Waveguide Components and Assemblies Market by Component (Adapters, Couplers, Loads and Filters, Isolators and Circulators, Duplexers, Phase Shifters), Spectrum (Radio, Microwave, EO/IR, Others), Sector, and Region - Global Forecast to 2027

Update: 11/28/2024

Waveguide Components and Assemblies Market Size & Growth

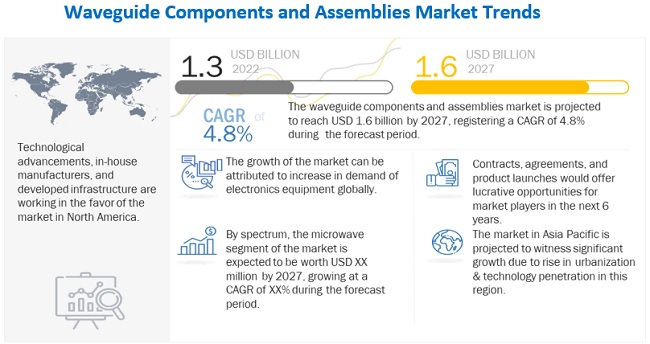

[201 Pages Report] The Global Waveguide Components and Assemblies Market Size was valued at USD 1.3 billion in 2022 and is estimated to reach USD 1.6 billion by 2027, growing at a CAGR of 4.8% during the forecast period. The market exhibits lucrative growth potential during the forecast period primarily due to the advancements in radar technologies, increased demand for microwave devices in electronic warfare systems and increasing launches of satellites and space exploration missions. Nevertheless, the requirement for new-generation warfare systems and demand for high-rate data transmission, to open several growth opportunities for Waveguide Components and Assemblies Industry during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Waveguide Components and Assemblies

The COVID-19 pandemic has not had uniform effects across the world in terms of absolute infection numbers and their trajectory. However, the pandemic is likely to negatively affect conflict dynamics in short to medium term through its detrimental and asymmetric economic impact on middle and particularly low-income countries. This comes about partly because of local restrictions, but more importantly, due to falling demands for key exports from high-income countries. For instance, due to the COVID-19 pandemic, the EU economy is expected to have suffered a historic recession between 2020 and 2021, wherein the economy of the member countries was expected to shrink by 7.5% on average. Though the European Commission projected the size of most EU member state economies to reach pre-pandemic levels in 2022 or 2023, there were minimal to no defense spending cuts, with major economies worldwide expressing their commitment to protecting military spending. However, R&D expenditure declined, and technological advancement was stuttered during the pandemic. Furthermore, the imposition of lockdown in key countries impacted the global supply chain. It resulted in a widespread and acute shortage of microchips and other essential components integral to the waveguide assemblies, increasing costs and timelines for critical projects.

Waveguide Components and Assemblies Market Trends

Driver: Advancements in radar technologies driving demand for waveguide components

In radar, a waveguide transfers radiofrequency energy to and fro the antenna, where the impedance needs to be matched for efficient power transmission. Advancements in radar technologies, including software-defined radars and digital components, drive the demand for military radars. Advanced radars with track-while-scan capabilities have enabled militaries to acquire additional targets while maintaining an overall view of the airspace to maintain situational awareness. Track-while-scan radars enable fighter aircraft, combat ships, and armored fighting vehicles to detect the presence of enemies, incoming missiles, and other such threats while tracking a particular target.

The use of digital signal processors (DSP) and solid-state amplifiers and transmitters has enabled radars to last longer, offer a higher output to power ratio, and maintain a relatively small form factor. The development of active electronically scanned arrays has made the development of 3D radars possible, which, in turn, is driving the demand for radars in the defense sector.

Developments in solid-state electronics, such as Gallium Nitride (GaN), have led to a new generation of Advanced Electronically Scanned Array (AESA) radars. These radars have higher target detection capabilities and the ability to track multiple targets. They also have a longer range and multi-function capabilities than the previous vacuum-tube-based radars. These capabilities have led to their large-scale adoption, with obsolete TWT and klystron-based radars replaced by these new systems. Various countries, such as India, Russia, and China, are developing new AESA radars for aerial, naval, and land-based platforms. For instance, Russia has developed the Zhuk Phazotron AE radar for use in MiG-35 aircraft, which is an upgraded variant of the MiG-29. India has also upgraded its fleet of Jaguar fighter aircraft with new ELM-2052 AESA radars from Israel. With waveguides being crucial for ensuring the functionality of military radars, a surge in demand for military radars is anticipated to drive the volumes of waveguides required to be integrated into such systems, thereby driving the waveguide components and assemblies market during the forecast period.

Restraints: Issues associated with poor transmission of signals in space-based applications

A satellite requires sensors to measure its current orientation or attitude, which is executed using RF interferometry, Earth sensing, or star tracking. End-use subsystems supported through waveguide assemblies, such as antennas, are typically passive devices, and they primarily focus on the available transmitted or received signal energy. For instance, a typical ground station communications transmitter with an output of 100 watts feeding through an antenna with a gain of 60 dB is expected to have an equivalent isotopically radiated power (EIRP) in the direction of the main antenna beam of 80 dBW or more.

The Van Allen radiation belt is a region of high-energy charged particles moving at speeds close to the speed of light that encircles the Earth. This can shorten the life of a satellite or spacecraft by damaging integrated circuits and sensors, resulting in poor quality of transmission. Thus, issues associated with poor transmission of signals act as a restraint to the growth of the end-use systems, thereby deleteriously affecting the prospects of the waveguide components and assemblies market.

Opportunities: Requirement for new-generation warfare systems

The development of new-generation missiles with high-end technologies is a major threat to strategic locations and platforms, such as military airbases and ships. Some of these new developments include nuclear-capable ballistic missiles and high-speed cruise missiles. Nuclear ballistic missiles can destroy various cities and lives. Various nations are developing advanced weapons capable of defeating high-end air defense systems such as the Medium Extended Air Defense System (MEADS), Patriot Advanced Capability-3 (PAC-3), and S-400. Countries such as India, China, and Russia have developed hypersonic missiles that are difficult to intercept for missile shields. India and Russia have jointly developed the BrahMos missile, which is difficult to intercept by older missile defense shields. These developments have led to the requirement for new-generation high-speed air defense radar systems.

There is an increasing demand for technologically advanced warfare systems from the defense forces. Governments worldwide are focusing on the development of stealth aircraft, but, at the same time, they are also investing heavily in advanced surveillance systems to counter stealth technology.

Several types of research have been undertaken on technologies such as quantum radars and their use for surveillance. According to an article published by China Daily in September 2018, quantum radars transmit subatomic particles instead of radio waves when searching for targets. They are not affected by radar-absorbent materials and low-signature designs. Traditional radar-jamming tactics cannot deceive these radars and can be adopted in future missile defense and space exploration. The development of sophisticated radar systems is also anticipated to encourage the R&D of waveguide components with enhanced performance capabilities and protection against advanced countermeasures.

Challenges: Adherence to stringent regulatory framework

Manufacturers of waveguide components and assemblies that supply their products to the defense integrators are required to comply with various rules and regulations laid down by their respective governments related to the sale of products and services. Non-compliance with regulations could result in severe consequences, including the imposition of fines and penalties, termination of contracts, and civil or criminal investigations. The respective governments impose various sanctions on manufacturers by curtailing the type and technologies that can be sold to foreign countries to avoid technical breaches of functional data, enabling the hostile forces to reverse-engineer an effective countermeasure. Due to the escalating geopolitical unrest, the trade relations between countries may become strained and lead to the imposition of trade restrictions on domestic companies, forbidding the export of defense products from manufacturing countries to the unfriendly countries limiting the growth prospects of the market by hindering potential sales.

Waveguide Components and Assemblies Market Segments

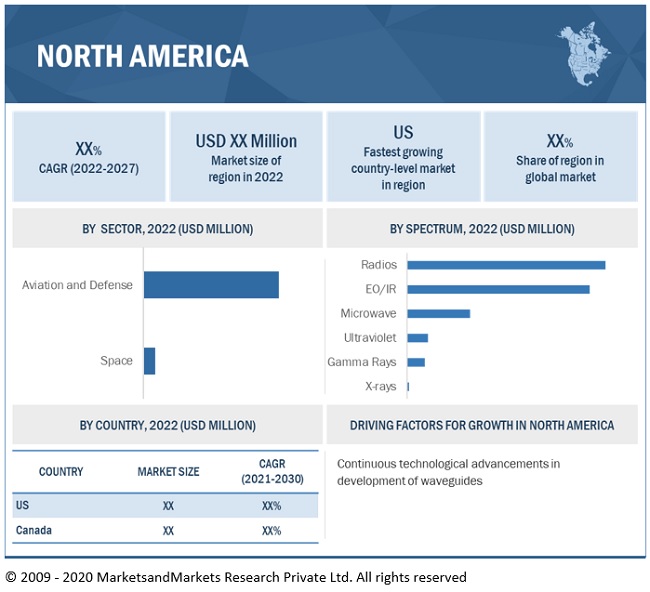

Based on sector, the aviation and defense segment of the waveguide components and assemblies market is estimated to account for the largest market share in 2022

Based on sector, the aviation and defense segment is expected to dominate the market share during the forecast period (2022 to 2027). Factors such as the increasing threats from terrorism and unconventional warfare around the globe have led to the increased demand for high-quality, integrated, precise, efficient, and cost-effective electromagnetic weapons for the military and defense forces. Non-lethal weapons, such as dazzlers, car-stopping microwave systems, medium-power microwave systems, and active denial systems, are integrated by homeland security forces to establish a tactical edge. The increased defense spending on procuring new platforms and modernizing the existing fleet are major factors expected to drive the growth of this segment during the forecast period.

Based on spectrum, the radios segment is estimated to account for the largest market share in 2022

Based on spectrum, the radios segment is expected to dominate the market share during the forecast period (2022 to 2027). Radio waves are widely operational in several industries, particularly the telecommunication industry. The drastic rise in communication and high-speed connectivity requirement is likely to increase the production of photonic devices and associated waveguide products and components. The spread of 5G mobile technology and wireless communication is a key driver for the demand for waveguides in the telecom industry. Most common wireless technologies utilize radio, in which distances can be as short as that for television or a few millions of kilometers for deep-space radio communications.

Waveguide Components and Assemblies Market Regional Analysis

The North American market is projected to contribute the largest share in 2022 in the waveguide components and assemblies market

Based on region, North America is expected to overtake Europe as the largest market for the waveguide components and assemblies market by 2030. The US is projected to be the major contributor to the region’s waveguide components and assemblies market, due to the rising demand for radar systems that encourage the evolution of waveguide components in the aerospace industry. The country has made heavy investments in advanced satellite and radar systems, in order to compete with the aerospace infrastructure development in China. This is another factor that is responsible to raise the demand for waveguide components and assemblies in the US.

To know about the assumptions considered for the study, download the pdf brochure

Waveguide Components and Assemblies Companies: Top Key Market Players

The Waveguide Components and Assemblies Market is dominated by a handful of established players, mainly due to the high technical expertise required to design the waveguide components and assemblies. The Waveguide Components and Assemblies Companies are dominated by globally established players such as

- Quantic Electronics (US)

- Millimeter Wave Products Inc. (US)

- Cobham Limited (UK)

- Ducommon Incorporated (US)

- ETL Systems (UK)

Major focus was given to the contracts and new product development due to the changing requirements of end-user industries globally.

Scope of the Waveguide Components and Assemblies Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.3 billion in 2022 |

|

Projected Market Size |

USD 1.6 billion by 2027 |

|

Growth Rate (CAGR) |

4.8% |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By sector, by component, by spectrum |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Quantic Electronics (US), Millimeter Wave Products Inc. (US), Cobham Limited (UK), Ducommun Incorporated (US), and ETL Systems (UK) are some of the major players of waveguide components and assemblies market. (20 Companies) |

The study categorizes the aircraft micro turbine engines market based on sector, spectrum, component and region.

By Sector

- Aviation and Defense

- Space

By Spectrum

- Radio

- Microwave

- EO/IR

- Ultraviolet

- X-ray

- Gamma ray

By Component

- Adapters

- Couplers

- Loads and Filters

- Isolators and Circulators

- Duplexers

- Phase Shifters

- Power Combiners

- Pressure Windows

Region

- North America

- Europe

- Asia Pacific

-

Rest of the World

- Middle East

- Africa

Recent Developments

- In December 2021, CAES, a business unit of Cobham Limited, released a wideband, Gallium Nitride (GaN) based, high-power wideband RF amplifier. This RF amplifier claims to offer the best RF output power-to-weight ratio. It also offers long-distance stand-off jamming and self-protection applications for a wide range of assets.

- In July 2020, Kete Microwave Electronics Co. Ltd. launched the KTWI260-30A, a waveguide isolator operating from 22 to 32 GHz.

- In April 2020, ETL Systems, one of the leaders in RF distribution and satellite communications, has launched the Falcon frequency converters. It offers a range of multiple hot-swap, up and down converters in the same compact 1U chassis, operating in frequencies of Ka, Ku, K, C, X, L, and IF-band.

Frequently Asked Questions (FAQ):

Which are the major companies in the waveguide components and assemblies market? What are their major strategies to strengthen their market presence?

Some of the key players in the waveguide components and assemblies market are key players in the market include Quantic Electronics (US), Millimeter Wave Products Inc. (US), Cobham Limited (UK), Ducommon Incorporated (US), and ETL Systems (UK), among others. Innovation through development of new products, solutions, and services was the major strategy adopted by these companies to strengthen their market presence.

What are the drivers and opportunities for the waveguide components and assemblies market?

The growth of the waveguide components and assemblies market can be mainly attributed to the enhanced defense spending on the development and adoption of new electromagnetic systems to be inducted onboard an expanding platform fleet. Nevertheless, the increasing demand for high rate data transmission and the installation of microwave-based components for surveillance and reconnaissance in aerial platforms are anticipated to open several growth opportunities for waveguide components and assemblies manufacturers during the forecast period.

Which region is expected to grow at the highest rate in the next five years?

The market in North America is projected to grow at the highest CAGR of from 2022 to 2027, showcasing strong demand for such equipment in the region. The US is projected to be the major contributor to the regional share of the waveguide components and assemblies market, driven by large investments for the development of microwave equipment in the aviation industry.

Which sector is expected to significantly lead in the coming years?

The demand from aviation and defense sector is envisioned to be significant during the forecast period as the unprecedented growth in threats from terrorism and unconventional warfare around the globe has been observed.

Which are the key technology trends prevailing in the waveguide components and assemblies market?

The advent of disruptive technologies, such as 3D printing waveguides and substrate integrated waveguide is expected to boost performance for applications in warfare systems that where these technologies would enhance performance.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

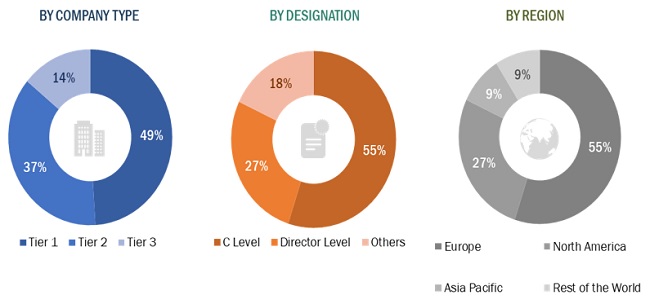

This research study on the waveguide components and assemblies market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect relevant information on the aircraft nacelle and thrust reverser market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess the prospects of the aircraft nacelle and thrust reverser market. A deductive approach, also known as the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The ranking of companies operating in the waveguide components and assemblies market was determined using secondary data from paid and unpaid sources and by analyzing the product excellence of major companies operating in the market. These companies were rated based on the development and quality of their products. Primary sources further validated these data points. Secondary sources referred for this research study on the waveguide components and assemblies market included government sources, such as International Air Transport Association (IATA); Federal Aviation Administration (FAA); corporate filings that included annual reports, investor presentations, and financial statements; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the waveguide components and assemblies market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across various regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

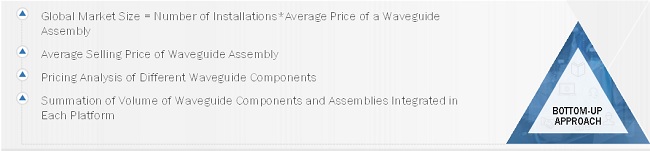

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the waveguide components and assemblies market size. The key players in the waveguide components and assemblies market were identified through extensive secondary research. This included the study of annual and financial reports of the top market players and extensive interviews with leaders, including Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the waveguide components and assemblies market. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

All possible parameters that affect the waveguide components and assemblies market and its segments covered in this research study were viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, added with detailed inputs, analyzed, and presented in this report on the waveguide components and assemblies market.

Waveguide Components and Assemblies Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Waveguide Components and Assemblies Market Size: Bottom-Up Approach

Data Triangulation

The data obtained from the processes explained above was verified and validated using the triangulation method to complete the market engineering process. The triangulation process was carried out for country-wise market estimations in terms of value. The following visually represents the data triangulation methodology used to validate and verify the information to arrive at the estimates.

Waveguide Couplers: An Essential Component of Waveguide Transmission Lines

Waveguide couplers are a type of waveguide component that is used to split or combine signals in a waveguide transmission line. They are designed to couple energy from one waveguide transmission line to another waveguide transmission line.

Waveguide couplers are an essential component of waveguide systems, and they often work in conjunction with other waveguide components and assemblies to achieve specific performance requirements. For example, waveguide filters and couplers are often used together to create complex filter structures that provide precise control of frequency response and bandwidth.

Innovation in Waveguide Couplers: Creating Demand for New and Upgraded Waveguide Components and Assemblies

Waveguide coupler manufacturers have a significant impact on the growth opportunities for the waveguide components and assemblies market. They constantly improve and innovate their products, leading to demand for new and upgraded waveguide components and assemblies. Manufacturers work closely with their customers to develop custom solutions, which often result in new components and assemblies. Manufacturers also provide technical support, leading to new developments in materials and manufacturing techniques, ultimately driving the market growth. Investment in research and development by successful manufacturers leads to new breakthroughs in waveguide components and assemblies and further growth opportunities for the market.

Custom Solutions to Meet Specific Application Requirements

The waveguide couplers and waveguide components and assemblies market is experiencing growth opportunities for key companies due to several factors. There is increasing demand for waveguide couplers and components due to the rising adoption of wireless communication and radar systems in industries such as defense, aerospace, and telecommunications. This is creating opportunities for companies such as Qorvo, Waveline, and API Technologies Corp. to expand their market share. Additionally, technological advancements and the development of new and improved waveguide couplers and components are creating growth opportunities for companies like Ducommun Incorporated and Pasternack Enterprises, Inc.

The demand for custom solutions is growing as customers require products that are tailored to their specific needs. Waveguide coupler manufacturers like API Technologies Corp. and Ducommun Incorporated are working closely with their customers to develop custom solutions, leading to growth opportunities in the market. Strategic partnerships are also driving growth for key companies in the waveguide couplers and waveguide components and assemblies market. Companies such as Qorvo and Pasternack Enterprises, Inc. are forming partnerships to expand their product offerings and enter new markets, which is expected to fuel their growth in the coming years. Overall, companies that invest in these areas are likely to experience continued growth and success in the market.

Report Objectives

- To define, describe, and forecast the size of the waveguide components and assemblies market based on sector, spectrum, component and region.

- To forecast the size of the various segments of the waveguide components and assemblies market based on four regions—North America, Europe, Asia Pacific, and Rest of the World—along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Waveguide Components and Assemblies Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Waveguide Components and Assemblies Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Waveguide Components and Assemblies Market