Automotive Test Equipment Market by Product (Engine, Chassis, and Transmission Dynamometer, Vehicle Emission, Wheel Alignment, & Fuel Injection Pump Tester), End Market, Vehicle, Application, Advance Technology, and Region - Global Forecast to 2025

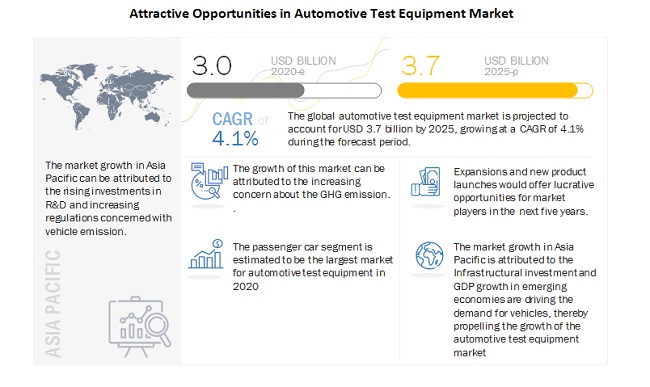

[253 Pages Report] The global automotive test equipment market size was valued at USD 3.0 billion in 2020 and is expected to reach USD 3.7 billion by 2025, at a CAGR of 4.1% during the forecast period 2020-2025. The automobile industry has witnessed a continuous increase in the integration of electronics architecture in vehicles. The rising demand for safety and comfort features has led to huge innovations and R&D efforts from OEMs and automotive suppliers for the testing of electronics components and compliance with government regulations. Moreover, the overall weight of the vehicles has increased due to the integration of electronic features. The regulations about vehicular fuel consumption and emissions will boost the demand for market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rise in stringent emissions norms to prevent environmental impact

The trend is to develop test equipment and its implementation to detect the emission levels in accordance with the law. The permissible NOx emissions from a diesel vehicle have dipped 10 times through 6 legislations (Euro 1 to Euro 6). There are emission standards that every vehicle must follow. The vehicle emission test system is used to test whether the vehicle follows the required standards of the industry. Moreover, test equipment and related software can help in detecting the emission level of passenger cars and improve fuel efficiency at the same time.

Also, the US Department of Transportation’s National Highway Traffic Safety Administration (NHSA) established a national program comprising new standards intended to reduce Greenhouse Gas (GHG) emissions and improve the fuel economy. The Environmental Protection Agency (EPA) has also set GHG emissions standards under the Clean Air Act to reduce the emission of greenhouse gases. The stringent Euro 6 norms, introduced by the European Union (EU), aim to make cars cleaner by lowering the exhaust emission of harmful gases such as nitrogen oxide (NOx), carbon monoxide (CO), and hydrocarbons. The new Euro 6 norms have different standards for petrol and diesel cars. These factors are fueling the growth of the automotive test equipment market, globally.

Restraint: Lack of R&D facilities for automotive test equipment

Numerous stringent emission norms and regulations mandated across the world have compelled OEMs to test their vehicles efficiently to ensure that they meet these norms. Modern vehicles such as hybrid cars with hybrid powertrains require different types of test equipment, such as mobile-based equipment and others. A limited number of companies, such as Ricardo (UK), Intertek (UK), and Horiba (Japan), provide testing solutions for hybrid cars. Various automobile manufacturers outsource these testing services, and this increases the overall price of the vehicle, which, in turn, affects vehicle sales. The testing of hybrid cars requires advanced research, as these cars need different types of test equipment. The lack of R&D facilities for automotive testing would result in less advanced and innovative products and hamper the quality of testing the vehicle.

Opportunity: Growing demand for onboard diagnostic tools

The demand for OBD testing has increased in recent years, owing to the self-diagnostic capability of OBD equipment. OBD provides complete control over the engine. In addition to detecting vehicle faults, OBD tools also offer emission control by providing early warnings about potential component failure. The troubleshooting properties of OBD-II allow users or technicians to detect vehicle faults. With the help of OBD tools, the user can read the status of the engine and diagnose the problem himself, rather than going to the auto shop to detect the problem.

Consumers tend to prefer application-based wireless devices, such as smartphones. Testing tool developers have developed various applications to work with OBD-II systems. For instance, Actron (US), a company that provides repair and diagnostic equipment, has released an application called Torque Pro for mobile devices that will allow users to perform vehicle diagnostics using their mobile phones. This application works wirelessly by connecting to the OBD-II serial port using Bluetooth technology. Torque Pro is also used to monitor the performance of the vehicle.

Challenge: Maintaining a balance between high cost & performance of test equipment

The dilemma faced by the automotive industry is between technological innovation and cost reduction. Technologies such as advance test equipment used for electric or hybrid vehicle testing come with an additional price tag compared to the conventional test equipment. Any technology takes time to become popular for its manufacturers to experience economies of scale. In the emerging economies, entry-level passenger cars are in demand, and automotive manufacturers need to provide their product at competitive prices. In this case, offering costly test equipment can be a hindrance. There is always a tradeoff between the incurring cost on product innovation and cost reduction by manufacturing conventional products. The challenge, therefore, is to come up with such automotive test equipment that are efficient and economical at the same time.

Passenger cars estimated to account for the largest market size during the forecast period

The passenger car segment is estimated to be the largest market for automotive test equipment in 2020. The increasing purchasing power of customers and the growing demand for passenger vehicles in emerging and developed countries have contributed to the growth of the automotive test equipment market for passenger vehicles. Also, the increasing stringency of mandates related to emissions and vehicle safety performance in several countries has inflated the demand for automotive test equipment.

Authorized service centers estimated to account for the largest market size during the forecast period

The increase in vehicle sales has driven the growth of the automotive test equipment market in authorized service centers. Also, the market has witnessed a rising number of innovations due to the growing demand for driver safety and vehicle diagnosis features that increase the durability of the automobile. With increasing functions of electronics in vehicles, stringent emission standards, and less time taken for diagnosis, the demand for equipment, software, and repair data has witnessed an increasing trend.

PC/Laptop based equipment estimated to account for the largest market size during the forecast period

PC/Laptop based testing equipment is primarily a hardware and software bundle, covering all the necessary cables, hardware, and software. These PC-based systems have features such as the capability to plot and log sensor data, calculate fuel efficiency, and estimate horsepower and torque. Also, many technicians prefer using PC/laptop-based equipment for data extraction and analysis from vehicle components.

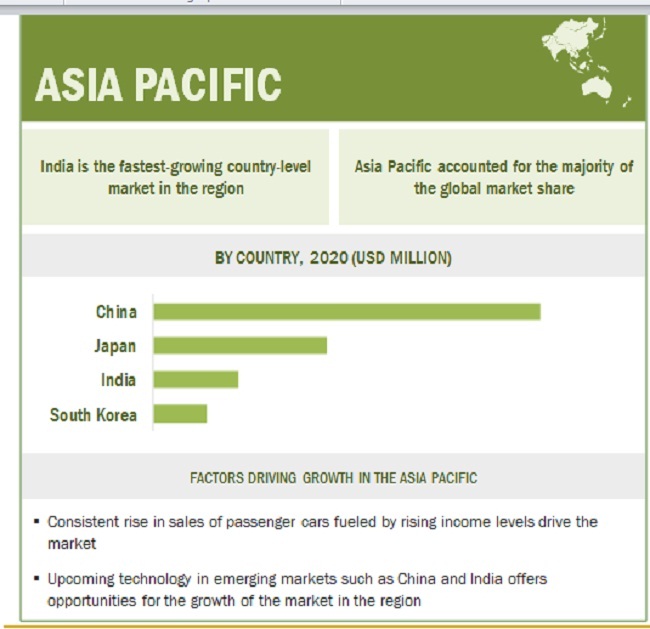

Asia Pacific region is estimated to account for the largest market size during the forecast period

The Asia Pacific region has emerged as a hub for automobile production and is estimated to be the largest market for automotive test equipment during the forecast period. The growing purchasing power of consumers has triggered the demand for automobiles in the region. Cost advantages for OEMs, low automobile penetration levels, and increased vehicle production offer attractive market opportunities for automobile manufacturers and automotive component suppliers. Also, due to the availability of cheap labor and low production cost, many major OEMs have launched production plants in the region or joined hands with major domestic vehicle manufacturers. The Asia Pacific region is home to key suppliers of automotive test equipment such as Horiba (Japan), Autel (China), and Sinfonia (Japan).

To know about the assumptions considered for the study, download the pdf brochure

Key market players

The global automotive test equipment market is dominated by major players such as ABB (Switzerland), Robert Bosch GmbH (Germany), Horiba Ltd(Japan), Honeywell (US), Siemens AG (Germany), and Delphi Technologies (UK). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive range of products in the aftermarket. The key strategies adopted by these companies to sustain their market position are new product development, partnership, and expansion.

Want to explore hidden markets that can drive new revenue in Automotive Test Equipment Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in Automotive Test Equipment Market?

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019. |

|

Forecast period |

2020–2025. |

|

Forecast units |

Value (USD) and Volume (Units). |

|

Segments covered |

Product Type, Application Type, End Market Type, Advance Technology Type, Vehicle Type, and Region. |

|

Geographies covered |

North America, Asia Pacific, Europe, and RoW. |

|

Companies covered |

Bosch (Germany), Siemens (Germany), Honeywell (US), ABB (Switzerland), Delphi (UK), and Horiba (Japan) |

This research report categorizes the automotive test equipment based on product type, application type, end market type, advance technology type, vehicle type, and region.

Based on vehicle type:

-

- Passenger Car

- Commercial Vehicle

Based on product type:

-

- Chassis dynamometer

- Engine dynamometer

- Vehicle emission test system

- Wheel alignment tester

- Fuel injection pump tester

- Transmission dynamometer

Based on application type:

-

- Mobile device-based equipment

- PC/laptop-based equipment

Based on end-market type:

-

- OEM assembly plant

- OEM R&D/ technical center

- Authorized service center

Based on advance technology size:

-

- ADAS testing

- ECU testing

- Data logger system

- Simulation testing

- EV testing

Based on the region:

-

Asia Pacific

-

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of the World

- Brazil

- Russia

Recent developments

- In March 2020, Actia established its vehicle inspection centers in the Philippines and Laos, with the test bench for heavy goods vehicles, light vehicles, and motorcycles. In the Philippines, the first 40 inspection centers were opened under the name QWIK. On the other hand, in Laos, Actia established two inspection lines for light and heavy goods vehicles.

- In November 2019, Robert Bosch had technically enhanced the BEA 950 emission tester and Bosch FSA7 40 vehicle system analysis. The FSA 740 features the measurement option for the 48V system and ergonomic trolley. The BEA 950 device, which is used for emission analysis, is now fitted with a 24-inch large screen.

- In November 2018, Bosch developed a diesel test bench, named, DCI 700. It allows accurate and reliable testing of all—Bosch and third-party manufacturers-common rail injectors for cars and commercial vehicles.

- In June 2018, Siemens announced the latest release of Simcenter Testlab software, its suite of data collection, analytics, and modeling software for test-based performance engineering in the core fields of noise and vibration, acoustics, and durability. This software is likely to provide a testing platform for several automotive scanning tools.

- In February 2017, Vector Informatik acquired US-based Vector Software, Inc. Vector Software specializes in automated embedded software testing in multiple industries such as automotive, aerospace, medical devices, industrial controls, rail, and other critical business sectors.

-

In May 2018, Horiba, a leading supplier of emission measurement and automotive test systems, launched its new SERVICE-ONE concept for the portable OBS-ONE emission measuring system that is designed for Real Driving Emission (RDE) testing of vehicles. With the broad range of service offers, Horiba significantly reduces costs and downtime while increasing flexibility for customers and the reliability of test systems.

- In June 2018, Horiba, a leading supplier of emission measurement and automotive test systems, and TNO, a center for applied scientific research from the Netherlands, agreed to start a collaboration on the industrialization of Smart Emission Measurement Systems (SEMS). By combining the strengths of both the organizations, new possibilities for measuring real-world driving emissions would become available through industrialization and large-scale deployment of SEMS.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except advance technology.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- France

- Italy

- Spain

- UK

We are interested in the regional automotive test equipment market for electric vehicles. Does this report cover electric vehicles?

Yes, the automotive test equipment market for electric vehicles is covered at a global level. However, regional level markets can be provided as separate customization.

Does this report include the impact of COVID-19 on various segments of the automotive test equipment market?

Yes, the market includes qualitative insights on the COVID-19 impact on various segments of automotive test equipment such as vehicles, products, etc.

Does this report contain the strategies adopted by various key players in the automotive test equipment market?

Yes, the market strategies adopted by major companies in the automotive test equipment market, between 2017 and 2020, were included. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

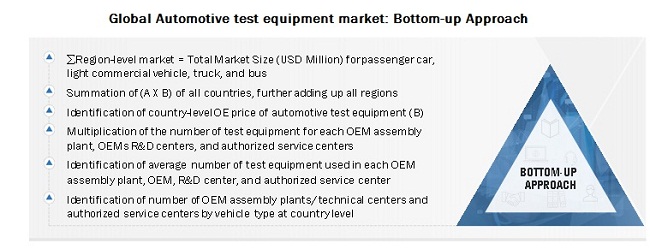

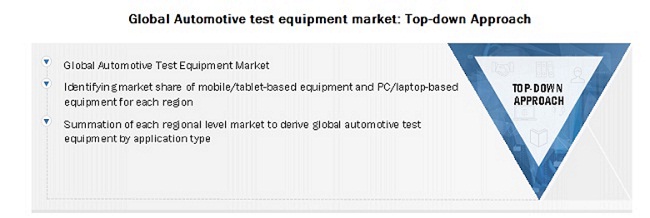

The study involved four major activities in estimating the current market size of the automotive test equipment. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, automobile OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the Department of Transportation (DOT)], automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global automotive test equipment market.

Primary Research

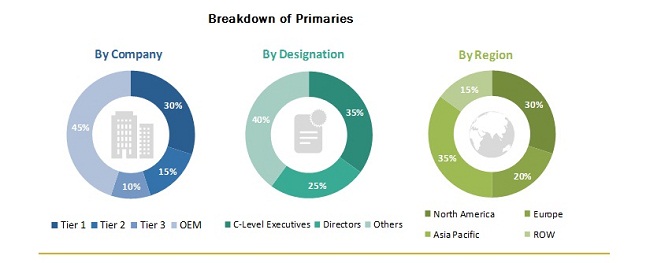

Extensive primary research has been conducted after acquiring an understanding of the automotive test equipment market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 40% and 60% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive test equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Automotive test equipment market: Bottom-up Approach

Global Automotive test equipment market: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides.

Report Objectives

- To analyze and forecast (2020 to 2025) the size of the automotive test equipment market, in terms of volume (units) and value (USD million), to segment the market and forecast its size, by volume and value, and based on region (Asia Pacific, Europe, North America, and the Rest of the World (RoW))

- To provide a detailed analysis of various factors influencing the global market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment the market and forecast its size, by volume and value, based on vehicle type (passenger cars and commercial vehicles)

- To segment the market and forecast the market size, by volume and value, based on the product (chassis dynamometer, engine dynamometer, vehicle emission test system, wheel alignment tester, transmission dynamometer, and fuel injection pump tester)

- To segment the market and forecast the market size, by volume and value, based on the application type (mobile device based equipment, and PC/laptop-based equipment)

- To segment the market and forecast its size, by volume and value, based on end market type (OEM assembly plant, OEM R&D/ technical center, and authorized service center)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

- To segment and forecast the global market size, in terms of volume (units) and value (USD Million)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive Test Equipment Market, By Advanced Technology at the regional level

- Market, By Product Type at country level

- Market, By End Market at country level

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Automotive Test Equipment Market