Digital Security Control Market by Hardware (Smart Card, SIM Card, Biometric technology, & Security Token), by Software (Anti-Phishing, Authentication, Network Surveillance, & Others), Service, Application, and Geography -Global forecast to 2020

Digital security control deals with protecting and securing an individual’s digital identity and other interactions carried out in the digital world. The DSC report is segregated based on hardware, software, services, applications, and geographic regions. DSC products and solutions are widely used in several applications, which include mobile security & telecommunication, finance & banking, healthcare, and commercial among others.

Furthermore, hardware products are classified into smart card, SIM card, biometric technology, and security token. The software appliances and solutions considered in the report include anti-phishing, authentication, network surveillance, security management, and web technologies.

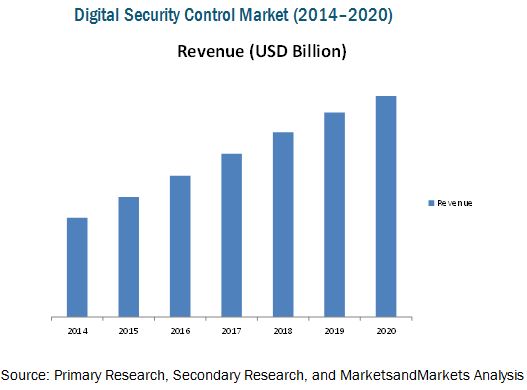

The global DSC market size is estimated to grow from USD 6.56 Billion in 2014 to USD 14.6 Billion by 2020, at a CAGR of 13.01% between 2015 and 2020. The market for hardware products is expected to grow at a CAGR of 13.61% during the forecast period. This growth is heralded by smart cards and biometric technologies.

The digital security control (DSC) products and solutions are successfully utilized in the fields of healthcare, telecommunication, finance, and government. With advancements in these products and solutions and the reducing costs, the DSC measures are expected to have a wider scope of application in areas such as mobile security, industrial, commercial, and transportation. Digital security offers a wide array of benefits and risks. It provides the convenience to the user by enabling the access to strong information such as one’s contact information, health information, and financial details among others. These advantages have led the DSC products and services to become an area of interest for new applications and end users from verticals such as medical, science, and corporate among others.

The global DSC market size is estimated to grow from USD 6.56 Billion in 2014 to USD 14.6 Billion by 2020, at a CAGR of 13.01% between 2015 and 2020.

Geographically, the DSC market is segmented into the North America, APAC, Europe, and RoW regions. North America accounts for a major market share and is followed by the European region, then by APAC. The RoW region covers a relatively smaller market share presently; however, it is expected to grow in the next five to seven years because of the increasing requirement of security systems in this region. Hence, the subsequent need for DSC solutions is expected to rise globally.

Key drivers for the DSC industry are the transition from magnetic strip technology to EMV, high level security obtained from biometric technology, and substantial growth of information security market. The DSC market, in spite of its exceptional demand, has some restraints in terms of its market growth. The key market restraints can be classified as large dependence on the technology, need for complex and expensive tools, and hacking posing as a problem in the digital world. Many enterprises are opting for multi-factor authentication services and this can be a major opportunity for the DSC market.

The report focuses on giving a detailed view of the complete DSC industry with regards to the application market, with detailed market segmentations, combined with the qualitative analysis of each and every aspect of the classification on the basis of application and geography. All the numbers, at every level of detail, are estimated till 2020, to give a glimpse of the potential size of this market.

Some of the major companies of the DSC market include Gemalto N.V. (Netherlands), FireEye, Inc. (U.S.), Oberthur Technologies (Japan), Safenet, Inc. (U.S.), and Vasco Data Security International, Inc. (U.S.).

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Design (Page No. - 18)

2.1 Market Size Estimation

2.1.1 Bottom-Up Approach

2.1.2 Top-Down Approach

2.2 Market Breakdown and Data Trangulation

2.3 Market Share Estimation

2.3.1 Key Data From Secondary Sources

2.3.2 Key Data From Primary Sources

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Opportunities in the Digital Security Control Market

4.2 Digital Security Control Market—Top Application Segments

4.3 Digital Security Control Market Based on Regions

4.4 North Americas and Europe Dominated the Digital Security Control Market

4.5 Global Digital Security Control Market Size Based on Software (2014, 2015, and 2020)

4.6 Digital Security Control Market: Service

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Transition From Magnetic Strip Technology to EMV

5.3.1.2 High Level Security Obtained From Biometric Technologies

5.3.1.3 Substantial Growth of Information Security Market

5.3.2 Restraints

5.3.2.1 Large Dependence on Technology

5.3.2.2 Need for Expensive and Complex Tools

5.3.2.3 Hacking to Pose A Problem in the Digital World

5.3.3 Opportunities

5.3.3.1 More Number of Enterprises Opting for MFA

5.3.4 Challenges

5.3.4.1 Providing Maximum Alerts to the User

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Degree of Competition

7 Market, By Hardware (Page No. - 47)

7.1 Introduction

7.2 Smart Card

7.2.1 Contact Smart Card

7.2.2 Contactless Smart Card

7.3 Sim Card (Subscriber Identity Module)

7.4 Biometric Technologies

7.5 Security Tokens

8 Market, By Service (Page No. - 53)

8.1 Introduction

8.2 Two-Factor Authentication

8.3 Three-Factor Authentication

8.4 Four-Factor Authentication

9 Market, By Software (Page No. - 57)

9.1 Introduction

9.2 Anit-Phishing

9.2.1 Firewall

9.2.2 Antivirus

9.2.3 Others

9.3 Authentication

9.3.1 Biometric

9.3.2 Turing Test

9.4 Network Surveillance

9.5 Security Management

9.6 Web Technologies

10 Market, By Application (Page No. - 63)

10.1 Introduction

10.2 Mobile Security and Telecommunication

10.3 Finance and Banking

10.4 Healthcare

10.5 Commercial

10.6 Other Applications

11 Market, By Geography (Page No. - 78)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe (RoE)

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Rest of APAC (RoAPAC)

11.5 Rest of the World (RoW)

11.5.1 Middle East

11.5.2 Africa

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Market Share Analysis, DSC System Market

12.3 Competitive Situation and Trends

12.3.1 New Product Launches

12.3.2 Contracts and Agreements

12.3.3 Mergers and Acquisitions

13 Company Profiles (Page No. - 105)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Gemalto NV

13.2 Fireeye, Inc.

13.3 Oberthur Technologies

13.4 Safenet, Inc.

13.5 RSA Security LLC

13.6 Vasco Data Security International, Inc.

13.7 3M

13.8 NEC Corporation

13.9 Morpho S.A.S (Safran)

13.10 HID Global (Actividentity, Inc.)

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 137)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (65 Tables)

Table 1 Global Digital Security Control Market Size, By Hardware, 2014–2020 (USD Million)

Table 2 Driver Analysis

Table 3 Restraint Analysis

Table 4 Digital Security Control Market Size, 2014–2020 (USD Million)

Table 5 Digital Security Control Market Size, 2014–2020 (Million Units)

Table 6 Smart Card Market Size, By Hardware, 2014–2020 (USD Million)

Table 7 Smart Card Market Size, By Hardware, 2014–2020 (Million Units)

Table 8 Biometric Technologies Market Size, By Hardware, 2014–2020 (USD Million)

Table 9 Biometric Technologies Market Size, By Hardware, 2014–2020 (Million Units)

Table 10 Digital Security Control Market, By Service, 2014–2020 (USD Million)

Table 11 Two-Factor Authentication Market, By Geography, 2014–2020 (USD Million)

Table 12 Digital Security Control Market Size, By Software, 2014–2020 (USD Million)

Table 13 Anti-Phishing Market Size, By Software, 2014–2020 (USD Million)

Table 14 Authentication Market Size, By Software, 2014–2020 (USD Million)

Table 15 Digital Security Control Market Size, By Application, 2014–2020 (USD Billion)

Table 16 Mobile Security and Telecommunication Market Size, By Region, 2014–2020 (USD Million)

Table 17 North America: Mobile Security and Telecommunication Market Size, By Country, 2014–2020 (USD Million)

Table 18 Europe: Mobile Security and Telecommunication Market Size, By Geography, 2014–2020 (USD Million)

Table 19 APAC: Mobile Security and Telecommunication Market Size, By Geography, 2014–2020 (USD Million)

Table 20 RoW: Mobile Security and Telecommunication Market Size, By Region, 2014–2020 (USD Million)

Table 21 Finance and Banking Market Size, By Region, 2014–2020 (USD Million)

Table 22 North America: Finance and Banking Market Size, By Country, 2014–2020 (USD Million)

Table 23 Europe: Finance and Banking Market Size, By Geography, 2014–2020 (USD Million)

Table 24 APAC: Finance and Banking Size, By Geography, 2014–2020 (USD Million)

Table 25 RoW: Finance and Banking Market Size, By Country, 2014–2020 (USD Million)

Table 26 Healthcare Market Size, By Region, 2014–2020 (USD Million)

Table 27 North America: Healthcare Market Size, By Country, 2014–2020 (USD Million)

Table 28 Europe: Healthcare Market Size, By Geography, 2014–2020 (USD Million)

Table 29 APAC: Healthcare Market Size, By Geography, 2014–2020 (USD Million)

Table 30 RoW: Healthcare Market Size, By Region, 2014–2020 (USD Million)

Table 31 Commercial Market Size, By Region, 2014–2020 (USD Million)

Table 32 North America: Commercial Market Size, By Country, 2014–2020 (USD Million)

Table 33 Europe: Commercial Market Size, By Geography, 2014–2020 (USD Million)

Table 34 APAC: Commercial Market Size, By Geography, 2014–2020 (USD Million)

Table 35 RoW: Commercial Market Size, By Region, 2014–2020 (USD Million)

Table 36 Other Applications Market Size, By Geography, 2014–2020 (USD Million)

Table 37 North America: Other Applications Market Size, By Country, 2014–2020 (USD Million)

Table 38 Europe: Other Applications Market Size, By Country, 2014–2020 (USD Million)

Table 39 APAC:Other Applications Market Size, By Geography, 2013–2020 (USD Million)

Table 40 RoW: Other Applications Market Size, By Region, 2014–2020 (USD Million)

Table 41 Digital Security Control Market Size, By Region, 2014–2020 (USD Billion)

Table 42 North America: DSC Market Size, By Country, 2014–2020 (USD Million)

Table 43 North America: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 44 U.S.: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 45 Canada: DSC Market Size, By Application, 2014–2020 (USD Billion)

Table 46 Mexico: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 47 Europe: DSC Market Size, By Country, 2014–2020 (USD Million)

Table 48 Europe: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 49 U.K.: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 50 Germany: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 51 France: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 52 RoE: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 53 APAC: DSC Market Size, By Geography, 2014–2020 (USD Million)

Table 54 APAC: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 55 China: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 56 Japan: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 57 India: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 58 Roapc: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 59 RoW: DSC Market Size, By Region, 2014–2020 (USD Million)

Table 60 RoW: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 61 Middle East: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 62 Africa: DSC Market Size, By Application, 2014–2020 (USD Million)

Table 63 New Product Launches, 2013-2015

Table 64 Contracts and Agreements, 2013-2015

Table 65 Mergers and Acquisition, 2013-2015

List of Figures (44 Figures)

Figure 1 Markets Covered

Figure 2 Years Considered for the Study

Figure 3 Digital Security Control Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Digital Security Control Market: Data Triangulation Model

Figure 7 Digital Security Control Market, By Software, Snapshot (2014–2020): Software Authentication Techniques Expected to Witness A High Growth

Figure 8 Digital Security Control Market, By Application, Snapshot (2014 vs 2020): the Healthcare Segment to Witness the Highest Growth During the Forecast Period

Figure 9 Attractive Market Opportunities for the Digital Security Control Market (2014–2020)

Figure 10 Finance and Banking Applications are Expected to Have the Largest Market Share During the Forecast Period

Figure 11 North America Accounted for the Largest Share in the Digital Security Control Market

Figure 12 North America and Europe Together Accounted for More Than Half of the Overall DSC Market in 2014

Figure 13 Anit-Phishing Accounted for the Largest Share in the Global Software Market

Figure 14 The Two-Factor Authentication Service to Account for the Largest Market Share

Figure 15 Drivers, Restraints, Opportunities and Challenges for the Digital Security Control Market

Figure 16 Value Chain Analysis

Figure 17 Porter’s Analysis

Figure 18 Porters Analysis: Digital Security Control

Figure 19 Threat of New Entrants

Figure 20 Threat of Substitutes

Figure 21 Bargaining Power of Suppliers

Figure 22 Bargaining Power of Buyers

Figure 23 Degree of Competition

Figure 24 Digital Security Control Market, By Hardware (USD Million)

Figure 25 Digital Security Control Market, By Service, 2014–2020

Figure 26 Digital Security Control Market, By Software, 2014 and 2020 (USD Million)

Figure 27 Digital Security Control Market, By Application, 2014 and 2020 (USD Million)

Figure 28 Geographic Snapshot of the Digital Security Control Market (2015–2020)

Figure 29 The North America DSC Market Snapshot

Figure 30 U.K. Accounted for the Largest Share in the European DSC Market

Figure 31 APAC: DSC Market Snapshot— India is the Most Lucrative Market

Figure 32 Companies Adopted New Product Launches and Partnerships as the Key Growth Strategies Between 2013 and 2015

Figure 33 Global DSC Market Share, By Key Player, 2014

Figure 34 Market Evolution Framework—New Product Launches Fueled the Market Growth in 2014

Figure 35 Battle for Market Share: New Contracts Was the Key Strategy

Figure 36 Gemalto NV : Company Snapshot

Figure 37 Fireeye, Inc.: Company Snapshot

Figure 38 Safenet, Inc.: Company Snapshot

Figure 39 RSA Security LLC: Company Snapshot

Figure 40 Vasco Data Security International, Inc.: Company Snapshot

Figure 41 Vasco Data Security Internal, Inc.: SWOT Analysis

Figure 42 3M: Company Snapshot

Figure 43 NEC Corporation: Company Snapshot

Figure 44 HID Global: Company Snapshot

The report also looks into the whole value chain and supply chain of the DSC market. It focuses on the parent market and sub-markets and thus, identifies the total market potential of DSC. The report also covers drivers, restraints, and opportunity analysis of the DSC market.

Major players in this market are Gemalto N.V. (Netherlands), FireEye, Inc. (U.S.), Oberthur Technologies (Japan), Safenet, Inc. (U.S.), and Vasco Data Security International, Inc. (U.S.).

Scope of the Report

This research report categorizes the DSC market based on hardware, software, service, application, and geography. It also covers the market size forecast from 2014 to 2020.

On the basis of the hardware:

The DSC market on the basis of the hardware consists of smart card, SIM card, biometric technology, and security token.

On the basis of software:

The software appliances and solutions for the DSC- anti-phishing, authentication, network surveillance, security management, and web technologies have been explained in detail in this report.

On the basis of the service:

The DSC market on the basis of service consists of two-, three-, and four-factor authentication services.

On the basis of the application areas:

The application areas of DSC have been categorized into mobile security & telecommunication, finance & banking, healthcare, and commercial among others.

On the basis of geography:

The geographic analysis covers the North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

The report also identifies drivers, restraints, opportunities, and current trends for the DSC market. Apart from the market segmentation, the report also includes the critical market data and qualitative information for each product and solution along with the qualitative analysis such as the Porter’s five force analysis, industry breakdown analysis, and value chain analysis.

Growth opportunities and latent adjacency in Digital Security Control Market

We are trying to estimate market share of alarm panels in South Africa in order to plug on our IoT technology to existing panels