Building Envelope Adhesives & Sealants Market by Technology, Adhesive Resin (PU, Acrylic, Rubber), Adhesive Application (Roofing, Walls), Sealant Resin (Silicone, PU), Sealant Application (Facade Panel Fixing, Roofing), & Region - Global Forecast to 2026

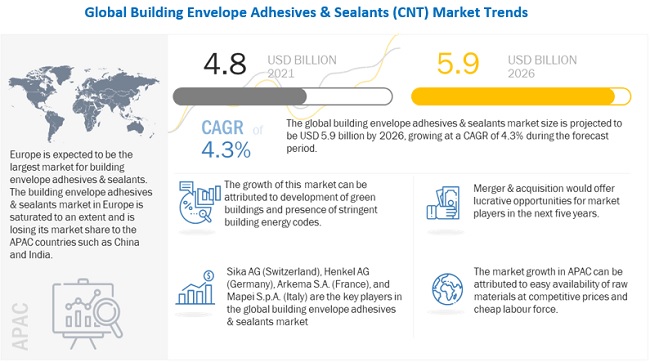

[244 Pages Report] The market size for building envelope adhesives & sealants is projected to grow from USD 4.8 Billion in 2021 to USD 5.9 Billion by 2026, at a CAGR of 4.3% between 2021 and 2026. The market growth of building envelope adhesives & sealants in the APAC region due to easy availability of raw materials at competitive prices and cheap labor force.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Building envelope adhesives & sealants Market

COVID-19 has made a significant economic impact on various financial as well as industrial sectors, such as travel and tourism, manufacturing, and aviation. The worst economic recession is expected during 2020-2021, according to World Bank and IMF. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, impacting the global economy.

In the recent past, the global economy became substantially more interconnected. The adverse consequences of various steps related to the containment of COVID-19 are evident from global supply chain disruptions, weaker demand for imported products and services, and an increase in the unemployment rate. Risk aversion has increased in the financial market, with all-time low interest rates and sharp declines in equity and commodity prices. Consumer and business confidence have also reduced significantly.

Building envelope adhesives & sealants Market Dynamics

Driver: Increased demand for construction adhesives & sealants in residential housing and infrastructure sectors

The increasing penetration of sealants in new applications, such as ductwork, anchoring application, and structural glazing in the construction industry is driving the building envelope adhesives & sealants market. The major applications of construction sealants are in window framing, sanitary & kitchen, expansion joints, floor systems, walls, and panels. Under changing atmospheric conditions, they provide stress-bearing capability and prevent from cracking.

Adhesives are used in various applications such as carpet laying, tile installation, and exterior insulation systems in the construction industry. These applications have spurred the growth of the building envelope adhesives & sealants market.

Restraint: Environmental regulations in the North American and European countries

Europe and North America are strictly regulated by environmental laws regarding the production of chemical and petro-based products. Agencies such as Epoxy Resin Committee (ERC), European Commission (EC), and other regulatory bodies are governing the manufacturing of solvent-based products in these regions. These regulations are restraining the growth of the construction adhesives market. The companies are not able to shift their entire focus on manufacturing green and environmentally-friendly products, which are also hampering their business revenue.

Opportunity: Growing demand for low-VOC, green, and sustainable adhesives

The rising trend of using environmentally-friendly or green products in various applications is driving the demand for green adhesives or those with low VOCs. Stringent regulations implemented by USEPA (United States Environmental Protection Agency), Europes REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have forced the manufacturers to produce environmentally friendly adhesives with low VOC levels. The shift toward a more sustainable product portfolio has provided the industry a significant growth opportunity.

The major players manufacture environmentally-friendly construction adhesives. These green adhesive solutions are made from renewable, recycled, remanufactured, or biodegradable materials; the use of these environmentally friendly products also benefits the health of the occupants

Challenge: Lack of awareness

There is a lack of awareness among the consumers as well as building professionals about building envelopes. The biggest gap between todays regulations and recommended energy performance are found in Southern Europe. There needs to be a major initiative in this region to raise awareness and bring building regulations.

In some cases, buildings are not even insulated to code, as per the location, weather conditions, and structure of the building; and this happens not necessarily due to design but because of lack of awareness on the part of some architects and building code officials. This has resulted in a lack of proper insulation in many commercial buildings in comparison to what it should be.

Use of polyurethane adhesives in various applications to boost the demand.

The market for polyurethane adhesive resin is driven by its demand in various applications such as faηade panel fixing, flooring, roofing, sanitary sealing, and wall joints. These adhesives are formulated by liquid reactive (two part), hot melt, and low-VOC technologies. The key players such as HB Fuller, 3M, and ICP Group are the main producers of polyurethane-based adhesives.

Use of thermal insulation solutions to minimize solar heat gain in summer and heat loss in winter through roof to drive the growth of building envelope adhesives market

Treatment of building with thermal insulation solutions like building envelope may help in reducing energy consumption. For APAC and the Middle East & Africa, roof is the major contributor of heat gain in buildings. Various studies are available to determine heat flow through different building components. High temperature in summer ranging from 104-122°F in this region necessitate cooling of buildings to provide a comfortable and workable living environment indoors. For non-conditioned residential and other types of buildings, peak temperature is managed by using roof insulation. The use of thermal insulation to minimize solar heat gain in summer and heat loss in winter through roof is expected to drive the growth of roof insulations, and thus the building envelope adhesives & sealants market.

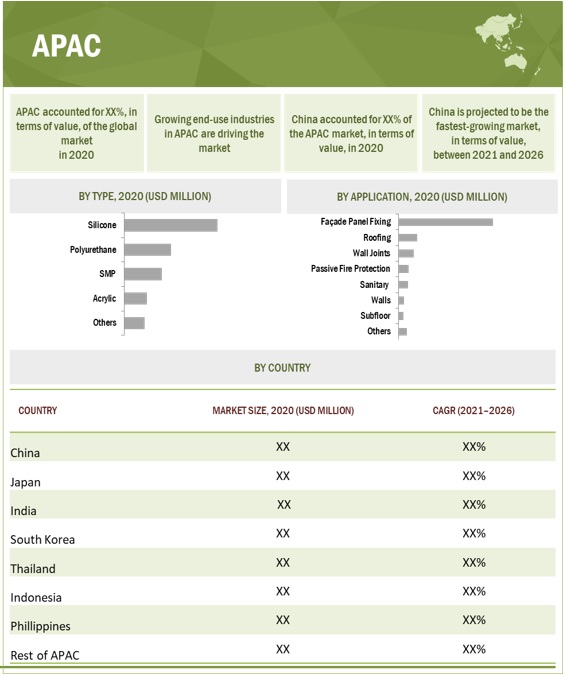

APAC is the fastest-growing building envelope adhesives & sealants market globally.

APAC is increasingly becoming an important trade and commerce center. The region is currently the fastest-growing and the largest market for building envelope adhesives & sealants. The manufacturers of building envelope adhesives & sealants are targeting this region as it has the largest construction industry, accounting for approximately 40% of the construction spending according to the World Bank. Easy availability of raw materials at competitive prices and cheap labor force have made APAC the biggest market for construction products. Global manufacturers are increasingly setting up their production plants in the region in a bid to ramp up production and increase sales.

The spread of COVID-19 started in China in early January 2020. Within a small period, the virus spread to other Asian countries, such as Japan, India, South Korea, and Thailand, resulting in a rapidly increasing number of positive cases and deaths. The pandemic situation led national governments across APAC to announce lockdowns, leading to a decrease in traffic and temporary closure of construction & mining activities, manufacturing industries, and others. Since China is a global manufacturing hub, it was significantly impacted by the COVID-19 pandemic; this in turn had an adverse effect on the Building envelope adhesives & sealants market in APAC in 2020.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players operating in the market are Sika AG (Switzerland), Henkel AG (Germany), Arkema S.A. (France), Mapei S.p.A. (Italy), The 3M Company (US), ICP Group (US), H.B. Fuller Company (US), The Dow Chemical Company (US), tremco illbruck GmbH (Germany), and Soudal Group (Belgium).

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

20212026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Technology |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players Sika AG (Switzerland), Henkel AG (Germany), Arkema S.A. (France), Mapei S.p.A. (Italy), The 3M Company (US), ICP Group (US), H.B. Fuller Company (US), The Dow Chemical Company (US), tremco illbruck GmbH (Germany), and Soudal Group (Belgium). (Total of 20companies) |

This research report categorizes the building envelope adhesives & sealants market based on type, method, end-use industry, and region.

By Technology

- Solvent-less

- Solvent-based

- Water-Based

By Adhesive Resin:

- Polyurethane

- Epoxy

- Acrylic

- Rubber

- Others

By Adhesive Application:

- Roofing

- Walls

- Subfloor

- Others

By Sealant Resin:

- Polyurethane

- Silicone

- Acrylic

- Silane Modified Polymer (SMP)

- Others

By Adhesive Application:

- Faηade Panel Fixing

- Wall Joints

- Sanitary

- Passive Fire Protection

- Roofing

- Walls

- Subfloor

- Others

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2020, Sika acquired Adeplast SA to strengthen its position in the local construction chemicals market and expand its manufacturing capacity in Romania.

- In January 2020, Bostik completed the acquisition of LIP Bygningsartikler AS (LIP), the Danish leader in tile adhesives, waterproofing systems, and floor preparation solutions, on 3rd January 2020. This acquisition is in line with Arkema's strategy to continuously grow its adhesives business through bolt-on acquisitions, which complement Bostik's geographic presence, product ranges, and technologies.

Frequently Asked Questions (FAQ):

What is the current size of the global building envelope adhesives & sealants market?

The global building envelope adhesives & sealants market is estimated to be USD 4.8 Billion in 2021 to USD 5.9 Billion by 2026, at a CAGR of 4.3% between 2021 and 2026.

Who are the major players of the building envelope adhesives & sealants market?

Companies such as Sika AG (Switzerland), Henkel AG (Germany), Arkema S.A. (France), Mapei S.p.A. (Italy), The 3M Company (US), ICP Group (US), H.B. Fuller Company (US), The Dow Chemical Company (US), tremco illbruck GmbH (Germany), and Soudal Group (Belgium).

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. New product launch and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for building envelope adhesives & sealants?

The polyurethane sealants market size is increasing due to the rising demand from APAC, which is witnessing increasing investments by the government for infrastructural development in green building space. The economic growth, increasing population, and rising standards of living are leading to increased demand for housing, civil, and infrastructural developments. Hence, the demand for building envelope sealants for glazing, expansion joints, flooring, roofing, and other applications in the emerging economies, especially China and India, for new residential applications, is increasing. Similarly, the demand for these sealants is increasing in applications where flexibility is needed.

Which is the fastest-growing region in the market?

APAC is projected to be the fastest-growing market for building envelope adhesives & sealants during the forecast period. Easy availability of raw materials at competitive prices and cheap labor force have made APAC the biggest market for Building envelope adhesives & sealants. Global manufacturers are increasingly setting up their production plants in the region in a bid to ramp up production and increase sales. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RISK ANALYSIS ASSESSMENT

2.6 LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS /GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 2 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 6 FAΗADE PANEL FIXING APPLICATION DOMINATED THE BUILDING ENVELOPE SEALANTS MARKET IN 2020

FIGURE 7 ROOFING APPLICATION DOMINATED THE BUILDING ENVELOPE ADHESIVES MARKET IN 2020

FIGURE 8 APAC TO BE THE FASTEST-GROWING BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET

FIGURE 9 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET TO WITNESS MODERATE GROWTH BETWEEN 2021 AND 2026

4.2 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY SEALANT APPLICATION

FIGURE 10 FAΗADE PANEL FIXING TO BE THE LARGEST SEALANT APPLICATION

4.3 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY SEALANT APPLICATION AND COUNTRY, 2020

FIGURE 11 CHINA AND FAΗADE PANEL FIXING SEGMENTS ACCOUNTED FOR THE LARGEST SHARES

4.4 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 12 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

4.5 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: GROWING DEMAND FROM APAC

FIGURE 13 INDIA TO REGISTER THE HIGHEST CAGR IN APAC MARKET

4.6 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: MAJOR COUNTRIES

FIGURE 14 CHINA AND INDIA TO EMERGE AS LUCRATIVE MARKETS

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 GREEN BUILDING OUTLOOK

TABLE 3 INVESTMENT OPPORTUNITY BY PROPERTY TYPE AND REGION AMONG GREEN BUILDING MARKET (USD BILLION)

5.3 INCENTIVES FOR GREEN BUILDING CONSTRUCTION

5.4 MARKET DYNAMICS

5.4.1 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN THE BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET

5.4.2 DRIVERS

5.4.2.1 Reduction in energy consumption and its related cost

5.4.2.2 Increased demand for construction adhesives & sealants in residential housing and infrastructure sectors

5.4.2.3 Development of green buildings

5.4.2.4 Presence of stringent building energy codes

5.4.3 RESTRAINTS

5.4.3.1 Environmental regulations in the North American and European countries

5.4.4 OPPORTUNITIES

5.4.4.1 High energy requirements

5.4.4.2 Growing demand for low-VOC, green, and sustainable adhesives

5.4.5 CHALLENGES

5.4.5.1 Lack of awareness

5.5 PORTERS FIVE FORCES ANALYSIS

FIGURE 15 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: PORTERS FIVE FORCES ANALYSIS

TABLE 4 PORTERS FIVE FORCES ANALYSIS

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 BARGAINING POWER OF BUYERS

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 THREAT OF SUBSTITUTES

5.5.5 THREAT OF NEW ENTRANTS

5.6 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.6.1 INTRODUCTION

5.6.2 TRENDS AND FORECAST OF GDP

TABLE 5 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 20182025

5.7 COVID-19 IMPACT

5.7.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 16 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.7.2 COVID-19 ECONOMIC IMPACT SCENARIO ASSESSMENT

FIGURE 17 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

FIGURE 18 SCENARIO-BASED ANALYSIS OF IMPACT OF COVID-19 ON BUSINESSES

5.8 EXPORT-IMPORT TRADE STATISTICS

5.8.1 TRADE SCENARIO 20172019

TABLE 6 COUNTRY-WISE EXPORT DATA, 20172019

TABLE 7 COUNTRY-WISE IMPORT DATA, 20172019

5.9 AVERAGE SELLING PRICE ANALYSIS

FIGURE 19 AVERAGE SELLING PRICE OF BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION

5.10 PATENTS ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

FIGURE 20 NUMBER OF PATENTS PUBLISHED, 20152021

5.10.3 PATENTS ANALYSIS BY JURISDICTION

FIGURE 21 PATENTS PUBLISHED BY EACH JURISDICTION, 20162021

5.10.4 TOP APPLICANTS

FIGURE 22 PATENTS PUBLISHED BY MAJOR APPLICANTS, 20162021

TABLE 8 RECENT PATENTS BY COMPANIES

5.11 REGULATIONS

5.11.1 LEED STANDARDS

TABLE 9 BY ARCHITECTURAL APPLICATIONS

TABLE 10 BY SPECIALTY APPLICATIONS

TABLE 11 BY SUBSTRATE-SPECIFIC APPLICATIONS

TABLE 12 BY SEALANT PRIMERS

5.12 CASE STUDY ANALYSIS

5.13 VALUE CHAIN ANALYSIS

FIGURE 23 BUILDING ENVELOPE ADHESIVES & SEALANTS: VALUE CHAIN ANALYSIS

5.14 TECHNOLOGY ANALYSIS

5.15 BUILDING ENVELOPE ADHESIVES & SEALANTS ECOSYSTEM

TABLE 13 BUILDING ENVELOPE ADHESIVES & SEALANTS ECOSYSTEM

6 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY TECHNOLOGY (Page No. - 84)

6.1 INTRODUCTION

TABLE 14 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (USD MILLION)

TABLE 15 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (KILOTON)

6.2 SOLVENT-LESS

6.2.1 STRINGENT REGULATIONS ABOUT LOW-VOC USAGE TO DRIVE THE GROWTH OF THIS TECHNOLOGY

TABLE 16 SOLVENT-LESS TECHNOLOGY MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 17 SOLVENT-LESS TECHNOLOGY MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

6.3 SOLVENT-BASED

6.3.1 THE TECHNOLOGY HAS LOST A SIGNIFICANT MARKET SHARE TO OTHER ADHESIVE TECHNOLOGIES

TABLE 18 SOLVENT-BASED TECHNOLOGY MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 19 SOLVENT-BASED TECHNOLOGY MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

6.4 WATER-BASED

6.4.1 INCREASING ADOPTION OF GREEN PRODUCTS TO DRIVE THE DEMAND

TABLE 20 WATER-BASED TECHNOLOGY MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 21 WATER-BASED TECHNOLOGY MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

7 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY ADHESIVE RESIN (Page No. - 90)

7.1 INTRODUCTION

TABLE 22 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (USD MILLION)

TABLE 23 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (KILOTON)

7.2 POLYURETHANE

7.2.1 USE OF POLYURETHANE ADHESIVES IN VARIOUS APPLICATIONS TO BOOST THE DEMAND

TABLE 24 POLYURETHANE ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 25 POLYURETHANE ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

7.3 EPOXY

7.3.1 GROWTH IS FUELED BY THE WIDE USE OF EPOXIES IN DEMANDING APPLICATIONS

TABLE 26 EPOXY ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 27 EPOXY ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

7.4 ACRYLIC

7.4.1 FAST SETTING TIME AND ECONOMICAL PRICE MAKE THEM SUI TABLE FOR BUILDING & CONSTRUCTION APPLICATIONS

TABLE 28 ACRYLIC ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 29 ACRYLIC ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

7.5 RUBBER

7.5.1 CONTACT ADHESIVES LIKE RUBBER GAIN STRENGTH OVER TIME, MAKING THEM USEFUL IN VARIOUS APPLICATIONS

TABLE 30 RUBBER ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 31 RUBBER ADHESIVE RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

7.6 OTHERS

TABLE 32 OTHER ADHESIVE RESINS MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 33 OTHER ADHESIVE RESINS MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

8 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY ADHESIVE APPLICATION (Page No. - 98)

8.1 INTRODUCTION

TABLE 34 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (USD MILLION)

TABLE 35 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (KILOTON)

8.2 ROOFING

8.2.1 USE OF THERMAL INSULATION SOLUTIONS TO MINIMIZE SOLAR HEAT GAIN IN SUMMER AND HEAT LOSS IN WINTER THROUGH ROOF TO DRIVE THE GROWTH

TABLE 36 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN ROOFING APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 37 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN ROOFING APPLICATION, BY REGION, 20192026 (KILOTON)

8.3 WALLS

8.3.1 CONSUMER DISPOSABLE INCOME GROWTH, POPULATION GROWTH, INCREASED GOVERNMENT INFRASTRUCTURE DEVELOPMENT INITIATIVES, AND PARTNERSHIPS WITH INTERNATIONAL INVESTORS ARE ALL DRIVING THE MARKET IN THE APAC

TABLE 38 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN WALLS APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 39 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN WALLS APPLICATION, BY REGION, 20192026 (KILOTON)

8.4 SUBFLOOR

8.4.1 INCREASED SPENDING ON HOUSING AND INFRASTRUCTURAL ACTIVITIES, LOW COST, AND ZERO MAINTENANCE DRIVE THE DEMAND

TABLE 40 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN SUBFLOOR APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 41 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN SUBFLOOR APPLICATION, BY REGION, 20192026 (KILOTON)

8.5 OTHERS

TABLE 42 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 20192026 (USD MILLION)

TABLE 43 BUILDING ENVELOPE ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 20192026 (KILOTON)

9 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY SEALANT RESIN (Page No. - 104)

9.1 INTRODUCTION

TABLE 44 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (USD MILLION)

TABLE 45 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (KILOTON)

9.2 POLYURETHANE

9.2.1 GROWTH OF GREEN BUILDINGS IN APAC TO THE DRIVE THE DEMAND

TABLE 46 POLYURETHANE SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 47 POLYURETHANE SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

9.3 SILICONE

9.3.1 SILICONE PRODUCTS TO CONTINUE REPLACING LOWER PERFORMANCE SEALANTS

TABLE 48 SILICONE SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 49 SILICONE SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

9.4 ACRYLIC

9.4.1 LOW CURING TIME, HIGH RESISTANCE TO SUNLIGHT, AND DURABILITY IN HUMIDITY TO DRIVE THE GROWTH

TABLE 50 ACRYLIC SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 51 ACRYLIC SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

9.5 SILANE MODIFIED POLYMER (SMP)

9.5.1 GROWTH IN RENOVATION WORK AND RISING DEMAND FROM EMERGING COUNTRIES TO DRIVE THE MARKET

TABLE 52 SMP SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 53 SMP SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

9.6 OTHERS

TABLE 54 OTHER SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (USD MILLION)

TABLE 55 OTHER SEALANT RESIN MARKET SIZE IN BUILDING ENVELOPE ADHESIVES & SEALANTS, BY REGION, 20192026 (KILOTON)

10 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY SEALANT APPLICATION (Page No. - 113)

10.1 INTRODUCTION

TABLE 56 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (USD MILLION)

TABLE 57 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (KILOTON)(KILOTON)(KILOTON)

10.2 FAΗADE PANEL FIXING

10.2.1 GROWING FAΗADE MATERIALS AND SYSTEM MARKET AND NEW TECHNOLOGIES TO BOOST THE DEMAND

TABLE 58 BUILDING ENVELOPE SEALANT MARKET SIZE IN FAΗADE PANEL FIXING APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 59 BUILDING ENVELOPE SEALANT MARKET SIZE IN FAΗADE PANEL FIXING APPLICATION, BY REGION, 20192026 (KILOTON)

10.3 WALL JOINTS

10.3.1 INCREASED BUILDING AND DEVELOPMENT ACTIVITIES, AS WELL AS INCREASED KNOWLEDGE OF ENVIRONMENTAL RISKS, ARE DRIVING THE DEMAND IN DEVELOPING ECONOMIES

TABLE 60 BUILDING ENVELOPE SEALANT MARKET SIZE IN WALL JOINTS APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 61 BUILDING ENVELOPE SEALANT MARKET SIZE IN WALL JOINTS APPLICATION, BY REGION, 20192026 (KILOTON)

10.4 SANITARY

10.4.1 THE INCREASING STANDARD OF LIVING IN EMERGING COUNTRIES IS LEADING TO INCREASED DEMAND FOR HOUSING

TABLE 62 BUILDING ENVELOPE SEALANT MARKET SIZE IN SANITARY APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 63 BUILDING ENVELOPE SEALANT MARKET SIZE IN SANITARY APPLICATION, BY REGION, 20192026 (KILOTON)

10.5 PASSIVE FIRE PROTECTION

10.5.1 BINDING SAFETY STANDARDS IN COMMERCIAL, MANUFACTURING, AND RESIDENTIAL BUILDINGS TO INCREASE THE DEMAND

TABLE 64 BUILDING ENVELOPE SEALANT MARKET SIZE IN PASSIVE FIRE PROTECTION APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 65 BUILDING ENVELOPE SEALANT MARKET SIZE IN PASSIVE FIRE PROTECTION APPLICATION, BY REGION, 20192026 (KILOTON)

TABLE 66 BUILDING ENVELOPE SEALANT MARKET SIZE IN ROOFING APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 67 BUILDING ENVELOPE SEALANT MARKET SIZE IN ROOFING APPLICATION, BY REGION, 20192026 (KILOTON)

TABLE 68 BUILDING ENVELOPE SEALANT MARKET SIZE IN WALLS APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 69 BUILDING ENVELOPE SEALANT MARKET SIZE IN WALLS APPLICATION, BY REGION, 20192026 (KILOTON)

TABLE 70 BUILDING ENVELOPE SEALANT MARKET SIZE IN SUBFLOOR APPLICATION, BY REGION, 20192026 (USD MILLION)

TABLE 71 BUILDING ENVELOPE SEALANT MARKET SIZE IN SUBFLOOR APPLICATION, BY REGION, 20192026 (KILOTON)

10.6 OTHERS

TABLE 72 BUILDING ENVELOPE SEALANT MARKET SIZE IN OTHER APPLICATIONS, 20192026 (USD MILLION)

TABLE 73 BUILDING ENVELOPE SEALANT MARKET SIZE IN OTHER APPLICATIONS, 20192026 (KILOTON)

11 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET, BY REGION (Page No. - 123)

11.1 INTRODUCTION

TABLE 74 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY REGION, 20192026 (USD MILLION)

TABLE 75 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY REGION, 20192026 (KILOTON)

11.2 APAC

11.2.1 IMPACT OF COVID-19 ON APAC

FIGURE 24 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SNAPSHOT

TABLE 76 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (USD MILLION)

TABLE 77 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (KILOTON)

TABLE 78 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (USD MILLION)

TABLE 79 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (KILOTON)

TABLE 80 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (USD MILLION)

TABLE 81 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (KILOTON)

TABLE 82 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (USD MILLION)

TABLE 83 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (KILOTON)

TABLE 84 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (USD MILLION)

TABLE 85 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (KILOTON)

TABLE 86 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (USD MILLION)

TABLE 87 APAC: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (KILOTON)

11.2.2 CHINA

11.2.2.1 Largest market for building envelope adhesives & sealants in APAC

11.2.3 JAPAN

11.2.3.1 Government initiatives regarding energy consumption performance of buildings is expected to boost the demand

11.2.4 SOUTH KOREA

11.2.4.1 Growing population and an increase in tourism are expected to drive the construction industry

11.2.5 INDIA

11.2.5.1 Government aid for residential sectors, coupled with increasing stringency of the energy conservation building code, to drive

the growth 134

11.2.6 THAILAND

11.2.6.1 Governments spending on infrastructure projects drives the demand in the country

11.2.7 INDONESIA

11.2.7.1 The presence of building energy code in the country drives the demand for building envelope adhesives & sealants

11.2.8 THE PHILIPPINES

11.2.8.1 Government spending on infrastructure development to boost the demand

11.2.9 REST OF APAC

11.3 NORTH AMERICA

11.3.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 25 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SNAPSHOT

TABLE 88 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (USD MILLION)

TABLE 89 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (KILOTON)

TABLE 90 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (USD MILLION)

TABLE 91 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (KILOTON)

TABLE 92 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (USD MILLION)

TABLE 93 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (KILOTON)

TABLE 94 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (USD MILLION)

TABLE 95 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (KILOTON)

TABLE 96 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (USD MILLION)

TABLE 97 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (KILOTON)

TABLE 98 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (USD MILLION)

TABLE 99 NORTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (KILOTON)

11.3.2 US

11.3.2.1 Building Energy Codes implemented by Department of Energy (DoE) to drive the growth

11.3.3 CANADA

11.3.3.1 Increasing use of building envelope, lighting, HVAC, and insulation to adhere to energy codes to drive the growth

11.3.4 MEXICO

11.3.4.1 The growing residential construction, coupled with implementation of energy codes, is driving the demand

11.4 EUROPE

11.4.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 26 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SNAPSHOT

TABLE 100 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (USD MILLION)

TABLE 101 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (KILOTON)

TABLE 102 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (USD MILLION)

TABLE 103 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (KILOTON)

TABLE 104 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (USD MILLION)

TABLE 105 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (KILOTON)

TABLE 106 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (USD MILLION)

TABLE 107 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (KILOTON)

TABLE 108 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (USD MILLION)

TABLE 109 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (KILOTON)

TABLE 110 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (USD MILLION)

TABLE 111 EUROPE: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (KILOTON)

11.4.2 GERMANY

11.4.2.1 EnEG and EnEV codes to positively impact the building envelope adhesives & sealants market

11.4.3 FRANCE

11.4.3.1 Implementation of energy policies and growing population to boost the demand

11.4.4 UK

11.4.4.1 Strong construction growth coupled with energy efficiency certificates implementation to boost the demand

11.4.5 ITALY

11.4.5.1 Implementation of energy efficiency certificates for buildings to positively impact building envelope adhesives & sealants market

11.4.6 RUSSIA

11.4.6.1 The existence of building codes and the growing construction industry drive the building envelope adhesives & sealants market in the country

11.4.7 NETHERLANDS

11.4.7.1 National plans about energy efficiency to fuel the growth of the market

11.4.8 SPAIN

11.4.8.1 Energy efficiency and safety requirements in buildings to drive the growth

11.4.9 BALTIC COUNTRIES

11.4.9.1 The presence of stringent building codes along with the growing demand for energy-efficient buildings drive the market

11.4.10 REST OF EUROPE

11.5 SOUTH AMERICA

11.5.1 IMPACT OF COVID-19 ON SOUTH AMERICA

TABLE 112 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (USD MILLION)

TABLE 113 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (KILOTON)

TABLE 114 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (USD MILLION)

TABLE 115 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (KILOTON)

TABLE 116 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (USD MILLION)

TABLE 117 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (KILOTON)

TABLE 118 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (USD MILLION)

TABLE 119 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (KILOTON)

TABLE 120 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (USD MILLION)

TABLE 121 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (KILOTON)

TABLE 122 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (USD MILLION)

TABLE 123 SOUTH AMERICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (KILOTON)

11.5.2 BRAZIL

11.5.2.1 Growing industrial sector, rising disposable income of the middle class, and energy efficiency labeling schemes to drive the growth

11.5.3 ARGENTINA

11.5.3.1 The existence of a national program for insulation fuels the demand for building envelope adhesives & sealants in the country

11.5.4 REST OF SOUTH AMERICA

11.6 MIDDLE EAST & AFRICA

11.6.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

TABLE 124 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY COUNTRY, 20192026 (KILOTON)

TABLE 126 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE RESIN, 20192026 (KILOTON)

TABLE 128 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY TECHNOLOGY, 20192026 (KILOTON)

TABLE 130 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY ADHESIVE APPLICATION, 20192026 (KILOTON)

TABLE 132 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT RESIN, 20192026 (KILOTON)

TABLE 134 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SIZE, BY SEALANT APPLICATION, 20192026 (KILOTON)

11.6.2 SAUDI ARABIA

11.6.2.1 Presence of various energy efficiency programs along with increased government spending to drive the market

11.6.3 SOUTH AFRICA

11.6.3.1 Implementation of National Building Regulations and Building Standards Act drives the demand

11.6.4 UAE

11.6.4.1 The existence of mandatory building codes drives the demand in the country

11.6.5 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE (Page No. - 170)

12.1 OVERVIEW

12.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY BUILDING ENVELOPE ADHESIVES & SEALANTS PLAYERS

12.2 COMPETITIVE SCENARIO

TABLE 136 PRODUCT FOOTPRINT OF COMPANIES

TABLE 137 APPLICATION FOOTPRINT OF COMPANIES

TABLE 138 REGION FOOTPRINT OF COMPANIES

TABLE 139 COMPANY FOOTPRINT

12.2.1 MARKET EVALUATION MATRIX

TABLE 140 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 141 MOST FOLLOWED STRATEGIES

TABLE 142 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

12.3 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SHARE ANALYSIS

FIGURE 27 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET SHARE ANALYSIS, 2020

12.4 REVENUE ANALYSIS

FIGURE 28 REVENUE ANALYSIS OF KEY PLAYERS, 20162020

12.4.1 3M COMPANY

12.4.2 HENKEL AG

12.4.3 ARKEMA S.A.

12.4.4 SIKA AG

12.5 COMPETITIVE SCENARIO AND TRENDS

TABLE 143 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: PRODUCT LAUNCHES, AUGUST 2016FEBRUARY 2021

TABLE 144 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: DEALS, AUGUST 2016APRIL 2021

TABLE 145 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET: OTHERS, MAY 2016FEBRUARY 2021

12.6 COMPANY EVALUATION QUADRANT

FIGURE 29 BUILDING ENVELOPE ADHESIVES & SEALANTS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

12.6.1 STAR

12.6.2 PERVASIVE

12.6.3 EMERGING LEADER

12.6.4 PARTICIPANT

12.6.5 COMPETITIVE BENCHMARKING

12.6.5.1 Company product footprint

12.7 MARKET RANKING ANALYSIS

TABLE 146 BUILDING ENVELOPE ADHESIVES & SEALANTS: MARKET RANKING

13 COMPANY PROFILES (Page No. - 185)

13.1 MAJOR COMPANIES

(Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view)*

13.1.1 SIKA AG

TABLE 147 SIKA AG: COMPANY OVERVIEW

FIGURE 30 SIKA AG: COMPANY SNAPSHOT

FIGURE 31 SIKA AG: SWOT ANALYSIS

13.1.2 HENKEL AG

TABLE 148 HENKEL AG: COMPANY OVERVIEW

FIGURE 32 HENKEL AG: COMPANY SNAPSHOT

FIGURE 33 HENKEL AG: SWOT ANALYSIS

13.1.3 ARKEMA (BOSTIK SA)

TABLE 149 ARKEMA (BOSTIK SA): COMPANY OVERVIEW

FIGURE 34 ARKEMA (BOSTIK SA): COMPANY SNAPSHOT

FIGURE 35 ARKEMA (BOSTIK SA): SWOT ANALYSIS

13.1.4 3M COMPANY

TABLE 150 3M COMPANY: COMPANY OVERVIEW

FIGURE 36 3M COMPANY: COMPANY SNAPSHOT

FIGURE 37 3M COMPANY: SWOT ANALYSIS

13.1.5 MAPEI S.P.A.

TABLE 151 MAPEI S.P.A: COMPANY OVERVIEW

FIGURE 38 MAPEI S.P.A.: COMPANY SNAPSHOT

13.1.6 H.B. FULLER

TABLE 152 H.B. FULLER COMPANY: COMPANY OVERVIEW

FIGURE 39 H.B. FULLER COMPANY: COMPANY SNAPSHOT

FIGURE 40 H.B. FULLER COMPANY: SWOT ANALYSIS

13.1.7 THE DOW CHEMICAL COMPANY

TABLE 153 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 41 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 42 THE DOW CHEMICAL COMPANY: SWOT ANALYSIS

13.1.8 TREMCO INC. (RPM INTERNATIONAL INC.)

TABLE 154 TREMCO INC. (RPM INTERNATIONAL INC.): COMPANY OVERVIEW

FIGURE 43 TREMCO INC. (RPM INTERNATIONAL INC.): COMPANY SNAPSHOT

FIGURE 44 TREMCO INC. (RPM INTERNATIONAL INC.): SWOT ANALYSIS

13.1.9 ICP GROUP

TABLE 155 ICP GROUP: COMPANY OVERVIEW

13.1.10 THE SOUDAL GROUP

TABLE 156 THE SOUDAL GROUP: COMPANY OVERVIEW

FIGURE 45 THE SOUDAL GROUP: COMPANY SNAPSHOT

13.2 OTHER KEY COMPANIES

13.2.1 CHOICE ADHESIVES

TABLE 157 CHOICE ADHESIVES: COMPANY OVERVIEW

13.2.2 SIGA

TABLE 158 SIGA: COMPANY OVERVIEW

13.2.3 THE HENRY COMPANY

TABLE 159 THE HENRY COMPANY: COMPANY OVERVIEW

13.2.4 ORGANIX BUILDING SYSTEM

TABLE 160 ORGANIX BUILDING SYSTEM: COMPANY OVERVIEW

13.2.5 NOVAGARD SOLUTIONS, INC.

TABLE 161 NOVAGARD SOLUTIONS, INC.: COMPANY OVERVIEW

13.2.6 PIDILITE (BUILDING ENVELOPE SYSTEMS INDIA (BESI))

TABLE 162 PIDILITE (BUILDING ENVELOPE SYSTEMS INDIA (BESI)): COMPANY OVERVIEW

13.2.7 THE GARLAND COMPANY, INC.

TABLE 163 THE GARLAND COMPANY, INC.: COMPANY OVERVIEW

13.2.8 W. R. MEADOWS, INC.

TABLE 164 W. R. MEADOWS, INC.: COMPANY OVERVIEW

13.2.9 LEXSUCO CORPORATION

TABLE 165 LEXSUCO CORPORATION: COMPANY OVERVIEW

13.2.10 MOMENTIVE PERFORMANCE MATERIALS INC. (GE ADVANCED MATERIALS)

TABLE 166 MOMENTIVE PERFORMANCE MATERIALS INC. (GE ADVANCED MATERIALS): COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 236)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

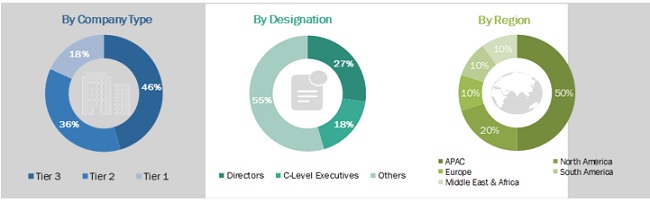

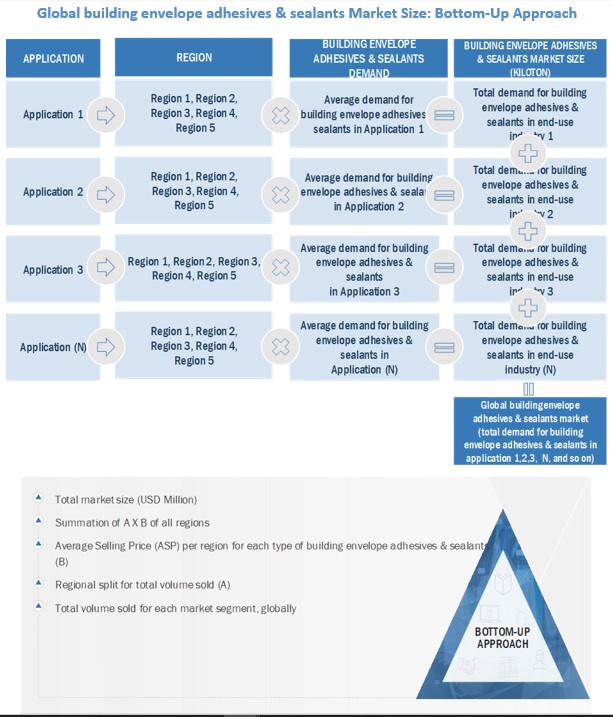

The study involves four major activities in estimating the current market size of building envelope adhesives & sealants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B, Bloomberg, Chemical Weekly, and Factiva, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The building envelope adhesives & sealants market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The primary sources from the supply side included CEOs, vice presidents, marketing and sales directors, business development managers, and technology and innovation directors of building envelope adhesives & sealants manufacturing companies and suppliers & distributors. The primary sources from the demand side included industry experts - directors of end-use industries, and related key opinion leaders.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the building envelope adhesives & sealants market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market was validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data was assumed to be correct.

Report Objectives

- To define, describe, and forecast the size of the building envelope adhesives & sealants market, in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by adhesive resin, technology, adhesive application, sealant resin, sealant application, and region

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product development, merger & acquisition, investment & expansion and joint venture & partnership

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Note: 1. Micro markets are defined as the subsegments of the building envelope adhesives & sealants market included in the report.

2. Core competencies of companies are determined in terms of the key developments, SWOT analysis, and key strategies adopted to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the building envelope adhesives & sealants market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Building Envelope Adhesives & Sealants Market