Monorail Market by Type (Straddle, and Suspended), Propulsion Type (Electric, and Maglev), Size (Large Monorail, Medium Monorail, and Compact Monorail), and Region - Global Forecast to 2021

The monorail market, in terms of value, is projected to grow at a CAGR of 2.75% from 2016 to 2021. The market is estimated to be USD 4.68 Billion in 2016. In this study, 2015 has been considered the base year and 2016 to 2021 the forecast period for estimating the market size of market.

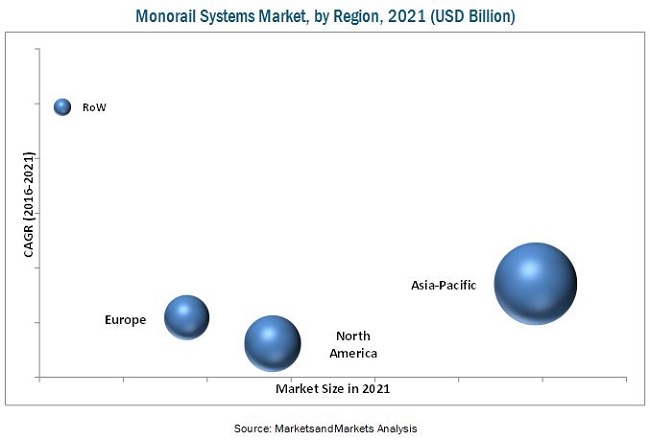

The report analyzes and forecasts the market size, in terms of volume (units) and value (USD million), of the market. The report segments the market and forecasts its size, by volume and value, on the basis of region, type, propulsion, and size. The report discusses the market for monorail systems in terms of volume & value. The regions covered in the report are Asia-Pacific, North America, Europe, and RoW. The Asia-Pacific region is dominated by developing countries such as China, India, and Korea, where the monorail system market is growing at a faster pace than in other countries of the region.

The secondary sources referred to for this research study include monorail industry organizations such as Japan Monorail Association (JMA), International Monorail Association (IMA), and The Monorail Society (TMS), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and monorail system associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research. The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the region-wise installation volumes and analyzing the demand trends. The market size, by value, is derived by multiplying the average selling price of monorail systems by the number of units.

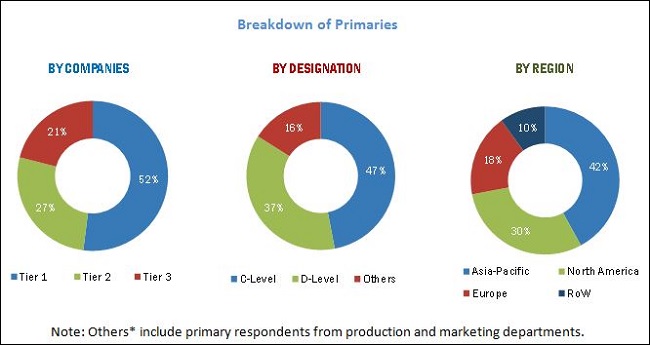

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the monorail systems industry consists of manufacturers such as Bombardier Transportation (Canada), Hitachi, Ltd. (Japan), Scomi Engineering Bhd. (Malaysia), Aerobus International, Inc. (USA), Mitsubishi Heavy Industries, Ltd. (Japan), Intamin Bahntechnik (Switzerland), Urbanaut Monorail Technology (USA) and research institutes such as the Japan Monorail Association (JMA), International Monorail Association (IMA), and The Monorail Society (TMS).

Target Audience

- Monorail Manufacturers

- Monorails material suppliers

- Industry associations and experts

- The Monorail Society

- Railroad Authorities/Organizations

- Industry Experts

- OEMs

Scope of the Report

Market By Type

Market By Propulsion

Market By Size

By Region

-

- Straddle

- Suspended

- Electric

- Maglev

- Large

- Medium

- Compact

- North America

- Asia-Pacific

- Europe

- RoW

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional regions (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of the monorail system market, by capacity

The monorail market, in terms of value, is projected to grow at a CAGR of 2.75% from 2016 to 2021. The market is estimated to be USD 4.68 Billion in 2016, and is projected to reach 5.36 Billion by 2021. Increase in urbanization has led to increase in demand for alternative transportation which has drive the monorail system industry.

Continuous technological improvisation led to change in monorail speeds and the distance it covers. Countries such as China, Japan, and Germany have developed monorail systems for longer distance and with faster speed compared to other monorail systems. The advantage of a monorail system is the space optimization for its installation over metro and other modes of transportation to commute. Monorails are considered as “rail of the future” due to improvement and development in the technology. Asian countries such as China, India and others are installing monorail systems as they are cost effective. Monorail systems are also being used for connecting two different lines of metro rails. For instance Chongqing monorail system implemented in China and also for connecting airports & shopping centers to the parking lots.

The growing need for urbanization, environmental sustainability, and increase in the traffic congestion has resulted in an increasing number of transport systems, which is expected to drive the demand for monorail systems. In developing countries, the increase in urbanization has led to an increase in the demand for transportation systems. Traffic congestion on the roads has also increased. This has led governments to develop infrastructure for rail networks such as metros, monorails, light rails, and trams. Countries have mostly constructed metros and heavy rails for travelling to longer distances whereas monorails are used to commute over shorter distances. The efficiency operation and low cost of installation of monorail systems has meant that most countries have opted for this as an alternative mode for transportation.

The Asia-Pacific region is estimated to dominate the monorail systems market, in terms of value, in 2016, as it comprises some of the fastest developing economies in the world, including China, India, and Korea. This has led to an increase in monorail systems installation volumes in recent years, with OEMs catering not only to the domestic demand but to overseas demand as well.

There is a lack of innovation and R&D for monorail systems. OEMs need to invest heavily in R&D to enhance the ability of monorail systems to improve its speed, reliability and efficiency in order to reduce turnaround time. Maglev monorail systems have a higher installation cost than electric monorail systems. These vehicles have not yet penetrated in the emerging markets. The high installation cost is one of the major factors preventing manufacturers from entering the Asia-Pacific market, particularly in countries such as china, India and Korea.

Bombardier Transportation (Canada) is a major player in the monorail systems market. It is an industry leader in the implementation and installation of monorail systems. It has a strong product portfolio, with fully automated monorail system under brand called “Innovia". Bombardier Transportation and Chinese CSR Nanjing Puzhen entered into a joint venture to develop and manufacture Innovia Monorail vehicles for urban transit systems in China. Bombardier Transportation (Canada) invested in a site in Brazil worth USD 15 million to manufacture its new and improved monorail systems that will strengthen its presence globally.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Urbanization

2.5.2.2 Infrastructure: Rail Network

2.5.2.3 Space Optimization

2.5.3 Supply-Side Analysis

2.5.3.1 Technological Advancements

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Opportunities in the Monorail Market

4.2 Market, By Region, 2016 & 2021

4.3 Market, By Type, 2016 & 2021

4.4 Market, By Propulsion, 2016 & 2021

4.5 Market, By Size, 2016 & 2021

4.6 Monorail Systems Lifecycle Analysis: Rise in Demand for Monorail Systems in Emerging Economies Such as Asia-Pacific and RoW

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Monorail Market Segmentation: By Size

5.2.2 Market Segmentation: By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of Urbanization

5.3.1.2 Space Optimization

5.3.1.3 Cost Efficiency

5.3.1.4 Aesthetics

5.3.2 Restraints

5.3.2.1 Low Market Penetration

5.3.2.2 Speed

5.3.2.3 Availability of Alternate Modes

5.3.3 Opportunities

5.3.3.1 Traffic Congestion

5.3.3.2 Technological Developments

5.3.3.3 Environmentally Compatible

5.3.3.4 Clichés

5.3.4 Challenges

5.3.4.1 Unreliable and Unsafe

5.3.4.2 Seating Capacity

5.3.4.3 Adaptability

5.3.4.4 Limited Manufacturers

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.1.1 High Capital Required

5.4.1.2 Technological Prevalence of Existing Players

5.4.2 Threat of Substitutes

5.4.2.1 Demand for Alternates

5.4.3 Bargaining Power of Buyers

5.4.3.1 Selective Feasibility

5.4.3.2 Benefit to the Society

5.4.4 Bargaining Power of Suppliers

5.4.4.1 Long Term Service Contracts

5.4.4.2 Upgraded Technology Infrastructure

5.4.5 Intensity of Competitive Rivalry

5.4.5.1 Highly Competitive

5.4.5.2 Opportunistic

6 Monorail Systems Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Straddle Monorail

6.3 Suspended Monorail

7 Monorail Market, By Propulsion (Page No. - 50)

7.1 Introduction

7.2 Electric Monorail Systems

7.3 Maglev Monorail Systems

8 Monorail Market, By Size (Page No. - 54)

8.1 Introduction

8.2 Large Size Segment

8.3 Medium Size Segment

8.4 Compact Size Segment

9 Monorail Market, By Region (Page No. - 59)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 South Korea

9.2.4 India

9.2.5 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 U.K.

9.4.3 Italy

9.4.4 Spain

9.5 RoW

9.5.1 Brazil

9.5.2 Russia

10 Competitive Landscape (Page No. - 81)

10.1 Market Ranking Analysis: Global Monorail System Market

10.2 Competitive Situation & Trends

10.3 New Product Launches

10.4 Mergers & Acquisitions

10.5 Supply Contracts/Joint Ventures/ Collaborations/ Partnerships/Agreements

10.6 Expansions

11 Company Profiles (Page No. - 86)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Scomi Engineering BHD

11.2 Siemens AG

11.3 Bombardier Inc.

11.4 Hitachi, Ltd.

11.5 CSR Corporation Limited

11.6 Mitsubishi Heavy Industries Ltd.

11.7 Urbanaut Monorail Technology

11.8 Aerobus International, Inc.

11.9 Intamin Bahntechnik

11.10 Woojin Industrial System

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 108)

12.1 Key Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (63 Tables)

Table 1 Monorail Market Size, By Type, 2014–2021 (Units)

Table 2 Monorail Market Size, By Type, 2014–2021 (USD Million)

Table 3 Straddle Type: Monorail Systems Market Size, By Region, 2014–2021 (Units)

Table 4 Straddle Type: Monorail Systems Market Size, By Region, 2014–2021 (USD Million)

Table 5 Suspended Type: Monorail Systems Market Size, By Region, 2014–2021 (Units)

Table 6 Suspended Type: Monorail Systems Market Size, By Region, 2014–2021 (USD Million)

Table 7 Monorail Market, By Propulsion, 2014—2021, (Units)

Table 8 Monorail Market, By Propulsion, 2014—2021 (USD Million)

Table 9 Monorail Market , By Type, 2014—2021 (Units)

Table 10 Monorail Market, By Type, 2014—2021 (USD Million)

Table 11 Monorail Market, By Type, 2014—2021 (Units)

Table 12 Monorail Market, By Type, 2014—2021 (USD Million)

Table 13 Monorail Market, By Size, 2014–2021 (Units)

Table 14 Monorail Market, By Size, 2014–2021 (USD Million)

Table 15 Large Size Segment: Monorail Systems Market Size, By Type, 2014–2021 (Units)

Table 16 Large Size Segment: Monorail Systems Market Size, 2014–2021 (USD Million)

Table 17 Medium Size Segment: Monorail Systems Market Size, 2014–2021 (Units)

Table 18 Medium Size Segment: Monorail Systems Market Size, 2014–2021 (USD Million)

Table 19 Compact Size Segment: Monorail Systems Market Size, 2014–2021 (Units)

Table 20 Compact Size Segment: Monorail Systems Market Size, 2014–2021 (USD Million)

Table 21 Monorail Market Size, By Region, 2014—2021, (Units)

Table 22 Monorail Market Size, By Region, 2014—2021, (USD Million)

Table 23 Asia-Pacific: Monorail Systems Market Size, By Country, 2014–2021, (Units)

Table 24 Asia-Pacific: Monorail Systems Market Size, By Country, 2014–2021 (USD Million)

Table 25 China: Monorail Systems Market Size, By Type, 2014–2021 (Units)

Table 26 China: Monorail Systems Market Size, By Type, 2014–2021 (USD Million)

Table 27 Japan: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 28 Japan: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 29 South Korea: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 30 South Korea: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 31 India: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 32 India: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 33 Rest of Asia-Pacific: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 34 Rest of Asia-Pacific: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 35 North America: Monorail Systems Market Size, By Country, 2014—2021 (Units)

Table 36 North America: Monorail Systems Market Size, By Country, 2014—2021 (USD Million)

Table 37 U.S.: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 38 U.S.: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 39 Canada: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 40 Canada.: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 41 Mexico: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 42 Mexico: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 43 Europe: Monorail Systems Market Size, By Country, 2014—2021 (Units)

Table 44 Europe: Monorail Systems Market Size, By Country, 2014—2021 (USD Million)

Table 45 Germany: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 46 Germany: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 47 U.K.: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 48 U.K.: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 49 Italy: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 50 Italy: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 51 Spain: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 52 Spain: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 53 RoW: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 54 RoW: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 55 Brazil: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 56 Brazil: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 57 Russia: Monorail Systems Market Size, By Type, 2014—2021 (Units)

Table 58 Russia: Monorail Systems Market Size, By Type, 2014—2021 (USD Million)

Table 59 Global Monorail System Market Ranking: 2015

Table 60 New Product Launches, 2014–2015

Table 61 Mergers & Acquisitions, 2015–2016

Table 62 Supply Contracts/Joint Ventures/Collaborations/Partnerships, 2013-2016

Table 63 Expansions, 2013-2016

List of Figures (43 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Urbanization Percentage

Figure 5 Average Congestion Levels By Country, 2016

Figure 6 Market Size Estimation Methodology: Bottom–Up Approach

Figure 7 Straddle Monorail Systems to Be the Largest Contributor to the Monorail Market, (2016 & 2021)

Figure 8 Electric Monorail Systems to Be the Largest Contributor to the Monorail Market, By Propulsion (2016 & 2021)

Figure 9 Monorail Market, By Size, 2016 & 2021

Figure 10 Asia-Pacific to Hold the Largest Share in the Monorail Market, By Region, in 2016

Figure 11 Traffic Congestion is Expected to Drive the Monorail Market

Figure 12 Asia-Pacific to Hold the Largest Market for Monorail Systems

Figure 13 Straddle Type to Hold the Largest Share, in the Monorail Market, By Value

Figure 14 Electric Segment is Estimated to Dominate the Market Throughout the Forecast Period, By Value, in the Monorail Market, By Propulsion

Figure 15 Large Monorail to Hold the Largest Share, in the Monorail Market, By Value

Figure 16 Rise in Demand for Monorail Systems in Emerging Regions, 2016

Figure 17 Monorail Market Segmentation

Figure 18 Growing Rate of Urbanization Expected to Drive the Monorail Systems Market

Figure 19 Porter’s Five Forces Analysis

Figure 20 Straddle Type Monorail Systems to Hold the Largest Market Share, in Terms of Value, 2016 & 2021

Figure 21 Asia-Pacific to Hold the Largest Share (Value) in the Straddle Monorail Systems Market From 2016 to 2021

Figure 22 Urbanization is Driving the Growth of the Suspended Monorail Systems Market, 2016 & 2021

Figure 23 Maglev Monorail Systems: Estimated to Be the Fastest Growing Segment in Monorail Systems Market

Figure 24 Large Size Segment is the Largest Segment of the Monorail Systems Market

Figure 25 Asia-Pacific is Expected to Hold the Largest Market Share in the Monorail Market in 2016

Figure 26 Asia-Pacific Monorail Systems Market Snapshot: China Accounts for the Largest Share of the Monorail Market (Value) in 2016

Figure 27 North American Monorail Systems Market: U.S. Estimated to Capture the Largest Share of the Monorail Market (Value) in 2016

Figure 28 Europe: Germany is the Largest Market in the Monorail Systems Market (Value), 2016—2021

Figure 29 RoW: Brazil is the Largest Market Size in the Monorail Systems Market (Value), 2016–2021

Figure 30 Companies Adopted Supply Contract/Partnership/Joint Venture/Agreement as the Key Growth Strategy From 2013 to 2016

Figure 31 Market Evaluation Framework: Supply Contracts/Partnerships/Joint Ventures/Collaborations Fuelled Market Growth From 2013–2016

Figure 32 Battle for Market Share: Supply Contracts /Partnerships/Joint Ventures/Collaborations Was the Key Strategy

Figure 33 Scomi Engineering BHD: Company Snapshot

Figure 34 Scomi Engineering BHD: SWOT Analysis

Figure 35 Siemens AG: Company Snapshot

Figure 36 Bombardier Inc: Company Snapshot

Figure 37 Bombardier Inc.: SWOT Analysis

Figure 38 Hitachi,Ltd.: Business Overview

Figure 39 Hitachi Ltd.: SWOT Analysis

Figure 40 CSR Corporation Limited: Company Snapshot

Figure 41 CSR Corporation Limited: SWOT Analysis

Figure 42 Mitsubishi Heavy Industries Ltd.: Business Overview

Figure 43 Woojin Industrial System: Company Snapshot

Growth opportunities and latent adjacency in Monorail Market