Drive by Wire Market by Application (Brake, Park, Shift, Steer, Throttle), Sensor (Brake Pedal, Throttle Position, Park, Gearshift, Handwheel, Pinion), Vehicle (On & Off-Highway, BEV, PHEV, FCEV, Autonomous), Component & Region - Global Forecast to 2027

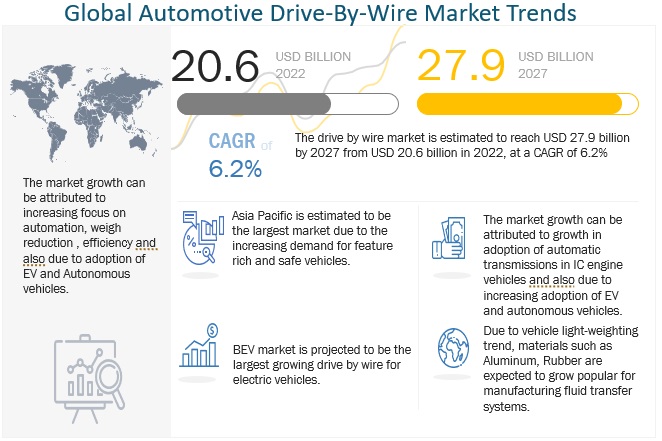

[314 Pages Report] The global drive by wire market was valued $20.6 billion in 2022 and is expected to reach $7.9 billion by 2027, at a CAGR of 6.2 % during the forecast period 2022-2027. The drive by wire market growth is seen mainly due to the developments in autonomous vehicles and increasing demand for luxury vehicles. Stringent emission and safety standards are also boosting the demand for drive-by-wire systems globally.

To know about the assumptions considered for the study, Request for Free Sample Report

Drive by wire Market Dynamics

Driver: Increasing Investment in Drive by System by major OEMs and system Manufacturers.

Many key players in the drive-by-wire industry are investing heavily in the R&D of brake-by-wire systems. For instance, in 2018, Brembo's brake-by-wire system, in its latest evolution, reduced the response time, surpassing the old standard of 300–500 milliseconds to 100 milliseconds. Additionally, to cater to the growing demand for lightweight vehicles, manufacturers are now reducing the overall weight of the vehicles to improve fuel economy and are using drive-by-wire technologies such as throttle-by-wire and steer-by-wire as technical solutions.

Restraint: High cost and semiconductor chip shortages may affect automotive drive-by-wire supply chains

The associated high cost is the major factor restraining the drive by wire market growth. As per the US Department of Transportation, the incremental cost for drive-by-wire is approximately USD 1,000-2,000 per system. This poses a restraint over the system's market, as it increases the overall cost of the vehicle. Also, in 2021, the automotive industry lost more than USD 200 billion due to the global microchip shortage.. Major global automakers such as Ford suspended operations at some of their plants to focus on truck assembly, where the profit margins are much better. Companies that need semiconductors are already reconsidering their long-term procurement strategies due to sustained semiconductor chip shortages. Major carmakers have already announced significant rollbacks in their production, lowering expected revenue for the fiscal year 2021 by billions of dollars.

Opportunity: Increasing adoption of EVs and Autonomous vehicle

The global automotive industry has witnessed a transformation over the last decade with digital communication technologies. Connected, autonomous, and semi-autonomous vehicles are more like a future package of new automotive technologies. These breakthrough technologies are transforming the traditional structure of the automotive industry by bringing in a new business model and changing the nature of the automotive industry. These connected and autonomous vehicles require many electrical connections and terminals. Also, as per the upcoming industry trends, autonomous vehicles are expected to be based on the electric driveline.

Challenges: Electronic Failure and Data hacking

The electric vehicle signifies the introduction of advanced technologies along with electric components. Several risks are associated with this technology, such as thermal runaway of battery bank and fire, which need to be cautiously assessed. Also, the sensors in these systems generate a lot of data stored by the OEMs. How this data is stored and used is subject to many government regulations to prevent data theft.

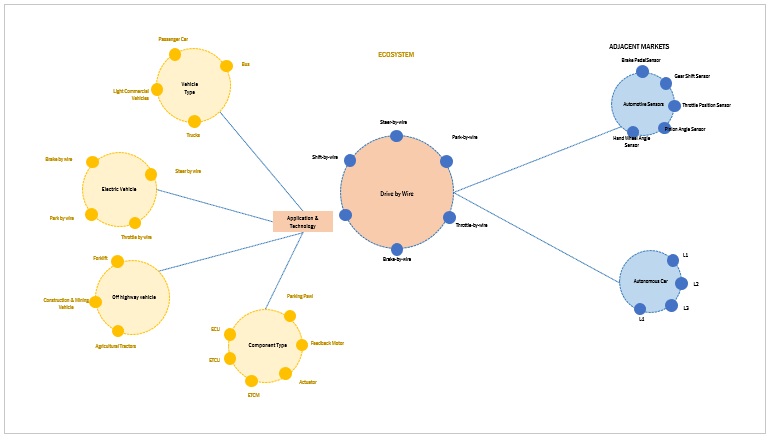

Drive By Wire Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

BEV drive by wire market is estimated to be the largest market during the forecast period

Global BEV sales increased significantly in recent years and shown a good recovery from the impact of the COVID-19 pandemic. The growth is mainly attributed to the expansion of BEV models to new segments in most regions, continued purchase incentives, and stringent emission standards. According to primary respondents and secondary research, BEVs are expected to witness a greater penetration of advanced automotive solutions, such as drive-by-wire systems, compared to PHEVs and HEVs. The drive-by-wire technology allows the brake, accelerator pedal, and other drivetrain components to be decoupled mechanically from the car's body. Considering these developments in autonomous driving and steer-by-wire technology, the market for BEV drive-by-wire is expected to grow.

The throttle-by-wire market is estimated to be the largest drive by wire market during the forecast period

Throttle-by-wire systems are expected to have the largest market share in the drive by wire market for application. The throttle-by-wire market has the largest penetrations among the passenger and commercial segment vehicles. The throttle-by-wire systems can be easily integrated with other electronic sub-systems and hence are easy to integrate. These systems allow fuel efficiency and respond better to driver input than mechanical systems. Also, they require a fraction of space compared to mechanical systems, along with a simpler design. These reasons will contribute to the growth of throttle-by-wire systems.

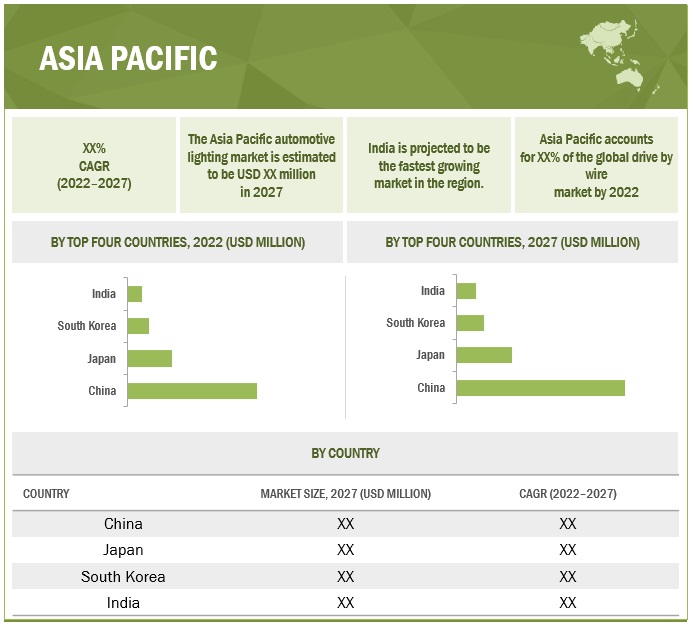

Asia Pacific is likely to be the largest drive by wire market during the forecast period

Asia Pacific has emerged as a hub for automotive production in recent years. There is an increasing demand for feature-rich, efficient, and highly safety-compliant vehicles. Also, this region is seeing an increasing demand for premium and luxury vehicles. All this positive growth in the automotive sector of this region has attracted OEMs to invest and manufacture vehicles with advanced features. OEMs such as Daimler, Volvo, BMW, Volkswagen, and Scania have manufacturing units and vital manufacturing and research partnerships in these countries, especially in India and China. Passenger car manufacturing inside the Asia Pacific accounts for 59% of the worldwide production of passenger vehicles. With the increasing disposable income, China has emerged as a key market for premium automobiles. . Thus, considering the above factors, it is quite evident that the drive by wire market is expected to grow significantly in the coming years.

Key Market Players

The key players in the drive by wire market are Bosch (Germany), Continental (Germany), Infineon Technologies (Germany), ZF (Germany), Nexteer Automotive (US). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$20.6 Billion |

|

Estimated Revenue by 2027 |

$27.9 Billion |

|

Revenue Rate |

Projected to grow at a CAGR of 6.2% |

|

Market Driver |

Increasing Investment in Drive by System by major OEMs and system Manufacturers |

|

Market Opportunity |

Increasing adoption of EVs and Autonomous vehicle |

|

Key Market Players |

Bosch (Germany), Continental (Germany), Infineon Technologies (Germany), ZF (Germany), Nexteer Automotive (US). |

This research report categorizes the drive by wire market by application, component, sensor type, on-highway vehicle type, off-highway vehicle type, electric & hybrid vehicle type, region and autonomous vehicle drive by wire market by application.

Based on the drive by wire market by application, the market has been segmented as follows:

- Throttle-by-wire

- Shift-by-wire

- Steer-by-wire

- Park-by-wire

- Brake-by-wire

Based on the drive by wire market by component, the market has been segmented as follows:

- Electronic Control Unit

- Engine Control Module

- Actuator

- Feedback Motor

- Parking Pawl

- Electronic Throttle Control Module

- Electronic Transmission Control Unit

Based on the drive by wire market by sensor type, the market has been segmented as follows:

- Throttle pedal sensor

- Throttle position sensor

- Pinion Angle Sensor

- Hand wheel angle sensor

- Gear shift position sensor

- Park sensor

- Brake Pedal Sensor

Based on the drive by wire market by on-highway vehicle type, the market has been segmented as follows:

- PC

- LCV

- Trucks

- Buses

Based on drive by wire market by off-highway vehicle type, the market has been segmented as follows:

- Agricultural Tractors

- Construction & Mining Equipment

- Forklift

Based on drive by wire market by electric & hybrid vehicle type, the market has been segmented as follows:

- BEV

- PHEV

- FCEV

Based on the electric vehicle drive by wire market by sensor type, the market has been segmented as follows:

- Throttle pedal sensor

- Throttle position sensor

- Pinion Angle Sensor

- Hand wheel angle sensor

- Gear shift position sensor

- Park sensor

- Brake Pedal Sensor

Based on autonomous vehicle drive by wire market by application, the market has been segmented as follows:

- Throttle-by-wire

- Shift-by-wire

- Steer-by-wire

- Park-by-wire

- Brake-by-wire

Based on drive by wire market by region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- Turkey

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Rest of the World

- Brazil

- Argentina

- Argentina

- Iran

- Rest of RoW

Recent Developments

- In 2021, Continental further developed its electro-hydraulic brake system MK C1. MK C2 offers higher availability and performance, is a more compact and lighter system that is easier to integrate into smaller vehicle models and complete vehicle platforms with diverse powertrain concepts and varying installation spaces. The vehicle-specific system application has also been simplified.

- In 2020, Continental AG and Nexteer Automotive, and CNXMotion entered into a partnership to develop Brake-to-Steer (BtS) technology and Steer-by-Wire (SbW). In May 2022, CNXMotion announced that it has developed two new software functions that it says provide backup safety layers for all variants of Electric Power Steering (EPS) and Steer-by-Wire (SbW) systems and across all SAE levels of driving automation (levels 1 – 5).

- In March 2020, ZF launched an industry-first Front Electric Park Brake, extending the range of Electric Park Brake (EPB) systems to a wider range of vehicles. With this solution, car manufacturers can now equip smaller vehicles with an advanced braking system and design their interiors without the classic handbrake lever or park brake pedal.

Frequently Asked Questions (FAQ):

How big is the drive by wire market?

The drive by wire market is estimated to grow from USD 20.6 billion in 2022 to reach USD 27.9 billion by 2027 at a CAGR of 6.2% during the forecast period.

Which of the drive-by-wire application will fare ahead of the others?

Throttle-by-wire is expected to lead the drive by wire market by application type segment.

What are the key market trends impacting the growth of the drive by wire market?

Increased R&D by the automakers to develop advanced drive-by-wire systems, such as steer-by-wire with brake-by-wire, throttle-by-wire, and park-by-wire, is expected to boost the drive by wire market. Also, global OEMs continuously collaborate with domestic players in emerging economies to develop products tailored to customer needs.

What are the key challenges for the seamless drive by wire market growth?

Key challenges include high development cost, high maintenance cost, lower penetration in the market, and systems prone to software or electronic failure.

What are the key challenges that can be faced due to supply chain disruptions?

Countries and companies manufacturing semiconductor chip are facing issues in production which has caused a ripple-down effect across all domains, including the automotive sector, which is dependent on semiconductor chips. This has resulted in severe chip shortages, pushing back deadlines by years in some cases. As a result, companies are looking to diversify their supply chains and frame several long-term and short-term strategies to mitigate this challenge. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

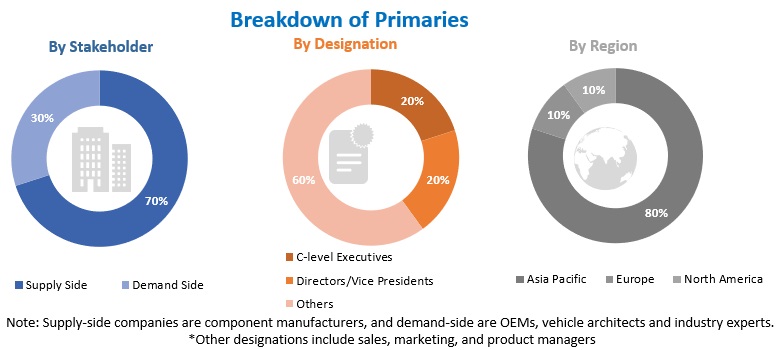

The study involved four major activities in estimating the current size of the drive by wire market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include publications from government sources [such as country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; free and paid automotive databases [Organisation Internationale des Constructeurs d'Automobiles (OICA), MarkLines, etc.] and trade, business, and professional associations; among others. Trade websites and technical articles have been used to identify and collect information useful for an extensive commercial study of the drive by wire market.

Primary Research

In the primary research process, various primary sources from both the supply side and demand side and other stakeholders were interviewed to obtain qualitative and quantitative information on the market. Primary interviews have been conducted to gather insights such as drive by wire penetration demand by application, sensor, component, and highest potential region for the drive by wire market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, vehicle architecture experts and related key executives from various key companies. Below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the drive by wire market. In these approaches, the production statistics for passenger cars, LCVs, trucks, and buses in a country and production statistics of BEVs, PHEVs, FCEVs, and autonomous vehicles at the regional level were considered to estimate the aggregate market of various drive by wire segments. The research methodology used to estimate the market size includes the following:

- Key players in the drive by wire market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts for detailed market insights.

- All application-level penetration rates, percentage shares, splits, and breakdowns for the drive by wire market was determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

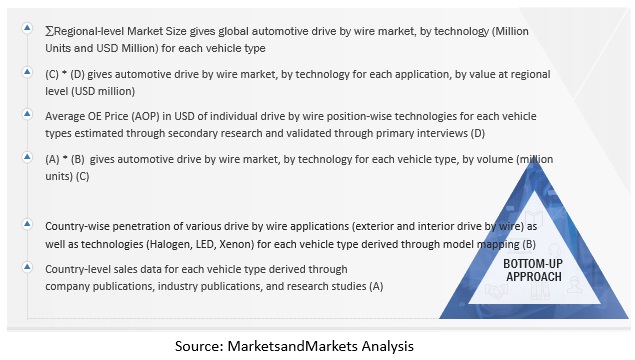

Bottom-UP Approach

In the bottom-up approach, vehicle production of each vehicle type at the country level was considered. Penetration of each drive by wire application was derived through model mapping for each vehicle type. The country-level production by vehicle type was then multiplied by the penetration for each application to determine the market size of the drive by wire market in terms of volume. The country-level market size, in terms of volume, by application, was then multiplied by the country-level average OE Price (AOP) of each drive by wire application to determine the market size in terms of value for each vehicle type. Summation of the country-level market size for each vehicle type by application, volume, and value, would give the regional-level market size. Further, the summation of the regional markets provided the market size. The market size for vehicle type was derived from the global market.

Drive By Wire Market (On-Highway Vehicle, Application, and Region): Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

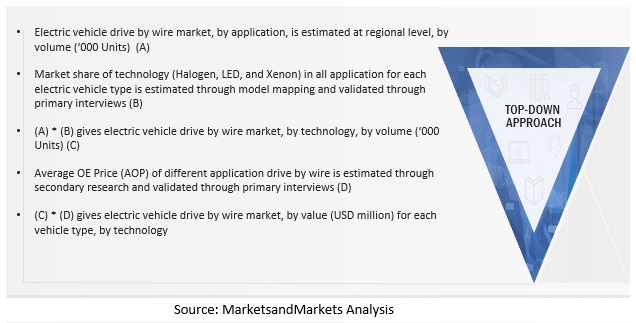

Top-Down Approach

The top-down approach was used to estimate and validate the market size of the drive by wire, by sensor type, by value. To derive the market size for sensor type (‘000 units), the global drive by wire market (‘000 units) is multiplied by the average number of sensors employed in each drive by application. Drive by wire sensor market, by volume, is further multiplied with the average selling price of respective sensors, giving the market, by value. The global market was further segmented at the regional level. A similar approach was used for deriving the market size of the component segment in terms of value.

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and sub-segments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To Define, Describe, And Forecast The Drive By Wire Market In Terms Of Volume (’000 Units) And Value (USD Million)

-

To Define, Describe, And Forecast The Global Market Based On Application, Sensor Type, Component, On-Highway Vehicle, Electric & Hybrid Vehicle, Autonomous Vehicle Application, Off-Highway Vehicle, And Region

- To Forecast The Market Size Of The Market, By Application, At The Component Level (Throttle-By-Wire, Steer-By-Wire, Shift-By-Wire, Brake-By-Wire, And Park-By-Wire)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To Sensor Type (Throttle Pedal Sensor, Throttle Position Sensor, Pinion Angle Sensor, Hand Wheel Angle Sensor, Gear Shift Position Sensor, Park Sensor, And Brake Pedal Sensor)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To Component (ECU—Electronic Control Unit, ECM—Engine Control Module, Actuator, Feedback Motor, Parking Pawl, ETCM—Electronic Throttle Control Module, And ETCU—Electronic Transmission Control Unit)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To On-Highway Vehicles (Passenger Cars, Light Commercial Vehicles, Buses, And Trucks)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To Off-Highway Vehicles (Construction & Mining Equipment, Agriculture Tractors, And Forklift)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To Electric & Hybrid Vehicles (BEV, HEV/PHEV, And FCEV)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To Autonomous Vehicles In Terms Of Application (Throttle-By-Wire, Steer-By-Wire, Shift-By-Wire, Brake-By-Wire, And Park-By-Wire)

- To Forecast The Market, In Terms Of Volume And Value, With Respect To 4 Key Regions—Asia Pacific, Europe, North America, And Row

- To Analyze The Impact Of COVID-19 On The Market (Pre-COVID Vs. Post-COVID)

- To Provide Detailed Information About Major Factors Influencing The Growth Of The Market (Drivers, Restraints, Opportunities, And Industry-Specific Challenges)

- To Strategically Analyze The Market With Respect To Individual Growth Trends And Prospects And Determine The Contribution Of Each Segment To The Total Market

- To Analyze The Opportunities In The Market For Stakeholders And Provide Details Of The Competitive Landscape For Market Leaders

- To Strategically Profile Key Players And Comprehensively Analyze Their Market Shares And Core Competencies

- To Analyze The Important Drive By Wire Component Suppliers In The Market And Provide Details Of The Company Profiles

- To Track And Analyze Competitive Developments Such As Joint Ventures, Mergers & Acquisitions, New Product Developments, And R&D In The Drive By Wire Market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Drive by wire market, by sensor type

- Throttle pedal sensor

- Throttle position sensor

- Pinion Angle Sensor

- Hand wheel angle sensor

- Gear shift position sensor

- Park sensor

- Brake Pedal Sensor

Drive by wire market, by component type

- Throttle pedal sensor

- ECU-Electronic Control Unit

- ECM-Engine Control Module

- Actuator

- Feedback motor

- Parking pawl

- ETCM-Electronic Throttle Control Module

- ETCU, Electronic Transmission Control Unit

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drive by Wire Market

Hello is brake and steer by wire included under "Other" in this report? (see overview graph) Or do you break out separately?