Sand Control Solutions Market by Location (Onshore, Offshore), Application (Cased hole, Open hole), Well Type (Horizontal, Vertical), Type (Gravel Pack, Frac Pack, Sand Screens, Inflow Control Devices, Others), and Region - Global Forecast to 2025

The global sand control solutions market size was valued at $2.1 billion in 2020 and to reach $3.2 billion by 2025, growing at a compound annual growth rate (CAGR) of 8.9% from 2020 to 2025. The continuous shale development activities and efforts to increase reserve to production ratio from the wells are the key factors driving the growth of the sand control solutions market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Sand Control Solutions Market

The COVID-19 outbreak has entire power industry negatively. According to IEA, the COVID-19 crisis has significantly impacted the oil & gas exploration & production activities. The decline is caused mainly due to delay in project construction activity and supply chain disruptions, as major countries imposed lockdown, social distancing measures for workers, and financial challenges.

China, which is largest consumer of oil, gas, and refined petroleum products, was under lockdown for about 2 months. Due to this, the oil prices started to decline in February 2020. Besides, in March 2020, Saudi Arabia and Russia witnessed an oil price war, when Saudi Arabia responded to Russia’s denial on cutting production so that prices could remain moderate. This lasted for days, resulting in a declining trend in oil prices in spring. Although it was just for a day, it had severely impacted economies of oil-producing countries. Since July 2020, the oil prices gained momentum, and are still lying in price ranges of USD 35–40. The impact of COVID-19 on crude oil prices, well drilling and production activities, exploration, completion, as well as on the supply chain has been analyzed in this report. Owing to the decline in drilling and production activities, the pandemic has negatively impacted the demand for sand control services in the short term.

Sand control solutions Market Dynamics

Driver: Increasing efforts for improving reserve to production ratio from existing/mature wells

The reserve to production ratio indicates the remaining lifespan of a natural resource, at a given production rate. With the dip in crude oil prices, oilfield operators are focusing on existing wells and improving the reserve to production ratio.

With the decline in oil reserves, major oil & gas companies have shifted their attention toward technological advancements to invent tools and techniques required to access residual reserves on conventional wells. Oilfield operator companies are currently focused on increasing recovery and extending the life of mature fields, hence, exceeding natural production levels. At present, the number of mature oilfields is quite high and is increasing due to the rising oil and gas production, which results in the rapid depletion of new fields. The recovery potential of these depleting resources is enormous with 80% of estimated reserves found in the Middle Eastern and North African regions, 43% in the Asia Pacific region, and 24% in Latin America. Further, more than 60% of the oilfields have become mature in Norway and the UK, which further creates enough demand for sand control solution services to extract the locked potential of the reservoirs.

Restraints: Fluctuating crude oil prices negatively impacting drilling activities

The ultimate factor influencing the complete oil & gas value chain is crude oil prices. Since 2014, oil prices have become too volatile, and North America’s rig count and drilling operations have been affected at a large scale. Many oil & gas companies are not able to sustain owing to such volatilities. According to press releases, though the prices have been stabilizing after 2016, the risk associated with drilling activities has increased. The chart below shows the price fluctuations of oil and gas on a quarterly basis from 2016 to 2019. Further, the impact of COVID-19 has resulted in a severe decline in oil & gas prices in the first quarter of 2020. As lockdown across geographies restricted people from movement outside their homes, the oil demand has declined and on 20 April 2020, the price of oil has reached a negative value for the first time in history.

Operational expenses are heavily dependent on oil & gas prices as the profit margins of the companies vary with the fluctuation in oil prices. Sand control services are directly related to operational expenditures per well, and the costs of the services are also dependent on oil prices. In low-cost scenarios, oilfield service providers experience a decline in contracts and projects

Opportunities: Increased offshore exploration and production activities

The oil & gas industry is experiencing continuous discoveries owing to the increased demand for oil and the tight supply due to the continued OPEC oil production cut. Major discoveries are being experienced in the offshore region, especially in western offshore Africa. According to the BP Statistical Review of 2019, the world still had unexplored 1,729.7 billion barrels of oil reserves by the end of 2018. Such promising reserves create opportunities for well drilling and production activities, which further creates opportunities for the sand control solutions market.

In 2019, Shell made a significant oil discovery at the Blacktip prospect in the deep-water US Gulf of Mexico. Gazprom, a Russian oil and gas company, discovered more than 500 billion cum of natural gas in two fields offshore the Yamal Peninsula in the Russian Arctic. Further, Thai PTTEP made the largest ever gas discovery in the Sarawak-Luconia-East Natuna basin, Malaysia. The estimated size is 2 trillion cubic feet, making this the seventh-largest global discovery of the year.

Furthermore, companies are spending money on acquiring more assets to start production in the African subcontinent. For instance, in mid-2018, Eni announced the fourth oil discovery in the exploration program on Block 15/06 offshore Angola, which has a production capacity exceeding 10,000 barrels of light oil per day. The well production process directly creates opportunities for the sand control solutions market. The accelerated oilfield discoveries are the best opportunities for the sand control solutions market in the upcoming years.

Challenges: Challenging operations in High-Pressure High Temperature (HPHT) wells

As the demand for oil and gas production is rising, the operators are opting for drilling activities in challenging geographic conditions. HPHT wells are one such example. Attractive new prospects such as deep-water high-pressure wells in the Gulf of Mexico, the commercial viability of previously uneconomic gas plays, and the increasing use of thermal recovery techniques have dramatically increased the requirement for operations in HPHT wells. However, the drilling of HPHT exploratory wells involves high-risk and high-cost operations with immense incident exposure levels. Sand production creates a number of safety hazards, which is a concern for HPHT well operation. Handling HPHT fluid in surface equipment is a major challenge with reference to corrosion, erosion, sand, wax, and hydrate formation. This creates a challenging environment for sand control solution and service providers.

To know about the assumptions considered for the study, download the pdf brochure

By location, the onshore segment is the largest contributor in the sand control solutions market in 2019.

At onshore oil & gas fields, sand control equipment/tools are placed in the wellbore to increase the flow rate and filter sand during extraction. Sand control solutions include gravel packs, screens, or a combination of both. Most onshore formations are hardened and have older sands and, hence, require sand control solutions to filter sand. Sand control techniques are designed based on the type of the well and the size and other properties such as permeability and porosity of the sand particles. The onshore location held a larger market size due to the presence of vast onshore oil & gas wells and increased dependency on conventional oil & gas, which is the most profitable and convenient to way meet the energy demand. Gravel packs are mainly installed for onshore locations. Onshore locations involve the placing of these systems in the wellbore to filter sand during extraction. The growing demand in onshore applications shows increasing oil production from basins such as Permian. Such factors are expected to boost the demand for the sand control solution market for the onshore location during the forecast period

By application, cased hole segment is expected to be the largest contributor during the forecast period.

Cased-hole sand control methods are more widely used due to technical reasons relating to the stability of the hole. In a cased-hole completion, production casing is set in the reservoir and ensures safe production operations. It also acts as a barrier and prevents solids, unwanted fluids, and gases from entering the wellbore. To achieve production, the casing and cement are perforated to allow the hydrocarbons to enter the well stream. This process involves running a perforation gun and a reservoir locating device into the wellbore, many times through a wireline, slackline, or coiled tubing. Once the reservoir level has been reached, the gun then shoots holes in the sides of the well to allow hydrocarbons to enter the well stream. The need to increase production from maturing oilfields and shale reservoirs drives the demand for cased-hole sand control solutions.

By well type, the horizontal segment is expected to be the largest contributor during the forecast period.

Horizontal drilling and multistage hydraulic fracturing have unlocked vast quantities of natural gas in shale reservoirs. Horizontal drilling and multistage hydraulic fracturing help increase the surface area of the reservoir that is in contact with the wellbore, which unlocks a huge quantity of natural gas in reservoirs. Operators are developing solutions to overcome the challenges while production, such as water shutoffs, and wax formations, which are higher in horizontal wells as compared to vertical wells.

According to the EIA, in 2018, wells drilled horizontally into tight oil & shale gas formations continue to account for an increasing share of natural gas and crude oil production in the US. Horizontal wells accounted for about 14% of the US natural gas production in shale formations in 2004, which increased to 97% in 2018.

By type, the gravel pack segment is expected to be the largest contributor during the forecast period.

Gravel packing is an effective means of preventing the formation of sand from entering the production string. Gravel pack systems are used to increase the surface area of the producing well to increase the production rates. In gravel packing, a steel screen is placed in the wellbore and the surrounding annulus is packed with the prepared gravel of a specific size designed to prevent the passage of formation sand. The primary objective is to stabilize the formation while causing minimal impairment to well productivity. Gravel pack systems are suitable for unconsolidated to tight sand formations, both open-hole or cased-hole wells, and for both conventional and unconventional applications. The advantages of an open-hole gravel pack are increased reliability and productivity from the well.

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific is segmented into China, Indonesia, India, Australia, Thailand, and the Rest of Asia Pacific. The Rest of Asia Pacific includes Malaysia, Myanmar, and Pakistan. China accounted for a share of 55.7% of the sand controls solutions market in Asia Pacific in 2019. The region accounts for a substantial portion of the global oil demand due to the rise in industrialization, urbanization, population growth, and the growth of the consumer class. This growth in oil demand propels oil & gas exploration and production activities, which drives the market for oilfield equipment and services, including sand control solutions.

The key regions for onshore oil & gas production in Asia Pacific include Daqing Field (China), Tahe Oil Field (China), Cooper Basin (Australia), Adavale Basin (Australia), Amadeus Basin (Australia), Digboi (India), and Ankleshwar (India). Despite considerable number of oil reserves, exploration and production industry in Asia Pacific needs more attention on production optimization and reserve replacement. The recovery rate of oil & gas needs to be improved as many Asian countries rely on imported crude oil for their energy needs. The need to develop new resources and increase production from existing fields would drive the growth of the sand control solutions market in Asia Pacific.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Location, Application, Well Type, Type, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East, Africa, and South America |

|

Companies covered |

Schlumberger (US), Halliburton (US), Baker Hughes Company (US), Weatherford (Switzerland), Superior Energy Services (US), Oil States International (US), Anton Oilfield Services (China), China Oilfield Services (China), Tendeka (UK), RGL Reservoir Management (Canada), KATT GmBH (Germany), MiddleEast Oilfield Services (Kuwait), Variperm (Canada), Mitchell Industries (US), Siao Petroleo (Brazil) |

This research report categorizes the sand control solutions market-based on type, pump type, application, and region.

Based on Location, the Sand control solutions market has been segmented as follows:

- Onshore

- Offshore

Based on application, the sand control solutions market has been segmented as follows:

- Open hole

- Cased hole

Based on Well type, the sand control solutions market has been segmented as follows:

- Horizontal

- Vertical

Based on type, the sand control solutions market has been segmented as follows:

- Gravel pack

- Frac pack

- Sand screens

- Inflow control devices

- others

Based on the region, the sand control solutions market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East

- Africa

Recent Developments

- In March 2020, Tendeka won a contract from Mubadala Petroleum, an oil & gas company, to provide FloElite sand screens and FloSure Autonomous Inflow Control Devices (AICDs) to Mubadala Petroleum’s Jasmine, Manora, and Nong Yao fields in the Gulf of Thailand. The contract also has the option of two 1-year extensions.

- In December 2020, Tendeka launched a one-trip remedial system to address the issue of sand control failure in wells. The Filtrex remedial sand control system provides the flexibility to be installed thru-tubing, through the tightest of restrictions. The Filtrex system provides the ability to perform sand clean out whilst installing the tool.

- In November 2020, Halliburton introduced the Xtreme Single-Trip Multizone (XSTMZTM) system for completing wells in deep-water and ultra-deep-water conditions up to 15,000-psi. Based on 10,000-psi rated Enhanced Single-Trip Multizone (ESTMZTM) system, the increased pressure rating of the XSTMZ system allows operators to isolate and frac pack multiple zones at higher pump rates with larger proppant volumes. It also supports the ability to create zonal compartments for better stimulation of long pay zones that have high-pressure differentials between them.

- In October 2019, Halliburton introduced the Xtreme Single-Trip Multizone (XSTMZTM) system for completing wells in deep-water and ultra-deep-water conditions up to 15,000-psi. Based on 10,000-psi rated Enhanced Single-Trip Multizone (ESTMZTM) system, the increased pressure rating of the XSTMZ system allows operators to isolate and frac pack multiple zones at higher pump rates with larger proppant volumes. It also supports the ability to create zonal compartments for better stimulation of long pay zones that have high-pressure differentials between them.

Frequently Asked Questions (FAQ):

What is the current size of the sand control solutions market?

The current market size of global sand control solutions market is billion $2.1 in 2020.

What is the major drivers for sand control solutions market?

The continuous shale development activities and the efforts to increase reserve to production ratio from the wells are the key factors driving the growth of the sand control solutions market.

Which is the fastest growing region during the forecasted period in sand control solutions market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing investments for development of offshore reserves and increasing production from mature wells

Which is the fastest growing segment, by type during the forecasted period in sand control solutions market?

The gravel pack segment, by type is the fastest growing segment during the forecasted period owing better reliability, longer life, and increased productivity from the well. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 SAND CONTROL SOLUTIONS MARKET, BY TYPE: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 SAND CONTROL SOLUTIONS MARKET: RESEARCH DESIGN

2.1.1 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

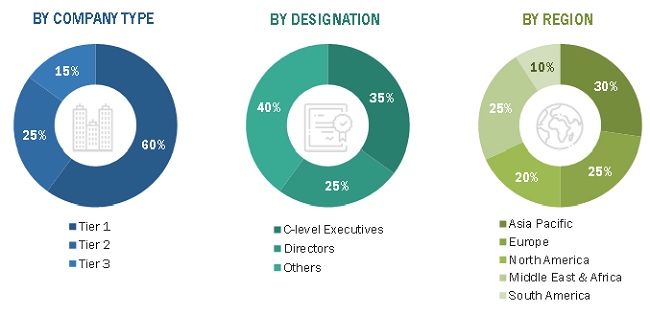

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 1 SAND CONTROL SOLUTIONS MARKET: PLAYERS/COMPANIES CONNECTED

2.2 SCOPE

2.2.1 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 TOP-DOWN APPROACH

2.3.3 IDEAL DEMAND-SIDE ANALYSIS

FIGURE 6 SAND CONTROL SOLUTIONS MARKET: DEMAND-SIDE ANALYSIS

2.3.3.1 Assumptions for demand-side analysis

2.3.3.2 Calculation

2.3.4 SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side assumptions

2.3.4.2 Supply-side calculation

FIGURE 7 MARKET RANKING & INDUSTRY CONCENTRATION, 2019

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: SAND CONTROL SOLUTIONS MARKET, 2018–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 2 SAND CONTROL SOLUTIONS MARKET SNAPSHOT

FIGURE 9 ONSHORE APPLICATION EXPECTED TO DOMINATE SAND CONTROL SOLUTIONS MARKET DURING FORECAST PERIOD

FIGURE 10 CASED-HOLE WELL COMPLETION SEGMENT IS EXPECTED TO LEAD SAND CONTROL SOLUTIONS MARKET DURING FORECAST PERIOD

FIGURE 11 HORIZONTAL SEGMENT EXPECTED TO LEAD SAND CONTROL SOLUTIONS MARKET DURING FORECAST PERIOD

FIGURE 12 GRAVEL PACK SEGMENT IS ESTIMATED TO LEAD SAND CONTROL SOLUTIONS MARKET DURING FORECAST PERIOD

FIGURE 13 NORTH AMERICAN MARKET DOMINATED SAND CONTROL SOLUTIONS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL SAND CONTROL SOLUTIONS MARKET

FIGURE 14 INCREASING OFFSHORE EXPLORATION AND PRODUCTION ACTIVITIES ARE EXPECTED TO BOOST GROWTH OF SAND CONTROL SOLUTIONS MARKET DURING FORECAST PERIOD

4.2 SAND CONTROL SOLUTIONS MARKET, BY LOCATION

FIGURE 15 ONSHORE SEGMENT HELD LARGER SHARE OF SAND CONTROL SOLUTION MARKET IN 2019

4.3 SAND CONTROL SOLUTIONS MARKET, BY APPLICATION

FIGURE 16 CASED-HOLE SEGMENT LED SAND CONTROL SOLUTIONS MARKET IN 2019

4.4 SAND CONTROL SOLUTIONS MARKET, BY WELL TYPE

FIGURE 17 HORIZONTAL SEGMENT HELD MAJOR SHARE OF SAND CONTROL SOLUTIONS MARKET IN 2019

4.5 SAND CONTROL SOLUTIONS MARKET, BY TYPE

FIGURE 18 GRAVEL PACK SEGMENT DOMINATED SAND CONTROL SOLUTIONS MARKET IN 2019

4.6 SAND CONTROL SOLUTIONS MARKET, BY REGION

FIGURE 19 NORTH AMERICA IS EXPECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4.7 NORTH AMERICAN SAND CONTROL SOLUTIONS MARKET, BY LOCATION & COUNTRY

FIGURE 20 ONSHORE SEGMENT AND US DOMINATED NORTH AMERICAN SAND CONTROL SOLUTIONS MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 YC SHIFT

FIGURE 21 YC SHIFT

5.3 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19 GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.4 ROAD TO RECOVERY

FIGURE 24 RECOVERY ROAD FOR 2020 & 2021

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.6 MARKET DYNAMICS

FIGURE 26 SAND CONTROL SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.6.1 DRIVERS

5.6.1.1 Increasing efforts for improving reserve to production ratio from existing/mature wells

FIGURE 27 PEAK LOSS OF OIL FROM MATURE CONVENTIONAL OILFIELDS, 2010–2017

5.6.1.2 Growing shale developments across geographies

TABLE 3 TECHNICALLY RECOVERABLE SHALE RESOURCES: TOP COUNTRIES

5.6.1.3 Increasing depths of wells

FIGURE 28 GLOBAL OIL & GAS UPSTREAM CAPITAL SPENDING (2014–2019)

5.6.2 RESTRAINTS

5.6.2.1 Fluctuating crude oil prices negatively impacting drilling activities

FIGURE 29 OIL & GAS PRICE TRENDS Q-O-Q BASIS (2016–2020)

5.6.2.2 Strict government regulations on E&P activities

5.6.2.3 Decreasing oil demand from Europe

FIGURE 30 OIL CONSUMPTION TREND IN EUROPE (2014–2040)

5.6.3 OPPORTUNITIES

5.6.3.1 Increased offshore exploration and production activities

5.6.3.2 High demand for subsea sand control solutions

5.6.4 CHALLENGES

5.6.4.1 Challenging operations in High-Pressure High Temperature (HPHT) wells

5.6.4.2 Impact of COVID-19 on oil and gas production activities

5.7 SUPPLY CHAIN OVERVIEW

FIGURE 31 SAND CONTROL SOLUTIONS SUPPLY CHAIN

5.7.1 KEY INFLUENCERS

5.7.1.1 Equipment manufacturers

5.7.1.2 Service providers

5.7.1.3 Oilfield operators

5.8 TECHNOLOGY ANALYSIS

5.8.1 TECHNOLOGICAL ADVANCEMENTS IN SAND CONTROL SOLUTIONS

5.9 CASE STUDY ANALYSIS

5.9.1 RGL RESERVOIR MANAGEMENT SAVED 1300 WELLS FROM EXPENSIVE WORKOVER OR SHUT-INS IN NORTHERN ALBERTA

TABLE 4 PROJECT STATISTICS

5.1 MARKET MAP

FIGURE 32 SAND CONTROL SOLUTIONS: MARKET MAP

6 IMPACT OF COVID-19 ON SAND CONTROL SOLUTIONS MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 73)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON GDP

TABLE 5 GDP ANALYSIS (IN PERCENTAGE)

6.3 SCENARIO ANALYSIS OF OIL & GAS INDUSTRY

FIGURE 33 CRUDE OIL PRICE VS. CRUDE OIL PRODUCTION (2018–2025)

6.4 OPTIMISTIC SCENARIO

TABLE 6 OPTIMISTIC SCENARIO: CASED HOLE SAND CONTROL SOLUTIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.5 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: CASED HOLE SAND CONTROL SOLUTIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.6 PESSIMISTIC SCENARIO

TABLE 8 PESSIMISTIC SCENARIO: CASED HOLE SAND CONTROL SOLUTIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

7 SAND CONTROL SOLUTIONS MARKET, BY LOCATION (Page No. - 78)

7.1 INTRODUCTION

FIGURE 34 ONSHORE LOCATION TO DOMINATE SAND CONTROL SOLUTIONS MARKET DURING FORECAST PERIOD

TABLE 9 SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION,2016–2019 (USD MILLION)

TABLE 10 SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2018–2025 (USD MILLION)

7.2 ONSHORE

7.2.1 INCREASING SHALE AND ONSHORE OILFIELD ACTIVITIES DRIVE SAND CONTROL MARKET

TABLE 11 ONSHORE: CASED HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 ONSHORE: CASED HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.3 OFFSHORE

7.3.1 INCREASED DEEPWATER AND ULTRA DEEPWATER PRODUCTION ACTIVITIES ARE EXPECTED TO DRIVE SAND CONTROL SOLUTIONS MARKET

TABLE 13 OFFSHORE: CASED HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 OFFSHORE: CASED HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8 SAND CONTROL SOLUTIONS MARKET, BY APPLICATION (Page No. - 83)

8.1 INTRODUCTION

FIGURE 35 CASED HOLE SEGMENT LED SAND CONTROL SOLUTIONS MARKET IN 2019

TABLE 15 SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 16 SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

8.2 OPEN HOLE

8.2.1 ASIA PACIFIC TO OFFER LUCRATIVE OPPORTUNITIES FOR OPEN-HOLE SAND CONTROL SOLUTIONS

TABLE 17 OPEN HOLE: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 OPEN HOLE: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 CASED HOLE

8.3.1 INCREASING EXPLORATION & PRODUCTION ACTIVITIES FROM UNCONVENTIONAL RESERVOIRS BOOST MARKET GROWTH

TABLE 19 CASED HOLE: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 CASED HOLE: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9 SAND CONTROL SOLUTIONS MARKET, BY WELL TYPE (Page No. - 88)

9.1 INTRODUCTION

FIGURE 36 HORIZONTAL SEGMENT DOMINATED SAND CONTROL SOLUTIONS MARKET, BY WELL TYPE, IN 2019

TABLE 21 OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 22 OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2020–2025 (USD MILLION)

9.2 HORIZONTAL

9.2.1 INCREASING PRODUCTION FROM SHALE RESERVES ARE EXPECTED TO DRIVE MARKET FOR HORIZONTAL WELL SEGMENT IN NORTH AMERICA

TABLE 23 HORIZONTAL: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 HORIZONTAL: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.3 VERTICAL

9.3.1 RISING PRODUCTION FROM MATURE WELLS DRIVES DEMAND FOR SAND CONTROL SOLUTIONS

TABLE 25 VERTICAL: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 VERTICAL: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10 SAND CONTROL SOLUTIONS MARKET, BY TYPE (Page No. - 93)

10.1 INTRODUCTION

FIGURE 37 GRAVEL PACK SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2019

TABLE 27 OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 28 OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

10.2 GRAVEL PACK

10.2.1 LONG LIFE AND INCREASED SAFETY OF OPERATIONS DRIVE MARKET FOR GRAVEL PACK SAND CONTROL SOLUTIONS

TABLE 29 GRAVEL PACK: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 GRAVEL PACK: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.3 FRAC PACK

10.3.1 INCREASING PRODUCTION FROM HIGHLY PERMEABLE FORMATIONS DRIVES FRAC PACK SAND CONTROL SOLUTIONS MARKET

TABLE 31 FRAC PACK: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 FRAC PACK: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.4 SAND SCREENS

10.4.1 LOW COST OF SAND SCREEN OPERATIONS BOOSTS THEIR MARKET GROWTH

TABLE 33 SAND SCREENS: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 SAND SCREENS: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.5 INFLOW CONTROL DEVICES

10.5.1 NEED TO BALANCE WELL FLOW AND REDUCE WATER PRODUCTION DRIVE DEMAND FOR INFLOW CONTROL DEVICES

TABLE 35 INFLOW CONTROL DEVICES: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 INFLOW CONTROL DEVICES: SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.6 OTHERS

TABLE 37 OTHERS: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 OTHERS: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11 SAND CONTROL SOLUTIONS MARKET, BY REGION (Page No. - 102)

11.1 INTRODUCTION

FIGURE 38 SAND CONTROL SOLUTIONS MARKET IN NORTH AMERICA IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 39 ASIA PACIFIC DOMINATED SAND CONTROL SOLUTIONS MARKET, 2019

TABLE 39 SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 SAND CONTROL SOLUTIONS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 40 GRAVEL PACK SAND CONTROL SOLUTIONS MARKET IN ASIA PACIFIC: REGIONAL SNAPSHOT

11.2.1 BY LOCATION

TABLE 41 ASIA PACIFIC: OPEN HOLE SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 42 ASIA PACIFIC: GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.2.2 BY APPLICATION

TABLE 43 ASIA PACIFIC: GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 44 ASIA PACIFIC:GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

11.2.3 BY WELL TYPE

TABLE 45 ASIA PACIFIC: GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 46 ASIA PACIFIC:GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2020–2025 (USD MILLION)

11.2.4 BY TYPE

TABLE 47 ASIA PACIFIC: GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 48 ASIA PACIFIC: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.5 BY COUNTRY

TABLE 49 ASIA PACIFIC: GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 50 ASIA PACIFIC: GRAVEL PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.2.5.1 China

11.2.5.1.1 Increasing activities from shale reserves surge demand for sand controls solutions

TABLE 51 CHINA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 52 CHINA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 53 CHINA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 54 CHINA:FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.2.5.2 India

11.2.5.2.1 Rising investments for offshore exploration & production activities are expected to drive sand controls solutions market

TABLE 55 INDIA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 56 INDIA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 57 INDIA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 58 INDIA:FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.5.3 Indonesia

11.2.5.3.1 Demand from mature wells is expected to boost market growth

TABLE 59 INDONESIA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 60 INDONESIA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 61 INDONESIA: FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 62 INDONESIA:FRAC PACK SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.5.4 Australia

11.2.5.4.1 Growing focus on offshore fields is likely to propel market growth

TABLE 63 AUSTRALIA: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 64 AUSTRALIA: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 65 AUSTRALIA: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 66 AUSTRALIA:SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.5.5 Thailand

11.2.5.5.1 Increasing investments to prevent natural gas shortage are likely to drive sand control solutions market

TABLE 67 THAILAND: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 68 THAILAND:SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 69 THAILAND: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 70 THAILAND:SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.2.5.6 Rest of Asia Pacific

TABLE 71 REST OF ASIA PACIFIC: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE,BY LOCATION, 2016–2019

TABLE 72 REST OF ASIA PACIFIC: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 73 REST OF ASIA PACIFIC: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 74 REST OF ASIA PACIFIC: SAND SCREENS SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 41 SAND CONTROL SOLUTIONS MARKET IN NORTH AMERICA: REGIONAL SNAPSHOT

11.3.1 BY LOCATION

TABLE 75 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.3.2 BY APPLICATION

TABLE 77 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

11.3.3 BY WELL TYPE

TABLE 79 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2020–2025 (USD MILLION)

11.3.4 BY TYPE

TABLE 81 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 82 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.5 BY COUNTRY

TABLE 83 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.3.5.1 US

11.3.5.1.1 Growing development of shale gas reserves to drive sand control solutions market

TABLE 85 US: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 86 US: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 87 US: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 88 US: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.5.2 Canada

11.3.5.2.1 Rising production of tight oil and growth in oil sand formations in Alberta to surge demand for sand controls solutions

TABLE 89 CANADA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 90 CANADA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 91 CANADA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 92 CANADA: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.3.5.3 Mexico

11.3.5.3.1 Investments for developing unconventional reserves to boost sand controls solutions market growth

TABLE 93 MEXICO: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 94 MEXICO: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 95 MEXICO: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 96 MEXICO: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4 EUROPE

11.4.1 BY LOCATION

TABLE 97 EUROPE: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 98 EUROPE: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.4.2 BY APPLICATION

TABLE 99 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 EUROPE: INFLOW CONTROL DEVICES SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

11.4.3 BY WELL TYPE

TABLE 101 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 102 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2020–2025 (USD MILLION)

11.4.4 BY TYPE

TABLE 103 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.5 BY COUNTRY

TABLE 105 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 106 EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.4.5.1 Russia

11.4.5.1.1 Investments in Arctic offshore are likely to drive Russian sand controls solutions market

TABLE 107 RUSSIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 108 RUSSIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 109 RUSSIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 110 RUSSIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.5.2 Norway

11.4.5.2.1 Increased production from mature wells to drive sand controls solutions market

TABLE 111 NORWAY: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 112 NORWAY: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 113 NORWAY: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 NORWAY: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.5.3 UK

11.4.5.3.1 Growing focus on offshore oil and gas production likely to accelerate demand for sand controls solutions

TABLE 115 UK: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 116 UK: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 117 UK: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 118 UK: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.4.5.4 Rest of Europe

TABLE 119 REST OF EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 120 REST OF EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 121 REST OF EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 122 REST OF EUROPE: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5 SOUTH AMERICA

11.5.1 BY LOCATION

TABLE 123 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 124 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.5.2 BY APPLICATION

TABLE 125 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 126 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

11.5.3 BY WELL TYPE

TABLE 127 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 128 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2020–2025 (USD MILLION)

11.5.4 BY TYPE

TABLE 129 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 130 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5.5 BY COUNTRY

TABLE 131 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 132 SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.5.5.1 Venezuela

11.5.5.1.1 Production of heavy oil and redevelopment of mature oilfields drive sand control solutions market

TABLE 133 VENEZUELA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 134 VENEZUELA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 135 VENEZUELA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 136 VENEZUELA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5.5.2 Brazil

11.5.5.2.1 Increasing production in deep-water offshore wells propels sand control solutions market growth

TABLE 137 BRAZIL: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 138 BRAZIL: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 139 BRAZIL: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 140 BRAZIL: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5.5.3 Argentina

11.5.5.3.1 Development of shale reserves is expected to boost sand control solutions market growth

TABLE 141 ARGENTINA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 142 ARGENTINA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 143 ARGENTINA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 144 ARGENTINA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.5.5.4 Rest of South America

TABLE 145 REST OF SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 146 REST OF SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 147 REST OF SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 148 REST OF SOUTH AMERICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.6 MIDDLE EAST

11.6.1 BY LOCATION

TABLE 149 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 150 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.6.2 BY APPLICATION

TABLE 151 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 152 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

11.6.3 BY WELL TYPE

TABLE 153 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 154 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE , 2020–2025 (USD MILLION)

11.6.4 BY TYPE

TABLE 155 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.6.5 BY COUNTRY

TABLE 157 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 158 MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.6.5.1 Saudi Arabia

11.6.5.1.1 Growing crude production from mature reserves is expected to drive sand controls solutions market

TABLE 159 SAUDI ARABIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 160 SAUDI ARABIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 161 SAUDI ARABIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 162 SAUDI ARABIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.6.5.2 UAE

11.6.5.2.1 Growing focus on increasing production from depleted wells to drive sand control solutions market

TABLE 163 UAE: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 164 UAE: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 165 UAE: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 166 UAE: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.6.5.3 Oman

11.6.5.3.1 Increasing production from maturing brownfields owing to government initiative to drive market growth

TABLE 167 OMAN: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 168 OMAN: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION,2020–2025 (USD MILLION)

TABLE 169 OMAN: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 170 OMAN: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.6.5.4 Kuwait

11.6.5.4.1 Upcoming investments for development of oilfields are likely to boost market growth

TABLE 171 KUWAIT: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 172 KUWAIT: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 173 KUWAIT: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 174 KUWAIT: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE,2020–2025 (USD MILLION)

11.6.5.5 Rest of Middle East

TABLE 175 REST OF MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.7 AFRICA

11.7.1 BY LOCATION

TABLE 179 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 180 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

11.7.2 BY APPLICATION

TABLE 181 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 182 REST OF MIDDLE EAST: SAND CONTROL SOLUTIONS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

11.7.3 BY WELL TYPE

TABLE 183 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2016–2019 (USD MILLION)

TABLE 184 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY WELL TYPE, 2020–2025 (USD MILLION)

11.7.4 BY TYPE

TABLE 185 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 186 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.7.5 BY COUNTRY

TABLE 187 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 188 AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.7.5.1 Egypt

11.7.5.1.1 Increasing applications in mature fields and investments in oil & gas sector act as driving force for sand control solutions market in Egypt

TABLE 189 EGYPT: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 190 EGYPT: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 191 EGYPT: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 192 EGYPT: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.7.5.2 Algeria

11.7.5.2.1 Upcoming drilling projects in Algeria are likely to boost sand control solutions market in country

TABLE 193 ALGERIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 194 ALGERIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 195 ALGERIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 196 ALGERIA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.7.5.3 Angola

11.7.5.3.1 Increasing offshore exploration & production activities owing to substantial investments are likely to drive sand control solutions market in Angola

TABLE 197 ANGOLA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 198 ANGOLA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 199 ANGOLA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 200 ANGOLA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

11.7.5.4 Rest of Africa

TABLE 201 REST OF AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2016–2019 (USD MILLION)

TABLE 202 REST OF AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY LOCATION, 2020–2025 (USD MILLION)

TABLE 203 REST OF AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 204 REST OF AFRICA: SAND CONTROL SOLUTIONS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 174)

12.1 OVERVIEW

FIGURE 42 KEY DEVELOPMENTS IN SAND CONTROL SOLUTIONS MARKET, JANUARY 2017–OCTOBER 2020

12.2 COMPETITIVE LEADERSHIP MAPPING, 2019

12.2.1 VISIONARY LEADERS

12.2.2 INNOVATORS

12.2.3 DYNAMIC DIFFERENTIATORS

12.2.4 EMERGING COMPANIES

FIGURE 43 SAND CONTROL SOLUTIONS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.3 MARKET RANKING, 2019

FIGURE 44 MARKET RANKING FOR THE SAND CONTROL SOLUTIONS MARKET, 2019

12.4 INDUSTRY CONCENTRATION, 2019

FIGURE 45 INDUSTRY CONCENTRATION, 2019

12.5 COMPETITIVE SCENARIO

FIGURE 46 MARKET EVALUATION FRAMEWORK

TABLE 205 DEVELOPMENTS OF KEY PLAYERS IN MARKET,JANUARY 2017–OCTOBER 2020

12.5.1 NEW PRODUCT LAUNCHES

12.5.2 EXPANSIONS & INVESTMENTS

12.5.3 CONTRACTS & AGREEMENTS

12.5.4 MERGERS & ACQUISITIONS

12.6 WINNERS VS. TAIL ENDERS

12.6.1 WINNERS

12.6.2 TAIL ENDERS

13 COMPANY PROFILES (Page No. - 184)

(Business overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis, COvid-19 impact, MNM view)*

13.1 SCHLUMBERGER

FIGURE 48 SCHLUMBERGER: SWOT ANALYSIS

13.2 HALLIBURTON

FIGURE 49 HALLIBURTON: COMPANY SNAPSHOT

FIGURE 50 HALLIBURTON: SWOT ANALYSIS

13.3 BAKER HUGHES COMPANY

FIGURE 51 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

FIGURE 52 BAKER HUGHES COMPANY: SWOT ANALYSIS

13.4 WEATHERFORD

FIGURE 54 WEATHERFORD: SWOT ANALYSIS

13.5 SUPERIOR ENERGY SERVICES

FIGURE 55 SUPERIOR ENERGY SERVICES: COMPANY SNAPSHOT

FIGURE 56 SUPERIOR ENERGY SERVICES: SWOT ANALYSIS

13.6 OIL STATES INTERNATIONAL

FIGURE 57 OIL STATES INTERNATIONAL: COMPANY SNAPSHOT

13.7 ANTON OILFIELD SERVICES

FIGURE 58 ANTON OILFIELD SERVICES: COMPANY SNAPSHOT

13.8 CHINA OILFIELD SERVICES

FIGURE 59 CHINA OILFIELD SERVICES: COMPANY SNAPSHOT

13.9 TENDEKA

13.10 RGL RESERVOIR MANAGEMENT

13.11 KATT GMBH

13.12 MIDDLE EAST OILFIELD SERVICES

13.13 VARIPERM

13.14 MITCHELL INDUSTRIES

13.15 SIAO PETROLEO

13.16 SHENZHEN MAX-WELL OILFIELD SERVICES LTD.

13.17 ZAMAM OFFSHORE SERVICES LIMITED

13.18 KERUI PETROLEUM

13.19 SAZOIL

13.20 ANDMIR GROUP

14 APPENDIX (Page No. - 225)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

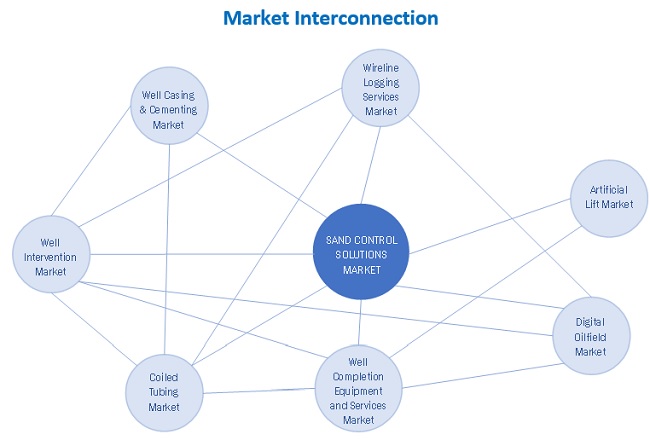

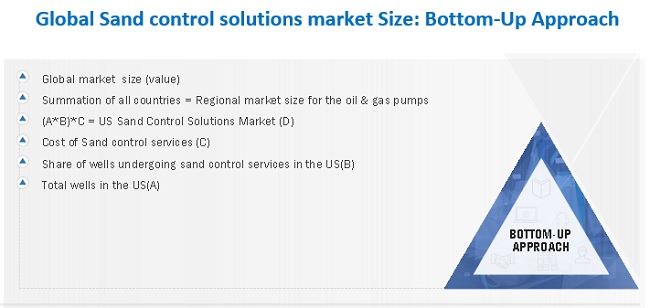

This study involved four major activities in estimating the current size of the sand control solutions market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global sand control solutions market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The sand control solutions market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-user, such as oilfield opertors, sand control service providers, and others. The supply-side is characterized by sand control equipment OEMS, raw material providers, service providers, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global sand control solutions market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the sand control solutions market by location, application, well type, type, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the sand control solutions market with respect to individual growth trends, future expansions, and contribution of each segment to the overall market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the sand control solutions market with respect to five regions (Asia Pacific, Europe, North America, South America, Middle East, and Africa)

- To profile and rank key players and comprehensively analyze their market share

- To track and analyze developments such as contracts & agreements, investments & expansions, new product developments, mergers & acquisitions, partnerships, collaborations, alliances, and joint ventures in the sand control solutions market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Sand Control Solutions Market