Crowdsourced Testing Market by Testing Type (Performance Testing, Functionality Testing, Usability Testing, Localization Testing, and Security Testing), Platform, Organization Size, Deployment Mode, Vertical and Region - Global Forecast to 2027

Updated on : May 24, 2024

Crowdsourced Testing Market Size, Growth Factors:

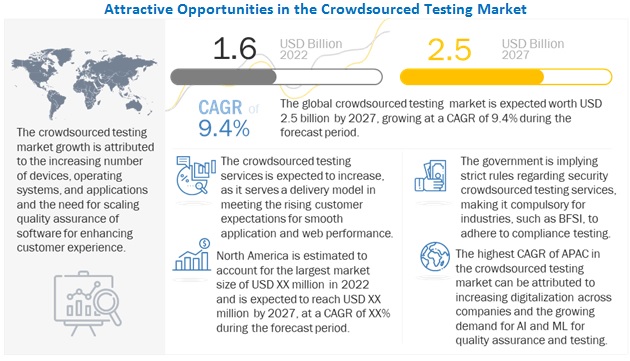

The global Crowdsourced Testing Market size to grow from USD 1.6 billion in 2022 to USD 2.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 9.4 % during the forecast period. Various factors such as the increasing number of devices, operating systems, and applications, requirement for adopting cost effective software development process, and increasing need to fill the in-house skill gap with crowdsourced testers during COVID-19.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Need for scaling quality assurance of software for enhancing customer experience

Over the past two decades, the technology adoption rate among enterprises has increased due to the rapid digitalization. With the growing digitalization, the number of digital products and services is also increasing. According to the OpenSignal report from 2016, more than 24,000 distinct Android devices were discovered. With the numerous combinations of mobile devices and operating systems being used, companies are finding possible reasonable approaches to strategize the testing of their applications on all these possible combinations to provide the best User Experience (UX). Hence, they invest in innovative end-user testing solutions, such as crowdsourced testing, to curtail the need for a feature-rich and customer-centric product offering. This product offering has become a key driver for determining products’ success. As per InMobi, there were over 313 million tablet and smartphones shipments just between April and June 2021; over 80% of these new devices were running Android. End-user testing on applications in real environments comprise a combination of devices, applications, and operating systems, which help companies ensure consistent quality and user experience. The adoption of crowdsourced testing is expected to increase among organizations, due to the rising number of devices and the increasing digitalization.

Restraint: Concerns over data privacy regulations across the globe

For scaling QA, organizations are increasingly using crowdsourced testing services. With the introduction of General Data Protection Regulation (GDPR), a new European Union (EU) legal framework that came into force on 25th May 2018, companies are working out methods to comply with the regulation in the best possible manner. In software testing, crowdsourcing has been growing in use; hence, it raises questions about data privacy and security. For complying with the GDPR regulations, crowd testers are needed to use test data that does not match any personal data. Hence, to perform end-user testing effectively, obtaining and applying appropriate test data is a must, especially for complex test scenarios. These regulations pose challenges for testers to perform crowdsourced testing effectively and produce optimum results.

Opportunity: Growth of IoT to increase the need for end-user testing services

IoT is a key digital transformation strategy that has given rise to enormous end-user applications. According to Ericsson Mobility Report, 2021, massive IoT will make up 51% of cellular IoT connections by 2027. The number of companies providing IoT testing services is also increasing, as the world is becoming more connected. IoT solutions involve a lot of product interaction with end users, and other IoT products and solutions. With this rapid growth, a huge number of IoT devices call for the increasing interaction with users. Crowdsourced testing exists as an efficient technique to test systems. By applying crowdsourced testing to the IoT solutions, the issues related to other numerous IoT connections can be tackled. With the growing IoT devices, there lies a huge opportunity for crowdsourced testing vendors.

Challenge: Managing the crowd to achieve efficiency in testing

Crowdsourced testing, with its vast pool of testers present across geographies, comes with its set of challenges. Managing a large group of testers and motivating them to find critical bugs and expand the test coverage come as a major challenge for the crowdsourced testing vendors. Additionally, ensuring the consistent involvement of crowd testers throughout the testing process, along with finding defects that are unique and valid as defined by customers, requires major efforts by companies. This signifies that it can be difficult for crowdsourced testing solution providers to ensure the entire product has been tested thoroughly enough to ensure usability even after the deployment of a large number of crowd testers for its testing.

Small and medium-sized enterprises segment is expected to account for a higher CAGR during the forecast period

The implementation of crowdsourced testing is expected to result in reduced costs and improved business efficiency for SMEs. The SMEs segment is expected to be a faster-growing segment in the crowdsourced testing market. Enhanced reliability, better scalability, user-engagement capabilities, CD and CI, and improved efficiency are the key factors that are expected to encourage SMEs to adopt crowdsourced testing at a rapid pace.

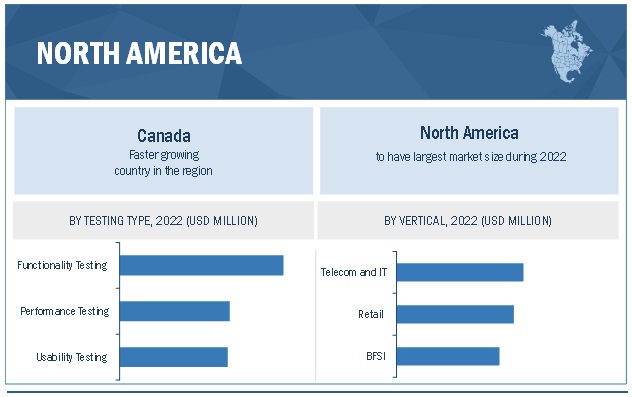

North America to account for largest market share during the forecast period

North America is estimated to hold the highest market share of the smart building market in 2022. North America is estimated to capture the largest share of the overall Crowdsourced testing market. The US holds a major portion of the market in this region. North America leads the global market in terms of the usage of Crowdsourced testing based solutions and services. The US and Canada are prominent countries contributing to technology development in this region; the growing device fragmentation appeals to the need for deploying crowdsourced testing for ensuring a good user experience on as many devices as possible. As the number of smartphone users is increasing in the region, for instance, as per the report by ScientiaMobile in June 2019, the number of smartphone users in North America have doubled up to 9.3 million in the past five years. Additionally, firms such as Global App Testing powers QA for some of the largest companies in the world including Facebook, Microsoft, and Warner Bros. By reducing the time and effort spend on testing, Global App testing provides above companies access to global testers for real-world results and helps deliver much higher quality applications.

To know about the assumptions considered for the study, download the pdf brochure

List of Crowdsourced Testing Companies

The crowdsourced testing market companies have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Crowdsourced testing market include Qualitest (US), Nomura Research Institute, Ltd. (Japan), Infosys Limited (India), Cigniti Technologies (US), EPAM Systems, Inc. (US), Flatworld Solutions Pvt. Ltd. (India), Test Yantra Software Solutions (India), Cobalt Labs Inc. (US), Bugcrowd Inc. (US), Qualitrix (India), Global App Testing (UK), Applause App Quality, Inc. (US), Synack (US), Testbirds (Germany), Rainforest QA, Inc. (US), Digivante Ltd (UK), Testlio Inc. (US), Crowdsprint (Australia), MyCrowd (US), Ubertesters Inc. (US), QA Mentor, Inc. (US), Crowd4Test (India), TestUnity (India), usabitest.com (Nigeria), Stardust testing (Canada), and ImpactQA (US). The study includes an in-depth competitive analysis of these key players in the Crowdsourced testing market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By testing type, platform, organization size, deployment mode, verticals and region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Crowdsourced Testing Companies |

Qualitest (Qualitest), Nomura Research Institute, Ltd. (NRI), Infosys Limited (Infosys), Cigniti Technologies (Cigniti Technologies), EPAM Systems, Inc. (EPAM Systems), Flatworld Solutions Pvt. Ltd. (Flatworld Solutions), Test Yantra Software Solutions (Test Yantra), Cobalt Labs Inc. (Cobalt Labs), Bugcrowd Inc. (Bugcrowd), Qualitrix (Qualitrix), Global App Testing (Global App Testing), Applause App Quality, Inc. (Applause), Synack (Synack), Testbirds (Testbirds GmbH), Rainforest QA, Inc. (Rainforest), Digivante Ltd (Digivante), Testlio Inc. (Testlio), Crowdsprint (Crowdsprint), MyCrowd (MyCrowd QA), Ubertesters Inc. (Ubertesters), QA Mentor, Inc. (QA Mentor), Crowd4Test (Crowd4Test), TestUnity (TestUnity), usabitest.com (Usabitest), STARDUST TESTING (StarDust), and ImpactQA (ImpactQA). |

This research report categorizes the Crowdsourced testing market to forecast revenues and analyze trends in each of the following subsegments:

By Testing Type:

- Performance Testing

- Functionality Testing

- Usability Testing

- Localization Testing

- Security Testing

- Others (automation testing, compliance testing, compatibility testing, and exploratory testing)

By Platform:

- Web Application

- Mobile Application

- Others (IoT devices and wearables)

By Organization size:

- Small and medium sized enterprises

- Large enterprises

By Deployment mode:

- Cloud

- On-premises

By Verticals:

- Telecom and IT

- BFSI

- Healthcare and Life Sciences

- Retail

- Media and Entertainment

- Others (energy and utilities, logistics and transportation, government, manufacturing, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Middle east

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Crowdsourced Testing Market News (Recent Developments):

- In May 2021 NRI Australia acquired Planit, With this acquisition, Planit continues to operate under NRI Australia’s brand. The acquisition is in line with NRI’s strategy to expand its capability and global footprint as part of the “Vision2022” strategy, which aims to expand NRI’s client base in other industrial sectors and enhance its presence across Asia Pacific, Europe, and North America.

- In February 2021 Qualitest acquired QA Infotech, an India-based company. It is one of the largest independent offshore testing providers having long standing relationship with marquee clients, especially in the eLearning, publishing, healthcare, travel, and retail verticals. This acquisition will enhance Qualitest’s automation capabilities and global right shoring Quality Assurance offerings.

- In June 2020 Qualitest expanded its AI-Powered Software Testing and QA Toolkit by global launch of Qualisense. It uses ML to help companies enhance software development strategies, streamline testing, and reduce the costs of ensuring software quality.

- In February 2020 Infosys and Applause had a partnership. The partnership will help Infosys in building end-to-end testing services for its clients. With the partnership, both companies want to deliver accelerated feedback from a full suite of testing capabilities that fit in the agile process set by the client.

Frequently Asked Questions (FAQ):

What is Crowdsourced testing?

According to Global App Testing, crowdsourced testing, also known as crowd testing, is a recent approach to QA. It combines human skills with technology to reduce problems involved in conventional testing. Instead of carrying out testing within your organization, crowdsourcing uses a dispersed, temporary workforce of multiple individual testers. It offers companies an opportunity to have their products tested by real users on real devices globally, ensuring a customer-centric emphasis.

Which countries are considered in the European region?

The report includes an analysis of the UK, France in the European region.

Which are the key drivers supporting the growth of the Crowdsourced testing market?

The key drivers supporting the growth of the Crowdsourced testing market include various factors the increasing number of devices, operating systems, and applications, need for scaling QA of software for enhancing customer experience, requirement for adopting cost effective software development process, and increasing need to fill the in-house skill gap with crowdsourced testers during COVID-19.

Which are the top companies in the Crowdsourced testing market?

The top companies in the Crowdsourced testing market include. Qualitest (Qualitest), Nomura Research Institute, Ltd. (NRI), Applause App Quality, Inc (Applause), Infosys Limited (Infosys), Cigniti Technologies (Cigniti Technologies), EPAM Systems, Inc. (EPAM Systems), Flatworld Solutions Pvt. Ltd. (Flatworld Solutions), Test Yantra Software Solutions (Test Yantra), Cobalt Labs Inc. (Cobalt Labs), Bugcrowd Inc. (Bugcrowd), Qualitrix (Qualitrix), Global App Testing (Global App Testing), Applause App Quality, Inc. (Applause), Synack (Synack), Testbirds (Testbirds GmbH), Rainforest QA, Inc. (Rainforest), Digivante Ltd (Digivante), Testlio Inc. (Testlio), Crowdsprint (Crowdsprint), MyCrowd (MyCrowd QA), Ubertesters Inc. (Ubertesters), QA Mentor, Inc. (QA Mentor), Crowd4Test (Crowd4Test), TestUnity (TestUnity), usabitest.com (Usabitest), STARDUST TESTING (StarDust), and ImpactQA (ImpactQA) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 6 CROWDSOURCED TESTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

TABLE 2 PRIMARY INTERVIEWS

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL THE OFFERINGS IN THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE): CROWDSOURCED TESTING MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 11 CROWDSOURCED TESTING MARKET, 2022–2027 (USD MILLION)

FIGURE 12 LEADING SEGMENTS IN THE MARKET IN 2022

FIGURE 13 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2022

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 INCREASING NUMBER OF DEVICES, OPERATING SYSTEMS, AND APPLICATIONS FOR SCALING QUALITY ASSURANCE TO DRIVE MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 15 RETAIL VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 CROWDSOURCED TESTING MARKET, BY 0RGANIZATION SIZE

FIGURE 16 LARGE ENTERPRISES TO LEAD MARKET GROWTH IN 2022

4.4 MARKET, BY DEPLOYMENT MODE

FIGURE 17 CROWDSOURCED TESTING CLOUD DEPLOYMENT MODE TO LEAD MARKET GROWTH IN 2022

4.5 MARKET, BY TESTING TYPE

FIGURE 18 FUNCTIONALITY TESTING TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.6 MARKET, BY PLATFORM

FIGURE 19 WEB CROWDSOURCED TESTING TO LEAD MARKET GROWTH DURING 2022–2027

4.7 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO SHOW FASTEST GROWTH RATE DURING THE FORECAST PERIOD

4.8 MARKET, BY COUNTRY

FIGURE 21 CANADA TO ACCOUNT FOR HIGH GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CROWDSOURCED TESTING MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in the number of devices, operating systems, and applications

5.2.1.2 Need for scaling quality assurance of software for enhancing customer experience

5.2.1.3 Requirement for adopting cost-effective software development process

5.2.1.4 Need to fill the in-house skill gap with crowdsourced testers during COVID-19

5.2.2 RESTRAINTS

5.2.2.1 Concerns over data privacy regulations across the globe

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of IoT to increase the need for end-user testing services

5.2.3.2 Adoption of cloud computing to enhance device virtualization and tester support

5.2.4 CHALLENGES

5.2.4.1 Managing the crowd to achieve efficiency in testing

5.2.4.2 Concerns over data security and confidentiality

5.3 INDUSTRY TRENDS

5.3.1 CROWDSOURCED TESTING: ECOSYSTEM

FIGURE 23 CROWDSOURCED TESTING MODEL

TABLE 4 CROWDSOURCED TESTING MARKET: ECOSYSTEM

5.3.2 MARKET: VALUE CHAIN ANALYSIS

FIGURE 24 VALUES CHAIN ANALYSIS

5.3.3 CASE STUDY ANALYSIS

5.3.3.1 Case study 1: With the help of Rainforest QA Cireson to cut QA testing time from weeks to hours

5.3.3.2 Case study 2: High-growth fintech app ramps up a global testing operation in two weeks with Testlio

5.3.3.3 Case study 3: SoundCloud paves road to revenue with Mobile Testing with the help of test IO

5.3.3.4 Case study 4: Specsavers saw testing timescales shrink and QA improve with Digivante

5.3.3.5 Case Study 5: Simplot embraced crowd testing for its latest venture using Crowdsprint Crowd testing platform

5.3.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.3.4.1 General data protection regulation

5.3.4.2 Sarbanes-Oxley Act Of 2002

5.3.4.3 Cloud Standard Customer Council

5.3.4.4 System and Organization Controls 2 Type II Compliance

5.3.4.5 ISO/IEC 27001

5.3.4.6 Payment Card Industry Data Security Standard

5.3.4.7 Health Insurance Portability and Accountability Act

5.3.4.8 Federal Information Security Management Act

5.3.4.9 Gramm-Leach-Bliley Act

5.3.5 CROWDSOURCED TESTING MARKET: PATENT ANALYSIS

5.3.5.1 Methodology

5.3.5.2 Document types of patents

TABLE 5 PATENTS FILED, 2019–2022

5.3.5.3 Innovation and patent applications

FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2021

5.3.5.3.1 Top applicants

FIGURE 26 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2021

TABLE 6 US: TOP TEN PATENT OWNERS IN THE MARKET, 2019–2021

TABLE 7 LIST OF A FEW PATENTS IN THE MARKET, 2020–2021

5.3.6 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 27 CROWDSOURCED TESTING MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.7 PRICING ANALYSIS

5.3.7.1 Average selling price of key players

TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS (USD)

5.3.8 TECHNOLOGY TRENDS

5.3.8.1 Introduction

5.3.8.2 Artificial intelligence and machine learning

5.3.8.3 Internet of things

5.3.8.4 Augmented/virtual reality testing

5.3.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 CROWDSOURCED TESTING MARKET: PORTER’S FIVE FORCES MODEL

5.3.9.1 Threat of new entrants

5.3.9.2 Threat of substitutes

5.3.9.3 Bargaining power of buyers

5.3.9.4 Bargaining power of suppliers

5.3.9.5 Degree of competition

5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE PLATFORMS

TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE PLATFORMS (%)

5.5 COVID-19 MARKET OUTLOOK FOR THE CROWDSOURCED TESTING MARKET

TABLE 11 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 12 CROWDSOURCED TESTING SOLUTIONS: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.5.1 CUMULATIVE GROWTH ANALYSIS

TABLE 13 MARKET: CUMULATIVE GROWTH ANALYSIS

5.6 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 14 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 CROWDSOURCED TESTING MARKET, BY TESTING TYPE (Page No. - 82)

6.1 INTRODUCTION

6.1.1 TESTING TYPES: MARKET DRIVERS

6.1.2 TESTING TYPES: COVID-19 IMPACT

FIGURE 29 LOCALIZATION TESTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 16 MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

6.2 PERFORMANCE TESTING

6.2.1 INCREASE IN DIVERSE DEVICES AND NUMBER OF USERS TO DRIVE THE GROWTH OF THE CROWDSOURCED PERFORMANCE TESTING INDUSTRY

TABLE 17 PERFORMANCE TESTING: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 PERFORMANCE TESTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 FUNCTIONALITY TESTING

6.3.1 INCREASE IN CUSTOMER EXPECTATIONS TO DRIVE THE GROWTH OF THE CROWDSOURCED FUNCTIONALITY TESTING INDUSTRY

TABLE 19 FUNCTIONALITY TESTING: CROWDSOURCED TESTING MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 FUNCTIONALITY TESTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.4 USABILITY TESTING

6.4.1 INCREASE IN THE NEED TO PROVIDE A BETTER USER EXPERIENCE TO DRIVE THE GROWTH OF THE CROWDSOURCED USABILITY TESTING INDUSTRY

TABLE 21 USABILITY TESTING: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 USABILITY TESTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.5 LOCALIZATION TESTING

6.5.1 LOCALIZATION TESTING TO SHOW THE FASTEST GROWTH IN THE MARKET BY TESTING TYPE

TABLE 23 LOCALIZATION TESTING: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 LOCALIZATION TESTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.6 SECURITY TESTING

6.6.1 INCREASE IN THE NEED FOR TACKLING DATA BREACHES TO DRIVE THE GROWTH OF THE CROWDSOURCED SECURITY TESTING INDUSTRY

TABLE 25 SECURITY TESTING: CROWDSOURCED TESTING MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 SECURITY TESTING: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.7 OTHER TESTING TYPES

TABLE 27 OTHER TESTING TYPES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 OTHER TESTING TYPES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 CROWDSOURCED TESTING MARKET, BY PLATFORM (Page No. - 92)

7.1 INTRODUCTION

7.1.1 PLATFORMS: MARKET DRIVERS

7.1.2 PLATFORMS: COVID-19 IMPACT

FIGURE 30 MOBILE SEGMENT TO GROW AT THE HIGHEST CAGR FROM 2022 TO 2027

TABLE 29 CROWDSOURCED TESTING SOLUTIONS MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 30 CROWDSOURCED TESTING SOLUTIONS MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

7.2 WEB

7.2.1 CROWDSOURCED TESTING ON WEB PLATFORMS TO SHOW HIGH GROWTH

TABLE 31 WEB: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 WEB: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 MOBILE

7.3.1 INCREASING NUMBER OF MOBILE-BASED APPLICATIONS TO DRIVE THE GROWTH OF THE MOBILE SEGMENT

TABLE 33 MOBILE: CROWDSOURCED TESTING MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 MOBILE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 OTHER PLATFORMS

TABLE 35 OTHER PLATFORMS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 OTHER PLATFORMS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 CROWDSOURCED TESTING MARKET, BY ORGANIZATION SIZE (Page No. - 98)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 37 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 38 MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 REDUCED COSTS AND IMPROVED BUSINESS EFFICIENCY FOR SMALL AND MEDIUM-SIZED ENTERPRISES TO DRIVE THE ADOPTION OF CROWDSOURCED TESTING SERVICES

TABLE 39 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 SMALL AND MEDIUM-SIZED ENTERPRISES: CROWDSOURCED TESTING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 QUALITY ASSURANCE, SECURITY, AND FASTER PRODUCT RELEASE TO DRIVE THE ADOPTION OF CROWDSOURCED TESTING SERVICES IN LARGE ENTERPRISES

TABLE 41 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 CROWDSOURCED TESTING MARKET, BY DEPLOYMENT MODE (Page No. - 103)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT MODES: MARKET DRIVERS

9.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 32 CLOUD-BASED TESTING TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 43 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 44 MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

9.2 CLOUD

9.2.1 BENEFITS OF EASY AVAILABILITY, HIGH SCALABILITY, AND LOW COST TO DRIVE CLOUD TESTING

TABLE 45 CLOUD: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 CLOUD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 ON-PREMISES

9.3.1 NEED FOR BETTER CONTROL OVER THE INFRASTRUCTURE AND TESTING PROCESS AS A WHOLE DRIVES THE ON-PREMISES TESTING

TABLE 47 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 ON-PREMISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 CROWDSOURCED TESTING MARKET, BY VERTICAL (Page No. - 108)

10.1 INTRODUCTION

10.1.1 VERTICALS: MARKET DRIVERS

10.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 33 RETAIL VERTICAL TO GROW AT THE HIGHEST CAGR FROM 2022 TO 2027

TABLE 49 CROWDSOURCED TESTING SOLUTIONS MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 50 CROWDSOURCED TESTING SOLUTIONS MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 TELECOM AND IT

10.2.1 HUGE COMPETITION AND NEED TO INCREASE CUSTOMER ENGAGEMENT TO DRIVE THE GROWTH OF THE MARKET IN THE TELECOM AND IT VERTICAL

TABLE 51 TELECOM AND IT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 TELECOM AND IT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.3.1 NEED TO COMBAT SECURITY CHALLENGES AND ISSUES TO DRIVE THE GROWTH OF THE CROWDSOURCED TESTING MARKET IN THE BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL

TABLE 53 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 RETAIL

10.4.1 INCREASE IN DIGITAL TRANSFORMATION AND CUSTOMER-CENTRIC SOLUTIONS TO DRIVE THE GROWTH OF THE MARKET IN THE RETAIL VERTICAL

TABLE 55 RETAIL: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 RETAIL: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 HEALTHCARE AND LIFE SCIENCES

10.5.1 INCREASE IN USER-CENTRIC SOFTWARE APPLICATIONS AND SOLUTIONS TO DRIVE THE GROWTH OF THE CROWDSOURCED TESTING MARKET IN THE HEALTHCARE AND LIFE SCIENCES VERTICAL

TABLE 57 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.6 MEDIA AND ENTERTAINMENT

10.6.1 INCREASE IN CUSTOMER EXPECTATIONS TO DRIVE THE GROWTH OF THE MARKET IN THE MEDIA AND ENTERTAINMENT VERTICAL

TABLE 59 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHER VERTICALS

TABLE 61 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 OTHER VERTICALS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 CROWDSOURCED TESTING MARKET, BY REGION (Page No. - 117)

11.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 63 MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATORY NORMS

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: CROWDSOURCED TESTING MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.4 UNITED STATES

11.2.4.1 Presence of major players in the US to drive the crowdsourced testing market growth in the US

TABLE 77 UNITED STATES: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 78 UNITED STATES: MARKET SIZE, BY TESTING TYPE, 2022–2027(USD MILLION)

TABLE 79 UNITED STATES: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 80 UNITED STATES: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 81 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 82 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 83 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 84 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 85 UNITED STATES: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 86 UNITED STATES: MARKET SIZE, BY VERTICAL, 2022–2027(USD MILLION)

11.2.5 CANADA

11.2.5.1 Rising digital investments to drive the growth of the crowdsourced testing market in Canada

TABLE 87 CANADA: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 88 CANADA: MARKET SIZE, BY TESTING TYPE, 2022–2027(USD MILLION)

TABLE 89 CANADA: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 91 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 94 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: CROWDSOURCED TESTING MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATORY NORMS

TABLE 97 EUROPE: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027(USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.4.1 Industry-specific growth in digital transformation in the UK to drive the crowdsourced testing market growth

TABLE 109 UNITED KINGDOM: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 110 UNITED KINGDOM: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 111 UNITED KINGDOM: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 112 UNITED KINGDOM: MARKET SIZE, BY PLATFORM, 2022–2027(USD MILLION)

TABLE 113 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 114 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 115 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 116 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 117 UNITED KINGDOM:MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Increasing digital transformation to drive the growth of the market in France

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: CROWDSOURCED TESTING MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATORY NORMS

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY TESTING TYPE, 2022–2027(USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.4 CHINA

11.4.4.1 Growth of the IT sector to drive the growth of the crowdsourced testing market in China

TABLE 131 CHINA: CROWDSOURCED TESTING MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 132 CHINA: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 133 CHINA: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 134 CHINA: MARKET SIZE, BY PLATFORM, 2022–2027(USD MILLION)

TABLE 135 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 136 CHINA: MARKET SIZE, BY OGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 137 CHINA: CROWDSOURCED TESTING MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 138 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 139 CHINA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 140 CHINA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.5 JAPAN

11.4.5.1 Growth of emerging technologies to drive the growth of the market in Japan

11.4.6 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: CROWDSOURCED TESTING MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATORY NORMS

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.4 MIDDLE EAST

11.5.4.1 Adoption of the latest technologies for enhancing IT infrastructure to drive the growth of the crowdsourced testing market in the Middle East

TABLE 153 MIDDLE EAST: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 155 MIDDLE EAST: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 156 MIDDLE EAST: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 158 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 159 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 160 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 162 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2022–2027(USD MILLION)

11.5.5 AFRICA

11.5.5.1 Sustainable economic development to enable the growth of the market in Africa

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: CROWDSOURCED TESTING MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATORY NORMS

TABLE 163 LATIN AMERICA: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027(USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.4 BRAZIL

11.6.4.1 Surge in IT services to drive the crowdsourced testing market growth in Brazil

TABLE 175 BRAZIL: MARKET SIZE, BY TESTING TYPE, 2016–2021 (USD MILLION)

TABLE 176 BRAZIL: MARKET SIZE, BY TESTING TYPE, 2022–2027 (USD MILLION)

TABLE 177 BRAZIL: MARKET SIZE, BY PLATFORM, 2016–2021 (USD MILLION)

TABLE 178 BRAZIL: MARKET SIZE, BY PLATFORM, 2022–2027(USD MILLION)

TABLE 179 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 180 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027(USD MILLION)

TABLE 181 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 182 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 183 BRAZIL: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 184 BRAZIL: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.5 MEXICO

11.6.5.1 Emerging software industry to drive the growth of the crowdsourced testing market in Mexico

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 170)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

TABLE 185 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE MARKET

12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 186 CROWDSOURCED TESTING MARKET: DEGREE OF COMPETITION

12.4 HISTORICAL REVENUE ANALYSIS

FIGURE 37 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 38 KEY CROWDSOURCED TESTING MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

12.6 COMPETITIVE BENCHMARKING

TABLE 187 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS, BY PLATFORM AND TESTING TYPE

TABLE 188 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS, BY REGION

TABLE 189 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES, BY PLATFORM AND TESTING TYPE

TABLE 190 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES, BY REGION

TABLE 191 MARKET: DETAILED LIST OF KEY STARTUP/SMES

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 39 STARTUP/SME CROWDSOURCED TESTING MARKET EVALUATION MATRIX, 2021

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 192 PRODUCT LAUNCHES, DECEMBER 2019–JUNE 2020

12.8.2 DEALS

TABLE 193 DEALS, APRIL 2019–OCTOBER 2021

13 COMPANY PROFILES (Page No. - 184)

13.1 MAJOR PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

13.1.1 INFOSYS

TABLE 194 INFOSYS: BUSINESS OVERVIEW

FIGURE 40 INFOSYS: FINANCIAL OVERVIEW

TABLE 195 INFOSYS: PRODUCTS OFFERED

TABLE 196 INFOSYS: DEALS

13.1.2 EPAM SYSTEMS

TABLE 197 EPAM SYSTEMS: BUSINESS OVERVIEW

FIGURE 41 EPAM SYSTEMS: FINANCIAL OVERVIEW

TABLE 198 EPAM SYSTEMS: PRODUCTS OFFERED

TABLE 199 EPAM SYSTEMS: PRODUCT LAUNCHES

TABLE 200 EPAM SYSTEMS: DEALS

13.1.3 CIGNITI TECHNOLOGIES

TABLE 201 CIGNITI TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 42 CIGNITI TECHNOLOGIES: FINANCIAL OVERVIEW

TABLE 202 CIGNITI TECHNOLOGIES: PRODUCTS OFFERED

13.1.4 NOMURA RESEARCH INSTITUTE

TABLE 203 NRI: BUSINESS OVERVIEW

FIGURE 43 NRI: FINANCIAL OVERVIEW

TABLE 204 NRI: PRODUCTS OFFERED

TABLE 205 NRI: DEALS

13.1.5 QUALITEST

TABLE 206 QUALITEST: BUSINESS OVERVIEW

TABLE 207 QUALITEST: PRODUCTS OFFERED

TABLE 208 QUALITEST: PRODUCT LAUNCHES

TABLE 209 QUALITEST: DEALS

13.1.6 TEST YANTRA

TABLE 210 TEST YANTRA: BUSINESS OVERVIEW

TABLE 211 TEST YANTRA: PRODUCTS OFFERED

13.1.7 FLATWORLD SOLUTIONS

TABLE 212 FLATWORLD SOLUTIONS: BUSINESS OVERVIEW

TABLE 213 FLATWORLD SOLUTIONS: PRODUCTS OFFERED

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

13.2 STARTUPS/SMES

13.2.1 GLOBAL APP TESTING

13.2.2 APPLAUSE

13.2.3 SYNACK

13.2.4 TESTBIRDS

13.2.5 RAINFOREST

13.2.6 DIGIVANTE

13.2.7 TESTLIO

13.2.8 CROWDSPRINT

13.2.9 MYCROWD QA

13.2.10 UBERTESTERS

13.2.11 QA MENTOR

13.2.12 CROWD4TEST

13.2.13 TESTUNITY

13.2.14 USABITEST

13.2.15 STARDUST

13.2.16 IMPACTQA

13.2.17 COBALT

13.2.18 BUGCROWD

13.2.19 QUALITRIX

14 ADJACENT/RELATED MARKETS (Page No. - 223)

14.1 PENETRATION TESTING MARKET

14.1.1 MARKET DEFINITION

14.1.2 MARKET OVERVIEW

14.1.3 PENETRATION TESTING MARKET, BY OFFERING

TABLE 214 PENETRATION TESTING MARKET SIZE, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 215 PENETRATION TESTING MARKET SIZE, BY OFFERING, 2020–2026 (USD MILLION)

14.1.4 PENETRATION TESTING MARKET, BY APPLICATION AREA

TABLE 216 PENETRATION TESTING MARKET SIZE, BY APPLICATION AREA, 2015–2020 (USD MILLION)

TABLE 217 PENETRATION TESTING MARKET SIZE, BY APPLICATION AREA, 2020–2026 (USD MILLION)

14.1.5 PENETRATION TESTING MARKET, BY DEPLOYMENT MODE

TABLE 218 PENETRATION TESTING MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 219 PENETRATION TESTING MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

14.1.6 PENETRATION TESTING MARKET, BY ORGANIZATION SIZE

TABLE 220 PENETRATION TESTING MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 221 PENETRATION TESTING MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

14.1.7 PENETRATION TESTING MARKET, BY VERTICAL

TABLE 222 PENETRATION TESTING MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 223 PENETRATION TESTING MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

14.1.8 PENETRATION TESTING MARKET, BY REGION

TABLE 224 PENETRATION TESTING MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 225 PENETRATION TESTING MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

14.2 AUTOMATION TESTING MARKET

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.3 AUTOMATION TESTING MARKET, BY COMPONENT

TABLE 226 AUTOMATION TESTING MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 227 AUTOMATION TESTING MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

14.2.4 AUTOMATION TESTING MARKET, BY TESTING TYPE

TABLE 228 AUTOMATION TESTING MARKET SIZE, BY TESTING TYPE, 2016–2020 (USD MILLION)

TABLE 229 AUTOMATION TESTING MARKET SIZE, BY TESTING TYPE, 2021–2026 (USD MILLION)

14.2.5 AUTOMATION TESTING MARKET, BY DYNAMIC TESTING

TABLE 230 AUTOMATION TESTING MARKET SIZE, BY DYNAMIC TESTING, 2016–2020 (USD MILLION)

TABLE 231 AUTOMATION TESTING MARKET SIZE, BY DYNAMIC TESTING, 2021–2026 (USD MILLION)

14.2.6 AUTOMATION TESTING MARKET, BY SERVICE

TABLE 232 AUTOMATION TESTING MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 233 AUTOMATION TESTING MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

14.2.7 AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE

TABLE 234 AUTOMATION TESTING MARKET SIZE, BY ENDPOINT INTERFACE, 2016–2020 (USD MILLION)

TABLE 235 AUTOMATION TESTING MARKET SIZE, BY ENDPOINT INTERFACE, 2021–2026 (USD MILLION)

14.2.8 AUTOMATION TESTING MARKET, BY ORGANIZATION SIZE

TABLE 236 AUTOMATION TESTING MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 237 AUTOMATION TESTING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

14.2.9 AUTOMATION TESTING MARKET, BY VERTICAL

TABLE 238 AUTOMATION TESTING MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 239 AUTOMATION TESTING MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

14.2.10 AUTOMATION TESTING MARKET, BY REGION

TABLE 240 AUTOMATION TESTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 241 AUTOMATION TESTING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14.3 SECURITY TESTING MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 SECURITY TESTING MARKET, BY TESTING TYPE

TABLE 242 SECURITY TESTING MARKET SIZE, BY TESTING TYPE, 2014–2019 (USD MILLION)

TABLE 243 SECURITY TESTING MARKET SIZE, BY TESTING TYPE, 2019–2025 (USD MILLION)

14.3.4 SECURITY TESTING MARKET, BY DEPLOYMENT MODE

TABLE 244 SECURITY TESTING MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 245 SECURITY TESTING MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

14.3.5 SECURITY TESTING MARKET, BY ORGANIZATION SIZE

TABLE 246 SECURITY TESTING MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 247 SECURITY TESTING MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

14.3.6 SECURITY TESTING MARKET, BY VERTICAL

TABLE 248 SECURITY TESTING MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 249 SECURITY TESTING MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.3.7 SECURITY TESTING MARKET, BY REGION

TABLE 250 SECURITY TESTING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 251 SECURITY TESTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15 APPENDIX (Page No. - 242)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

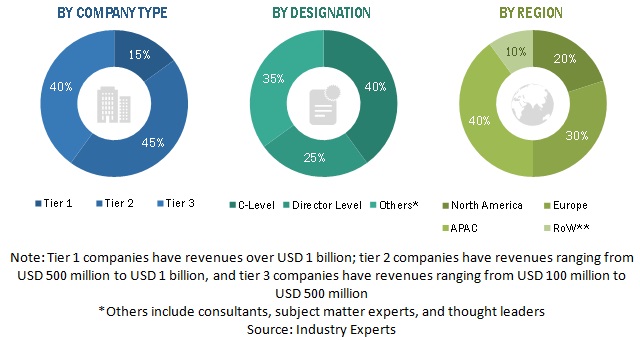

The study involved four major activities in estimating the current size of the Crowdsourced testing market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Crowdsourced testing market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Crowdsourced testing market. The primary sources from the demand side included Crowdsourced testing end users, network administrators/consultants/specialists, Chief Information Officers (CIOs) and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global Crowdsourced testing market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the Crowdsourced testing market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, the key companies offering Crowdsourced testing solutions and services were identified. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer Crowdsourced testing was identified through similar sources. Then through primaries, the data on revenue generated through specific Crowdsourced testing components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global crowdsourced testing market based on testing types, platforms, organization size, deployment mode, verticals, and regions from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze the impact of COVID-19 on the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total cmarket.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the crowdsourced testing market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market

Crowdtesting Market:

The "crowdsourced testing market" is also known as "crowdtesting market". Crowdtesting and crowdsourced testing are often used interchangeably, as they both involve utilizing a community of testers to evaluate software products. Crowdtesting typically refers to the process of testing software applications or products by leveraging the power of a large group of people, often recruited online from a pool of qualified testers, to perform tests and provide feedback.

New Business Opportunities in Crowdtesting Market:

The crowdtesting market presents several new business opportunities, including:

- Specialized testing services: As the demand for crowdtesting increases, there may be opportunities for companies to specialize in niche testing areas, such as accessibility testing, security testing, or performance testing.

- Platform development: Companies can develop platforms that enable organizations to run their own crowdtesting campaigns, providing tools and resources to manage testers, test cases, and results.

- Test management services: Companies can offer test management services that provide end-to-end management of the testing process, including test case creation, test execution, and results analysis.

- AI-powered testing: Companies can develop AI-powered testing solutions that use machine learning algorithms to identify defects, predict future defects, and automate testing tasks.

- Mobile app testing: With the increasing number of mobile apps being developed, there is a growing need for specialized mobile app testing services that can ensure apps work seamlessly across different platforms and devices.

- Remote testing services: With the rise of remote work, companies can offer remote testing services that enable testers to work from anywhere in the world, providing greater flexibility and accessibility.

Overall, the crowdtesting market presents a range of new business opportunities for companies that can provide specialized testing services, develop innovative testing platforms and tools, and leverage emerging technologies like AI to improve the testing process.

Some of the top companies in the Crowdtesting Market are Applause, Testbirds, BugFinders, Testlio, UserTesting, Rainforest QA, Crowdsourced Testing, Global App Testing, uTest, and Digivante.

Industries Getting Impacted in the Future by Crowdtesting Market:

The crowdtesting market is likely to impact a wide range of industries, including:

- Software development: The software development industry is one of the primary beneficiaries of crowdtesting, with companies using crowdtesting to quickly and efficiently test software products before launch.

- E-commerce: E-commerce companies can use crowdtesting to improve the user experience of their websites and apps.

- Healthcare: The healthcare industry can use crowdtesting to ensure the safety and effectiveness of medical devices and software.

- Gaming: The gaming industry can use crowdtesting to test new games and ensure they work correctly on a range of devices and platforms.

- Automotive: The automotive industry can use crowdtesting to test new software and features in cars.

- Education: The education industry can use crowdtesting to validate educational software and ensure it meets the needs of students and educators.

Future Crowdtesting Market Trends:

Here are some of the future crowdtesting market trends that are likely to emerge:

- Increased use of AI and machine learning: As the use of AI and machine learning continues to grow, we can expect to see more crowdtesting platforms and tools that use these technologies to automate and improve the testing process.

- Greater focus on security testing: With the growing number of cybersecurity threats, we can expect to see increased demand for crowdtesting services that specialize in security testing.

- Growth in mobile app testing: With the increasing popularity of mobile devices, we can expect to see more crowdtesting services that specialize in mobile app testing.

- Increased emphasis on accessibility testing: As companies become more aware of the need for accessible products and services, we can expect to see increased demand for crowdtesting services that specialize in accessibility testing.

- Greater use of crowdsourced testing: While crowdtesting is becoming more popular, we can expect to see continued growth in crowdsourced testing, where companies outsource their testing needs to a community of testers.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Crowdsourced Testing Market