Double Glazing Glass Market by Material (Glass, Frame & Spacer Bar, Sealant), Application (Window & Door, Facade), Spacer Thickness (Less than 10mm, 10mm to 12mm, More than 12mm), Industry, and Region - Global Forecast to 2025

Updated on : June 18, 2024

Double Glazing Glass Market

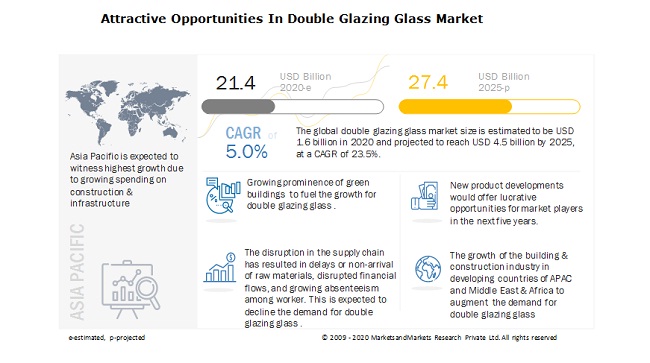

The global double glazing glass market was valued at USD 21.4 billion in 2020 and is projected to reach USD 27.4 billion by 2025, growing at 5.0% cagr from 2020 to 2025. The market is growing due to the superior energy efficiency achieved by using it in windows, doors, and façade applications. The double glazing glass demand is expected to decline in 2020 due to COVID-19. However, the end of lockdown would stimulate the double glazing glass demand during the forecast period.

To know about the assumptions considered Request for Free Sample Report

Impact of COVID-19 on the global double glazing glass market

The COVID-19 pandemic has negatively affected the double glazing glass demand across the construction & infrastructure sector. The disruption in the supply chain has resulted in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers have compelled construction & infrastructure companies to operate at zero or partial capacities, resulting in reduced double glazing glass demand.

Driver: Commercial industry to dominate the market in terms of value

The commercial segment led the overall double glazing glass market in 2019 in terms of value due to the increased demand from the APAC, North America, and Europe. Growing construction projects in India, China, and other Asian countries has given rise to eth consumption of insulating glazed units, which in turn supports the growth of double glazing glass in the commercial industry. Furthermore, the growing IT/ITes sector is also augmenting the growth of glass in façade applications.

Restraint: Lack of awareness is a major restrain for the double glazing glass market

Despite excellent properties and superior performance of double- glazing glass material, there has been a lack of knowledge and awareness amongst the people regarding the benefits of products. As per the industry experts, in developing countries like India, not only people from outside but also people within the industry tend to have inadmissible understanding associated with double-glazing glass and solutions. Lack of awareness about the long-term energy-efficient solutions offered by double-glazing glass among the consumers is acting as a hindering factor behind the growth of the double-glazing glass market.

Opportunity: Prospering building & construction activities in emerging economies is an excellent opportunity for the double glazing glass Market

The growth of the building & construction industry in developing countries of APAC and the Middle East & Africa have opened up new growth prospects for the double-glazing glass manufacturers. The growing population, rapid urbanization & industrialization, and improving wealth along with living standards, have boosted the building & construction sector growth across APAC. For instance, according to the UN Department of Economic and Social Affairs, 55% of the world’s population lives in urban areas, a proportion that is projected to rise to 68% by 2050. Such a surge in populace shifts will generate huge demand for energy-efficient residential and commercial buildings in the region.

Market recovery from COVID-19 is one of the major challenges in the double glazing glass Market

The COVID-19 outbreak has pulled down the demand for double glazing glass across the globe due to a decline in demand from the construction & infrastructure industry. The pandemic has abruptly interrupted the operations and global supply chain across various industries, which in turn have negatively affected the double-glazing glass market. Various countries have imposed lockdown to prevent the further spread of the virus. Europe and North America are the most severely affected regions due to COVID-19. Companies need to cope up with this sudden impact brought by the pandemic and have to work efficiently on their supply chain and improve their distribution network to tackle the sudden fluctuations in the market.

In terms of value, window & door application is the fastest-growing segment in the global double glazing glass market.

One of the major applications of double-glazing glass includes windows and doors. Double-paned windows solutions are proven high-performance, energy-efficient, and glazing systems that dramatically cut energy consumption and pollution sources. Further, its advantages include less air leakage, reduced heat loss, and warmer window surfaces that improve comfort and minimize condensation. Similarly, double glazed doors enhance interior elegance while offering a seamless experience with all the benefits.

Glass to lead the market in the material segment of the double glazing glass in terms of value and volume during the forecast period.

Glass holds the majority of the market in the double glazing glass market. Glass with different thicknesses is used as per the application in industrial, residential, and commercial industries. Major manufacturers of glass, such as Nippon Sheet Glass (Japan), AGC Inc. (Japan), and Saint-Gobain (France) offers an extensive range of glass along with different coatings to manufacture insulated glazing unit across the globe

To know about the assumptions considered for the study, download the pdf brochure

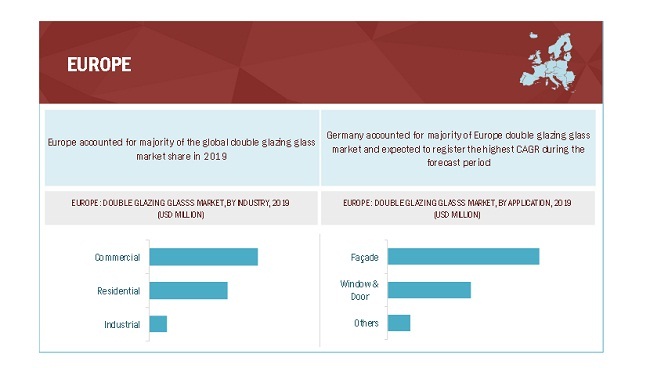

Europe held the largest market share in the double glazing glass market in terms of value.

Europe is the largest double glazing glass market, and the trend is expected to remain the same during the forecasted period. Rising energy consumption and costs, requirements for legislative building compliance, and the need to manage the greenhouse gas emission are driving the growth of double glazing glass products. Furthermore, the government initiatives for green buildings and energy-efficient performance have made double glazing glass a very prominent choice amongst contractors boosting the market growth in Europe. However, COVID-19 is expected to affect the market in Europe. The UK, Italy, France, and Spain are the most severely affected countries in Europe that will face a sharp decline in the double glazing glass market in 2020 due to the closure of manufacturing facilities as well as a suspension in construction projects.

Double Glazing Glass Market Players

The key players in the global double glazing glass market are Metro Performance Glass (New Zealand), CN Glass Limited (UK), Glass & Glazing Systems Pvt. Ltd (India), T & I Sealed Units Limited (UK), Clayton Glass Ltd (UK), Shenzhen Sun Global Glass Co., Ltd. (China), TAMCO Gulf Ltd. (UAE), Weatherbeater Windows (UK), and Abbey & Burton Glass (UK). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the industry. The study includes an in-depth competitive analysis of these companies in the double glazing glass, with their company profiles, recent developments, and key market strategies.

Double Glazing Glass Market Report Scope

This research report categorizes the double glazing glass market based on material, spacer thickness, application, industry, and region.

By Material:

- Glass

- Frame and Spacer

- Sealant

- Others

By Spacer thickness:

- Less than 10mm

- 10mm to 12mm

- More than 12mm

By Application:

- Window & door

- Façade

- Others

By Industry:

- Residential

- Commercial

- Industrial

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In July 2019, Clayton Glass expanded its glass manufacturing facility to become the largest glass factory anywhere in mainland UK. The company invested USD 1.7 million for this expansion and installed an all-new and third fully automated Bystronic IGU line.

- In October 2019, Clayton Glass acquired the services, business, and manufacturing capabilities of Nottinghamshire-based glass manufacturer, Global Glass, from Aperture Trading Limited. This acquisition has permitted Clayton to significantly increase its sales levels, manufacturing capacities, and geographical reach.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of double glazing glass?

The growing prominence of green buildings and the adoption of energy-efficient solutions in the construction industry is driving the double glazing glass market.

Which is the fastest growing country for the double glazing glass market?

China is the fastest-growing country for the double glazing glass market on account due to the presence of major double glazing glass manufacturers and the flourishing growth of the construction & infrastructure sector.

What are the major materials in the double glazing glass market?

Glass, frame & spacer sealant, and others are the key materials in the market.

What are the challenges in the double glazing glass market?

The development of new products and technology is a major challenge for the double glazing glass market.

Which material in the double glazing glass market holds the largest share?

Glass holds the largest share in the double glazing glass market.

What are the different spacer thickness of double glazing glass?

Less than 10mm, 10mm to 12mm, and more than 12mm are the various spacer thickness available in the market.

Who are the manufacturers of double glazing glass?

Metro Performance Glass (New Zealand), CN Glass Limited (UK), Glass & Glazing Systems Pvt. Ltd (India), T & I Sealed Units Limited (UK), Clayton Glass Ltd (UK), Shenzhen Sun Global Glass Co., Ltd. (China), TAMCO Gulf Ltd. (UAE), Weatherbeater Windows (UK), and Abbey & Burton Glass (UK) among many others, are some of the manufacturers operating in the market.

What are the different applications of double glazing glass?

Window & door, façade, and others are the major applications of double glazing glass.

What are the major industries for double glazing glass?

The major industries for double glazing glass are commercial, residential, and industrial.

What is the biggest restraint for double glazing glass?

Shift towards closed molding processes is restraining market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 DOUBLE GLAZING GLASS MARKET SEGMENTATION

1.3 MARKET SCOPE

1.3.1 DOUBLE GLAZING GLASS MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 DOUBLE GLAZING GLASS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET NUMBER ESTIMATION

2.2.1 SUPPLY SIDE ANALYSIS

FIGURE 3 MARKET NUMBER ESTIMATION

2.2.2 DEMAND SIDE ANALYSIS

FIGURE 4 MARKET NUMBER ESTIMATION METHODOLOGY

2.3 DATA TRIANGULATION

FIGURE 5 DOUBLE GLAZING GLASS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 6 FACADE APPLICATION DOMINATED THE DOUBLE GLAZING GLASS MARKET

FIGURE 7 COMMERCIAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE

FIGURE 8 10MM TO 12MM SEGMENT DOMINATED THE MARKET

FIGURE 9 GLASS MATERIAL LED THE DOUBLE GLAZING GLASS MARKET

FIGURE 10 US LED THE DOUBLE GLAZING GLASS MARKET

FIGURE 11 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DOUBLE GLAZING GLASS MARKET

FIGURE 12 INCREASING FOCUS ON ADOPTION OF ENERGY-EFFICIENT SOLUTIONS

4.2 DOUBLE GLAZING GLASS MARKET, BY APPLICATION AND REGION, 2019

FIGURE 13 EUROPE AND FACADE SEGMENT ACCOUNTED FOR LARGEST SHARES

4.3 DOUBLE GLAZING GLASS MARKET, BY MANUFACTURING PROCESS

FIGURE 14 10MM TO 12MM SEGMENT TO DOMINATE THE DOUBLE GLAZING GLASS MARKET

4.4 DOUBLE GLAZING GLASS MARKET, BY INDUSTRY

FIGURE 15 COMMERCIAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE

4.5 DOUBLE GLAZING GLASS MARKET, BY KEY COUNTRIES

FIGURE 16 CHINA TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE DOUBLE GLAZING GLASS MARKET

5.2.1 DRIVER

5.2.1.1 Growing importance of green buildings

5.2.1.2 Excellent energy-saving performance

5.2.2 RESTRAINT

5.2.2.1 Lack of awareness and hesitation toward adoption

5.2.2.2 Declining construction sector due to COVID-19

5.2.3 OPPORTUNITY

5.2.3.1 Growing building & construction activities in emerging economies

5.2.3.2 Stringent government regulations

5.2.4 CHALLENGE

5.2.4.1 Developing new products

5.2.4.2 Market recovery from COVID-19

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 PORTER'S FIVE FORCES OF DOUBLE GLAZING GLASS MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 DOUBLE GLAZING GLASS MARKET, BY MATERIAL (Page No. - 45)

6.1 INTRODUCTION

FIGURE 19 GLASS TO CONTINUE DOMINATING THE MARKET

TABLE 1 DOUBLE GLAZING GLASS MARKET SIZE, BY MATERIAL, 2018-2025 (USD MILLION)

6.2 GLASS

6.3 FRAME & SPACER BAR

6.4 SEALANT

6.5 OTHERS

7 DOUBLE GLAZING GLASS MARKET, BY APPLICATION (Page No. - 49)

7.1 INTRODUCTION

FIGURE 20 FACADE REMAINS THE LARGEST APPLICATION THROUGH 2025

TABLE 2 DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 3 DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION SQUARE METER)

7.2 WINDOW & DOOR

7.2.1 DOUBLE GLAZING GLASS MARKET IN WINDOW & DOOR, BY REGION

TABLE 4 DOUBLE GLAZING GLASS MARKET SIZE IN WINDOW & DOOR, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 5 DOUBLE GLAZING GLASS MARKET SIZE IN WINDOW & DOOR, BY REGION, 2018-2025 (USD MILLION)

7.3 FACADE

FIGURE 21 APAC TO BE THE FASTEST-GROWING MARKET IN THE FACADE APPLICATION

7.3.1 DOUBLE GLAZING GLASS MARKET IN FACADE, BY REGION

TABLE 6 DOUBLE GLAZING GLASS MARKET SIZE IN FACADE, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 7 DOUBLE GLAZING GLASS MARKET SIZE IN FACADE, BY REGION, 2018-2025 (USD MILLION)

7.4 OTHERS

7.4.1 DOUBLE GLAZING GLASS MARKET IN OTHER APPLICATIONS, BY REGION

TABLE 8 DOUBLE GLAZING GLASS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 9 DOUBLE GLAZING GLASS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

8 DOUBLE GLAZING GLASS MARKET, BY SPACER THICKNESS (Page No. - 55)

8.1 INTRODUCTION

FIGURE 22 10MM TO 12MM SEGMENT TO LEAD THE DOUBLE GLAZING GLASS MARKET

TABLE 10 DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (USD MILLION)

TABLE 11 DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (MILLION SQUARE METER)

8.2 LESS THAN 10MM

8.2.1 DOUBLE GLAZING GLASS MARKET IN LESS THAN 10MM THICKNESS, BY REGION

TABLE 12 LESS THAN 10MM: DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 13 LESS THAN 10MM: DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.3 10MM TO 12MM

FIGURE 23 EUROPE TO LEAD THE DOUBLE GLAZING GLASS MARKET

8.3.1 DOUBLE GLAZING GLASS MARKET IN 10MM TO 12MM THICKNESS, BY REGION

TABLE 14 10MM TO 12MM: DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 15 10MM TO 12MM: DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.4 MORE THAN 12MM

8.4.1 DOUBLE GLAZING GLASS MARKET IN MORE THAN 12MM THICKNESS,BY REGION

TABLE 16 MORE THAN 12MM: DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 17 MORE THAN 12MM: DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

9 DOUBLE GLAZING GLASS MARKET, BY INDUSTRY (Page No. - 61)

9.1 INTRODUCTION

FIGURE 24 COMMERCIAL SEGMENT TO LEAD THE DOUBLE GLAZING GLASS MARKET

TABLE 18 DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

TABLE 19 DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

9.2 RESIDENTIAL

9.2.1 DOUBLE GLAZING GLASS MARKET IN RESIDENTIAL, BY REGION

TABLE 20 DOUBLE GLAZING GLASS MARKET SIZE IN RESIDENTIAL, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 21 DOUBLE GLAZING GLASS MARKET SIZE IN RESIDENTIAL, BY REGION, 2018-2025 (USD MILLION)

9.3 COMMERCIAL

FIGURE 25 COMMERCIAL SEGMENT TO LEAD THE DOUBLE GLAZING GLASS MARKET

9.3.1 DOUBLE GLAZING GLASS MARKET IN COMMERCIAL, BY REGION

TABLE 22 DOUBLE GLAZING GLASS MARKET SIZE IN COMMERCIAL, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 23 DOUBLE GLAZING GLASS MARKET SIZE IN COMMERCIAL, BY REGION, 2018-2025 (USD MILLION)

9.4 INDUSTRIAL

9.4.1 DOUBLE GLAZING GLASS MARKET IN INDUSTRIAL, BY REGION

TABLE 24 DOUBLE GLAZING GLASS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018-2025 (MILLION SQUARE METER)

TABLE 25 DOUBLE GLAZING GLASS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018-2025 (USD MILLION)

10 DOUBLE GLAZING GLASS MARKET, BY REGION (Page No. - 67)

10.1 INTRODUCTION

FIGURE 26 GERMANY TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 26 DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 27 DOUBLE GLAZING GLASS MARKET SIZE, BY REGION, 2018-2025 (MILLION SQUARE METER)

10.2 NORTH AMERICA

FIGURE 27 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SNAPSHOT

TABLE 28 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 29 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION SQUARE METER)

TABLE 30 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 31 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

TABLE 32 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (USD MILLION)

TABLE 33 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (MILLION SQUARE METER)

TABLE 34 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 35 NORTH AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION SQUARE METER)

10.2.1 US

10.2.1.1 Demand for double glazed windows in residential construction

TABLE 36 US: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 37 US: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.2.2 CANADA

10.2.2.1 Rise in demand for green building materials

TABLE 38 CANADA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 39 CANADA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.3 EUROPE

FIGURE 28 EUROPE: DOUBLE GLAZING GLASS MARKET SNAPSHOT

TABLE 40 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 41 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION SQUARE METER)

TABLE 42 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 43 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

TABLE 44 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (USD MILLION)

TABLE 45 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (MILLION SQUARE METER)

TABLE 46 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 47 EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION SQUARE METER)

10.3.1 FRANCE

10.3.1.1 Growing focus on reducing energy consumption to drive the market

TABLE 48 FRANCE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 49 FRANCE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.3.2 GERMANY

10.3.2.1 Largest double glazing glass market in Europe

TABLE 50 GERMANY: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 51 GERMANY: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.3.3 UK

10.3.3.1 Increasing replacement of single glazing windows with double glazing windows

TABLE 52 UK: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 53 UK: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.3.4 ITALY

10.3.4.1 Building renovation and energy redevelopment projects to drive the market

TABLE 54 ITALY: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 55 ITALY: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.3.5 SPAIN

10.3.5.1 Augmenting demand from the residential industry

TABLE 56 SPAIN: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 57 SPAIN: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.3.6 REST OF EUROPE

TABLE 58 REST OF EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 59 REST OF EUROPE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.4 APAC

FIGURE 29 APAC: DOUBLE GLAZING GLASS MARKET SNAPSHOT

TABLE 60 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 61 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION SQUARE METER)

TABLE 62 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 63 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

TABLE 64 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (USD MILLION)

TABLE 65 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (MILLION SQUARE METER)

TABLE 66 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 67 APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION SQUARE METER)

10.4.1 CHINA

10.4.1.1 Largest construction market in the world

TABLE 68 CHINA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 69 CHINA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.4.2 JAPAN

10.4.2.1 Growing usage of energy-saving materials

TABLE 70 JAPAN: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 71 JAPAN: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.4.3 INDIA

10.4.3.1 One of the fastest-growing construction markets in the world

TABLE 72 INDIA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 73 INDIA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.4.4 AUSTRALIA

10.4.4.1 Surging demand for IGUs for thermal and noise insulation

TABLE 74 AUSTRALIA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 75 AUSTRALIA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.4.5 REST OF APAC

TABLE 76 REST OF APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 77 REST OF APAC: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.5 MEA

TABLE 78 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 79 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION SQUARE METER)

TABLE 80 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 81 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

TABLE 82 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (USD MILLION)

TABLE 83 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (MILLION SQUARE METER)

TABLE 84 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 85 MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION SQUARE METER)

10.5.1 UAE

10.5.1.1 Rising trend of green buildings supporting market growth

TABLE 86 UAE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 87 UAE: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.5.2 SAUDI ARABIA

10.5.2.1 Ongoing and upcoming large commercial construction projects to fuel the growth

TABLE 88 SAUDI ARABIA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 89 SAUDI ARABIA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.5.3 REST OF MEA

TABLE 90 REST OF MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 91 REST OF MEA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.6 LATIN AMERICA

TABLE 92 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 93 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION SQUARE METER)

TABLE 94 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 95 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

TABLE 96 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (USD MILLION)

TABLE 97 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY SPACER THICKNESS, 2018-2025 (MILLION SQUARE METER)

TABLE 98 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 99 LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION SQUARE METER)

10.6.1 BRAZIL

10.6.1.1 Investment in energy efficiency projects to reduce GHG emissions

TABLE 100 BRAZIL: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 101 BRAZIL: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.6.2 MEXICO

10.6.2.1 Growing usage in residential windows boosting market growth

TABLE 102 MEXICO: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 103 MEXICO: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

10.6.3 REST OF LATIN AMERICA

TABLE 104 REST OF LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (USD MILLION)

TABLE 105 REST OF LATIN AMERICA: DOUBLE GLAZING GLASS MARKET SIZE, BY INDUSTRY, 2018-2025 (MILLION SQUARE METER)

11 COMPETITIVE LANDSCAPE (Page No. - 106)

11.1 INTRODUCTION

FIGURE 30 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY BETWEEN 2016 AND 2019

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 DYNAMIC DIFFERENTIATORS

11.2.2 INNOVATORS

11.2.3 VISIONARY LEADERS

11.2.4 EMERGING COMPANIES

FIGURE 31 DOUBLE GLAZING GLASS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

11.3 COMPETITIVE BENCHMARKING

11.3.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN DOUBLE GLAZING GLASS MARKET

11.3.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 33 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN DOUBLE GLAZING GLASS MARKET

11.4 COMPETITIVE SCENARIO

11.4.1 NEW PRODUCT DEVELOPMENT

11.4.2 MERGER & ACQUISITION

11.4.3 EXPANSION

12 COMPANY PROFILES (Page No. - 113)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition, Right to Win)*

12.1 SAINT-GOBAIN

FIGURE 34 SAINT-GOBAIN: COMPANY SNAPSHOT

FIGURE 35 SAINT-GOBAIN: SWOT ANALYSIS

12.2 AGC INC.

FIGURE 36 AGC INC.: COMPANY SNAPSHOT

FIGURE 37 AGC INC.: SWOT ANALYSIS

12.3 NIPPON SHEET GLASS CO., LTD

FIGURE 38 NIPPON SHEET GLASS CO., LTD: COMPANY SNAPSHOT

FIGURE 39 NIPPON SHEET GLASS CO., LTD: SWOT ANALYSIS

12.4 METRO PERFORMANCE GLASS

FIGURE 40 METRO PERFORMANCE GLASS: COMPANY SNAPSHOT

FIGURE 41 METRO PERFORMANCE GLASS: SWOT ANALYSIS

12.5 GUARDIAN INDUSTRIES

FIGURE 42 GUARDIAN INDUSTRIES: SWOT ANALYSIS

12.6 CN GLASS LIMITED

12.7 GLASS & GLAZING SYSTEMS PVT. LTD

12.8 T & I SEALED UNITS LIMITED

12.9 CLAYTON GLASS LTD

12.1 SHENZHEN SUN GLOBAL GLASS CO., LTD,

12.11 TAMCO GULF LTD.

12.12 WEATHERBEATER WINDOWS

12.13 CLEARVIEW LTD

12.14 ABBEY & BURTON GLASS

12.15 RAVENSBY GLASS CO. LTD

12.16 OTHERS

12.16.1 CHEVRON GLASS PTY LTD

12.16.2 CARDINAL GLASS INDUSTRIES, INC

12.16.3 OLYMPIC GLASS

12.16.4 ORION GLASS

12.16.5 QINGDAO MIGO GLASS CO., LTD.

12.16.6 PREMIER GLASS WORKS

12.16.7 STEVENAGE GLASS COMPANY LTD

12.16.8 GUNJ GLASS WORKS LTD.

12.16.9 ARABIAN PROCESSING GLASS CO.

12.16.10 THAI-GERMAN SPECIALTY GLASS CO., LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development and Growth Strategies, Threat from Competition, Right to Win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 145)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

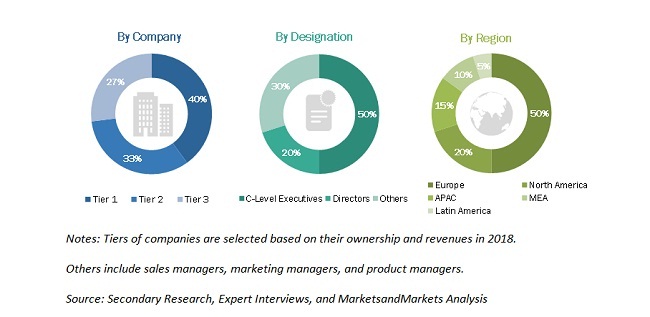

The study involves two major activities in estimating the current size of the double glazing glass market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The double glazing glass market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the construction & infrastructure sector. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total double glazing glass market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall double glazing glass market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive, aerospace & defense, marine, and rail industries.

Report Objectives

- To analyze and forecast the global double glazing glass market in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size on the basis of material, spacer thickness, application, and industry

- To analyze and forecast the market size on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To strategically analyze the markets with respect to individual growth trends, future prospects, and contribution to the global market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To analyze competitive development strategies, such as acquisition, new product launch, and expansion in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies*

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC double glazing glass market

- Further breakdown of Rest of European double glazing glass market

- Further breakdown of Rest of North American double glazing glass market

- Further breakdown of Rest of MEA double glazing glass market

- Further breakdown of Rest of Latin American double glazing glass market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Double Glazing Glass Market