Continuous Testing Market by Service (Professional Services and Managed Services), Interface (Web, Mobile, and Desktop), Deployment Type, Organization Size, Industry Vertical, and Region - Global Forecast to 2023

[147 Pages Report] The Continuous Testing Market predicted to grow from $1.01 Billion in 2017 to reach $2.41 Billion by 2023 at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period 2018 to 2023, while 2017 has been considered as the base year for estimating the market size.

Objective of the Continuous Testing Market Study

The main objective of this report is to define, describe, and forecast the continuous testing market by service, deployment type, organization size, interface, industry vertical, and region. The report provides detailed information related to the major factors (drivers, restraints, opportunities, and industry-specific challenges), influencing the market growth. The report forecasts the market size with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America. The report profiles the key players and comprehensively analyzes their core competencies. Moreover, this report tracks and analyzes competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities in the market.

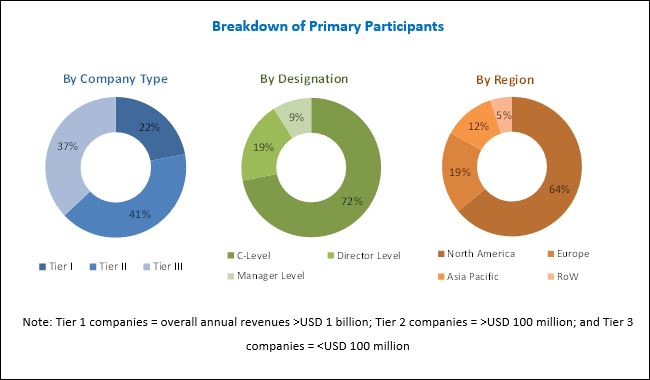

The research methodology used to estimate and forecast the continuous testing market began with the collection and analysis of data on the key vendors product offerings and business strategies from secondary sources.These secondary sources include IT service providers, technology providers, press releases, investor presentations of companies, white papers, technology journals, certified publications, and articles from recognized authors, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Moreover, vendor offerings have been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the continuous testing market from the revenue of the key market solution and service providers. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Industry Ecosystem

The major vendors in the continuous testing market include Mindtree (India), EPAM Systems (US), HCL Technologies (India), Atos (France), Tech Mahindra (India), Hexaware (India), Tricentis (Austria), Cigniti (India), Larsen and Toubro Infotech (India), NIIT Technologies (India), CA Technologies (US), IBM (US), Capgemini (France), Spirent Communications (UK), Micro Focus (UK), Syntel (US), Cognizant (US), Parasoft (US), Softcrylic (US), LogiGear (US), QualiTest (US), Testplant (UK), Vector Software (US), QA Mentor (US), and SmartBear Software(US).

Key Target Audience for Continuous Testing Market

- Continuous testing providers

- Professional service providers

- Managed service providers

- System integrators

- Cloud vendors

- Research organizations

- Resellers and distributors

Scope of the Continuous Testing Market Study

|

Report Metric |

Details |

|

Market size available for years |

20172023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Service, Deployment Type, Organization size, interface, industry vertical and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Mindtree (India), EPAM Systems (US), HCL Technologies (India), Atos (France), Tech Mahindra (India), Hexaware (India), Tricentis (Austria), Cigniti (India), Larsen and Toubro Infotech (India), NIIT Technologies (India), CA Technologies (US), IBM (US), Capgemini (France), Spirent Communications (UK), Micro Focus (UK), Syntel (US), Cognizant (US), Parasoft (US), Softcrylic (US), LogiGear (US), QualiTest (US), Testplant (UK), Vector Software (US), QA Mentor (US), and SmartBear Software(US). |

The research report categorizes the continuous testing market to forecast the revenues and analyze the trends in each of the following submarkets:

Continuous Testing Market By Service

- Managed Services

- Professional Services

- Implementation

- Advisory and Consulting

- Support and Maintenance

- Training and Education

Market By Interface

- Web

- Desktop

- Mobile

Continuous Testing Market By Deployment Type

- On-premises

- Cloud

Market By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Market By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Transportation and Logistics

- Healthcare

- Manufacturing

- Telecom and IT

- Energy and Utilities

- Government

- Media and Entertainment

- Others (Education, and Travel and Hospitality)

Continuous Testing Market By Region

- North America

- Europe

- MEA

- APAC

- Latin America

The continuous testing market is expected to grow from USD 1.15 Billion in 2018 to USD 2.41 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period, owing to the growing need for continuous and timely delivery of software. In addition to this, organizations across various industry verticals are looking forward to digital transformation for enhancing their business operations and DevOps going mainstream are the factors that are driving the growth of market. Moreover, enterprises consider continuous testing important, as they help them minimize their business risks associated with their software assets.

The rapidly changing competitive scenarios has encouraged enterprises to adopt continuous testing to facilitate continuous delivery by continual improvement through feedback from business stakeholders, and by proper validation of processes and transactions. The Banking, Financial Services, and Insurance (BFSI) companies deal with critical credit management, collection management, and fraud detection management in its day to day financial operations. BFSI organizations are looking forward to provide customer friendly digital solutions and software platforms, so that they can serve their customers in a better way. The BFSI industry has been a major contributor, in terms of the revenue generated, in the continuous testing market.

The adoption of smart devices, IoT, cloud, and mobile technologies has transformed organizations across various industry verticals. With the help of these technologies, organizations streamline their business flows and operations. Hence, based on the specific nature of their requirements, organizations are customizing their mobile technology solutions. The rapid adoption of the mobile technology and the proliferation of smartphone users have increased the demand for mobile-based software and applications. Many mobile technology vendors help enterprises test their technology platforms that assist them in meeting their business goals. These platforms also help in creating and managing connections with people, machines, and information across enterprises, readily available at any time and anywhere. continuous testing market empowers organizations to seamlessly integrate their software with their existing systems, thereby facilitating them to enhance their business operations through the effective implementation of smart technologies. As a result, the mobile segment is expected to grow at the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

North America is estimated to account for the largest market size and dominate the continuous testing market from 2018 to 2023. This region has a high concentration of BFSI, retail and consumer goods, healthcare, and transportation and logistics companies, which largely contribute to the market. However, the Asia Pacific (APAC) region is expected to provide opportunities for continuous testing service providers. These growth opportunities can be attributed to the increasing commercial investments by several companies in the APAC region. However, the heavy dependency of organizations on traditional testing approaches is expected to restrain the growth of market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American continuous testing market into countries

- Further breakdown of the European market into countries

- Further breakdown of the APAC market into countries

- Further breakdown of the MEA market into countries

- Further breakdown of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the Continuous Testing Market

4.2 Market By Service

4.3 Market By Deployment Type

4.4 Market By Organization Size

4.5 Market By Interface

4.6 Market By Industry Vertical and Region

5 Continuous Testing Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Devops Going Mainstream

5.2.1.2 Growing Need for Continuous and Timely Delivery

5.2.1.3 Digital Transformations

5.2.2 Restraints

5.2.2.1 Heavy Dependency on Traditional Approaches

5.2.3 Opportunities

5.2.3.1 Advancements in AI, Neural Networks, and Machine Learning Technologies

5.2.3.2 Increasing Adoption of IoT-Enabled Devices

5.2.4 Challenges

5.2.4.1 Heterogeneous Test Environment

5.2.4.2 Lack of Skilled and Experienced Test Automation Professionals

6 Market, By Service (Page No. - 33)

6.1 Introduction

6.2 Managed Services

6.3 Professional Services

6.3.1 Implementation

6.3.2 Advisory and Consulting

6.3.3 Support and Maintenance

6.3.4 Training and Education

7 Continuous Testing Market By Deployment Type (Page No. - 40)

7.1 Introduction

7.2 On-Premises

7.3 Cloud

8 Market By Organization Size (Page No. - 44)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Continuous Testing Market, By Interface (Page No. - 48)

9.1 Introduction

9.2 Web

9.3 Mobile

9.4 Desktop

10 Market, By Industry Vertical (Page No. - 52)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Retail and Consumer Goods

10.4 Transportation and Logistics

10.5 Healthcare

10.6 Manufacturing

10.7 Telecom and It

10.8 Energy and Utilities

10.9 Government

10.10 Media and Entertainment

10.11 Others

11 Continuous Testing Market, By Region (Page No. - 64)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 84)

12.1 Overview

12.2 Market Ranking

12.3 Competitive Scenario

12.3.1 New Product/Service Launches and Product Upgradations

12.3.2 Business Expansions

12.3.3 Acquisitions

12.3.4 Partnerships, Agreements, and Collaborations

13 Company Profiles (Page No. - 90)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 EPAM Systems

13.2 Mindtree

13.3 HCL Technologies

13.4 ATOS

13.5 Tech Mahindra

13.6 Hexaware

13.7 Tricentis

13.8 Cigniti

13.9 Larsen & Toubro Infotech

13.10 NIIT Technologies

13.11 Qualitest

13.12 CA Technologies

13.13 Logigear

13.14 IBM

13.15 Capgemini

13.16 Parasoft

13.17 Softcrylic

13.18 Spirent Communications

13.19 Cognizant

13.20 Micro Focus

13.21 Syntel

13.22 Key Innovators

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 137)

14.1 Key Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (66 Tables)

Table 1 United States Dollar Exchange Rate

Table 2 Continuous Testing Market Size, By Service, 20162023 (USD Million)

Table 3 Managed Services: Market Size By Region, 20162023 (USD Million)

Table 4 Professional Services: Market Size By Type, 20162023 (USD Million)

Table 5 Professional Services: Market Size By Region, 20162023 (USD Million)

Table 6 Implementation Market Size, By Region, 20162023 (USD Million)

Table 7 Advisory and Consulting Market Size, By Region, 20162023 (USD Million)

Table 8 Support and Maintenance Market Size, By Region, 20162023 (USD Million)

Table 9 Training and Education Market Size, By Region, 20162023 (USD Million)

Table 10 Continuous Testing Market Size, By Deployment Type, 20162023 (USD Million)

Table 11 On-Premises: Market Size By Region, 20162023 (USD Million)

Table 12 Cloud: Market Size By Region, 20162023 (USD Million)

Table 13 Market Size By Organization Size, 20162023 (USD Million)

Table 14 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 15 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 16 Market Size By Interface, 20162023 (USD Million)

Table 17 Web: Market Size By Region, 20162023 (USD Million)

Table 18 Mobile: Market Size By Region, 20162023 (USD Million)

Table 19 Desktop: Market Size By Region, 20162023 (USD Million)

Table 20 Continuous Testing Market Size, By Industry Vertical, 20162023 (USD Million)

Table 21 Banking, Financial Services, and Insurance: Market Size By Region, 20162023 (USD Million)

Table 22 Retail and Consumer Goods: Market Size By Region, 20162023 (USD Million)

Table 23 Transportation and Logistics: Market Size By Region, 20162023 (USD Million)

Table 24 Healthcare: Market Size By Region, 20162023 (USD Million)

Table 25 Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 26 Telecom and It: Market Size By Region, 20162023 (USD Million)

Table 27 Energy and Utilities: Market Size By Region, 20162023 (USD Million)

Table 28 Government: Market Size By Region, 20162023 (USD Million)

Table 29 Media and Entertainment: Market Size By Region, 20162023 (USD Million)

Table 30 Others: Market Size By Region, 20162023 (USD Million)

Table 31 Continuous Testing Market Size, By Region, 20162023 (USD Million)

Table 32 North America: Market Size By Service, 20162023 (USD Million)

Table 33 North America: Market Size By Professional Service, 20162023 (USD Million)

Table 34 North America: Market Size By Deployment Type, 20162023 (USD Million)

Table 35 North America: Market Size By Organization Size, 20162023 (USD Million)

Table 36 North America: Market Size By Interface, 20162023 (USD Million)

Table 37 North America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 38 Europe: Market Size, By Service, 20162023 (USD Million)

Table 39 Europe: Market Size By Professional Service, 20162023 (USD Million)

Table 40 Europe: Market Size By Deployment Type, 20162023 (USD Million)

Table 41 Europe: Market Size By Organization Size, 20162023 (USD Million)

Table 42 Europe: Market Size By Interface, 20162023 (USD Million)

Table 43 Europe: Market Size By Industry Vertical, 20162023 (USD Million)

Table 44 Asia Pacific: Continuous Testing Market Size, By Service, 20162023 (USD Million)

Table 45 Asia Pacific: Market Size By Professional Service, 20162023 (USD Million)

Table 46 Asia Pacific: Market Size By Deployment Type, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size By Organization Size, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size By Interface, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size By Industry Vertical, 20162023 (USD Million)

Table 50 Middle East and Africa: Continuous Testing Market Size, By Service, 20162023 (USD Million)

Table 51 Middle East and Africa: Market Size By Professional Service, 20162023 (USD Million)

Table 52 Middle East and Africa: Market Size By Deployment Type, 20162023 (USD Million)

Table 53 Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size By Interface, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size By Industry Vertical, 20162023 (USD Million)

Table 56 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 57 Latin America: Market Size By Professional Service, 20162023 (USD Million)

Table 58 Latin America: Market Size By Deployment Type, 20162023 (USD Million)

Table 59 Latin America: Market Size By Organization Size, 20162023 (USD Million)

Table 60 Latin America: Market Size By Interface, 20162023 (USD Million)

Table 61 Latin America: Market Size By Industry Vertical, 20162023 (USD Million)

Table 62 Market Ranking for the Continuous Testing Market, 2018

Table 63 New Product/Service Launches and Product Upgradations, 20162017

Table 64 Business Expansions, 2017

Table 65 Acquisitions, 20162017

Table 66 Partnerships, Agreements, Collaborations, and Contracts, 20162017

List of Figures (48 Figures)

Figure 1 Continuous Testing Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Continuous Testing Market: Assumptions

Figure 8 Top 3 Segments With the Largest Market Shares in 2018

Figure 9 Market Regional Snapshot

Figure 10 The Growing Need for the Continuous and Timely Delivery of Software is Expected to Drive the Growth of the Continuous Testing Market

Figure 11 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 12 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 13 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Mobile Interface is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Banking, Financial Services, and Insurance Industry Vertical, and North America are Estimated to Dominate the Continuous Testing Services Market in 2018

Figure 16 Continuous Testing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 18 Implementation Segment is Expected to Have the Highest CAGR During the Forecast Period

Figure 19 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Mobile Interface is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Retail and Consumer Goods Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Key Developments By the Leading Players in the Continuous Testing Services Market, 20152018

Figure 27 Continuous Testing Market Evaluation Framework

Figure 28 EPAM Systems: Company Snapshot

Figure 29 EPAM Systems: SWOT Analysis

Figure 30 Mindtree: Company Snapshot

Figure 31 Mindtree: SWOT Analysis

Figure 32 HCL Technologies: Company Snapshot

Figure 33 HCL Technologies: SWOT Analysis

Figure 34 ATOS: Company Snapshot

Figure 35 ATOS: SWOT Analysis

Figure 36 Tech Mahindra: Company Snapshot

Figure 37 Tech Mahindra: SWOT Analysis

Figure 38 Hexaware: Company Snapshot

Figure 39 Cigniti: Company Snapshot

Figure 40 Larsen & Toubro Infotech: Company Snapshot

Figure 41 NIIT Technologies: Company Snapshot

Figure 42 CA Technologies: Company Snapshot

Figure 43 IBM: Company Snapshot

Figure 44 Capgemini: Company Snapshot

Figure 45 Spirent Communications: Company Snapshot

Figure 46 Cognizant: Company Snapshot

Figure 47 Micro Focus: Company Snapshot

Figure 48 Syntel: Company Snapshot

Growth opportunities and latent adjacency in Continuous Testing Market