Automotive Secondary Wiring Harness Market by Application (Engine, Cabin, Door Harness, Airbag Harness, Electronic Parking Brakes, Electronic Gear Shift System), Vehicle Type, EV type (BEV, HEV, PHEV), and Region - Global Forecast to 2022

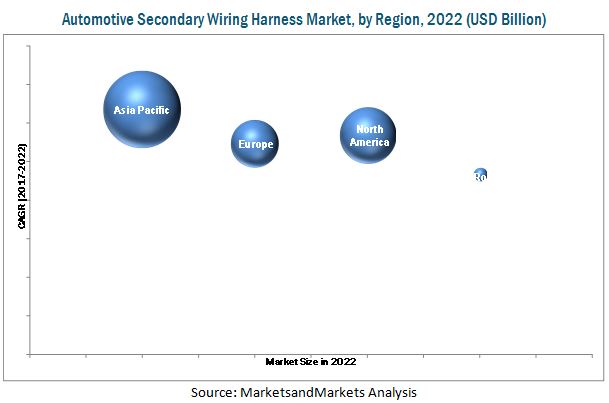

The automotive secondary wiring harness market is projected to grow at a CAGR of 11.91% during the forecast period 2017–2022, to reach at a market size of USD 22.90 Billion by 2022. The base year for the report is 2016 and the forecast year is 2022. The objective of the study is to analyze and forecast (2017–2022) the market size, in terms of volume (units) and value (USD billion), of the market. The report segments the market by application, vehicle type, electric vehicle type and region North America, Europe, Asia-Pacific, and the Rest of the World (RoW). A detailed study of various market leaders has been done and opportunity analysis has been provided in the report.

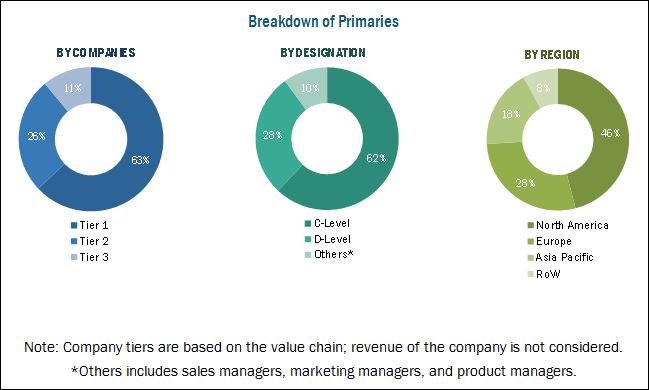

Various secondary sources such as company annual reports/presentations, press releases, industry association publications, International Organization of Motor Vehicle Manufacturers (OICA), International Cable makers Federation (ICF), Automobile wiring harness manufacturers, Automotive Wire and Cable Manufacturers, Wiring Harness Component Suppliers, Wiring Harness Design Companies, MarkLines database, magazine articles, encyclopedias, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases have been used to identify and collect information useful for an extensive study of this market. The primary sources experts from related industries, automotive wiring harness manufacturers, and wiring harness experts have been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations. The bottom up approach has been used to estimate and validate the size of the market. In this approach, the market size, by volume, is derived by number of secondary wires used in different vehicle types at country level. The market size, by value, is derived by multiplying the average selling price of secondary wiring harness by the number of secondary wires in each application in each vehicle type at country level.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive secondary wiring harness market consists of various wiring harness manufacturers such as Sumitomo Electric Industries, Ltd. (Japan), Lear Corporation. (US), Delphi Automotive LLP. (UK), Yazaki Corporation. (Japan), and Furukawa Electric Co., Ltd. (Japan) and research institutes such as International Organization of Motor Vehicle Manufacturers (OICA), International Cable makers Federation (ICF), Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automobile wiring harness manufacturers

- Conducting material manufacturers

- Distributors and suppliers of insulators and conductors

- Electric vehicle manufacturers

- Industry associations and experts

- Insulators manufacturers

- Raw material suppliers

Scope of the Report

Market By Automotive Application

Market By Vehicle Type

Market By Electric Vehicle

Market By Region

-

- Engine Harness

- Cabin (Interior)

- Door Harness

- Airbag Harness

- Electronic Parking Brakes

- Electronic Gear Shift System

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- HEV

- BEV

- PHEV

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

- Market, by country, by application

- Profiling of additional market players (Up to 3)

The market is projected to grow at a CAGR of 11.91% from 2017, to reach USD 22.90 Billion by 2022. Rising demand for compact wiring harness and emerging new advanced technologies have fueled the growth of this market globally. The growing trend of electric vehicles is also a major factor that has contributed to the growth of this market.

Governments of various countries have mandated use of certain electronic safety features such as Anti-Lock Braking System (ABS), Electronic Braking System (EBS), and Electronic Stability Program (ESP) in vehicles. For instance, in April 2015, Indian government has made the ABS mandatory for commercial vehicles (CVs). These norms are propelling the demand for high-end electronic and safety features in vehicles, mainly in passenger cars (PC), and are going to raise the demand for automotive secondary wiring harnesses globally. At present, copper is predominantly used as conducting material in wiring harness. However, in some manufacturing processes, stainless steel is added with copper to enhance strength and reduce weight. The advanced models of infotainment systems are powered by optical fiber to improve performance and safety, and most of wire harnesses these days are coated with heat-shrinkable tubing protection against heat and fluctuating voltage.

The cabin (interior) harness segment in terms of value, is estimated to lead the market, by application type, during the forecast period. The high demand for the cabin (interior) harness is propelled by systems such as infotainment, lighting, seat harness and steering wheel harness. Passenger cars segment is estimated to lead the market, by vehicle type. The market for passenger cars is growing because of the higher adoption growth of high end electronics and advanced systems in passenger cars.

The most prominent regional markets include Asia Pacific and North America, which together constituted the maximum share in the total revenue of market. Asia Pacific region is expected to dominate the market during the forecast period, aided by China and India the fastest developing countries in the region. Increase in use of high end electronics, advanced systems and rising vehicle production owing to high demand for premium vehicles is intensifying the demand for the automotive secondary wiring harness. The growing infrastructural development in this region is also supporting the market growth, as it has raised the demand for heavy vehicles that require advanced technology automotive wiring for heat insulation. In Europe, the market has already reached maturity level because most of the vehicles are equipped with high-end electronics and safety features. In Europe, Germany is estimated to dominate the market during the forecast period. In North America, Mexico and Canada are also contributing to the market growth with increasing vehicle production capacity and commissioning of new vehicle assembly plants.

The key factors restraining the growth of the automotive secondary wiring harness market include the wiring harness corrosion and fluctuating raw material cost. The market is dominated by many international as well as domestic players such as Sumitomo Electric Industries, Ltd. (Japan), Lear Corporation. (US), Delphi Automotive LLP. (UK), Yazaki Corporation. (Japan), and Furukawa Electric Co., Ltd. (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Automotive Secondary Wiring Harness Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Urbanization Percentage

2.4.2.2 Rising Advanced Technologies

2.4.2.3 Electrification of Vehicle

2.4.3 Supply-Side Analysis

2.4.3.1 Stringent Emission Norms

2.4.3.2 Complex Electronic Systems

2.5 Automotive Secondary Wiring Harness Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Introduction

4.2 Opportunities in this Market

4.3 Automotive Secondary Wiring Harness Market, By Vehicle Type

4.4 Market, By Application Type

4.5 Market, By Electric Vehicle Type

4.6 Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Automotive Secondary Wiring Harness Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Evs

5.2.1.2 Increasing Vehicle Production

5.2.1.3 Complex Electronic Systems in Vehicle

5.2.2 Restraints

5.2.2.1 Wiring Harness Corrosion

5.2.3 Opportunities

5.2.3.1 Opportunities in Autonomous Vehicle Technology

5.2.3.2 Security and Safety Mandates in Various Countries Globally

5.2.3.3 Increase in Retrofit of Various Systems in Vehicles

5.2.4 Challenges

5.2.4.1 Rising Demand of PCB in Automotive

5.2.4.2 Fluctuating Raw Material Prices

5.2.4.3 High Cost of Advanced Technology Systems

5.2.4.4 Industry Shifting Towards Light Weight Wiring Harness

5.3 Industry Trends

5.3.1 Printed Circuit Board (PCB)

5.3.1.1 PCB Application in Automotive Industry

6 Market, By Application Type (Page No. - 45)

6.1 Introduction

6.2 Cabin (Interior)

6.2.1 Infotainment

6.2.2 Lighting

6.2.3 Seat Harness

6.2.4 Steering Wheel Harness

6.3 Door Harness

6.3.1 Door Handle Harness

6.3.2 Power Door Lock Harness

6.3.3 Power Mirror

6.4 Engine Harness

6.5 Airbag Harness

6.6 Electronic Gear Shift System

6.7 Electronic Parking Brakes

7 Market, By Vehicle Type (Page No. - 62)

7.1 Introduction

7.1.1 Passenger Car

7.1.2 Light Commercial Vehicle (LCV)

7.1.3 Heavy Commercial Vehicle (LCV)

8 Automotive Secondary Wiring Harness, By Electric Vehicle Type (Page No. - 71)

8.1 Introduction

8.1.1 Battery Electric Vehicle (BEV)

8.1.2 Hybrid Electric Vehicle (HEV)

8.1.3 Plug-In Hybrid Vehicle (PHEV)

9 Market, By Region (Page No. - 79)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Italy

9.4 North America

9.4.1 US

9.4.2 Canada

9.4.3 Mexico

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Russia

10 Competitive Landscape (Page No. - 106)

10.1 Market Ranking Analysis: Automotive Secondary Wiring Harness

10.2 Expansions

10.3 New Product Launches/ Development

10.4 Joint Ventures & Acquisition

10.5 Supply Contract

11 Company Profiles (Page No. - 114)

(Business Overview, Recent Developments)*

11.1 Sumitomo Electric Industries, Ltd.

11.2 Lear Corporation.

11.3 Delphi Automotive LLP

11.4 Yazaki Corporation

11.5 Furukawa Electric Co., Ltd.

11.6 Nexans

11.7 Samvardhana Motherson Group.

11.8 Leoni AG

11.9 THB Group

11.10 Spark Minda, Ashok Minda Group

*Details on Business Overview, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 130)

12.1 Key Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customization

12.6 Related Reports

12.7 Author Details

List of Tables (85 Tables)

Table 1 Global Automotive Secondary Wiring Harness Market Size, By Application, 2015–2022 (Million Units)

Table 2 Market Size, By Application, 2015–2022 (USD Million)

Table 3 Cabin (Interior): Market Size, By Vehicle, 2015–2022 (Million Units)

Table 4 Cabin (Interior): Market Size, By Vehicle, 2015–2022 (USD Million)

Table 5 Infotainment: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 6 Infotainment: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 7 Lighting: Market Size, By Vehicle, 2015–2022 (Thousand Units)

Table 8 Lighting: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 9 Seat Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 10 Seat Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 11 Steering Wheel Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 12 Steering Wheel Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 13 Door Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 14 Door Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 15 Door Handle Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 16 Door Handle Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 17 Power Door Lock Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 18 Power Door Lock Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 19 Power Mirror: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 20 Power Mirror: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 21 Engine Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 22 Engine Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 23 Airbag Harness: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 24 Airbag Harness: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 25 Electronic Gear Shift System: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 26 Electronic Gear Shift System: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 27 Electronic Parking Brakes: Market Size, By Vehicle, 2015–2022 (Million Units)

Table 28 Electronic Parking Brakes: Market Size, By Vehicle, 2015–2022 (USD Million)

Table 29 Market Size, By Vehicle Type, 2015–2022 (Million Units)

Table 30 Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 31 Passenger Car: Market Size, By Application, 2015–2022 (Million Units)

Table 32 Passenger Car: Market Size, By Application, 2015–2022 (USD Million)

Table 33 Light Commercial Vehicle (LCV): Market Size, By Application, 2015–2022 (Million Units)

Table 34 Light Commercial Vehicle (LCV): Market Size, By Application, 2015–2022 (USD Million)

Table 35 Heavy Commercial Vehicle (LCV): Market Size, By Application, 2015–2022 (Million Units)

Table 36 Heavy Commercial Vehicle (LCV): Market Size, By Application, 2015–2022 (USD Million)

Table 37 Market Size, By Electric Vehicle Type, 2015–2022 (000’ Units)

Table 38 Market Size, By Electric Vehicle Type, 2015–2022 (USD Million)

Table 39 Battery Electric Vehicle (BEV): Market Size, By Region, 2015–2022 (Ooo’ Units)

Table 40 Battery Electric Vehicle (BEV): Market Size, By Region, 2015–2022 (USD Thousand)

Table 41 Hybrid Electric Vehicle (HEV): Market Size, By Region, 2015–2022 (000’ Units)

Table 42 Hybrid Electric Vehicle (HEV): Market Size, By Region, 2015–2022 (USD Thousand)

Table 43 Plug-In Hybrid Vehicle (PHEV): Market Size, By Region, 2015–2022 (000’ Units)

Table 44 Plug-In Hybrid Vehicle (PHEV): Market Size, By Region, 2015–2022 (USD Thousand)

Table 45 Automotive Secondary Wiring Harness Market Size, By Region, 2015–2022 (Million Units)

Table 46 Market Size, By Region, 2015–2022 (USD Million)

Table 47 Asia Pacific: Market Size, By Country, 2015–2022 (Million Units)

Table 48 Asia Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 49 China: Market Size, By Application, 2015–2022 (Million Units)

Table 50 China: Market Size, By Application, 2015–2022 (USD Million)

Table 51 Japan: Market Size, By Application, 2015–2022 (Million Units)

Table 52 Japan: Market Size, By Application, 2015–2022 (USD Million)

Table 53 India: Market Size, By Application, 2015–2022 (Million Units)

Table 54 India: Market Size, By Application, 2015–2022 (USD Million)

Table 55 South Korea: Market Size, By Application, 2015–2022 (Million Units)

Table 56 South Korea: Market Size, By Application, 2015–2022 (USD Million)

Table 57 Europe: Market Size, By Country, 2015–2022 (Million Units)

Table 58 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 59 Germany: Market Size, By Application, 2015–2022 (Million Units)

Table 60 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 61 France: Market Size, By Application, 2015–2022 (Million Units)

Table 62 France: Market Size, By Application, 2015–2022 (USD Million)

Table 63 UK: Market Size, By Application, 2015–2022 (Million Units)

Table 64 UK: Market Size, By Application, 2015–2022 (USD Million)

Table 65 Italy: Market Size, By Application, 2015–2022 (Million Units)

Table 66 Italy: Market Size, By Application, 2015–2022 (USD Million)

Table 67 North America: Market Size, By Country, 2015–2022 (Million Units)

Table 68 North America: Market Size, 2015–2022 (USD Million)

Table 69 US: Market Size, By Application, 2015–2022 (Million Units)

Table 70 US: Market Size, By Application, 2015–2022 (USD Million)

Table 71 Canada: Market Size, By Application, 2015–2022 (Million Units)

Table 72 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 73 Mexico: Market Size, By Application, 2015–2022 (Million Units)

Table 74 Mexico: Market Size, By Application, 2015–2022 (USD Million)

Table 75 Rest of the World (RoW): Market Size, By Country, 2015–2022 (Million Units)

Table 76 Rest of the World (RoW): Market Size, 2015–2022 (USD Million)

Table 77 Brazil: Automotive Secondary Wiring Harness Market Size, By Application, 2015–2022 (Million Units)

Table 78 Brazil: Market Size, By Application, 2015–2022 (USD Million)

Table 79 Russia: Market Size, By Application, 2015–2022 (Million Units)

Table 80 Russia: Market Size, By Application, 2015–2022 (USD Million)

Table 81 Automotive Secondary Wiring Harness: 2015–2016

Table 82 Expansions, 2013–2017

Table 83 New Product Launches/ Development, 2014–2017

Table 84 Joint Venture&Acquisition, 2015–2017

Table 85 Supply Contract, 2013–2016

List of Figures (57 Figures)

Figure 1 Automotive Secondary Wiring Harness Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews:

Figure 5 Urbanization vs Vehicle Sales in 2015

Figure 6 Global Automotive Wiring Harness Market Size: Bottom-Up Approach

Figure 7 Key Countries in the Market (USD Million): China is Estimated to Be the Largest Market By 2022

Figure 8 Asia Pacific is Estimated to Be the Largest Market for Automotive Secondary Wiring Harness (USD Million)

Figure 9 Market, By Application Type, 2017 vs 2022 (USD Million)

Figure 10 Market, By Vehicle Type, 2017 vs 2022 (USD Million)

Figure 11 Market, By Electric Vehicle Type, 2017 vs 2022 (USD Million)

Figure 12 Increased Use of Advanced Systems in Vehicles is Expected to Drive this Market

Figure 13 Passenger Cars to Hold the Largest Share in the Market, 2017 vs 2022 (USD Million)

Figure 14 Cabin (Interior) to Hold the Largest Share in the Market, 2017 vs 2022 (USD Million)

Figure 15 HEV to Hold the Largest Share in the Market, 2017 vs 2022 (USD Million)

Figure 16 Asia Pacific to Hold the Largest Market Share in the Market, 2017 vs 2022 (USD Million)

Figure 17 Automotive Secondary Wiring Harness: Market Dynamics

Figure 18 Global Electric Vehicle Sales, 2010 – 2016

Figure 19 Global Passenger Car Production, 2015 – 2022

Figure 20 Global Commercial Vehicle (LCV & LCV) Production, 2015 – 2022

Figure 21 Infotainment System Evolution

Figure 22 Automotive Safety Technology

Figure 23 PCB Timeline

Figure 24 PCB Automotive Application

Figure 25 Automotive Secondary Wiring Harness Market, By Application, 2017–2022 (USD Million)

Figure 26 Market, By Cabin (Interior), 2017–2022 (USD Million)

Figure 27 Market, By Door Harness, 2017–2022 (USD Million)

Figure 28 Market, By Engine Harness, 2017–2022 (USD Million)

Figure 29 Market, By Airbag Harness, 2017–2022 (USD Million)

Figure 30 Market, By Electronic Gear Shift System, 2017–2022 (USD Million)

Figure 31 Market, By Electronic Parking Brakes Harness, 2017–2022 (USD Million)

Figure 32 Passenger Car Segment to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 33 Passenger Car: Cabin (Interior) Segment to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 34 Light Commercial Vehicle (LCV): Cabin (Interior) Segment to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 35 Heavy Commercial Vehicle (LCV): Cabin (Interior) Segment to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 36 Automotive Secondary Wiring Harness Market, By Electric Vehicle Type, 2017 vs 2022 (USD Million)

Figure 37 Market, By Battery Electric Vehicle (BEV) Type, 2017 vs 2022 (USD Thousand)

Figure 38 Market, By Hybrid Electric Vehicle (HEV) Type, 2017 vs 2022 (USD Thousand)

Figure 39 Market, By Plug-In Hybrid Vehicle (PHEV) Type, 2017 vs 2022 (USD Thousand)

Figure 40 Regional Snapshot: Market, 2017 vs 2022 (USD Million)

Figure 41 Asia Pacific Market Snapshot: China to Hold the Largest Market Share in 2017

Figure 42 Europe Market Snapshot: Germany to Hold the Largest Market Share in 2017

Figure 43 North America: Market, 2017–2022 (In USD Million)

Figure 44 Rest of the World (RoW): Market, 2017–2022 (USD Million)

Figure 45 Companies That Adopted Supply Contract/Partnership/Joint Venture/Agreement as the Key Growth Strategy From 2013 to 2017

Figure 46 Market Evaluation Framework: Supply Contract /Partnership/Joint Venture/Collaboration-Fueled Market Growth During 2013–2017

Figure 47 Battle for Market Share: Supply Contract /Partnership/Joint Venture/ Expansion/Collaboration is the Key Strategy

Figure 48 Sumitomo Electric Industries, Ltd.: Company Snapshot

Figure 49 Lear Corporation.: Company Snapshot

Figure 50 Delphi Automotive LLP.: Company Snapshot

Figure 51 Yazaki Corporation.: Company Snapshot

Figure 52 Furukawa Electric Co., Ltd.: Company Snapshot

Figure 53 Nexans: Company Snapshot

Figure 54 Samvardhana Motherson Group.: Company Snapshot

Figure 55 Leoni AG: Company Snapshot

Figure 56 THB Group.: Company Snapshot

Figure 57 Spark Minda, Ashok Minda Group.: Company Snapshot

Growth opportunities and latent adjacency in Automotive Secondary Wiring Harness Market