Air Purification Systems Market Product (Dust Collectors, Fume & Smoke Collectors, Vehicle Exhaust, Others), Technology (HEPA, ESP, Activated Carbon, Ionic Filters, Others), End-Use Sector (Automotive, Construction, Healthcare, Others) - Forecast to 2020

[205 Pages Report] The air purification systems market size is estimated to grow from USD 14.46 Billion in 2015 to reach USD 20.65 Billion by 2020, at a CAGR of 7.38%. The segments considered for this report are based on product type, technology, end-use, and region. The segmentation based on product type consists of dust collectors, fume & smoke collectors, vehicle exhaust, mist eliminators, and fire/emergency exhaust, and others including air cleaners, industrial UV systems, and commercial kitchen ventilation systems. On the basis of technology, the report has been segmented into High-Efficiency Particulate Air (HEPA), electrostatic precipitator, activated carbon, and ionic filters, and others which include ultraviolet light air filters and ozone generators. The end-use sectors for air purification systems are automotive, construction, healthcare & medical, energy & utilities, and manufacturing, and others including residential, education, aviation, and hospitality sectors. The final segment, that is, region, consists of North America, Europe, Asia-Pacific, and the Rest of the World (RoW). The base year considered for the study is 2014 and the market size is projected from 2015 to 2020. Factors such as increasing health problems due to air pollution, increasing urban population, rapid industrialization, and laws & regulations, have driven the growth of the global air purification industry.

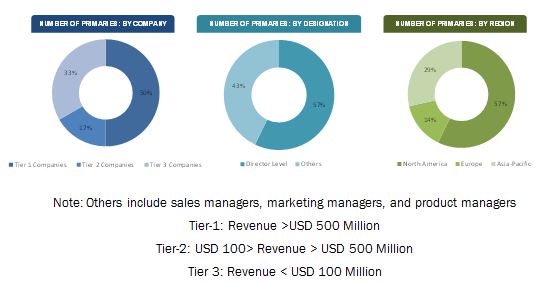

The research methodology used to estimate and forecast the air purification market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global air purification market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the figure below:

The air purification systems market comprises companies such as Honeywell International Inc. (U.S.), 3M Company (U.S.), Sharp Corporation (Japan), Daikin Industries, Ltd. (Japan), and Air Products and Chemicals, Inc. (U.S.).

Target audience

- Air purification solutions providers

- Environmental service providers

- Government and regulatory bodies

- Market research and consulting firms

- Commercial R&D institutions

- Associations and industry bodies

Scope of the Report

The research report segments the air purification market to following submarkets:

By product:

- Dust collectors

- Fume & smoke collectors

- Vehicle exhaust

- Mist eliminators

- Fire/Emergency exhaust

- Others (air cleaners, industrial UV systems, and commercial kitchen ventilation systems)

By technology:

- HEPA

- Electrostatic precipitator

- Activated carbon

- Ionic filters

- Others (ultraviolet light air filters and ozone generators)

By end-use sector:

- Automotive

- Construction

- Healthcare & medical

- Energy & utilities

- Manufacturing

- Others (residential, education, aviation, and hospitality sectors)

By region:

- North America

- Europe

- Asia-Pacific

- RoW

MarketsandMarkets projects that the air purification systems market size will grow from USD 14.46 Billion in 2015 to reach USD 20.65 Billion by 2020, at an estimated CAGR of 7.38%. Accelerated urbanization, growth in infrastructural activities, and increasing industrialization has multiplied the rate of air pollution in the environment which has resulted in the need for air purification systems across the globe. The increasing income and spending capacity of people in developing economies and increasing demand in various end-use sectors such as automotive, building & construction, healthcare & medical, manufacturing, and energy & utilities are the major factors driving the growth of the air purification market. The strict regulations pertaining to industrial emissions and concern about occupational health and safety of the workers have led the industrial and commercial sector bodies to prioritize the concern for air purification needs at all their operating and manufacturing facilities.

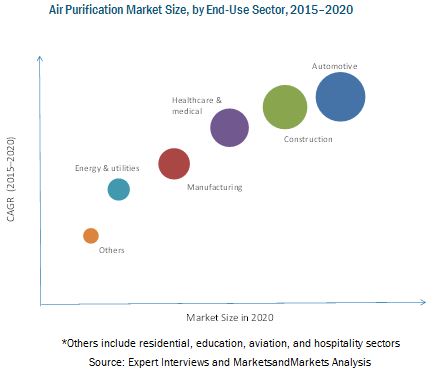

The end-use sectors of air purification systems are automotive, energy & utilities, construction, manufacturing, healthcare & medical, and others which include residential, education, aviation, and hospitality sectors. The automotive sector accounted for the largest market share in 2014 and is projected to be the fastest-growing market for air purification systems from 2015 to 2020. The rising demand for automobiles across the world and the increasing concern for indoor air quality of automobiles are expected to drive the automotive air purification market. The construction and healthcare & medical sectors are expected to follow automotive sector, registering the second- and third-highest CAGR, respectively, during the forecast period.

The air purification market, on the basis of technology, has been segmented into High-Efficiency Particulate Air (HEPA), electrostatic precipitator, activated carbon, and ionic filters. Among these technologies, HEPA is projected to register the fastest growth in the studied market followed by electrostatic precipitator.

Mergers and acquisitions were the major strategies adopted by most of the players in the air purification market. Companies such as Daikin Industries, Ltd. (U.S.), Clean Teq Holding Limited (Australia), and Mann+Hummel GmbH (Germany) were the key players that adopted these strategies to increase the reach of their offerings, improve their production capacity, and focus on core operations. Companies aim to serve the market efficiently by investing in manufacturing facilities and acquiring distribution centers in the fast-growing regions.

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency Considered

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations of the Research Study

3 Executive Summary (Page No. - 31)

3.1 Air Purification Systems Market Evolved Significantly to Its Current Position Since 1823

3.2 Air Purification Systems Market: Driving Factors

3.3 Dust Collectors Segment Projected to Grow at the Highest Rate in the Air Purification Market in 2020

3.4 Automotive to Be the Largest End-Use Sector for Air Purification Systems By 2020

3.5 Asia-Pacific is Projected to Dominate the Air Purification Market By 2020

3.6 Air Purification Systems Market in China Witnessed the Highest Growth in 2014

4 Premium Insights (Page No. - 38)

4.1 Emerging Economies to Have Higher Demand for Air Purification Systems

4.2 Hepa Segment is Projected to Grow at the Highest CAGR From 2015 to 2020

4.3 Dust Collectors Captured the Largest Share in Asia-Pacific in 2014

4.4 China Dominated the Air Purification Market in 2014

4.5 Automotive Was the Major End-Use Sector for Air Purification Application in 2014

4.6 Air Purification Industry: Life Cycle Analysis, By Region – Asia-Pacific Region Witnessing High Growth

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Evolution

5.3 Air Purification Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Health Problems Due to Air Pollution

5.4.1.2 Laws and Regulations Enforced By Governments

5.4.1.3 Increasing Urbanization and Industrialization

5.4.1.4 Increase in Consumer Spending Power

5.4.2 Restraints

5.4.2.1 High Pricing of Products Limiting Consumption

5.4.2.2 Positioning of Air Purification Systems as Luxury Goods

5.4.3 Opportunities

5.4.3.1 Growing Environmental Concern

5.4.3.2 Emerging Asia-Pacific Market

5.4.4 Challenges

5.4.4.1 Ever-Changing Consumer Requirements Leading to High Cost of R&D Activities for New Entrants

5.5 Value Chain Analysis

6 Air Purification Systems Market, By Product (Page No. - 54)

6.1 Introduction

6.1.1 Growth in Demand for Dust Collectors to Drive Air Purification Market

6.2 Air Purification Products Market, By Region

6.2.1 Dust Collectors

6.2.2 Fume & Smoke Collectors

6.2.2.1 Asia-Pacific to Lead the Market for Fume/Smoke Collectors From 2015 to 2020

6.2.3 Vehicle Exhaust

6.2.4 Mist Eliminators

6.2.5 Fire/Emergency Exhaust

6.2.5.1 Fire/Emergency Exhaust Market, By Region

6.2.6 Others

6.2.6.1 Others Market, By Region

7 Air Purification Systems Market, By Technology (Page No. - 63)

7.1 Introduction

7.1.1 Hepa is the Most Widely Used Technology in the Air Purification Market

7.2 Air Purification Technologies, By Region

7.2.1 Hepa

7.2.1.1 Hepa Segment is Projected to Witness the Highest Growth in Asia-Pacific

7.2.2 Electrostatic Precipitators

7.2.2.1 Asia-Pacific to Lead the Market for Electrostatic Precipitators From 2015 to 2020

7.2.3 Activated Carbon

7.2.3.1 Activated Carbon Market, By Region

7.2.4 Ionic Filters

7.2.4.1 Ionic Filters Market, By Region

7.2.5 Others

7.2.5.1 Others Market, By Region

8 Air Purification Systems Market, By End-Use Sector (Page No. - 72)

8.1 Introduction

8.2 Automotive

8.2.1 Automotive Market, By Region

8.3 Construction

8.3.1 Construction Market Size, By Region

8.4 Healthcare & Medical

8.4.1 Health Care & Medical Market Size, By Region

8.5 Energy & Utility

8.5.1 Energy & Utility Market Size, By Region

8.6 Manufacturing

8.6.1 Manufacturing Market Size, By Region

8.7 Others

8.7.1 Others Market Size, By Region

9 Air Purification Systems Market, By Region (Page No. - 82)

9.1 Introduction

9.2 North America

9.2.1 North America: Air Purification Systems Market, By Country

9.2.2 North America: Air Purification Systems Market, By Product

9.2.3 North America: Air Purification Systems Market, By Technology

9.2.4 North America: Air Purification Systems Market, By End-Use Sector

9.2.5 U.S.

9.2.5.1 U.S.: Economic Indicators

9.2.5.2 U.S.: Air Purification Systems Market, By Product

9.2.5.3 U.S.: Air Purification Systems Market, By Technology

9.2.5.4 U.S.: Air Purification Systems Market, By End-Use Sector

9.2.6 Canada

9.2.6.1 Canada: Economic Indicators

9.2.6.2 Canada: Air Purification Systems Market, By Product

9.2.6.3 Canada: Air Purification Systems Market, By Technology

9.2.6.4 Canada: Air Purification Systems Market, By End-Use Sector

9.2.7 Mexico

9.2.7.1 Mexico: Economic Indicators

9.2.7.2 Mexico: Air Purification Systems Market, By Product

9.2.7.3 Mexico: Air Purification Systems Market, By Technology

9.2.7.4 Mexico: Air Purification Systems Market, By End-Use Sector

9.3 Europe

9.3.1 Europe: Air Purification Systems Market, By Country

9.3.2 Europe: Air Purification Systems Market, By Product

9.3.3 Europe: Air Purification Systems Market, By Technology

9.3.4 Europe: Air Purification Systems Market, By End-Use Sector

9.3.5 Germany

9.3.5.1 Germany: Economic Indicators

9.3.5.2 Germany: Air Purification Systems Market, By Product

9.3.5.3 Germany: Air Purification Systems Market, By Technology

9.3.5.4 Germany: Air Purification Systems Market, By End-Use Sector

9.3.6 U.K.

9.3.6.1 U.K.: Economic Indicators

9.3.6.2 U.K.: Air Purification Systems Market, By Product

9.3.6.3 U.K.: Air Purification Systems Market, By Technology

9.3.6.4 U.K.: Air Purification Systems Market, By End-Use Sector

9.3.7 France

9.3.7.1 France: Economic Indicators

9.3.7.2 France: Air Purification Systems Market, By Product

9.3.7.3 France: Air Purification Systems Market, By Technology

9.3.7.4 France: Air Purification Systems Market, By End-Use Sector

9.3.8 Spain

9.3.8.1 Spain: Economic Indicators

9.3.8.2 Spain: Air Purification Systems Market, By Product

9.3.8.3 Spain: Air Purification Systems Market, By Technology

9.3.8.4 Spain: Air Purification Systems Market, By End-Use Sector

9.3.9 Italy

9.3.9.1 Italy: Economic Indicators

9.3.9.2 Italy: Air Purification Systems Market, By Product

9.3.9.3 Italy: Air Purification Systems Market, By Technology

9.3.9.4 Italy: Air Purification Systems Market, By End-Use Sector

9.3.10 Rest of Europe

9.3.10.1 Rest of Europe: Air Purification Systems Market, By Product

9.3.10.2 Rest of Europe: Air Purification Systems Market, By Technology

9.3.10.3 Rest of Europe: Air Purification Systems Market, By End-Use Sector

9.4 Asia-Pacific

9.4.1 Asia-Pacific: Air Purification Systems Market, By Country

9.4.2 Asia-Pacific: Air Purification Systems Market, By Product

9.4.3 Asia-Pacific: Air Purification Systems Market, By Technology

9.4.4 Asia-Pacific: Air Purification Systems Market, By End-Use Sector

9.4.5 China

9.4.5.1 China: Economic Indicators

9.4.5.2 China: Air Purification Systems Market, By Product

9.4.5.3 China: Air Purification Systems Market, By Technology

9.4.5.4 China: Air Purification Systems Market, By End-Use Sector

9.4.6 Japan

9.4.6.1 Japan: Economic Indicators

9.4.6.2 Japan: Air Purification Systems Market, By Product

9.4.6.3 Japan: Air Purification Systems Market, By Technology

9.4.6.4 Japan: Air Purification Systems Market, By End-Use Sector

9.4.7 South Korea

9.4.7.1 South Korea: Economic Indicators

9.4.7.2 South Korea: Air Purification Systems Market Size, By Product

9.4.7.3 South Korea: Air Purification Systems Market, By Technology

9.4.7.4 South Korea: Air Purification Systems Market, By End-Use Sector

9.4.8 India

9.4.8.1 India: Economic Indicators

9.4.8.2 India: Air Purification Systems Market, By Product

9.4.8.3 India: Air Purification Systems Market, By Technology

9.4.8.4 India: Air Purification Systems Market, By End-Use Sector

9.4.9 Rest of Asia-Pacific

9.4.9.1 Rest of Asia-Pacific: Air Purification Systems Market, By Product

9.4.9.2 Rest of Asia-Pacific: Air Purification Systems Market, By Technology

9.4.9.3 Rest of Asia-Pacific: Air Purification Systems Market, By End-Use Sector

9.5 Rest of the World

9.5.1 RoW: Air Purification Systems Market Size, By Country

9.5.2 RoW: Air Purification Systems Market, By Product

9.5.3 RoW: Air Purification Systems Market Size, By Technology

9.5.4 RoW: Air Purification Systems Market Size, By End-Use Sector

9.5.5 Brazil

9.5.5.1 Brazil: Economic Indicators

9.5.5.2 Brazil: Air Purification System Market Size, By Product

9.5.5.3 Brazil: Air Purification System Market, By Technology

9.5.5.4 Brazil: Air Purification System Market, By End-Use Sector

9.5.6 South Africa

9.5.6.1 South Africa: Economic Indicators

9.5.6.2 South Africa: Air Purification System Market Size, By Product

9.5.6.3 South Africa: Air Purification System Market, By Technology

9.5.6.4 South Africa: Air Purification System Market, By End-Use Sector

9.5.7 UAE

9.5.7.1 UAE: Economic Indicators

9.5.7.2 UAE: Air Purification System Market Size, By Product

9.5.7.3 UAE: Air Purification System Market, By Technology

9.5.7.4 UAE: Air Purification System Market, By End-Use Sector

9.5.8 Others in RoW

9.5.8.1 Others in RoW: Air Purification System Market Size, By Product

9.5.8.2 Others in RoW: Air Purification System Market, By Technology

9.5.8.3 Others in RoW: Air Purification System Market, By End-Use Sector

10 Competitive Landscape (Page No. - 169)

10.1 Overview

10.1.1 Growth Scenario of Top Five Companies in the Air Purification Market (2010-2014)

10.2 Competitive Situation & Trends

10.2.1 Mergers & Acquisitions Have Fueled the Growth of the Air Purification System Market

10.2.2 Mergers & Acquisitions Were the Key Strategies Undertaken By Market Leaders in the Air Purification Market

10.3 Mergers & Acquisitions

10.4 Expansions , Investments & Divestments

10.5 New Product Launches

10.6 Partnerships, Contracts, Agreements & Joint Ventures

11 Company Profiles (Page No. - 177)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Honeywell International Inc.

11.3 3M Company

11.4 Sharp Corporation

11.5 Daikin Industries, Ltd.

11.6 Air Products and Chemicals, Inc.

11.7 Clean Teq Holdings Limited

11.8 Alfa Laval AB

11.9 SPX Corporation

11.10 Mann+Hummel GmbH

11.11 Clarcor Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 201)

12.1 Discussion Guide

12.2 Introducing RT: Real Time Market Intelligence

12.3 Available Customizations

List of Tables (191 Tables)

Table 1 Impact of Key Drivers on the Air Purification Market

Table 2 World Urbanization Prospects

Table 3 High Pricing of Products May Restrain Market Growth

Table 4 Opportunities for Growth of Air Purification Market

Table 5 Ever-Changing Consumer Requirements is the Biggest Challenge Faced By This Industry

Table 6 Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 7 Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 8 Dust Collectors Market Size, By Region, 2013–2020 (USD Billion)

Table 9 Dust Collectors Market Size, By Region, 2013–2020 (Thousand Units)

Table 10 Fume/Smoke Collectors Market Size, By Region, 2013–2020 (USD Billion)

Table 11 Fume/Smoke Collectors Market Size, By Region, 2013–2020 (Thousand Units)

Table 12 Vehicle Exhaust Market Size, By Region, 2013–2020 (USD Billion)

Table 13 Vehicle Exhaust Market Size, By Region, 2013–2020 (Thousand Units)

Table 14 Mist Eliminators Market Size, By Region, 2013–2020 (USD Billion)

Table 15 Mist Eliminators Market Size, By Region, 2013–2020 (Thousand Units)

Table 16 Fire/Emergency Exhaust Market Size, By Region, 2013–2020 (USD Billion)

Table 17 Fire/Emergency Exhaust Market Size, By Region, 2013–2020 (Thousand Units)

Table 18 Others Market Size, By Region, 2013–2020 (USD Billion)

Table 19 Others Market Size, By Region, 2013–2020 (Thousand Units)

Table 20 Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 21 Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 22 Hepa Market Size, By Region, 2013–2020 (USD Billion)

Table 23 Hepa Market Size, By Region, 2013–2020 (Thousand Units)

Table 24 Electrostatic Precipitators Market Size, By Region, 2013–2020 (USD Billion)

Table 25 Electrostatic Precipitators Market Size, By Region, 2013–2020 (Thousand Units)

Table 26 Activated Carbon Market Size, By Region, 2013–2020 (USD Billion)

Table 27 Activated Carbon Market Size, By Region, 2013–2020 (Thousand Units)

Table 28 Ionic Filters Market Size, By Region, 2013–2020 (USD Billion)

Table 29 Ionic Filters Market Size, By Region, 2013–2020 (Thousand Units)

Table 30 Others Market Size, By Region, 2013–2020 (USD Million)

Table 31 Others Market Size, By Region, 2013–2020 (Thousand Units)

Table 32 Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 33 Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 34 Automotive Market Size, By Region, 2013–2020 (USD Billion)

Table 35 Automotive Market Size, By Region, 2013–2020 (Thousand Units)

Table 36 Construction Market Size, By Region, 2013–2020 (USD Billion)

Table 37 Construction Market Size, By Region, 2013–2020 (Thousand Units)

Table 38 Health Care & Medical Market Size, By Region, 2013–2020 (USD Billion)

Table 39 Health Care & Medical Market Size, By Region, 2013–2020 (Thousand Units)

Table 40 Energy & Utility Market Size, By Region, 2013–2020 (USD Billion)

Table 41 Energy & Utility Market Size, By Region, 2013–2020 (Thousand Units)

Table 42 Manufacturing Market Size, By Region, 2013–2020 (USD Billion)

Table 43 Manufacturing Market Size, By Region, 2013–2020 (Thousand Units)

Table 44 Others Market Size, By Region, 2013–2020 (USD Billion)

Table 45 Others Market Size, By Region, 2013–2020 (Thousand Units)

Table 46 Air Purification Market Size, By Region, 2013–2020 (USD Billion)

Table 47 Air Purification Market Size, By Region, 2013–2020 (Thousand Units)

Table 48 North America: Air Purification Systems Market Size, By Country, 2013–2020 (USD Billion)

Table 49 North America: Air Purification Systems Market Size, By Country, 2013–2020 (Thousand Units)

Table 50 North America: Air Purification Systems Market Size, By Product, 2013–2020 (USD Billion)

Table 51 North America: Air Purification Systems Market Size, By Product, 2013-2020 (Thousand Units)

Table 52 North America: Air Purification Systems Market Size, By Technology, 2013–2020 (USD Billion)

Table 53 North America: Air Purification Systems Market Size, By Technology, 2013–2020 (Thousand Units)

Table 54 North America: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 55 North America: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 56 U.S.: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 57 U.S.: Air Purification Systems Market Size, By Product, 2013–2020 (Thousand Units)

Table 58 U.S.: Air Purification Systems Market Size, By Technology, 2013–2020 (USD Billion)

Table 59 U.S.: Air Purification Systems Market Size, By Technology, 2013–2020 (Thousand Units)

Table 60 U.S.: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 61 U.S.: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 62 Canada: Air Purification Systems Market Size, By Product, 2013–2020 (USD Billion)

Table 63 Canada: Air Purification Systems Market Size, By Product, 2013-2020 (Thousand Units)

Table 64 Canada: Air Purification Systems Market Size, By Technology, 2013–2020 (USD Billion)

Table 65 Canada: Air Purification Systems Market, By Technology, 2013–2020 (Thousand Units)

Table 66 Canada: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 67 Canada: Air Purification Systems Market, By End-Use Sector, 2013–2020 (Thousand Units)

Table 68 Mexico: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 69 Mexico: Air Purification Systems Market Size, By Product, 2013-2020 (Thousand Units)

Table 70 Mexico: Air Purification Systems Market Size, By Technology, 2013–2020 (USD Billion)

Table 71 Mexico: Air Purification Systems Market Size, By Technology, 2013–2020 (Thousand Units)

Table 72 Mexico: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 73 Mexico: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 74 Europe: Air Purification Market Size, By Country, 2013–2020 (USD Billion)

Table 75 Europe: Air Purification Systems Market Size, By Country, 2013–2020 (Thousand Units)

Table 76 Europe: Air Purification Systems Market Size, By Product, 2013–2020 (USD Billion)

Table 77 Europe: Air Purification Systems Market Size, By Product, 2014-2020 (Thousand Units)

Table 78 Europe: Air Purification Systems Market Size, By Technology, 2013–2020 (USD Billion)

Table 79 Europe: Air Purification Systems Market Size, By Technology, 2013–2020 (Thousand Units)

Table 80 Europe: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 81 Europe: Air Purification Systems Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 82 Germany: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 83 Germany: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 84 Germany: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 85 Germany: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 86 Germany: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 87 Germany: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 88 U.K.: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 89 U.K.: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 90 U.K.: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 91 U.K.: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 92 U.K.: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 93 U.K.: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 94 France: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 95 France: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 96 France: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 97 France: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 98 France: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 99 France: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 100 Spain: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 101 Spain: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 102 Spain: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 103 Spain: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 104 Spain: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 105 Spain: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 106 Italy: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 107 Italy: Air Purification Market Size, By Product, 2013-2020 (Thousand Units)

Table 108 Italy: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 109 Italy: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 110 Italy: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 111 Italy: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 112 Rest of Europe: Air Purification Market Size, By Product, 2013-2020 (USD Billion)

Table 113 Rest of Europe: Air Purification Market Size, By Product, 2013-2020 (Thousand Units)

Table 114 Rest of Europe: Air Purification Market Size, By Technology, 2013-2020 (USD Billion)

Table 115 Rest of Europe: Air Purification Market Size, By Technology, 2013-2020 (Thousand Units)

Table 116 Rest of Europe: Air Purification Market Size, By End-Use Sector, 2013-2020 (USD Billion)

Table 117 Rest of Europe: Air Purification Market Size, By End-Use Sector, 2013-2020 (Thousand Units)

Table 118 Asia-Pacific: Air Purification Market Size, By Country, 2013–2020 (USD Billion)

Table 119 Asia-Pacific: Air Purification Market Size, By Country, 2013–2020 (Thousand Units)

Table 120 Asia-Pacific: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 121 Asia-Pacific: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 122 Asia-Pacific: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 123 Asia-Pacific: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 124 Asia-Pacific: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 125 Asia-Pacific: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 126 China: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 127 China: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 128 China: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 129 China: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 130 China: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 131 China: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 132 Japan: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 133 Japan: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 134 Japan: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 135 Japan: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 136 Japan: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 137 Japan: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 138 South Korea: Air Purification Market Size, By Product, 2013–2020 (USD Million)

Table 139 South Korea: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 140 South Korea: Air Purification Market Size, By Technology, 2013–2020 (USD Million)

Table 141 South Korea: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 142 South Korea: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 143 South Korea: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 144 India: Air Purification Market Size, By Product, 2013–2020 (USD Million)

Table 145 India: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 146 India: Air Purification Market Size, By Technology, 2013–2020 (USD Million)

Table 147 India: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 148 India: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Million)

Table 149 India: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 150 Rest of Asia-Pacific: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 151 Rest of Asia-Pacific: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 152 Rest of Asia-Pacific: Air Purification Market Size, By Technology, 2013–2020 (USD Million)

Table 153 Rest of Asia-Pacific: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 154 Rest of Asia-Pacific: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 155 Rest of Asia-Pacific: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 156 RoW: Air Purification Market Size, By Country, 2013–2020 (USD Billion)

Table 157 RoW: Air Purification Market Size, By Country, 2013–2020 (Thousand Units)

Table 158 RoW: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 159 RoW: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 160 RoW: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 161 RoW: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 162 RoW: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 163 RoW: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 164 Brazil: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 165 Brazil: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 166 Brazil: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 167 Brazil: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 168 Brazil: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 169 Brazil: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 170 South Africa: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 171 South Africa: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 172 South Africa: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 173 South Africa: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 174 South Africa: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 175 South Africa: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 176 UAE: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 177 UAE: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 178 UAE: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 179 UAE: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 180 UAE: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 181 UAE: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 182 Others in RoW: Air Purification Market Size, By Product, 2013–2020 (USD Billion)

Table 183 Others in RoW: Air Purification Market Size, By Product, 2013–2020 (Thousand Units)

Table 184 Others in RoW: Air Purification Market Size, By Technology, 2013–2020 (USD Billion)

Table 185 Others in RoW: Air Purification Market Size, By Technology, 2013–2020 (Thousand Units)

Table 186 Others in RoW: Air Purification Market Size, By End-Use Sector, 2013–2020 (USD Billion)

Table 187 Others in RoW: Air Purification Market Size, By End-Use Sector, 2013–2020 (Thousand Units)

Table 188 Mergers & Acquisitions, 2013–2015

Table 189 Expansions, Investments & Divestments, 2012–2015

Table 190 New Product Launches, 2012–2015

Table 191 Partnerships, Contracts, Agreements & Joint Ventures, 2013–2015

List of Figures (51 Figures)

Figure 1 Air Purification Market

Figure 2 Air Purification Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Limitations of the Research Study

Figure 7 Evolution of Air Purification Systems

Figure 8 Air Purification Market Snapshot (2015 vs 2020)

Figure 9 The Highest Demand for Air Purification Systems is Expected From the Automotive Sector By 2020

Figure 10 Asia-Pacific is Projected to Be the Market Leader in the Air Purification Market By 2020

Figure 11 China Was the Fastest-Growing Country for the Air Purification Market in 2014

Figure 12 Leading Market Players Adopted Mergers & Acquisitions as the Key Strategy From 2011 to 2015

Figure 13 Emerging Economies Offer Attractive Opportunities in the Air Purification Market

Figure 14 HEPA Technology Had the Largest Market Size 2014

Figure 15 The Largest Share Was Captured By China in the Emerging Asia-Pacific Market in 2014

Figure 16 China is Projected to Be the Fastest-Growing Market for Air Purification Systems From 2015 to 2020

Figure 17 Automotive: Major End-Use Sector in 2014

Figure 18 Air Purification Industry Life Cycle, By Region

Figure 19 Evolution of Air Purification

Figure 20 Air Purification Market Segmentation

Figure 21 Increasing Level of Air Pollution and Laws & Regulations Result in Increased Demand for Air Purification Systems

Figure 22 Middle Class Population, Growth Ratio, 2009–2030

Figure 23 Value Chain Analysis

Figure 24 Dust Collector Segment is Projected to Grow at the Highest CAGR, 2015–2020

Figure 25 HEPA is Projected to Grow at the Highest CAGR, 2015–2020

Figure 26 Air Purification Market, By End-Use Sector, 2015 vs 2020 (USD Billion)

Figure 27 Geographic Snapshot (2015–2020): the Market in China is Projected to Grow at the Highest Rate

Figure 28 North American Air Purification Market Snapshot: the U.S. is Projected to Be the Fastest-Growing Market During the Forecast Period (2015–2020)

Figure 29 U.S. Air Purification Market, By Technology, 2015 vs 2020

Figure 30 Asia-Pacific Air Purification Market Snapshot: China is Projected to Be the Fastest-Growing Country During the Forecast Period (2015-2020)

Figure 31 Companies Adopted Mergers & Acquisitions as the Key Growth Strategies During the Studied Period (2011–2015)

Figure 32 Daikin Industries, Ltd. Grew at the Highest Rate From 2010 to 2014

Figure 33 2015 is Observed to Be the Most Active Year in Terms of Number of Developments in the Air Purification Market

Figure 34 Mergers & Acquisitions: the Key Strategies, 2011–2015

Figure 35 Annual Developments in the Air Purification Market, 2011–2015

Figure 36 Geographic Revenue Mix of Top Five Market Players

Figure 37 Honeywell International Inc.: Company Snapshot

Figure 38 Honeywell International Inc.: SWOT Analysis

Figure 39 3M Company: Company Snapshot

Figure 40 3M Company: SWOT Analysis

Figure 41 Sharp Corporation : Company Snapshot

Figure 42 Sharp Corporation: SWOT Analysis

Figure 43 Daikin Industries, Ltd. : Company Snapshot

Figure 44 Daikin Industries, Ltd. :SWOT Analysis

Figure 45 Air Products and Chemicals, Inc.: Company Snapshot

Figure 46 Air Products and Chemicals, Inc.: SWOT Analysis

Figure 47 Clean TEQ Holdings Limited: Company Snapshot

Figure 48 Alfa Laval AB: Company Snapshot

Figure 49 SPX Corporation: Company Snapshot

Figure 50 Mann+Hummel GmbH: Company Snapshot

Figure 51 Clarcor Inc.: Company Snapshot

Growth opportunities and latent adjacency in Air Purification Systems Market