Dust Control Systems Market by Type (Wet and Dry), Mobility (Mobile Controllers and Fixed Controllers), End-use Industry (Construction, Mining, Oil & Gas, Chemical, Textile, Pharmaceutical, and Food & Beverage), and Region Global Forecast to 2023

[128 Pages Report] The dust control systems market was valued at USD 14.93 Billion in 2017, and is projected to reach 20.08 Billion by 2023, at a CAGR of 5.08% during the forecast period.

The years considered for the study are as follows:

- Base year - 2017

- Estimated year - 2018

- Projected year - 2023

- Forecast period - 2018 to 2023

For More details on this research, Request Free Sample Report

The objectives of the report

- Determining and projecting the size of dust control systems market with respect to type, mobility, end-use industry, and regional markets, over the period ranging from 2018 to 2023.

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Analyzing the demand-side factors on the basis of the following:

- Impact of macroeconomic and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to find the value of market for dust control systems for regions such as North America, Europe, Asia Pacific, South America, and RoW

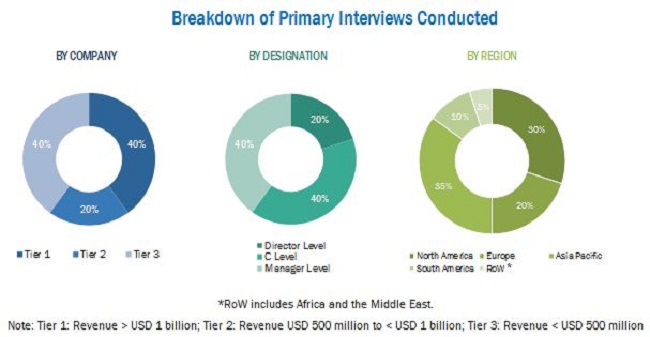

- The key players have been identified through different secondary sources and information on market data was gathered through sources such as the World Fact Book (CIA), the Associated General Contractors of America (AGC), and Centers for Disease Control and Prevention (CDC), while their market share in respective regions was determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the market for dust control systems include component suppliers; dust control systems manufacturing companies such as Donaldson Company (US), Illinois Tool Works (US), Sly Filters (UK); and government bodies & regulatory associations such as the Associated General Contractors of America (AGC), Centers for Disease Control and Prevention (CDC), and the National Bureau of Statistics (NBS).

Target Audience:

The stakeholders for the report are as follows:

- Supply side: Dust control system components providers, suppliers, distributors, importers, exporters, and service providers

- Demand side: Construction and mining contractors, textile companies, wood processing companies, farmers, and component suppliers

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies

- Other related associations, research organizations, and industry bodies: Stavros Niarchos Foundation Cultural Center (SNFCC), the Associated General Contractors of America (AGC), Centers for Disease Control and Prevention (CDC)

Scope of the Report:

This research report categorizes the market based on type, mobility, end-use industry, and region.

Based on type, the market has been segmented as follows:

- Wet

- Wet scrubbers

- Wet electrostatic precipitators (WEPS)

- Dry

- Bag dust collectors

- Cyclone dust collectors

- Electrostatic dust collectors

- Vacuum dust collectors

- Modular dust collectors

Based on mobility, the market has been segmented as follows:

- Mobile controllers

- Handheld

- Self-propelled

- Tractor-mounted

- Trailed

- Fixed controllers

- Construction

- Mining

- Oil & gas

- Chemical

- Textile

- Pharmaceuticals

- Food & beverage

- Others (power & utility and metal & finishing industries)

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East and Africa)

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific dust control systems market

- Further breakdown of the Rest of European dust control systems market

Application Breakdown

- Further breakdown of the open field applications of dust control systems

Company Information

- Detailed analysis and profiling of additional market players (up to five)

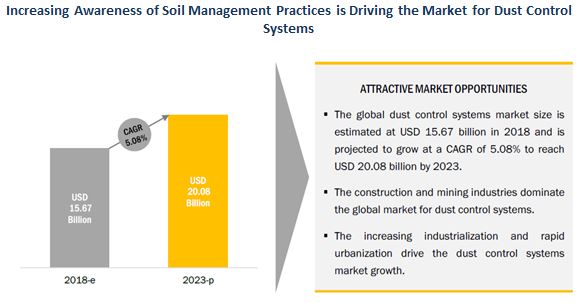

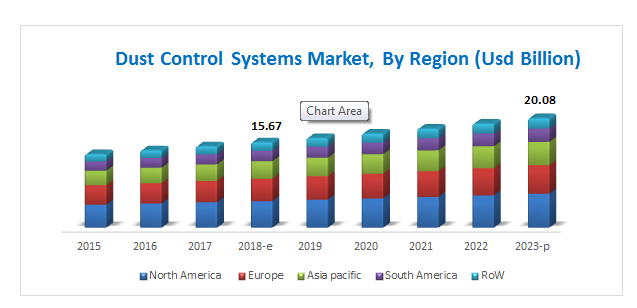

The dust control systems market is projected to reach USD 20.08 Billion by 2023 from USD 15.67 Billion in 2018, at a CAGR of 5.08% during the forecast period. The rise in health awareness among consumers and rapid urbanization & industrialization are expected to fuel the demand for dust control systems.

Based on type, the market for dust control systems has been segmented into wet and dry. The wet segment accounted for a larger market share of the global market in 2017. Wet dust control systems are further segmented into wet scrubbers and wet electrostatic precipitators. As wet electrostatic precipitators are used to treat sub-micron particulates, such as aerosols or fumes, their demand is expected to grow at a higher rate. The dry dust control systems are segmented into bag dust collectors, electrostatic dust collectors, vacuum dust collectors, modular dust collectors, and cyclone dust control systems. The electrostatic dust collectors segment is projected to grow at the highest CAGR, followed by the bag dust collectors segment.

By mobility, the market for dust control systems has been segmented into mobile controllers and fixed controllers. The mobile controllers segment dominated the global market with a relatively larger share in 2017. Mobile controllers include sub-types such as handheld, self-propelled, tractor-mounted, and trailed. Easy and efficient working of tractor-mounted dust control systems makes it the dominant and fastest-growing market, globally.

Based on end-use industry, the market for dust control systems has been segmented into construction, mining, oil & gas, chemical, textile, pharmaceutical, food & beverage, and others, which include power & utility, and metal & finishing industries. The construction segment accounted for the largest market share in 2017. Rapid urbanization and industrialization are fueling the demand for dust control systems in the construction and mining industries. The food & beverage and pharmaceutical industries with limited use of dust control systems provide an opportunity for the market.

For More details on this research, Request Free Sample Report

Asia Pacific accounted for the largest share in the global market, in terms of value, in 2017, owing to the rising health awareness. The wide acceptance and availability of dust control systems, especially in countries such as Australia & New Zealand, China, and India, along with their growth potential, are the major drivers contributing to the penetration of the market in the Asia Pacific dust control systems industry. Stringent government regulations for dust control to reduce pollution is driving the market for dust control systems in the region.

The key players in global dust control systems market include Nederman Holding (Sweden), Donaldson Company (US), and Illinois Tool Works (US). Other players in the market include Sly Filters (UK), Spraying Systems (US), CW Machine Worx (US), Dust Control Systems (UK), Colliery Dust Control (South Africa), Duztech AB (Sweden), Dust Control Technologies (US), Savic (Belgium), Heylo (Germany), BossTek (US), EmiControls (Italy), and Beltran Technologies (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Growth Opportunities in the Dust Control Systems Market

4.2 Asia Pacific: Market for Dust Control Systems, By End-Use Industry & Country

4.3 Dry Dust Control Systems Market, By Type

4.4 Market for Dust Control Systems, By Mobility

4.5 Market for Dust Control Systems, By End-Use Industry

4.6 Market for Dust Control Systems, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Urbanization and Industrialization

5.2.1.2 Growth in Environmental Concerns

5.2.1.3 Increase in Awareness About Soil Management Practices

5.2.2 Restraints

5.2.2.1 High Costs Associated With Advanced Dust Control Systems

5.2.3 Opportunities

5.2.3.1 Increase in Demand for Dust Control Systems From the Construction and Mining Industries

5.2.3.2 Technological Advancements

5.2.3.3 Increase in Demand With Innovation of New Products

5.2.3.4 Regulations Supporting Dust Control

5.2.4 Challenges

5.2.4.1 Dust Collection in the Food and Pharmaceutical Industries

5.2.4.2 Lack of Awareness

6 Market for Dust Control Systems, By Type (Page No. - 37)

6.1 Introduction

6.2 Dry

6.2.1 Bag Dust Collectors

6.2.2 Cyclone Dust Collectors

6.2.3 Electrostatic Dust Collectors

6.2.4 Vacuum Dust Collectors

6.2.5 Modular Collectors

6.3 Wet

6.3.1 Wet Scrubbers

6.3.2 Wet Electrostatic Precipitators

7 Market for Dust Control Systems, By Mobility (Page No. - 43)

7.1 Introduction

7.2 Mobile Controllers

7.2.1 Handheld

7.2.2 Self-Propelled

7.2.3 Tractor-Mounted

7.2.4 Trailed

7.3 Fixed Controllers

8 Market for Dust Control Systems, By End-Use Industry (Page No. - 48)

8.1 Introduction

8.2 Construction

8.3 Mining

8.4 Oil & Gas

8.5 Chemical

8.6 Textile

8.7 Pharmaceutical

8.8 Food & Beverage

8.9 Others

9 Market for Dust Control Systems, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 India

9.4.3 Australia & New Zealand

9.4.4 Japan

9.4.5 Rest of Asia Pacific

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Rest of the World (RoW)

9.6.1 Africa

9.6.2 The Middle East

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 Market Ranking, By Key Player

10.3 Competitive Scenario

10.3.1 Acquisitions

10.3.2 Expansions

10.3.3 New Product Launches

10.3.4 Agreements

11 Company Profiles (Page No. - 96)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Nederman

11.2 Donaldson Company

11.3 Illinois Tool Works

11.4 Sly Filters

11.5 Spraying Systems Co.

11.6 CW Machine Worx

11.7 Dust Control Systems

11.8 Colliery Dust Control

11.9 Duztech AB

11.10 Dust Control Technologies

11.11 Savic Group

11.12 Heylo

11.13 Bosstek

11.14 Emicontrols

11.15 Beltran Technologies

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 120)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (73 Tables)

Table 1 US Dollar Exchange Rate, 2014-2017

Table 2 Dust Control Systems Market Size, By Type, 20162023 (USD Billion)

Table 3 Market Size for Dust Control Systems, By Region, 20162023 (USD Billion)

Table 4 Dry DCS Market Size, By Type, 20162023 (USD Billion)

Table 5 Dry DCS Market Size, By Region, 20162023 (USD Billion)

Table 6 Wet DCS Market Size, By Type, 20162023 (USD Billion)

Table 7 Wet DCS Market Size, By Region, 20162023 (USD Billion)

Table 8 Market Size for Dust Control Systems, By Mobility, 20162023 (USD Billion)

Table 9 Mobile Controllers Market Size, By Type, 20162023 (USD Billion)

Table 10 Mobile Controllers Market Size, By Region, 20162023 (USD Billion)

Table 11 Fixed Controllers Market Size, By Region, 20162023 (USD Billion)

Table 12 Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Billion)

Table 13 Market Size for Dust Control Systems for the Construction Industry, By Region, 20162023 (USD Billion)

Table 14 Market Size for Dust Control Systems for the Mining Industry, By Region, 20162023 (USD Million)

Table 15 Market Size for Dust Control Systems for the Oil & Gas Industry, By Region, 20162023 (USD Million)

Table 16 Market Size for Dust Control Systems for the Chemical Industry, By Region, 20162023 (USD Million)

Table 17 Market Size for Dust Control Systems for the Textile Industry, By Region, 20162023 (USD Million)

Table 18 Market Size for Dust Control Systems for the Pharmaceutical Industry, By Region, 20162023 (USD Million)

Table 19 Market Size for Dust Control Systems for the Food & Beverage Industry, By Region, 20162023 (USD Million)

Table 20 Market Size for Dust Control Systems for Other End-Use Industries, By Region, 20162023 (USD Million)

Table 21 Dust Control Systems Market Size, By Region, 20162023 (USD Billion)

Table 22 North America: Market Size for Dust Control Systems, By Country, 20162023 (USD Billion)

Table 23 North America: Market Size for Dust Control Systems, By Type, 20162023 (USD Billion)

Table 24 North America: Wet DCS Market Size, By Type, 20162023 (USD Billion)

Table 25 North America: Dry DCS Market Size, By Type, 20162023 (USD Million)

Table 26 North America: Market Size for Dust Control Systems, By Mobility, 20162023 (USD Billion)

Table 27 North America: Mobile Controllers Market Size, By Type, 20162023 (USD Billion)

Table 28 North America: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Billion)

Table 29 US: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 30 Canada: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 31 Mexico: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 32 Europe: Market Size for Dust Control Systems, By Country, 20162023 (USD Billion)

Table 33 Europe: Dust Control Systems Market Size, By Type, 20162023 (USD Billion)

Table 34 Europe: Wet DCS Market Size, By Type, 20162023 (USD Billion)

Table 35 Europe: Dry DCS Market Size, By Type, 20162023 (USD Million)

Table 36 Europe: Market Size for Dust Control Systems, By Mobility, 20162023 (USD Billion)

Table 37 Europe: Mobile Controllers Market Size, By Type, 20162023 (USD Billion)

Table 38 Europe: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 39 Germany: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 40 France: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 41 UK: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 42 Asia Pacific: Market Size for Dust Control Systems, By Country, 20162023 (USD Billion)

Table 43 Asia Pacific: Market Size for Dust Control Systems, By Type, 20162023 (USD Billion)

Table 44 Asia Pacific: Wet DCS Market Size, By Type, 20162023 (USD Billion)

Table 45 Asia Pacific: Dry DCS Market Size, By Type, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size for Dust Control Systems, By Mobility, 20162023 (USD Billion)

Table 47 Asia Pacific: Market Size for Dust Control Systems, By Mobile Controllers, 20162023 (USD Billion)

Table 48 Asia Pacific: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 49 China: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 50 India: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 51 Australia & New Zealand: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 52 South America: Market Size for Dust Control Systems, By Country, 20162023 (USD Million)

Table 53 South America: Market Size for Dust Control Systems, By Type, 20162023 (USD Million)

Table 54 South America: Wet DCS Market Size, By Type, 20162023 (USD Million)

Table 55 South America: Dry DCS Market Size, By Type, 20162023 (USD Million)

Table 56 South America: Market Size for Dust Control Systems, By Mobility, 20162023 (USD Million)

Table 57 South America: Mobile Controllers Market Size, By Type, 20162023 (USD Million)

Table 58 South America: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 59 Brazil: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 60 Argentina: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 61 RoW: Market Size for Dust Control Systems, By Region, 20162023 (USD Million)

Table 62 RoW: Market Size for Dust Control Systems, By Type, 20162023 (USD Million)

Table 63 RoW: Wet DCS Market Size, By Type, 20162023 (USD Million)

Table 64 RoW: Dry DCS Market Size, By Type, 20162023 (USD Million)

Table 65 RoW: Market Size for Dust Control Systems, By Mobility, 20162023 (USD Million)

Table 66 RoW: Mobile Controllers Market Size, By Type, 20162023 (USD Million)

Table 67 RoW: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 68 Africa: Market Size for Dust Control Systems, By End-Use Industry, 20162023 (USD Million)

Table 69 Middle East: Dust Control Systems Market Size, By End-Use Industry, 20162023 (USD Million)

Table 70 Acquisitions, 20132017

Table 71 Expansions, 20142015

Table 72 New Product Launches, 20152018

Table 73 Agreements, 2013

List of Figures (35 Figures)

Figure 1 Dust Control Systems Market Segmentation

Figure 2 Regional Scope

Figure 3 Market for Dust Control Systems: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market for Dust Control Systems, By Type, 2018 vs 2023

Figure 9 Market Size for Dust Control Systems, By End-Use Industry, 2018 vs 2023

Figure 10 Market for Dust Control Systems, By Region

Figure 11 Growth of Construction and Mining Practices Driving the Market for Dust Control Systems

Figure 12 Construction Was the Largest Segment in the Asia Pacific DCS Market

Figure 13 Bag Dust Collectors Segment to Dominate the Market During the Forecast Period

Figure 14 Mobile Controllers Dominated the Mobility Segment Across All Regions in 2017

Figure 15 Construction Segment to Dominate the Market Between 2018 and 2023

Figure 16 North America Accounted for the Largest Share of the Global Market

Figure 17 Dust Control Systems Market Dynamics

Figure 18 Canada: Gross Domestic Product (GDP) Contribution By the Construction Industry, 20052010

Figure 19 Wet Dust Control Systems Projected to Be the Larger Segment During the Forecast Period

Figure 20 Mobile Controllers Projected to Be the Larger Segment During the Forecast Period

Figure 21 Construction is Projected to Be the Largest Segment During the Forecast Period

Figure 22 Market Size for Dust Control Systems, By Region, 2018 vs 2023 (USD Billion)

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Strategies Adopted By Leading Players in the Market Between 2013 & 2018

Figure 26 Market Ranking of Dust Control Systems Industry Players

Figure 27 Strengthening Market Presence Through New Product Launches and Acquisitions Between 2015 & 2017

Figure 28 Nederman: Company Snapshot

Figure 29 Nederman: SWOT Analysis

Figure 30 Donaldson Company: Company Snapshot

Figure 31 Donaldson Company: SWOT Analysis

Figure 32 Illinois Tool Works: Company Snapshot

Figure 33 Illinois Tool Works: SWOT Analysis

Figure 34 Sly Filters: SWOT Analysis

Figure 35 Spraying Systems: SWOT Analysis

Growth opportunities and latent adjacency in Dust Control Systems Market