Aviation Analytics Market by Application (Fuel Management, Route Management, Flight Risk Management, inspection, others), End-User (MROs, Airlines, Airports, OEMs), Component, Deployment, Business Function, and - Global Forecast to 2027

Update: 11/22/2024

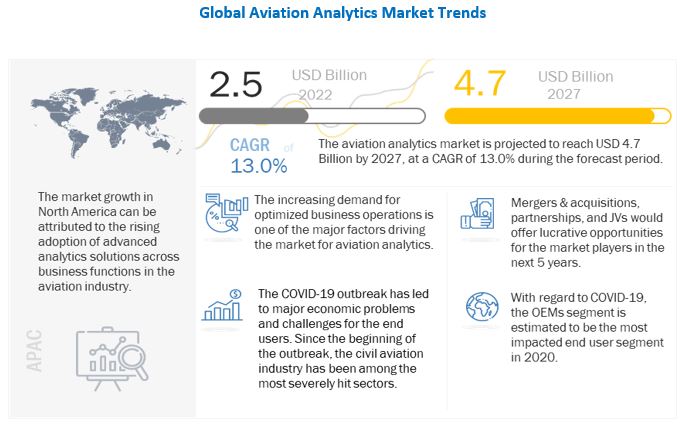

The Global Aviation analytics market Size was valued at USD 2.5 billion in 2022 and is estimated to reach USD 4.7 billion by 2027, growing at a CAGR of 13% during the forecast period.

The increasing requirement to procure advanced analytical software by the aviation industry has led software developers to enhance the capabilities of their predictive, prescriptive, and descriptive analytics solutions for several business functions. Listed below are some of the new technologies observed in the Aviation Analytics Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Aviation Analytics Market

The COVID-19 pandemic has negatively impacted the airport segment of the aviation analytics market.

As several major airports halted their operations completely for a minimum of one business quarter, the lack of business activities has severely impacted revenue generations at airports. Several flights got canceled and delayed for an unforeseen period as governments imposed lockdowns and restricted people movements. International air traffic is negatively affected due to closed international borders. According to IATA, the aviation industry is expected to witness a loss of USD 63 billion from 2020-21.

Aviation Analytics Market Ecosystem

Aviation Analytics Market Segment Overview

Based on component, the solutions segment is projected to lead the market during the forecast period.

Based on component, the aviation analytics market is segmented into solutions and services.

The solutions segment is expected to lead the market during the forecast period due to increased demand for customized aviation analytics solutions that can tackle uncertainties in the aviation business. The services segment offers on-demand functionalities of aviation analytics, such as weather reporting and navigation, to focus on specific targeted areas. The aviation analytics services segment is anticipated to grow at a CAGR of 12.6% during the forecast period.

Based on application, the mobility & functionality segment is projected to grow at the highest CAGR during forecast period.

Based on application, the aviation analytics market is segmented into flight risk management, fuel management, route management, fleet management, inventory management, wealth management, inspection, performance monitoring, predictive analysis, part replacement, supply chain planning, energy management, emergency management, mobility & functionality, and others.

Aviation analytics majorly deals with collecting and analyzing historical data and trends to forecast various stages of a certain business function. The advent of modern analytics tools that are coupled with big data and artificial intelligence provides accurate solutions to analyze critical business functions. This has led to the growing demand for aviation analytics solutions from various OEMs and aircraft maintenance providers to gauge consumer trends and offer their services accordingly. Operational cost savings, improved efficiency, and better customer reach are some of the key benefits of implementing aviation analytics.

Based on end user, the airlines segment is projected to grow at the highest CAGR during forecast period.

Based on end user, the aviation analytics market is segmented into airlines, airports, MROs, and OEMs. The airports segment is expected to lead the market during the forecast period, owing to the increased number of airports in various regions to cater to the rising demand for air travel.

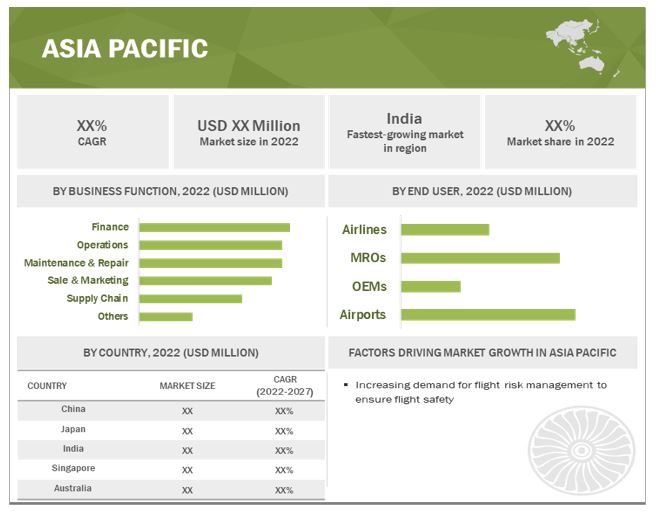

The aviation analytics market in Asia Pacific is projected to grow at the highest CAGR from 2022 to 2027.

The availability of technical expertise and workforce in countries such as China, Japan, and India is one of the major factors driving the aviation analytics market in the Asia Pacific region.

The growing demand for improved functional efficiency and an effective supply chain has positively impacted the aviation analytics market. The presence of startups providing analytics solutions, such as IBS Software Services, is one of the key reasons that aircraft OEMs and MRO solution providers are attracted to the Asia Pacific region where they can procure specifically devised solutions. Aircraft OEMs, such as Boeing and Airbus, are offering contracts to aviation analytics solution providers in China and India. The region is anticipated to showcase a positive growth rate post-COVID-19 scenario.

To know about the assumptions considered for the study, download the pdf brochure

Top 5 Key Market Players in Aviation Analytics Industry

The global Aviation Analytics Companies are dominated by a few globally established players such as

- Oracle Corporation (US),

- General Electric (US),

- Lufthansa Technik (Germany),

- SAP (Germany), and

- IBM Corporation (US).

Aviation Analytics Market Scope

|

Report Metric |

Details |

|

Estimated Value

|

USD 2.5 billion in 2022 |

| Projected Value | USD 4.7 billion by 2027 |

| Growth Rate | CAGR of 13.0% |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Component, By Deployment, By Business Function, By Application, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Rest of the World |

|

Companies covered |

IBM Corporation (US), IFS (Sweden), Ramco Systems (India), Rusada (Switzerland). SAP (Germany), Swiss AviationSoftware (Switzerland), Lufthansa Technik (Germany), General Electric (US), and Honeywell International (US). and others. Total 25 Market Players |

Aviation Analytics Market Dynamics

Driver: Growing emphasis on identifying new market opportunities by analyzing customer behavior and preferences

Aviation analytics helps companies in identifying consumer shifts in preferences so that they can design and offer the best-suited solutions to consumers.

The awareness regarding consumer demands helps airlines to improve their offerings. Large enterprises and SMEs have made significant investments in the field of analytics to ensure customer comfort. Enterprises emphasize smart data and big data analytics to enhance customer experience, resulting in customer loyalty and increased revenues.

In 2019, SAP partnered with an automotive and industry supplier Schaeffler to identify intersecting technology road maps and further drive Schaeffler’s digital transformation by using data analytics. This partnership is focused on improving the customer experience.

Restraint: Lack of appropriate analytical skills

The integration between conventional and modern aviation devices is difficult, which requires huge amount of investments and expertise.

In some cases, new devices have different protocols that make these difficult to adopt. Integration of legacy data systems with new technologies is time and effort-consuming and may distract an organization from its core business activities owing to lack of proper analytical skills .

Opportunity: Use of AI-based analytics solutions for critical functions in aviation industry

The use of aviation analytics in aviation business models requires skilled professionals and can be time-consuming.

Artificial intelligence (AI) is a collection of technologies that excel at extracting insights and patterns from large sets of data, which are then employed to make predictions based on that information. Thus, AI is being used to automate the analytics process to make it more efficient and accessible, owing to the improved user interface through natural language processing.

Companies such as SAP SE and Oracle Corporation offer several aviation analytics solutions that are based upon the use of AI platforms. For example, Oracle Analytics and Oracle cloud ERP are based on AI. Automation platforms, content management systems, and CRMs are some of the available AI-based analytics solutions in the market. Thus, the incorporation of AI into data analytics can act as an opportunity for the aviation analytics market to grow.

Challenge: Economic challenges faced by the aviation industry due to COVID-19

The COVID-19 outbreak has led to major economic problems and challenges for the aviation industry.

Since the beginning of the outbreak, the civil aviation industry has been among the most severely hit sectors globally. The International Civil Aviation Organization (ICAO) and International Air Transport Association (IATA) actively monitor the economic impact on the aviation industry and regularly publishes reports and forecasts.

Aviation Analytics Market Categorization

The study categorizes the aviation analytics market based on Component, Deployment, Application, End User and region.

By Component

- Services

- Solutions

By Deployment

- On-premise

- Cloud

By Business Function

- Finance

- Operations

- Maintenance & Repair

- Sales & Marketing

- Supply Chain

- Others

By Application

- Flight Risk Management

- Fuel Management

- Rout Management

- Fleet Management

- Inventory Management

- Wealth Management

- Inspection

- Performance Monitoring

- Predictive Analysis

- Part Replacement

- Supply Chain Planning

- Energy Management

- Emergency Management

- Mobility & Functionality

- Others

By End User

-

OEMs

- Aircraft OEMs

- Engine OEMs

-

Airlines

- Small Airlines

- Medium Airlines

- Large Airlines

-

Airports

- Small Airports

- Medium Airports

- Large Airports

-

MROs

- Small MROs

- Medium MROs

- Large MROs

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments in Aviation Analytics Industry

- In July 2022, General Electric signed an MoU with Microsoft and Teradata to work on a solution to lower carbon emissions. The three businesses plan to start collaborating to create a product that will give airplane operators the tools they need to monitor, report, and reduce emissions right away. To tackle the problem of cutting aircraft emissions, the collaboration combines the software solutions of three top companies.

- In July 2022, Askdata, a start-up with a focus on search-driven analytics, was acquired by SAP SE to improve its capacity to support businesses in making more informed decisions. Users can search, engage with, and work together on real-time data to maximize business insights. Askdata's customized experience, which is available in many different languages, connects live to source apps without moving data and keeps the entire business context to deliver insightful responses and proactive insights.

- In July 2022, IFS AB finalized a deal to acquire Ultimo Software Solutions, a Dutch company that offers cloud Enterprise Asset Management (EAM) software. Ultimo Software Solutions has established a solid reputation for the comprehensiveness, adaptability, and customizability of its SaaS EAM solutions. As the only vendor now able to provide Cloud native EAM solutions that cater to every firm with either sophisticated end-to-end business demands or as a standalone point solution, IFS AB stands out from competitors thanks to its partnership with Ultimo Software Solutions.

- In July 2022, Malaysia Airlines extended its relationship with SITA to complete a significant upgrade that will provide quick, secure, and dependable network connectivity between its hub in Kuala Lumpur and its international operations. Malaysia Airlines will use SITA Connect, which was created especially for the aviation sector, to satisfy its demands within and outside of airports. SITA's global presence at over 650 airports in 220 countries and territories will provide easy access to new features and apps, cut connectivity costs, improve service quality as well as simplify the check-in process for passengers.

- In May 2022, Oracle Corporation signed a contract to buy Adi Insights, a leading supplier of workforce management systems. The acquisition will enable SuitePeople, NetSuite's human resource management platform, to manage overtime, capture time, estimate demand, and schedule shifts.

Frequently Asked Questions (FAQs):

What are your views on the growth prospect of the aviation analytics market?

Response: The aviation analytics market is expected to grow substantially owing to the growing trend of digitization and expected increasing demand for aircraft fleet, globally.

What are the key sustainability strategies adopted by leading players operating in the aviation analytics market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft actuators market. The major players include IBM Corporation (US), SAP (Germany), Lufthansa Technik (Germany), General Electric (US), and Oracle Corporation (US). and others, these players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the aviation analytics market?

Response: Some of the major emerging technologies and use cases disrupting the market include demand for Software as a Service (SaaS), predictive analytics, and integration of big data technology in aviation analytics applications.

Who are the key players and innovators in the ecosystem of the aviation analytics market?

Response: The key players in the aviation analytics market include IBM Corporation (US), IFS (Sweden), Ramco Systems (India), SAP (Germany), Swiss AviationSoftware (Switzerland), Lufthansa Technik (Germany), General Electric (US), and Honeywell International (US) and others.

Which region is expected to hold the highest market share in the aviation analytics market?

Response: Aviation analytics market in North America is projected to hold the highest market share during the forecast period due to the presence of several aviation analytics service providers in the region.

Which application, such as inspection, performance monitoring, predictive analysis, part replacement and mobility & functionality, is expected to drive the growth of the market in the coming years?

Response: For the aviation analytics market, mobility & functionality is projected to grow at the highest CAGR during the forecast period from 2022 to 2027.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

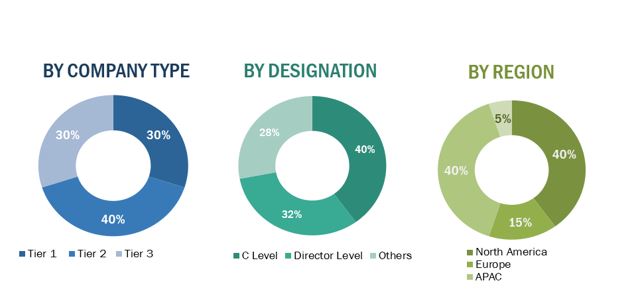

The study involved various activities in estimating the market size for aviation analytics. Exhaustive secondary research was undertaken to collect information on the aviation analytics market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the aviation analytics market.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, European Aviation Safety Agency, United Nations Conference on Trade and Development (UNCTAD), press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the aviation analytics market.

Primary Research

The aviation analytics market comprises several stakeholders such as aircraft MROs, airlines & aircraft operators, aircraft manufacturers, lessors, aircraft engine manufacturers, regulatory bodies, research institutes and organizations, wholesalers, retailers, and distributors of aviation analytics software and services in its supply chain. The supply side is characterized by technological advancements taking place in the field of aviation analytics such as the predictive analytics, blockchain, artificial intelligence, big data analytics. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the aviation analytics market.

To know about the assumptions considered for the study, download the pdf brochure

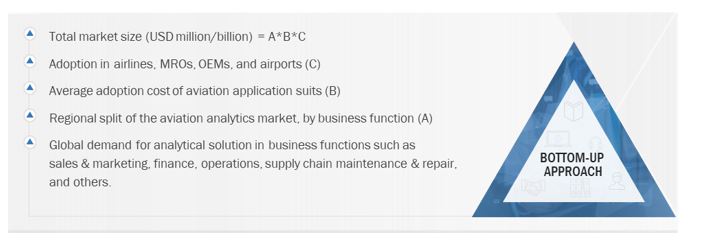

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the aviation analytics market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aviation analytics market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global aviation analytics market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the aviation analytics market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the aviation analytics market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the aviation analytics market based on technology, application, end user, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the aviation analytics market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the aviation analytics market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aviation analytics market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aviation analytics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aviation Analytics Market