Missile Defense System Market by Technology (Fire Control System, Weapon System, Countermeasure System, and Command and Control System), Range (Short, Medium, and Long), Threat type, Domain (Ground, Air, Marine, and Space), and Region (2021-2026)

Update: 11/28/2024

Missile Defense System Market Size and Share

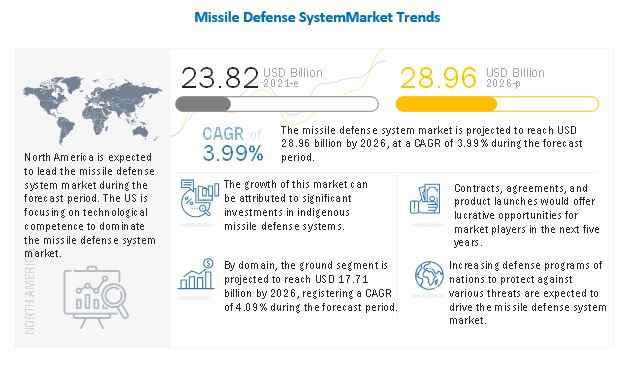

The Global Missile Defense System Market Size was valued at USD 23.82 billion in 2021 and is estimated to reach USD 28.96 billion by 2026, growing at a CAGR of 3.9% during the forecast period.

The Missile Defense System Industry share is expected to witness growth due to a consistent increase in defense budget across the globe and the need for an advanced missile defense system to counter the modern combat around the country’s border. Furthermore, increasing investments in missile defense programs by the governments of several countries, such as India, the US, and China, Saudi Arabia, among others are also expected to offer growth opportunities for the market player.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Missile Defense System Market

The COVID-19 outbreak has led to multiple challenges for the defense industry. Though the industry was not severely affectedbut still has faced many economic problems post the COVID-19 outbreak. Since the beginning of the outbreak, the defense industry has been hit globally.

The drying up of private financing, reduction of defense expenditure in 2020 across the globe, and postponement of scheduled contracts have somewhat impacted the defense industry. Hence, the research and development-related activities to missile defense system have been delayed, due to which the testing of some missile defense technology has been delayed. Moreover, with the slowdown of the supply chain of the missile defense system due to COVID-19, many companies are expected to face slack in production. Thus, impacting the market growth.

Missile Defense System Market Trends

Drivers: Increasing defense programs of nations to protect against various threats

The performance of the US’s weapon systems is unmatched, ensuring a tactical combat advantage for the US military over any adversary. The Fiscal Year (FY) 2020 acquisition (Procurement and Research, Development, Test, and Evaluation (RDT&E)) funding requested by the US Department of Defense (DoD) totals USD 247.3 billion, which includes funding in the Base budget and the Overseas Contingency Operations (OCO) fund, totaling USD 143.1 billion for Procurement and USD 104.3 billion for RDT&E. The funding in the budget request represents a balanced portfolio approach to implement the military force objective established by the National Defense Strategy. Of the USD 247.3 billion in the request, USD 83.9 billion finances Major Defense Acquisition Programs (MDAPs), which are acquisition programs that exceed a cost threshold established by the Under Secretary of Defense for Acquisition and Sustainment. According to the Missile Defense Agency, there has been an increase of over 1,200 additional ballistic missiles over the last 5 years. The number of ballistic missiles outside the US, the North Atlantic Treaty Organization, Russia, and China has risen to over 5,900. Hundreds of launchers and missiles are currently within the range of US defense.

Increasing use of early warning systems for potential air and missile attacks

Air and missile defense systems are used to monitor various enemy airborne units, such as aircraft, UAVs, and ballistic and cruise missiles. These systems generally use long-range L-band radars and satellites for surveillance. These systems provide early warning and tracking capabilities to command and control systems. Countries such as the US, Russia, China, India, and North Korea have developed intercontinental ballistic missiles, and are working on missiles with hypersonic capabilities. Early warning systems are required to successfully defend against airborne threats. Hence, various countries are investing heavily in the development of such systems. In March 2019, Northrop Grumman Corporation secured a contract worth USD 350 million from the Polish government to develop two battle management systems to assist Polish military authorities in dealing with uncertain information concerning potential air and missile attacks.

Restraints:High cost of missile defense systems

The cost has been one of the key factors galvanizing the missile defense program. It is often the anvil upon which the success or failure of a missile defense system is forged. Cost is never the sole reason why a system is deployed or scuttled, nor should it be. The US Army successfully developed and then deployed the Safeguard Anti-ballistic Missile (ABM) system in North Dakota at a cost of USD 23 billion in 2000, excluding the cost of developing and building the nuclear warheads. The Safeguard ABM system’s mission is to protect an Intercontinental Ballistic Missile (ICBM) field from Soviet attack¯in the form of a retaliatorystrike. The system was fully consistent with the consensus strategic concept of the day and even with the ABM Treaty. And yet it survived only four months before the US Department of Defense shut it down because it was too expensive to operate, given what became to be perceived as its marginal contribution to US security.

Despite the compelling need to protect US forces against an existing theater ballistic missile threat, a series of test failures led to cuts, delaying the Theater High Altitude Area Defense (THAAD) program by several years. The program got “healthy” by hitting two of its targets. Budgets rose and the testing program was quickly ended.

Opportunities: Development of new-generation air and missile defense systems

The development of new-generation missiles with high-end technologies is a major threat to strategic locations and platforms, such as military airbases and ships. Some of these new developments include nuclear-capable ballistic missiles and high-speed cruise missiles. Various countries are developing such advanced weapons capable of defeating high-end air defense systems, such as the Medium Extended Air Defense System (MEADS), the Patriot Advanced Capability-3 (PAC-3), and the S-400. Countries like India, China, and Russia have developed hypersonic missiles that are difficult to intercept for missile shields. India and Russia have jointly developed the BrahMos missile, which is difficult to intercept by older missile defense shields. These developments have led to the requirement for new-generation high-speed air defense electronic warfare systems. Governments worldwide are focusing on the development of stealth aircraft. At the same time, they are also investing heavily in advanced surveillance systems to counter stealth technology.

Challenges: Inability of missile defense systems to intercept threats on any part of the trajectory

Currently, missile defense systems are only developed and designed to carry out an interception at the mid-course (middle) or terminal (final) stage of a missile’s trajectory, even though a missile is slowest during its boost (beginning) phase. The 2019 US Missile Defense Review and Congress have both called for further study of “boost-phase intercept” capabilities, proposing the controversial development of interceptors in space or other emerging capabilities, such as drones or lasers. “Left of launch” capabilities have also been proposed, which would aim to counter a missile threat before it is even launched.

Missile Defense System Market Segments

The weapon system technology segmentaccounted for the largest share of the missile defense system market in 2020.

By technology, the weapon system segment accounted for the largest share (43.9%) of the missile defense system market in 2020. Weapon systems include interceptors, gun/turret systems, and missile launchers that are used to destroy incoming threats, including ballistic missiles. Missile launchers are designed to launch all kinds of surface-to-air missiles (SAMs) from the ground to destroy incoming enemy missiles. A missile launcher is not only capable of launching missiles but can also be integrated with command-and-control stations of missile defense systems. This enables commanders and crew of missile defense systems to improve the execution of their air and missile defense operations by properly evaluating the threat and taking required command decisions for missile defense fire.

The short range segment is expected to lead the missile defense system during the forecast period

Based on range, the missile defense system market has been segmented into short (up to 1,000 km), medium (1,000-3,000 km), long (>3,000 km). Increasing threats of intermediate-range missile launches and asymmetric warfare are some of the factors fueling the growth of the missile defense system market. The short range segment is expected to lead the market from USD 13,092 million in 2021 and is projected to reach USD 15,939 million by 2026, at a CAGR of 4.01% from 2021 to 2026. An increasing threat from intercontinental ballistic attacks across the world is fueling the growth of the intermediate-range missile defense system segment.

The hypersonic missiles threat type segmentis projected to grow at the highest CAGR rate for the missile defense system market during the forecast period.

Based on threat type, the missile defense system market has been segmented into subsonic missile, supersonic missile, and hypersonic missile. The missile defense system market, by threat type, is estimated to be USD 23,914 million in 2021 and is projected to reach USD 29,703 million by 2026, at a CAGR of 4.43% from 2021 to 2026.The hypersonic missile segment is projected to grow at highest CAGR of 7.78% from 2021 to 2026. Technological advancements, continuous R&Ds, as well as the need for advanced missile defense systems across the globe are some of the major factors driving the growth of the threat type segment of the missile defense system market.

The ground domain segment is expected to dominate the market during the forecast period

Based on domain, the missile defense system market has been segmented into ground, air, marine, and space. The need for advanced, multi-domain integration capable missile defense systems across the globe is one of the major factors driving the growth of the domain segment of the missile defense system market.

Missile Defense System Market Regions

The North American market is projected to contribute the largest share from 2021 to 2026

North America is projected to be the largest regional share of missile defense system market during the forecast period. Major companies such Northrop Grumman Corporation , Lockheed Martin, Boeing, Raytheon Technologies, and General Dynamics Corporation are based in the US. These players continuously invest in the R&D of new and advanced technology used in missile defense system.

To know about the assumptions considered for the study, download the pdf brochure

Missile Defense System Industry Companies: Top Key Market Players

The Missile Defense System Companies are dominated by globally established players such as:

- Northrop Grumman Corporation (US)

- Lockheed Martin (US)

- Boeing (US)

- Raytheon Technologies (US)

- General Dynamics Corporation (US)

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 23.82 billion in 2021 |

|

Projected Market Size |

USD 28.96 billion by 2026 |

|

Missile Defense System Market Growth Rate |

3.9% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Technology, By Range, By Threat Type, By Domain and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Northrop Grumman Corporation (US), Lockheed Martin (US), Boeing (US), Raytheon Technologies (US), and General Dynamics Corporation (US). |

The study categorizes the missile defense system market based on technology, range, threat type, domain, and Region.

By Technology

- Fire Control System

- Weapon System

- Countermeasure System

- Command & Control System

By Range

- Short

- Medium

-

Long

By Threat Type

- Subsonic Missiles

- Supersonic Missiles

- Hypersonic Missiles

By Domain

- Ground

- Air

- Marine

- Space

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In 2021, the US Army Contracting Command issued a USD 11.62 million FMS modification contract to Northrop Grumman to install its Integrated Air and Missile Defense Battle Command System (IBCS) in Poland with an estimated completion date of 31 December 2025.

- In 2020, Boeing’s Huntsville operation was awarded a USD 249 million contract modification in support of the only operationally deployed missile defense capable of shielding the entire US against long-range ballistic missile attacks.

- In 2019, Israel Aerospace Industries entered into an agreement with the Indian Navy to provide Naval Medium Range Surface-to-Air Missile systems worth USD 93 million.

Frequently Asked Questions (FAQs) Addressed by the Report

- What are your views on the growth prospect of the Missile defense system market?

- Response: The Missile defense system market is expected to grow substantially owing to the technological development in designing of the technologically advanced missile defense system.

- What are the key sustainability strategies adopted by leading players operating Missile defense system market?

- Response: Key players have adopted various organic and inorganic strategies to strengthen their position in theMissile defense system market. The major players includeNorthrop Grumman Corporation (US), Lockheed Martin (US), Boeing (US), Raytheon Technologies (US), and General Dynamics Corporation (US). These players have adopted various strategies, such as new product development and agreements, to expand their global presence in the market further.

- What are the new emerging technologies and use cases disrupting Missile defense system?

- Response: Some of the major emerging technologies and use cases disrupting the market include hypersonic threat type missiles, long range missile defense system and development of weapon system for space domain.

- Who are the key players and innovators in the ecosystem of theaircraftMissile defense system market?

- Response: The key players in the Missile defense system market include Northrop Grumman Corporation (US), Lockheed Martin (US), Boeing (US), Raytheon Technologies (US), and General Dynamics Corporation (US)..

- Which region is expected to hold the highest market share in the Missile defense system market?

- Response: Missile defense system in North America is projected to hold the highest market share during the forecast period. . The key factor responsible for North AmericaMissile defense systemgrowth, owing to the rise in defense expenditure and demand for technologically advanced missile defense system.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Missile defense system market?

The Missile defense system market is expected to grow substantially owing to the technological development in designing of the technologically advanced missile defense system.

What are the key sustainability strategies adopted by leading players operating Missile defense system market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Missile defense system market. The major players include Northrop Grumman Corporation (US), Lockheed Martin (US), Boeing (US), Raytheon Technologies (US), and General Dynamics Corporation (US). These players have adopted various strategies, such as new product development and agreements, to expand their global presence in the market further.

What are the new emerging technologies and use cases disrupting Missile defense system?

Some of the major emerging technologies and use cases disrupting the market include hypersonic threat type missiles, long range missile defense system and development of weapon system for space domain.

Who are the key players and innovators in the ecosystem of the aircraft Missile defense system market?

The key players in the Missile defense system market include Northrop Grumman Corporation (US), Lockheed Martin (US), Boeing (US), Raytheon Technologies (US), and General Dynamics Corporation (US).

Which region is expected to hold the highest market share in the Missile defense system market?

Missile defense system in North America is projected to hold the highest market share during the forecast period. . The key factor responsible for North America Missile defense system growth, owing to the rise in defense expenditure and demand for technologically advanced missile defense system. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the missile defense system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as Worldbank defense expenditure database; department of defense websites, corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from missile defense system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, threat type, range, domain, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using missile defense system were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of missile defense system and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

missile defense system Manufacturers and Solution providers |

Others |

|

Lockheed Martin Corporation |

Frontier Electronic Systems Corp. |

|

Boeing Company |

Adsys Controls Inc. |

|

Raytheon Technologies Corporation |

Thales Group |

|

Northrop Grumman Corporation |

Hanwha Defense |

|

Saab AB |

Denel Dynamics |

|

General Dynamics |

Dynetics, Inc. |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the missile defense system market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Missile Defense System Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the missile defense system market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the missile defense system market.

Report Objectives

- To define, describe, segment, and forecast the size of the missile defense system market based on technology, range, threat type, domain and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the missile defense system market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Missile Defense System Market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Missile Defense System Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Missile Defense System Market