In-Memory Database Market by Application (Transaction, Reporting, Analytics), Data Type (Relational, SQL, and NEWSQL), Processing Type (OLAP and OLTP), Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2021

[160 Pages Report] The overall in-memory database market is expected to grow from USD 2.10 billion in 2015 to USD 6.58 billion by 2021, at a CAGR of 19.3% from 2016 to 2021.

In-memory database refers to the technology that stores the data fully or partially in the memory on either single or distributed servers. The In-Memory Database technology keeps the whole database in the main memory of the system. The technology supports the transactional, operational, and analytical workloads. It helps in reducing latency in the data, which further helps in extraction of data for its processing on real-time basis. Moreover, the massive amount of data (big data) is being generated across various industries. The need for analyzing this data in real time has been fulfilled by in-memory database solutions, as these solutions provide quick accessibility and processing of data.

Being a growing sub-set of the Database Management System (DBMS), in-memory database has the capability of working with data in memory rather than reading and writing it from the file system. With an in-built capability of performing data management functions at a faster magnitude, the in-memory database has lower memory and Central Processing Unit (CPU) requirements. Moreover, unlike traditional disk-based systems, the in-memory database system carries no file Input/output (I/O) burden. Due to the aforesaid features and capabilities of in-memory database systems, the market has shown significant growth in various enterprises.

The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

In-Memory Database Market Dynamics

Drivers

- Faster data processing

- Falling RAM prices

- Masive amount of data being generated from various industries

Restraints

- Memory space constraints

- Lack of standards

Opportunities

- Non-embedded applications requiring exceptional performance

- Emergence of Hybrid Transactional and Analytical Processing (HTAP)

- Increasing demand for real-time processing

Challenges

- Volatile nature of memory

- Data security concerns

Faster data processing, falling RAM prices, and massive amount of data being generated from various industries drives the global in-memory database market

BFSI, government & defense, and retail & consumer are few of the verticals which have shown tremendous adoption of in-memory database systems. This is due to the data-centric characteristics of these verticals. Apart from this, the healthcare and life sciences industry has shown significant growth rate during the forecast period. There are various opportunities prevailing in this market, which include non-embedded applications requiring exceptional performance, emergence of Hybrid Transactional & Analytical Processing (HTAP), and increasing demand for real-time processing. On the other hand, the market also has a few challenges, such as volatile nature of memory and data security concerns.

The following are the major objectives of the study.

- To describe and forecast the in-memory database market, in terms of value, by application, data type, processing type, deployment model, organization size, vertical and region

- To describe and forecast the market, in terms of volume, by type and application

- To describe and forecast the reed sensor market, in terms of value, by regionAsia Pacific (APAC), Europe, North America, Middle East and Africa (MEA), and Latin America along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of in-memory database

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the in-memory database ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the in-memory database market

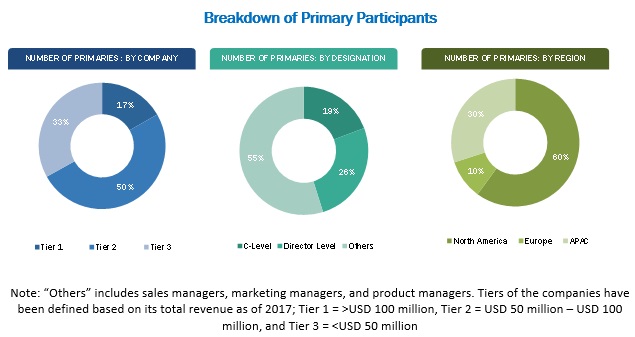

During this research study, major players operating in the in-memory database market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The in-memory database market comprises a network of players involved in the research and product development; distribution and sale; and post-sales services. Key players considered in the analysis of the in-memory database market are Microsoft (US), IBM (US), Oracle (US), SAP SE (Germany), Teradata (US), Amazon Web Services (US), Tableau (US), Kognitio (UK), VoltDB (US), DataStax (US), ENEA (Sweden), McObject (US) and Altibase (South Korea).

Major In-Memory Database Market Developments:

- In November 2016, SAP launched IoT Application Enablement solution. The SAP HANA Cloud Platform IoT service facilitates customers to develop IoT solutions effectively and achieve fast time to value.

- In October 2015, Oracle launched a new set of Oracle Database Cloud Services which further expands its portfolio of Oracle Cloud Platform Services. This enables customers to leverage from real-time transaction processing through Oracle Database In-Memory on-cloud.

- In May 2013, Teradata launched Teradata Intelligent memory, a database technology that is instrumental in delivering high speed in-memory performance at a cost-effective way. The software helps customers to configure exact amount of in-memory capability required to handle critical workloads.

Target Audience

- Independent Software Vendors

- Business Analytics Software Providers

- Application Design and Software Developers

- System Integrators

- IT Service Providers

- Cloud Service Providers

Report Scope:

By Application:

- Transaction

- Reporting

- Analytics

- Others

By Data Type:

- Relational

- NoSQL

- NewSQL

By Processing Type:

- Online Analytical Processing (OLAP)

- Online Transaction Processing (OLTP)

By Deployment Model:

- On Premise

- On Demand

By Organization Size:

- Large Enterprises

- Small and Medium Enterprises

By Vertical:

- Healthcare and Life Sciences

- BFSI

- Manufacturing

- Retail and Consumer Goods

- IT and Telecommunication

- Transportation

- Media and Entertainment

- Energy and Utilities

- Government and Defense

- Academia and Research

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- MEA

- Latin America

Critical questions which the report answers

- What are new application areas which the in-memory database companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the clients specific requirements. The available customization options are as follows:

Product Analysis:

- Product matrix gives a detailed comparison of product portfolio of each company.

Geographic Analysis:

- Further breakdown of the North America In-Memory Database Market

- Further breakdown of the Europe in-memory database market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information:

- Detailed analysis and profiling of additional market players

The overall in-memory database market is expected to grow from USD 2.10 billion in 2015 to USD 6.58 billion by 2021, at a CAGR of 19.3% from 2016 to 2021. Faster data processing, falling RAM prices, and massive amount of data being generated from various industries are the drivers that propel the growth of the market.

In-memory database refers to the technology that stores the data fully or partially in the memory on either single or distributed servers. The in-Memory Database technology keeps the whole database in the main memory of the system. The technology supports the transactional, operational, and analytical workloads. It helps in reducing latency in the data, which further helps in extraction of data for its processing on real-time basis. Moreover, the massive amount of data (big data) is being generated across various industries. The need for analyzing this data in real time has been fulfilled by in-memory database solutions, as these solutions provide quick accessibility and processing of data.

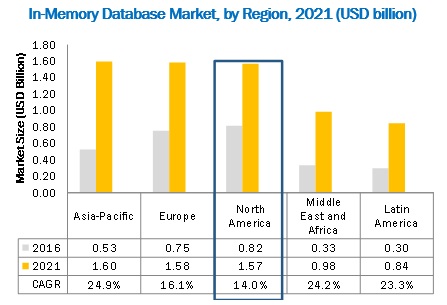

The in-memory database market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for in-memory database. Many Asian countries are leveraging from information-intensive technologies to gain edge over competition. Major countries in APAC such as India, China, and others are digitalizing and promoting the emerging technologies such as mobility, IoT, cloud, BI, and analytics. This has provided tremendous opportunities for the growth of in-memory database market. Hence, there are outstanding chances for the growth of data being generated from connected devices. It provides a major opportunity for in-memory database vendors as data-centric enterprises will require faster analytics and timely access to data, more than ever.

Faster data processing, falling RAM prices, and massive amount of data being generated from various industries drives the global in-memory database market

Faster data processing

In-memory processing is the technology used for faster processing of data by storing it in the main memory databases and is increasingly recommended to meet the Business Intelligence (BI) needs. Hence, the in-memory processing technology has helped the in-memory database market to gain traction among businesses of all sizes across industries, particularly in the field of data analytics. Faster processing of data leverages organizations with broader customer insights, helping companies to offer differentiated products and services to meet specific customer needs.

Falling RAM prices

An in-memory database has gained traction owing to the reduced prices of computer memory and increasing shift towards the use of analytics solutions for decision making, as businesses of every size are expecting immediate response times. Furthermore, the decline in the semiconductor technologies and rapid maturation of infrastructure of computing technologies are some other factors driving the use of in-memory databases. This has made in-memory database budget-friendly, making it feasible across various businesses, particularly SMEs.

Massive amount of data being generated from various industries such as BFSI, government & defense, and retail & consumer goods

The BFSI vertical is expected to have the largest market size in the in-memory database market. The BFSI vertical has witnessed high adoption of in-memory databases as they are well-suited and capable enough to handle high speed transactions available in various industries such as BFSI.

The retail & consumer goods vertical is expected to grow at the highest CAGR during the forecast period. In-memory databases with their rapid data processing capabilities will enable retailers to utilize real-time analytics to drive better insights into business processes and their customers; leading to optimized operations, and improved decision-making.

Due to the increasing workload and rising threats, the government and defense have relied on immediate decision-making through real-time data processing. In-memory database technologies are playing a vital role to attain operational efficiency in these sectors.

Real-time analytics has influenced the defense sector for making right decision in time. For this tremendous data is needed to analyze the information about different vehicles used in war, opposition strengths or any movement, location tracking, and other historical information related to the war to make the right move at the right time during the war. Thus, real-time data analytics is very important to manage extreme situation which arise in the defense sector.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for in-memory databases?

The memory space constraints and lack of standards are major factor restraining the growth of the in-memory database market.

In terms of analytical functions for various applications, such as big data applications which have been defined by petabytes of data; In-memory database solutions have provided limited memory space. This is due to memory space constraints on the size of in-memory databases, which depends on the amount of RAM physically available in the server. For example, if a database size is under 3 GB on 32-bit OS platforms, it is limited by the 32-bit address space. For 64-bit OS platforms, the database size will depend on the physical memory available in the system. . In most cases, the in-memory databases are designed as per specific application requirements and are developed and adapted accordingly.

The performance of data accessibility on in-memory database is still limited by the architecture of the application driving it. Sometimes, the structure and implementation of a database, the hardware on which the database runs, and the connectivity to the external devices may create problem in the overall processing performance of the in-memory solutions. For example, an expert on an in-memory database specific to a use case cannot be an expert in another, due to difference in data structure and the way data is stored & accessed.

Key players considered in the analysis of the in-memory database market are Microsoft (US), IBM (US), Oracle (US), SAP SE (Germany), Teradata (US), Amazon Web Services (US), Tableau (US), Kognitio (UK), VoltDB (US), DataStax (US), ENEA (Sweden), McObject (US) and Altibase (South Korea). These players are increasingly undertaking product launches and product upgradations to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Vendor Comparison Methodology

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the In-Memory Database Market

4.2 Market Share of Applications and Top Three Regions

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

4.5 Market Top Three Verticals

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By Data Type

5.2.3 By Processing Type

5.2.4 By Deployment Model

5.2.5 By Organization Size

5.2.6 By Vertical

5.2.7 By Region

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Faster Data Processing

5.4.1.2 Falling Ram Prices

5.4.1.3 Massive Amount of Data Being Generated From Various Industries Such as BFSI, Government & Defense, and Retail & Consumer Goods

5.4.2 Restraints

5.4.2.1 Memory Space Constraints

5.4.2.2 Lack of Standards

5.4.3 Opportunities

5.4.3.1 Non-Embedded Applications Requiring Exceptional Performance

5.4.3.2 Emergence of Hybrid Transactional and Analytical Processing (HTAP)

5.4.3.3 Increasing Demand for Real-Time Processing

5.4.4 Challenges

5.4.4.1 Volatile Nature of Memory

5.4.4.2 Data Security Concerns

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 In-Memory Database Architecture

6.4 Strategic Benchmarking

7 In-Memory Database Market Analysis, By Application (Page No. - 46)

7.1 Introduction

7.2 Transaction

7.3 Reporting

7.4 Analytics

7.5 Others

8 In-Memory Database Market Analysis, By Data Type (Page No. - 51)

8.1 Introduction

8.2 Relational

8.3 Nosql

8.4 Newsql

9 Market Analysis By Processing Type (Page No. - 55)

9.1 Introduction

9.2 Online Analytics Processing (OLAP)

9.3 Online Transaction Processing

10 In-Memory Database Market Analysis, By Deployment Model (Page No. - 59)

10.1 Introduction

10.2 On-Premises

10.3 On-Demand

11 Market Analysis By Organization Size (Page No. - 63)

11.1 Introduction

11.2 Large Enterprises

11.3 Small and Medium Enterprises (SMES)

12 In-Memory Database Market Analysis, By Vertical (Page No. - 67)

12.1 Introduction

12.2 Banking, Financial Services, and Insurance

12.3 Government and Defense

12.4 Healthcare and Life Sciences

12.5 Retail and Consumer Goods

12.6 Transportation and Logistics

12.7 IT and Telecommunications

12.8 Manufacturing

12.9 Energy and Utilities

12.10 Others

13 Geographic Analysis (Page No. - 79)

13.1 Introduction

13.2 North America

13.2.1 United States (U.S.)

13.2.2 Canada

13.3 Europe

13.3.1 Germany

13.3.2 France

13.3.3 Rest of Europe

13.4 Asia-Pacific

13.4.1 China

13.4.2 India

13.4.3 Japan

13.4.4 Rest of Asia-Pacific

13.5 Middle East and Africa

13.5.1 Middle East

13.5.2 Africa

13.6 Latin America

13.6.1 Mexico

13.6.2 Brazil

13.6.3 Rest of Latin America

14 Competitive Landscape (Page No. - 105)

14.1 Overview

14.2 Competitive Situations and Trends

14.2.1 Partnerships, Agreements, and Collaborations

14.2.2 New Product Launches

14.2.3 Expansions

14.2.4 Mergers and Acquisitions

14.3 In-Memory Databse Market: Vendor Comparison

14.4 Vendor Inclusion Criteria

14.5 Vendors Evaluated

15 Company Profiles (Page No. - 114)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

15.1 Introduction

15.2 Microsoft Corporation

15.3 IBM Corporation

15.4 Oracle Corporation

15.5 SAP SE

15.6 Teradata Corporation

15.7 Amazon Web Services

15.8 Tableau Software

15.9 Kognitio Ltd.

15.10 VoltDB

15.11 Datastax

15.12 Enea Ab

15.13 Mcobject LLC

15.14 Altibase Corporation

15.15 Starcounter

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15.16 Key Innovators

15.16.1 Activeviam

15.16.2 Memsql

15.16.3 Aerospike

15.16.4 Sqlite

16 Appendix (Page No. - 151)

16.1 Key Insights

16.2 Recent Developments

16.3 Discussion Guide

16.4 Knowledge Store: Marketsandmarkets Subscription Portal

16.5 Available Customization

16.6 Related Reports

16.7 Author Details

List of Tables (69 Tables)

Table 1 In-Memory Database Market Size and Growth, 20142021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Application 20142021 (USD Billion)

Table 3 Transaction: Market Size, By Region, 20142021 (USD Million)

Table 4 Reporting: Market Size, By Region, 20142021 (USD Million)

Table 5 Analytics: Market Size, By Region, 20142021 (USD Million)

Table 6 Others: Market Size, By Region, 20142021 (USD Million)

Table 7 In-Memory Database Market Size, By Data Type, 20142021 (USD Billion)

Table 8 Relational: Market Size, By Region, 20142021 (USD Million)

Table 9 Nosql Data Type: Market Size, By Region, 20142021 (USD Million)

Table 10 Newsql Data Type: Market Size, By Region, 20142021 (USD Million)

Table 11 In-Memory Database Market Size, By Processing Type, 20142021 (USD Billion)

Table 12 Online Analytics Processing: Market Size, By Region, 20142021 (USD Million)

Table 13 Online Analytics Processing: InMarket Size, By Region, 20142021 (USD Million)

Table 14 In-Memory Database Market Size, By Deployment Model, 20142021 (USD Billion)

Table 15 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 16 On-Demand: Market Size, By Region, 20142021 (USD Million)

Table 17 In-Memory Database Market Size, By Organization Size, 20142021 (USD Billion)

Table 18 Large Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 19 Small and Medium Enterprises: Market Size, By Region, 20142021 (USD Million)

Table 20 In-Memory Database Market Size, By Vertical, 20142021 (USD Billion)

Table 21 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Million)

Table 22 Government and Defense: Market Size, By Region, 20142021 (USD Million)

Table 23 Healthcare and Life Sciences: Market Size, By Region, 20142021 (USD Million)

Table 24 Retail and Consumer Goods: Market Size, By Region, 20142021 (USD Million)

Table 25 Transportation and Logistics: Market Size, By Region, 20142021 (USD Million)

Table 26 IT and Telecommunications: Market Size, By Region, 20142021 (USD Million)

Table 27 Manufacturing: Market Size, By Region, 20142021 (USD Million)

Table 28 Energy and Utilities: In-Memory Database Size, By Region, 20142021 (USD Million)

Table 29 Others: Market Size, By Region, 20142021 (USD Million)

Table 30 In-Memory Database Market Size, By Region, 20142021 (USD Billion)

Table 31 North America: Market Size, By Country, 20142021 (USD Million)

Table 32 North America: Market Size, By Vertical, 20142021 (USD Million)

Table 33 North America: Market Size, By Application, 20142021 (USD Million)

Table 34 North America: Market Size, By Data Type, 20142021 (USD Million)

Table 35 North America: Market Size, By Processing Type, 20142021 (USD Million)

Table 36 North America: Market Size, By Deployment Model, 20142021 (USD Million)

Table 37 North America: In-Memory Database Market Size, By Organization Size, 20142021 (USD Million)

Table 38 Europe: Market Size, By Country, 20142021 (USD Million)

Table 39 Europe: Market Size, By Vertical, 20142021 (USD Million)

Table 40 Europe: Market Size, By Application, 20142021 (USD Million)

Table 41 Europe: Market Size, By Data Type, 20142021 (USD Million)

Table 42 Europe: Market Size, By Processing Type, 20142021 (USD Million)

Table 43 Europe: Market Size, By Deployment Model, 20142021 (USD Million)

Table 44 Europe: Market Size, By Organization Size, 20142021 (USD Million)

Table 45 Asia-Pacific: In-Memory Database Market Size, By Country, 20142021 (USD Million)

Table 46 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Data Type, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Processing Type, 20142021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Deployment Model, 20142021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Million)

Table 52 Middle East and Africa: In-Memory Database Market Size, By Country , 20142021 (USD Million)

Table 53 Middle East and Africa: Market Size, By Vertical, 20142021 (USD Million)

Table 54 Middle East and Africa: Market Size, By Application, 20142021 (USD Million)

Table 55 Middle East and Africa: Market Size, By Data Type, 20142021 (USD Million)

Table 56 Middle East and Africa: Market Size, By Processing Type, 20142021 (USD Million)

Table 57 Middle East and Africa: Market Size, By Deployment Model, 20142021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Million)

Table 59 Latin America: In-Memory Database Market Size, By Country, 20142021 (USD Million)

Table 60 Latin America: Market Size, By Vertical, 20142021 (USD Million)

Table 61 Latin America: Market Size, By Application, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Data Type, 20142021 (USD Million)

Table 63 Latin America: Market Size, By Processing Type, 20142021 (USD Million)

Table 64 Latin America: Market Size, By Deployment Model, 20142021 (USD Million)

Table 65 Latin America: Market Size, By Organization Size, 20142021 (USD Million)

Table 66 Partnerships, Agreements, and Collaborations, 20122016

Table 67 New Product Launches, 20122016

Table 68 Expansions, 20122016

Table 69 Mergers and Acquisitions, 20132016

List of Figures (55 Figures)

Figure 1 Market Segmentation

Figure 2 In-Memory Database Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 In-Memory Database Market: Assumptions

Figure 8 Top Three Largest Revenue Segments of the Market, 20162021

Figure 9 North America is Expected to Hold the Largest Market Share in the Market

Figure 10 Growth Trends in the In-Memory Database Market

Figure 11 Asia-Pacific is Expected to Have the Highest Growth Opportunity in the In-Memory Database Market During the Forecast Period

Figure 12 Market Investment Scenario: Asia-Pacific is the Best Market to Invest During the Forecast Period

Figure 13 Banking, Financial Services, & Insurance and Government & Defense Verticals are Estimated to Have the Largest Market Size During the Forecast Period

Figure 14 Market Segmentation: By Application

Figure 15 Market Segmentation: By Data Type

Figure 16 Market Segmentation: By Processing Type

Figure 17 Market Segmentation: By Deployment Model

Figure 18 Market Segmentation: By Organization Size

Figure 19 Market Segmentation: By Vertical

Figure 20 Market Segmentation: By Region

Figure 21 In-Memory Database Market: Evolution

Figure 22 Market Drivers, Restraints, Opportunities, and Challenges

Figure 23 Market Value Chain Analysis

Figure 24 In-Memory Database: Architecture

Figure 25 In-Memory Database Market: Strategic Benchmarking

Figure 26 Transaction Application is Expected to Have the Largest Market Size

Figure 27 Relational Data Type is Estimated to Have the Largest Market Size

Figure 28 Online Transaction Processing Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 29 On-Premises Deployment Model is Estimated to Have the Largest Market Size During Forecast Period

Figure 30 Large Enterprises Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 31 Banking, Financial Services, and Insurance Vertical is Estimated to Have the Largest Market Size During the Forecast Period

Figure 32 North America is Expected to Have the Largest Market Size in the In-Memory Database Market During the Forecast Period

Figure 33 North America Market Snapshot

Figure 34 Asia-Pacific Market Snapshot

Figure 35 Companies Adopted Partnership, Agreement, and Collaboration as the Key Growth Strategy During the Period 20122016

Figure 36 Market Evaluation Framework

Figure 37 Battle for Market Share: Partnership, Collaboration, and Agreement Was the Key Strategy in the In-Memory Database Market

Figure 38 Evaluation Criteria

Figure 39 Evaluation Overview Table: Product Offering

Figure 40 Evaluation Overview Table: Product Offering

Figure 41 Geographic Revenue Mix of Top Five Market Players

Figure 42 Microsoft Corporation: Company Snapshot

Figure 43 Microsoft Corporation: SWOT Analysis

Figure 44 IBM Corporation: Company Snapshot

Figure 45 IBM Corporation: SWOT Analysis

Figure 46 Oracle Corporation: Company Snapshot

Figure 47 Oracle Corporation: SWOT Analysis

Figure 48 SAP SE: Company Snapshot

Figure 49 SAP SE: SWOT Analysis

Figure 50 Teradata Corporation: Company Snapshot

Figure 51 Teradata Corporation: SWOT Analysis

Figure 52 Amazon Web Services: Company Snapshot

Figure 53 Tableau Software: Company Snapshot

Figure 54 Partnerships, Collaborations, and Agreements, 20122014

Figure 55 New Product Launches and Product Upgradations, 20122015

Growth opportunities and latent adjacency in In-Memory Database Market