Asia and South America. AMETEK Programmable Power is a subsidiary of AMETEK which offers AC and DC electronic load.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Voltage, current type, application, and region |

|

Geographies covered |

North America, South America, Asia Pacific, Europe, and Middle East & Africa |

|

Companies covered |

Keysight Technologies (US), AMETEK (US), National Instrument (US), Chroma ATE (Taiwan), Teledyne Technologies (US) |

This research report categorizes the electronic load market by voltage, current type, application, and region.

By Voltage:

- High Voltage

- Low Voltage

By Application:

- Aerospace, Defense & Government Services

- Automotive

- Energy

- Wireless Communications & Infrastructure

- Others

By Current Type:

- AC

- DC

By Region:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- Which revolutionary technology trends are expected over the next five years?

- Which elements of the electronic load market are expected to lead by 2024?

- Which type of electronic load is likely to get the maximum opportunity to grow during the forecast period?

- Which region is expected to lead with the highest market share by 2024?

- How are companies implementing organic and inorganic strategies to gain an increase in the electronic load market share?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Electronic Load Market, By Voltage: Inclusions & Exclusions

1.2.2 Market, By Current Type: Inclusions & Exclusions

1.2.3 Market, By Application: Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.1.1 Key Data From Primary Sources

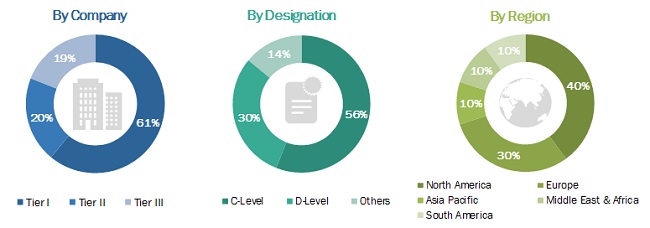

2.1.1.2 Breakdown of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Supply-Side Analysis

2.3.1.1 Assumptions

2.3.1.1.1 Key Primary Insights

2.3.1.2 Calculation

2.3.2 Demand Analysis

2.3.2.1 Key Parameters/Trends

2.3.3 Forecast

2.4 Market Breakdown and Data Triangulation

2.5 Primary Insights

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Electronic Load Market

4.2 Market, By Region

4.3 North American Market, By End-User & Country

4.4 Market, Voltage

4.5 Market, By Current Type

4.6 Market, By Application

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Emphasis on Testing of Consumer Electronics & Appliances

5.2.1.2 Maximizing the Reliability of Wireless Communication

5.2.2 Restraints

5.2.2.1 High Capital Cost of Electronic Loads

5.2.3 Opportunities

5.2.3.1 Support Policies and Infrastructure Development for Electric Vehicles (EV)

5.2.3.2 Increasing Investments in Research and Development (R&D) for Test and Measurement Equipment

5.2.4 Challenges

5.2.4.1 Rapid Technological Changes

5.2.4.2 Trade War Threats and Growing Political Instability

6 Electronic Load Market, By Voltage (Page No. - 45)

6.1 Introduction

6.2 High Voltage

6.2.1 Continuous Focus to Produce Highly Energy-Efficient Products is Likely to Drive the High Voltage Segment

6.3 Low Voltage

6.3.1 Rise in the Usage of Portable Devices is Expected to Drive the Low-Voltage Segment

7 Electronic Load Market, By Current Type (Page No. - 49)

7.1 Introduction

7.2 AC

7.2.1 Rising Demand for Test Equipment in R&D is Likely to Drive the AC Electronic Load Segment

7.3 DC

7.3.1 Increasing Investments for Advancements in Battery Technology are Expected to Drive the DC Electronic Load Segment

8 Electronic Load Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Aerospace, Defense & Government Services

8.2.1 Increasing Investments in the Aerospace & Defense Industry are Likely to Drive the Market

8.3 Automotive

8.3.1 Rising Adoption of Electric Vehicles and Increasing Investments for Autonomous Vehicles are Driving the Market

8.4 Energy

8.4.1 Need for Increasing Operational Efficiency is Driving the Market

8.5 Wireless Communication and Infrastructure

8.5.1 Ensuring Efficient Operation of the Electronic Components is Expected to Drive the Demand for Electronic Loads

8.6 Others

9 Electronic Loads Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Focus on R&D for Aerospace & Defense is Expected to Drive the Market in the US

9.2.2 Canada

9.2.2.1 Growing Investments for Autonomous Vehicles are Expected to Drive the Market

9.2.3 Mexico

9.2.3.1 Rise in Foreign Direct Investments (Fdi) for the Automotive Sector is Expected to Drive the Market in Mexico

9.3 Asia Pacific

9.3.1 China

9.3.1.1 Government Support Policies for Electric Mobility are Driving the Market for Electronic Loads

9.3.2 Australia

9.3.2.1 Increasing Adoption of 5G Technology is Driving the Market for Electronic Loads in Australia

9.3.3 Japan

9.3.3.1 Increasing Focus on 5G Deployment is Expected to Drive the Electronic Load Market

9.3.4 India

9.3.4.1 Government Tax Rebates to Increase the Usage of Electric Vehicles is Expected to Drive the Market

9.3.5 South Korea

9.3.5.1 Strong Establishment of 5G Network Infrastructure is Expected to Drive the Electronic Load Market

9.3.6 Rest of Asia Pacific

9.4 Europe

9.4.1 Germany

9.4.1.1 Increasing Demand for Electronic Loads to Test Power Supplies is Expected to Drive the Electronic Load Market in Germany

9.4.2 UK

9.4.2.1 Increase in Focus on Deployment of 5G Network is Expected to Drive the Market

9.4.3 France

9.4.3.1 Increasing Investments in R&D are Expected to Drive the Market in France

9.4.4 Russia

9.4.4.1 Rising Adoption of Electric Vehicles is Expected to Drive the Electronic Load Market

9.4.5 Spain

9.4.5.1 Increasing Subsidies to Promote the Growth of Electric Vehicles are Expected to Drive the Market in Spain

9.4.6 Italy

9.4.6.1 Increase in Focus on Electric Vehicle Support Infrastructure is Expected to Drive the Electronic Load Market

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Middle East

9.5.1.1 Increase in Defense Spending and Focus on Aerospace Manufacturing are Expected to Drive the Demand for Electronic Loads

9.5.2 Africa

9.5.2.1 Increase in Focus on Renewables is Expected to Drive the Demand for Electronic Loads

9.5.3 South America

9.5.4 Brazil

9.5.4.1 Increasing Investments in Aerospace & Defense is Expected to Drive the Market in Brazil

9.5.5 Argentina

9.5.5.1 Government Support Policies for Wireless Communication and Infrastructure is Expected to Drive the Demand for Electronic Loads Market in Argentina

9.5.6 Chile

9.5.6.1 Growth in Wireless Communication and Infrastructure is Expected to Drive the Market in the Country

10 Competitive Landscape (Page No. - 104)

10.1 Overview

10.2 Market Share, 2018

10.3 Competitive Scenario

10.3.1 New Product Developments

10.3.2 Investments & Expansions

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Innovators

10.4.3 Emerging Companies

10.4.4 Dynamic Differentiators

11 Company Profile (Page No. - 110)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Keysight Technologies

11.2 Ametek

11.3 National Instruments

11.4 Chroma Ate

11.5 Teledyne Technologies

11.6 Good Will Instrument

11.7 Rigol Technologies

11.8 B&K Precision

11.9 Tektronix

11.10 Kikusui Electronics

11.11 Matsusada Precision

11.12 Magna-Power Electronics

11.13 NH Research

11.14 Beich Electronics

11.15 Itech Electronics

11.16 Ainuo Instrument

11.17 NF Corporation

11.18 Hφcherl & Hackl

11.19 Array Electronics

11.20 Spellman High Voltage Electronics

11.21 Siglent Technologies

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 139)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (101 Tables)

Table 1 Electronic Load Market: Players/Companies Connected

Table 2 Electronic Load Market: Industry/Country Analysis

Table 3 Electronic Load Market Snapshot

Table 4 Recent Investments in the Indian Consumer Electronics Market

Table 5 Support Policies for Electric Vehicles (EV)

Table 6 Investments By Major Manufacturing Companies in Research & Development

Table 7 Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 8 High Voltage: Market Size, By Region, 20172024 (USD Thousand)

Table 9 Low Voltage: Market Size, By Region, 20172024 (USD Thousand)

Table 10 Electronic Load Market Size, By Current Type, 20172024 (USD Thousand)

Table 11 AC: Electronic Load Market Size, By Region, 20172024 (USD Thousand)

Table 12 DC: Market Size, By Region, 20172024 (USD Thousand)

Table 13 Electronic Load Market Size, By Application, 20172024 (USD Thousand)

Table 14 Aerospace, Defense & Government Services: Market Size, By Region, 20172024 (USD Thousand)

Table 15 Automotive: Electronic Load Market Size, By Region, 20172024 (USD Thousand)

Table 16 Energy: Market Size, By Region, 20172024 (USD Thousand)

Table 17 Wireless Communication and Infrastructure: Market Size, By Region, 20172024 (USD Thousand)

Table 18 Others: Electronic Load Market Size, By Region, 20172024 (USD Thousand)

Table 19 Electronic Load Market Size, By Region, 20172024 (USD Thousand)

Table 20 North America: Market Size, By Voltage, 20172024 (USD Thousand)

Table 21 North America: Market Size, By Current Type, 20172024 (USD Thousand)

Table 22 North America: Market Size, By Application, 20172024 (USD Thousand)

Table 23 North America: Market Size, By Country, 20172024 (USD Thousand)

Table 24 US: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 25 US: Market Size, By Current Type, 20172024 (USD Thousand)

Table 26 US: Market Size, By Application, 20172024 (USD Thousand)

Table 27 Canada: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 28 Canada: Market Size, By Current Type, 20172024 (USD Thousand)

Table 29 Canada: Market Size, By Application, 20172024 (USD Thousand)

Table 30 Mexico: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 31 Mexico: Market Size, By Current Type, 20172024 (USD Thousand)

Table 32 Mexico: Market Size, By Application, 20172024 (USD Thousand)

Table 33 Asia Pacific: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 34 Asia Pacific: Market Size, By Current Type, 20172024 (USD Thousand)

Table 35 Asia Pacific: Market Size, By Application, 20172024 (USD Thousand)

Table 36 Asia Pacific: Market Size, By Country, 20172024 (USD Thousand)

Table 37 China: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 38 China: Market Size, By Current Type, 20172024 (USD Thousand)

Table 39 China: Market Size, By Application, 20172024 (USD Thousand)

Table 40 Australia: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 41 Australia: Market Size, By Current Type, 20172024 (USD Thousand)

Table 42 Australia: Market Size, By Application, 20172024 (USD Thousand)

Table 43 Japan: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 44 Japan: Market Size, By Current Type, 20172024 (USD Thousand)

Table 45 Japan: Market Size, By Application, 20172024 (USD Thousand)

Table 46 India: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 47 India: Market Size, By Current Type, 20172024 (USD Thousand)

Table 48 India: Market Size, By Application, 20172024 (USD Thousand)

Table 49 South Korea: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 50 South Korea: Market Size, By Current Type, 20172024 (USD Thousand)

Table 51 South Korea: Market Size, By Application, 20172024 (USD Thousand)

Table 52 Rest of Asia Pacific: Electronic Load Market Size, By Application, 20172024 (USD Thousand)

Table 53 Rest of Asia Pacific: Market Size, By Country, 20172024 (USD Thousand)

Table 54 Europe: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 55 Europe: Market Size, By Current Type , 20172024 (USD Thousand)

Table 56 Europe: Market Size, By Application, 20172024 (USD Thousand)

Table 57 Europe: Market Size, By Country, 20172024 (USD Thousand)

Table 58 Germany: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 59 Germany: Market Size, By Current Type, 20172024 (USD Thousand)

Table 60 Germany: Market Size, By Application, 20172024 (USD Thousand)

Table 61 UK: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 62 UK: Market Size, By Current Type, 20172024 (USD Thousand)

Table 63 UK: Market Size, By Application, 20172024 (USD Thousand)

Table 64 France: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 65 France: Market Size, By Current Type, 20172024 (USD Thousand)

Table 66 France: Market Size, By Application, 20172024 (USD Thousand)

Table 67 Russia: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 68 Russia: Market Size, By Current Type, 20172024 (USD Thousand)

Table 69 Russia: Market Size, By Application, 20172024 (USD Thousand)

Table 70 Spain: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 71 Spain: Market Size, By Current Type, 20172024 (USD Thousand)

Table 72 Spain: Market Size, By Application, 20172024 (USD Thousand)

Table 73 Italy: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 74 Italy: Market Size, By Current Type, 20172024 (USD Thousand)

Table 75 Italy: Market Size, By Application, 20172024 (USD Thousand)

Table 76 Rest of Europe: Electronic Load Market Size, By Application, 20172024 (USD Thousand)

Table 77 Rest of Europe: Market Size, By Country, 20172024 (USD Thousand)

Table 78 Middle East & Africa: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 79 Middle East & Africa: Market, By Current Type, 20172024 (USD Thousand)

Table 80 Middle East & Africa: Market Size, By Application, 20172024 (USD Thousand)

Table 81 Middle East & Africa: Market Size, By Country, 20172024 (USD Thousand)

Table 82 Middle East: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 83 Middle East: Market, By Current Type, 20172024 (USD Thousand)

Table 84 Middle East: Market Size, By Application, 20172024 (USD Thousand)

Table 85 Africa: Market Size, By Voltage, 20172024 (USD Thousand)

Table 86 Africa: Market, By Current Type, 20172024 (USD Thousand)

Table 87 Africa: Market Size, By Application, 20172024 (USD Thousand)

Table 88 South America: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 89 South America: Market, By Current Type, 20172024 (USD Thousand)

Table 90 South America : Market Size, By Application, 20172024 (USD Thousand)

Table 91 South America: Market Size, By Country, 20172024 (USD Thousand)

Table 92 Brazil: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 93 Brazil: Electronic Loadmarket, By Current Type, 20172024 (USD Thousand)

Table 94 Brazil: Market Size, By Application, 20172024 (USD Thousand)

Table 95 Argentina: Electronic Load Market Size, By Voltage, 20172024 (USD Thousand)

Table 96 Argentina: Market, By Current Type, 20172024 (USD Thousand)

Table 97 Argentina: Market Size, By Application, 20172024 (USD Thousand)

Table 98 Chile: Market Size, By Voltage, 20172024 (USD Thousand)

Table 99 Chile: Electronic Load market, By Current Type, 20172024 (USD Thousand)

Table 100 Chile: Market Size, By Application, 20172024 (USD Thousand)

Table 101 Developments By Key Players in the Electronic Load Market, January 2016November 2019

List of Figures (33 Figures)

Figure 1 Electronic Load Market: Research Design

Figure 2 Research Methodology: Illustration of Electronic Load Company Revenue Estimation (2018)

Figure 3 Ranking of Key Players and Market Share, 2018

Figure 4 Data Triangulation Methodology

Figure 5 Key Service Providers Point of View

Figure 6 North America Dominated the Electronic Load Market in 2018

Figure 7 Low Voltage Segment is Expected to Hold the Largest Share of the Electronic Load Market, By Voltage Type, During the Forecast Period

Figure 8 DC Segment is Expected to Lead the Market, By Current Type, During the Forecast Period

Figure 9 Wireless Communication and Infrastructure Segment is Expected to Lead the Market, By Application, During the Forecast Period

Figure 10 Growth of 5G Technology is Expected to Drive the Market, 20192024

Figure 11 North American Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Aerospace, Defense & Government Services and the US Dominated the Market in 2018

Figure 13 Low Voltage Segment is Projected to Dominate the Market, By Voltage, Until 2024

Figure 14 DC Segment is Projected to Dominate the Market, By Current Type, Until 2024

Figure 15 Wireless Communication and Infrastructure Segment is Projected to Dominate the Market, By Application, Until 2024

Figure 16 Electronic Load: Electronic Load Market Dynamics

Figure 17 Price Trend of Electronic Loads

Figure 18 US and China Trade Relationship

Figure 19 Low Voltage Segment Held the Largest Market Share in 2018

Figure 20 DC Segment Held the Highest Electronic Load Market Share in 2018

Figure 21 Wireless Communication and Infrastructure Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 22 Regional Snapshot: North America Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Electronic Load Market Share, By Region, 2018

Figure 24 North America: Regional Snapshot

Figure 25 Asia Pacific: Regional Snapshot

Figure 26 Key Developments in the Market, 20172019

Figure 27 Keysight Technologies LED the Market in 2018

Figure 28 Electronic Load Market (Global) Competitive Leadership Mapping

Figure 29 Keysight Technologies: Company Snapshot

Figure 30 Ametek: Company Snapshot

Figure 31 National Instruments: Company Snapshot

Figure 32 Chroma Ate: Company Snapshot

Figure 33 Teledyne Technologies: Company Snapshot

This study involved four major activities in estimating the current size of the electronic load market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as US DoE data, industry publications, several newspaper articles, Factiva, and journals to identify and collect information useful for a technical, market-oriented, and commercial study of the electronic load market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The electronic load market comprises several stakeholders such as companies related to the automotive, aerospace, defense & government, wireless communication and infrastructure, consumer electronics & appliances, medical equipment manufacturers, battery manufacturers, power utilities, and solar panel manufacturers. The demand side of the market was derived using the investments by end-user in test and measurement equipment. The supply side is characterized by using the segmental revenue of major players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global electronic load market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the electronic load sector.

Report Objectives

- To define, describe, and forecast the electronic load market based on voltage, current type, application, and region

- To provide detailed information regarding the major factors influencing the growth of the electronic load market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions (along with countries), namely, North America, South America, Asia Pacific, Europe, and Middle East & Africa.

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as contracts & agreements, investments & expansions, new product developments, and partnerships in the electronic load market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Electronic Load Market