In-Memory Computing Market by Component (Solutions & Services), Solution (IMDB (OLTP & OLAP), IMDG, and Data Stream Processing), Service, Application (Risk Management & Fraud Detection, Predictive Analysis), Vertical, and Region - Global Forecast to 2025

In-Memory Computing (IMC) Market - Size, Share & Growth Report

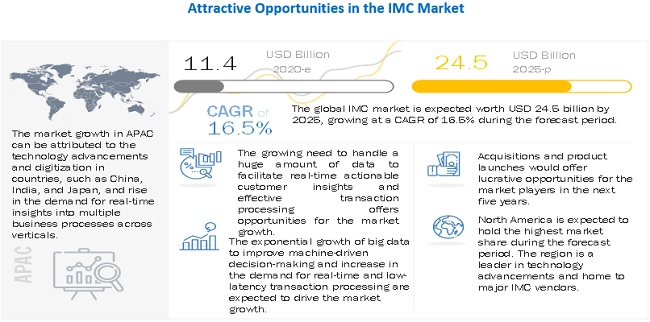

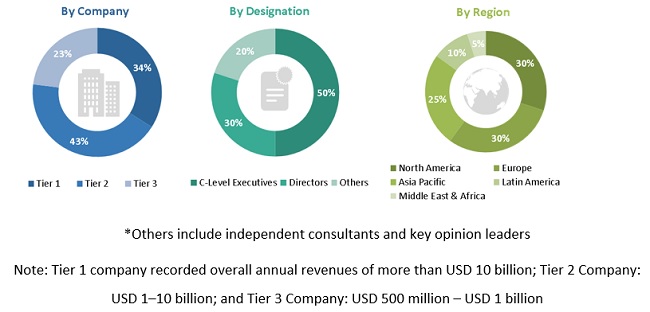

[412 Pages Report] The global In-Memory Computing Market size was reached $11.4 billion in 2020 and is anticipated to hit a revenue around $24.5 billion by the cease of 2025, at a increasing CAGR of 16.5% during the forecast period (2020-2025). The base year for estimation is 2019 and the market size available for the years 2014 to 2025.

The exponential growth of big data to improve machine-driven decision-making, decrease in the overall cost of RAM and TCO, and an increase in production with real-time and low-latency transactional processing to drive the growth of In-Memory Computing Market. Data security concerns and Incompetence to develop BI applications are one of the major challenges in the IMC market. Moreover, Lack of standards, Increasing volatility of data, and Lack of skilled workforce and complexity involved in data extraction as one of the key restraining factors in the In-Memory Computing Market.

To know about the assumptions considered for the study, Request for Free Sample Report

In a short time, the COVID-19 outbreak has affected markets and customers' behavior, and substantially impacted economies and societies. With offices, educational institutions, and manufacturing facilities shutting down for an indefinite period; major sports and events being postponed; and work-from-home and social distancing policies in effect, businesses are increasingly looking for technologies to assist them in these difficult times. Analytics professionals, business intelligence professionals, and professionals providing expertise in advanced analytics such as AI and ML are called for their expertise to help executives make business decisions on how to respond to new business challenges caused by the COVID-19 outbreak. From the silent generation to baby boomers using Zoom for the first time, to legacy-reliant organizations modernizing in cloud, there is a huge wave of ‘digital acceleration’ building toward a ‘new normal.’ The efficient remote working is being observed across verticals that previously thought it is impossible. The work-life balance may be strange, but employees are now being trusted more openly by their employers to work from home in an environment that suits their needs. In light of this monumental shift to remote working and cloud-based technologies, the long-term effects of COVID-19 as a catalyst for change in all aspects of life would be profound, and a strong instance of this can be found in the contact center industry.

Businesses are opting for In-Memory Computing solutions for managing voluminous data and meeting customer expectations. Industries such as eCommerce, logistics, online learning, food delivery, and online business collaboration are witnessing a huge spike in their business, which is straining the limits of their customer-facing or internal applications. Businesses are facing the immediate need to speed up and scale out their applications, for which one of the fastest approaches is to deploy in-memory data grids. The in-memory computing market is witnessing more customers demanding IMC solutions and services during the COVID-19 crisis.

In-Memory Computing Market Growth Dynamics

Driver: Exponential growth of big data to improve machine-driven decision-making

Big data is characterized by three V’s: volume, velocity, and variety. As the number of transactions increases in enterprises, the amount of data also increases. In verticals such as telecommunication, BFSI, online gaming, and entertainment, data generated per second is huge. Due to the increasing data volumes, organizations are facing huge problems in processing large amounts of information within a specific time frame. Therefore, the use of traditional disk-based data management systems and the manipulation of massive data becomes quite difficult.

Traditional disk-based systems are not capable of ingesting high- velocity data because of the limitation of mechanical disks. In this data extraction and manipulation process, most of the time, data remains in transit state, and processors remain idle for almost 85% of the total time. IMC- based solutions such as IMDG and in-memory computing platform built around big data can handle three Vs because of their speed and scalability. These solutions process big data with the type of latencies that produce actionable insights and machine-driven decision-making.

Through In-Memory Computing , organizations store data in the main memory of servers; hence the time, which is wasted in input/output operations, can be utilized for data processing. Thus, In-Memory Computing helps speed up the process of analyzing all the structured and unstructured data. Organizations are creating, collecting, storing, and hoping to capitalize on structured and unstructured data, driving the overall IMC market growth. For example, BFSI organizations can track the effect of market fluctuations on their portfolios (‘strategies’) of long and short equity positions in various markets, and immediately identify strategies requiring rebalancing through In-Memory Computing.

Restraint: Lack of skilled workforce and complexity involved in data extraction

In-Memory Computing is a new standard in technology development. The availability of trained technical staff and consulting professionals is the major challenge of IMC implementation. Many organizations or technology adopters suffer typical challenges with radical technologies in early adoption phases. These challenges include the lack of general standards and absence of proven architectural patterns. With the emergence of successful vendors, increase in the network of implementation partners, and recent open-source momentum, skill availability challenges are expected to drop rapidly; however, for the interim period, In-Memory Computing continues to be a niche technology and skill availability continues to be a challenge.

Due to reasons such as the shortage of skilled workforce and complexity of big data solutions, organizations report trouble in extracting value from structured, unstructured, or semi-structured data. The complete life cycle of data analytics in cloud goes through various processes, including data discovery, data modeling, data mining, and visualization. These processes make big data analytics-related projects quite complex. Such complexities faced by business organizations across verticals act as obstacles for IMC solution vendors in the In-Memory Computing Market. According to World Economic Forum’s Future of Jobs 20184, the demand is accelerating for a variety of wholly new specialist roles related to understanding and leveraging the latest emerging technologies. These specialist roles are big data specialists, AI and ML specialists, process automation experts, information security analysts, user experience and human-machine interaction designers, robotics engineers, and blockchain specialists.

Opportunity: Emergence of AI and ML based technologies to gain real-time actionable customer insights

With the advent of emerging technologies such as AI and ML, companies are witnessing huge opportunities as these technologies offer real-time insights with in-built automation. IMC solutions with the AI technology can automatically capture complete agent-customer interactions to offer hidden insights and opportunities. AI in IMC supports businesses to optimize outcomes through valuable customer insights. In-Memory Computing makes the identification of actionable insights possible through high-volume discovery, as it offers both high-level views and drill-down details. Real-time IMC provides the next best actionable guidance message to agents, post customer interactions are captured and analyzed, leading to improved customer interaction and operational efficiency. The benefits and features of IMC include measuring accurate performance metrics, discovering call patterns and trends, staffing and training problems, training and back-end issues, and discovering new revenue streams. The use cases of real-time IMC are increasingly witnessed across verticals, such as BFSI, healthcare and life sciences, and retail and eCommerce.

Challenge: Incompetence to develop BI applications

Organizations nowadays are using techniques integrated with In-Memory Computing system related to advanced analytics, which is a part of BI, such as Analytics of Things (AoT), predictive analytics, and machine learning ML. These techniques are complex in nature and require an in-depth analytical knowledge. BI can get complex depending on the architecture used. To build a BI tool using the BI platform, a person requires technical skills, analytical skills, and critical thinking, and many end-use verticals do not have enough people with these specific analytical skills and knowledge. Organizations spend most of their time in capturing and correcting data generated from various sources instead of analyzing it. It is not necessary that all the employees working with data have skills in data science. Business knowledge is also required in conjunction with appropriate training to help build a data-driven and decision-making culture. Thus, an analytics capability gap, which is needed to build complex BI solution, is one of the biggest challenges faced by most end-use businesses in the In-Memory Computing Market.

By solution, the IMDB solutions segment is expected to account for the higher market share during the forecast period

By solution, the IMDB solutions segment is expected to account for a higher market share during the forecast period. The highest market share of the IMDB segment is attributed to the increasing demand for boosting performance and scalability, and building real-time applications, which are the major factors for the fast growth of the IMC market across the globe. IMDB solutions also help reduce development and operational costs through standardization on an IMC system. IMC solutions comprise In-Memory Data Grid (IMDG), In-Memory Database (IMDB), and Streaming Data Analysis. These solutions are a type of middleware software that enables businesses to store data in RAM, across a cluster of computers, and process it in parallel. Most of these solutions offered are claimed to be easy to deploy and are feature-rich to address complex computing rigors and requirements. IMC solutions are designed from the ground up to store data in a distributed fashion, where the entire dataset is divided into individual computers’ memory, each storing only a portion of the overall dataset. Once data is partitioned, parallel distributed processing becomes a technical necessity because data is stored in a partitioned way.

By application, the risk management and fraud detection segment to record the higher CAGR during the forecast period

In the In-Memory Computing Market by application, the risk management and fraud detection segment is expected to record the higher market share during the forecast period. The growth of the risk management and fraud detection segment is attributed to the need of organizations to keenly focus on the enhancement of their risk intelligence capabilities to fight risk exposures. Moreover, the application helps companies mitigate risks and align critical business processes by functionalities, such as managing IT security-based compliance and mandates that include ISO 27001, and providing automated risk notifications. IMC solutions have emerged as an important requirement for enterprises to conduct an accurate analysis of data stored in the RAM of servers and storage. Even enterprises with limited financial resources and IT expertise have started implementing IMC-enabled applications to help non-technical users to quickly perform complex data analysis. IMC product capabilities are integrated with diverse business applications scattered through different verticals and designed to replenish the unique demands of business segments. Apart from established players in the IMC industry, the new entrants in the market are introducing new solutions to lure customers. The market players are focusing on meeting the demands of customers with unique product features. The report segments the overall In-Memory Computing Market by the following business applications: risk management and fraud detection, sentiment analysis, geospatial/GIS processing, sales and marketing optimization, predictive analysis, supply chain management, and others (image processing, route optimization, claim processing and modeling, and trade promotion simulations).

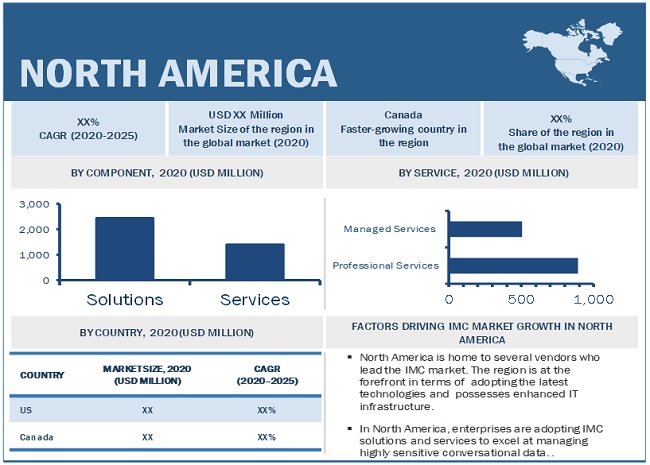

North America to account for the largest market size during the forecast period

North America is expected to hold the largest market size in the global In-Memory Computing Market during the forecast period. The increasing demand for analytics and advanced analytics platforms by small and medium businesses and government agencies would fuel the demand for IMC products in North America. The rising adoption of cloud and IoT, and increasing use of the web are some of the factors driving the In-Memory Computing Market growth in Europe. APAC is expected to record the fastest growth rate during the forecast period. The adoption of IMC technology by different verticals, such as manufacturing and retail, is expected to contribute to the growth of the In-Memory Computing Market in APAC region. The increasing number of players across different regions is further expected to drive the In-Memory Computing Market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major In-memory computing companies includes Microsoft(US), Oracle(US), SAP (Germany), IBM (US), SAS Institute (US), TIBCO (US), Software AG (Germany), Fujitsu (Japan), Red Hat (US), Altibase (US), GigaSpaces (US), GridGain (US), Hazelcast (US), MongoDB (US), Exasol (Germany), Intel (Germany), Qlik (US), Salesforce (US), Workday (US), Teradata (US), Kognitio (UK), Enea (Sweden), VoltDB (US), McObject (US), and MemSQL (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Market Size in 2025 |

USD 24.5 billion |

|

CAGR |

16.5% |

|

Segments covered |

Component (Solutions & Services), Solution (IMDB [OLTP & OLAP], IMDG, and Data Stream Processing), Service, Application (Risk Management & Fraud Detection, Predictive Analysis), Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Microsoft (US), Oracle (US), SAP (Germany), IBM (US), SAS Institute (US), TIBCO (US), Software AG (Germany), Fujitsu (Japan), Red Hat (US), Altibase (US), GigaSpaces (US), GridGain (US), Hazelcast (US), MongoDB (US), Exasol (Germany), Intel (Germany), Qlik (US), Salesforce (US), Workday (US), Teradata (US), Kognitio (UK), Enea (Sweden), VoltDB (US), McObject (US), and MemSQL (US) |

The research report categorizes the In-Memory Computing Market to forecast the revenues and analyze trends in each of the following subsegments:

By Component

-

Solutions

-

In-Memory Database (IMDB)

- Online Analytical Processing (OLAP)

- Online Transaction Processing (OLTP)

- In-Memory Data Grid (IMDG)

- Data Stream Processing

-

In-Memory Database (IMDB)

-

Services

-

Professional Services

- Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

By Application

- Risk Management and Fraud Detection

- Sentiment Analysis

- Geospatial/GIS Processing

- Sales and Marketing Optimization

- Predictive Analysis

- Supply Chain Management

- Others (Image Processing, Route Optimization, Claim Processing and Modelling, and Trade Promotion Simulations)

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- IT and Telecom

- Retail and eCommerce

- Healthcare and Life Sciences

- Transportation and Logistics

- Government and Defence

- Energy and Utilities

- Media and Entertainment

- Others (Education, Manufacturing, and Travel And Hospitality)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In July 2020, Microsoft released the next-generation of its Azure Stack HCI service. Microsoft is rolling out a preview of Azure Stack HCI v2, which will enable users to run the service on their own servers and include built-in integration with Azure Arc, among other new features. The new iteration of Azure Stack HCI announced is a new host OS separated from Windows Server, which is designed specifically to run HCI and is integrated with Azure with hybrid by design.

- In August 2020, IBM revealed the next generation of its IBM POWER central processing unit (CPU) family: IBM POWER10. Designed to offer a platform to meet the unique needs of enterprise hybrid cloud computing, the IBM POWER10 processor uses a design focused on energy efficiency and performance in a 7nm form factor with an expected improvement of up to 3x greater processor energy efficiency, workload capacity, and container density than the IBM POWER9 processor. Designed over five years with hundreds of new and pending patents, the IBM POWER10 processor is an important evolution in IBM's roadmap for POWER.

- In September 2020, SAS accelerates development of analytics and data science talent with new academic program To help its students seize job opportunities, the University of South Florida (USF) worked with SAS to launch a Tier 3 SAS Academic Specialization in Healthcare Analytics. The new SAS Academic Specialization gives higher education institutions more options for generating the SAS talent employers are seeking.

- In July 2020, Citrix and Microsoft partner to accelerate the future of work. Citrix and Microsoft partnered to accelerate the future of work. The companies partnered to simplify cloud transformation and speed the adoption of digital workspaces and virtual desktops to enable greater agility, productivity, and security. Under the terms of the deal, Microsoft will select Citrix Workspace as a preferred digital workspace solution, and Citrix will select Microsoft Azure as a preferred cloud platform, moving existing on-premises Citrix customers to Microsoft Azure to enable people to work anywhere across devices.

- In June 2020, Wipro and IBM collaborate to help clients accelerate their cloud journeys Wipro Limited, a leading global information technology, consulting, and business process services company, announced a collaboration with IBM to assist Wipro customers embark on a seamless and secure hybrid cloud journey. Through this alliance, Wipro will develop hybrid cloud offerings to help businesses migrate, manage, and transform mission-critical workloads and applications, with security across public or private cloud and on-premises IT environments.

- In April 2020, Tech Mahindra and IBM to help their clients modernize operations leveraging cloud Tech Mahindra Ltd., a leading provider of digital transformation, consulting, and business reengineering services and solutions, is collaborating with IBM to help businesses transform their operations and accelerate their hybrid cloud strategies. Tech Mahindra will help clients migrate core business applications to the IBM public cloud using IBM Cloud Paks. As part of this relationship, IBM and Tech Mahindra will establish innovation centers designed to help address complex business problems across industries, including telecommunication, manufacturing, financial services, insurance, retail, and healthcare.

- In September 2020, SAS and RTI partnership combine best in research, expertise and analytics SAS and RTI International are partnering to tackle some of the world’s greatest challenges by bringing joint offerings to government agencies and other organizations. SAS and RTI combine more than 100 years of expertise in research and analytics and will build on a long relationship of collaboration and innovation.

- In October 2019, SAP paves the way for Sri Lankan businesses to become intelligent enterprises Driving digitization for local businesses in Sri Lanka, SAP in partnership with Sri Lanka SAP User Group (SLSUG) signified the importance of enterprises going digital with its intelligent offerings and solutions empowering them to become Intelligent Enterprises. The company’s Intelligent Enterprise strategy allows for businesses to rapidly transform data into insight – feeding process automation, innovation, and optimal experiences.

Frequently Asked Questions (FAQ):

What is the In-Memory Computing Market Size?

What is the In-Memory Computing Market growth?

Who are the key vendors in the In-Memory Computing Market?

Which countries are considered in the European region?

Which are the type of deployments considered in the In-Memory Computing Market?

Does this report include the impact of COVID-19 on the In-Memory Computing Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 63)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 73)

2.1 RESEARCH DATA

FIGURE 6 IN-MEMORY COMPUTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 IN-MEMORY COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF IN-MEMORY COMPUTING MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF IN-MEMORY COMPUTING MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY — APPROACH 3 — BOTTOM-UP (DEMAND SIDE): SHARE OF IN-MEMORY COMPUTING THROUGH OVERALL IN-MEMORY COMPUTING SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 12 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 STARTUP/SME COMPETITIVE EVALUATION QUADRANT METHODOLOGY

FIGURE 13 START-UP/SME COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON IN-MEMORY COMPUTING MARKET

FIGURE 14 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 87)

TABLE 4 GLOBAL IN-MEMORY COMPUTING MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

FIGURE 15 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

FIGURE 17 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO HOLD LARGEST MARKET SIZE IN 2020

FIGURE 18 IN-MEMORY DATABASE SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 19 ON-PREMISES SEGMENT TO HOLD HIGHER MARKET SHARE IN 2020

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 21 RISK MANAGEMENT AND FRAUD DETECTION SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD HIGHEST MARKET SHARE IN 2020

FIGURE 23 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE AND ASIA PACIFIC TO GROW AT HIGHEST CAGR IN 2020

4 PREMIUM INSIGHTS (Page No. - 94)

4.1 ATTRACTIVE OPPORTUNITIES IN IN-MEMORY COMPUTING MARKET

FIGURE 24 INCREASING DEMAND FOR REAL-TIME AND LOW-LATENCY TRANSACTION PROCESSING CONTRIBUTES TO MARKET GROWTH

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 25 PREDICTIVE ANALYSIS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICA MARKET: BY COMPONENT AND TOP THREE VERTICALS

FIGURE 26 SOLUTIONS SEGMENT AND BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD HIGH MARKET SHARES IN 2020

4.4 MARKET: BY REGION

FIGURE 27 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 96)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IN-MEMORY COMPUTING MARKET

5.2.1 DRIVERS

5.2.1.1 Exponential growth of big data to improve machine-driven decision-making

5.2.1.2 Decrease in the overall cost of RAM and TCO

5.2.1.3 Increase in production with real-time and low-latency transaction processing

5.2.2 RESTRAINTS

5.2.2.1 Lack of standards

5.2.2.2 Increase in volatility of data

5.2.2.3 Lack of skilled workforce and complexity involved in data extraction

5.2.3 OPPORTUNITIES

5.2.3.1 Real-time analysis of data

5.2.3.2 Growth in the need for parallel processing and columnar databases

5.2.3.3 Emergence of AI- and ML-based technologies to gain real-time actionable customer insights

5.2.4 CHALLENGES

5.2.4.1 Data security concerns

5.2.4.2 Incompetence to develop BI applications

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 MARKET EVOLUTION

5.3.1 INTRODUCTION

FIGURE 29 EVOLUTION OF IN-MEMORY COMPUTING MARKET

5.4 CASE STUDY ANALYSIS

5.4.1 INTRODUCTION

5.4.1.1 Use case: Scenario 1

5.4.1.2 Use case: Scenario 2

5.4.1.3 Use case: Scenario 3

5.4.1.4 Use case: Scenario 4

5.4.1.5 Use case: Scenario 5

5.4.1.6 Use case: Scenario 6

5.5 PATENT ANALYSIS

5.5.1 IOT PATENTS FILED

5.6 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS

5.7 TECHNOLOGY ANALYSIS

5.7.1 IN-MEMORY COMPUTING AND AI

5.7.2 IN-MEMORY COMPUTING AND ML

5.7.3 IN-MEMORY COMPUTING AND BLOCKCHAIN

5.7.4 IN-MEMORY COMPUTING AND GEOSPATIAL INFORMATION PROCESSING

5.8 REGULATORY IMPLICATIONS

5.8.1 GENERAL DATA PROTECTION REGULATION

5.8.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.8.3 DODD-FRANK WALL STREET REFORM AND CONSUMER PROTECTION

5.8.4 EUROPEAN BANKING REGULATIONS

5.9 PRICING ANALYSIS

6 IN-MEMORY COMPUTING MARKET: COVID-19 IMPACT (Page No. - 112)

FIGURE 31 MARKET TO WITNESS MINOR DECLINE BETWEEN 2020 AND 2021

7 IN-MEMORY COMPUTING MARKET, BY COMPONENT (Page No. - 113)

7.1 INTRODUCTION

7.1.1 COMPONENTS: COVID-19 IMPACT

7.1.2 COMPONENTS: MARKET DRIVERS

FIGURE 32 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7.2 SOLUTIONS

FIGURE 33 DATA STREAM PROCESSING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 8 SOLUTIONS: IN-MEMORY COMPUTING MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 9 SOLUTIONS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.1 IN-MEMORY DATABASE

FIGURE 34 ONLINE ANALYTICAL PROCESSING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 12 IMDB: MARKET SIZE, BY PROCESSING TYPE, 2014–2019 (USD MILLION)

TABLE 13 IMDB: MARKET SIZE, BY PROCESSING TYPE, 2019–2025 (USD MILLION)

TABLE 14 IMDB: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 15 IMDB: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.1.1 Online analytical processing

TABLE 16 ONLINE ANALYTICAL PROCESSING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 17 ONLINE ANALYTICAL PROCESSING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.1.2 Online transaction processing

TABLE 18 ONLINE TRANSACTIONAL PROCESSING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 19 ONLINE TRANSACTIONAL PROCESSING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.2 IN-MEMORY DATA GRID

TABLE 20 IN-MEMORY DATA GRID: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 IN-MEMORY DATA GRID: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.3 DATA STREAM PROCESSING

TABLE 22 DATA STREAM PROCESSING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 23 DATA STREAM PROCESSING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 SERVICES

FIGURE 35 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 25 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 26 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 27 SERVICES: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.1 PROFESSIONAL SERVICES

FIGURE 36 CONSULTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 29 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 30 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.1.1 Consulting

TABLE 32 CONSULTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 33 CONSULTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.1.2 System Integration and Implementation

TABLE 34 SYSTEM INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 35 SYSTEM INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.1.3 Support and Maintenance

TABLE 36 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 37 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.2 MANAGED SERVICES

TABLE 38 MANAGED SERVICES: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 39 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 IN-MEMORY COMPUTING MARKET, BY APPLICATION (Page No. - 132)

8.1 INTRODUCTION

8.1.1 APPLICATIONS: COVID-19 IMPACT

8.1.2 APPLICATIONS: MARKET DRIVERS

FIGURE 37 PREDICTIVE ANALYSIS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 40 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 41 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

8.2 RISK MANAGEMENT AND FRAUD DETECTION

TABLE 42 RISK MANAGEMENT AND FRAUD DETECTION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 RISK MANAGEMENT AND FRAUD DETECTION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 SENTIMENT ANALYSIS

TABLE 44 SENTIMENT ANALYSIS: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 45 SENTIMENT ANALYSIS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 GEOSPATIAL/GIS PROCESSING

TABLE 46 GEOSPATIAL/GIS PROCESSING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 47 GEOSPATIAL/GIS PROCESSING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5 SALES AND MARKETING OPTIMIZATION

TABLE 48 SALES AND MARKETING OPTIMIZATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 49 SALES AND MARKETING OPTIMIZATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.6 PREDICTIVE ANALYSIS

TABLE 50 PREDICTIVE ANALYSIS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 51 PREDICTIVE ANALYSIS: INMARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.7 SUPPLY CHAIN MANAGEMENT

TABLE 52 SUPPLY CHAIN MANAGEMENT: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 53 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.8 OTHERS

TABLE 54 OTHERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 OTHERS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 IN-MEMORY COMPUTING MARKET, BY DEPLOYMENT MODE (Page No. - 143)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

9.1.2 DEPLOYMENT MODES: MARKET DRIVERS

FIGURE 38 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 56 MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 57 NG MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

9.2 CLOUD

TABLE 58 CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 59 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 ON-PREMISES

TABLE 60 ON-PREMISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 61 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 IN-MEMORY COMPUTING MARKET, BY ORGANIZATION SIZE (Page No. - 148)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

10.1.2 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 39 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 62 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 63 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 64 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 65 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 LARGE ENTERPRISES

TABLE 66 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 67 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 IN-MEMORY COMPUTING MARKET, BY VERTICAL (Page No. - 153)

11.1 INTRODUCTION

11.1.1 VERTICALS: COVID-19 IMPACT

11.1.2 VERTICALS: MARKET DRIVERS

FIGURE 40 HEALTHCARE AND LIFE SCIENCES VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 68 MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 69 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 70 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 71 BANKING, FINANCIAL SERVICES, AND INSURANCES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 IT AND TELECOM

TABLE 72 IT AND TELECOM: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 73 IT AND TELECOM: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.4 RETAIL AND ECOMMERCE

TABLE 74 RETAIL AND ECOMMERCE: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 75 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.5 HEALTHCARE AND LIFE SCIENCES

TABLE 76 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 77 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.6 TRANSPORTATION AND LOGISTICS

TABLE 78 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 79 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.7 GOVERNMENT AND DEFENSE

TABLE 80 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 81 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.8 ENERGY AND UTILITIES

TABLE 82 ENERGY AND UTILITIES: IN-MEMORY COMPUTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 83 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.9 MEDIA AND ENTERTAINMENT

TABLE 84 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 85 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.10 OTHERS

TABLE 86 OTHERS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 87 OTHERS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 IN-MEMORY COMPUTING MARKET, BY REGION (Page No. - 166)

12.1 INTRODUCTION

FIGURE 41 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 88 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 89 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

12.2.4 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

12.2.5 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

12.2.6 CALIFORNIA CONSUMER PRIVACY ACT

12.2.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY IMDB PROCESSING TYPE, 2014–2019 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY IMDB PROCESSING TYPE, 2019–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 101 NORTH AMERICA: IN-MEMORY COMPUTING MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.2.8 UNITED STATES

TABLE 110 UNITED STATES: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 111 UNITED STATES: INMARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.2.9 CANADA

TABLE 112 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

12.3.3 EUROPE: REGULATORY IMPLICATIONS

12.3.4 GENERAL DATA PROTECTION REGULATION

TABLE 114 EUROPE: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY IMDB PROCESSING TYPE, 2014–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY IMDB PROCESSING TYPE, 2019–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 126 EUROPE: IN-MEMORY COMPUTING MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.3.5 UNITED KINGDOM

TABLE 134 UNITED KINGDOM: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3.6 GERMANY

TABLE 136 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 137 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3.7 FRANCE

TABLE 138 FRANCE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 139 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.3.8 REST OF EUROPE

TABLE 140 REST OF EUROPE: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

12.4.4 PERSONAL DATA PROTECTION ACT

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 142 ASIA PACIFIC: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY IMDB PROCESSING TYPE, 2014–2019 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY IMDB PROCESSING TYPE, 2019–2025 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: IN-MEMORY COMPUTING MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.4.5 CHINA

TABLE 162 CHINA: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 163 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4.6 JAPAN

TABLE 164 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 165 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4.7 INDIA

TABLE 166 INDIA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 167 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.4.8 REST OF ASIA PACIFIC

TABLE 168 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.3 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

12.5.4 PERSONAL DATA PROTECTION LAW

TABLE 170 MIDDLE EAST AND AFRICA: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY IMDB PROCESSING TYPE, 2014–2019 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY IMDB PROCESSING TYPE, 2019–2025 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: IN-MEMORY COMPUTING MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.5.5 KINGDOM OF SAUDI ARABIA

TABLE 190 KINGDOM OF SAUDI ARABIA: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 191 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5.6 UNITED ARAB EMIRATES

TABLE 192 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 193 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5.7 SOUTH AFRICA

TABLE 194 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 195 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.5.8 REST OF MIDDLE EAST AND AFRICA

TABLE 196 REST OF MIDDLE EAST AND AFRICA: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

12.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

12.6.4 FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALS

TABLE 198 LATIN AMERICA: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY IMDB PROCESSING TYPE, 2014–2019 (USD MILLION)

TABLE 203 LATIN AMERICA:MARKET SIZE, BY IMDB PROCESSING TYPE, 2019–2025 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 208 LATIN AMERICA: IN-MEMORY COMPUTING MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 209 LATIN AMERICA: INMARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12.6.5 BRAZIL

TABLE 218 BRAZIL: IN-MEMORY COMPUTING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 219 BRAZIL: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.6.6 MEXICO

TABLE 220 MEXICO: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 221 MEXICO: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

12.6.7 REST OF LATIN AMERICA

TABLE 222 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 223 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 224)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 45 MARKET EVALUATION FRAMEWORK

13.3 SHARE OF KEY PLAYERS IN IN-MEMORY COMPUTING MARKET, 2019

FIGURE 46 MARKET SHARE OF KEY PLAYERS, 2019

13.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

13.4.1 INTRODUCTION

FIGURE 47 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF KEY MARKET PLAYERS

13.5 KEY MARKET DEVELOPMENTS

13.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 224 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2020

13.5.2 BUSINESS EXPANSIONS

TABLE 225 BUSINESS EXPANSIONS, 2019

13.5.3 MERGERS AND ACQUISITIONS

TABLE 226 MERGERS AND ACQUISITIONS, 2018

13.5.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 227 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2018–2020

14 COMPANY EVALUATION QUADRANT AND COMPANY PROFILES (Page No. - 234)

14.1 OVERVIEW

14.2 COMPANY EVALUATION QUADRANT DEFINITIONS AND METHODOLOGY

14.2.1 MARKET RANKING ANALYSIS, BY COMPANY

FIGURE 48 RANKING OF KEY PLAYERS, 2020

14.2.2 STAR

14.2.3 EMERGING LEADERS

14.2.4 PERVASIVE

14.2.5 PARTICIPANT

14.3 COMPANY EVALUATION QUADRANT, 2020

FIGURE 49 IN-MEMORY COMPUTING MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

14.4 COMPANY PROFILES

(Business overview, Solutions and services offered, Recent developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

14.4.1 IBM

FIGURE 50 IBM: COMPANY SNAPSHOT

14.4.2 SAP

FIGURE 51 SAP: COMPANY SNAPSHOT

14.4.3 ORACLE

FIGURE 52 ORACLE: COMPANY SNAPSHOT

14.4.4 SAS INSTITUTE

FIGURE 53 SAS INSTITUTE: COMPANY SNAPSHOT

14.4.5 MICROSOFT

FIGURE 54 MICROSOFT: COMPANY SNAPSHOT

14.4.6 TIBCO

14.4.7 ALTIBASE

14.4.8 GIGASPACES

14.4.9 SOFTWARE AG

14.4.10 RED HAT

14.4.11 HAZELCAST

14.4.12 MONGODB

14.4.13 EXASOL

14.4.14 INTEL

14.4.15 QLIK

14.4.16 SALESFORCE

14.4.17 TERADATA

14.4.18 WORKDAY

14.4.19 KOGNITIO

14.4.20 ENEA

14.4.21 VOLTDB

14.4.22 MCOBJECT

14.4.23 MEMSQL

14.4.24 FUJITSU

*Details on Business overview, Solutions and services offered, Recent developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 283)

15.1 ADJACENT/RELATED MARKETS

15.1.1 BIG DATA MARKET

TABLE 228 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 229 SOLUTIONS: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 230 SOLUTIONS: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 231 BIG DATA ANALYTICS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 232 DATA DISCOVERY MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 233 DATA VISUALIZATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 234 DATA MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 235 SERVICES: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 236 SERVICES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 237 MANAGED SERVICES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 238 PROFESSIONAL SERVICES: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 239 PROFESSIONAL SERVICES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 240 CONSULTING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 241 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 242 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 243 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 244 ON-PREMISES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 245 CLOUD: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 246 CLOUD: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 247 PUBLIC CLOUD: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 248 PRIVATE CLOUD: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 249 HYBRID CLOUD: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 250 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 251 LARGE ENTERPRISES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 252 SMALL AND MEDIUM-SIZED ENTERPRISES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 253 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 254 MARKETING AND SALES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 255 OPERATIONS: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 256 FINANCE: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 257 HUMAN RESOURCES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 258 BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 259 BANKING, FINANCIAL SERVICES, AND INSURANCE: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 260 GOVERNMENT AND DEFENSE: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 261 HEALTHCARE AND LIFE SCIENCES: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 262 MANUFACTURING: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 263 RETAIL AND CONSUMER GOODS: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 264 MEDIA AND ENTERTAINMENT: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 265 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 266 TRANSPORTATION AND LOGISTICS: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 267 OTHERS: BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 268 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 269 NORTH AMERICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 270 NORTH AMERICA: BIG DATA MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 271 NORTH AMERICA: BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 272 NORTH AMERICA: BIG DATA MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 273 NORTH AMERICA: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 274 NORTH AMERICA: BIG DATA MARKET SIZE, BY CLOUD TYPE, 2018–2025 (USD MILLION)

TABLE 275 NORTH AMERICA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 276 NORTH AMERICA: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 277 NORTH AMERICA: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 278 NORTH AMERICA: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 279 UNITED STATES: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 280 UNITED STATES: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 281 CANADA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 282 CANADA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 283 EUROPE: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 284 EUROPE: BIG DATA MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 285 EUROPE: BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 286 EUROPE: BIG DATA MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 287 EUROPE: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 288 EUROPE: BIG DATA MARKET SIZE, BY CLOUD TYPE, 2018–2025 (USD MILLION)

TABLE 289 EUROPE: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 290 EUROPE: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 291 EUROPE: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 292 EUROPE: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 293 UNITED KINGDOM: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 294 GERMANY: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 295 FRANCE: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 296 REST OF EUROPE: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 297 ASIA PACIFIC: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 298 ASIA PACIFIC: BIG DATA MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 299 ASIA PACIFIC: BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 300 ASIA PACIFIC: BIG DATA MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 301 ASIA PACIFIC: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 302 ASIA PACIFIC: BIG DATA MARKET SIZE, BY CLOUD TYPE, 2018–2025 (USD MILLION)

TABLE 303 ASIA PACIFIC: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 304 ASIA PACIFIC: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 305 ASIA PACIFIC: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 306 ASIA PACIFIC: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 307 CHINA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 308 JAPAN: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 309 INDIA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 310 REST OF ASIA PACIFIC: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 311 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 312 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 313 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 314 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 315 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 316 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY CLOUD TYPE, 2018–2025 (USD MILLION)

TABLE 317 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 318 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 319 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 320 MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 321 KINGDOM OF SAUDI ARABIA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 322 UNITED ARAB EMIRATES: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 323 SOUTH AFRICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 324 REST OF MIDDLE EAST AND AFRICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 325 LATIN AMERICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 326 LATIN AMERICA: BIG DATA MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 327 LATIN AMERICA: BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 328 LATIN AMERICA: BIG DATA MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 329 LATIN AMERICA: BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 330 LATIN AMERICA: BIG DATA MARKET SIZE, BY CLOUD TYPE, 2018–2025 (USD MILLION)

TABLE 331 LATIN AMERICA: BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 332 LATIN AMERICA: BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

TABLE 333 LATIN AMERICA: BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

TABLE 334 LATIN AMERICA: BIG DATA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 335 BRAZIL: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 336 MEXICO: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 337 REST OF LATIN AMERICA: BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

15.1.2 STREAM ANALYTICS MARKET

TABLE 338 STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 339 STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 340 SOFTWARE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 341 SOFTWARE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 342 SERVICES: STREAMING ANALYTICS MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 343 SERVICES: STREAMING ANALYTICS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 344 SERVICES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 345 SERVICES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 346 PROFESSIONAL SERVICES: STREAMING ANALYTICS MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 347 PROFESSIONAL SERVICES: STREAMING ANALYTICS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 348 PROFESSIONAL SERVICES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 349 PROFESSIONAL SERVICES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 350 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 351 DEPLOYMENT AND INTEGRATION MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 352 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 353 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 354 MANAGED SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 355 MANAGED SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 356 STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 357 STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 358 FRAUD DETECTION: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 359 FRAUD DETECTION: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 360 SALES AND MARKETING: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 361 SALES AND MARKETING: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 362 PREDICTIVE ASSET MANAGEMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 363 PREDICTIVE ASSET MANAGEMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 364 RISK MANAGEMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 365 RISK MANAGEMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 366 NETWORK MANAGEMENT AND OPTIMIZATION: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 367 NETWORK MANAGEMENT AND OPTIMIZATION: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 368 LOCATION INTELLIGENCE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 369 LOCATION INTELLIGENCE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 370 SUPPLY CHAIN MANAGEMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 371 SUPPLY CHAIN MANAGEMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 372 OTHERS: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 373 OTHERS: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 374 STREAMING ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 375 STREAMING ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 376 LARGE ENTERPRISES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 377 LARGE ENTERPRISES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 378 SMALL AND MEDIUM-SIZED ENTERPRISES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 379 SMALL AND MEDIUM-SIZED ENTERPRISES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 380 STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 381 STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 382 CLOUD: STREAMING ANALYTICS MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 383 CLOUD: STREAMING ANALYTICS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 384 CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 385 CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 386 PUBLIC CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 387 PUBLIC CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 388 PRIVATE CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 389 PRIVATE CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 390 HYBRID CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 391 HYBRID CLOUD: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 392 ON-PREMISES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 393 ON-PREMISES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 394 STREAMING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 395 STREAMING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2025 (USD MILLION)

TABLE 396 BANKING, FINANCIAL SERVICES, AND INSURANCE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 397 BANKING, FINANCIAL SERVICES, AND INSURANCE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 398 TELECOMMUNICATIONS AND IT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 399 TELECOMMUNICATIONS AND IT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 400 RETAIL AND ECOMMERCE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 401 RETAIL AND ECOMMERCE: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 402 HEALTHCARE AND LIFE SCIENCES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 403 HEALTHCARE AND LIFE SCIENCES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 404 MANUFACTURING: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 405 MANUFACTURING: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 406 GOVERNMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 407 GOVERNMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 408 ENERGY AND UTILITIES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 409 ENERGY AND UTILITIES: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 410 TRANSPORTATION AND LOGISTICS: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 411 TRANSPORTATION AND LOGISTICS: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 412 MEDIA AND ENTERTAINMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 413 MEDIA AND ENTERTAINMENT: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 414 OTHERS: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 415 OTHERS: STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 416 STREAMING ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 417 STREAMING ANALYTICS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 418 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 419 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 420 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 421 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 422 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 423 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 424 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 425 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 426 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 427 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 428 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 429 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 430 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 431 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY CLOUD TYPE, 2020–2025 (USD MILLION)

TABLE 432 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 433 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2025 (USD MILLION)

TABLE 434 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 435 NORTH AMERICA: STREAMING ANALYTICS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 436 UNITED STATES: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 437 UNITED STATES: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 438 UNITED STATES: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 439 UNITED STATES: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 440 CANADA: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 441 CANADA: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 442 CANADA: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 443 CANADA: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 444 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 445 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 446 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 447 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 448 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 449 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 450 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 451 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 452 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 453 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 454 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 455 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 456 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY CLOUD TYPE, 2014–2019 (USD MILLION)

TABLE 457 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY CLOUD TYPE, 2020–2025 (USD MILLION)

TABLE 458 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 459 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2025 (USD MILLION)

TABLE 460 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 461 EUROPE: STREAMING ANALYTICS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 462 UNITED KINGDOM: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 463 UNITED KINGDOM: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 464 UNITED KINGDOM: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 465 UNITED KINGDOM: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 466 GERMANY: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 467 GERMANY: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 468 GERMANY: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 469 GERMANY: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 470 FRANCE: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 471 FRANCE: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 472 FRANCE: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 473 FRANCE: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 474 SPAIN: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 475 SPAIN: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 476 SPAIN: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 477 SPAIN: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 478 REST OF EUROPE: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 479 REST OF EUROPE: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 480 REST OF EUROPE: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 481 REST OF EUROPE: STREAMING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 482 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 483 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 484 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 485 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 486 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 487 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 488 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 489 ASIA PACIFIC: STREAMING ANALYTICS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)