Wireless Network Test Equipment Market by Equipment Type (Drive Test Equipment, Monitoring Equipment, OSS with Geolocation Equipment, SON Testing Equipment), Network Technology (2G/3G/4G and 5G), End User, and Region - Global Forecast to 2023

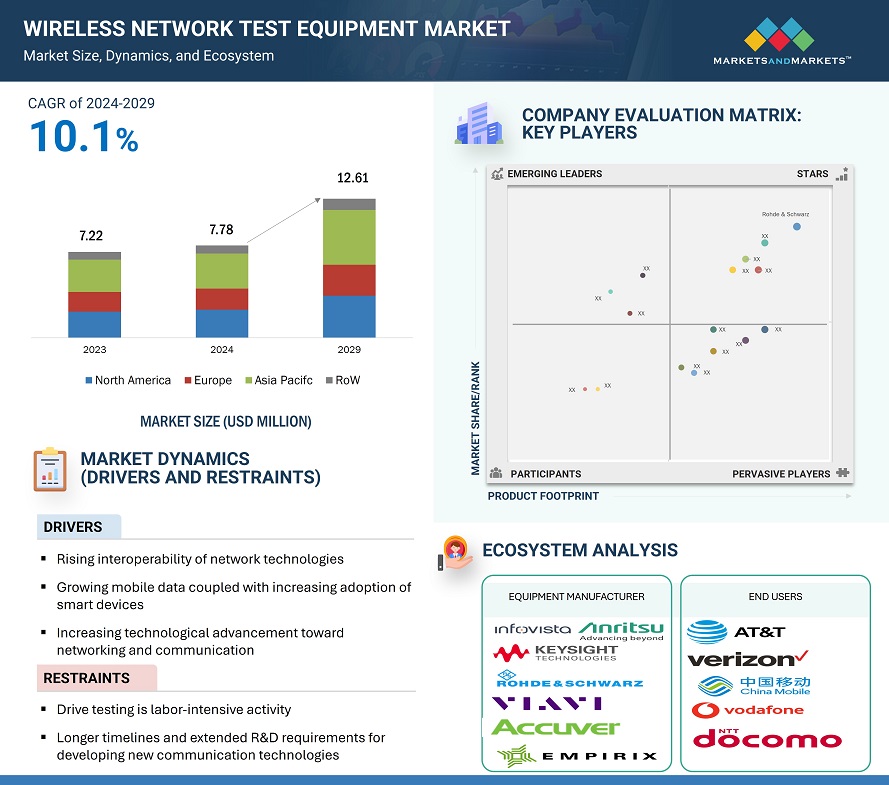

The wireless network test equipment market is projected to grow from USD 7.78 billion in 2024 to USD 12.61 billion by 2029 at a CAGR of 10.1%.

The growth of the wireless network test equipment market is driven by the rapid expansion of wireless communication technologies, such as 5G and Wi-Fi 6/6E, which demand advanced testing solutions to ensure seamless performance. Increasing adoption of IoT devices, smart city projects, and connected ecosystems further fuels the need for robust network testing to manage escalating data traffic and maintain quality of service. Additionally, rising investments in telecom infrastructure by governments and private entities and growing reliance on cloud computing and edge networks amplify the market's trajectory. The competitive pressure to deliver superior user experiences compels network operators and manufacturers to adopt sophisticated test equipment, enhancing the market's appeal.

Attractive Opportunities for Players in Wireless Network Test Equipment Market

To know about the assumptions considered for the study, Request for Free Sample Report

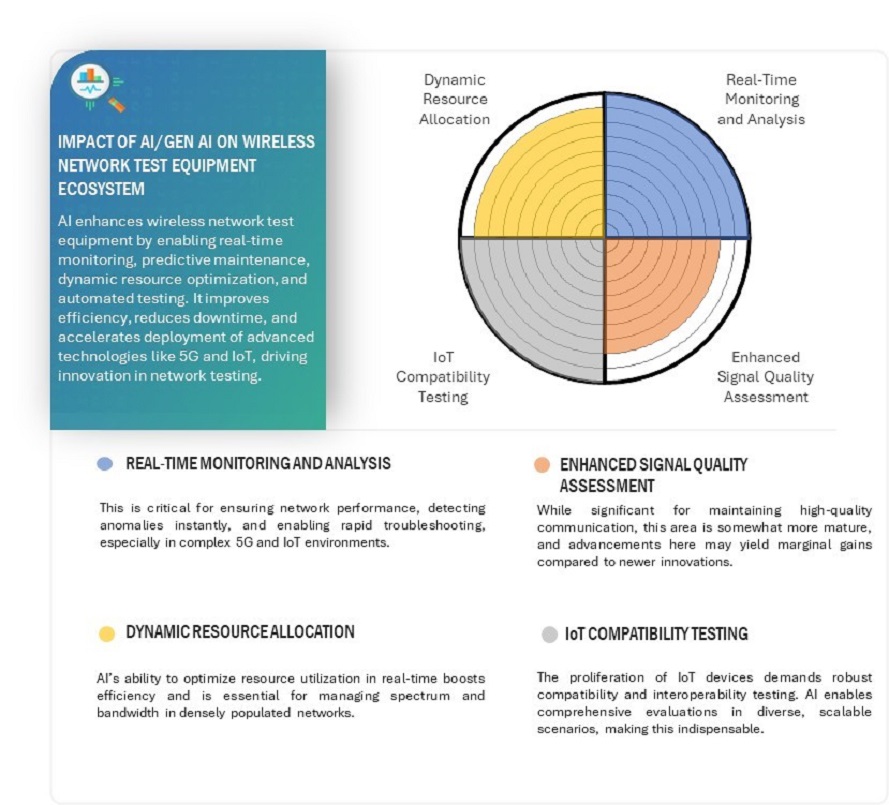

Impact of AI/Gen AI on Wireless Network Test Equipment Market

AI and generative AI significantly transform the wireless network test equipment market by enabling smarter, faster, and more precise testing methodologies. AI-driven analytics enhance fault detection, predictive maintenance, and network optimization, reducing downtime and operational costs. Generative AI facilitates the simulation of complex network scenarios, enabling testing under diverse conditions, including high traffic loads and cybersecurity threats, accelerating time-to-market for wireless solutions. These technologies also streamline the integration of 5G, IoT, and edge networks by automating test processes and generating actionable insights, improving efficiency and accuracy. Furthermore, the increasing reliance on AI-based network management systems encourages test equipment manufacturers to develop AI-compatible tools, fostering innovation and competition in the market. This convergence of AI and test equipment is set to reshape traditional testing paradigms, addressing the challenges of rapidly evolving wireless ecosystems.

Market Dynamics:

Driver: Rising cybersecurity concerns necessitating advanced testing

The growing threat of cyberattacks in wireless networks has become a critical driver for the wireless network testing equipment market. As wireless communication systems, including 5G and IoT networks, become increasingly integral to industries, they are exposed more to sophisticated cyber threats, such as unauthorized access, data breaches, and denial-of-service (DoS) attacks. These risks necessitate advanced testing solutions capable of identifying real-time vulnerabilities and ensuring network operations' integrity and security. Wireless test equipment integrated with cybersecurity testing features allows operators to simulate attacks, assess system resilience, and implement robust security protocols proactively.

The proliferation of connected devices, particularly IoT endpoints, further amplifies the cybersecurity challenge. These devices often lack comprehensive inbuilt security measures, creating additional entry points for attackers. Moreover, industries such as healthcare, finance, and critical infrastructure demand heightened security measures to protect sensitive data and maintain regulatory compliance. Network testing equipment incorporating AI-driven analytics and automated threat detection is increasingly essential to address these concerns effectively.

Investments in advanced wireless testing equipment are growing as organizations prioritize secure communication channels. This trend is expected to persist as cybersecurity remains a top priority in the wireless ecosystem, driving innovation and adoption in the market.

Restraint: Prolonged development timelines and extensive R&D as a market restraint

The extended timelines and substantial R&D requirements for developing new wireless communication technologies significantly restrain the wireless network testing equipment market. The lengthy innovation cycles in mobile communication systems often result in end users continuing to rely on existing network test equipment, reducing the demand for new products. Furthermore, the slow pace of technology adoption and deployment limits the market's annual growth potential.

For example, the commercialization of first-generation (1G) communication systems began in Japan in 1979, and it took a decade for second-generation (2G) systems to emerge, focusing on improving coverage and capacity. Similarly, 3G research commenced in 1992, but the first 3G network based on CDMA was only launched a decade later, in 2002, by SK Telecom in South Korea. The rollout of 4G systems, which rely on Internet Protocol (IP) and LTE standards, also followed a gradual timeline, with Sprint Nextel launching the first WiMAX smartphone, the HTC Evo 4G, in the United States in 2010.

These extended intervals between technological shifts slow the adoption of new test equipment, as existing tools remain relevant for years. Consequently, the demand for frequent upgrades is diminished, constraining market growth. This restraint highlights the challenge for manufacturers to sustain innovation and profitability in a market influenced by the longevity of communication technologies.

Opportunity: Deployment of LTE and LTE-advanced (4G) networks

The roll-out of Long-Term Evolution (LTE) and LTE-Advanced (4G) networks presents a significant opportunity for the wireless network testing equipment market. LTE, a 4G wireless broadband technology developed by the Third Generation Partnership Project (3GPP), has rapidly evolved to meet the growing demand for faster connections and higher bandwidth. The global deployment of LTE networks was initiated to address the surge in mobile data traffic, creating a high demand for network testing solutions. This growing data transfer generates a substantial opportunity for manufacturers of network test equipment.

Currently, handling the transition between LTE and legacy networks during a call is a notable challenge, as LTE offers higher bandwidth compared to traditional networks. When users initiate calls, the data flow is split between LTE and voice services, requiring networks that can seamlessly manage both. Therefore, the widespread adoption of LTE will create significant demand for testing equipment tailored to LTE gateways, access points, and the integration of voice and data services.

Telecom companies are actively upgrading their LTE infrastructure to meet increasing demand for wireless access while also adopting the enhanced capabilities of LTE-Advanced, which serves as a bridge to 5G. This infrastructure development provides a rich opportunity for the wireless network testing equipment market to grow as companies invest in testing solutions to ensure optimal performance and seamless integration of next-generation wireless technologies.

Challenge: Shortage of skilled workforce to interpret collected data

The lack of a skilled workforce to effectively interpret insights from collected network testing data presents a significant challenge for the wireless network test equipment market. As wireless networks become increasingly data-dependent, there is a growing demand for employees with specialized skills to analyze and utilize test results effectively. However, this shift often creates a skill gap between experienced workers and newer employees unfamiliar with advanced testing processes.

While the basic operation of network testing equipment is straightforward and does not require extensive technical expertise, the challenge lies in interpreting the insights derived from the testing data. Some testers rely on personal instincts or prior experience to evaluate network performance, which may lead to inconsistencies and errors. Such subjective judgment can undermine the reliability of diagnostics and predictions provided by advanced testing tools. Furthermore, issues such as dropped metrics, service outages, and inaccurate alert signals may result in skepticism among experienced operators regarding the efficacy of the testing technology.

The challenge is even greater for newer workers, as they may lack the necessary knowledge to interpret data correctly or assess network conditions. This deficiency in skill and understanding hampers the effectiveness of the entire network testing process, posing a challenge to ensuring accurate and reliable network diagnostics.

Market Ecosystem:

The wireless network test equipment market ecosystem involves equipment manufacturers and end user (telecommunications service providers and enterprises) working collaboratively to ensure robust connectivity. Equipment manufacturers provide advanced tools for testing and optimizing modern networks, while service providers and enterprises utilize these solutions to maintain performance, reliability, and support critical applications. This synergy drives innovation and strengthens wireless infrastructure.

Source: Interviews with Experts, Secondary Research, Whitepapers, Journals, Magazines, and MarketsandMarkets Analysis

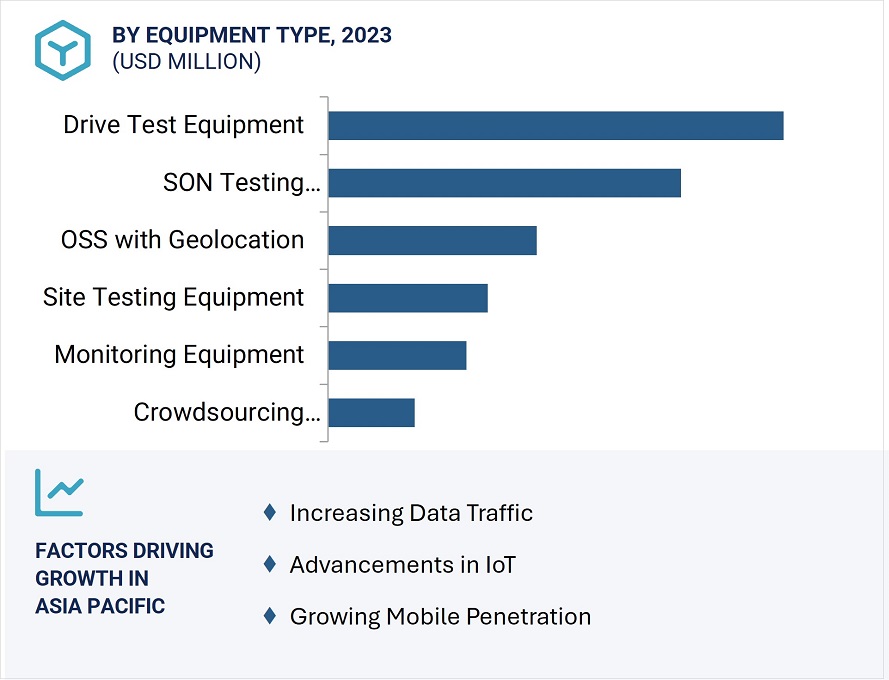

Rapid growth anticipated for OSS with geolocation equipment from 2024 to 2029

The market for wireless network test equipment integrated with Operations Support Systems (OSS) and geolocation capabilities is expected to grow at the highest CAGR from 2024 to 2029. OSS are critical for telecommunications service providers, enabling them to effectively manage network infrastructure through network inventory, service provisioning, configuration management, and fault detection. The addition of geolocation technology enhances these systems by offering precise data on the physical location of devices within a network, significantly improving the accuracy and efficiency of testing and management processes.

Geolocation utilizes GPS receivers built into mobile devices to collect location-based data, which can be used for network analysis, optimization, and troubleshooting. This integration allows service providers to conduct targeted tests and resolve issues in specific areas of the network, reducing downtime and improving service quality. As networks become increasingly complex with the adoption of 5G and IoT, the demand for advanced OSS with geolocation capabilities continues to rise. The need for enhanced user experiences and efficient resource allocation further supports this trend. Consequently, the combined use of OSS and geolocation will drive significant growth in the wireless network test equipment market over the forecast period.

Enterprises expected to witness significant growth in the wireless network test equipment market

The enterprise segment is projected to grow at a higher CAGR during the forecast period, driven by the increasing need for efficient network management and optimization. Enterprises allocate substantial budgets to ensure their network infrastructure operates seamlessly and supports critical business functions. However, the constant effort to maintain and monitor network resources often leaves organizations with limited time to develop innovative strategies for optimizing their network utilization. This challenge has led to the growing adoption of wireless network test equipment as a cost-effective solution for managing and analyzing networks.

Wireless network test equipment enables enterprises to streamline their network operations by centralizing and virtualizing network management processes. These tools provide real-time insights into network performance, allowing businesses to identify and resolve issues promptly, optimize bandwidth allocation, and ensure the uninterrupted delivery of critical applications. With the rise of data-intensive applications, cloud-based services, and IoT adoption, enterprises increasingly require tools that offer scalability, automation, and enhanced performance monitoring.

Wireless test equipment's ability to enhance operational efficiency, reduce downtime, and support the delivery of high-speed business applications positions it as a vital asset for enterprises. This growing reliance on advanced network management solutions is expected to drive substantial growth in the enterprise segment during the forecast period.

Wireless Network Test Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific set to lead wireless network test equipment market growth with highest CAGR during the forecast period

The wireless network test equipment market in the Asia Pacific region is anticipated to grow at the highest CAGR during the forecast period, driven by a combination of demographic, economic, and technological factors. Asia Pacific’s massive population and rising disposable incomes are contributing to a rapid increase in the adoption of advanced mobile devices across several countries. This widespread adoption has led to a surge in mobile data services, with competitive pricing from mobile operators enabling broader access to these services for diverse users.

The growing penetration of 3G and 4G/LTE technologies in Asia Pacific and an escalating demand for high-speed data services have amplified the need for robust wireless network infrastructure. This, in turn, fuels the demand for wireless network test equipment to ensure seamless network performance, optimized bandwidth usage, and improved service quality. Notably, countries like Japan, China, and South Korea are emerging as global leaders in deploying 5G networks, further driving the region’s reliance on advanced testing solutions.

Additionally, government initiatives to enhance digital infrastructure, along with the proliferation of IoT and smart city projects, are bolstering the adoption of wireless network test equipment. Asia Pacific dynamic technology landscape positions it as a critical growth hub for the market during the forecast period.

Key Market Players:

Major players in the wireless network test equipment market include Anritsu (Japan), Infovista (France), Keysight Technologies (US), Rohde & Schwarz (Germany), VIAVI Solutions Inc. (US), ACCUVER (US), Hammer Technologies Inc. (US), EXFO Inc. (Canada), Spirent Communications (UK), TEOCO (US), RADCOM LTD. (Israel), Thales (France), NETSCOUT (US), Bird (US), and Teledyne LeCroy Xena ApS (Denmark) are among the major players offering wireless network test equipment.

Scope of the Report:

|

Report Metric |

Details |

| Market size value in 2024 | USD 7.78 Billion |

| Market size value in 2029 | USD 12.61 Billion |

| Growth rate | CAGR of 10.1% |

|

Years considered for providing market size |

2018-2023 |

|

Base year considered |

2017 |

|

Forecast period |

20278-2029 |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

|

| Key Market Driver | Mobile Data Coupled With Increasing Adoption Of Smart Devices |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Network Technology, 5G Technology |

| Highest CAGR Segment | 5G Segment |

In this report, the overall wireless network test equipment market has been segmented into equipment type, network technology, end user, and geography.

Wireless Network Test Equipment Market, By Equipment Type:

- Drive Test Equipment

- Crowdsourcing Equipment

- Monitoring Equipment

- OSS with Geolocation Equipment

- SON Testing Equipment

- Site Testing Equipment

Wireless Network Test Equipment Market, By Network Technology

- 2G/3G/4G

- 5G

Wireless Network Test Equipment Market, By End User

- Telecommunication Service Providers

- Enterprises

Wireless Network Test Equipment Market, By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Middle East & Africa

Recent Developments:

- In February 2024, Rohde & Schwarz presented its Wi-Fi 7 multi-channel single-box test solutions for R&D and production at MWC 2024. Rohde & Schwarz will display its R&S CMX500 multi-technology multi-channel signaling tester at MWC 2024 with newly added Wi-Fi 7 testing capabilities. With this functionality, the one-box tester allows R&D engineers of wireless devices to comprehensively test their design’s operation in cellular and noncellular standards of the latest generation in a single instrument setup.

- In October 2023, Viavi Solutions Inc. announced the availability of NITRO Wireless, a portfolio of solutions enabling all participants in the ecosystem – equipment manufacturers, service providers, semiconductor companies, software developers, and system integrators – to accelerate technology development by validating performance at each stage.

- In April 2022, Rohde & Schwarz launched the FSW signal and spectrum analyzer. Its new front end continues the path of innovation with unrivaled error vector magnitude EVM measurement accuracy for wideband modulated signals in the mmWave range. This makes testing any high-end communication component or systems, including 5G NR FR2 or IEEE 802.11ay / ad chipsets, amplifiers, user equipment, and base stations.

- In February 2022, Viavi partnered with Rohde & Schwarz to offer an integrated solution for conformance testing of O-RAN Radio Units (O-RUs), including the O-RU Test Manager, which provides a seamless user experience.

- In February 2023, Keysight Technologies announced its new E7515R solution based on its 5G Network Emulation Solutions platform, a streamlined network emulator specifically designed for protocol, radio frequency (RF), and functional testing of all cellular internet of things (CIoT) technologies, including RedCap. The E7515R expands Keysight’s 5G Network Emulation Solutions portfolio, the industry’s most robust, which is used in mobile device validation across the workflow, from early design to acceptance and deployment.

Frequently Asked Questions (FAQs)

What are the estimated and projected sizes of the global wireless network test equipment market in 2024 and 2029, respectively? What is the projected CAGR of the market during the forecast period?

The wireless network test equipment market is projected to grow from USD 7.78 billion in 2024 to USD 12.61 billion at a CAGR of 10.1%.

Who are the winners in the global wireless network test equipment market?

Rohde & Schwarz (Germany), Keysight Technologies (US), Anritsu (Japan), VIAVI Solutions Inc. (US), and Infovista (France) are the winners in the global market.

Which region will likely capture the largest wireless network test equipment market share between 2024 and 2029?

Asia Pacific is projected to account for the largest share of the wireless network test equipment market from 2024 to 2029.

Which factors are driving the wireless network test equipment market and are expected to create opportunities for market players in the future?

Growing mobile data coupled with increasing adoption of smart devices is among the factors driving the wireless network test equipment market. Additionally, investments in R&D and positive outcomes from testing phase of 5G networks act as an opportunity for market players during the forecast period.

What major strategies players in the wireless network test equipment market have adopted in recent years?

Key players have adopted product launches and acquisitions to strengthen their position in the wireless network test equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

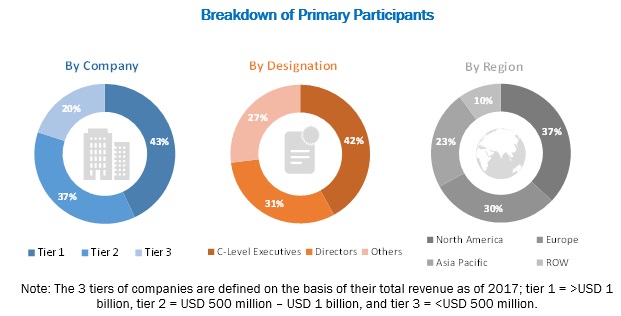

The study involved 4 major activities for estimating the current size of the wireless network test equipment market. An exhaustive secondary research was carried out to collect information on the market. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases (Wireless Network Association, Small Cell Forum, OneSource, and Factiva) have been used to identify and collect information for an extensive technical and commercial study of the wireless network test equipment market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects. Key players in the wireless network test equipment market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the wireless network test equipment market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry¡¯s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the wireless network test equipment market, in terms of value, by equipment type, network technology, and end user

- To describe and forecast the track geometry measurement system market, in terms of value, by region¡ªNorth America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze opportunities for stakeholders in the wireless network test equipment market by identifying its high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company¡¯s specific need. The following customization options are available for the report.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Wireless Network Test Equipment Market