Mobile Application Security Market by Solution (Antivirus & Antitheft, Data Recovery and Others), Deployment Type (Cloud & On Premise), User Type, Industry Vertical (BFSI, Healthcare & Others) and by Region - Global Forecast to 2020

[163 Pages Report] MarketsandMarkets forecasts the global mobile application security market is expected to grow from USD 808.8 Million in 2015 to USD 2.5 Billion in 2020 at a compound annual growth rate of 25.7% during the forecast period.

Mobile apps such as gaming apps, social media, and shopping apps are at the core of this market. The growing adoption of mobile devices among users has changed the process of sales, marketing, and branding of a product. The companies now prefer to introduce mobile apps to their customers to make purchase. The rising downloads of these apps and increasing use of mobile devices to visit various company websites has increased the risk of cyber-attacks and violation of security policies. This has laid the foundation for mobile application security solutions.

The mobile application security market has been segmented on the basis of solutions, deployment types, user types, and industry verticals. The global market is segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. The global market is provided for each region from 2015 to 2020.

Major players of the mobile application security ecosystem were identified across region and their offerings, distribution channel; their regional presence was understood through in-depth discussions. Also, average revenue generated by these companies segmented by region were used to arrive at the overall mobile application security market size. This overall market size is used in the top-down procedure to estimate the sizes of other individual markets via percentage splits from secondary and primary research. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors and marketing executives.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analysed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

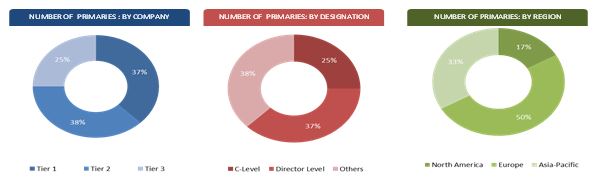

The breakdown of profiles of primary discussion participants is depicted in the below figure:

The ecosystem for the market comprises mobile application security solution providers, internet service providers, cloud service providers, and verticals.

Major companies in the ecosystem are as follows.

- Mobile Application security solution provider: Trend Micro, Symantec, Virtu, McAfee, and others.

- Internet service providers : At&T, Verizon, AOL, and others

- Cloud Service providers : Zscaler, Veracode, Vasco, Mojave Networks, and others

Key Target audience:

- Mobile application security solution providers

- Internet service providers

- System Integrators

- Cloud service providers

- Software developers

- Investment research firms

Scope of the report

The research report segments the market into following submarkets

- On the basis of Solutions:

- Anti-Virus

- Anti-Theft

- Web security

- Data backup and recovery

- IAM and Authentication

- Compliance management

- On the basis of Deployment types:

- On Premises

- Cloud

- On the basis of User types:

- Large enterprise

- SMBs

- Individuals

- On the basis of Industry verticals:

- BFSI

- Healthcare

- Retail

- Government

- IT and Telecom

- Education

- Media and entertainment

- Manufacturing and aerospace and defense

- Others

- On the basis of regions:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the Europe in the market

- Further breakdown of the Latin America in the market

Company Information

Detailed analysis and profiling of additional market players

The mobile application security market is expected to grow to USD 2.5 Billion in 2020, at a compound annual growth rate (CAGR) of 25.7% due to continuous emergence of new technologies. Moreover, the emergence of cloud-based solutions is helping this market grow progressively.

One of the other major factors driving this market is the adoption of standards and privacy regulations and growing demand for end-to-end security solutions. With the growth in the mobile device usage, the risk of data theft, phishing has also increased. This has encouraged organizations to roll out regulations to boost the demand for this market.

With the increasing adoption rate of Bring your own Devices (BYOD), the security-related issues are also increasing. The most common mobile attacks registered till 2014 include data interception, unauthorized location tracking, spamming, browser exploits, phishing, keystroke logging, malware, theft/loss, network exploits, spoofing, and zero-day-exploit. In 2014, the U.S. accounted for an increase in Android mobile malware encounter rate which reached 7% as compared to 4% in 2013.

The strong inclination toward internet and the need to be connected to the web is driving the market for mobile application security market in all regions.

In terms of regions, North America is expected to be account for the largest market size, while Middle East & Africa (MEA) and Asia-Pacific (APAC) are expected to experience an increase in market traction during the forecast period. Latin America is expected to experience a high growth rate and high adoption trend in this market. The increasing penetration and adoption of mobile devices has been a major driver for the fast growth in the APAC market.

The execution of mobile application security market solutions would allow enterprises to embrace the cloud application services by applying discovery and analysis process for all the devices used across the business network. As workers require access to business information for business purpose, organizations have been encouraging the application of mobile application security for concurrent malware scanning, URL filtering, and strong content scanning.

Increasing malware threat and growing demand for end-to-end security suites are pushing the growth of the mobile application security market. However, it is anticipated that the major vendors would face stiff competition from the local vendors from diverse regions. On the flip side, the lack of acceptance from large enterprises would hinder the growth of this market.

The mobile application security market is a consolidated market with big players, such as Symantec, McAfee, VMware, Avast Software, Trend Micro, MobileIron, AirPatrol Corporation, Lookout, AVG Technology, and Kaspersky. Majority of these players adopted both organic such as new product developments as well as inorganic growth strategies such as partnerships and collaborations with various other vendors to cater to the growing needs of this market.

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Key Data Taken From Secondary Sources

2.1.2 Key Data Taken From Primary Sources

2.2 Market Share Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.4.1 Key Industry Insights

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities in Market

4.2 Mobile Application Security Market

4.3 Market Potential

4.4 Mobile Application Security Deployment Type Market (2015)

4.5 Mobile Application Security Regional Market

4.6 Lifecycle Analysis, By Region 2015

5 Mobile Application Security Market Overview (Page No. - 40)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Market, By Solution

5.3.2 Market, By Deployment Type

5.3.3 Market, By User Type

5.3.4 Market, By Industry Vertical

5.3.5 Market, By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Malware Threats

5.4.1.2 Growing Demand for End-To-End Security Suites

5.4.1.3 Increasing Dependency on the Internet

5.4.2 Restraints

5.4.2.1 High Cost of Mobile Application Security Solutions

5.4.2.2 Lack of Acceptance in the Enterprise Segment

5.4.3 Opportunities

5.4.3.1 Increasing Demand for Saas-Based Mobile Application Security Solutions

5.4.3.2 Strong Need for Protection Against Web-Based Malware

5.4.4 Challenges

5.4.4.1 Growing Intricacy of Application-Based Malware Threats

5.4.4.2 Anti-Social and Terrorist Organizations are Targeting Business and Social Environment Through Mobile Application Attacks

6 Mobile Application Security Market: Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Standards and Regulations

6.4.1 Federal Information Processing Standards (FIPS)

6.4.2 Payment Card Industry Data Security Standard (PCI DSS)

6.4.3 Health Insurance Portability and Accountability Act (HIPAA)

7 Mobile Application Security Market Size and Forecast, By Solution (Page No. - 57)

7.1 Introduction

7.1.1 Anti-Virus

7.1.1.1 Overview

7.1.1.2 Market Size and Forecast

7.1.2 Anti-Theft

7.1.2.1 Overview

7.1.2.2 Market Size and Forecast

7.1.3 Web Security

7.1.3.1 Overview

7.1.3.2 Market Size and Forecast

7.1.4 Data Backup and Recovery

7.1.4.1 Overview

7.1.4.2 Market Size and Forecast

7.1.5 IAM and Authentication

7.1.5.1 Overview

7.1.5.2 Market Size and Forecast

7.1.6 Compliance Management

7.1.6.1 Overview

7.1.6.2 Market Size and Forecast

8 Mobile Application Security Market Size and Forecast, By Deployment Type (Page No. - 70)

8.1 Introduction

8.2 On-Premise

8.3 Cloud

9 Market Size and Forecast, By User Type (Page No. - 76)

9.1 Introduction

9.1.1 Large Enterprise

9.1.1.1 Overview

9.1.2 SMB

9.1.2.1 Overview

9.1.3 Individual

9.1.3.1 Overview

10 Mobile Application Security Market Size and Forecast, By Vertical (Page No. - 85)

10.1 Introduction

10.2 BFSI

10.2.1 Overview

10.3 Healthcare

10.3.1 Overview

10.4 Retail

10.4.1 Overview

10.5 Government

10.5.1 Overview

10.6 IT and Telecom

10.6.1 Overview

10.7 Education

10.7.1 Overview

10.8 Media and Entertainment

10.8.1 Overview

10.9 Manufacturing and Aerospace and Defense

10.9.1 Overview

10.10 Others (Transportation and Logistics, Law Agencies and Energy and Utilities)

10.10.1 Overview

11 Geographic Analysis (Page No. - 99)

11.1 Introduction

11.2 North America

11.2.1 Overview

11.2.2 United States (U.S.)

11.2.3 Canada

11.3 Europe

11.3.1 Overview

11.4 Asia-Pacific

11.4.1 Overview

11.5 Middle East and Africa

11.5.1 Overview

11.6 Latin America

11.6.1 Overview

12 Competitive Landscape (Page No. - 122)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 Partnerships

12.2.2 New Product Launches

12.2.3 Acquisitions

13 Company Profile (Page No. - 129)

13.1 Introduction

13.2 Symantec Corporation

13.2.1 Overview

13.2.2 Products and Services Offered

13.2.3 Recent Developments

13.2.4 MnM View

13.2.4.1 Key Strategies

13.2.4.2 SWOT Analysis

13.3 Trend Micro, Inc.

13.3.1 Business Overview

13.3.2 Products and Services Offered

13.3.3 Recent Developments

13.3.4 MnM View

13.3.4.1 Key Strategies

13.3.4.2 SWOT Analysis

13.4 VMWare (EMC)

13.4.1 Overview

13.4.2 Products and Services Offered

13.4.3 Recent Developments

13.4.4 MnM View

13.4.4.1 Key Strategies

13.4.4.2 SWOT Analysis

13.5 Mobileiron

13.5.1 Overview

13.5.2 Products and Services Offered

13.5.3 Recent Developments

13.5.4 MnM View

13.5.4.1 Key Strategies

13.5.4.2 SWOT Analysis

13.6 MCAFEE (Intel)

13.6.1 Business Overview

13.6.2 Products and Services Offered

13.6.3 Recent Developments

13.6.4 MnM View

13.6.4.1 Key Strategies

13.6.4.2 SWOT Analysis

13.7 AVG Technologies

13.7.1 Business Overview

13.7.2 Products and Services Offered

13.7.3 Recent Developments

13.7.4 MnM View

13.7.4.1 Key Strategies

13.8 Avast Software S.R.O.

13.8.1 Business Overview

13.8.2 Products and Services Offered

13.8.3 Recent Developments

13.8.4 MnM View

13.8.4.1 Key Strategies

13.9 Kaspersky Lab

13.9.1 Business Overview

13.9.2 Products and Services Offered

13.9.3 Recent Developments

13.9.4 MnM View

13.9.4.1 Key Strategies

13.10 Airpatrol Corporation

13.10.1 Business Overview

13.10.2 Products and Services Offered

13.10.3 Recent Developments

13.10.4 MnM View

13.10.4.1 Key Strategies

13.11 Lookout, Inc.

13.11.1 Business Overview

13.11.2 Products and Services Offered

13.11.3 Recent Developments

13.11.4 MnM View

13.11.4.1 Key Strategies

13.12 Introducing RT: Real-Time Market Intelligence

13.13 Available Customizations

13.14 Related Reports

List of Tables (70 Tables)

Table 1 Global Mobile Application Security Market Size and Growth Rate, 20132020 (USD Million, Y-O-Y %)

Table 2 Growing Demand for End-To-End Security Suites Will Boost the Mobile Application Market

Table 3 Lack of Acceptance in the Enterprise Segment Will Limit the Growth of the Market

Table 4 Strong Need for Protection Against Web-Based Malware Will Act as an Opportunity for the Market

Table 5 The Growing Intricacy of Web-Based Malware Threats Will Be the Major Challenge for Solution Providers

Table 6 Mobile Application Security Market, By Solutions, 20132020 (USD Million)

Table 7 Anti-Virus Market: Market Size, By Region, 20132020 (USD Million)

Table 8 Anti-Virus Market: Market Size, By User Type , 20132020 (USD Million)

Table 9 Anti-Theft Market: Market Size, By Region, 20132020 (USD Million)

Table 10 Anti-Theft Market: Market Size, By User Type , 20132020 (USD Million)

Table 11 Web Security Market: Market Size, By Region, 20132020 (USD Million)

Table 12 Web Security Market: Market Size, By User Type , 20132020 (USD Million)

Table 13 Data Backup and Recovery Market: Market Size, By Region, 20132020 (USD Million)

Table 14 Data Backup and Recovery Market: Market Size, By User Type , 20132020 (USD Million)

Table 15 IAM and Authentication Market: Market Size, By Region, 20132020 (USD Million)

Table 16 IAM and Authentication: Market Size, By User Type , 20132020 (USD Million)

Table 17 Compliance Management Market: Market Size, By Region, 20132020 (USD Million)

Table 18 Compliance Management Market: Market Size, By User Type , 20132020 (USD Million)

Table 19 Mobile Application Security Market, By Deployment Type, 20132020 (USD Million)

Table 20 On-Premise Market: Market Size, By Region, 20132020 (USD Million)

Table 21 Cloud Market : Market Size, By Region, 20132020 (USD Million)

Table 22 Market Size, By User Type , 20132020 (USD Million)

Table 23 Large Enterprise Market: Market Size, By Region, 20132020 (USD Million)

Table 24 Large Enterprise Market : Market Size, By Region, 20132020 (USD Million)

Table 25 SMB Market: Market Size, By Region, 20132020 (USD Million)

Table 26 SMB Market : Market Size, By Solution, 20132020 (USD Million)

Table 27 Individuals Market: Market Size, By Region, 20132020 (USD Million)

Table 28 Individuals Market: Market Size, By Solution , 20132020 (USD Million)

Table 29 Mobile Application Security Market Size, By Vertical , 20132020 (USD Million)

Table 30 BFSI Market, By Region: Market Size, By Region, 20132020 (USD Million)

Table 31 Healthcare Market : Market Size, By Region, 20132020 (USD Million)

Table 32 Retail Market: Market Size, By Region, 20132020 (USD Million)

Table 33 Government Market: Market Size, By Region, 20132020 (USD Million)

Table 34 IT and Telecom Market: Market Size, By Region, 20132020 (USD Million)

Table 35 Education Market: Market Size, By Region, 20132020 (USD Million)

Table 36 Media and Entertainment Market: Market Size, By Region, 20132020 (USD Million)

Table 37 Manufacturing and Aerospace and Defense Market: Market Size, By Region, 20132020 (USD Million)

Table 38 Others Market: Market Size, By Region, 20132020 (USD Million)

Table 39 Mobile Application Security Market Size, By Region, 20132020 (USD Million)

Table 40 North America: Market Size, By Solution, 20132020 (USD Million)

Table 41 North America: Market Size, By Deployment Type, 20132020 (USD Million)

Table 42 North America: Market Size, By User Type, 20132020 (USD Million)

Table 43 North America: Market Size, By Vertical, 20132020 (USD Million)

Table 44 United States: Market Size, By Solution, 20132020 (USD Million)

Table 45 United States: Market Size, By Deployment Type, 20132020 (USD Million)

Table 46 United States: Market Size, By User Type, 20132020 (USD Million)

Table 47 United States: Market Size, By Vertical, 20132020 (USD Million)

Table 48 Canada: Market Size, By Solution, 20132020 (USD Million)

Table 49 Canada: Market Size, By Deployment Type, 20132020 (USD Million)

Table 50 Canada: Market Size, By Vertical, 20132020 (USD Million)

Table 51 Canada: Market Size, By User Type, 20132020 (USD Million)

Table 52 Europe : Market Size, By Solution, 20132020 (USD Million)

Table 53 Europe : Market Size, By Deployment Type, 20132020 (USD Million)

Table 54 Europe : Market Size, By User Type, 20132020 (USD Million)

Table 55 Europe : Market Size, By Vertical, 20132020 (USD Million)

Table 56 Asia-Pacific : Market Size, By Solution, 20132020 (USD Million)

Table 57 Asia-Pacific : Market Size, Deployment Type, 20132020 (USD Million)

Table 58 Asia-Pacific : Market Size, By User Type, 20132020 (USD Million)

Table 59 Asia-Pacific : Mobile Application Security Market Size, By Vertical, 20132020 (USD Million)

Table 60 Middle East and Africa : Market Size, By Solution, 20132020 (USD Million)

Table 61 Middle East and Africa : Market Size, By Deployment Type, 20132020 (USD Million)

Table 62 Middle East and Africa : Market Size, By User Type, 20132020 (USD Million)

Table 63 Middle East and Africa : Market Size, By Vertical, 20132020 (USD Million)

Table 64 Latin America : Market Size, By Solution, 20132020 (USD Million)

Table 65 Latin America : Market Size, By Deployment Type, 20132020 (USD Million)

Table 66 Latin America: Market Size, By User Type, 20132020 (USD Million)

Table 67 Latin America : Market Size, By Vertical, 20132020 (USD Million)

Table 68 Partnerships, 20122015

Table 69 New Product Launches, 20132015

Table 70 Acquisitions, 20122015

List of Figures (58 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interview: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Mobile Application Security Market Size, Solutions Snapshot (20152020): Market for Anti-Virus is Expected to Double in the Next 5 Years

Figure 7 Market Size, Industry Vertical Snapshot (20152020): Retail and Healthcare Will Dominate the Market

Figure 8 Global Market Share: Na Will Exhibit the Highest Market Share in 2015

Figure 9 Growing Usage of Smartphone Applications is Driving the Market

Figure 10 Anti-Virus, Anti-Theft and Web Security are the Top Three Solutions Gaining the Highest Traction in Terms of Market Size

Figure 11 APAC is Expected to Have the Highest Market Growth Potential in the Years to Come

Figure 12 On-Premises Will Continue to Dominate the Market During the Forecasted Period

Figure 13 Europe Market to Grow Faster Than North America

Figure 14 Regional Lifecycle: Mea and Latin America Expected to Be in the Introduction Phase for the Year 2015

Figure 15 Market Evolution

Figure 16 Market Segmentation: By Solution

Figure 17 Market Segmentation: By Deployment Type

Figure 18 Market Segmentation: By User Type

Figure 19 Market Segmentation: By Industry Vertical

Figure 20 Market Segmentation: By Region

Figure 21 Increase in Malware Threats Will Drive the Mobile Application Security Market

Figure 22 Value Chain Analysis

Figure 23 Porters Five Forces Analysis (2015): Availability of Substitute Products Have Decreased the Value of the Mobile Application Security Solutions

Figure 24 Anti-Virus Solution is Expected to Contribute Highest to the Market

Figure 25 North America and Europe is Expected to Contribute Highest in Anti-Virus Solution Market

Figure 26 Europe is Expected to Adopt Data Backup and Recovery Solution Expensively

Figure 27 On-Premises is Contributing Highest to Market in 2015

Figure 28 On-Premises Deployment Type Will Grow Substantially in Asia-Pacific

Figure 29 Mobile Application Security Cloud Deployment Will Grow Extensively in Europe

Figure 30 Large Enterprises are Expected to Contribute Highest Revenue to Mobile Application Security Market

Figure 31 Mobile Application Security Solutions are Expected to Adopt Substantially By Large Enterprises in North America

Figure 32 North America has A Considerable Amount of Adoptions of Mobile Application Security Solution Among SMBs

Figure 33 Individuals in Asia-Pacific Will Continue to Implement Mobile Application Security Solutions During the Forecast Period

Figure 34 BFSI Sector is Growing Significantly Among Other Industry Verticals in Mobile Application Security Market

Figure 35 Healthcare is Having Largest Contribution in Market in 2015

Figure 36 Retail Industry is Adopting Mobile Application Security Solutions Substantively in Europe

Figure 37 IT and Telecom Sector is Adopting Mobile Application Security Solutions Considerably in North America

Figure 38 North America Market Snapshot: On-Premises Deployment to Contribute Maximum to the Market

Figure 39 Asia Pacific Market Snapshot: Retail Industry is Expected to Gain Popularity Among the Users

Figure 40 Companies Adopted New Product Launches as the Key Growth Strategy Over the Last 3 Years

Figure 41 Market Evaluation Framework

Figure 42 Battle for Market Share: Partnerships and New Product Launches Were the Key Strategies

Figure 43 Geographic Revenue Mix of Top 3 Market Players

Figure 44 Symantec Corporation: Company Snapshot

Figure 45 Symantec Corporation: SWOT Analysis

Figure 46 Trend Micro, Inc.: Company Snapshot

Figure 47 Trend Micro, Inc.: SWOT Analysis

Figure 48 VMWare (EMC): Company Snapshot

Figure 49 VMWare: SWOT Analysis

Figure 50 Mobileiron: Company Snapshot

Figure 51 Panasonic: SWOT Analysis

Figure 52 MCAFEE: Company Snapshot

Figure 53 MCAFEE: SWOT Analysis

Figure 54 AVG Technologies: Company Snapshot

Figure 55 Avast Software S.R.O.: Company Snapshot

Figure 56 Kaspersky Lab: Company Snapshot

Figure 57 Airpatrol Corporation: Company Snapshot

Figure 58 Lookout, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Mobile Application Security Market

"Market opportunity assessment for a startup looking to enter software market."

Indepth understanding of anti-virus, anti-theft, web security, data backup and recovery, IAM and authentication, compliance management and also to understand how this market differs from the MarketsandMarkets forecasts Mobile Anti-Malware Market to grow from $2.5B US in 2015 to $5.7B by 2020, at a CAGR of 18.0% from 2015 to 2020.