In-Memory Analytics Market by Component (Software, Services), Application (Risk Management & Fraud Detection, Sales & Marketing Optimization, and Financial Management), Deployment, Organization Size, Vertical, Region - Global Forecast to 2022

[154 Pages Report] The global in-memory analytics market is expected to grow from USD 1.26 billion in 2017 to USD 3.85 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 25.1% from 2017 to 2022. In-memory analytics is referred to as an analytical platform in which users run queries and interact with the data stored in the main memory instead of the hard disk. This approach facilitates faster query response, high performance, reduced operational costs, and encourages self-service analytics. It helps reduce the latency of data, thus enabling real-time data analysis with faster extraction of data. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Market Dynamics

Drivers

- Digital transformation using real-time data analytics

- Technological advancements in computing power

- Growing volume of data

- Growing trend for self-service BI tools

Restraints

- Lack of awareness across industries

Opportunities

- Reduction of main memory hardware costs

- Improved scalability and security with cloud-based in-memory analytics

- Higher adoption by SMBs

Challenges

- Management and maintenance of data quality

- Lack of end user and developer skills to deploy BI applications

Digital transformation using real-time data analytics drives the global in-memory analytics market

Real-time analytics is being incorporated in all industry verticals to generate quick insights to make strategic decisions. With the ever-increasing volume and complexity of data being used by enterprises today, there is an increasing pressure to utilize this data fully to make quick offline decisions and adjustments to the current processes. Real-time technologies such as Kafta, Spark, and MemSQL are being used by various industries to power their advanced analytics capabilities. The need to store, analyze, and visualize data in real time is forcing organizations to find suitable solutions which can improve decision-making abilities and reduce cost. There are various advantages of processing data in real-time, which include quickly responding to customer trends, better sales insights, early fraud detection, and service improvements. In-memory analytics incorporates both analytics and transaction processing on a single platform that can be used to handle various data types and execute complex transactions and queries easily. It caters to above requirements, providing speedy access to accurate information which leads to better and faster decision-making, easier identification of competitive opportunities, revenue growth, increased efficiency, and reduced risks.

The following are the major objectives of the study.

- To describe and forecast the in-memory analytics market, in terms of value, by component, deployment model, organization size, application, vertical, and region

- To describe and forecast the in-memory analytics market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, Latin America, and Middle East and Africa (MEA)

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the in-memory analytics ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, agreements, expansions, and partnerships in the in-memory analytics market

The research methodology used to estimate and forecast the in-memory analytics market begun with capturing data on key vendor’s revenues through secondary research, which included directories and databases (Hoovers, Bloomberg, Businessweek, Factiva, and OneSource). The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global in-memory analytics market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments.

To know about the assumptions considered for the study, download the pdf brochure

The in-memory analytics ecosystem comprises vendors, such as SAP (Germany), Oracle (US), Kognitio (UK), MicroStrategy (US), SAS Institute (US), ActiveViam (UK), IBM (US), Information Builders (US), Hitachi (Japan), Software AG (Germany), AWS (US), Qlik Technologies (US), ADVIZOR Solutions (US), and Exasol (Germany). Other stakeholders of the in-memory analytics market include system integrators, Value-Added Resellers (VARs), service providers and distributors, cloud BI platform vendors, Information Technology (IT) service providers, consulting service providers, managed service providers, market research and consulting firms, and cloud service providers. These In-Memory Analytics Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of In-Memory Analytics Software.

Major Market Developments in In-Memory Analytics Market

- In December 2016, MicroStrategy launched MicroStrategy 10.6 which provides optimized in-memory performance and provides a mobile user experience for both Android and iOS users.

- In September 2016, SAP and Samsung Electronics opened a joint research center dedicated to memory solutions to be used in next-generation in-memory computing to provide customers with optimized in-memory solutions.

- In June 2016, IBM launched the new version of its database software, IBM DB2 V11.1 for developers to easily integrate on-premises applications to cloud and enable hybrid data architecture. It is a powerful multi-workload software that powers next generation of applications, including mobile, advanced analytics, cognitive, and in-memory computing, to easily deploy across a massively parallel processing architecture and to improve response time.

Key Target Audience for In-Memory Analytics Market

- Service providers and distributors

- In-memory analytics application builders

- Independent Software Vendors (ISVs)

- Analytics consulting companies

- Enterprises

- End-users

Scope of the In-Memory Analytics Market research report

By Component

- Software

- Service

- Managed service

- Professional service

- Support and maintenance

- Consulting

By Application

- Risk management and fraud detection

- Sales and marketing optimization

- Financial management

- Supply chain optimization

- Predictive asset management

- Product and process management

- Others (network management and workforce management)

By Deployment Model

- On-premises

- Cloud

By Organization Size

- Small and Medium-Sized Businesses (SMBs)

- Large enterprises

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications and IT

- Retail and eCommerce

- Healthcare and life sciences

- Manufacturing

- Government and defense

- Energy and utilities

- Media and entertainment

- Transportation and logistics

- Others (education, travel and hospitality, research and outsourcing services)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North American in-memory analytics market

- Further breakdown of the European in-memory analytics market

- Further breakdown of the APAC in-memory analytics market

- Further breakdown of the MEA in-memory analytics market

- Further breakdown of the Latin American in-memory analytics market

Company Information

- Detailed analysis and profiling of additional market players

The overall in-memory analytics market is expected to grow from USD 1.26 billion in 2017 to USD 3.85 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 25.1% from 2017 to 2022. Digital transformation using real-time data analytics, technological advancements in computing power, growing volume of data, and inclination towards self-service BI are the key factors driving the growth of this market.

In-memory analytics is referred to as an analytical platform in which users run queries and interact with the data stored in the main memory instead of the hard disk. This approach facilitates faster query response, high performance, reduced operational costs, and encourages self-service analytics. It helps reduce the latency of data, thus enabling real-time data analysis with faster extraction of data. Companies have started to realize the importance of in-memory analytics owing to the advantages it offers, such as reduced complexity in processing data, reduced storage size as the data is compressed, elimination of separate data layers such as data indexes, and most importantly, the removal of traditional Data Warehouses (DW) that used the time-consuming Extract, Transform, and Load (ETL) process to retrieve and store data.

The in-memory analytics market has been segmented, based on component, deployment model, organization size, application, vertical, and region. The in-memory analytics market has witnessed high growth in recent years. The in-memory analytics software subsegment is gaining traction among various industries due to its ability to build high-performance analytical applications across data sets. The adoption of in-memory analytics for applications such as risk management and fraud detection, sales and marketing optimization, and supply chain optimization is increasing across various verticals. The demand for in-memory analytics in BFSI and government sectors is growing owing to its features such as centrally managed data, high-impact visualizations, and flexibility to use.

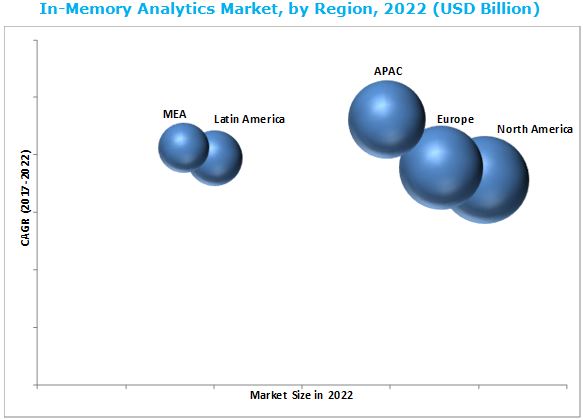

The in-memory analytics market in APAC is expected to grow at the highest CAGR during the forecast period. Major countries in the region, such as India, China, and Singapore are digitizing and promoting the emerging technologies such as mobility, IoT, cloud, BI, and analytics, which have huge growth opportunities. Verticals such as BFSI, retail and ecommerce, and telecommunication and IT would foster the demand for in-memory analytics solutions. The companies operating in this region will benefit from the flexible economic conditions, industrialization- and globalization-motivated policies of the governments, as well as the expanding digitalization, which are expected to have a huge impact on the industries in the region.

Predictive asset management is expected to grow at the highest growth rate in the in-memory analytics market during the forecast period

Risk Management and Fraud Detection

Risk management and fraud detection mainly cover the enterprise risk associated with financial risk, operations risk, or risk associated with an organization’s network efficiency, and preventing company from both internal fraud activities and external fraud activities. Organizations use the risk management and fraud detection application to enhance their risk intelligence capabilities to fight risk exposures. By using advanced analytical frameworks, companies can avoid, address or quickly recover from major risk events.

Sales and Marketing Optimization

In-memory analytics software implemented sales and marketing optimization application assists companies in optimizing marketing spend, not in the traditional sense of applying a marketing mix model, but in delivering optimization through strategy and efficiency at the marketing process level. Additionally, the sales and marketing optimization application also incorporates the project management process and information technology management in designing and delivering tailored marketing services. This approach helps companies with quick delivery and tailored solutions which are scalable across different regions, business segments, and functions.

Supply Chain Optimization

The analytics application for supply chain planning and optimization offers data administration and visualization capacities for the supply chain. The supply chain optimization application gets inputs from machines, hardware, GPS information from vehicles, sensors on streets, and so forth. When this information is handled, and dissected, valuable data for warehouse management, transport administration, and track & follow is generated. This application is gradually gaining traction because of its ability to handle supply chain challenges such as visibility of global supply chain and logistics processes, managing demand volatility and cost fluctuation in the supply chain. The implementation of analytics in the supply chain is gaining traction because it holds huge potential for innovations and provides a competitive advantage.

Predictive Asset Management

In-memory analytics solutions are finding increased usage for predictive asset management to proactively manage risks. Organizations that introduce sensors in equipment, and then use diagnostic models to learn how the sensor data relates to product problems or failures, can then create predictive models that recommend the possibility of failure and ways to prevent it. The early identification of the potential concerns helps organizations in the cost-effective deployment of the limited resources, enhance quality, and maximize equipment uptime, which ultimately is expected to result in improving customer satisfaction.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for in-memory analytics?

Lack of awareness across industries regarding the benefits of in-memory analytics is a major factor restraining the growth of the market. Organizations are unaware of the tangible cost-of-ownership benefits such as reduced disk space requirements, faster query processing, and reduction of administrative labor. It is necessary for organizations to evaluate the benefits of in-memory analytics for their overall business operations to understand the cost/benefit aspects of the overall in-memory analytics strategy. It is especially observed in asset-intensive industries such as manufacturing, transportation, telecommunication, and utilities as these organizations will not be able to realize the value of generating rapid insights if all the supporting business processes are not taking advantage of it.

Key players in the market include SAP (Germany), Oracle (US), Kognitio (UK), MicroStrategy (US), SAS Institute (US), ActiveViam (UK), IBM (US), Information Builders (US), Hitachi (Japan), Software AG (Germany), AWS (US), Qlik Technologies (US), ADVIZOR Solutions (US), and Exasol (Germany). These players are increasingly undertaking partnerships, agreements, and product launches to develop and introduce new technologies and products in the market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 In-Memory Analytics Market Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Market

4.2 Market Share, By Regions

4.3 Market By Vertical and Region

4.4 Life Cycle Analysis, By Region, 2017

5 In-Memory Analytics Market Overview (Page No. - 36)

5.1 Market Overview

5.1.1 Introduction

5.1.2 Market Dynamics

5.1.2.1 Drivers

5.1.2.1.1 Digital Transformation Using Real-Time Data Analytics

5.1.2.1.2 Technological Advancements in Computing Power

5.1.2.1.3 Growing Volume of Data

5.1.2.1.4 Growing Trend for Self-Service BI Tools

5.1.2.2 Restraints

5.1.2.2.1 Lack of Awareness Across Industries

5.1.2.3 Opportunities

5.1.2.3.1 Reduction of Main Memory Hardware Costs

5.1.2.3.2 Improved Scalability and Security With Cloud-Based In-Memory Analytics

5.1.2.3.3 Higher Adoption By SMBS

5.1.2.4 Challenges

5.1.2.4.1 Management and Maintenance of Data Quality

5.1.2.4.2 Lack of End User and Developer Skills to Deploy BI Applications

5.2 Industry Trends

5.2.1 Introduction

5.2.2 In-Memory Analytics Use Cases

5.2.2.1 Introduction

5.2.2.2 Use Case 1: Kognitio (Telecommunications Sector)

5.2.2.3 Use Case 2: Activeviam (Financial Services—Risk Management)

5.2.2.4 Use Case 3: Advizor Solutions Inc. (Healthcare Sector— Sudbury Regional Hospital)

5.2.3 In-Memory Analytics Architecture

5.2.3.1 In-Memory Architecture

6 In-Memory Analytics Market Analysis, By Component (Page No. - 45)

6.1 Introduction

6.2 Software

6.3 Services

6.3.1 Managed Services

6.3.2 Professional Services

6.3.2.1 Support and Maintenance

6.3.2.2 Consulting

7 Market Analysis, By Application (Page No. - 54)

7.1 Introduction

7.2 Risk Management and Fraud Detection

7.3 Sales and Marketing Optimization

7.4 Financial Management

7.5 Supply Chain Optimization

7.6 Predictive Asset Management

7.7 Product and Process Management

7.8 Other Applications

8 In-Memory Analytics Market Analysis, By Deployment Model (Page No. - 63)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Market Analysis, By Organization Size (Page No. - 67)

9.1 Introduction

9.2 Small and Medium Businesses

9.3 Large Enterprises

10 In-Memory Analytics Market Analysis, By Vertical (Page No. - 71)

10.1 Introduction

10.2 BFSI

10.3 Retail & E-Commerce

10.4 Government & Defense

10.5 Healthcare & Life Sciences

10.6 Manufacturing

10.7 Telecommunications & IT

10.8 Energy & Utilities

10.9 Media & Entertainment

10.10 Transportation & Logistics

10.11 Others

11 Geographic Analysis (Page No. - 82)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East & Africa

11.6 Latin America

12 In-Memory Analytics Market Competitive Landscape (Page No. - 101)

12.1 Introduction

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Microquadrant

12.3 Product Offering

12.4 Business Strategy

13 Company Profiles (Page No. - 105)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 SAP SE

13.2 Microstrategy Incorporated

13.3 Kognitio Ltd

13.4 SAS Institute, Inc.

13.5 Hitachi Group Company

13.6 Activeviam

13.7 Oracle Corporation

13.8 IBM Corporation

13.9 Information Builders, Inc.

13.10 Software AG

13.11 Amazon Web Services

13.12 Qlik Technologies, Inc.

13.13 Advizor Solutions, Inc.

13.14 Exasol

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 145)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (72 Tables)

Table 1 Us Dollar Exchange Rate, 2014-2016

Table 2 In-Memory Analytics Market Size and Growth, 2015–2022 (USD Billion, Y-O-Y %)

Table 3 Market Size, By Component, 2015–2022 (USD Million)

Table 4 Software: Market Size, By Region, 2015–2022 (USD Million)

Table 5 Services: In-Memory Analytics Market Size, By Region, 2015–2022 (USD Million)

Table 6 Services: Market Size, By Type, 2015–2022 (USD Million)

Table 7 Managed Services: Market Size, By Region, 2015–2022 (USD Million)

Table 8 Professional Services: Market Size, By Region, 2015–2022 (USD Million)

Table 9 Professional Services: Market Size, By Type, 2015-2022 (USD Million)

Table 10 Support and Maintenance Services: Market Size, By Region, 2015–2022 (USD Million)

Table 11 Consulting Services: Market Size, By Region, 2015–2022 (USD Million)

Table 12 In-Memory Analytics Market Size, By Application, 2015-2022 (USD Million)

Table 13 Risk Management and Fraud Detection: Market Size, By Region, 2015-2022 (USD Million)

Table 14 Sales and Marketing Optimization: Market Size, By Region, 2015-2022 (USD Million)

Table 15 Financial Management: Market Size, By Region, 2015-2022 (USD Million)

Table 16 Supply Chain Optimization: Market Size, By Region, 2015-2022 (USD Million)

Table 17 Predictive Asset Management: Market Size, By Region, 2015-2022 (USD Million)

Table 18 Product and Process Management: Market Size, By Region, 2015-2022 (USD Million)

Table 19 Other Applications: Market Size, By Region, 2015-2022 (USD Million)

Table 20 In-Memory Analytics Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 21 On-Premises: Market Size, By Region, 2015-2022 (USD Million)

Table 22 Cloud: Market Size, By Region, 2015-2022 (USD Million)

Table 23 Market Size, By Organization Size, 2015–2022 (USD Million)

Table 24 Small and Medium Businesses: Market Size, By Region, 2015–2022 (USD Million)

Table 25 Large Enterprises: Market Size, By Region, 2015–2022 (USD Million)

Table 26 In-Memory Analytics Market Size, By Vertical, 2015–2022 (USD Million)

Table 27 BFSI: Market Size, By Region, 2015–2022 (USD Million)

Table 28 Retail & E-Commerce: Market Size, By Region, 2015–2022 (USD Million)

Table 29 Government & Defense: Market Size, By Region, 2015–2022 (USD Million)

Table 30 Healthcare & Life Sciences: Market Size, By Region, 2015–2022 (USD Million)

Table 31 Manufacturing: Market Size, By Region, 2015–2022 (USD Million)

Table 32 Telecommunications & It: Market Size, By Region, 2015–2022 (USD Million)

Table 33 Energy & Utilities: Market Size, By Region, 2015–2022 (USD Million)

Table 34 Media & Entertainment: Market Size, By Region, 2015–2022 (USD Million)

Table 35 Transportation & Logistics: Market Size, By Region, 2015–2022 (USD Million)

Table 36 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 37 In-Memory Analytics Market Size, By Region, 2015-2022 (USD Million)

Table 38 North America: Market Size, By Component, 2015-2022 (USD Million)

Table 39 North America: Market Size, By Service, 2015-2022 (USD Million)

Table 40 North America: Market Size, By Professional Services, 2015-2022 (USD Million)

Table 41 North America: Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 42 North America: Market Size, By Vertical, 2015-2022 (USD Million)

Table 43 North America: Market Size, By Application, 2015-2022 (USD Million)

Table 44 North America: Market Size, By Organization Size, 2015-2022 (USD Million)

Table 45 Europe: In-Memory Analytics Market Size, By Component 2015-2022 (USD Million)

Table 46 Europe: Market Size, By Service, 2015-2022 (USD Million)

Table 47 Europe: Market Size, By Professional Service, 2015-2022 (USD Million)

Table 48 Europe: Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 49 Europe: Market Size, By Vertical, 2015-2022 (USD Million)

Table 50 Europe: Market Size, By Application, 2015-2022 (USD Million)

Table 51 Europe: Market Size, By Organization Size, 2015-2022 (USD Million)

Table 52 Asia-Pacific: In-Memory Analytics Market Size, By Component, 2015-2022 (USD Million)

Table 53 Asia-Pacific: Market Size, By Service, 2015-2022 (USD Million)

Table 54 Asia-Pacific: Market Size, By Professional Service, 2015-2022 (USD Million)

Table 55 Asia-Pacific: Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 56 Asia-Pacific: Market Size, By Vertical, 2015-2022 (USD Million)

Table 57 Asia-Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 58 Asia-Pacific: Market Size, By Organization Size, 2015-2022 (USD Million)

Table 59 Middle East & Africa: In-Memory Analytics Market Size, By Component, 2015-2022 (USD Million)

Table 60 Middle East & Africa: Market Size, By Service, 2015-2022 (USD Million)

Table 61 Middle East & Africa: Market Size, By Professional Service, 2015-2022 (USD Million)

Table 62 Middle East & Africa: Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 63 Middle East & Africa: Market Size, By Vertical, 2015-2022 (USD Million)

Table 64 Middle East & Africa: Market Size, By Application, 2015-2022 (USD Million)

Table 65 Middle East & Africa: Market Size, By Organization Size, 2015-2022 (USD Million)

Table 66 Latin America: In-Memory Analytics Market Size, By Component, 2015-2022 (USD Million)

Table 67 Latin America: Market Size, By Service, 2015-2022 (USD Million)

Table 68 Latin America: Market Size, By Professional Service, 2015-2022 (USD Million)

Table 69 Latin America: Market Size, By Deployment Model, 2015-2022 (USD Million)

Table 70 Latin America: Market Size, By Vertical, 2015-2022 (USD Million)

Table 71 Latin America: Market Size, By Application, 2015-2022 (USD Million)

Table 72 Latin America: Market Size, By Organization Size, 2015-2022 (USD Million)

List of Figures (40 Figures)

Figure 1 In-Memory Analytics Market: Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Global In-Memory Analytics Market is Expected to Grow at A Rapid Pace During the Forecast Period

Figure 9 Market Snapshot By Component (2017 Vs 2022)

Figure 10 Market Snapshot By Service (2017–2022)

Figure 11 In-Memory Analytics Market Snapshot By Professional Service (2017–2022)

Figure 12 Market Snapshot By Organization Size (2017 Vs 2022)

Figure 13 Market Snapshot By Application (2017–2022)

Figure 14 Market Snapshot By Deployment Model (2017–2022)

Figure 15 Market Snapshot By Vertical (2017 Vs 2022)

Figure 16 Market is Driven By the Drastic Reduction in Memory Prices and Improved Scalability and Security With Cloud-Based Solutions

Figure 17 North America Commands the In-Memory Analytics Market With Covering the Largest Market Size in 2017

Figure 18 BFSI Vertical and North America are Expected to Have the Largest Market Size in 2017

Figure 19 Asia-Pacific to Have Exponential Growth During 2017–2022

Figure 20 In-Memory Analytics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 In-Memory Analytics Architecture

Figure 22 Service Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Managed Services Sub segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Support and Maintenance Services Sub segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Predictive Asset Management In-Memory Analytics Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Cloud Based In-Memory Analytics Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 27 Small and Medium Businesses Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 28 Retail & E-Commerce Vertical is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Geographic Snapshot: Asia-Pacific is Estimated to Have the Highest CAGR in the In-Memory Analytics Market

Figure 30 North America In-Memory Analytics Market Snapshot

Figure 31 Asia-Pacific Market Snapshot

Figure 32 SAP SE: Company Snapshot

Figure 33 Microstrategy Incorporated: Company Snapshot

Figure 34 SAS Institute, Inc.: Company Snapshot

Figure 35 Hitachi, Ltd.: Company Snapshot

Figure 36 Oracle Corporation: Company Snapshot

Figure 37 IBM Corporation: Company Snapshot

Figure 38 Software AG: Company Snapshot

Figure 39 Amazon Web Services: Company Snapshot

Figure 40 Qlik Technologies, Inc.: Company Snapshot

Growth opportunities and latent adjacency in In-Memory Analytics Market