Data Bus Market by Protocol (MIL-STD-1553, AFDX/ARINC 664, ARINC 429/629, CAN, TTP), Application (Marine, Commercial Aviation, Military Aviation, Automotive), Component (Micro couplers, Cables, Connectors, Accessories), and Region - Global Forecast to 2021

The data bus market is projected to grow from USD 15.70 Billion in 2016 to USD 19.47 Billion by 2021, at a CAGR of 4.41% during the forecast period. The objective of this study is to analyze, define, describe, and forecast the market on the basis of protocol, application, component, and region. The report also focuses on the competitive landscape of this market by profiling companies based on their financial position, product portfolio, growth strategies, and analyzing their core competencies and market share to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnership, mergers & acquisitions (M&A), new product developments, and research & development (R&D) activities in the global data bus market. The year 2015 has been considered as the base year, and the duration between 2016 and 2021 has been considered as the forecast period for this market study.

The data bus market is projected to grow from USD 15.70 Billion in 2016 to USD 19.47 Billion by 2021, at a CAGR of 4.41% during the forecast period. Intensive electrification in automotive, commercial aviation, and marine sectors, modernization of military aircraft, telematics, and need to reduce Swap specifications are the major factors, which are expected to drive the market globally. There is a positive trend towards adoption of AFDX/ARINC 664 and MIL-STD technologies by market leaders. China, India, Brazil, Russia, and Saudi Arabia are the key countries that are expected to witness an increase in demand for data bus.

Based on protocol, the data bus market has been segmented into ARINC 429/629, CAN, TTP, AFDX/ARINC 429/629, and MIL-STD-1553. The ARINC 429/629 segment is estimated to lead the market in 2016. This growth can be attributed to use of these protocols in major applications, namely marine and aircraft, to achieve high accuracy.

Based on application, the marine segment is expected to lead the data bus market during the forecast period. It is estimated to account for the largest share of the market due to upgradation of old military naval systems, which means integration of new technology into the existing naval systems. Data bus plays a vital role in naval systems as it provides a path for data, and connects all on-board computers and sensors.

Based on component, the cables segment is expected to lead the data bus market during the forecast period. It is estimated to account for the largest share of the market due to technological advancements, and use of fiber optics over copper cables, and lightweight cables to save space and cost.

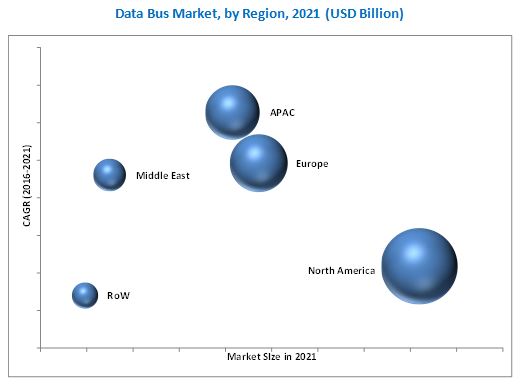

North America is estimated to account for the largest share of the data bus market in 2016. The growth of the market in North America can be attributed to the growth of the electric car industry due to environmental regulations and green initiatives. Furthermore, the Asia-Pacific market is expected to grow at the highest rate. Rise in defense spending of countries in the Asia-Pacific region is expected to drive the data bus market during the forecast period.

The U.S. and the U.K. are witnessing economic slowdown. The U.S. government has drastically reduced its defense spending. According to the U.S. DoD, in 2015, the country solely accounted for approximately USD 650 billion of the total defense spending. Besides the U.K. and the U.S., the European Union, which is recovering from economic crisis, is mulling over trimming its defense budget. In addition, the life cycle of a data bus varies from 35-45years, after which, a data bus is upgraded. Key players prefer replacing the data bus than upgrading it. Hence, the market for data bus remains stagnant for a long period, thereby restraining the growth of the data bus market.

The data bus market is a diversified and competitive market with a large number of players. Key players in the market are TE Connectivity (Switzerland), Amphenol Corporation (U.S.), Fujikura Ltd. (Japan), Corning Inc. (U.S.)., and Rockwell Collins (U.S.), among others. TE Connectivity is the leading player in the data bus market. The company has presence in 20 countries of America, Asia-Pacific, Europe, the Middle East, and Africa. In 2015, the company’s transportation solutions business accounted for a share of approximately 40% of the data bus connectors market. The company focuses on carrying out innovations for each of its products that are launched in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Geographical Coverage

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Shareholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 New Airline Business Models & Emerging Economies

2.2.2 Supply Side Analysis

2.2.2.1 Global It Spending

2.2.2.2 Aircraft Deliveries (2016-2035)

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 35)

3.1 Evolution of Military Data Bus

3.2 North America to Lead Data Bus Market

3.3 Can Protocol to Have Largest Market Share During Forecast Period

3.4 New Product Launches are the Key Focus to Cater to New Requirements Across Applications

4 Premium Insights (Page No. - 41)

4.1 Increasing Global Demand for Data Bus

4.2 Data Bus Market Size, By Protocol, 2016 & 2021

4.3 Market Size, By Application, 2016 & 2021

4.4 Market Size, By Component, 2016 & 2021

4.5 Market Share and Growth Analysis, By Region

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Protocol

5.2.2 By Application

5.2.3 By Component

5.2.4 By Region

5.3 Evolution of Data Bus Protocols

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need to Reduce Swap Specifications

5.4.1.2 Increase in Commercial Aircraft Deliveries

5.4.1.3 Need for Data Integrity & Reliability

5.4.1.4 Need for Acquisition of Flight Data Units

5.4.1.5 Need to Reduce Wiring in Aircraft

5.4.1.6 Telematics

5.4.1.7 Modernization of Military Aircraft

5.4.1.8 Intensive Electrification in Automotive, Commercial Aviation, and Maritime Applications

5.4.2 Restraints

5.4.2.1 Defense Budget Cuts

5.4.2.2 Product Life Cycle

5.4.3 Challenges

5.4.3.1 Increasing Bandwidth

5.4.3.2 Certification Process

5.4.4 Opportunities

5.4.4.1 Glass Cockpits

5.4.4.2 Luxury Car Segment

5.4.5 Burning Issues

5.4.5.1 Safety Critical AFDX

5.4.5.2 Evolution of Mil-Std 1553

5.4.6 Wining Imperative

5.4.6.1 Developing Cost-Efficient Data Bus

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Industry Trends

6.5 Strategic Benchmarking

6.5.1 Technological Integration & Product Enhancement

6.6 Technology Trends

6.6.1 Fiber Optic Cables Over Copper Cables

6.6.2 Ethernet

6.6.3 Distributed Architecture

6.6.4 Emerging TTP to As6802

6.6.5 Flexray as an Emerging Automotive Protocol

6.6.6 Fly-By-Optics

6.6.7 Lightweight Data Bus Cables

7 Data Bus Market, By Component (Page No. - 63)

7.1 Introduction

7.2 Micro Couplers

7.3 Cables

7.4 Connectors

7.5 Accessories

8 Data Bus Market, By Application (Page No. - 70)

8.1 Introduction

8.2 Marine

8.3 Commercial Aviation

8.4 Military Aviation

8.5 Automotive

9 Data Bus Market, By Protocol (Page No. - 78)

9.1 Introduction

9.2 Arinc 429/629

9.3 Can

9.4 TTP

9.5 AFDX/Arinc 664

9.6 Mil-Std 1553

9.6.1 Factors Influencing the Growth of the Mil-Std 1553 Segment in the Data Bus Market

10 Data Bus Market, By Region (Page No. - 83)

10.1 Introduction

10.2 North America

10.2.1 By Protocol

10.2.2 By Application

10.2.3 By Component

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Protocol

10.2.4.1.2 By Application

10.2.4.1.3 By Component

10.2.4.2 Canada

10.2.4.2.1 By Protocol

10.2.4.2.2 By Application

10.2.4.2.3 By Component

10.3 Europe

10.3.1 By Protocol

10.3.2 By Application

10.3.3 By Component

10.3.4 By Country

10.3.4.1 U.K.

10.3.4.1.1 By Protocol

10.3.4.1.2 By Application

10.3.4.1.3 By Component

10.3.4.2 Russia

10.3.4.2.1 By Protocol

10.3.4.2.2 By Application

10.3.4.2.3 By Component

10.3.4.3 France

10.3.4.3.1 By Protocol

10.3.4.3.2 By Application

10.3.4.3.3 By Component

10.3.4.4 Germany

10.3.4.4.1 By Protocol

10.3.4.4.2 By Application

10.3.4.4.3 By Component

10.4 Asia-Pacific

10.4.1 By Protocol

10.4.2 By Application

10.4.3 By Component

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Protocol

10.4.4.1.2 By Application

10.4.4.1.3 By Component

10.4.4.2 India

10.4.4.2.1 By Protocol

10.4.4.2.2 By Application

10.4.4.2.3 By Component

10.4.4.3 South Korea

10.4.4.3.1 By Protocol

10.4.4.3.2 By Application

10.4.4.3.3 By Component

10.4.4.4 Japan

10.4.4.4.1 By Protocol

10.4.4.4.2 By Application

10.4.4.4.3 By Component

10.5 The Middle East

10.5.1 By Protocol

10.5.2 By Application

10.5.3 By Component

10.5.4 By Country

10.5.4.1 Saudi Arabia

10.5.4.1.1 By Protocol

10.5.4.1.2 By Application

10.5.4.1.3 By Component

10.5.4.2 U.A.E.

10.5.4.2.1 By Protocol

10.5.4.2.2 By Application

10.5.4.2.3 By Component

10.6 Rest of the World (RoW)

10.6.1 By Protocol

10.6.2 By Application

10.6.3 By Component

10.6.4 By Country

10.6.4.1 Brazil

10.6.4.1.1 By Protocol

10.6.4.1.2 By Application

10.6.4.1.3 By Component

10.6.4.2 South Africa

10.6.4.2.1 By Protocol

10.6.4.2.2 By Application

10.6.4.2.3 By Component

11 Competitive Landscape (Page No. - 131)

11.1 Overview

11.2 Market Share Analysis, By Company

11.3 Regional Market Share Analysis

11.4 Competitive Situation & Trends

11.4.1 New Product Launches & Developments

11.4.2 Agreements

11.4.3 Acquisitions

11.4.4 Contracts

11.4.5 Partnerships

11.4.6 Other Developments

12 Company Profiles (Page No. - 143)

12.1 Introduction

12.2 Financial Highlights of Key Players

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.3 TE Connectivity Ltd.

12.4 Amphenol Corporation

12.5 Fujikura Ltd.

12.6 Esterline Technologies Corporation

12.7 Corning Inc.

12.8 Rockwell Collins

12.9 Nexans SA

12.10 Astronics Corporation

12.11 Data Device Corporation

12.12 Optical Cable Corporation

12.13 Huber+Suhner AG

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 176)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (95 Tables)

Table 1 Key Growth Factors of Data Bus Market

Table 2 Long Product Life Cycle: A Key Restraint for Growth of the Market

Table 3 Obtaining Mandatory Data Bus Certifications: A Challenge

Table 4 Automotive Industry Paving Favorable Avenues in the Market

Table 5 Emerging Trends in Market

Table 6 Global Data Bus Market Size, By Component, 2014-2021 (USD Million)

Table 7 Micro Couplers: Market Size, By Region, 2014-2021 (USD Million)

Table 8 Cables: Data Bus Market Size, By Region, 2014-2021 (USD Million)

Table 9 Connectors: Market Size, By Region, 2014-2021 (USD Million)

Table 10 Accessories: Data Bus Market Size, By Region, 2014-2021 (USD Million)

Table 11 Data Bus Market Size, By Application, 2014-2021 (USD Million)

Table 12 Market Size, By Protocol, 2014-2021 (USD Million)

Table 13 Market Size, By Region, 2014-2021 (USD Million)

Table 14 North America: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 15 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 16 North America: Market Size, By Component, 2014-2021 (USD Million)

Table 17 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 18 U.S.: Market Landscape (2015)

Table 19 U.S.: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 20 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 21 U.S.: Market Size, By Component, 2014-2021 (USD Million)

Table 22 Canada: Market Landscape (2015)

Table 23 Canada: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 24 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 25 Canada: Market Size, By Component, 2014-2021 (USD Million)

Table 26 Europe: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 27 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 28 Europe: Market Size, By Component, 2014-2021 (USD Million)

Table 29 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 30 U.K.: Market Landscape (2015)

Table 31 U.K.: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 32 U.K.: Market Size, By Application, 2014-2021 (USD Million)

Table 33 U.K.: Market Size, By Component, 2014-2021 (USD Million)

Table 34 Russia: Market Landscape (2015)

Table 35 Russia: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 36 Russia: Market Size, By Application, 2014-2021 (USD Million)

Table 37 Russia: Market Size, By Component, 2014-2021 (USD Million)

Table 38 France: Market Landscape (2015)

Table 39 France: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 40 France: Market Size, By Application, 2014-2021 (USD Million)

Table 41 France: Market Size, By Component, 2014-2021 (USD Million)

Table 42 Germany: Market Landscape (2015)

Table 43 Germany: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 44 Germany: Market Size, By Application, 2014-2021 (USD Million)

Table 45 Germany: Market Size, By Component, 2014-2021 (USD Million)

Table 46 Asia-Pacific: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Component, 2014-2021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Country, 2014-2021 (USD Million)

Table 50 China: Market Landscape (2015)

Table 51 China: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 52 China: Market Size, By Application, 2014-2021 (USD Million)

Table 53 China: Market Size, By Component, 2014-2021 (USD Million)

Table 54 India: Market Landscape (2015)

Table 55 India: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 56 India: Market Size, By Application, 2014-2021 (USD Million)

Table 57 India: Market Size, By Component, 2014-2021 (USD Million)

Table 58 South Korea: Market Landscape (2015)

Table 59 South Korea: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 60 South Korea: Market Size, By Application, 2014-2021 (USD Million)

Table 61 South Korea: Market Size, By Component, 2014-2021 (USD Million)

Table 62 Japan: Market Landscape (2015)

Table 63 Japan: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 64 Japan: Market Size, By Application, 2014-2021 (USD Million)

Table 65 Japan: Market Size, By Component, 2014-2021 (USD Million)

Table 66 Middle East: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 67 Middle-East: Market Size, By Application, 2014-2021 (USD Million)

Table 68 Middle East: Market Size, By Component, 2014-2021 (USD Million)

Table 69 Middle East: Market Size, By Country, 2014-2021 (USD Million)

Table 70 Saudi Arabia: Market Landscape (2015)

Table 71 Saudi Arabia: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 72 Saudi Arabia: Market Size, By Application,2014-2021 (USD Million)

Table 73 Saudi Arabia: Market Size, By Component, 2014-2021 (USD Million)

Table 74 U.A.E.: Market Landscape (2015)

Table 75 U.A.E.: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 76 U.A.E.: Market Size, By Application, 2014-2021 (USD Million)

Table 77 U.A.E.: Market Size, By Component, 2014-2021 (USD Million)

Table 78 Rest of the World: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 79 Rest of the World: Market Size, By Application, 2014-2021 (USD Million)

Table 80 Rest of the World: Market Size, By Component, 2014-2021 (USD Million)

Table 81 Rest of the World: Market Size, By Country, 2014-2021 (USD Million)

Table 82 Brazil: Market Landscape (2015)

Table 83 Brazil: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 84 Brazil: Market Size, By Application, 2014-2021 (USD Million)

Table 85 Brazil: Market Size, By Component, 2014-2021 (USD Million)

Table 86 South Africa: Market Landscape (2015)

Table 87 South Africa: Data Bus Market Size, By Protocol, 2014-2021 (USD Million)

Table 88 South Africa: Market Size, By Application, 2014-2021 (USD Million)

Table 89 South Africa: Market Size, By Component, 2014-2021 (USD Million)

Table 90 New Product Launches & Developments, 2013-2016

Table 91 Agreements, 2013-2016

Table 92 Acquisitions, 2011-2016

Table 93 Contracts, 2011-2016

Table 94 Partnerships, 2013-2016

Table 95 Other Developments, 2010-2015

List of Figures (77 Figures)

Figure 1 Research Design

Figure 2 Military Spending Matrix, By Country, 2013

Figure 3 Annual Spending of U.S. Department of Defense to Decline By 2020

Figure 4 South Asia Accounts for the Highest Annual GDP Growth Rate in 2015

Figure 5 New Opportunities in Commercial Aviation By 2035

Figure 6 Global Premium Car Sales: China to Lead the Premium Car Market By 2020 (In Thousands Units)

Figure 7 Global Passenger Vehicle Sales 2010–2015

Figure 8 Global Automotive Sales, 2014-2015

Figure 9 Global It Spending, 2014–2016 (USD Billion)

Figure 10 Aircraft Deliveries, By Region, 2016-2035

Figure 11 Market Size Estimation Methodology: Bottom-Up Approach

Figure 12 Market Size Estimation Methodology: Top-Down Approach

Figure 13 Data Triangulation Methodology

Figure 14 Assumptions of the Research Study

Figure 15 Evolution of MIL-STD 1553 Data Bus

Figure 16 North America to Lead Data Bus Market, 2016 & 2021 (USD Billion)

Figure 17 Can Protocol to Lead Data Bus Market, 2016 & 2021(USD Billion)

Figure 18 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific to Emerge as A Lucrative Market for Data Bus

Figure 20 Data Bus Revenue Pockets

Figure 21 Acquisitions & New Product Launches Were the Key Growth Strategies Adopted By Top Players

Figure 22 Attractive Market Opportunities in the Market

Figure 23 Growth Opportunities for Can Protocol

Figure 24 Growth Opportunities for Market in Marine Application

Figure 25 Micro Couplers Segment to Witness High Growth Between 2016 and 2021

Figure 26 Untapped Data Bus Market in Asia-Pacific Region

Figure 27 Asia-Pacific Estimated to Witness Increased Growth By 2021

Figure 28 Data Bus Market, By Protocol

Figure 29 Market, By Application

Figure 30 Market, By Component

Figure 31 Data Bus Market, By Region

Figure 32 Evolution - 1970

Figure 33 Need to Reduce Swap Specifications Fueling the Growth of the Market

Figure 34 Data Bus Market: Supply Chain Analysis

Figure 35 Supply Chain of Hardware Components

Figure 36 Data Bus Market: Value Chain Analysis

Figure 37 Technological Integration & Product Enhancement

Figure 38 Russia, India, and China: Attractive Markets for Data Bus Components

Figure 39 The Micro Couplers Segment in Asia-Pacific is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 40 Data Bus Cables Market, By Region (%)

Figure 41 Connectors Segment in North America to Lead the Market

Figure 42 Data Bus Accessories Market, By Region, 2016-2021 (USD Million)

Figure 43 Ship Deliveries, 2014-2021

Figure 44 Commercial Aircraft Deliveries, 2014-2021 (Units)

Figure 45 Data Bus Market for Fixed-Wing Aircraft to Hold Largest Share Between 2014 to 2021

Figure 46 Global Defense Spending, By Country, 2015

Figure 47 Average Age of Fixed-Wing Fleet for Southeast Asian Countries

Figure 48 Airborne and Land-Based Platforms to Occupy More Than Two-Thirds of the Market in the Military Aviation Sector By 2021

Figure 49 Global Automotive Industry Overview

Figure 50 Data Bus Market: Geographic Snapshot (2016-2021)

Figure 51 Russia, India, and China: Lucrative Markets for Data Bus

Figure 52 North America Data Bus Market Snapshot: the U.S. is Estimated to Account for the Largest Market Share in 2016

Figure 53 Europe Data Bus Market Snapshot: Russia Estimated to Account for the Largest Market Share in 2016

Figure 54 Asia-Pacific Data Bus Market Snapshot: China to Account for the Largest Market Share in 2016

Figure 55 Middle East Data Bus Market Snapshot: Saudi Arabia to Account for the Largest Market Share in 2016

Figure 56 Rest of the World Data Bus Market Snapshot: Brazil to Account for the Largest Market Share in 2016

Figure 57 Organic and Inorganic Growth Strategies Followed By Key Players in the Data Bus Market, 2011-2016

Figure 58 Market Share Analysis, 2015

Figure 59 Data Bus Market, By Region 2015

Figure 60 Strategic Acquisitions & New Product Developments are the Key Growth Strategies

Figure 61 Regional Revenue Mix of Top Players

Figure 62 Financial Highlights

Figure 63 TE Connectivity Ltd.: Company Snapshot

Figure 64 TE Connectivity Ltd.: SWOT Analysis

Figure 65 Amphenol Corporation: Company Snapshot

Figure 66 Amphenol Corporation: SWOT Analysis:

Figure 67 Fujikura Ltd.: Company Snapshot

Figure 68 Fujikura Ltd.: SWOT Analysis

Figure 69 Esterline Technologies Corporation: Company Snapshot

Figure 70 Esterline Technologies Corporation: SWOT Analysis

Figure 71 Corning Inc.: Company Snapshot

Figure 72 Corning Inc.: SWOT Analysis

Figure 73 Rockwell Collins: Company Snapshot

Figure 74 Nexans SA: Company Snapshot

Figure 75 Astronics Corporation: Company Snapshot

Figure 76 Optical Cable Corporation: Company Snapshot

Figure 77 Huber+Suhner AG: Company Snapshot

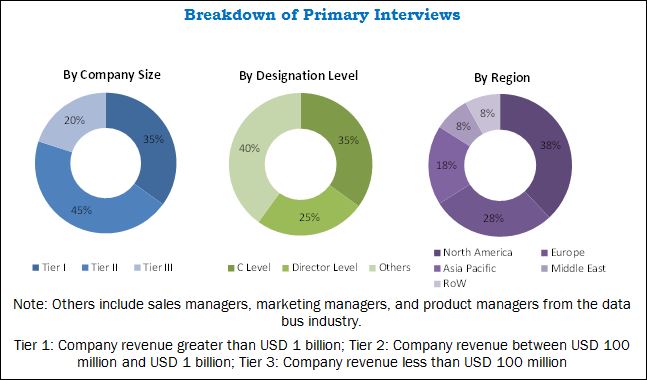

The research methodology used to estimate and forecast the data bus market included study of data and revenues of key players in the market through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Admiration (FAA), International Air transport Association (IATA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall data bus market size from the revenue of key players in the market. After arriving at the overall market size, the market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures was employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Breakdown of profiles of primaries is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The ecosystem of the data bus market comprises protocol, application, and component industries. The data bus value chain includes raw material manufactures, such as Optical Cable Corporation (U.S.), Sterlite Tech (India), among others. Key players operating in the market include TE connectivity (Switzerland), Amphenol Corporations (U.S.), Fujikura Ltd. (Japan), and Corning Inc. (U.S.). Acquisition and new product launches are the major strategies adopted by key players operational in the data bus market. Furthermore, products manufactured by these companies are used by firms, , such as Airbus (France), Boeing (U.S.), Volvo (Sweden), Boeing (U.S.), Newport News Shipbuilding (U.S.), Pipavav (India), and Volkswagen (Germany). This report will help data bus manufacturers, suppliers, distributers, and sub-component manufacturers to identify hot revenue pockets in this market.

Target Audience for this Report

- Data Bus Manufacturers

- Original Equipment Manufacturers (OEMs)

- Sub-component Manufacturers

- Technology Support Providers

- Government and Certification Bodies

- Aircraft manufacturer Associations

- Ships, Automotive manufacturers

“This study answers several questions for stakeholders, primarily, which market segments to focus on during the next two to five years for prioritizing their efforts and investments.”

Scope of the Report:

Data Bus Market, By Component

- Micro Couplers

- Cables

- Connectors

- Accessories

Data Bus Market, By Application

- Marine

- Commercial Aviation

- Military Aviation

- Automotive

Data Bus Market, By Protocol

- ARINC 429/629

- CAN

- TTP

- AFDC/ARINC 664

- MIL-STD-1553

Data Bus Market, By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Rest of the World

Available Customizations

Along with market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for this report:

-

Geographic Analysis

- Further breakdown of the Rest of the World market

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

Growth opportunities and latent adjacency in Data Bus Market

Hello, We need the bus and coach market data of the past years, by region and country. We sell our products to 66 countries. For new market research and benchmarks, we need sale amounts, applications, seats, specifications of buses and coaches sold in that country. Do you have data or a report for these information? Waiting for your response impatiently.