Soil Stabilization Market by Method (Mechanical and Chemical), Application (Industrial, Non-agricultural, and Agricultural), Additive (Polymer and Mineral & Stabilizing Agents), and Region (APAC, North America, Europe) - Global Forecast to 2022

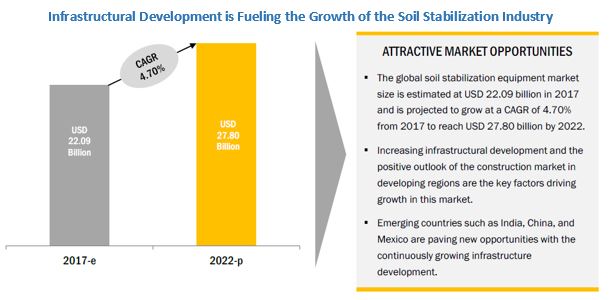

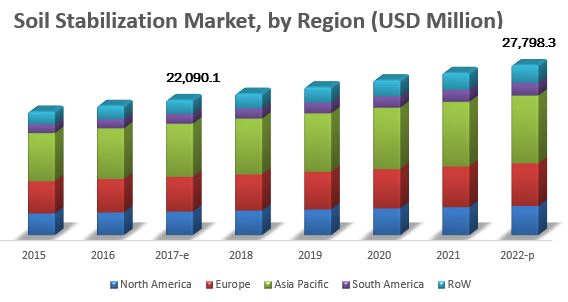

[125 Pages Report] The global soil stabilization market was valued at USD 21.14 Billion in 2016; this is projected to grow at a CAGR of 4.70% from 2017, to reach USD 27.80 Billion by 2022. The objectives of the report are to define, segment, and estimate the size of the global market, in both quantitative and qualitative terms. Furthermore, the market has been segmented on the basis of method, additive, application and region. The report also aims to provide detailed information about the crucial factors influencing the growth of the market, strategical analysis of micro markets, opportunities for stakeholders, details of the competitive landscape, and profiles of the key players, with respect to their market shares and competencies.

For More details on this research, Request Free Sample Report

The years considered for the study are as follows:

- Base year: 2016

- Beginning of the projection period: 2017

- End of the projection period: 2022

Research Methodology:

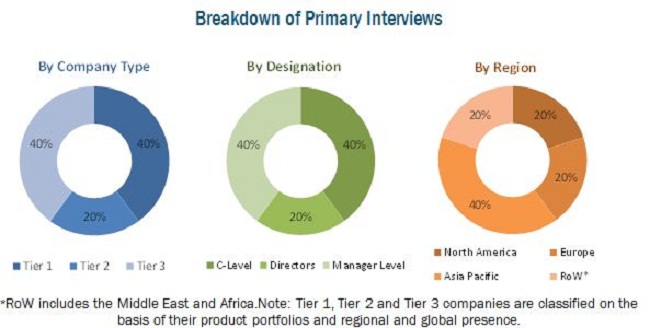

This research study involved the usage of extensive secondary sources (which include directories and databases)-such as Bloomberg Businessweek and Factiva-to identify and collect information useful for a technical, market-oriented, and commercial study of the soil stabilization market. The primary sources mainly included industry experts from core and related industries and preferred suppliers, dealers, manufacturers, equipment providers, technology developers, alliances, standards & certification organizations from companies and organizations related to all segments of this industrys value chain. In-depth interviews were conducted with various primary respondents-including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants-to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the quantitative and qualitative frameworks used in drafting this research report.

To know about the assumptions considered for the study, download the pdf brochure

The key manufacturers in the soil stabilization market include Caterpillar (US), AB VOLVO (Sweden), FAYAT (France), WIRTGEN GROUP (Germany), and CARMEUSE (US). These companies have diversified product portfolios and advanced technologies for soil stabilization equipment at major strategic locations. The other companies which are profiled include Global Road Technology (Australia), Soilworks (US), Graymont (Canada), SNF Holding (US), Aggrebind (US), IRRIDAN USA (US), and Altacrete (US).

The stakeholders for soil stabilization market are mentioned below:

- Supply side: Manufacturers, suppliers, distributors, importers, and exporters of soil stabilizers

- Demand side: Landscape maintenance personnel, OEMs, turnkey contractors, machine designers, and component suppliers

- Regulatory bodies: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies

Scope of the Report:

On the basis of method, the market has been segmented into the following:

- Mechanical method

- Chemical method

On the basis of application, the market has been segmented into the following:

- Industrial

- Non-agriculture

- Agriculture

On the basis of additive, the market has been segmented into the following:

- Polymers

- Mineral & stabilizing agents

- Other additives (agricultural waste, sludge, chelates & salts)

On the basis of region, the market has been segmented into the following:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (the Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

- Further breakdown of soil stabilization into mechanical method and chemical method

- Further breakdown of the Rest of Europe soil stabilization market into the Netherlands, Belgium, Sweden, Austria, Finland, Hungary, and Switzerland

- Further breakdown of the Rest of Asia Pacific soil stabilization market into Thailand, Vietnam, Indonesia, Malaysia, the Philippines, and South Korea

- Further breakdown of the RoW soil stabilization market into the Middle East and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The soil stabilization market is projected to reach USD 27.80 Billion by 2022, from USD 22.09 Billion in 2017, growing at a CAGR of 4.70%. Rapid urbanization and improved quality & properties of soil stabilization materials are some of the major factors that are expected to drive the demand for soil stabilization.

For More details on this research, Request Free Sample Report

Based on application, the soil stabilization market has been segmented into industrial, non-agriculture, and agriculture. The industrial segment dominated the global market, and this trend is expected to continue through the forecast period. The rising technological advancements in machinery and additives help the industry players grow and capitalize on the existing opportunities. Soil stabilization finds industrial applications in roads, airfields, railroads, embankments, reservoirs, bank protection, canals, dams, and coastal engineering. With the infrastructure development across the globe, innovations are foreseen to drive the market for soil stabilization materials in the coming years.

The global market has been segmented, on the basis of method, into mechanical and chemical. The mechanical method segment dominated the global market with a majority of the share. The mechanical method includes various soil stabilization machines such as compactors, rollers, and pavers to improve the strength of the soil. The mechanical method helps in properly and consistently mixing the soil, which can be used in subgrades and design of foundations.

Asia Pacific is estimated to account for the largest share in the global soil stabilization market, in terms of value, in 2016, owing to increasing awareness about soil management practices. With rapid urbanization, the use of soil stabilization has increased; thus, it contributed to the growth in awareness about improved quality and properties of soil stabilization additives. The focus of manufacturers on investments to purchase soil stabilization machines is another factor contributing to the growth of this market in the Asia Pacific region. The continuous modernization of various additives/stabilizing agents and stabilization machines by the manufacturers in the Asia Pacific region presents several opportunities for the soil stabilization industry. This has also increased the demand for infrastructural development among the industrial and non-agricultural sectors in the region, and further provides opportunities for soil stabilization machine manufacturers in the region.

South America is projected to be the fastest-growing region in the global market during the forecast period, owing to the increase in the usage of soil stabilization in the agricultural as well as industrial sector. The soil stabilization market in South America is in its emerging phase and is experiencing rapid growth. Brazil and Argentina are focused on industrial and agricultural sectors due to the emphasis on transportation and production of crops for export in the global market. The regional market players for soil stabilization is also focused on the reduction of dust control and soil erosion, as it helps to minimize wastage of crop and improve crop yield to meet consumer demand in the international market.

Established infrastructure in developing countries is one of the major factors restraining the growth of the soil stabilization market, globally. Developed countries such as the US, Germany, the UK, and Japan have established infrastructure for public, commercial, and transport sectors. The already-developed infrastructure in these countries presents low prospects for new construction activities.

The key players in global soil stabilization market include Caterpillar (US), AB VOLVO (Sweden), FAYAT (France), WIRTGEN GROUP (Germany), CARMEUSE (US), Global Road Technology (Australia), Soilworks (US), Graymont (Canada), SNF Holding (US), Aggrebind (US), IRRIDAN USA (US), and Altacrete (Canada).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Growth Opportunities in this Market

4.2 Market, By Application

4.3 Market, Agriculture Segment, By Sub-Application

4.4 Market, By Method

4.5 Asia Pacific: Market, By Additives & Country

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Urbanization

5.2.1.2 Improved Quality and Properties of Soil Stabilization Additives

5.2.2 Restraints

5.2.2.1 Established Infrastructure in Developed Countries

5.2.2.2 High Cost of Stabilization Equipment

5.2.3 Opportunities

5.2.3.1 Technological Advancements

5.2.3.2 Increasing Awareness About Soil Management Practices

5.2.4 Challenges

5.2.4.1 Technical Knowledge Barriers

5.2.4.2 Volatile Costs of Raw Materials

5.3 Soil Stabilization Process

5.3.1 Introduction

5.3.2 Pulverizing

5.3.3 Spreading

5.3.4 Blending

5.3.5 Reshaping

5.3.6 Compacting

5.3.7 Paved Or Chip Sealing

6 Soil Stabilization Market, By Method (Page No. - 39)

6.1 Introduction

6.2 Mechanical Method

6.3 Chemical Method

7 Soil Stabilization Market, By Additives (Page No. - 43)

7.1 Introduction

7.2 Polymers

7.2.1 Synthetic Polymers

7.2.2 Biopolymers

7.3 Mineral & Stabilizing Agents

7.3.1 Portland Cement

7.3.2 Lime

7.3.3 Fly Ash

7.3.4 Other Mineral & Stabilizing Agents

7.4 Other Additives

7.4.1 Agricultural Waste

7.4.2 Sludge

7.4.3 Chelates & Salts

8 Soil Stabilization Market, By Application (Page No. - 49)

8.1 Introduction

8.2 Industrial

8.2.1 Roads

8.2.2 Landfills/Contaminated Land

8.2.3 Others

8.3 Non-Agriculture

8.3.1 Golf Courses/Sports Grounds

8.3.2 Residential

8.3.3 Others

8.4 Agriculture

8.4.1 Open-Field Application

8.4.2 Greenhouse

9 Soil Stabilization Market, By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Italy

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia & New Zealand

9.4.5 Rest of Asia Pacific

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Rest of the World (RoW)

9.6.1 Middle East

9.6.2 Africa

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Market Ranking, By Key Player in the Equipment Market

10.3 Market Ranking, By Key Player in the Additives Market

10.4 Competitive Scenario

10.4.1 New Product Launches

10.4.2 Acquisitions

10.4.3 Expansions

11 Company Profiles (Page No. - 95)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.1 Caterpiller

11.2 AB Volvo

11.3 Fayat

11.4 Wirtgen Group

11.5 Carmeuse

11.6 Global Road Technology

11.7 Soilworks

11.8 Graymont

11.9 SNF Holding

11.10 Aggrebind

11.11 Irridan USA

11.12 Altacrete

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 117)

12.1 Discussion Guide

12.2 Company Developments

12.2.1 Acquisition

12.2.2 New Product Development/Launches and Product Enhancement

12.2.3 Expansions

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (66 Tables)

Table 1 US Dollars Exchange Rate, 2014-2016

Table 2 Market Size for Soil Stabilization, By Method, 20152022 (USD Million)

Table 3 Mechanical Soil Stabilization Market Size, By Region, 20152022 (USD Million)

Table 4 Market Size for Chemical Soil Stabilization, By Region, 20152022 (USD Million)

Table 5 Market Size for Soil Stabilization, By Additives, 20152022 (USD Million)

Table 6 Polymers: Soil Stabilization Market Size, By Region, 20152022 (USD Million)

Table 7 Mineral & Stabilizing Agents : Market Size for Soil Stabilization, By Region, 20152022 (USD Million)

Table 8 Other Additives: Soil Stabilization Market Size, By Region, 20152022 (USD Million)

Table 9 Soil Stabilization Market Size, By Application, 20152022 (USD Million)

Table 10 Soil Stabilization Market Size for Industrial Application, By Region, 20152022 (USD Million)

Table 11 Soil Stabilization Market Size for Non-Agriculture Application, By Region, 20152022 (USD Million)

Table 12 Soil Stabilization Market Size for Agriculture Application, By Region, 20152022 (USD Million)

Table 13 Soil Stabilization Market Size, By Region, 20152022 (USD Million)

Table 14 North America: Soil Stabilization Market Size, By Country, 20152022 (USD Million)

Table 15 North America: Market Size, By Method, 20152022 (USD Million)

Table 16 North America: Market Size, By Application, 20152022 (USD Million)

Table 17 North America: Market Size, By Industrial Application, 20152022 (USD Million)

Table 18 North America: Market Size, By Non-Agriculture Application, 20152022 (USD Million)

Table 19 North America: Market Size, By Agriculture Application, 20152022 (USD Million)

Table 20 North America: Market Size, By Additives, 20152022 (USD Million)

Table 21 North America: Market Size, By Polymers, 20152022 (USD Million)

Table 22 North America: Market Size, By Mineral & Stabilizing Agents, 20152022 (USD Million)

Table 23 North America: Market Size, By Other Additives, 20152022 (USD Million)

Table 24 Europe: Soil Stabilization Market Size, By Country, 20152022 (USD Million)

Table 25 Europe: Market Size, By Method, 20152022 (USD Million)

Table 26 Europe: Market Size, By Application, 20152022 (USD Million)

Table 27 Europe: Market Size, By Industrial Application, 20152022 (USD Million)

Table 28 Europe: Market Size, By Non-Agriculture Application, 20152022 (USD Million)

Table 29 Europe: Market Size, By Agriculture Application, 20152022 (USD Million)

Table 30 Europe: Market Size, By Additives, 20152022 (USD Million)

Table 31 Europe: Market Size, By Polymers, 20152022 (USD Million)

Table 32 Europe: Market Size, By Mineral & Stabilizing Agents, 20152022 (USD Million)

Table 33 Europe: Market Size, By Other Additives, 20152022 (USD Million)

Table 34 Asia Pacific: Soil Stabilization Market Size, By Country, 20152022 (USD Million)

Table 35 Asia Pacific: Market Size, By Method, 20152022 (USD Million)

Table 36 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 37 Asia Pacific: Market Size, By Industrial Application, 20152022 (USD Million)

Table 38 Asia Pacific: Market Size, By Non-Agriculture Application, 20152022 (USD Million)

Table 39 Asia Pacific: Market Size, By Agriculture Application, 20152022 (USD Million)

Table 40 Asia Pacific: Market Size, By Additives, 20152022 (USD Million)

Table 41 Asia Pacific: Market Size, By Polymers, 20152022 (USD Million)

Table 42 Asia Pacific: Market Size, By Mineral & Stabilizing Agents, 20152022 (USD Million)

Table 43 Asia Pacific: Market Size, By Other Additives, 20152022 (USD Million)

Table 44 South America: Soil Stabilization Market Size, By Region, 20152022 (USD Million)

Table 45 South America: Market Size, By Method, 20152022 (USD Million)

Table 46 South America: Market Size, By Application, 20152022 (USD Million)

Table 47 South America: Market Size, By Industrial Application, 20152022 (USD Million)

Table 48 South America: Market Size, By Non-Agriculture Application, 20152022 (USD Million)

Table 49 South America: Market Size, By Agriculture Application, 20152022 (USD Million)

Table 50 South America: Market Size, By Additives, 20152022 (USD Million)

Table 51 South America: Market Size, By Polymers, 20152022 (USD Million)

Table 52 South America: Market Size, By Mineral & Stabilizing Agents, 20152022 (USD Million)

Table 53 South America: Soil Stabilization Market Size, By Other Additives, 20152022 (USD Million)

Table 54 RoW: Soil Stabilization Market Size, By Region, 20152022 (USD Million)

Table 55 RoW: Market Size, By Method, 20152022 (USD Million)

Table 56 RoW: Market Size, By Application, 20152022 (USD Million)

Table 57 RoW: Market Size, By Industrial Application, 20152022 (USD Million)

Table 58 RoW: Market Size, By Non-Agriculture Application, 20152022 (USD Million)

Table 59 RoW: Market Size, By Agriculture Application, 20152022 (USD Million)

Table 60 RoW: Market Size, By Additives, 20152022 (USD Million)

Table 61 RoW: Market Size, By Polymers, 20152022 (USD Million)

Table 62 RoW: Market Size, By Mineral & Stabilizing Agents, 20152022 (USD Million)

Table 63 RoW: Market Size, By Other Additives, 20152022 (USD Million)

Table 64 New Product Launches, 20142017

Table 65 Acquisitions, 20152017

Table 66 Expansions, 20142016

List of Figures (35 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Regional Scope

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Global Soil Stabilization Market, By Method, 2017 vs 2022

Figure 9 Soil Stabilization Market (Chemical), By Additives, 2017 vs 2022

Figure 10 North America: Soil Stabilization Market (Chemical), By Application, 2017 & 2022

Figure 11 Soil Stabilization Market (Chemical), By Region

Figure 12 Infrastructural Development is Fueling the Growth of the Industry

Figure 13 Industrial Segment to Dominate the Market During the Forecast Period

Figure 14 Open Field Dominated the Agriculture Application Market Across All Regions in 2016

Figure 15 Mechanical Segment to Dominate the Global Market Between 2017 to 2022

Figure 16 China and Mineral & Stabilizing Agents Held the Largest Share in this Market

Figure 17 Market Dynamics

Figure 18 Global Infrastructure Investment: Equity and Ppp By Type of Owner

Figure 19 Mechanical Method is Projected to Form the Larger Segment During the Forecast Period

Figure 20 Polymers to Experience the Highest CAGR During the Forecast Period

Figure 21 Industrial Segment is Projected to Be the Fastest-Growing During the Forecast Period

Figure 22 Asia Pacific is Expected to Dominate the Global Market By 2022

Figure 23 Brazil to Be the Most Attractive Market for Soil Stabilization Manufacturers (20172022)

Figure 24 Europe Snapshot: Soil Stabilization Market

Figure 25 Asia Pacific Snapshot: Soil Stabilization Market

Figure 26 South America Snapshot: Soil Stabilization Market

Figure 27 Key Developments By Leading Players in this Market for 2012-2017

Figure 28 Caterpillar: Company Snapshot

Figure 29 Caterpillar: SWOT Analysis

Figure 30 AB Volvo: Company Snapshot

Figure 31 AB Volvo: SWOT Analysis

Figure 32 Fayat: Company Snapshot

Figure 33 Fayat: SWOT Analysis

Figure 34 Wirtgen Group: SWOT Analysis

Figure 35 Carmeuse: SWOT Analysis

Growth opportunities and latent adjacency in Soil Stabilization Market