Smart Transportation Market for Roadway & Railway By Technology (AVLS, TIS, EPS, & Intelligent Vehicle Initiatives), Components (CCTV Camera, GPS, Display, Automated Stop Announcement & Wi-Fi), Application, and Region - Global forecast to 2021

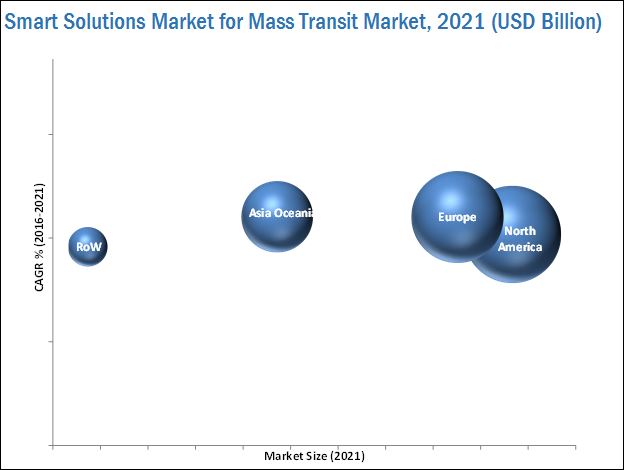

The smart transportation market for mass transit is projected to grow at a CAGR of 8.90% during the forecast period, to reach a market size of USD 44.78 Billion by 2021. The smart transportation market for mass transit is primarily driven by rising population, urbanization, infrastructural spending and environmental concerns for emission control. With the growth in urbanization, there would be an increase in the number of commuters which would increase the demand for public transport during the forecast period.

With the extension in public transit (roadways & railway) networks and investment in smart cities by governments, there has been a substantial upsurge in number of solutions to deal with the rising demand for public transport. This has eventually led to the commuter being offered a safe, comfortable, and convenient service. Hence, the smart solutions market for mass transit is projected to grow at a CAGR of 8.90% during the forecast period, to reach USD 44.7

8 Billion by 2021. The base year considered for the study is 2015, and the forecast period is 2016 to 2021. The primary objective of the study is to define, describe, and forecast the global smart transportation market for mass transit on the basis of components, technology, application and region, and to provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities and challenges).

The research methodology used in the report involves various secondary sources such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, and world economic outlook, trade websites, technical articles, and press release, industry magazines along with paid databases. To get the smart transportation market numbers, the number of public transits have been considered, country -wise. These public transits are multiplied with the penetration of each component in that particular country. The country-wise market size, by volume is multiplied with the country-wise average selling price of each type of component. This results in the country-wise market size for that particular component, in terms of value, which is further added to arrive at the regional market. Further the regional level data is added to derive global numbers. The same approach has been used to calculate the market sizes, by volume and value for the applications. The summation of the country-wise and regional-level market size, in terms of value, provides the size of the global smart solutions market for mass transit.

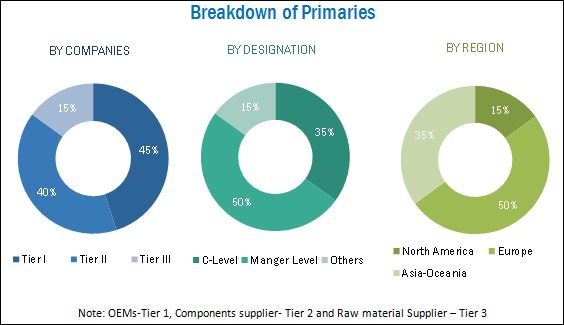

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The smart transportation market for mass transit ecosystem consists of system manufacturers such as Thales Group (France), Siemens AG (Germany) and, Kapsch TrafficCom (Austria) amongst others; traveler information system manufacturer such as WS Atkins Plc (U.K.)and Q-Free ASA (Norway) among others; and the manufacturers of parking assist systems include Swarco AG (Austria) and TransCore LP (U.S.) amongst others; these OEMs integrate these equipments and sell them to end-users to cater to their business requirements.

Target Audience

- Smart public transportation solution providers

- Manufacturers of smart public transportation components

- Raw material suppliers for smart public transportation components

- Transportation authorities

- Legal and regulatory authorities

- Fleet operators

Scope of the Report

-

Smart Transportation Market, By Technology

-

For Roadways

- Automatic Vehicle Location System

- Traveler Information System

- Electronic Payment System

- Intelligent Vehicle Initiative System

-

For Railways

- Automatic Vehicle Location System

- Traveler Information System

- Electronic Payment System

- Intelligent Vehicle Initiative System

-

For Roadways

-

Smart Transportation Market, By Component

-

For Roadways

- CCTV Cameras

- GPS Device

- Displays

- Automated stop announcement

- Wi-Fi devices

-

For Railways

- CCTV camera

- GPS Device

- Displays

- Automated stop announcement

- Wi-Fi devices

-

For Roadways

-

Smart Transportation Market, By Application

-

For Roadways

- Traffic management and traffic signal control system

- Emergency vehicle notification system (e-call)

- Smart ticketing system

- Automated passenger counter system

-

For Railways

- Emergency vehicle notification system (e-call)

- Automated passenger counter system

-

For Roadways

-

Smart Transportation Market, By Region

- North America

- Europe

- Asia-Oceania

- RoW

Available Customizations

- Country level smart solutions market for mass transit , By Application and By Components

Key Country:

-

Asia-Pacific

- China

- Japan

- South Korea

- Hong Kong

- Singapore

-

Europe

- Germany

- U.K.

- France

- The Netherlands

- Austria

-

North America

- U.S.

- Canada

- Mexico

-

RoW

- UAE

- Russia

-

Smart solutions market for mass transit , By Region, further breakdown Of the Rest of Europe into country-level markets

- Italy

- Portugal

- Sweden

- Turkey

The smart transportation market for mass transit is projected to grow at a CAGR of 8.90% during the forecast period, to reach a market size of USD 44.78 Billion by 2021. A wide array of upcoming railway projects, increased urbanization, and the growing need of public transport has led to the increase in demand for smart transportation solutions and its related components, software and services. Additionally technological advancements, such as the implementation of automatic vehicle location systems, traveler information systems, and electronic payment systems have led the demand for smart solutions market for mass transit solutions. These advancements helps to improve the fuel economy, lower emission levels, reduce traffic congestion that increase traveler convenience.

In this report, the global market for mass transit is broadly segmented based on its use into roadways and railways. Region-wise, Asia-Oceania and Europe are estimated to dominate the market for roadways and railways. The Asia-Oceania market is growing due to rising industrialization, urbanization, and government spending on the transportation sector. The growth of the European market can be credited to the improved socio-economic conditions in economies such as Germany, the U.K., and France.

Due to increasing need for surveillance and vehicle tracking, there has been an increased in the use of Wi-Fi devices, in public transits (both roadways and railways) which is driving the demand for smart solutions in mass transit.

The smart transportation market for smart ticketing systems is expected to grow for both roadways and railways. This growth is owing to the advantages offered in terms of efficiency, and reliability. These services make the travel experience better as well as reduce losses which leads to better performance.

The automated vehicle location system is estimated to be the fastest growing market in the roadways transportation segment. This growth is owing to the advantages AVLS offers such as vehicle tracking. This helps the transportation agency to keep a real time check on its fleet and provide assistance in case of medical emergency.

Key factors restraining the growth of the smart solutions market for mass transit includes the data storage concerns, security and management, the high cost of components and its complex nature, and slow GDP growth rate of developing countries. The necessity of providing real time information with the help of all these technologies and components means these systems are vulnerable to cyber attacks. This would have a negative impact on the SPT market.

The smart transportation market for mass transit is dominated by a few global players such as Thales Group (France), Siemens AG (Germany), Kapsch TrafficCom (Austria), TomTom International (The Netherlands), WS Atkins Plc. (U.K.), Q-Free ASA (Norway), Swarco AG (Austria), TransCore LP (U.S.), Iteris Inc. (U.S.), and Efkon AG (Austria). The Thales Group has a strong product offering and invested heavily in R&D to retain its position in the market. The company has also adopted new product development and supply contracts as key strategies while Siemens AG has followed the strategies of new product development and mergers & acquisitions to emerge as a prominent player in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Smart Transportation Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Rising Urbanization Around the Globe

2.4.2.2 Increasing Traffic Congestions

2.4.2.3 Infrastructure: Rail Network

2.4.3 Supply-Side Analysis

2.4.3.1 Technological Advancements

2.5 Market Estimation

2.5.1 Bottom-Up Approach

2.5.2 Smart Transportation Market Breakdown & Data Triangulation

2.5.3 Assumptions

3 Executive Summary (Page No. - 33)

3.1 Smart Solutions Market for Mass Transit : Roadways, By Region

3.2 Smart Transportation Market for Mass Transit : Roadways, By Technology

3.3 Market for Mass Transit : Roadways, By Application

3.4 Market for Mass Transit : Roadways, By Components

3.5 MARKET : Railways, By Region

3.6 Market for Mass Transit : Railways, By Technology

3.7 Market for Mass Transit : Railways, By Application

3.8 Market for Mass Transit : Railways, By Components

3.9 MARKET — Growth Trends

4 Premium Insights (Page No. - 43)

4.1 Smart Solutions Market for Mass Transit Size, 2016 vs 2021 (USD Billion)

4.2 MARKET for Roadways & Railways, 2016 (USD Billion)

4.3 MARKET for Roadways & Railways, By Region, 2016

4.4 MARKET for Roadways, By Technology, 2016

4.5 MARKET for Railways, By Technology, 2016

4.6 MARKET for Roadways & Railways, By Application, 2016

4.7 MARKET for Roadways, By Components, 2016

4.8 MARKET for Railways, By Components, 2016

5 Market Overview (Page No. - 49)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Smart Solutions Market for Mass Transit Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Global Trend in Vehicular Emission Reduction to Drive the Demand for Smart Solutions Market for Mass Transit

5.3.1.2 Increased Government Funding and Investments for Transportation Infrastructure Development

5.3.1.3 Rise in Demand for Safety, Comfort, and Convenience

5.3.1.4 Increased Population, Urbanization & Industrialization Will Boost the Demand for Smart Public Transportation

5.3.2 Restraints

5.3.2.1 Concerns Related to Data Storage, Security & Management (Data Commercialization)

5.3.2.2 Capital-Intensive Nature of Smart Solutions for Mass Transit System

5.3.2.3 Slow GDP Growth Rate in Developing Economies

5.3.3 Opportunities

5.3.3.1 Requirement of Public-Private Partnership (PPPS)

5.3.3.2 New Prospects for Data Driven Services and Electric Mobility Solutions (E-Mobility and Mobility on Demand)

5.3.3.3 Future Potential for Telecommunication Service Providers (TSP)

5.3.4 Challenges

5.3.4.1 Lack of Interoperability

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants: Low

5.4.2 Threat of Substitutes: Medium

5.4.3 Bargaining Power of Suppliers: Medium

5.4.4 Bargaining Power of Buyers: Medium

5.4.5 Intensity of Competitive Rivalry: Medium

6 Smart Solutions Market for Mass Transit, By Components (Page No. - 64)

6.1 Introduction

6.2 Hardware Components for Smart Solutions Market for Mass Transit

6.2.1 Interface Board

6.2.2 Multifunctional Board

6.2.3 Vehicle Detection Board

6.2.4 Communication Board

6.3 Smart Solutions for Mass Transit Components Market, By Transportation Mode

6.3.1 Roadways MARKET, By Components

6.3.2 Railways MARKET, By Components

6.4 CCTV Cameras Market, By Region & Transportation Mode

6.4.1 Roadways CCTV Cameras Market, By Region

6.4.2 Railways CCTV Cameras Market, By Region

6.5 GPS Devices Market, By Region & Transportation Mode

6.5.1 Roadways GPS Devices Market, By Region

6.5.2 Railways GPS Devices Market, By Region

6.6 Digital Displays Market, By Region & Transportation Mode

6.6.1 Roadways Digital Displays Market, By Region

6.6.2 Railways Digital Displays Market, By Region

6.7 Automated Stop Announcement Systems Market, By Region & Transportation Mode

6.7.1 Roadways Automated Stop Announcement Systems Market, By Region

6.7.2 Railways Automated Stop Announcement Systems Market, By Region

6.8 Wi-Fi Devices Market, By Region & Transportation Mode

6.8.1 Roadways Wi-Fi Devices Market, By Region

6.8.2 Railways Wi-Fi Devices Market, By Region

7 Smart Solutions Market for Mass Transit for Roadways, By Software & Services (Page No. - 80)

7.1 Software

7.1.1 Introduction

7.1.2 Visualization Software

7.1.3 Video Detection and Management Software

7.1.4 Transit Management System

7.1.5 Roadways Smart Solutions Market for Mass Transit, By Software

7.2 Services

7.2.1 Introduction

7.2.2 Business and Cloud Services

7.2.3 Support and Maintenance Services

7.2.4 Roadways Smart Solutions Market for Mass Transit, By Services

8 Smart Solutions Market for Mass Transit, By Technology (Page No. - 84)

8.1 Introduction

8.2 Smart Solutions Market for Mass Transit, By Technology

8.2.1 Roadways MARKET, By Technology

8.2.2 Railways MARKET, By Technology

8.3 Automatic Vehicle Location System Market, By Region & Transportation Mode

8.3.1 Roadways Automatic Vehicle Location System Market, By Region

8.3.2 Railways Automatic Vehicle Location System Market, By Region

8.4 Traveler Information System Market, By Region & Transportation Mode

8.4.1 Roadways Traveler Information System Market, By Region

8.4.2 Vehicle to Vehicle (V2V) and Vehicle to Infrastructure (V2I) Communication

8.4.3 Railways Traveler Information System Market, By Region

8.5 Electronic Payment System Market, By Region & Transportation Mode

8.5.1 Roadways Electronic Payment System Market, By Region

8.5.2 Railways Electronic Payment System Market, By Region

8.6 Intelligent Vehicle Initiative System Market, By Region & Transportation Mode

8.6.1 Roadways Intelligent Vehicle Initiative System Market, By Region

8.6.2 Railways Intelligent Vehicle Initiative System Market, By Region

9 MARKET, By Application (Page No. - 94)

9.1 Introduction

9.2 Smart Solutions for Mass Transit Application Market, By Transportation Mode

9.2.1 Roadways Smart Solutions Market for Mass Transit, By Application

9.2.2 Railways Smart Solutions Market for Mass Transit, By Application

9.3 Smart Solutions Market for Mass Transit, By Protocol

9.4 Traffic Management and Traffic Signal Control System Market, By Region & Transportation Mode

9.4.1 Roadways Traffic Management and Traffic Signal Control System Market, By Region

9.5 Smart Ticketing System Market, By Region & Transportation Mode

9.5.1 Roadways Smart Ticketing System Market, By Region

9.6 Emergency Vehicle Notification System Market, By Region & Transportation Mode

9.6.1 Roadways Emergency Vehicle Notification System Market, By Region

9.6.2 Railways Emergency Vehicle Notification System Market, By Region

9.7 Automated Passenger Counter System Market, By Region & Transportation Mode

9.7.1 Roadways Automated Passenger Counter System Market, By Region

9.7.2 Railways Automated Passenger Counter System Market, By Region

10 Smart Solutions Market for Mass Transit, By Region & Transportation Mode (Page No. - 106)

10.1 Introduction

10.2 Smart Solutions Market for Mass Transit, By Transportation Mode

10.2.1 Roadways MARKET, By Region

10.2.2 Railways MARKET, By Region

10.3 North America: MARKET, By Country & Transportation Mode

10.3.1 North America: Roadways MARKET, By Country

10.3.2 North America: Railways MARKET, By Country

10.4 Europe: MARKET, By Country & Transportation Mode

10.4.1 Europe: Roadways MARKET, By Country

10.4.2 Europe: Railways MARKET, By Country

10.5 Asia-Oceania: MARKET, By Country & Transportation Mode

10.5.1 Asia-Oceania: Roadways MARKET, By Country

10.5.2 Asia-Oceania: Railways MARKET, By Country

10.6 Rest of the World (RoW): MARKET, By Country & Transportation Mode

10.6.1 RoW: Roadways MARKET, By Country

10.6.2 RoW: Railways MARKET, By Country

11 Competitive Landscape (Page No. - 119)

11.1 Overview

11.2 Smart Transportation Market Ranking Analysis: Smart Solutions Market for Mass Transit

11.3 Expansion and Supply Contracts

11.4 New Product Launch

11.5 Mergers & Acquisitions

11.6 Agreements/Partnerships/Joint Venture / Collaboration

12 Company Profile (Page No. - 126)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Introduction

12.2 Thales Group

12.3 Siemens AG

12.4 Kapsch Trafficcom

12.5 Tomtom International BV

12.6 WS Atkins PLC.

12.7 Q-Free ASA

12.8 Swarco AG

12.9 Transcore, LP

12.10 Iteris Inc

12.11 Efkon AG.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 154)

13.1 Insights of Industry Experts

13.2 Additional Developments

13.3 Discussion Guide

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Introducing RT: Real Time Market Intelligence

13.6 Available Customizations

13.6.1 Smart Solutions Market for Mass Transit, By Application

13.6.1.1 Traffic Management and Traffic Signal Control System, By Country

13.6.1.2 Smart Ticketing System, By Country

13.6.1.3 Emergency Vehicle Notification System, By Country

13.6.1.4 Automated Passenger Counter System, By Country

13.6.2 Smart Solutions Market for Mass Transit, By Component

13.6.2.1 CCTV Cameras, By Country

13.6.2.2 GPS Devices, By Country

13.6.2.3 Digital Displays, By Country

13.6.2.4 Automated Stop Announcement Systems, By Country

13.6.2.5 Wi-Fi Devices, By Country

13.6.3 Smart Solutions Market for Mass Transit, By Country

13.6.3.1 for Roadways

13.6.3.1.1 Italy

13.6.3.1.2 Portugal

13.6.3.1.3 Sweden

13.6.3.1.4 Turkey

13.6.3.2 for Railways

13.6.3.2.1 Italy

13.6.3.2.2 Portugal

13.6.3.2.3 Sweden

13.6.3.2.4 Turkey

13.7 Related Reports

13.8 Author Details

List of Tables (73 Tables)

Table 1 Porter’s Five Forces Analysis

Table 2 Smart Solutions for Mass Transit Components Market, By Transportation Mode, 2015-2021 (‘000 Units)

Table 3 Smart Solutions for Mass Transit Components Market, By Transportation Mode, 2015-2021 (USD Million)

Table 4 Smart Solutions Market for Mass Transit for Roadways, By Component, 2015-2021 ('000 Units)

Table 5 Smart Transportation Market for Mass Transit for Roadways, By Component, 2015-2021 (USD Million)

Table 6 Smart Solutions Market for Mass Transit for Railways, By Component, 2015-2021('000 Units)

Table 7 Market for Mass Transit for Railways, By Component, 2015-2021 (USD Million)

Table 8 Roadways CCTV Camera: Market for Mass Transit, By Region, 2015-2021 ('000 Units)

Table 9 Roadways CCTV Cameras: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 10 Railways CCTV Cameras: Market for Mass Transit, By Region, 2015-2021 (‘000 Units)

Table 11 Railways CCTV Cameras: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 12 Roadways GPS Devices: Market for Mass Transit, By Region, 2015-2021 (‘000 Units)

Table 13 Roadways GPS Devices: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 14 Railways GPS Devices: Market for Mass Transit, By Region, 2015-2021 (‘000 Units)

Table 15 Railways GPS Devices: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 16 Roadways Digital Displays: Smart Solutions Market for Mass Transit, By Region, 2015-2021 (‘000 Units)

Table 17 Roadways Digital Displays: Smart Transportation Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 18 Railways Digital Displays: MARKET, By Region, 2015-2021 (‘000 Units)

Table 19 Railways Digital Displays: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 20 Roadways Automated Stop Announcement Systems: MARKET, By Region, 2015-2021 (‘000 Units)

Table 21 Roadways Automated Stop Announcement Systems: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 22 Railways Automated Stop Announcement Systems: MARKET, By Region, 2015-2021 (‘000 Units)

Table 23 Railways Automated Stop Announcement Systems: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 24 Roadways Wi-Fi Devices: Market for Mass Transit, By Region, 2015-2021 (‘000 Units)

Table 25 Roadways Wi-Fi Devices: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 26 Railways Wi-Fi Devices: Market for Mass Transit, By Region, 2015-2021 (‘000 Units)

Table 27 Railways Wi-Fi Devices: Market for Mass Transit, By Region, 2015-2021 (USD Million)

Table 28 Roadways: Smart Solutions Market for Mass Transit, By Software, 2015–2021 (USD Million)

Table 29 Roadways: Market, By Services, 2015-2021 (USD Million)

Table 30 Roadways: Market, By Technology, 2015–2021 (USD Million)

Table 31 Global Railways: Market, By Technology, 2015–2021 (USD Million)

Table 32 Roadways Automatic Vehicle Location System Market, By Region, 2015–2021 (USD Million)

Table 33 Railways Automatic Vehicle Location System Market, By Region, 2015–2021 (USD Million)

Table 34 Roadways Traveler Information System Market, By Region, 2015–2021 (USD Million)

Table 35 Railways Traveler Information System Market, By Region, 2015–2021 (USD Million)

Table 36 Roadways Electronic Payment System Market, By Region, 2015–2021 (USD Million)

Table 37 Railways Electronic Payment System Market, By Region, 2015–2021 (USD Million)

Table 38 Roadways Intelligent Vehicle Initiative System Market, By Region, 2015–2021 (USD Million)

Table 39 Railways Intelligent Vehicle Initiative System Market, By Region, 2015–2021 (USD Million)

Table 40 Smart Solutions for Mass Transit Applications Market, By Transportation Mode, 2015–2021 (‘000 Million)

Table 41 Smart Transportation Market for Mass Transit, By Application & Transportation Mode, 2015–2021 (USD Million)

Table 42 Roadways: Market, By Application, 2015–2021 (‘000 Units)

Table 43 Roadways: Market, By Application, 2015–2021 (USD Million)

Table 44 Railways: Smart Solutions Market for Mass Transit, By Application, 2015–2021 (‘000 Units)

Table 45 Railways: Smart Solutions Market for Mass Transit, By Application, 2015–2021 (USD Million)

Table 46 Roadways Traffic Management and Traffic Control System: Smart Solutions Market for Mass Transit, By Region, 2015–2021 (‘000 Units)

Table 47 Roadways Traffic Management and Traffic Control System: Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 48 Roadways Smart Ticketing System: Market for Mass Transit, By Region, 2015–2021 (‘000 Units)

Table 49 Roadways Smart Ticketing System: Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 50 Roadways Emergency Vehicle Notification System: Market for Mass Transit, By Region, 2015–2021 (‘000 Units)

Table 51 Roadways Emergency Vehicle Notification System: Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 52 Railway Emergency Vehicle Notification System: Market for Mass Transit, By Region, 2015–2021 (‘000 Units)

Table 53 Railways Emergency Vehicle Notification System: Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 54 Roadways Automated Passenger Counter System: Market for Mass Transit, By Region, 2015–2021 (‘000 Units)

Table 55 Roadways Automated Passenger Counter System: arket for Mass Transit, By Region, 2015–2021 (USD Million)

Table 56 Railways Automated Passenger Counter System: Market for Mass Transit, By Region, 2015–2021 (‘000 Units)

Table 57 Roadways Automated Passenger Counter System: Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 58 Market for Mass Transit, By Transportation Mode, 2015–2021 (USD Million)

Table 59 Roadways Smart Solutions Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 60 Railways Smart Solutions Market for Mass Transit, By Region, 2015–2021 (USD Million)

Table 61 North America: Market for Mass Transit for Roadways, By Country, 2015–2021 (USD Million)

Table 62 North America: Market for Mass Transit for Railways, By Country, 2015–2021 (USD Million)

Table 63 Europe: Market for Mass Transit for Roadways, By Country, 2015–2021 (USD Million)

Table 64 Europe:Market for Mass Transit for Railways, By Country, 2015–2021 (USD Million)

Table 65 Asia-Oceania: Market for Mass Transit for Roadways, By Country, 2015–2021 (USD Million)

Table 66 Asia-Oceania: Market for Mass Transit for Railways, By Country, 2015–2021 (USD Million)

Table 67 RoW: Market for Mass Transit for Roadways, By Country, 2015–2021 (USD Million)

Table 68 RoW: Market for Mass Transit for Railways, By Country, 2015–2021 (USD Million)

Table 69 Smart Transportation Market for Mass Transit Ranking: 2015

Table 70 Expansion and Supply Contracts, 2016

Table 71 New Product Launches, 2015-2016

Table 72 Mergers & Acquisitions, 2014-2016

Table 73 Agreements/Partnerships/ Joint Venture/Collaboration, 2011–2016

List of Figures (64 Figures)

Figure 1 Ecosystem of Smart Transportation System

Figure 2 Smart Transportation Market for Mass Transit Segmentation

Figure 3 Geographic Scope of: Market for Mass Transit

Figure 4 Market for Mass Transit : Research Design

Figure 5 Research Design Model

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 7 Urban Population, 2005 vs 2015

Figure 8 Traffic Congestion Rate, 2016

Figure 9 Rail Network, 2015

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Data Triangulation

Figure 12 The North America is Estimated to Hold the Largest Market Size, 2016–2021 (USD Million)

Figure 13 Automatic Vehicle Location System is Estimated to Be the Highest Growing Market, 2016–2021 (USD Million)

Figure 14 Automated Passenger Counter System is Estimated to Hold the Largest Market Size, 2016–2021 (USD Million)

Figure 15 GPS Devices is Estimated to Be Fastest Growing Market, 2016–2021 (USD Million)

Figure 16 Europe Smart Solutions for Mass Transit is Projected to Hold the Largest Market Size, 2016–2021 (USD Million)

Figure 17 Traveler Information System is Estimated to Hold the Largest Market Size, 2016–2021 (USD Million)

Figure 18 Emergency Vehicle Location System is Estimated to Be Fastest Growing Market, 2016–2021 (USD Million)

Figure 19 Wi-Fi Devices is Estimated to Be Fastest Growing Market, 2016–2021 (USD Million)

Figure 20 U.K. & China are Projected to Be the Fastest Growing Market During the Forecast Period, 2016–2021

Figure 21 Attractive Smart Transportation Market Opportunities for Smart Solutions for Mass Transit System

Figure 22 Roadways to Constitute Majority of Share in the Global Smart Solutions Market for Mass Transit, 2016 (USD Billion)

Figure 23 Europe Leads the Market for Railway Smart Solutions for Mass Transit System, 2016 (USD Billion)

Figure 24 Electronic Payment System Dominates the Roadways Smart Solutions Market for Mass Transit, 2016

Figure 25 Traveler Information System Dominates the Railways Smart Solutions Market for Mass Transit, 2016

Figure 26 With the Growing Traffic Congestion, the Demand for Traffic Management and Traffic Signal Control System is Estimated to Rise, 2016)

Figure 27 Automated Stop Announcement System to Constitute Major Share for Roadways Smart Solutions Market for Mass Transit, 2016

Figure 28 Automated Stop Announcement System to Constitute Majority Share for Railway Smart Solutions Market for Mass Transit 2016

Figure 29 Growing Urban Population and Demand of Optimized Traffic Management Systems Estimated to Raise the Demand for Smart Solutions Market for Mass Transit

Figure 30 Emission Limits: Europe vs the U.S.

Figure 31 Transportation Infrastructure Spending By Key Countries, 2015 (USD Billion)

Figure 32 Urban Population in Emerging Economies

Figure 33 Porter’s Five Forces Analysis (2016): Presence of Global Players Increase the Degree of Competition

Figure 34 Presence of Well-Established Players & High Entry Barriers Have the Highest Impact on Market Entrants

Figure 35 Availability of Substitutes & Technological Advancements Influence the Threat of Substitutes

Figure 36 Low Supplier Concentration & Product Differentiation Keeps the Bargaining Power of Suppliers in Check

Figure 37 High Degree of Independence Increases Bargaining Power of Buyers

Figure 38 Well Established Players & Long Term Contracts Limits the Competition

Figure 39 Smart Solutions for Mass Transit System Smart Transportation Market for Roadways and Railways

Figure 40 Component Penetration for Roadways and Railways, 2016

Figure 41 Roadways Electronic Payment System Holds the Largest Market Share in the Smart Solutions for Mass Transit System

Figure 42 Traveler Information System & Electronic Payment System are Expected to Dominate the Technology Market Share in Smart Solutions for Mass Transit Share for Railways

Figure 43 Railways to Hold the Largest Market for Smart Solutions Market for Mass Transit, 2016–2021 (USD Million)

Figure 44 Traffic Management and Traffic Signal Control System to Drive the Market for Smart Solutions for Mass Transit System for Roadways, 2016–2021 (USD Million)

Figure 45 Region-Wise Snapshot of the Roadways Smart Solutions Market for Mass Transit, By Volume (2016): North America Accounts for the Largest Market Share.

Figure 46 Railways Smart Solutions Market for Mass Transit : Europe is Estimated to Have the Largest Market Share, 2016

Figure 47 Smart Solutions Market for Mass Transit for Roadways & Railways, 2016–2021 (USD Million)

Figure 48 North America: U.S. is Leading Market in the Smart Solutions for Mass Transit System

Figure 49 Germany Contributes the Highest in Smart Solutions for Mass Transit System Market in Europe

Figure 50 Companies Adopted Supply Contracts as A Key Growth Strategy From 2014 to 2016

Figure 51 Smart Transportation Market Evaluation Framework: Agreements/Partnerships/Supply Contracts/Joint Ventures Fuelled Market Growth From 2012 to 2016

Figure 52 Battle for Market Share: Agreements/Partnerships/Supply Contracts/Joint Ventures Was the Key Strategy

Figure 53 Thales Group: Company Snapshot

Figure 54 Thales Group: SWOT Analysis

Figure 55 Siemens AG: Company Snapshot

Figure 56 Siemens AG: SWOT Analysis

Figure 57 Kapsch Trafficcom: Company Snapshot

Figure 58 Kapsch Trafficcom: SWOT Analysis

Figure 59 Tomtom International BV: Company Snapshot

Figure 60 Tomtom International: SWOT Analysis

Figure 61 WS Atkins PLC.: Company Snapshot

Figure 62 WS Atkins PLC: SWOT Analysis

Figure 63 Q-Free ASA: Company Snapshot

Figure 64 Iteris Inc: Company Snapshot

Growth opportunities and latent adjacency in Smart Transportation Market