Energy-Efficient Window Market by Component (Glass, Frame, and Hardware), Application (New Construction and Renovation & Reconstruction), End-Use Sector (Residential and Non-Residential), Glazing Type, and Region - Global Forecast to 2026

Updated on : September 02, 2025

Energy Efficient Windows Market

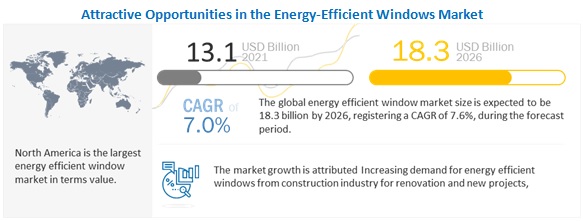

The global energy-efficient windows market was valued at USD 13.1 billion in 2021 and is projected to reach USD 18.3 billion by 2026, growing at 7.0% cagr from 2021 to 2026. The double glazed windows accounted for a share of 64.6% in terms of value in the energy-efficient windows market in 2020 and is projected to reach USD 11.6 billion by 2026 at a CAGR of 6.6%. The non-residential sector is projected to witness the highest CAGR of 6.5%, growing from USD 7.1 billion in 2021 to USD 9.9 billion by 2026 for energy-efficient windows market.

To know about the assumptions considered for the study, download the pdf brochure

Impact of COVID-19 on global energy-efficient windows market

According to the data provided by the Glass Alliance Europe, the overall glass production in Europe reached a volume of 35.85 million tonnes, in 2020, with a decrease of 2.6% compared with 2019 (36.80 million tonnes). The glass market suffered from the COVID-19 pandemic at different levels for each glass subsector. The flat glass production in Europe decreased from 11.4 million tonnes in 2019 to 10.8 million tonnes in 2020. Restrictions in the construction and renovation business also saw a halt which directly affected the demand for energy-efficient windows. The lockdown also affected the disposable income of many households further reducing their purchasing power. All these factors have had a negative impact on the global energy-efficient windows market

The construction industry was adversely affected by the impact of COVID-19. With restrictions in non-essential activities, the industry nearly came to a halt across the globe. According to the International Energy Agency (IEA), in 2019, the global investment in energy efficiency in the building sector rose by 2% to approximately USD 152 billion. However, due to the COVID-19 pandemic, various building construction activities, such as new and existing projects, onsite productivity, and contract value, were estimated to have slowed by 24% in 2020 when compared to 2019. However, there has been a rebound in activity during 2021.

The impact of the pandemic has affected supply chains, worldwide affecting the supply of materials and components across borders and fabrication facilities. This has resulted in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers. These factors affected everyone, from international construction companies to local construction contractors.

APAC is home to multiple developing countries, and such lockdowns act as huge setbacks to the economy. The construction industry holds a big chunk of a countries GDP, and due to COVID-19, all economies saw a great decline in GDP as well as the construction industry. Heavy layoffs were reported in the construction sector and other industries in the US in 2020. In Europe, the building & construction industry was estimated to be contracted by 60%–70% in 2020. In the building sector of Europe, a sudden drop was reported for glass demand in 2020, particularly in countries with the most stringent confinement measures in place. Slowdown and cessation of activities in the construction and window industries led to subsequent plant closures in the glass processing and insulated glass window assembly segments. These factors were the primary reasons for reduced projections in insulating glass window consumption for 2020

Increasing use of energy-efficient windows in non-residential sector

Non-residential constructions that use energy-efficient windows include commercial buildings, such as offices, hotels, hospitals, educational institutes, and airports. Large commercial buildings are built with the concept of saving energy. These buildings are also built for breakeven in the long run, and hence opting for energy-efficient windows seems to be a favorable option. Growing economies are witnessing increasing demand for green buildings in the commercial construction segment. Recently, European and North American countries have also seen a spurt in demand for such buildings. In developing countries, the construction of educational institutions and hospitals is increasing, leading to a growth in the energy-efficient windows market in the non-residential end-use sector

Lack of awareness amongst consumers is restraining the market growth

The energy-efficient windows market has a positive outlook due to high growth in the construction industry. However, in some developing or under-developed countries in APAC, Africa, and South America, people are less aware of the benefits of these window systems. There is a lack of knowledge about a building’s energy efficiency. This discourages the population of these countries from investing in insulation materials. Many architects and engineers in these countries overlook the building’s energy efficiency while building commercial or residential infrastructure. They are not aware of the cost-savings that can be attained by using energy-efficient window materials to make low-energy houses. Many benefits of energy-efficient windows such as superior thermal and lighting performance, reduced condensation, and reduced fading of interior furnishings are not known to builders and consumers; hence, they do not adhere to building guidelines for weather conditions and often use the wrong type of window which may cost more or is not efficient enough

To know about the assumptions considered for the study, download the pdf brochure

North America is likely to grow at the second-fastest rate due to continued financial support from governments. Based on the end-use sector, the non-residential sector led the North American market in 2020. The US dominates the market in the region. Canada and Mexico have started adopting energy-efficient windows, which will take some time to gain popularity. Due to the COVID–19 pandemic, the construction industry has seen a steep fall in the allocation of new projects. However, recovery is expected due to government support and the resurgence of the global economy. By 2026, the market is expected to expand.

Energy Efficient Windows Market Players

The key players in the global energy-efficient windows market are:

- YKK AP, Inc. (Japan)

- Builders FirstSource, Inc. (US)

- Jeld-Wen Holdings, Inc. (US)

- Deceuninck NV (Belgium)

- PGT, Inc. (US)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the energy-efficient windows industry. The study includes an in-depth competitive analysis of these key players in the energy-efficient windows market, with their company profiles, recent developments, and key market strategies.

Energy Efficient Windows Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Glazing Type, End-use sectors, Application, Component, and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

YKK AP, Inc. (Japan), Jeld-Wen Holding, Inc. (U.S.), Builders FirstSource, Inc. (U.S.), Deceuninck NV (Belgium) and PGT, Inc. (US) are some of the key players in the energy-efficient windows market. Other players include Apogee Enterprises Inc. (US), Schott AG (Germany), Ply Gem Holdings, Inc. (US), Central Glass Co. Ltd (Japan), Associated Materials LLC (US), China Glass Holdings Ltd (China), and VKR Holding A/S (Denmark) |

This research report categorizes the energy-efficient windows market based on Glazing Type, End-use sectors, Application, component, and Region

Energy-Efficient Windows Market, by Glazing Type:

- Double Glazed

- Triple Glazed

- Others

Energy-Efficient Windows Market, by End-use Sector:

- Non-residential

- Residential

Energy-Efficient Windows Market, by Component:

- Glass

- Frame

- Hardware

Energy-Efficient Windows Market, by Application:

- New construction

- Renovation & reconstruction

Energy-Efficient Windows Market, by Region:

- North America

- Europe

- APAC

- MEA

- South America

Recent Developments

- In Jan 2021, Builders FirstSource Inc. completed the merger of BMC Stock Holdings to become the country’s premier supplier of a wide variety of building materials and services.

- In Jan 2020, Saint-Gobain S.A. announced an acquisition of Continental Building Products. This acquisition helped the company to expand its geographic reach in North, East, and Southeast America.

- In Dec 2019, YKK AP, Inc. acquired Erie Architectural Products Group to meet the increasing demand for highly engineered, unitized, and prefabricated solutions

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the energy-efficient windows market?

High demand from non-residential sector is driving the energy-efficient windows market

Which is the fastest-growing region-level market for energy-efficient windows?

North America is the fastest-growing energy-efficient windows market due to the presence of major energy-efficient windows manufacturers.

What are the factors contributing to the final price of energy-efficient windows?

Raw materials plays a vital role in the costs along with environmental compliances.

What are the challenges in the energy-efficient windows market?

The market is at a developing stage and growing at a decent pace. It has many small manufactures with no clear global leader.

Who are the major manufacturers?

Double glazed energy efficient window, in terms of value hold the largest share.

How is the energy-efficient windows market aligned?

The major players active in the market are YKK AP, Inc. (Japan), Jeld-Wen Holding, Inc. (U.S.), Builders FirstSource, Inc. (U.S.), Deceuninck NV and PGT, Inc.

What are the major applications for energy-efficient windows?

The major applications of energy-efficient windows is renovation & reconstruction.

What is the biggest restraint in the energy-efficient windows market?

High installation and window cost is the biggest restraint. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 ENERGY-EFFICIENT WINDOWS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED IN THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE ANALYSIS

2.1.2 DEMAND-SIDE APPROACH

2.1.2.1 Energy-Efficient Windows Market

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – top leaders in energy efficient window landscape

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 ENERGY-EFFICIENT WINDOWS MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 ENERGY-EFFICIENT WINDOWS MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 ENERGY-EFFICIENT WINDOWS MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.7.1 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 5 NON-RESIDENTIAL SECTOR ACCOUNTED FOR LARGER SHARE OF ENERGY-EFFICIENT WINDOWS MARKET IN 2020

FIGURE 6 DOUBLE-GLAZED WINDOWS DOMINATED ENERGY-EFFICIENT WINDOWS MARKET IN 2020

FIGURE 7 FRAME TO BE FASTEST-GROWING SEGMENT OF ENERGY-EFFICIENT WINDOWS MARKET

FIGURE 8 RENOVATION & RECONSTRUCTION DOMINATED ENERGY-EFFICIENT WINDOWS MARKET IN 2020

FIGURE 9 NORTH AMERICA LED ENERGY-EFFICIENT WINDOWS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN ENERGY-EFFICIENT WINDOWS MARKET

FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN ENERGY-EFFICIENT WINDOWS MARKET BETWEEN 2021 AND 2026

4.2 ENERGY-EFFICIENT WINDOWS MARKET, BY END-USE SECTOR AND APPLICATION, 2020

FIGURE 11 NON-RESIDENTIAL SECTOR LED ENERGY-EFFICIENT WINDOWS MARKET WITH RENOVATION & RECONSTRUCTION AS MAJOR APPLICATION

4.3 ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE, 2021-2026

FIGURE 12 DOUBLE-GLAZED WINDOWS TO DOMINATE MARKET

4.4 ENERGY-EFFICIENT WINDOWS MARKET, BY REGION

FIGURE 13 NORTH AMERICA TO DOMINATE ENERGY-EFFICIENT WINDOWS MARKET

4.5 ENERGY-EFFICIENT WINDOWS MARKET GROWTH BY KEY COUNTRIES

FIGURE 14 CHINA TO BE FASTEST-GROWING ENERGY-EFFICIENT WINDOWS MARKET, (2021–2026)

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ENERGY-EFFICIENT WINDOWS MARKET

5.2.1 DRIVERS

5.2.1.1 Optimum energy-saving option

5.2.1.2 Increasing government initiatives to adopt energy-efficient windows

TABLE 1 LEGAL REQUIREMENT FOR RENOVATION OF WINDOWS IN EUROPE

5.2.1.3 Growing construction market

TABLE 2 UPCOMING CONSTRUCTION PROJECTS IN EUROPE

5.2.2 RESTRAINTS

5.2.2.1 High investment requirements

TABLE 3 DOUBLE-HUNG WINDOWS AVERAGE PRICE RANGE BASED ON FRAME MATERIAL (USD)

5.2.2.2 Higher cost of glass bonding adhesives than conventional adhesives

FIGURE 16 PRICE COMPARISON: CONVENTIONAL ADHESIVES VS. GLASS-BONDING ADHESIVES

5.2.2.3 Lack of awareness about energy-efficient windows

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing support for energy management in buildings from public and private sectors

TABLE 4 FEDERAL FUNDING FOR ENERGY-EFFICIENCY IN BUILDINGS (DOE)

5.2.3.2 Urban population growth

TABLE 5 URBAN POPULATION GROWTH IN 2020 IN EUROPE

5.2.4 CHALLENGES

5.2.4.1 High carbon emissions in glass production

5.3 INDUSTRY TRENDS

FIGURE 17 ENERGY-EFFICIENT WINDOWS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 6 ENERGY-EFFICIENT WINDOWS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

5.5 ECOSYSTEM: ENERGY-EFFICIENT WINDOWS MARKET

5.6 VALUE CHAIN ANALYSIS

5.7 SUPPLY CHAIN ANALYSIS

5.8 IMPACT OF COVID-19

5.8.1 IMPACT OF COVID-19 ON ENERGY-EFFICIENT WINDOWS MARKET

5.8.2 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY

TABLE 7 IMPACT OF COVID-19 ON ECONOMIES

5.9 ENERGY-EFFICIENT WINDOWS MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 8 ENERGY-EFFICIENT WINDOWS MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.9.1 OPTIMISTIC SCENARIO

5.9.2 PESSIMISTIC SCENARIO

5.9.3 REALISTIC SCENARIO

5.10 AVERAGE PRICING

TABLE 9 ENERGY-EFFICIENT WINDOWS PRICE BASED ON MATERIAL AND QUALITY

5.11 KEY MARKETS FOR IMPORT/EXPORT

TABLE 10 COUNTRY-WISE EXPORT OF HS CODE 761010 (ALUMINUM; STRUCTURES (EXCLUDING PREFABRICATED BUILDINGS OF HEADING NO. 9406) AND PARTS OF STRUCTURES, DOORS, WINDOWS AND THEIR FRAMES, AND THRESHOLDS FOR DOORS) IN 2020

TABLE 11 COUNTRY-WISE IMPORT OF HS CODE 761010 (ALUMINUM; STRUCTURES (EXCLUDING PREFABRICATED BUILDINGS OF HEADING NO. 9406) AND PARTS OF STRUCTURES, DOORS, WINDOWS AND THEIR FRAMES, AND THRESHOLDS FOR DOORS) IN 2020

TABLE 12 COUNTRY-WISE EXPORT OF HS CODE 441810 (WOOD; WINDOWS, FRENCH WINDOWS, AND THEIR FRAMES) IN 2020

TABLE 13 COUNTRY-WISE IMPORT OF HS CODE 441810 (WOOD; WINDOWS, FRENCH WINDOWS, AND THEIR FRAMES) IN 2020

TABLE 14 COUNTRY-WISE EXPORT OF HS CODE 392520 (PLASTICS; BUILDERS' WARE, DOORS, WINDOWS AND THEIR FRAMES, AND THRESHOLDS FOR DOORS) IN 2020

TABLE 15 COUNTRY-WISE IMPORT OF HS CODE 392520 (PLASTICS; BUILDERS' WARE, DOORS, WINDOWS AND THEIR FRAMES, AND THRESHOLDS FOR DOORS) IN 2020

5.12 CASE STUDY ANALYSIS

5.13 TARIFF AND REGULATIONS

TABLE 16 CURRENT STANDARD CODES FOR ENERGY-EFFICIENT/INSULATED GLASS IN BUILDINGS

TABLE 17 RATING SYSTEMS FOR ENERGY-EFFICIENT WINDOWS

TABLE 18 GLASS STANDARDS AND GUIDELINES, AS PER FENESTRATION & GLAZING INDUSTRY ALLIANCE (FGIA)

5.14 PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

TABLE 19 PATENTS SUMMARY FOR LAST 10 YEARS

FIGURE 19 PATENTS APPLICATION SUMMARY FOR LAST 10 YEARS

FIGURE 20 PUBLICATION TRENDS - LAST 10 YEARS

5.14.4 LEGAL STATUS OF PATENTS

FIGURE 21 PUBLICATION TRENDS - LAST 10 YEARS

5.14.5 JURISDICTION ANALYSIS

FIGURE 22 PUBLICATION TRENDS - LAST 10 YEARS

5.14.6 TOP COMPANIES/APPLICANTS

FIGURE 23 PUBLICATION TRENDS - LAST 10 YEARS

5.14.7 LIST OF PATENTS

5.14.7.1 Guardian Industries Corp.

TABLE 20 PATENTS BY GUARDIAN INDUSTRIES CORP.

5.14.7.2 Corning Inc.

TABLE 21 PATENTS BY CORNING INC.

5.14.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 22 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6 ENERGY-EFFICIENT WINDOWS MARKET, BY GLAZING TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 24 DOUBLE-GLAZED ENERGY-EFFICIENT WINDOWS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 23 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 24 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

6.1.1 DOUBLE GLAZED

FIGURE 25 NORTH AMERICA TO BE BIGGEST MARKET FOR DOUBLE-GLAZED ENERGY-EFFICIENT WINDOWS

TABLE 25 DOUBLE-GLAZED ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 DOUBLE-GLAZED ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.1.1.1 Double-glazed Low-E windows

6.1.1.2 Double-glazed gas-filled window

6.1.1.3 Double-glazed Low-E gas-filled windows

6.1.2 TRIPLE GLAZED

FIGURE 26 NORTH AMERICA TO BE LARGEST MARKET FOR TRIPLE-GLAZED ENERGY-EFFICIENT WINDOWS

TABLE 27 TRIPLE-GLAZED ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 TRIPLE-GLAZED ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.1.2.1 Triple-glazed Low-E window

6.1.2.2 Triple-glazed gas-filled window

6.1.2.3 Triple-glazed low-E gas-filled window

6.1.3 OTHERS

FIGURE 27 NORTH AMERICA TO BE LARGEST MARKET FOR OTHER GLAZED ENERGY-EFFICIENT WINDOWS

TABLE 29 OTHER GLAZED ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 OTHER GLAZED ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 ENERGY-EFFICIENT WINDOWS MARKET, BY COMPONENT (Page No. - 82)

7.1 INTRODUCTION

FIGURE 28 GLASS COMPONENT TO DOMINATE ENERGY-EFFICIENT WINDOWS MARKET DURING FORECAST PERIOD

TABLE 31 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 32 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

7.2 GLASS

FIGURE 29 NORTH AMERICA TO BE BIGGEST MARKET FOR GLASS FOR ENERGY-EFFICIENT WINDOWS

TABLE 33 ENERGY-EFFICIENT WINDOWS MARKET SIZE FOR GLASS, BY REGION, 2017-2020 (USD MILLION)

TABLE 34 ENERGY-EFFICIENT WINDOWS MARKET SIZE FOR GLASS, BY REGION, 2021–2026 (USD MILLION)

7.3 FRAME

FIGURE 30 NORTH AMERICA TO BE LARGEST MARKET FOR FRAMES FOR ENERGY-EFFICIENT WINDOWS

TABLE 35 ENERGY-EFFICIENT WINDOWS MARKET SIZE FOR FRAMES, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 ENERGY-EFFICIENT WINDOWS MARKET SIZE FOR FRAMES, BY REGION, 2021–2026 (USD MILLION)

7.3.1 VINYL WINDOW

7.3.2 ALUMINUM WINDOW

7.3.3 WOODEN WINDOW

7.4 HARDWARE

FIGURE 31 APAC TO BE FASTEST-GROWING MARKET FOR HARDWARE FOR ENERGY-EFFICIENT WINDOWS

TABLE 37 ENERGY-EFFICIENT WINDOWS MARKET SIZE FOR HARDWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 ENERGY-EFFICIENT WINDOWS MARKET SIZE FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

8 ENERGY-EFFICIENT WINDOWS MARKET, BY END-USE SECTOR (Page No. - 89)

8.1 INTRODUCTION

FIGURE 32 NON-RESIDENTIAL SECTOR TO DOMINATE ENERGY-EFFICIENT WINDOWS MARKET DURING FORECAST PERIOD

TABLE 39 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017-2020 (USD MILLION)

TABLE 40 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

8.1.1 NON-RESIDENTIAL

FIGURE 33 APAC TO BE FASTEST-GROWING ENERGY-EFFICIENT WINDOWS MARKET IN NON-RESIDENTIAL SECTOR

TABLE 41 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN NON-RESIDENTIAL SECTOR, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN NON-RESIDENTIAL SECTOR, BY REGION, 2021–2026 (USD MILLION)

8.1.2 RESIDENTIAL

FIGURE 34 NORTH AMERICA TO BE FASTEST-GROWING ENERGY-EFFICIENT WINDOWS MARKET FOR RESIDENTIAL SECTOR

TABLE 43 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN RESIDENTIAL SECTOR, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN RESIDENTIAL SECTOR, BY REGION, 2021–2026 (USD MILLION)

9 ENERGY-EFFICIENT WINDOWS MARKET, BY APPLICATION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 35 RENOVATION & RECONSTRUCTION TO DOMINATE ENERGY-EFFICIENT WINDOW MARKET DURING FORECAST PERIOD

TABLE 45 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 46 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.1.1 RENOVATION & RECONSTRUCTION

FIGURE 36 NORTH AMERICA TO BE FASTEST-GROWING RENOVATION & RECONSTRUCTION MARKET

TABLE 47 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN RENOVATION & RECONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN RENOVATION & RECONSTRUCTION, BY REGION, 2021–2026 (USD MILLION)

9.1.2 NEW CONSTRUCTION

FIGURE 37 NORTH AMERICA TO BE BIGGEST NEW CONSTRUCTION MARKET

TABLE 49 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN NEW CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 ENERGY-EFFICIENT WINDOWS MARKET SIZE IN NEW CONSTRUCTION, BY REGION, 2021–2026 (USD MILLION)

10 ENERGY-EFFICIENT WINDOWS MARKET, BY REGION (Page No. - 101)

10.1 INTRODUCTION

FIGURE 38 CHINA TO BE FASTEST-GROWING ENERGY-EFFICIENT WINDOWS MARKET

FIGURE 39 NORTH AMERICA TO LEAD ENERGY-EFFICIENT WINDOWS MARKET

TABLE 51 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 40 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SNAPSHOT

TABLE 53 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 54 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.2.1 US

TABLE 61 US: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 62 US: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 63 US: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 64 US: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.2.2 CANADA

TABLE 65 CANADA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 66 CANADA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 67 CANADA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 68 CANADA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.2.3 MEXICO

TABLE 69 MEXICO: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 70 MEXICO: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 71 MEXICO: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 72 MEXICO: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 41 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SNAPSHOT

TABLE 73 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 74 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 75 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 76 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 77 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 79 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 80 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 82 EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.3.1 GERMANY

TABLE 83 GERMANY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 84 GERMANY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 85 GERMANY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 86 GERMANY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.3.2 UK

TABLE 87 UK: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 88 UK: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 89 UK: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 90 UK: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.3.3 FRANCE

TABLE 91 FRANCE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 92 FRANCE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 93 FRANCE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 94 FRANCE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.3.4 RUSSIA

TABLE 95 RUSSIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 96 RUSSIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 97 RUSSIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 98 RUSSIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.3.5 ITALY

TABLE 99 ITALY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 100 ITALY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 101 ITALY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 102 ITALY: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 103 REST OF EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 104 REST OF EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 105 REST OF EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 106 REST OF EUROPE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.4 APAC

FIGURE 42 APAC: ENERGY-EFFICIENT WINDOWS MARKET SNAPSHOT

TABLE 107 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 108 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 109 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 110 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 111 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 112 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 113 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 114 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

TABLE 115 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 116 APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.4.1 CHINA

TABLE 117 CHINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 118 CHINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 119 CHINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 120 CHINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.4.2 JAPAN

TABLE 121 JAPAN: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 122 JAPAN: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 123 JAPAN: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 124 JAPAN: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.4.3 INDIA

TABLE 125 INDIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 126 INDIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 127 INDIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 128 INDIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.4.4 SOUTH KOREA

TABLE 129 SOUTH KOREA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 130 SOUTH KOREA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 131 SOUTH KOREA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 132 SOUTH KOREA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.4.5 REST OF APAC

TABLE 133 REST OF APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 134 REST OF APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 135 REST OF APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 136 REST OF APAC: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA (MEA)

TABLE 137 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 138 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 139 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 140 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 141 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 142 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 143 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 144 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

TABLE 145 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 146 MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.5.1 SOUTH AFRICA

TABLE 147 SOUTH AFRICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 148 SOUTH AFRICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 149 SOUTH AFRICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 150 SOUTH AFRICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.5.2 SAUDI ARABIA

TABLE 151 SAUDI ARABIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 152 SAUDI ARABIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 153 SAUDI ARABIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 154 SAUDI ARABIA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.5.3 UAE

TABLE 155 UAE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 156 UAE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 157 UAE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 158 UAE: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.6 REST OF MEA

TABLE 159 REST OF MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 160 REST OF MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 161 REST OF MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 162 REST OF MEA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.7 SOUTH AMERICA

TABLE 163 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 164 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 165 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 166 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 167 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 168 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 169 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 170 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

TABLE 171 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 172 SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.7.1 BRAZIL

TABLE 173 BRAZIL: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 174 BRAZIL: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 175 BRAZIL: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 176 BRAZIL: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.7.2 ARGENTINA

TABLE 177 ARGENTINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 178 ARGENTINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 179 ARGENTINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 180 ARGENTINA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

10.7.3 REST OF SOUTH AMERICA

TABLE 181 REST OF SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2017–2020 (USD MILLION)

TABLE 182 REST OF SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 183 REST OF SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2017–2020 (USD MILLION)

TABLE 184 REST OF SOUTH AMERICA: ENERGY-EFFICIENT WINDOWS MARKET SIZE, BY END-USE SECTOR, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 154)

11.1 INTRODUCTION

11.2 MARKET SHARE ANALYSIS

FIGURE 43 SHARE OF TOP COMPANIES IN ENERGY-EFFICIENT WINDOWS MARKET

TABLE 185 DEGREE OF COMPETITION: ENERGY-EFFICIENT WINDOWS - GLASS MARKET

TABLE 186 DEGREE OF COMPETITION: ENERGY-EFFICIENT WINDOWS - WINDOW MARKET

11.3 MARKET RANKING

FIGURE 44 RANKING OF TOP THREE PLAYERS IN ENERGY-EFFICIENT WINDOWS MARKET

11.4 MARKET EVALUATION FRAMEWORK

TABLE 187 ENERGY-EFFICIENT WINDOWS MARKET: DEALS, 2016-2021

TABLE 188 ENERGY-EFFICIENT WINDOWS MARKET: OTHERS, 2016-2021

11.5 COMPANY EVALUATION MATRIX

TABLE 189 COMPANY PRODUCT FOOTPRINT

TABLE 190 COMPANY REGION FOOTPRINT

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 PARTICIPANT

11.5.4 EMERGING LEADER

FIGURE 45 ENERGY-EFFICIENT WINDOWS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

11.5.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ENERGY-EFFICIENT WINDOWS MARKET

11.5.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ENERGY-EFFICIENT WINDOWS MARKET

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.7 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 48 ENERGY-EFFICIENT WINDOWS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

12 COMPANY PROFILES (Page No. - 169)

12.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 SAINT-GOBAIN S.A.

TABLE 191 SAINT-GOBAIN S.A.: BUSINESS OVERVIEW

FIGURE 49 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

12.1.2 ASAHI GLASS CO. LTD.

TABLE 192 ASAHI GLASS CO. LTD.: BUSINESS OVERVIEW

FIGURE 50 ASAHI GLASS CO. LTD.: COMPANY SNAPSHOT

12.1.3 YKK AP, INC.

TABLE 193 YKK AP, INC.: BUSINESS OVERVIEW

FIGURE 51 YKK AP, INC.: COMPANY SNAPSHOT

12.1.4 JELD-WEN HOLDINGS, INC.

TABLE 194 JELD-WEN HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 52 JELD-WEN HOLDINGS, INC.: COMPANY SNAPSHOT

12.1.5 NIPPON SHEET GLASS CO. LTD.

TABLE 195 NIPPON SHEET GLASS CO. LTD.: BUSINESS OVERVIEW

FIGURE 53 NIPPON SHEET GLASS CO. LTD.: COMPANY SNAPSHOT

12.1.6 BUILDERS FIRSTSOURCE, INC.

TABLE 196 BUILDERS FIRSTSOURCE, INC.: BUSINESS OVERVIEW

FIGURE 54 BUILDERS FIRSTSOURCE, INC.: COMPANY SNAPSHOT

12.1.7 SCHOTT AG

TABLE 197 SCHOTT AG: BUSINESS OVERVIEW

FIGURE 55 SCHOTT AG: COMPANY SNAPSHOT

12.1.8 PLY GEM HOLDINGS, INC.

TABLE 198 PLY GEM HOLDINGS, INC.: BUSINESS OVERVIEW

12.1.9 CENTRAL GLASS CO., LTD.

TABLE 199 CENTRAL GLASS CO., LTD.: BUSINESS OVERVIEW

FIGURE 56 CENTRAL GLASS CO., LTD.: COMPANY SNAPSHOT

12.1.10 BMC STOCK HOLDINGS, INC.

TABLE 200 BMC STOCK HOLDINGS, INC.: BUSINESS OVERVIEW

12.1.11 ASSOCIATED MATERIALS LLC

TABLE 201 ASSOCIATED MATERIALS LLC: BUSINESS OVERVIEW

12.1.12 APOGEE ENTERPRISES, INC.

TABLE 202 APOGEE ENTERPRISES, INC.: BUSINESS OVERVIEW

FIGURE 57 APOGEE ENTERPRISES, INC.: COMPANY SNAPSHOT

12.1.13 DECEUNINCK NV

TABLE 203 DECEUNINCK NV.: BUSINESS OVERVIEW

FIGURE 58 DECEUNINCK NV: COMPANY SNAPSHOT

12.1.14 PGT, INC.

TABLE 204 PGT, INC.: BUSINESS OVERVIEW

FIGURE 59 PGT, INC.: COMPANY SNAPSHOT

12.1.15 VITRO ARCHITECTURAL GLASS

TABLE 205 VITRO ARCHITECTURAL GLASS: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 TURKIYE SISE VE CAM FABRIKALARI A.S. (ÞIÞECAM GROUP)

12.2.2 VKR HOLDINGS A/S

12.2.3 DREW INDUSTRIES INCORPORATED

12.2.4 INWIDO AB

12.2.5 CHINA GLASS HOLDINGS LIMITED

12.2.6 ANDERSON CORPORATION

12.2.7 ATRIUM CORPORATION

12.2.8 GUARDIAN INDUSTRIES CORP

12.2.9 KOLBE & KOLBE MILLWORK CO., INC.

12.2.10 MARVIN WINDOWS AND DOORS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 209)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORT

13.5 AUTHOR DETAILS

Overview of Insulating Window Market

The insulating window market includes windows that are designed to reduce heat transfer between the interior and exterior of a building. These windows are usually made of two or more panes of glass with a sealed airspace between them, which serves as an insulating barrier. Insulating windows offer various benefits such as energy savings, reduced noise pollution, increased comfort, and improved indoor air quality. They are widely used in both residential and commercial buildings.

The Insulating Window Market is connected with energy-efficient Insulating Window Market as the latter is a subcategory of the former. Insulating windows are designed to reduce heat loss or gain, while energy-efficient insulating windows are specifically engineered to minimize energy loss, reduce greenhouse gas emissions, and improve overall energy efficiency.

The Insulating Window Market will likely have a positive impact on the energy-efficient Insulating Window Market as more and more consumers become aware of the benefits of energy-efficient windows. As the demand for energy-efficient insulating windows increases, the market for such products is expected to grow significantly.

Insulating Window Market Trends

Some futuristic growth use-cases of Insulating Window Market could include the development of smart insulating windows that can automatically adjust to changing weather conditions and lighting, the integration of self-cleaning and anti-glare features, and the use of advanced nanotechnology coatings to enhance their thermal insulation properties.

Top Companies in Insulating Window Market

The top players in the Insulating Window Market include Saint-Gobain S.A., Asahi Glass Co., Ltd., Nippon Sheet Glass Co., Ltd., AGC Inc., Central Glass Co., Ltd., PPG Industries, Inc., Guardian Industries Corp., Schott AG, Taiwan Glass Ind. Corp., and Xinyi Glass Holdings Limited.

Insulating Window Market Impact on Different Industries

The Insulating Window Market is likely to impact several other industries in the future. For example, the construction industry may see a shift towards building designs that incorporate energy-efficient windows. The glass manufacturing industry may need to adapt to new manufacturing processes to produce insulating windows with advanced coatings and technologies. The home automation industry may see the integration of insulating windows with smart home systems, while the solar energy industry could potentially integrate energy-efficient windows with solar power technologies.

Speak to our Analyst today to know more about Insulating Window Market!

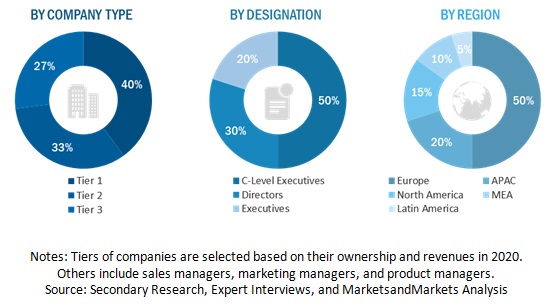

The study involves two major activities in estimating the current size of the energy-efficient windows market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The energy-efficient windows market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of end use sectors of energy-efficient windows such as residential and non-residential. Advancements in technology and diverse applications in various end-use industry describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total energy-efficient windows market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall energy efficient windows market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the various end-use sectors of energy efficient windows.

Report Objectives

- To define, describe, and forecast the energy-efficient windows market in terms of value

- To provide detailed information about drivers, restraints, opportunities, and challenges influencing market growth

- To identify and measure the market size by glazing type, component, application, end-use sector, and region

-

To analyze significant market trends in North America, Europe, Asia Pacific (APAC),

South America, and the Middle East & Africa (MEA), along with their key countries - To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC energy-efficient windows market

- Further breakdown of Rest of European energy-efficient windows market

- Further breakdown of Rest of North American energy-efficient windows market

- Further breakdown of Rest of MEA energy-efficient windows market

- Further breakdown of Rest of South American energy-efficient windows market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Energy-Efficient Window Market