Electromagnetic Weapons Market by Product (Lethal Weapons, Non-lethal Weapons), Application (Homeland Security, Military), Platform (Land, Naval, Airborne), Technology (Particle Beam Weapons, Laser-induced Plasma Channel), and Region 2026

Update: 11/22/2024

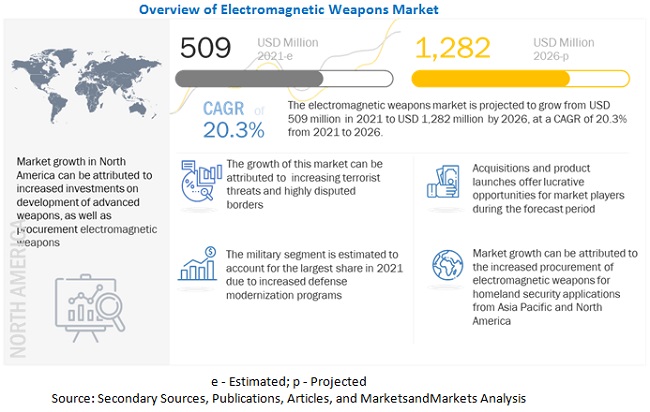

[201 Pages Report] The Global Electromagnetic Weapons Market Size was valued at USD 509 million in 2021 and is estimated to reach USD 1,282 million by 2026, growing at a CAGR of 20.3% during the forecast period. The key drivers propelling the growth of the global Electromagnetic Weapons Industry is the defense of terrorist attacks, chemical, biological, radiological, and nuclear materials so that civilian lives and the national security of a country can be preserved. Electromagnetic weapons like particle beam weapons, high power microwaves, and rail guns are being used to defend against attacks from threats like ballistic missiles, anti-satellite weapons, and nuclear weapons, etc. The Asia Pacific region will dominate the market due to the growing investments in electromagnetic weapons solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Electromagnetic weapons Market:

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacturing of electromagnetic weapons, including systems, subsystems, and components, has also been impacted. Although electromagnetic weapons are for national integration and of prime importance, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed.

Market Dynamics

Driver: Rising demand for electromagnetic weapons in combat operations

The rapid development of high-power microwave weapons and adopting electromagnetic weapons to deal with the threat of Unmanned Aerial Vehicles (UAVs) has become one of the advanced electromagnetic energy technologies. In 2021, these weapons are increasingly being integrated into military platforms such as navy, airborne, mobile vehicles, and satellites. In recent decades, multiple defense manufacturers and integrators have been researching and developing electromagnetic weapons, and, currently, they are increasingly becoming more operational. For instance, in February 2021, The US Air Force awarded a contract for Raytheon's High-Energy electromagnetic Weapon System, a system designed to counter drone threats to be deployed on an unidentified combatant command base for operator training and an initial performance evaluation. Similarly, in July 2020, Northrop Grumman Corporation has formed a strategic supplier agreement with Epirus, Inc. to offer the company’s Electromagnetic Pulse (EMP) capability as a component of Northrop Grumman’s Counter-Unmanned Aerial System (C-UAS) systems-of-systems solution offering.

Restraint: Restrictions on on anti-personnel high power microwave

Electromagnetic weapons are not authoritatively defined under international law, nor are they currently on the agenda of any existing multilateral mechanism. Nevertheless, there are several legal regimes that would apply to electromagnetic weapons.

The prospect of electromagnetic weapons raises questions for several bodies of international law, most notably those that place restrictions on the use of force. Some EMWs are classified as ‘nonlethal’ or ‘less-lethal’ weapons, with proponents setting them apart from ‘lethal’ weapons. Low-energy microwave weapon systems are one of the most controversial topics in defense, as they may be used for anti-personnel purposes. The use of microwave weapons that heat the skin surface was banned in 1995 by the UN decision (Protocol on microwave Weapons (1995), annexed to the framework Convention on Prohibitions or Restrictions on the Use of Certain Conventional Weapons (CCW)).

Due to these factors, various EMW systems developed for military application in warfare have not been put in service. For instance, the Active Denial System developed by Raytheon was introduced to the US Army. Although the US DoD shipped the ADS to Afghanistan, deployment was halted due to humanitarian laws and other factors. The Joint Non-Lethal Weapons Directorate of the US is currently working on the deployment capability of the ADS without violating international laws.

Opportunity: Increase in research and development of advanced electromagnetic weapon technologies

Improved system reliability is a crucial factor in the selection of an electromagnetic weapon by any country. The incorporation of advanced hardware units helps gather and distribute capability across various defense platforms like combat vehicles. These electromagnetic weapons are deployed in strategic locations to increase detection rates. State-of-the-art electromagnetic weapons with high accuracy have led countries with border disputes and regional threats to rely on these advanced electromagnetic weapons to assist in border protection. Thus, the rising R&D in advanced electromagnetic weapons technologies is providing a wide range of opportunities in defense sector applications.

Challenge: Increased barriers in designing military grade electromagnetic weapon systems

Complexity in the design of electromagnetic weapon systems used by the defense industry has increased, resulting in increased complications of the weapon systems. The need for electromagnetic weapon system components offering parallel operations with lower power consumption, as well as the size and weight reduction, in the defense industry has resulted in increased complexity of the design of electromagnetic weapon systems. On the other hand, continuous upgrades in military electronics require modern electromagnetic weapon systems to match the design requirements of the electronic equipment and systems. It is a big challenge for vendors to keep pace with the changing process and technological developments and to be on par with technological breakthroughs to design advanced and complex architectures suitable for military systems and equipment manufacturers. Failure to do so might reduce the number of contracts, agreements, and licenses; and, in turn, affect the overall performance of electromagnetic weapon systems in terms of efficiency and reliability.

Based on product type, the lethal weapons segment is projected to grow at the highest CAGR during the forecast period.

These lethal products, mainly focused for military application, include rail gun, electromagnetic bombs (e-bombs), plasma cannon (electrothermal accelerator), microwave gun, navy laser cannon, gun-launched guided projectile, automatic shotguns, and several others. Huge investments are being made in the R&D as well as demonstration and testing of lethal electromagnetic weapons.

Based on platform, the Naval platform segment is projected to grow at the highest CAGR during the forecast period.

Naval electromagnetic weapons systems consist of weapons that are used in naval applications, for instance, on combat ships and submarines, among others. The naval segment is further divided into combat ships, submarines, and unmanned surface vehicles. Defense ships are specifically designed for use by coast guards and naval forces to ensure the security of water borders.

Based on technology, the particle beam weapons technology segment is projected to grow at the highest CAGR during the forecast period.

Based on technology, the particle beam weapons segment is projected to account for the largest in 2021. This segment is projected to grow at a CAGR of 20.5% during the forecast period. This growth can be attributed to the easy installation and low power consumption of particle beam weapons. Compared to conventional ordnance, they have next to zero time of flight, which allows for a longer decision time and a quicker reaction time.

The electromagnetic weapons market in Asia Pacific is projected to grow at the highest CAGR from 2021 to 2026.

Asia-Pacific contributed a share of 22.5% to the electromagnetic weapons market in 2021. China, India, Japan, Australia, South Korea, and rest of Asia-Pacific have been considered in the Asia-Pacific electromagnetic weapons market. The demand for electromagnetic weapons market has increased in recent years, due to the rapid economic development and increasing security threats, across Asia-Pacific region and the increase in border disputes. The military spending of China, Japan, and India has been increasing in recent years due to increased possibilities of being targeted by terrorist attacks.

To know about the assumptions considered for the study, download the pdf brochure

Top Key Players in Electromagnetic Weapons Market:

The Electromagnetic Weapons Companies are dominated by a few globally established players such as

-

Lockheed Martin Corporation (US),

-

Raytheon technologies (US),

-

Northrop Grumman Corporation (US),

-

Honeywell International (US),

-

Thales Group (France),

-

Rheinmetall AG (Germany), BAE Systems (UK), Elbit Systems (Israel) and QinetiQ Group (US) and others.

Electromagnetic Weapons Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 509 million |

| Projected Market Size | USD 1,282 million |

| Growth Rate | CAGR of 20.3% |

|

Market size available for years |

2018–2026 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Platform, By Technology, By Application, By Product |

|

Base Year considered |

2021 |

The study categorizes the electromagnetic weapons market based on technology, application, platform, product, and region.

Electromagnetic Weapons Market By Technology

- Particle Beam Weapons (PBW)

- High Laser-induced Plasma Channel (LIPC)

By Application

- Homeland security

- Military

By Platform

- Land

- Airborne

- Naval

By Product

- Lethal weapons

- Non-lethal weapons

Electromagnetic Weapons Market By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In February 2021, The US Air Force awarded a contract for Raytheon's High-Energy electromagnetic Weapon System; a system designed to counter drone threats to be deployed on an unidentified combatant command base for operator training and an initial performance evaluation.

- In June 2021, Northrop Grumman Corporation received an order worth USD 146 million from the US Air Force to install Large Aircraft Infrared Countermeasure (LAIRCM) systems on US and international fixed-wing and rotary-wing aircraft.

- In June 2020, BAE Systems plc. signed a contract with US Army to develop an electromagnetic rail gun. This contract allows BAE Systems Plc. to leverage our ongoing research, development, and testing to advance railgun technologies and further develop railgun weapon systems for Army applications, enhancing their effectiveness against multiple types of threats.

- In July 2020, General Atomics Electromagnetic Systems (GA-EMS) was selected as a prime contractor for the US Army Combat Capabilities Development Command (CCDC) Aviation and Missile Center’s (AvMC) Electromagnetic Guided Missile (EGM) prototype program under the Aviation and Missile Technology Consortium (AMTC). GA-EMS will develop advanced missile conceptual designs in direct support of the Multi-Domain Operations (MDO) for the Army Modernization Campaign.

Frequently Asked Questions (FAQ):

What are your views on the growth perspective of the electromagnetic weapons market? What is the current scenario of the electromagnetic weapons systems and how is the market expected to grow in near future?

The electromagnetic weapons market is expected to grow in the near future. With the advancements in weapon technologies and various countries like US, Russia China and India, upgrading their defense systems due to an increase in potential terrorist attacks and border disputes, the research and development of newer and better performing electromagnetic weapon technologies is in full swing.

What could be the upcoming trends and technologies in the electromagnetic weapons ecosystem? How are these trends expected to shape the future demand for these systems?

The most promising electromagnetic weapon technology is the particle beam weapons (PBW), followed by laser-induced plasma channel technology. Deployment of weapons based on these technologies by countries like US and Russia fill compel other countries to adopt them in their defense resources.

What are technological and business challenges faced by different stakeholders in the electromagnetic weapons industry?

The most prominent technology and business challenge that different stakeholders in the electromagnetic weapons industry may face is that it requires high investment in research and development of electromagnetic weapon technologies.

Who are the emerging market players in electromagnetic weapons market?

Companies like Lockheed Martin Corporation (US), Raytheon technologies (US), Northrop Grumman Corporation (US), Honeywell International (US), Thales Group (France), Rheinmetall AG (Germany), BAE Systems (UK), Elbit Systems (Israel) and QinetiQ Group (US) and others .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SEGMENTATION

1.2.2 REGIONAL SCOPE

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY & PRICING

1.4 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 INCLUSIONS & EXCLUSIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

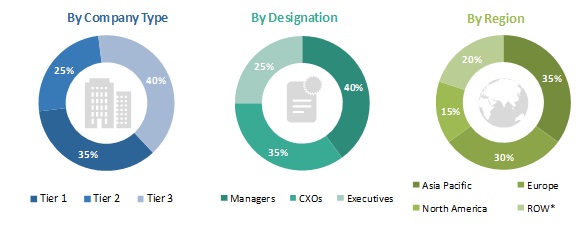

FIGURE 3 BREAK DOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.3 Primary details

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increase in military spending of emerging countries

2.2.2.2 Growth of military expenditure on the development of modern warfare

FIGURE 4 MILITARY EXPENDITURE, 2019-2020

2.2.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

FIGURE 5 NUMBER OF TERRORIST ATTACKS IN 2019, BY COUNTRY

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Major US defense contractor financial trends

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Market size estimation

2.3.1.2 Electromagnetic weapons market research methodology

FIGURE 6 RESEARCH METHODOLOGY

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.3 COVID-19 impact on the electromagnetic weapons market

2.3.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET TRIANGULATION

2.4.1 TRIANGULATION THROUGH SECONDARY

FIGURE 9 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 10 ELECTROMAGNETIC WEAPONS MARKET, BY PLATFORM, 2021 VS. 2026 (USD MILLION)

FIGURE 11 ELECTROMAGNETIC WEAPONS MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 ELECTROMAGNETIC WEAPONS MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ELECTROMAGNETIC WEAPONS MARKET

FIGURE 13 INCREASING TERRORIST THREATS AND HIGHLY DISPUTED BORDERS EXPECTED TO DRIVE THE MARKET

4.2 ELECTROMAGNETIC WEAPONS MARKET, BY PRODUCT

FIGURE 14 LETHAL WEAPONS SEGMENT EXPECTED TO LEAD THE MARKET BY 2026

4.3 ELECTROMAGNETIC WEAPONS MARKET, BY TECHNOLOGY

FIGURE 15 PARTICLE BEAM WEAPONS (PBW) SEGMENT EXPECTED TO ACHIEVE A HIGHER GROWTH BY 2026

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 ELECTROMAGNETIC WEAPONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased demand for electromagnetic weapons in combat operations

5.2.1.2 Rising modernization and investments in the defense sector for developing electromagnetic weapons for military platforms

5.2.1.3 Rapid advancements in AI, big data analytics, and robotic technologies

5.2.1.4 Increasing focus on the development of small, compact electromagnetic weapons for a UAV platform

5.2.2 RESTRAINTS

5.2.2.1 Restrictions on anti-personnel high power microwave

5.2.2.2 Utilization of electromagnetic weapons for law enforcement missions

5.2.2.3 Possibility of high collateral damage by use of electromagnetic weapons

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in research and development of advanced electromagnetic weapon technologies

5.2.4 CHALLENGES

5.2.4.1 Increased barriers in designing military-grade electromagnetic weapon systems

5.2.4.2 Integrating existing weapon control and operating systems with new electromagnetic weapon technologies

5.3 IMPACT OF COVID-19 ON THE ELECTROMAGNETIC WEAPONS MARKET

FIGURE 17 IMPACT OF COVID-19 ON THE ELECTROMAGNETIC WEAPONS MARKET

5.4 RANGES AND SCENARIOS

FIGURE 18 IMPACT OF COVID-19 ON THE ELECTROMAGNETIC WEAPONS MARKET: THREE GLOBAL SCENARIOS

5.5 VALUE CHAIN ANALYSIS OF THE ELECTROMAGNETIC WEAPONS MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTROMAGNETIC WEAPON MANUFACTURERS

5.7 ELECTROMAGNETIC WEAPONS MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 APPLICATION

FIGURE 20 MARKET ECOSYSTEM MAP: ELECTROMAGNETIC WEAPONS MARKET

FIGURE 21 ELECTROMAGNETIC WEAPONS MARKET: MARKET ECOSYSTEM

TABLE 1 ELECTROMAGNETIC WEAPONS MARKET ECOSYSTEM

5.7.4 DEMAND-SIDE IMPACTS

5.7.4.1 Key developments from February 2020 to June 2021

TABLE 2 KEY DEVELOPMENTS IN THE ELECTROMAGNETIC WEAPONS MARKET

5.7.5 SUPPLY-SIDE IMPACT

5.7.5.1 Key developments from February 2020 to December 2020

TABLE 3 KEY DEVELOPMENTS IN THE ELECTROMAGNETIC WEAPONS MARKET

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 ELECTROMAGNETIC WEAPONS: PORTER’S FIVE FORCE ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 DEGREE OF COMPETITION

5.9 REGULATORY LANDSCAPE

5.9.1 NORTH AMERICA

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

6 INDUSTRY TRENDS (Page No. - 64)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 HIGH ENERGY MICROWAVES

6.2.2 PARTICLE BEAM ENERGY

6.2.3 ACTIVE DENIAL SYSTEM

6.3 USE CASE ANALYSIS

6.3.1 USE CASE: MICROWAVE WEAPON

6.3.2 USE CASE: ACTIVE DENIAL SYSTEM

6.4 IMPACT OF MEGATRENDS

6.4.1 ARTIFICIAL INTELLIGENCE, BIG DATA ANALYTICS, AND ROBOTIC TECHNOLOGIES

6.4.2 MACHINE LEARNING

6.4.3 DEEP LEARNING

6.5 TECHNOLOGY ANALYSIS

6.6 INNOVATION & PATENT REGISTRATIONS

TABLE 5 IMPORTANT INNOVATION & PATENT REGISTRATIONS, 2007-2019

7 ELECTROMAGNETIC WEAPONS MARKET, BY TECHNOLOGY (Page No. - 69)

7.1 INTRODUCTION

FIGURE 22 PARTICLE BEAM WEAPONS (PBW) SEGMENT EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 6 MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 7 MARKET FOR PARTICLE BEAM WEAPONS (PBW), BY REGION, 2018–2026 (USD MILLION)

TABLE 8 MARKET FOR LASER-INDUCED PLASMA CHANNEL (LIPC), BY REGION, 2018–2026 (USD MILLION)

7.2 PARTICLE BEAM WEAPONS (PBW)

7.2.1 CHARGED PARTICLE BEAM WEAPONS

7.2.2 NEUTRAL PARTICLE BEAM WEAPONS

7.3 LASER-INDUCED PLASMA CHANNEL (LIPC)

8 ELECTROMAGNETIC WEAPONS MARKET, BY PRODUCT (Page No. - 73)

8.1 INTRODUCTION

FIGURE 23 LETHAL WEAPONS SEGMENT EXPECTED TO LEAD DURING THE FORECAST PERIOD

TABLE 9 MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 10 MARKET FOR LETHAL WEAPONS, BY REGION, 2018–2026 (USD MILLION)

TABLE 11 MARKET FOR NON- LETHAL WEAPONS, BY REGION, 2018–2026 (USD MILLION)

8.2 LETHAL WEAPONS

8.2.1 RAIL GUNS

8.2.2 ELECTROMAGNETIC BOMBS

8.2.3 ELECTROMAGNETIC PULSE (NUCLEAR AND NON-NUCLEAR EMP)

8.3 NON-LETHAL WEAPONS

8.3.1 PULSED ENERGY PROJECTILE

9 ELECTROMAGNETIC WEAPONS MARKET, BY PLATFORM (Page No. - 78)

9.1 INTRODUCTION

FIGURE 24 NAVAL SEGMENT EXPECTED TO LEAD DURING THE FORECAST PERIOD

TABLE 12 MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 13 MARKET FOR LAND PLATFORM, BY REGION, 2018–2026 (USD MILLION)

TABLE 14 MARKET FOR AIRBORNE PLATFORM, BY REGION, 2018–2026 (USD MILLION)

TABLE 15 MARKET FOR NAVAL PLATFORM, BY REGION, 2018–2026 (USD MILLION)

9.2 LAND

9.2.1 ARMORED VEHICLES

9.2.1.1 Combat vehicles

9.2.1.1.1 Easy installation of electromagnetic weapons on combat vehicles to fuel the demand for electromagnetic weapon systems

9.2.1.2 Combat support vehicles

9.2.1.2.1 Electromagnetic weapon systems are efficient, accurate, and can be easily installed on combat support vehicles

9.2.1.3 Unmanned armored ground vehicles

9.2.1.3.1 High demand for unmanned armored ground vehicles to fuel the demand for electromagnetic weapon systems

9.2.2 HANDHELD ELECTROMAGNETIC WEAPONS

9.2.2.1 Compact, light, and energy-efficient electromagnetic weapons to fuel the demand for electromagnetic weapon systems

9.2.3 WEAPON SYSTEMS

9.2.3.1 Launch systems

9.2.3.1.1 Demand for precision targeting and attack weapons to fuel the demand for electromagnetic weapon systems

9.2.3.2 Defense systems

9.2.3.2.1 Demand for a low-cost alternative of rocket interceptors to fuel the demand for electromagnetic weapon systems

9.3 AIRBORNE

9.3.1 HELICOPTERS

9.3.1.1 Low cost of engagement and easy installation to fuel the demand for electromagnetic weapon systems

9.3.2 FIGHTER JETS

9.3.2.1 Demand for military fighter aircraft to attract OEMs, which will drive the market for electromagnetic weapons

9.3.3 SPECIAL MISSION AIRCRAFTS

9.3.3.1 Demand for precision strike ability using special mission aircraft to drive the market for electromagnetic weapons

9.3.4 TACTICAL UAVS

9.3.4.1 Demand for low equipment size, weight, and power consumption weapons in UAVs to drive the market for electromagnetic weapons

9.4 NAVAL

9.4.1 COMBAT SHIPS

9.4.1.1 Demand for precise and accurate attack naval weapons to drive the market for electromagnetic weapons

9.4.2 SUBMARINES

9.4.2.1 Demand for the ability to penetrate below the water surface without attenuation to drive the market for electromagnetic weapons

9.4.3 UNMANNED SURFACE VEHICLES

9.4.3.1 Demand for unmanned surface vehicles with combat capabilities to drive the market for electromagnetic weapons

10 ELECTROMAGNETIC WEAPONS MARKET, BY APPLICATION (Page No. - 86)

10.1 INTRODUCTION

FIGURE 25 MILITARY SEGMENT EXPECTED TO LEAD DURING THE FORECAST PERIOD

TABLE 16 MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 17 MARKET FOR HOMELAND SECURITY, BY REGION, 2018–2026 (USD MILLION)

TABLE 18 MARKET FOR MILITARY, BY REGION, 2018–2026 (USD MILLION)

10.2 HOMELAND SECURITY

10.2.1 AIRPORT PROTECTION

10.2.1.1 Electromagnetic weapons to safeguard airports from incoming missiles, mortars, anti-aircraft missiles, drones, and other threats

10.2.2 CRITICAL INFRASTRUCTURE PROTECTION

10.2.2.1 Ground-based electromagnetic weapons to protect critical infrastructure from terrorist attacks

10.2.3 CHEMICAL, BIOLOGICAL, RADIOLOGICAL, NUCLEAR, AND EXPLOSIVES (CBRNE) DEFENSE

10.2.3.1 High-energy microwaves can be placed on to strategic locations to intercept ballistic, nuclear missiles and destroy them on course

10.2.4 OTHERS

10.3 MILITARY

10.3.1 BORDER PROTECTION

10.3.1.1 Demand for better intelligence, force modernization, and meeting equipment needs to fuel the electromagnetic weapons market

10.3.2 TACTICAL AIR AND MISSILE DEFENSE

10.3.2.1 Electromagnetic weapons to defend against nuclear-armed intercontinental ballistic missiles (ICBMs) and shorter- ranged non-nuclear tactical and theater missiles

10.3.3 MARITIME PROTECTION

10.3.3.1 Electromagnetic weapons against sea-skimming cruise missiles

10.3.4 MILITARY BASE PROTECTION

10.3.4.1 Electromagnetic weapons on strategic positions to defend military bases against incoming threats, such as missiles and drones

10.3.5 ANTI-BALLISTIC MISSILE DEFENSE

10.3.5.1 High-performance tactical electromagnetic missile defense systems could now influence military force deployment strategies

10.3.6 ANTI-SATELLITE MISSILE DEFENSE

10.3.6.1 Electromagnetic anti-satellite weapon system uses a high-energy beam to kill or destroy a killer satellite

10.3.7 COMMAND, CONTROL, AND INFORMATION WARFARE

10.3.7.1 High-power electromagnetic weapons can disable or destroy the electronics of command and communication systems

10.3.8 BATTLEFIELD AIR INTERDICTION

10.3.8.1 High power microwaves are as pervasive in combat as unmanned aerial vehicles

10.3.9 CLOSE AIR SUPPORT (CAS)

10.3.9.1 Electromagnetic weapons offer incredible speed and range, accuracy, and limited collateral damage in close air support

10.3.10 OTHERS

11 REGIONAL ANALYSIS (Page No. - 95)

11.1 INTRODUCTION

FIGURE 26 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2021-2026

TABLE 19 MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 COVID-19 IMPACT ON NORTH AMERICA

11.2.2 PESTE ANALYSIS: NORTH AMERICA

FIGURE 27 NORTH AMERICA ELECTROMAGNETIC WEAPONS: MARKET SNAPSHOT

TABLE 20 NORTH AMERICA: ELECTROMAGNETIC WEAPONS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 21 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

11.2.3 US

TABLE 25 US: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 26 US: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 27 US: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 28 US: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.2.4 CANADA

TABLE 29 CANADA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 30 CANADA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 31 CANADA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 32 CANADA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3 EUROPE

11.3.1 COVID-19 IMPACT ON EUROPE

11.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 28 EUROPE ELECTROMAGNETIC WEAPONS: MARKET SNAPSHOT

TABLE 33 EUROPE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 34 EUROPE: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 35 EUROPE: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 36 EUROPE: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 37 EUROPE: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

11.3.3 RUSSIA

TABLE 38 RUSSIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 39 RUSSIA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 40 RUSSIA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 41 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.4 FRANCE

TABLE 42 FRANCE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 43 FRANCE: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 44 FRANCE: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 45 FRANCE: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 46 GERMANY: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 47 GERMANY: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 48 GERMANY: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 49 GERMANY: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.6 UK

TABLE 50 UK: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 51 UK: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 52 UK: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 53 UK: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.7 ITALY

TABLE 54 ITALY: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 55 ITALY: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 56 ITALY: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 57 ITALY: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 58 REST OF EUROPE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 59 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 60 REST OF EUROPE: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 61 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 COVID-19 IMPACT ON ASIA PACIFIC

11.4.2 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 29 ASIA PACIFIC ELECTROMAGNETIC WEAPONS: MARKET SNAPSHOT

TABLE 62 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

11.4.3 CHINA

TABLE 67 CHINA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 68 CHINA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 69 CHINA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 70 CHINA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.4 INDIA

TABLE 71 INDIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 72 INDIA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 73 INDIA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 74 INDIA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.5 JAPAN

TABLE 75 JAPAN: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 76 JAPAN: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 77 JAPAN: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 78 JAPAN: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.6 SOUTH KOREA

TABLE 79 SOUTH KOREA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 80 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 81 SOUTH KOREA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 82 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.7 AUSTRALIA

TABLE 83 AUSTRALIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 84 AUSTRALIA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 85 AUSTRALIA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 86 AUSTRALIA: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.8 REST OF ASIA PACIFIC

TABLE 87 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 88 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 90 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5 REST OF THE WORLD

11.5.1 COVID-19 IMPACT ON THE REST OF THE WORLD

11.5.2 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 91 REST OF THE WORLD: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 92 REST OF THE WORLD: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 93 REST OF THE WORLD: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 94 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 95 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

11.5.3 ISRAEL

TABLE 96 ISRAEL: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 97 ISRAEL: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 98 ISRAEL: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 99 ISRAEL: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.4 TURKEY

TABLE 100 TURKEY: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 101 TURKEY: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 102 TURKEY: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 103 TURKEY: MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 133)

12.1 INTRODUCTION

12.2 COMPETITIVE OVERVIEW

TABLE 104 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET BETWEEN 2018 AND 2020

FIGURE 30 MARKET EVALUATION FRAMEWORK: CONTRACTS IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS BETWEEN 2017 AND 2021

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 STARS

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE PLAYERS

12.3.4 PARTICIPANTS

FIGURE 31 COMPETITIVE LEADERSHIP MAPPING

12.4 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

12.4.1 PROGRESSIVE COMPANIES

12.4.2 RESPONSIVE COMPANIES

12.4.3 DYNAMIC COMPANIES

12.4.4 STARTING BLOCKS

FIGURE 32 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)

12.5 MARKET SHARE OF KEY PLAYERS, 2020

FIGURE 33 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE ELECTROMAGNETIC WEAPONS, 2020

TABLE 105 MARKET: DEGREE OF COMPETITION

12.6 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2020

FIGURE 34 RANKING OF TOP PLAYERS IN THE MARKET, 2020

FIGURE 35 REVENUE ANALYSIS OF MARKET PLAYERS, 2016-2020

12.7 COMPETITIVE BENCHMARKING

TABLE 106 COMPANY FOOTPRINT (25 COMPANIES)

TABLE 107 COMPANY PRODUCT FOOTPRINT

TABLE 108 COMPANY APPLICATION FOOTPRINT

TABLE 109 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE SCENARIO

12.8.1 NEW PRODUCT LAUNCHES

TABLE 110 NEW PRODUCT LAUNCHES, 2019-2021

12.8.2 DEALS

TABLE 111 DEALS, 2018–2021

13 COMPANY PROFILES (Page No. - 150)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products/Solutions Offered, Recent Developments, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

13.2.1 RAYTHEON TECHNOLOGIES CORPORATION

FIGURE 36 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 112 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

TABLE 113 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

13.2.2 NORTHROP GRUMMAN CORPORATION

FIGURE 37 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 114 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

TABLE 115 NORTHROP GRUMMAN CORPORATION: DEALS

13.2.3 LOCKHEED MARTIN CORPORATION

FIGURE 38 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 116 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

13.2.4 THALES GROUP

FIGURE 39 THALES GROUP: COMPANY SNAPSHOT

TABLE 117 THALES GROUP: PRODUCT LAUNCHES

13.2.5 BAE SYSTEMS PLC.

FIGURE 40 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 118 BAE SYSTEMS PLC: DEALS

13.2.6 THE BOEING COMPANY

FIGURE 41 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 119 THE BOEING COMPANY: DEALS

13.2.7 RHEINMETALL AG.

FIGURE 42 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 120 RHEINMETALL AG.: PRODUCT LAUNCHES

TABLE 121 RHEINMETALL AG.: DEALS

13.2.8 L3HARRIS TECHNOLOGIES

FIGURE 43 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 122 L3HARRIS TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 123 L3HARRIS TECHNOLOGIES: DEALS

13.2.9 RAFAEL ADVANCED DEFENSE SYSTEMS

TABLE 124 RAFAEL ADVANCED DEFENSE SYSTEMS: PRODUCT LAUNCHES

TABLE 125 RAFAEL ADVANCED DEFENSE SYSTEMS: DEALS

13.2.10 QINETIQ GROUP PLC.

FIGURE 44 QINETIQ GROUP PLC.: COMPANY SNAPSHOT

TABLE 126 QINETIQ GROUP PLC.: PRODUCT LAUNCHES

13.2.11 HONEYWELL INC.

FIGURE 45 HONEYWELL INC.: COMPANY SNAPSHOT

TABLE 127 HONEYWELL INC.: DEALS

13.2.12 DYNETICS

13.2.13 ELBIT SYSTEMS LTD.

FIGURE 46 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 128 ELBIT SYSTEMS LTD.: DEALS

13.2.14 EAGLE-PICHER

TABLE 129 EAGLE-PICHER: PRODUCT LAUNCHES

13.2.15 GENERAL ATOMICS

TABLE 130 GENERAL ATOMICS: DEALS

13.2.16 EPIRUS INC.

TABLE 131 EPIRUS INC.: PRODUCT LAUNCHES

TABLE 132 EPIRUS INC.: DEALS

13.2.17 DIRECTED ENERGY TECHNOLOGIES INC.

13.2.18 ROKETSAN

TABLE 133 ROKETSAN: PRODUCT LAUNCHES

*Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 196)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

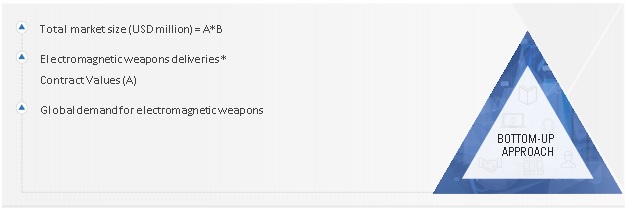

The study involved various activities in estimating the market size for electromagnetic weapons. Exhaustive secondary research was undertaken to collect information on the electromagnetic weapons market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the electromagnetic weapons market.

Secondary Research

The market share of companies in the electromagnetic weapons market was determined by using the secondary data acquired through paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study on the electromagnetic weapons market included government sources, such as the US Department of defense (DOD); federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to arrive at the overall size of the electromagnetic weapons market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the current scenario of the electromagnetic weapons market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the electromagnetic weapons market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electromagnetic weapons market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global electromagnetic weapons market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the electromagnetic weapons market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the electromagnetic weapons market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the electromagnetic weapons market based on technology, application, platform, product, and region.

- To understand the structure of the market by identifying its various segments and subsegments.

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World, along with the major countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the electromagnetic weapons market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the electromagnetic weapons market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the electromagnetic weapons market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the electromagnetic weapons market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electromagnetic Weapons Market