Connected Aircraft Market by Type (Hardware (SATCOM, Data Management Systems, Interface Devices, Software (Fleet Operations, Fleet Monitoring)), Connectivity (In-Flight, Air-To-Air, Air-To-Ground), Platform, and Region- Global Forecast to 2028

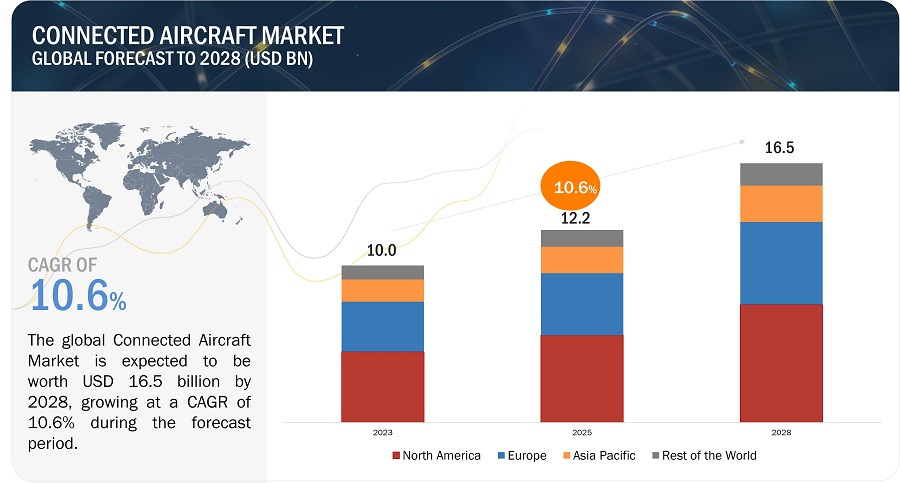

[232 Pages Report] The Connected Aircraft Market size is projected to grow from USD 10.0 Billion in 2023 to USD 16.5 Billion by 2028, at a CAGR of 10.6% from 2023 to 2028. Connected Aircraft Systems allow for considerably enhanced operational efficiency of an aircraft along with enhancing passenger experience. The emergence of IoT and Industry 4.0 technologies considerably aid the connected aircraft ecosystem. These factors are driving growth in the market.

Connected Aircraft Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Connected Aircraft Market Dynamics

Driver: Growing demand to increase the airline operational efficiency

Airline operational efficiency is a crucial factor driving the connected aircraft market. Airlines are increasingly adopting connected aircraft technologies to streamline their operations, cut costs, and improve overall efficiency. Connected aircraft technologies offer real-time data analytics, which is instrumental in boosting operational efficiency. Airlines can gain valuable insights into fleet performance and health by collecting and analyzing data from various onboard systems such as engines, avionics, and flight controls. This enables proactive maintenance, faster issue resolution, and minimizes unexpected downtime, resulting in maximum aircraft availability.

Predictive maintenance systems are also gaining prominence in the connected aircraft market. These systems employ advanced algorithms and machine learning to forecast potential faults or failures in advance. Maintenance teams can schedule repairs and part replacements by detecting early warning signs, minimizing disruptions, and optimizing maintenance operations. Connected aircraft technologies contribute to improved flight planning and fuel optimization. Airlines can optimize flight routes, altitudes, and speeds by leveraging real-time weather data, air traffic information, and performance analytics, resulting in reduced fuel consumption and emissions. This helps airlines meet environmental regulations and lowers operational costs in the fiercely competitive aviation industry.

Restraints: Limited bandwidth for connected aircraft

The limited availability of bandwidth is a significant limitation in the connected aircraft market. Bandwidth refers to the capacity of a network to transmit data efficiently. Strong and reliable network infrastructure is crucial for seamless communication between aircraft, ground systems, and other devices. When bandwidth is scarce or insufficient, it poses obstacles for connected aircraft operations. Real-time data transmission, such as flight information, sensor data, or video feeds, may suffer from delays or interruptions. This can hinder critical functions like monitoring aircraft performance, sharing situational awareness, and making timely decisions.

Limited bandwidth becomes an even more pressing concern in remote areas or congested airspace, where connectivity infrastructure may be lacking. These regions often lack network coverage or resources to support high-speed data transmission. The constraints of limited bandwidth can impact the efficiency, safety, and responsiveness of connected aircraft systems. It can impede potential benefits such as real-time analytics, remote monitoring, or seamless collaboration between aircraft and ground teams.

Opportunity: Increased focus on predictive maintenance

Predictive maintenance is a key opportunity in the connected aircraft market, which involves leveraging advanced data analytics and real-time monitoring to identify potential issues and predict when maintenance actions should be taken on aircraft components or systems. This proactive approach helps optimize maintenance schedules, minimize unplanned downtime, and enhance operational efficiency. In connected aircraft, sensors and monitoring systems continuously collect data on the performance and condition of critical components. This data is analyzed using sophisticated algorithms and machine learning techniques. Predictive maintenance systems can anticipate potential failures or malfunctions before they occur by detecting patterns and anomalies.

Predictive maintenance enables airlines and aircraft operators to schedule maintenance activities during planned downtimes, minimizing disruption to flight schedules. This proactive approach helps avoid costly unscheduled maintenance, reduces the risk of in-flight incidents, and improves safety. It offers cost-saving benefits. Early detection of issues allows airlines to optimize spare parts usage and reduce inventory costs. It also helps extend the lifespan of aircraft components by addressing maintenance needs promptly, thereby reducing the need for premature replacements. As connected aircraft technology advances, predictive maintenance will continue to play a vital role in enhancing safety, reliability, and profitability in the aviation industry.

Challenge: Lack of skilled labor

The connected aircraft market faces a significant challenge due to the lack of skilled labor. As aviation technology advances and aircraft become more connected, there is a growing demand for professionals with specialized skills to operate, maintain, and troubleshoot these complex systems. However, the shortage of skilled labor poses obstacles to the successful implementation and operation of connected aircraft. Pilot training is affected by the lack of skilled labor. Connected aircraft rely on advanced avionics systems and digital interfaces, requiring pilots to possess a thorough understanding of the technology. Skilled pilots must be trained to interact effectively with integrated systems, interpret data, and make informed decisions. The shortage of qualified pilots with the necessary technical expertise can hinder the seamless integration and optimal utilization of connected aircraft capabilities.

Skilled maintenance technicians are crucial to ensure the proper functioning of connected aircraft. These technicians require specialized training to handle the intricate systems and advanced sensors in connected aircraft. They must be proficient in diagnosing and repairing complex technical issues and conducting regular maintenance procedures. The shortage of skilled maintenance technicians can lead to longer maintenance cycles, increased downtime, and potential disruptions to operations. Moreover, the ground crew responsible for supporting aircraft operations also face challenges related to the lack of skilled labor. Ground crew members need to be trained in the intricacies of the connected systems, such as data management, communication protocols, and system integration. They must possess the skills to efficiently monitor and maintain the connectivity infrastructure, troubleshoot network issues, and ensure uninterrupted data exchange. Insufficient training and expertise among ground crew members can result in operational inefficiencies, delays, and increased risks to passenger services.

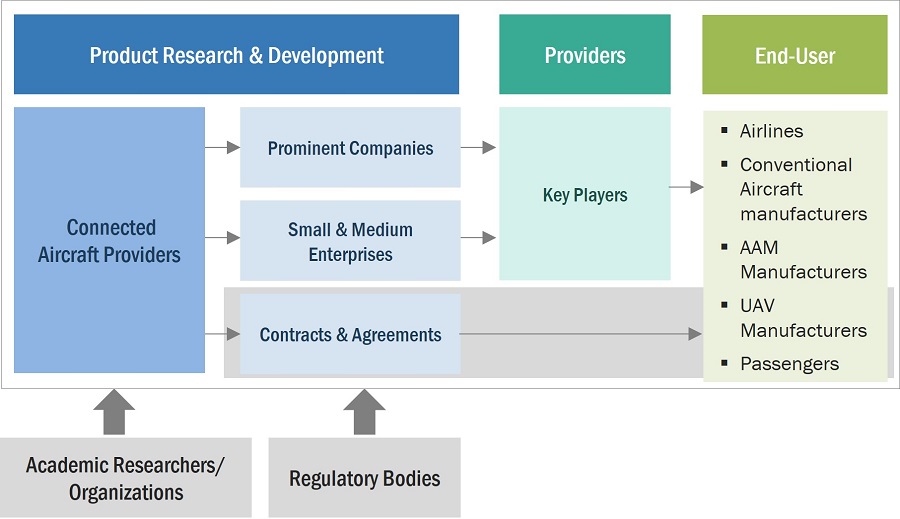

Connected Aircraft Market Ecosystem:

Prominent players in this market consist of reputable, financially secure manufacturers and solution providers. They have solidified their position through a wide range of products, cutting-edge technologies, and extensive global sales and marketing networks. Some key companies include Honeywell International (US), Raytheon Technologies (US), Thales Group (France), Viasat Inc (US), and Gogo Inc (US). The major end users of this market will be aircraft manufacturers, MRO service providers, airliners, and defense organizations.

Software Segment to lead market share during the forecast period.

Based on type, the Connected Aircraft Market has been segmented into hardware and software. The software solutions segment is expected to hold a larger market share as well as grow at a higher CAGR during the forecast period. The connected Aircraft market is a software-heavy ecosystem where end users are frequently required to upgrade their software and pay for yearly subscriptions. These factors are the major factors driving the growth in the market.

Advanced air mobility is expected to grow the highest during the forecast period.

Based on the platform, the Advanced air mobility (AAM) segment is expected to grow the highest during the forecast period. AAM is a niche market that is gaining immense market potential in the coming decade. AAM platforms are installed with some of the state of technologies to aid aircraft operations. The high growth of the AAM market clubbed with the need for high-end software and hardware driving the market growth.

The in-flight connectivity segment is expected to lead the market during the forecast period.

Based on connectivity, the in-flight connectivity segment is expected to have a larger market share as well as have a high CAGR during the forecast period. Enhancing in-flight connectivity to enhance passenger experience as well as crew connectivity is one of the major factor’s airliners are investing in. High-speed connectivity has become the need for passengers as well as to ensure seamless connectivity across the aircraft. These factors are driving the growth in the market.

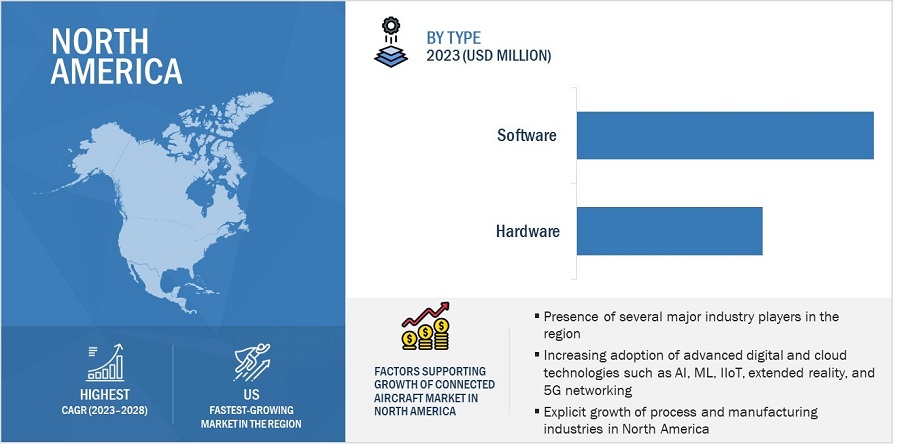

North America is projected to witness the highest market share during the forecast period.

North America leads the Connected Aircraft Market due presence of key players, solution providers, and component manufacturers, which are major factors expected to boost the growth of the Connected Aircraft Market in the region. These players invest in extensive R&D to develop IoT systems and advanced sensor solutions along with seamless connectivity and advanced processing software. Major manufacturers and suppliers of Connected Aircraft Solutions in this region include Honeywell International (US), Raytheon Technologies (US), Viasat Inc (US), and Gogo Inc (US).

Connected Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Connected Aircraft Market include Honeywell International (US), Raytheon Technologies (US), Thales Group (France), Viasat Inc (US), and Gogo Inc (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Platform, Type, Connectivity, and Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Middle East, Rest of the World |

|

Companies Covered |

Gogo Inc. (US), Honeywell International Inc (US), Raytheon Technologies Corporation (US), Thales Group (France), Viasat Inc (US), and TE Connectivity Ltd. (Switzerland). |

Connected Aircraft Market Highlights

This research report categorizes the Connected Aircraft Market based on Platform, Type, Connectivity, and Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Type |

|

|

By Connectivity |

|

|

By Region |

|

Recent Developments

- In May 2023, FlyExclusive chose Gogo Inc.’s popular AVANCE platform to upgrade 40 of their private aircraft. The decision was taken to benefit from Gogo's acclaimed connectivity and customer service, enhancing the overall experience for their passengers.

- In June 2023, Honeywell announced the signing of a Memorandum of Understanding (MOU) with ST Engineering. The collaboration aims to explore potential opportunities in retrofit, modification, and upgrade (RMU) programs for both fixed-wing and rotary-wing aircraft platforms.

- In February 2023, GE's subsidiary in India announced that it had signed a contract with Cochin Shipyard to provide a digital solutions package to increase the capabilities of the LM2500 marine gas turbines that will power the Indian Navy's first Indigenous Aircraft Carrier-1 (IAC-1) Vikrant, which was commissioned in August 2022.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Connected Aircraft Market?

Passengers are increasingly demanding more connected services during flights. In-flight Wi-Fi, streaming entertainment, and other connected amenities have become essential for a positive flying experience. Airlines that can offer these services are more likely to attract and retain customers. These are major growth factors in the connected aircraft market.

What are the key sustainability strategies adopted by leading players operating in the Connected Aircraft Market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Connected Aircraft Market. The major players include Honeywell International (US), Raytheon Technologies (US), Thales Group (France), Viasat Inc (US), and Gogo Inc (US). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Connected Aircraft Market?

Advanced sensors and IoT (Internet of Things) devices are significant technological trends in the connected aircraft industry. They play a crucial role in enhancing safety, efficiency, and maintenance practices. Advanced sensors on aircraft enable real-time monitoring of parameters like temperature, pressure, vibration, and component health. By collecting and transmitting data, these sensors help detect faults or anomalies in critical systems, ensuring prompt action to prevent potential failures and prioritize passenger safety.

Who are the key players and innovators in the ecosystem of the Connected Aircraft Market?

The key players in the Connected Aircraft Market include Honeywell International (US), Raytheon Technologies (US), Thales Group (France), Viasat Inc (US), and Gogo Inc (US) are some of the major players.

Which region is expected to hold the highest market share in the Connected Aircraft Market?

The Connected Aircraft Market in North America is projected to hold the highest market share and highest CAGR during the forecast period due to the presence of several large Connected Aircraft solution providers in the region. The region also has some of the aircraft manufacturers, such as Boeing (US) and Bombardier (Canada), to name a few.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for optimum airline operations- Increased demand for in-flight connectivity- Improved airline and passenger safety- Advancements in communications technologiesRESTRAINTS- Limited availability of bandwidth- Cybersecurity risksOPPORTUNITIES- Integration of advanced aircraft solutions- Emphasis on predictive maintenanceCHALLENGES- Lack of skilled labor- Challenges associated with software updates and maintenance

- 5.3 IMPACT OF RECESSION ON CONNECTED AIRCRAFT MARKET

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSR&DCOMPONENT MANUFACTURINGASSEMBLERS AND INTEGRATORSEND USERS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.6 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.9 VOLUME DATA, BY PLATFORM

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.11 TRADE ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 TECHNOLOGY ANALYSISROBOTICSDATA ANALYTICS

-

5.15 USE CASE ANALYSISCONNECTED AIRCRAFT SYSTEMS FOR MILITARY OPERATIONSCOMMUNICATIONS SYSTEMS FOR AIRCRAFT

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDS5GARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)ADVANCED SENSORS AND INTERNET OF THINGS (IOT)AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR)BLOCKCHAIN TECHNOLOGY

-

6.3 IMPACT OF MEGATRENDSCLOUD COMPUTINGQUANTUM COMPUTINGSUSTAINABLE TECHNOLOGIES

-

6.4 INNOVATIONS AND PATENT ANALYSIS

- 6.5 TECHNOLOGICAL ROADMAP

- 7.1 INTRODUCTION

-

7.2 HARDWARESATELLITE COMMUNICATIONS SYSTEMS- Need for connectivity in adverse weather conditions to drive growthDATA MANAGEMENT SYSTEMS- Improved operational efficiency to drive growthINTERFACING DEVICES- Demand for enhanced passenger experience to drive growthOTHERS

-

7.3 SOFTWAREFLEET OPERATIONS- Optimum management and performance to drive growth- Flight management systems- Electronic flight bags- Passenger and crew connectivity systemsFLEET MONITORING- Predictive maintenance and real-time monitoring to drive growth- Fuel and engine monitoring systems- Structure monitoring systems- Component monitoring systems

- 8.1 INTRODUCTION

-

8.2 COMMERCIAL AVIATIONNARROW-BODY AIRCRAFT- Increased passenger demand to drive growthWIDE-BODY AIRCRAFT- Improved performance and safety to drive growthREGIONAL JETS- Better passenger connectivity to drive growthCOMMERCIAL HELICOPTERS- Widespread use in emergency services to drive growth

-

8.3 BUSINESS AVIATION AND GENERAL AVIATIONBUSINESS JETS- Emphasis on privacy and comfort to drive growthLIGHT AND ULTRALIGHT AIRCRAFT- Improved flying experience to drive growth

-

8.4 MILITARY AVIATIONFIGHTER AIRCRAFT- increased operational agility to drive growthTRANSPORT AIRCRAFT- Logistics management and fuel efficiency to drive growthSPECIAL MISSION AIRCRAFT- Need for enhanced mission capabilities to drive growthMILITARY HELICOPTERS- Ability to support critical missions to drive growth

-

8.5 UNMANNED AERIAL VEHICLESMILITARY- Rising defense investments to drive growthCOMMERCIAL- Advanced sensor and flight capabilities to drive growthGOVERNMENT AND LAW- Efficient monitoring and surveillance to drive growth

-

8.6 ADVANCED AIR MOBILITYAIR TAXIS- Expanding urban population to drive growthAIR SHUTTLES AND AIR METROS- Development of cutting-edge technologies to drive growthPERSONAL AIR VEHICLES- Demand for safe and convenient transportation to drive growthCARGO AIR VEHICLES- Rapid deployment in commercial logistics industry to drive growthAIR AMBULANCES AND MEDICAL EMERGENCY VEHICLES- Growing demand from health industry to drive growth

- 9.1 INTRODUCTION

-

9.2 IN-FLIGHT CONNECTIVITYDEMAND FOR INTERNET AND OTHER SERVICES TO DRIVE GROWTH

-

9.3 AIR-TO-AIR CONNECTIVITYNEED FOR SAFETY TO DRIVE GROWTH

-

9.4 AIR-TO-GROUND CONNECTIVITYNEED FOR REAL-TIME INFORMATION TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISUS- Increased preference for in-flight connectivity to drive growthCANADA- Demand for real-time data analytics to drive growth

-

10.3 EUROPERECESSION IMPACT ANALYSISPESTLE ANALYSISFRANCE- Integration of advanced technologies to drive growthGERMANY- Increased R&D activities to drive growthITALY- Demand for real-time connectivity to drive growthUK- Need for better fuel efficiency to drive growthRUSSIA- Installation of connectivity solutions in existing fleets to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ANALYSISPESTLE ANALYSISCHINA- Low maintenance costs to drive growthINDIA- Rising technology adoption by airlines to drive growthJAPAN- Rapid adoption of advanced connectivity solutions to drive growthAUSTRALIA- Ongoing technological advancements to drive growthSOUTH KOREA- Emphasis on smart and connected solutions to drive growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EASTRECESSION IMPACT ANALYSISPESTLE ANALYSISSAUDI ARABIA- Demand for improved in-flight experience to drive growthUAE- Increased investments in connected aircraft to drive growthISRAEL- Expertise in advanced communications systems and data analytics to drive growthREST OF MIDDLE EAST

-

10.6 REST OF THE WORLDRECESSION IMPACT ANALYSISLATIN AMERICA- Improved interconnected air travel to drive growthAFRICA- Domestic fleet upgrades to drive growth

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 MARKET RANKING ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS, 2022

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT ANALYSIS

-

11.7 START-UP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEALS/DEVELOPMENTS

-

12.1 KEY PLAYERSGOGO INC.- Business overview- Products/Solutions offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Solutions offered- Recent developments- MnM viewVIASAT INC.- Business overview- Products/Solutions offered- Recent developments- MnM viewTE CONNECTIVITY LTD.- Business overview- Products/Solutions offeredCOBHAM PLC- Business overview- Products/Solutions offered- Recent developmentsBAE SYSTEMS- Business overview- Products/Solutions offered- Recent developmentsPANASONIC AVIONICS CORPORATION- Business overview- Products/Solutions offered- Recent developmentsANUVU- Business overview- Products/Solutions offered- Recent developmentsKONTRON AG- Business overview- Products/Solutions offeredASTRONICS- Business overview- Products/Solutions offered- Recent developmentsIRIDIUM COMMUNICATIONS INC.- Business overview- Products/Solutions offered- Recent developmentsRAMCO SYSTEMS- Business overview- Products/Solutions offered- Recent developmentsGARMIN- Business overview- Products/Solutions offered- Recent developments

-

12.2 OTHER PLAYERSBROTECSAPIJET LLCEXSYN AVIATION SOLUTIONSFLIGHT DATA SYSTEMSJEPPESENFLEETPLAN.NETBYTRON AVIATION SYSTEMSULTRAMAINFLIGHTMANDONICA INTERNATIONAL INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 CONNECTED AIRCRAFT MARKET ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 AVERAGE PRICE ANALYSIS OF CONNECTED AIRCRAFT SOLUTIONS

- TABLE 6 VOLUME DATA, BY PLATFORM, 2023–2028 (UNITS)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 11 COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING CONNECTED AIRCRAFT, BY TYPE (%)

- TABLE 13 KEY BUYING CRITERIA FOR CONNECTED AIRCRAFT, BY TYPE

- TABLE 14 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 15 PATENTS FOR CONNECTED AIRCRAFT

- TABLE 16 CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 17 CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 HARDWARE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 19 HARDWARE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 SOFTWARE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 21 SOFTWARE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 CONNECTED AIRCRAFT MARKET, BY FLEET OPERATION, 2020–2022 (USD MILLION)

- TABLE 23 CONNECTED AIRCRAFT MARKET, BY FLEET OPERATION, 2023–2028 (USD MILLION)

- TABLE 24 CONNECTED AIRCRAFT MARKET, BY FLEET MONITORING, 2020–2022 (USD MILLION)

- TABLE 25 CONNECTED AIRCRAFT MARKET, BY FLEET MONITORING, 2023–2028 (USD MILLION)

- TABLE 26 CONNECTED AIRCRAFT MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 27 CONNECTED AIRCRAFT MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 28 COMMERCIAL AVIATION: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 29 COMMERCIAL AVIATION: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 BUSINESS AVIATION AND GENERAL AVIATION: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 31 BUSINESS AVIATION AND GENERAL AVIATION: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 MILITARY AVIATION: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 33 MILITARY AVIATION: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 UNMANNED AERIAL VEHICLES: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 35 UNMANNED AERIAL VEHICLES: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 ADVANCED AIR MOBILITY: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 37 ADVANCED AIR MOBILITY: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 39 CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 40 CONNECTED AIRCRAFT MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 41 CONNECTED AIRCRAFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 48 US: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 49 US: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 US: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 51 US: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 52 CANADA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 53 CANADA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 54 CANADA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 55 CANADA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 57 EUROPE: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 EUROPE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 59 EUROPE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 61 EUROPE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 62 FRANCE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 63 FRANCE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 FRANCE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 65 FRANCE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 66 GERMANY: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 67 GERMANY: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 GERMANY: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 69 GERMANY: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 70 ITALY: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 71 ITALY: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 ITALY: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 73 ITALY: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 74 UK: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 75 UK: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 UK: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 77 UK: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 78 RUSSIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 79 RUSSIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 RUSSIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 81 RUSSIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 82 REST OF EUROPE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 83 REST OF EUROPE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 REST OF EUROPE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 85 REST OF EUROPE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 92 CHINA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 93 CHINA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 94 CHINA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 95 CHINA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 96 INDIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 97 INDIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 INDIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 99 INDIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 100 JAPAN: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 101 JAPAN: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 JAPAN: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 103 JAPAN: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 104 AUSTRALIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 105 AUSTRALIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 AUSTRALIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 107 AUSTRALIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 108 SOUTH KOREA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 109 SOUTH KOREA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 SOUTH KOREA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 111 SOUTH KOREA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 122 SAUDI ARABIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 123 SAUDI ARABIA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 124 SAUDI ARABIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 125 SAUDI ARABIA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 126 UAE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 127 UAE: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 UAE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 129 UAE: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 130 ISRAEL: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 131 ISRAEL: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 132 ISRAEL: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 133 ISRAEL: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 136 REST OF MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 138 REST OF THE WORLD: CONNECTED AIRCRAFT MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 139 REST OF THE WORLD: CONNECTED AIRCRAFT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 141 REST OF THE WORLD: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 REST OF THE WORLD: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 143 REST OF THE WORLD: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 145 LATIN AMERICA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 LATIN AMERICA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 147 LATIN AMERICA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 148 AFRICA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 149 AFRICA: CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 AFRICA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2020–2022 (USD MILLION)

- TABLE 151 AFRICA: CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 152 STRATEGIES ADOPTED BY KEY PLAYERS IN CONNECTED AIRCRAFT MARKET, 2020–2023

- TABLE 153 CONNECTED AIRCRAFT MARKET: DEGREE OF COMPETITION, 2022

- TABLE 154 COMPANY FOOTPRINT

- TABLE 155 SEGMENT FOOTPRINT

- TABLE 156 KEY START-UPS/SMES

- TABLE 157 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 158 PRODUCT LAUNCHES, 2020–2023

- TABLE 159 DEALS, 2020–2023

- TABLE 160 OTHER DEALS/DEVELOPMENTS, 2020–2023

- TABLE 161 GOGO INC.: COMPANY OVERVIEW

- TABLE 162 GOGO INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 163 GOGO INC.: DEALS

- TABLE 164 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 165 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 166 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 167 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 168 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 169 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 170 THALES GROUP: COMPANY OVERVIEW

- TABLE 171 THALES GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 172 THALES GROUP: DEALS

- TABLE 173 VIASAT INC.: COMPANY OVERVIEW

- TABLE 174 VIASAT INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 175 VIASAT INC.: DEALS

- TABLE 176 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 177 TE CONNECTIVITY LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 178 COBHAM PLC: COMPANY OVERVIEW

- TABLE 179 COBHAM PLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 180 COBHAM PLC: DEALS

- TABLE 181 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 182 BAE SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 183 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 184 BAE SYSTEMS: DEALS

- TABLE 185 PANASONIC AVIONICS CORPORATION: COMPANY OVERVIEW

- TABLE 186 PANASONIC AVIONICS CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 187 PANASONIC AVIONICS CORPORATION: DEALS

- TABLE 188 ANUVU: COMPANY OVERVIEW

- TABLE 189 ANUVU: PRODUCTS/SOLUTIONS OFFERED

- TABLE 190 ANUVU: DEALS

- TABLE 191 KONTRON AG: COMPANY OVERVIEW

- TABLE 192 KONTRON AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 193 ASTRONICS: COMPANY OVERVIEW

- TABLE 194 ASTRONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 195 ASTRONICS: DEALS

- TABLE 196 IRIDIUM COMMUNICATIONS INC.: COMPANY OVERVIEW

- TABLE 197 IRIDIUM COMMUNICATIONS INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 198 IRIDIUM COMMUNICATIONS INC.: DEALS

- TABLE 199 RAMCO SYSTEMS: COMPANY OVERVIEW

- TABLE 200 RAMCO SYSTEMS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 201 RAMCO SYSTEMS: DEALS

- TABLE 202 GARMIN: COMPANY OVERVIEW

- TABLE 203 GARMIN: PRODUCTS/SOLUTIONS OFFERED

- TABLE 204 GARMIN: PRODUCT LAUNCHES

- TABLE 205 GARMIN: DEALS

- TABLE 206 BROTECS: COMPANY OVERVIEW

- TABLE 207 APIJET LLC: COMPANY OVERVIEW

- TABLE 208 EXSYN AVIATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 209 FLIGHT DATA SYSTEMS: COMPANY OVERVIEW

- TABLE 210 JEPPESEN: COMPANY OVERVIEW

- TABLE 211 FLEETPLAN.NET: COMPANY OVERVIEW

- TABLE 212 BYTRON AVIATION SYSTEMS: COMPANY OVERVIEW

- TABLE 213 ULTRAMAIN: COMPANY OVERVIEW

- TABLE 214 FLIGHTMAN: COMPANY OVERVIEW

- TABLE 215 DONICA INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 1 CONNECTED AIRCRAFT MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SOFTWARE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 9 AIR-TO-GROUND CONNECTIVITY TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 10 ADVANCED AIR MOBILITY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 12 INCREASING DEMAND FOR ENHANCED PASSENGER EXPERIENCE

- FIGURE 13 COMMERCIAL AVIATION TO SECURE MAXIMUM MARKET SHARE IN 2023

- FIGURE 14 SATELLITE COMMUNICATIONS SYSTEMS TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 15 GERMANY TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

- FIGURE 16 CONNECTED AIRCRAFT MARKET DYNAMICS

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 REVENUE SHIFT CURVE

- FIGURE 19 CONNECTED AIRCRAFT MARKET ECOSYSTEM MAP

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING CONNECTED AIRCRAFT, BY TYPE

- FIGURE 21 KEY BUYING CRITERIA FOR CONNECTED AIRCRAFT, BY TYPE

- FIGURE 22 TECHNOLOGICAL ADVANCEMENTS IN CONNECTED AIRCRAFT

- FIGURE 23 CONNECTED AIRCRAFT MARKET, BY TYPE, 2023–2028

- FIGURE 24 CONNECTED AIRCRAFT MARKET, BY PLATFORM, 2023–2028

- FIGURE 25 CONNECTED AIRCRAFT MARKET, BY CONNECTIVITY, 2023–2028

- FIGURE 26 CONNECTED AIRCRAFT MARKET, BY REGION, 2023–2028

- FIGURE 27 NORTH AMERICA: CONNECTED AIRCRAFT MARKET SNAPSHOT

- FIGURE 28 EUROPE: CONNECTED AIRCRAFT MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: CONNECTED AIRCRAFT MARKET SNAPSHOT

- FIGURE 30 MIDDLE EAST: CONNECTED AIRCRAFT MARKET SNAPSHOT

- FIGURE 31 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 32 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 34 COMPANY EVALUATION MATRIX, 2022

- FIGURE 35 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 38 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 40 VIASAT INC.: COMPANY SNAPSHOT

- FIGURE 41 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 42 COBHAM PLC: COMPANY SNAPSHOT

- FIGURE 43 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 44 KONTRON AG: COMPANY SNAPSHOT

- FIGURE 45 ASTRONICS: COMPANY SNAPSHOT

- FIGURE 46 IRIDIUM COMMUNICATIONS INC.: COMPANY SNAPSHOT

- FIGURE 47 RAMCO SYSTEMS: COMPANY SNAPSHOT

- FIGURE 48 GARMIN: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for the Connected Aircraft Market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

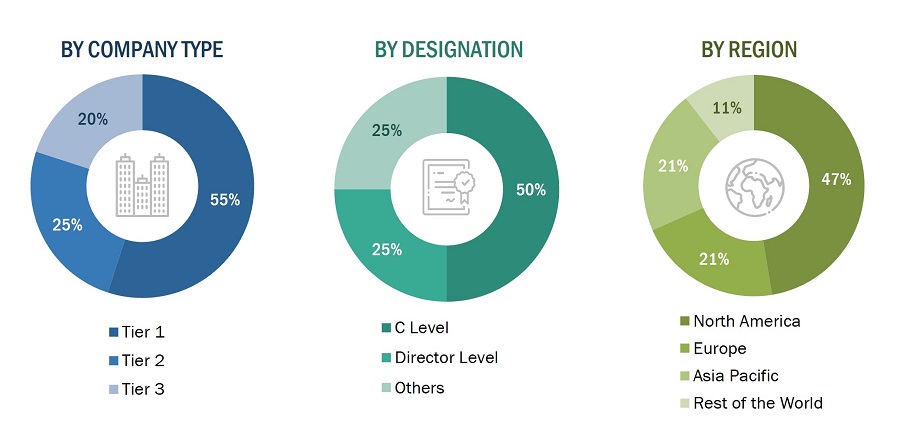

Primary Research

The Connected Aircraft Market comprises several stakeholders, such as raw material providers, aircraft connectivity system manufacturers, and aircraft connected system providers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in aircraft connectivity systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Connected Aircraft Market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the connected aircraft market by determining the fleet size in various countries along with the revenues of key market players, which helped in deriving the regional market size. Summation of all regional markets has led to determining the global size of the connected aircraft market.

Market size estimation methodology: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. For the calculation of specific market segments, the size of the most appropriate, immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenue obtained for various market segments.

- Companies supplying connected aircraft technology, as well as components, were included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were not available, company earnings were estimated based on the number of employees, press releases, and any publicly available data.

- Company revenue was calculated based on the various operating segments.

- All publicly available company contracts related to the connected aircraft market were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of each connected aircraft system in each segment was estimated.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Connected Aircraft Market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Connected Aircraft Market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East, and the Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Market Definition

Connected aircraft refers to a cutting-edge technological ecosystem within the aviation industry, which is equipped with advanced communication systems, sensors, and data analytics capabilities. This enables seamless and real-time connectivity between the aircraft, ground-based operations, and maintenance facilities. This integrated connectivity empowers airlines to optimize flight operations, enhance safety through real-time monitoring, improve fuel efficiency, and offer passengers a range of benefits, such as in-flight entertainment, internet connectivity, and personalized services. Connected aircraft facilitates predictive maintenance, enabling quicker and more efficient troubleshooting and repairs, thus revolutionizing the way airlines operate and deliver services in a digitally interconnected aviation landscape. Connected aircraft revolutionizes modern-day flying, improving fleet management, flight safety, passenger experience, maintenance, flight operations, aircraft turnaround time, and costs.

Market Stakeholders

- Connected aircraft solution providers.

- Connected aircraft manufacturers.

- Subsystem manufacturers

- Airlines

- Regulatory authorities

- Connected aircraft software/hardware providers.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Connected Aircraft Market