Electronic Flight Bag (EFB) Market by Component (Hardware and Software), End User (OEM, Aftermarket), Application, Platform (Commercial Aviation, Business and General Aviation, and Military Aviation), and Region - 2026

Update: 10/23/2024

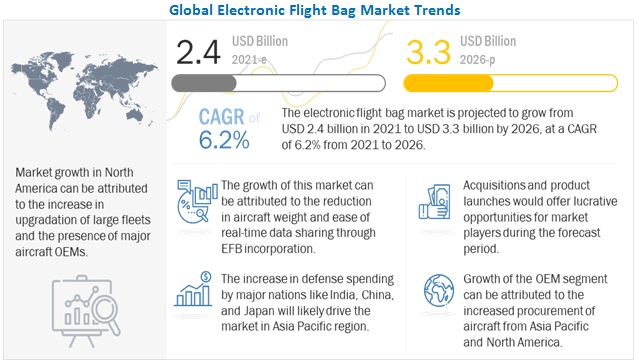

[216 Pages Report] The Global Electronic Flight Bag Market Size was valued at USD 2.4 Billion in 2021 and is estimated to reach USD 3.3 Billion by 2026, growing at a CAGR of 6.2% during the forecast period. Some of the major factors driving this Electronic Flight Bag (EFB) Industry include reduction in aircraft weight through EFB incorporation, increase in aircraft deliveries, real-time data sharing through EFBs, and the use of EFBs for helicopters and eVTOL vehicles.

To know about the assumptions considered for the study, Request for Free Sample Report

Electronic Flight Bag Market Dynamics

Drivers: Reduction in aircraft weight through EFB incorporation

Innovation towards achieving additional weight savings in an aircraft has always been a constant approach of the aviation sector as an airframe made from heavy materials results reduces aircraft efficiency and increases the fuel expenditure of the airline, thereby reducing profit margins. On this note, an aircraft using the conventional paper flight bag adds 18kgs to the aircraft weight, while the same documents and manuals can be accessed digitally on an EFB weighing a maximum of 2.2kg. According to an American Airlines report from 2013, the removal of the kitbag from its entire fleet saved a minimum of 400,000 gallons of fuel annually. Furthermore, an EFB offers additional ease of access to the pilots for accessing a particular document rather than chafing through a bulk of papers in case of any adverse situation, thereby enhancing their response time and agility to respond in unfavorable scenarios. With the global aviation industry setting ambitious goals to improve an average annual fuel efficiency rate of 1.5%, the need for more fuel-efficient aircraft serves as a driver for the growth of the EFB market.

Opportunities: EFBs for helicopters and eVTOL vehicles

EFBs have been highly successful in augmenting the situational awareness of fixed wing aircraft, and manufacturers have begun actively seeking opportunities for the integration of EFBs in rotary wing aircraft. Since the helicopter cockpits have space constraints, an EFB system can help simplify the documentation and operation of helicopters by shaving off the weight of bulky documents that are otherwise required to be carried in a conventional flight bag. EFB systems can also calculate performance figures, thereby reducing the requirement for making manual calculations by the pilots and enhancing their ability to react quickly to an adverse scenario.Moreover, with eVTOLs emerging with the development of the urban air mobility (UAM) concept, the EFBs can function as emergency manuals to the UAM pilot in case something goes wrong. On this note, theeVTOL market is projected to grow to USD 411 million by 2030 at a CAGR of 20.8% driven by developments in the field of electric propulsion technologies.Such developments are envisioned to open up new avenues for customized EFBs.

Challenges: Propensity to failure due to software bugs and the dependency for constant updates

Since EFBs are digital in nature, they are vulnerable to errors in the software and program design and require regular database updates and software revision processes to be carried out by the operators for sustaining high accuracy. This poses a challenge to the growth of the EFB market since the decision to update depends solely on the operator, and failure to do so could lead to malfunctioning of the device and result in accidents. For instance, in April 2015, American Airlines had to ground several aircraft because of technical issues with the app installed on their iPads. The pilots had to uninstall and re-install the updated app to rectify the problem. Such system failures are challenges faced by software developers and program designers of EFBs.

Restraints: High training, initial set-up costs

The introduction of the EFB technology involves training pilots and crew to utilize the full potential of the systems wherein the training is required to reflect the level of functionality and complexity of using the EFB systems. However, the lack of proper training can cause problems in interpreting EFB systems, and an incorrect entry of data pointer can lead to accidents during take-off and landing.

Moreover, personnel training and implementation of EFBs require considerable monetary resources to be invested inthe standardization of procedures. For instance, though the cost of implementation of portable Class 1 EFBs is typically low, the cost of implementing Class 3 EFBs is high as the associated cost of integration of the EFB into the aircraft and approval fee from different regulatory authorities is higher. This deters the rampant adoption of EFBs across all aviation platforms.

Rise in orders for narrow-body aircraft to drive segment

The demand for domestic air travel has been increasing over the years in countries such as the US, the UK, Australia, and India. With the increase in air travel, the demand for narrow-body aircraft is expected to grow across the world. The A320 neo, Bombardier C-series, next-generation B737, and Embraer aircraft are some of the aircraft considered under the narrow-body aircraft segment. Airbus slowed down production in early 2020; however, in January 2021, it announced plans to ramp up production of single-aisle planes in response to the demand for these aircraft. This segment is projected to grow the fastest at a CAGR of 8.2%

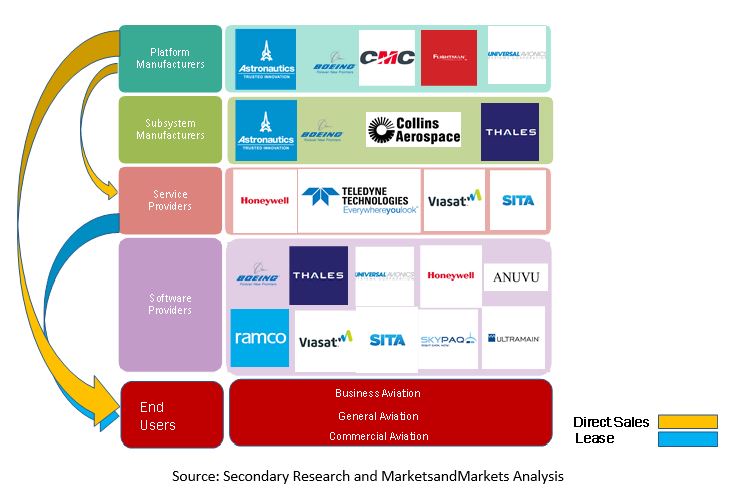

Electronic Flight Bag Market Ecosystem

Platform Manufacturers: These are well-established manufacturers of EFBs that are popular in the market and are used in various civil, business, commercial and military applications. Some companies that fall in this category are Astronautics Corp. of America (US), Boeing (US), CMC Electronics (US), and Flightman (Ireland).

Subsystem Manufacturers: These are the players that manufacture essential EFB components. Some well-known subsystem manufacturers include Astronautics Corp. of America (US), Boeing (US), Collins Aerospace (US), and Thales (France)

Service Providers: These players provide services related to data connectivity and hardware. Some of the service providers in this market are Honeywell (US), SITA (Switzerland), etc.

Software Providers: These companies offer suitable software for chart plotting, connectivity, and communications. These software packages are used in Class 3 EFBs. Some examples of software providers in the electronic flight bag market are Ramco Systems (India), Honeywell (US), and Thales (France).

From the market ecosystem figure above, it can be observed that platform manufacturers of EFBs directly sell EFBs to service providers and to end users such as business aviation, general aviation, and commercial aviation companies.

The commercial aviation segment accounts for the largest market share during the forecast period

Based on platform, the electronic flight market is segmented into three categories: which are commercial, business & general aviation, and military aviation. However, commercial aviation is projected to dominate the market share as the strong sector growth which is driven by increasing air travel, a rise in disposable income of the middle-class population, and increased trade and tourism across the globe has also copped new business opportunities for EFB manufacturers. Since most airlines install EFBs in their aircraft fleet to improve aircraft connectivity, optimize flight paths, or reduce weight, the demand for EFBs is expected to rise on account of new aircraft procurement and ongoing fleet modernization initiatives undertaken by the airline operators.

The software segment is projected to dominate market share during the forecast period

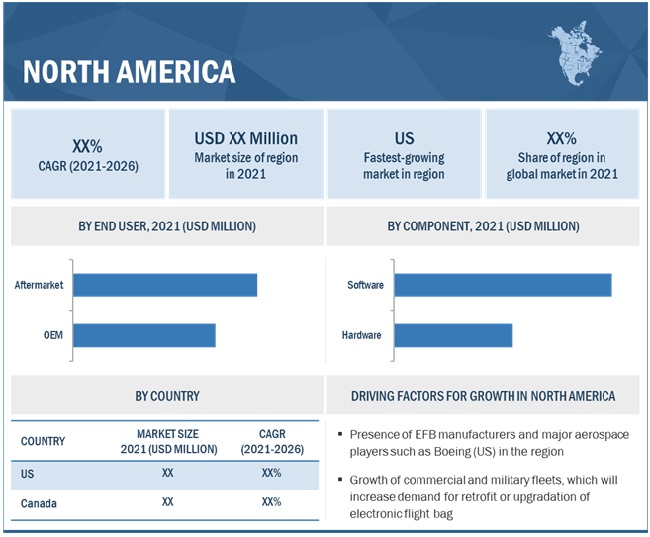

Based on component, the EFB market is segmented into hardware and software. Since software is integral to the operation of both new and old models of EFBs, the software segment is projected to dominate market share as the end users would be required to resort to reliable software services and updates to ensure the optimum operational capabilities of EFB hardware installed onboard their fleet.

The aftermarket segment accounts for the largest market share during the forecast period

The current fleet size comprises a large number of older generation aircraft wherein EFBs are not a standard fitment and need to be installed through the retrofit channel. Airlines buy aircraft EFBs as per their requirements and install them in aircraft. Installation during this stage is majorly done by the supplier of aircraft systems, an in-house airline installation crew, or by a third party. Most aftermarket companies offer services related to the maintenance, upgrade, or replacement of EFBs. With airlines opting to modernize their existing fleet as a cost-saving effort against procuring new aircraft, the aftermarket segment of the EFB market is expected to grow substantially during the forecast period.

The North American marketis projected tocontribute the largest share

Electronic flight bag market in North America is projected to hold the highest market share during the forecast period. The US is expected to lead the North American electronic flight bag market in 2021. The growth of the market in North America can be attributed to the presence of several EFB manufacturers such as The Boeing Company (US), Raytheon Technologies Corporation (US), and Honeywell International Inc. (US), in the region. These major market players continuously invest in R&D to develop EFB systems for aircraft applications with improved efficiency and reliability.Furthermore, the growth of the EFB market in this region is also driven by rapid growth in aircraft manufacturing, technological advancements, and increased air travel.

To know about the assumptions considered for the study, download the pdf brochure

Electronic Flight Bag Industry Companies: Top Key Market Players

The Electronic Flight Bag Companies are dominated by globally established players such as Raytheon Technologies Corporation (US), Honeywell International Inc. (US), The Boeing Company (US), Thales Group (France), and Astronautics Corp. of America (US), among others.

Electronic Flight Bag Market Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 2.4 Billion |

|

Projected Market Size |

USD 3.3 Billion |

|

Growth Rate |

CAGR of 6.2% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, By Component, and By End Use. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World (Latin America + Africa) |

|

Companies covered |

Honeywell (US), Thales (France), Ramco Systems (India), Boeing (US) and Astronautics Corp. of America (US) |

The study categorizes the electronic flight bag market based By Platform, By Component, By End Use, By Application and Geography.

Electronic Flight Bag Market By Platform

- Commercial Aviation

- Business and General Aviation

- Military Aviation

By Component

- Hardware

- Software

By End Use

- OEM

- Aftermarket

By Application

Electronic Flight Bag Market By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In June 2021, Collins Aerospace, a Raytheon Technologies business, plans to increase the operating efficiency of inflight services, enhance the passenger experience, and reduce cabin touchpoints with its new Electronic Cabin Bag (eCB) solution.

- In June 2020, Ultramain Systems launched ULTRAMAIN ELB for Windows OS.

- In August 2019, Boeing, through its subsidiary Jeppesen launched tailored charts for avionics, which were initially introduced with Honeywell Primus Epic INAV avionics systems for tailored chart customers operating Embraer E2 commercial aircraft. Regional airline Wideroe of Norway was the first operator to use the new tailored navigation service.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the electronic flight bag market?

The electronic flight bag market is expected to grow substantially owing to increase in aircraft deliveries and the need for more light aircraft with improved systems which also increase crew efficiency.

What are the new emerging technologies and use cases disrupting the EFB market?

Some of the major emerging technologies and use cases disrupting the market include the use of electronic flight folders, airport moving charts, navigation charts with own ship position indicators and real-time weather charts.

Who are the key players and innovators in the ecosystem of the Electronic Flight Bag Market?

The key players in Electronic Flight Bag Market include Collins Aerospace (US), Honeywell (US), Boeing (US), Thales (France), and Astronautics Corp. of America (US)

Which region is expected to hold the highest market share in the Electronic Flight Bag Market?

Electronic flight bag market in North America is projected to hold the highest market share during the forecast period. The growth of the EFB market in this region is also driven by rapid growth in aircraft manufacturing, technological advancements, and increased air travel. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKETS COVERED

FIGURE 1 ELECTRONIC FLIGHT BAG MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

TABLE 1 PRIMARY INTERVIEWEE DETAILS

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary insights

2.1.2.3 Breakdown of primaries

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increasing demand for aftermarket services

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Advancements in EFB technology

2.3 MARKET SIZE ESTIMATION

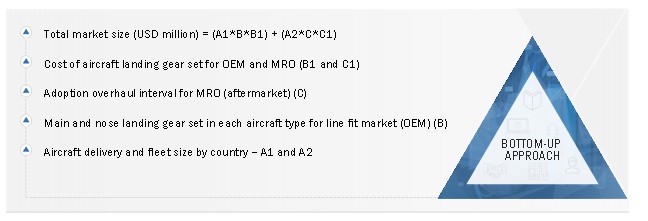

2.4 RESEARCH APPROACH AND METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.2 ELECTRONIC FLIGHT BAG (EFB) MARKET FOR OEM

FIGURE 4 MARKET SIZE CALCULATION FOR OEM

2.4.3 ELECTRONIC FLIGHT BAG (EFB) AFTERMARKET

FIGURE 5 MARKET SIZE CALCULATION FOR AFTERMARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)

2.4.4 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION & VALIDATION

FIGURE 9 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

TABLE 2 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 GROWTH RATE ASSUMPTIONS

2.8 RISKS

TABLE 3 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 10 OEM SEGMENT TO HAVE HIGHER CAGR DURING FORECAST PERIOD

FIGURE 11 COMMERCIAL AVIATION TO LEAD ELECTRONIC FLIGHT BAG MARKET DURING FORECAST PERIOD

FIGURE 12 SOFTWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN ELECTRONIC FLIGHT BAG MARKET

FIGURE 14 REDUCTION IN AIRCRAFT WEIGHT AND EASE OF REAL-TIME DATA SHARING THROUGH EFB INCORPORATION DRIVE MARKET GROWTH

4.2 ELECTRONIC FLIGHT BAG, BY END USER

FIGURE 15 AFTERMARKET SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 ELECTRONIC FLIGHT BAG SOFTWARE MARKET, BY TYPE

FIGURE 16 TYPE B SOFTWARE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 ASIA PACIFIC ELECTRONIC FLIGHT BAG, BY COUNTRY, 2021

FIGURE 17 CHINA ESTIMATED TO DOMINATE ELECTRONIC FLIGHT BAG MARKET IN ASIA PACIFIC IN 2021

4.5 ELECTRONIC FLIGHT BAG, BY PLATFORM

FIGURE 18 COMMERCIAL AVIATION TO DOMINATE ELECTRONIC FLIGHT BAG MARKET FROM 2021 TO 2026

4.6 ELECTRONIC FLIGHT BAG, BY COMPONENT

FIGURE 19 SOFTWARE SEGMENT TO HOLD LEADING POSITION DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR ELECTRONIC FLIGHT BAG MARKET DURING FORECAST PERIOD

5.2.1 DRIVERS

5.2.1.1 Reduction in aircraft weight through EFB incorporation

5.2.1.2 Real-time data sharing a possibility through EFBs

5.2.1.3 Post pandemic driver: Increase in aircraft deliveries up to 2024

5.2.2 RESTRAINTS

5.2.2.1 Lack of unified global regulatory frameworks/mandates

5.2.2.2 High training, initial set-up costs

5.2.3 OPPORTUNITIES

5.2.3.1 EFBs for helicopters and eVTOL vehicles

5.2.4 CHALLENGES

5.2.4.1 Cybersecurity threats as a result of interconnected systems

5.2.4.2 Propensity for failure due to software bugs and updates

5.3 COVID-19 IMPACT ON ELECTRONIC FLIGHT BAG MARKET

FIGURE 21 COVID-19 IMPACT ON ELECTRONIC FLIGHT BAG MARKET

FIGURE 22 COVID-19 IMPACT ON SUPPLY AND DEMAND IN ELECTRONIC FLIGHT BAG MARKET

5.4 RANGE/SCENARIOS

FIGURE 23 PESSIMISTIC, REALISTIC, AND OPTIMISTIC SCENARIOS OF ELECTRONIC FLIGHT BAG MARKET WITH REGARDS TO COVID-19 PANDEMIC

5.5 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE: ELECTRONIC FLIGHT BAG (ANNUAL SOFTWARE SUBSCRIPTION)

5.6 OPERATIONAL DATA

TABLE 5 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-2038

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS FOR ELECTRONIC FLIGHT BAG MARKET

5.7.1 RESEARCH & DEVELOPMENT

5.7.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

5.7.3 ASSEMBLY, TESTING, AND APPROVAL

5.7.4 DISTRIBUTION AND AFTER-SALE SERVICES

5.8 MARKET ECOSYSTEM MAP

FIGURE 25 MARKET ECOSYSTEM MAP FOR ELECTRONIC FLIGHT BAG MARKET

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.9.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRONIC FLIGHT BAG MARKET

FIGURE 26 REVENUE SHIFT CURVE FOR ELECTRONIC FLIGHT BAG

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS OF ELECTRONIC FLIGHT BAG MARKET

TABLE 6 PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWERS OF SUPPLIERS

5.10.4 BARGAINING POWERS OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 TRADE ANALYSIS: IMPORT/EXPORT DATA

TABLE 7 GLOBAL IMPORTERS AND EXPORTERS OF AIRCRAFT PARTS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 FAA REGULATIONS

5.12.2 EASA REGULATIONS

5.12.3 CASA REGULATIONS

5.12.4 ICAO REGULATIONS

5.13 CASE STUDIES

5.13.1 SRILANKAN AIRLINES

5.13.2 LUFTHANSA CITYLINE

5.13.3 RYANAIR

5.13.4 REGA

5.13.5 UTAIR HELICOPTER SERVICES

6 INDUSTRY TRENDS (Page No. - 67)

6.1 INTRODUCTION

6.2 MARKET EVOLUTION

FIGURE 28 EFB MARKET EVOLUTION

6.2.1 SOFTWARE

6.2.2 HARDWARE

6.3 TECHNOLOGY ANALYSIS

6.3.1 CLOUD TECHNOLOGY

6.3.2 DATA ANALYTICS

6.3.3 BATTERY TECHNOLOGY

6.4 CERTIFICATION FOR EFB

6.5 INNOVATIONS & PATENT REGISTRATIONS

TABLE 8 INNOVATIONS & PATENT REGISTRATIONS, 2016–2021

7 ELECTRONIC FLIGHT BAGS MARKET, BY PLATFORM (Page No. - 70)

7.1 INTRODUCTION

7.2 COVID-19 IMPACT ON PLATFORM SEGMENT OF ELECTRONIC FIGHT BAG MARKET

7.2.1 MOST IMPACTED PLATFORM SEGMENT

7.2.2 LEAST IMPACTED PLATFORM SEGMENT

FIGURE 29 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET FROM 2021 TO 2026

TABLE 9 ELECTRONIC FIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 10 ELECTRONIC FIGHT BAG MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.3 COMMERCIAL AVIATION

TABLE 11 COMMERCIAL ELECTRONIC FIGHT BAG MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 12 COMMERCIAL ELECTRONIC FIGHT BAG MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.3.1 NARROW-BODY AIRCRAFT

7.3.1.1 Rise in orders for narrow-body aircraft to drive segment

7.3.2 WIDE-BODY AIRCRAFT

7.3.2.1 Weight reduction in wide-body aircraft boost segment growth

7.3.3 REGIONAL AIRCRAFT

7.3.3.1 Retrofits of EFB systems in regional aircraft to drive segment growth

7.4 BUSINESS & GENERAL AVIATION

TABLE 13 BUSINESS & GENERAL AVIATION ELECTRONIC FIGHT BAG MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 14 BUSINESS & GENERAL AVIATION ELECTRONIC FIGHT BAG MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.4.1 LIGHT AIRCRAFT

7.4.1.1 Usage of light aircraft for various purposes will drive market for EFBs

7.4.2 BUSINESS JETS

7.4.2.1 Rise in popularity of business jets to act as a catalyst for EFB demand

7.4.3 COMMERCIAL HELICOPTERS

7.4.3.1 Increasing popularity of EFBs to ease pilot tasks and reduce weight boost segment growth

7.5 MILITARY AVIATION

TABLE 15 MILITARY ELECTRONIC FIGHT BAG MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 16 MILITARY ELECTRONIC FIGHT BAG MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.5.1 COMBAT AIRCRAFT

7.5.1.1 Growing procurement of fighter aircraft to fuel demand for electronic flight bags during forecast period

7.5.2 TRANSPORT AIRCRAFT

7.5.2.1 Use of EFBs for navigation and flight planning in transport fuels segment growth

7.5.3 MILITARY HELICOPTERS

7.5.3.1 Use in flight planning applications fuels segment growth

8 ELECTRONIC FLIGHT BAG MARKET, BY COMPONENT (Page No. - 77)

8.1 INTRODUCTION

FIGURE 30 SOFTWARE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 18 BY COMPONENT, 2021–2026 (USD MILLION)

8.2 HARDWARE

TABLE 19 MARKET, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 20 BY HARDWARE, 2021–2026 (USD MILLION)

8.2.1 PORTABLE (CLASS 1, 2)

8.2.1.1 Portable EFB segment to grow due to affordability and easy availability of hardware

8.2.2 INSTALLED (CLASS 3)

8.2.2.1 High certification standards and hardware challenges lead to slower growth rate

8.3 SOFTWARE

TABLE 21 BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 22 BY SOFTWARE, 2021–2026 (USD MILLION)

8.3.1 TYPE A

8.3.1.1 Low cost and availability of PEDs a major driving factor for growth

8.3.2 TYPE B

8.3.2.1 High functionality, advanced functions, and compatibility with PEDs drive Type B segment

8.3.3 TYPE C

8.3.3.1 High certification standards and stringent airworthiness requirements inhibit Type C segment

9 ELECTRONIC FLIGHT BAG MARKET, BY END USER (Page No. - 82)

9.1 INTRODUCTION

9.1.1 IMPACT OF COVID-19 ON END USER SEGMENT

9.1.1.1 Highest impacted end user segment

9.1.1.2 Least impacted end user segment

FIGURE 31 AFTERMARKET SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 23 BY END USER, 2017–2020 (USD MILLION)

TABLE 24 BY END USER, 2021–2026 (USD MILLION)

9.2 OEM

9.2.1 INCREASING AIRCRAFT DELIVERIES TO DRIVE SEGMENT

TABLE 25 OEM MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 26 ELECTRONIC FLIGHT BAG OEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

9.3 AFTERMARKET

9.3.1 AFTERMARKET INSTALLATION FOR OLDER FLEETS BOOSTS SEGMENT

TABLE 27 ELECTRONIC FLIGHT BAG AFTERMARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 28 ELECTRONIC FLIGHT BAG AFTERMARKET, BY PLATFORM, 2021–2026 (USD MILLION)

10 ELECTRONIC FLIGHT BAG MARKET, BY APPLICATION (Page No. - 86)

10.1 INTRODUCTION

10.2 AIRPORT MOVING CHARTS

10.2.1 IMPROVED SITUATIONAL AND ENVIRONMENTAL AWARENESS DRIVES SEGMENT

10.3 FLIGHT PERFORMANCE MONITORING

10.3.1 REDUCTION IN COST DUE TO FLIGHT PERFORMANCE MONITORING BOOSTS SEGMENT

10.4 FLIGHT PLANNING

10.4.1 FUEL SAVINGS DUE TO EFFICIENT ROUTE PLANNING AND OPTIMIZATION - KEY FACTOR FOR SEGMENT GROWTH

10.5 WEATHER UPDATES

10.5.1 IMPROVEMENT OF SAFETY PARAMETERS DUE TO LIVE WEATHER REPORTS FUELS SEGMENT

10.6 E-MANUALS

10.6.1 SEGMENT DRIVEN BY REDUCTION OF WEIGHT DUE TO DIGITIZATION OF MANUALS

10.7 OTHERS

10.7.1 ADDED FUNCTIONALITIES TO SUPPLEMENT CREW PERFORMANCE MAKE FLIGHTS SAFER

11 ELECTRONIC FLIGHT BAG MARKET, BY REGION (Page No. - 88)

11.1 INTRODUCTION

FIGURE 32 MARKET: REGIONAL SNAPSHOT

11.2 IMPACT OF COVID-19 ON BY REGION

FIGURE 33 : GLOBAL SCENARIOS

TABLE 29 , BY REGION, 2017–2020 (USD MILLION)

TABLE 30 , BY REGION, 2021–2026 (USD MILLION)

TABLE 31 ELECTRONIC FLIGHT BAG AFTERMARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 ELECTRONIC FLIGHT BAG AFTERMARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 ELECTRONIC FLIGHT BAG OEM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 ELECTRONIC FLIGHT BAG OEM MARKET, BY REGION, 2021–2026 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 34 NORTH AMERICA: ELECTRONIC FLIGHT BAG MARKET SNAPSHOT

11.3.1 PESTLE ANALYSIS

TABLE 35 NORTH AMERICA: , BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 36 NORTH AMERICA: BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 38 NORTH AMERICA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: ELECTRONIC FLIGHT BAG IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: ELECTRONIC FLIGHT BAG IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: ELECTRONIC FLIGHT BAG IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: ELECTRONIC FLIGHT BAG IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: ELECTRONIC FLIGHT BAG IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: ELECTRONIC FLIGHT BAG IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 46 NORTH AMERICA: BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: BY END USER, 2017–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: BY END USER, 2021–2026 (USD MILLION)

11.3.2 US

11.3.2.1 Technological advancements in air travel to drive EFB market in US

TABLE 53 US: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 54 US: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 55 US: BY END USER, 2017–2020 (USD MILLION)

TABLE 56 US: BY END USER, 2021–2026 (USD MILLION)

TABLE 57 US: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 58 US: BY COMPONENT, 2021–2026 (USD MILLION)

11.3.3 CANADA

11.3.3.1 Increased delivery of new aircraft to drive market in Canada

TABLE 59 CANADA: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 60 CANADA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 61 CANADA: BY END USER, 2017–2020 (USD MILLION)

TABLE 62 CANADA: BY END USER, 2021–2026 (USD MILLION)

TABLE 63 CANADA: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 64 CANADA: BY COMPONENT, 2021–2026 (USD MILLION)

11.4 EUROPE

FIGURE 35 EUROPE: ELECTRONIC FLIGHT BAG MARKET SNAPSHOT

11.4.1 PESTLE ANALYSIS

TABLE 65 EUROPE: BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 66 EUROPE: BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 68 EUROPE: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 70 EUROPE: IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 71 EUROPE: IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 72 EUROPE: IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 73 EUROPE: IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 74 EUROPE: IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 75 EUROPE: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 76 EUROPE: BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 77 EUROPE: BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 78 EUROPE: BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 79 EUROPE: BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 80 EUROPE: BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: BY END USER, 2017–2020 (USD MILLION)

TABLE 82 EUROPE: BY END USER, 2021–2026 (USD MILLION)

11.4.2 UK

11.4.2.1 Technological advancements in air travel drive market in UK

TABLE 83 UK: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 84 UK: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 85 UK: BY END USER, 2017–2020 (USD MILLION)

TABLE 86 UK: BY END USER, 2021–2026 (USD MILLION)

TABLE 87 UK: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 88 UK: BY COMPONENT, 2021–2026 (USD MILLION)

11.4.3 FRANCE

11.4.3.1 Significant investments in aerospace to drive market in France

TABLE 89 FRANCE: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 90 FRANCE: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 91 FRANCE: BY END USER, 2017–2020 (USD MILLION)

TABLE 92 FRANCE: BY END USER, 2021–2026 (USD MILLION)

TABLE 93 FRANCE: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 94 FRANCE: BY COMPONENT, 2021–2026 (USD MILLION)

11.4.4 GERMANY

11.4.4.1 Rising commercial aircraft fleet and investments in aviation sector to drive market in Germany

TABLE 95 GERMANY: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 96 GERMANY: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 97 GERMANY: BY END USER, 2017–2020 (USD MILLION)

TABLE 98 GERMANY: BY END USER, 2021–2026 (USD MILLION)

TABLE 99 GERMANY: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 100 GERMANY: BY COMPONENT, 2021–2026 (USD MILLION)

11.4.5 ITALY

11.4.5.1 Aviation industry growing in air freight and passenger volume in Italy

TABLE 101 ITALY: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 102 ITALY: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 103 ITALY: BY END USER, 2017–2020 (USD MILLION)

TABLE 104 ITALY: BY END USER, 2021–2026 (USD MILLION)

TABLE 105 ITALY: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 106 ITALY: BY COMPONENT, 2021–2026 (USD MILLION)

11.4.6 SPAIN

11.4.6.1 Increasing procurement of new military aircraft to drive Spain market

TABLE 107 SPAIN: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 108 SPAIN: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 109 SPAIN: BY END USER, 2017–2020 (USD MILLION)

TABLE 110 SPAIN: BY END USER, 2021–2026 (USD MILLION)

TABLE 111 SPAIN: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 112 SPAIN: BY COMPONENT, 2021–2026 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 113 REST OF EUROPE: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 114 REST OF EUROPE: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 115 REST OF EUROPE: BY END USER, 2017–2020 (USD MILLION)

TABLE 116 REST OF EUROPE: BY END USER, 2021–2026 (USD MILLION)

TABLE 117 REST OF EUROPE: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 118 REST OF EUROPE: BY COMPONENT, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC ELECTRONIC FLIGHT BAG MARKET SNAPSHOT

11.5.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 120 ASIA PACIFIC: BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: BY END USER, 2017–2020 (USD MILLION)

TABLE 122 ASIA PACIFIC: BY END USER, 2021–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: BY SOFTWARE, 2021–2026 (USD MILLION)

11.5.2 CHINA

11.5.2.1 Increasing demand for aerospace products to drive market in China

TABLE 137 CHINA: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 138 CHINA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 139 CHINA: BY END USER, 2017–2020 (USD MILLION)

TABLE 140 CHINA: BY END USER, 2021–2026 (USD MILLION)

TABLE 141 CHINA: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 142 CHINA: BY COMPONENT, 2021–2026 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Increased commercial and military aircraft fleets to drive market in India

TABLE 143 INDIA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 144 INDIA: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 145 INDIA: BY END USER, 2017–2020 (USD MILLION)

TABLE 146 INDIA: BY END USER, 2021–2026 (USD MILLION)

TABLE 147 INDIA: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 148 INDIA: BY COMPONENT, 2021–2026 (USD MILLION)

11.5.4 JAPAN

11.5.4.1 Increasing in-house development of aircraft to drive market in Japan

TABLE 149 JAPAN: BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 150 JAPAN: BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 151 JAPAN: BY END USER, 2017–2020 (USD MILLION)

TABLE 152 JAPAN: BY END USER, 2021–2026 (USD MILLION)

TABLE 153 JAPAN: BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 154 JAPAN: BY COMPONENT, 2021–2026 (USD MILLION)

11.5.5 AUSTRALIA

11.5.5.1 Increase in air traffic and new aircraft deliveries to fuel Australian market

TABLE 155 AUSTRALIA: ELECTRONIC FLIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 156 AUSTRALIA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 157 AUSTRALIA: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 158 AUSTRALIA: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 159 AUSTRALIA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 160 AUSTRALIA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.6 SOUTH KOREA

11.5.6.1 Modernization programs in aviation industry to drive South Korean market

TABLE 161 SOUTH KOREA: ELECTRONIC FLIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 162 SOUTH KOREA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 163 SOUTH KOREA: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 164 SOUTH KOREA: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 165 SOUTH KOREA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 166 SOUTH KOREA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.7 REST OF ASIA PACIFIC

11.5.7.1 Large number of MRO players to drive market

TABLE 167 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 171 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.6 MIDDLE EAST

FIGURE 37 MIDDLE EAST: ELECTRONIC FLIGHT BAG MARKET SNAPSHOT

11.6.1 PESTLE ANALYSIS

TABLE 173 MIDDLE EAST: ELECTRONIC FLIGHT BAG MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 174 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 175 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 176 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 177 MIDDLE EAST: ELECTRONIC FLIGHT BAG IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 178 MIDDLE EAST: ELECTRONIC FLIGHT BAG IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 179 MIDDLE EAST: ELECTRONIC FLIGHT BAG IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 180 MIDDLE EAST: ELECTRONIC FLIGHT BAG IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 181 MIDDLE EAST: ELECTRONIC FLIGHT BAG IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 182 MIDDLE EAST: ELECTRONIC FLIGHT BAG IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 183 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 184 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 185 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 186 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 187 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 188 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 189 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 190 MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

11.6.2 SAUDI ARABIA

11.6.2.1 Technological advancements in air travel to drive market in Saudi Arabia

TABLE 191 SAUDI ARABIA: ELECTRONIC FLIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 192 SAUDI ARABIA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 193 SAUDI ARABIA: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 194 SAUDI ARABIA: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 195 SAUDI ARABIA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 196 SAUDI ARABIA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.3 UAE

11.6.3.1 Significant investments in aerospace to boost market in UAE

TABLE 197 UAE: ELECTRONIC FLIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 198 UAE: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 199 UAE: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 200 UAE: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 201 UAE: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 202 UAE: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.4 ISRAEL

11.6.4.1 Procurement of military aircraft to drive market in Israel

TABLE 203 ISRAEL: ELECTRONIC FLIGHT BAG MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 204 ISRAEL: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 205 ISRAEL: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 206 ISRAEL: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 207 ISRAEL: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 208 ISRAEL: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.5 REST OF MIDDLE EAST

11.6.5.1 Aftermarket services like maintenance and repair lead market growth in Rest of Middle East

TABLE 209 REST OF MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 210 REST OF MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 211 REST OF MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 212 REST OF MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 213 REST OF MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 214 REST OF MIDDLE EAST: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.7 REST OF THE WORLD

FIGURE 38 REST OF THE WORLD: ELECTRONIC FLIGHT BAG MARKET SNAPSHOT

11.7.1 PESTLE ANALYSIS

TABLE 215 REST OF THE WORLD: ELECTRONIC FLIGHT BAG MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 216 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 217 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 218 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 219 REST OF THE WORLD: ELECTRONIC FLIGHT BAG IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 220 REST OF THE WORLD: ELECTRONIC FLIGHT BAG IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 221 REST OF THE WORLD: ELECTRONIC FLIGHT BAG IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 222 REST OF THE WORLD: ELECTRONIC FLIGHT BAG IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 223 REST OF THE WORLD: ELECTRONIC FLIGHT BAG IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 224 REST OF THE WORLD: ELECTRONIC FLIGHT BAG IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 225 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 226 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 227 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 228 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 229 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 230 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY SOFTWARE, 2021–2026 (USD MILLION)

TABLE 231 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 232 REST OF THE WORLD: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

11.7.2 AFRICA

11.7.2.1 Foreign investments in aviation industry to act as driver for market in Africa

TABLE 233 AFRICA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 234 AFRICA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 235 AFRICA: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 236 AFRICA: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 237 AFRICA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 238 AFRICA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

11.7.3 LATIN AMERICA

11.7.3.1 Growing aircraft fleets to boost market in Latin America

TABLE 239 LATIN AMERICA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 240 LATIN AMERICA: ELECTRONIC FLIGHT BAG, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 241 LATIN AMERICA: ELECTRONIC FLIGHT BAG, BY END USER, 2017–2020 (USD MILLION)

TABLE 242 LATIN AMERICA: ELECTRONIC FLIGHT BAG, BY END USER, 2021–2026 (USD MILLION)

TABLE 243 LATIN AMERICA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 244 LATIN AMERICA: ELECTRONIC FLIGHT BAG, BY COMPONENT, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 164)

12.1 INTRODUCTION

12.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 39 RANKING OF KEY PLAYERS IN ELECTRONIC FLIGHT BAG, 2020

12.2.1 WINNING IMPERATIVES, BY KEY PLAYER

12.3 MARKET SHARE ANALYSIS

FIGURE 40 SHARE OF LEADING PLAYERS IN ELECTRONIC FLIGHT BAG, 2020

12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2016–2020

FIGURE 41 REVENUE OF LEADING PLAYERS IN ELECTRONIC FLIGHT BAG, 2020

12.5 COMPETITIVE LEADERSHIP MAPPING

12.5.1 VISIONARY LEADER

12.5.2 INNOVATOR

12.5.3 DYNAMIC DIFFERENTIATOR

12.5.4 EMERGING COMPANY

FIGURE 42 ELECTRONIC FLIGHT BAG COMPETITIVE LEADERSHIP MAPPING, 2020

12.6 ELECTRONIC FLIGHT BAG COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

FIGURE 43 ELECTRONIC FLIGHT BAG (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2020

12.7 COMPETITIVE BENCHMARKING

TABLE 245 COMPANY PRODUCT FOOTPRINT

TABLE 246 COMPANY FOOTPRINT, BY COMPONENT

TABLE 247 COMPANY PLATFORM FOOTPRINT

TABLE 248 COMPANY REGIONAL FOOTPRINT

12.8 COMPETITIVE SCENARIO

12.8.1 NEW PRODUCT LAUNCHES

TABLE 249 NEW PRODUCT LAUNCHES, 2015–JUNE 2021

12.8.2 DEALS

TABLE 250 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, 2015–MAY 2021

13 COMPANY PROFILES (Page No. - 177)

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

13.1 KEY COMPANIES

13.1.1 ASTRONAUTICS CORPORATION OF AMERICA

TABLE 251 ASTRONAUTICS CORPORATION OF AMERICA: BUSINESS OVERVIEW

TABLE 252 ASTRONAUTICS CORPORATION OF AMERICA: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

13.1.2 THE BOEING COMPANY

TABLE 253 THE BOEING COMPANY: BUSINESS OVERVIEW

FIGURE 44 THE BOEING COMPANY: COMPANY SNAPSHOT

TABLE 254 THE BOEING COMPANY: PRODUCT/SERVICES OFFERED

TABLE 255 THE BOEING COMPANY: PRODUCT LAUNCHES

TABLE 256 THE BOEING COMPANY: DEALS

13.1.3 THALES GROUP

TABLE 257 THALES GROUP: BUSINESS OVERVIEW

FIGURE 45 THALES GROUP: COMPANY SNAPSHOT

TABLE 258 THALES GROUP: PRODUCTS/SERVICES OFFERED

13.1.4 HONEYWELL INTERNATIONAL INC.

TABLE 259 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

FIGURE 46 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

TABLE 260 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES OFFERED

13.1.5 RAMCO SYSTEMS

TABLE 261 RAMCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 47 RAMCO SYSTEMS: COMPANY SNAPSHOT

TABLE 262 RAMCO SYSTEMS: PRODUCTS/SERVICES OFFERED

TABLE 263 RAMCO SYSTEMS: DEALS

13.1.6 VIASAT INC

TABLE 264 VIASAT INC: BUSINESS OVERVIEW

FIGURE 48 VIASAT INC: COMPANY SNAPSHOT

TABLE 265 VIASAT INC: PRODUCTS/SERVICES OFFERED

13.1.7 TELEDYNE TECHNOLOGIES

TABLE 266 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 49 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 267 TELEDYNE TECHNOLOGIES: PRODUCTS/SERVICES OFFERED

TABLE 268 TELEDYNE TECHNOLOGIES: DEALS

13.1.8 SITA

TABLE 269 SITA: BUSINESS OVERVIEW

TABLE 270 SITA: PRODUCTS/SERVICES OFFERED

13.1.9 CMC ELECTRONICS INC

TABLE 271 CMC ELECTRONICS INC: BUSINESS OVERVIEW

TABLE 272 CMC ELECTRONICS: PRODUCT/SERVICES OFFERED

13.1.10 DAC INTERNATIONAL

TABLE 273 DAC INTERNATIONAL: BUSINESS OVERVIEW

TABLE 274 DAC INTERNATIONAL: PRODUCTS/SERVICES OFFERED

13.1.11 COLLINS AEROSPACE

TABLE 275 COLLINS AEROSPACE: BUSINESS OVERVIEW

TABLE 276 COLLINS AEROSPACE: PRODUCTS/SERVICES OFFERED

TABLE 277 COLLINS AEROSPACE: PRODUCT LAUNCHES

13.1.12 FLIGHTMAN

TABLE 278 FLIGHTMAN: BUSINESS OVERVIEW

TABLE 279 FLIGHTMAN: PRODUCTS/SERVICES OFFERED

13.1.13 UNIVERSAL AVIONICS

TABLE 280 UNIVERSAL AVIONICS: BUSINESS OVERVIEW

TABLE 281 UNIVERSAL AVIONICS: PRODUCTS/SERVICES OFFERED

13.1.14 ANUVU

TABLE 282 ANUVU: BUSINESS OVERVIEW

TABLE 283 ANUVU: PRODUCTS/SERVICES OFFERED

TABLE 284 ANUVU: DEALS

13.2 OTHER COMPANIES

13.2.1 BYTRON AVIATION SYSTEMS

TABLE 285 BYTRON AVIATION SYSTEMS: BUSINESS OVERVIEW

TABLE 286 BYTRON AVIATION SYSTEMS: PRODUCTS/SERVICES OFFERED

13.2.2 ULTRAMAIN SYSTEMS

TABLE 287 ULTRAMAIN SYSTEMS: BUSINESS OVERVIEW

TABLE 288 ULTRAMAIN SYSTEMS: PRODUCTS/SERVICES OFFERED

TABLE 289 ULTRAMAIN SYSTEMS: PRODUCT LAUNCHES

TABLE 290 ULTRAMAIN SYSTEMS: DEALS

13.2.3 INTERNATIONAL FLIGHT SUPPORT

TABLE 291 INTERNATIONAL FLIGHT SUPPORT: BUSINESS OVERVIEW

TABLE 292 INTERNATIONAL FLIGHT SUPPORT: PRODUCTS/SERVICES OFFERED

13.2.4 APPRIMUS INFORMATIK GMBH

TABLE 293 APPRIMUS INFORMATIK GMBH: BUSINESS OVERVIEW

TABLE 294 APPRIMUS INFORMATIK GMBH: PRODUCTS/SERVICES OFFERED

13.2.5 SMART4AVIATION

TABLE 295 SMART4AVIATION: BUSINESS OVERVIEW

TABLE 296 SMART4AVIATION: PRODUCTS/SERVICES OFFERED

TABLE 297 SMART4AVIATION: DEALS

13.2.6 AFSYS

TABLE 298 AFSYS: BUSINESS OVERVIEW

TABLE 299 AFSYS: PRODUCTS/SERVICES OFFERED

13.2.7 SKYPAQ

TABLE 300 SKYPAQ: BUSINESS OVERVIEW

TABLE 301 SKYPAQ: PRODUCTS/SERVICES OFFERED

13.2.8 LUFTHANSA SYSTEMS

TABLE 302 LUFTHANSA SYSTEMS: BUSINESS OVERVIEW

TABLE 303 LUFTHANSA SYSTEMS: PRODUCTS/SERVICES OFFERED

13.2.9 SCANDINAVIAN AVIONICS

TABLE 304 SCANDINAVIAN AVIONICS: BUSINESS OVERVIEW

TABLE 305 SCANDINAVIAN AVIONICS: PRODUCTS/SERVICES OFFERED

TABLE 306 SCANDINAVIAN ELECTRONICS: DEALS

13.2.10 MOVING TERRAIN

TABLE 307 MOVING TERRAIN: BUSINESS OVERVIEW

TABLE 308 MOVING TERRAIN: PRODUCTS/SERVICES OFFERED

13.2.11 AVPLANEFB

TABLE 309 AVPLANEFB: BUSINESS OVERVIEW

TABLE 310 AVPLANEFB: PRODUCTS/SERVICES OFFERED

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 210)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

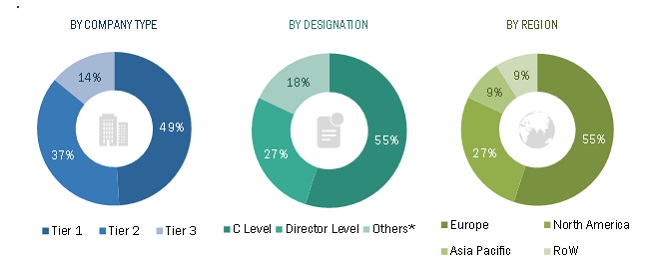

The study involved four major activities in estimating the current size of the electronic flight bag market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from EFB vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using EFBs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of EFBs and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

Supply Side |

Demand SIde |

Regulatory Bodies |

|

Airbus |

SpiceJet |

DGCA |

|

Safran |

Air India |

|

|

|

Indigo |

|

|

|

Bombay Flying Club |

|

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electronic flight bag market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Electronic flight bag market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the electronic flight bag market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the electronic flight bag market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the electronic flight bag market on the basis of type, sub-system, aircraft type, end user, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East, and Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the electronic flight bag market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the electronic flight bag market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Electronic flight bag market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electronic Flight Bag (EFB) Market

Hello, I would like to understand the EFB development, especially iOS vs. surface/windows. Is there any trend visible? Best regards, Sven Gartz