Aircraft Health Monitoring Market Size, Share, Industry Report, Statistics & Growth by Platform (Civil, Military, & Advanced Air Mobility Aviation), Installation (Onboard, On Ground), Fit (Linefit, Retrofit), End User, Solution, Technology, System, Operation Mode and Region - Global Forecast to 2028

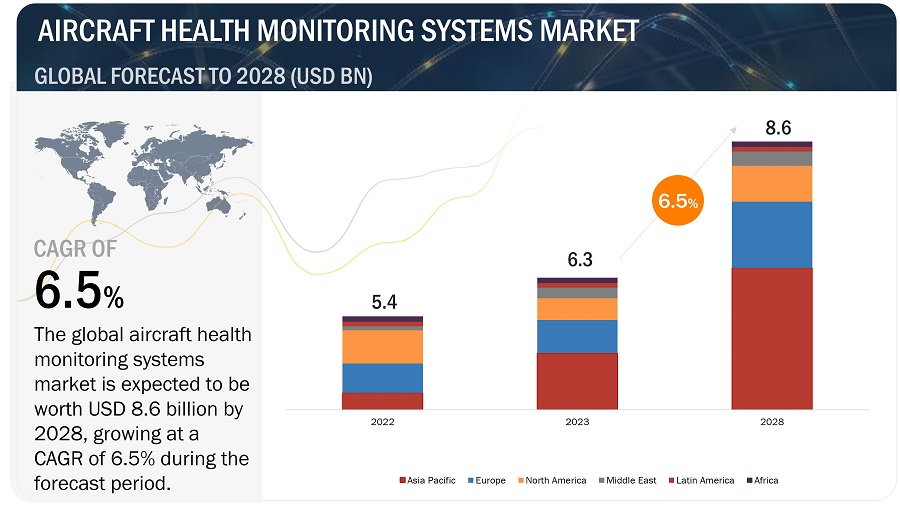

The Aircraft Health Monitoring Market size is projected to grow from USD 6.3 Billion in 2023 to USD 8.6 Billion by 2028, at a CAGR of 6.5% from 2023 to 2028. Airlines are looking for ways to increase operating efficiency and cut maintenance costs as the number of passengers on their aircraft grows. Aircraft health monitoring systems assist airlines in identifying and resolving potential maintenance issues before they become serious concerns, ensuring that planes remain safe and operational. Technology advancements have made aeroplane health monitoring systems more dependable, accurate, and cost-effective. This has made it easier for airlines to use these technologies and reap the benefits they provide.

Aircraft Health Monitoring Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft health monitoring systems Market Dynamics

Driver: Adoption of predictive maintenance

The adoption of predictive maintenance in the Aircraft Health Monitoring Industry is based on the need to reduce maintenance costs and minimize downtime while improving the safety and reliability of aircraft. Predictive maintenance is a proactive approach that uses data collected by AHMS to predict when maintenance is required, allowing airlines to take corrective action before a failure occurs. By adopting predictive maintenance, airlines reduce their maintenance costs by minimizing the number of unscheduled maintenance events and extending the life of their aircraft components. This is achieved by using data analytics to detect potential issues early, allowing airlines to schedule maintenance activities, thereby minimizing the impact on their operations.

Restraint: Lack of uniform data standards and susceptibility to harsh working conditions

Multiple data centers connected to airports, lessors, aircraft operators, airlines, aircraft & engine OEMS, component OEMS, and MROS, among others, generate massive amounts of data in the aviation and aerospace sectors. The absence of standardization of data in terms of a specific format complicates data analysis and has an impact on the operation of aviation health monitoring systems.

Aircraft health monitoring systems work in different environmental situations such as weather, altitude, and temperature changes. Such disparities in response to structural analysis can result in erroneous alerts to the aircraft health monitoring system. Sensors in aviation health monitoring systems must perform in accordance with the aircraft in extreme and demanding temperature, shock, vibration, acceleration, sand, and dust conditions, among others.

Opportunity: Adoption by MRO providers

Maintenance, Repair, and Overhaul (MRO) providers are essential players in the aircraft health monitoring industry, responsible for maintaining and repairing aircraft. The adoption of aircraft health monitoring system (AHMS) technology by MRO providers presents an opportunity for the AHMS market because it allows these providers to offer more advanced maintenance solutions to their customers. By incorporating AHMS technology into their maintenance operations, MRO providers can improve the accuracy and efficiency of their maintenance processes. AHMS can provide real-time data on the health of aircraft systems and components, enabling MRO providers to identify potential issues before they become critical and plan maintenance activities more efficiently. This can help reduce downtime and increase the overall reliability and safety of aircraft. Furthermore, the adoption of AHMS technology can differentiate MRO providers from their competitors and improve their competitiveness in the market.

Challenge: Regulatory requirements

The challenge of regulatory requirements in the aircraft health monitoring system (AHMS) market is the need to comply with safety regulations and standards set by aviation authorities. These regulations require airlines and aircraft manufacturers to implement AHMS to ensure that their aircraft are safe and reliable. For example, the US Federal Aviation Administration (FAA) requires commercial aircraft to be equipped with AHMS to monitor critical systems and detect potential safety issues. The European Aviation Safety Agency (EASA) has also set similar requirements for AHMS in commercial aircraft. In addition to safety regulations, there are also standards such as the ARINC 429 and ARINC 629 that specify the communication protocols used in AHMS.

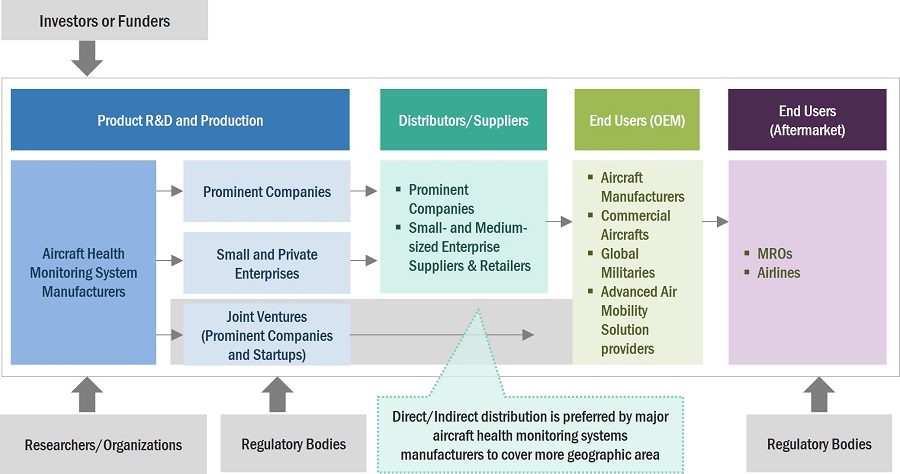

Aircraft Health Monitoring Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Aircraft health monitoring systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. The prominent companies are Safran (France), Airbus S.E (Netherlands), Raytheon Technologies Corporation (US), Honeywell International Inc (US), Teledyne Technologies Inc (US), General Electric (US), and The Boeing Company (US) among others.

The MRO segment accounts for the largest market size during the forecast period

Based on end user, the aircraft health monitoring market has been segmented into MRO, OEMs and Airlines are considered in the aircraft health monitoring market. The MRO is estimated to be account for the largest share in the aircraft health monitoring market. As the average age of the worldwide commercial aircraft fleet rises, so do the maintenance requirements. Airlines and MRO suppliers are seeking for solutions to optimise maintenance schedules, decrease downtime, and boost aircraft reliability as aircraft age. Aircraft health monitoring systems give real-time data on the health of important systems and components, allowing MRO providers to detect possible problems early and implement preventative maintenance actions. MRO providers are under pressure to cut costs while maintaining high levels of safety and reliability.

The commercial aviation segment is projected to grow at the highest CAGR during the forecast period

Based on the platform, the aircraft health monitoring market has been segmented into civil aviation, military aviation and advanced air mobility segments. Commercial aviation will register the fastest growth in the aircraft health monitoring market owing to the high demand for health monitoring systems, solutions, and services. The civil aviation sector is the largest AHMS market, accounting for the vast bulk of total AHMS revenue. This is owing to the enormous number of commercial aeroplanes operating worldwide. Governments and aviation regulatory organisations all around the world are enforcing stringent safety standards for commercial flights. By providing real-time data on the health of crucial systems and components, AHMS can assist airlines in meeting these regulations.

The hardware segment accounts for the largest market size during the forecast period

Based on solution, the aircraft health monitoring market is segmented into hardware, software and services. the aircraft health monitoring market is estimated to be dominated by the hardware segment with the highest market share in 2023. Sensors and data acquisition units, for example, are vital for collecting real-time data on the health of critical systems and components. This data is used to monitor the aircraft's performance and identify potential difficulties before they become severe issues. These factors will drive the AHMS market.

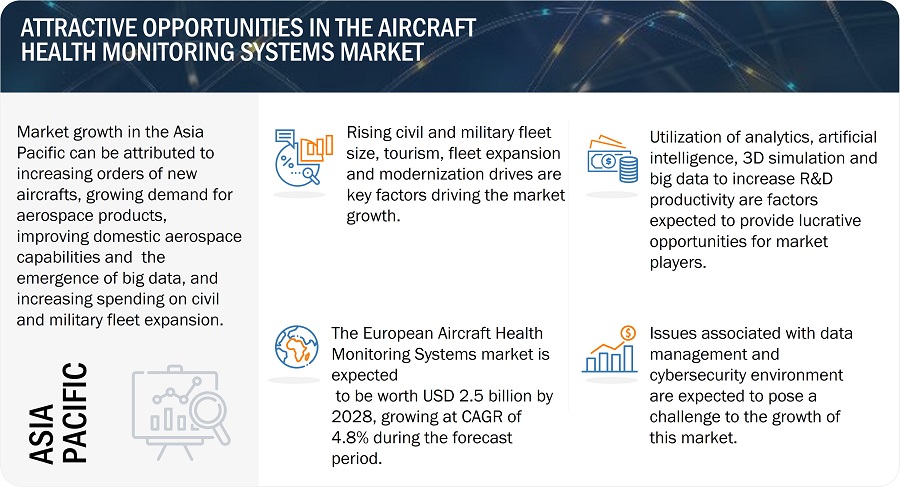

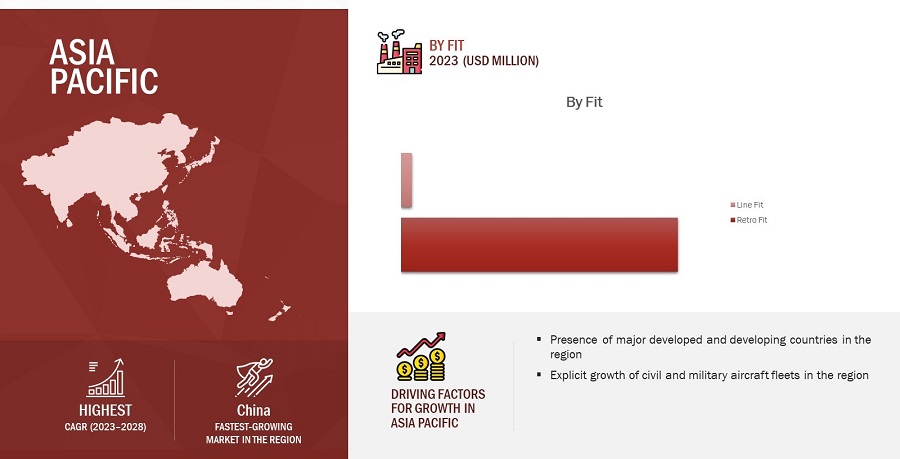

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is projected to be the fastest-growing region in the aircraft health monitoring market during the forecast period, backed by significant development in air transport, Air travel in the Asia-Pacific area is increasing significantly, owing to rising disposable incomes and a burgeoning middle class. As a result, the number of commercial aircraft operating in the region has increased, creating demand for AHMS. Some of the world's main manufacturers of AHMS hardware components and software are based in the APAC area. This has fueled technological developments in the sector, making AHMS more dependable, accurate, and cost-effective. This, in turn, is expected to drive the aircraft health monitoring market in the Asia Pacific region.

Asia Pacific is projected to hold the highest market share during the forecast period

Aircraft Health Monitoring Market Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Aircraft Health Monitoring Companies are Safran (France), Airbus S.E (Netherlands), Raytheon Technologies Corporation (US), Honeywell International Inc (US), Teledyne Technologies Inc (US), The Boeing Company (US), and Curtiss-Wright Corporation (US) among others.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

6.5% |

|

Estimated Market Size in 2023 |

USD 6.3 Billion |

|

Projected Market Size in 2028 |

USD 8.6 Billion |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Platform, By Solution, By Technology, By Operation Mode, By System, By Component, By Fit, By End User, By Installation & By Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Middle East, Latin America, Africa |

|

Companies Covered |

Safran S.A.(France), Airbus S.A.S (Netherlands), Raytheon Technologies Corporation (US), Honeywell International Inc (US), Teledyne Technologies Inc (US) amongst others. |

Aircraft Health Monitoring Market Highlights

This research report categorizes the Aircraft Health Monitoring Systems market based on Platform, Solution, Technology, Operation Mode, System, Fit, End User, Installation and Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Solution |

|

|

By Technology |

|

|

By Operation Mode |

|

|

By System |

|

|

By End User |

|

|

By Installation |

|

|

By Fit |

|

|

By Region |

|

Recent Developments in Aircraft Health Management

- Honeywell and Lufthansa Technik are enhancing their collaboration on Lufthansa Technik’s digital platform AVIATAR to improve the customer experience in aviation analytics. Honeywell Connected Maintenance analytics are now being fully integrated into AVIATAR’s Predictive Health Analytics (PHA) suite

- Air France KLM Engineering & Maintenance (AFI KLM E&M) has been awarded a component support contract by India’s Akasa Air. AFI KLM E&M subsidiary EPCOR will also provide dedicated APU solutions. The group MRO will supply the airline with an adaptive package of flight-hour solutions including repair services, access to a spare parts pool, provision of a main base kit (MBK) and dedicated logistical support.

- In December 2022, The Helicopter Company (THC), signed an HCare In-Service contract with Airbus SE to cover its future fleet of six ACH160 helicopters. The HCare In-Service package has been tailored to THC’s planned operational needs, providing parts availability services to optimize maintenance planning and service delivery.

- In March 2023, Safran Helicopter Engines subsidiary of Safran Group signed a contract with Coldstream Helicopters Ltd. to support Makila engines powering its AS332L1 Super Puma fleet. This Support-By-the-Hour (SBH) contract formalizes a long-term maintenance, repair, and overhaul (MRO) services agreement supporting Coldstream’s Makila 1A1 engines. Coldstream is the global launch customer for this SBH program, which Safran has specifically designed for utility operators of the Airbus Super Puma family. This contract will be managed by Safran Helicopter Engines Canada, in Mirabel, Quebec, which provides North American customers with support services for the Arrius, Arriel, and Makila engines as well as repair and overhaul of engines, modules, and accessories.

Frequently Asked Questions (FAQ):

What is the current size of the aircraft health monitoring market?

The aircraft health monitoring market size is projected to grow from USD 6.3 billion in 2023 to USD 8.6 billion by 2028, at a CAGR of 6.5% from 2023 to 2028.

Who are the winners in the aircraft health monitoring market?

Safran (France), Airbus S.E (Netherlands), Raytheon Technologies Corporation (US), Honeywell International Inc (US), Teledyne Technologies Inc (US), are some of the winners in the market.

What are some of the technological advancements in the market?

Safran Group launched Cassiopée NODE, its latest flight data processing software, to help airlines needing to process ever-greater amounts of flight data. Cassiopée NODE is designed to handle larger volumes of data more quickly. It is intended primarily for original equipment manufacturers (OEMs) and operators with large fleets.

What are the factors driving the growth of the market?

The increasing demand for real-time monitoring of aircraft systems is driven by the growing complexity of modern aircraft systems. Aircraft systems are becoming more sophisticated, with a greater number of components and a higher level of integration between systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for real-time monitoring- Adoption of predictive maintenance- Increase in commercial and military aircraft fleet sizeRESTRAINTS- Lack of uniform data standards and susceptibility to harsh working conditionsOPPORTUNITIES- Adoption by MRO providers- Increasing need for sensors for structural monitoring- Advancements in sensor technology- Need for cost-effective maintenance solutionsCHALLENGES- Cybersecurity risk- Regulatory requirements- Management of large volumes of data- Integration of AHMS with existing aircraft systems for cost-effective maintenance

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS IN AIRCRAFT HEALTH MONITORING SYSTEM MARKET

-

5.4 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTRAW MATERIALOEMS (COMPONENT MANUFACTURERS)ASSEMBLERS & INTEGRATORSEND USERS

- 5.5 AVERAGE SELLING PRICE ANALYSIS

-

5.6 AIRCRAFT HEALTH MONITORING SYSTEM MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 RECESSION IMPACT ANALYSIS

-

5.9 CASE STUDY ANALYSISTECH MAHINDRA HELPS IN IDENTIFYING DEFECTS ON AIRCRAFT THAT CAUSE FLIGHT DELAYS OR CANCELLATIONS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY ANALYSISFAILURE DIAGNOSIS EXPERT SYSTEMWIRELESS SENSOR NETWORKPREDICTIVE MAINTENANCEINTERNET OF THINGS (IOT)MACHINE LEARNINGARTIFICIAL INTELLIGENCE (AI)BIG DATA ANALYTICS IN AIRCRAFT HEALTH MONITORING SYSTEMSINTEGRATED VEHICLE HEALTH MANAGEMENT (IVHM)

-

6.3 FUTURISTIC PLATFORMSSTRUCTURAL HEALTH MONITORING IN UNMANNED AERIAL VEHICLESONBOARD IVHM SYSTEM CONCEPT FOR ALL-ELECTRIC AIRCRAFTHEALTH AND USAGE MONITORING SYSTEM (HUMS) FOR EVTOL/PAV

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASE ANALYSIS: AIRCRAFT HEALTH MONITORING SYSTEM MARKETAIRBUS LAUNCHES SKYWISE HEALTH MONITORING (SHM)HEALTH MONITORING & PREDICTIVE MAINTENANCE SYSTEM OF ROLLS-ROYCE

-

6.6 IMPACT OF MEGATRENDSCONNECTED AIR FLEETCONSTRUCTIVE TECHNOLOGIES IN SUPPLY CHAIN MANAGEMENTAUTOMATION FOR ENHANCING AIRCRAFT HEALTH

-

6.7 INNOVATION AND PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 CIVIL AVIATIONINCREASING AIR TRAFFIC TO BOOST DEMAND FOR AIRCRAFT HEALTH MONITORING SYSTEMSNARROW-BODY AIRCRAFT- Rising air traffic to drive segmentREGIONAL TRANSPORT AIRCRAFT- Rising demand for regional transport aircraft in US and Asia PacificWIDE-BODY AIRCRAFT- Increasing international passenger air travel to drive segmentBUSINESS JETS- Rising use of condition monitoring in business jets to limit noise and vibrationsCOMMERCIAL HELICOPTERS- Expanding applications of commercial helicopters to contribute to market growth

-

7.3 MILITARY AVIATIONRISING GLOBAL DEFENSE EXPENDITURE TO BOOST DEMAND FOR ADVANCED AIRCRAFT HEALTH MONITORING SYSTEMSFIGHTER AIRCRAFT- Growing national security concerns to drive segmentTRANSPORT AIRCRAFT- Increasing use of transport aircraft in military operations to drive demandSPECIAL MISSION AIRCRAFT- Growing defense spending and territorial disputes to drive demandMILITARY HELICOPTERS- Increasing utilization in search & rescue and combat operations to drive segmentUAVS- Increasing use in rescue and ISR operations to drive segment

-

7.4 ADVANCED AIR MOBILITYRISING INVESTMENTS IN AAM PROGRAMS TO DRIVE SEGMENTAIR TAXIS- Viable and efficient mode of tackling on-road traffic congestionAIR SHUTTLES & AIR METROS- Quick and efficient way of commutingPERSONAL AERIAL VEHICLES- Increased R&D for economical vehicles capable of longer-range flights to drive segmentCARGO DRONES- Efficiency and ease of operation to drive demandAIR AMBULANCES & MEDICAL EMERGENCY VEHICLES- Life-saving asset for emergency transportLAST-MILE DELIVERY VEHICLES- Rise in e-commerce sector to drive segment

- 8.1 INTRODUCTION

- 8.2 OEMS

- 8.3 AIRLINES

- 8.4 MROS

- 9.1 INTRODUCTION

-

9.2 HARDWARESENSORS- Engines & auxiliary power units- Aerostructures- Ancillary systemsAVIONICSFLIGHT DATA MANAGEMENT SYSTEMSCONNECTED AIRCRAFT SOLUTIONSGROUND SERVERS

-

9.3 SOFTWAREONBOARD SOFTWAREDIAGNOSTIC FLIGHT DATA ANALYSISPROGNOSTIC FLIGHT DATA ANALYSIS SOFTWARE

-

9.4 SERVICESFLIGHT HEALTH MONITORING DATA TRANSMISSIONFLIGHT DATA MONITORING (FDM)

- 10.1 INTRODUCTION

- 10.2 ONBOARD

- 10.3 ON-GROUND

- 11.1 INTRODUCTION

- 11.2 LINE-FIT

- 11.3 RETROFIT

- 12.1 INTRODUCTION

- 12.2 REAL-TIME

- 12.3 NON-REAL-TIME

- 13.1 INTRODUCTION

- 13.2 ENGINE HEALTH MONITORING

- 13.3 STRUCTURE HEALTH MONITORING

- 13.4 COMPONENT HEALTH MONITORING

- 14.1 INTRODUCTION

- 14.2 DIAGNOSTICS

- 14.3 PROGNOSTICS

- 14.4 ADAPTIVE CONTROL

- 14.5 PRESCRIPTIVE

- 15.1 INTRODUCTION

-

15.2 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISUS- Presence of major industrial OEMs and small players to drive marketCANADA- Increased focus on developing advanced military fleet to drive market

-

15.3 EUROPEEUROPE: PESTLE ANALYSISUK- Presence of manufacturing facilities to increase AHMS demandGERMANY- Ongoing collaborations among industry players to drive marketFRANCE- Focus of manufacturers on business expansion to drive marketRUSSIA- High investment in advanced aircraft tech to drive marketITALY- Contracts with armed forces to boost market for industry playersREST OF EUROPE

-

15.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISCHINA- Large-scale domestic manufacturing to boost marketINDIA- Rising government focus on military and defense to propel marketJAPAN- Increased demand from air force to support market growthAUSTRALIA- Increasing demand from airlines to boost marketSOUTH KOREA- Rising security concerns from neighboring countries to drive marketREST OF ASIA PACIFIC

-

15.5 MIDDLE EASTMIDDLE EAST: PESTLE ANALYSISUAE- Increasing demand for private planes to drive marketSAUDI ARABIA- Modernization of existing fleets to drive marketISRAEL- Continuous fleet expansion to drive marketREST OF MIDDLE EAST

-

15.6 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISBRAZIL- Increasing demand for modern narrow-body aircraft to drive marketMEXICO- Domestic airline demand for commercial aircraft to drive marketREST OF LATIN AMERICA

-

15.7 AFRICAAFRICA: PESTLE ANALYSISSOUTH AFRICA- Increased use of private jets and expanding tourism industry to drive marketNIGERIA- Government focus on developing aircraft industry to drive marketREST OF AFRICA

-

16.1 INTRODUCTIONCOMPETITIVE OVERVIEW

- 16.2 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2022

- 16.3 MARKET SHARE ANALYSIS, 2022

- 16.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2022

-

16.5 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT ANALYSIS

-

16.6 COMPANY EVALUATION MATRIX: STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

16.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 17.1 INTRODUCTION

-

17.2 KEY PLAYERSAIRBUS SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSAFRAN GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTELEDYNE CONTROLS LLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBOEING- Business overview- Products/Services/Solutions offered- Recent developmentsGENERAL ELECTRIC- Business overview- Products/Services/Solutions offered- Recent developmentsMEGGITT PLC- Business overview- Products/Services/Solutions offered- Recent developmentsROLLS-ROYCE PLC- Business overview- Products/Services/Solutions offered- Recent developmentsFLYHT AEROSPACE SOLUTIONS LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsCURTISS-WRIGHT CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsAIR FRANCE KLM- Business overview- Products/Services/Solutions offered- Recent developmentsLUFTHANSA- Business overview- Recent developmentsACELLENT TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsSITA- Business overview- Products/Services/Solutions offered- Recent developmentsEMBRAER- Business overview- Products/Services/Solutions offered- Recent developments

-

17.3 OTHER PLAYERSINTELSAT- Business overview- Products/Services/Solutions offeredAMETEK, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsTECH MAHINDRA LIMITED- Business overview- Products/Services/Solutions offered- Recent developmentsULTRA PRECISION CONTROL SYSTEMS- Business overview- Products/Services/Solutions offered- Recent developmentsVENTURA AEROSPACE, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsACR ELECTRONICS, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsBEANAIR- Business overview- Products/Services/Solutions offered- Recent developmentsRSL ELECTRONICS LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsAPIJET LLC- Business overview- Products/Services/Solutions offered- Recent developmentsEXSYN AVIATION SOLUTIONS- Business overview- Products/Services/Solutions offered- Recent developments

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

- TABLE 1 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM

- TABLE 2 AVERAGE SELLING PRICE OF AIRCRAFT HEALTH MONITORING SYSTEM COMPONENT

- TABLE 3 AIRCRAFT HEALTH MONITORING SYSTEM MARKET ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT HEALTH MONITORING SYSTEMS AND PRODUCTS (%)

- TABLE 6 KEY BUYING CRITERIA FOR AIRCRAFT HEALTH MONITORING SYSTEMS AND PRODUCTS

- TABLE 7 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 8 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 9 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 10 CIVIL AVIATION: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 11 CIVIL AVIATION: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 12 MILITARY AVIATION: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 13 MILITARY AVIATION: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 14 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 15 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 16 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 17 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 18 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 19 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 20 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 21 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 22 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY OPERATION MODE, 2019–2022 (USD MILLION)

- TABLE 23 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY OPERATION MODE, 2023–2028 (USD MILLION)

- TABLE 24 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 25 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 26 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 27 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 28 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 41 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 42 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 43 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 44 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 45 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 46 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 47 US: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 48 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 49 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 50 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 51 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 52 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 53 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 54 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 55 CANADA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 57 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 58 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 59 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 61 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 62 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 63 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 64 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 65 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 66 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 67 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 68 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 69 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 70 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 71 UK: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 72 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 73 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 74 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 75 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 76 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 77 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 78 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 79 GERMANY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 80 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 81 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 82 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 83 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 85 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 86 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 87 FRANCE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 88 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 89 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 90 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 91 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 92 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 93 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 94 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 95 RUSSIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 96 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 97 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 98 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 99 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 100 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 101 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 102 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 103 ITALY: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 104 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 122 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 123 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 124 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 125 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 126 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 127 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 129 CHINA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 130 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 131 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 132 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 133 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 134 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 135 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 136 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 137 INDIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 138 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 139 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 141 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 142 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 143 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 144 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 145 JAPAN: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 146 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 147 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET SIZE, BY FIT, 2023–2028 (USD MILLION)

- TABLE 148 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 149 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 150 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 151 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 152 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 153 AUSTRALIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 155 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 156 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 157 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 158 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 159 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 160 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 161 SOUTH KOREA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 172 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 174 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 180 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 181 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 182 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 183 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 184 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 185 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 186 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 187 UAE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 188 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 189 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 190 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 191 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 192 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 193 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 194 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 195 SAUDI ARABIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 196 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 197 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 198 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 199 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 200 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 201 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 202 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 203 ISRAEL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 213 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 215 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 222 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 223 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 224 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 225 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 226 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 227 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 228 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 229 BRAZIL: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 230 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 231 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 232 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 233 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 234 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 235 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 236 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 237 MEXICO: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 241 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 243 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 245 REST OF LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 246 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 247 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 248 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 249 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 250 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 251 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 252 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 253 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 254 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 255 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 256 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 257 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 258 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 259 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 260 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 261 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 262 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 263 SOUTH AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 264 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 265 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 266 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 267 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 268 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 269 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 270 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 271 NIGERIA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 272 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 273 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 274 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 275 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 276 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 277 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN CIVIL AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 278 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 279 REST OF AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 280 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRCRAFT HEALTH MONITORING SYSTEM MARKET BETWEEN 2019 AND 2023

- TABLE 281 DEGREE OF COMPETITION

- TABLE 282 COMPANY PRODUCT FOOTPRINT

- TABLE 283 COMPANY INDUSTRY FOOTPRINT

- TABLE 284 COMPANY REGIONAL FOOTPRINT

- TABLE 285 AIRCRAFT HEALTH MONITORING SYSTEM MARKET: KEY STARTUPS/SMES

- TABLE 286 AIRCRAFT HEALTH MONITORING SYSTEM MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2019–DECEMBER 2023

- TABLE 287 AIRCRAFT HEALTH MONITORING SYSTEM MARKET: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 288 AIRBUS SE: BUSINESS OVERVIEW

- TABLE 289 AIRBUS SE: NEW PRODUCT DEVELOPMENTS

- TABLE 290 AIRBUS SE: DEALS

- TABLE 291 SAFRAN GROUP: BUSINESS OVERVIEW

- TABLE 292 SAFRAN GROUP: NEW PRODUCT DEVELOPMENT

- TABLE 293 SAFRAN GROUP: DEALS

- TABLE 294 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 295 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 296 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 297 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 298 TELEDYNE CONTROLS LLC: BUSINESS OVERVIEW

- TABLE 299 TELEDYNE CONTROLS LLC: NEW PRODUCT DEVELOPMENT

- TABLE 300 TELEDYNE CONTROLS LLC: DEALS

- TABLE 301 BOEING: BUSINESS OVERVIEW

- TABLE 302 BOEING: DEALS

- TABLE 303 GENERAL ELECTRIC: BUSINESS OVERVIEW

- TABLE 304 GENERAL ELECTRIC: NEW PRODUCT DEVELOPMENT

- TABLE 305 GENERAL ELECTRIC: DEALS

- TABLE 306 MEGGITT PLC: BUSINESS OVERVIEW

- TABLE 307 MEGGITT PLC: DEALS

- TABLE 308 ROLLS-ROYCE PLC: BUSINESS OVERVIEW

- TABLE 309 ROLLS-ROYCE PLC: DEALS

- TABLE 310 FLYHT AEROSPACE SOLUTIONS LTD.: BUSINESS OVERVIEW

- TABLE 311 FLYHT AEROSPACE SOLUTIONS LTD.: DEALS

- TABLE 312 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- TABLE 313 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 314 AIR FRANCE KLM: BUSINESS OVERVIEW

- TABLE 315 AIR FRANCE KLM: DEALS

- TABLE 316 LUFTHANSA: BUSINESS OVERVIEW

- TABLE 317 LUFTHANSA: DEALS

- TABLE 318 ACELLENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 319 SITA: BUSINESS OVERVIEW

- TABLE 320 SITA: DEALS

- TABLE 321 EMBRAER: BUSINESS OVERVIEW

- TABLE 322 EMBRAER: DEALS

- TABLE 323 INTELSAT: BUSINESS OVERVIEW

- TABLE 324 AMETEK, INC.: BUSINESS OVERVIEW

- TABLE 325 AMETEK, INC.: DEALS

- TABLE 326 TECH MAHINDRA LIMITED: BUSINESS OVERVIEW

- TABLE 327 ULTRA PRECISION CONTROL SYSTEMS: BUSINESS OVERVIEW

- TABLE 328 VENTURA AEROSPACE, INC.: BUSINESS OVERVIEW

- TABLE 329 ACR ELECTRONICS, INC.: BUSINESS OVERVIEW

- TABLE 330 BEANAIR: BUSINESS OVERVIEW

- TABLE 331 RSL ELECTRONICS LTD.: BUSINESS OVERVIEW

- TABLE 332 APIJET LLC: BUSINESS OVERVIEW

- TABLE 333 EXSYN AVIATION SOLUTIONS: BUSINESS OVERVIEW

- TABLE 334 EXSYN AVIATION SOLUTIONS: DEALS

- FIGURE 1 AIRCRAFT HEALTH MONITORING SYSTEM MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 AIRCRAFT HEALTH MONITORING SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 QUARTERLY REVENUE OF TOP COMPANIES, 2022–2023

- FIGURE 8 QUARTERLY REVENUE OF MAJOR AIRCRAFT MANUFACTURERS, 2022–2023

- FIGURE 9 RESEARCH ASSUMPTIONS

- FIGURE 10 STRUCTURE SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 11 ONBOARD SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 REAL-TIME SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 14 INCREASING INVESTMENTS DRIVE AIRCRAFT HEALTH MONITORING SYSTEM MARKET

- FIGURE 15 RETROFIT SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 DIAGNOSTICS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 AIRCRAFT HEALTH MONITORING SYSTEM MARKET DYNAMICS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 AIRCRAFT HEALTH MONITORING SYSTEM MARKET ECOSYSTEM MAP

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 RECESSION IMPACT ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT HEALTH MONITORING SYSTEMS AND PRODUCTS

- FIGURE 24 KEY BUYING CRITERIA FOR AIRCRAFT HEALTH MONITORING SYSTEMS AND PRODUCTS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 CIVIL AVIATION SEGMENT TO HOLD LARGEST MARKET SHARE BETWEEN 2023 AND 2028

- FIGURE 27 MROS SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 28 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE BETWEEN 2023 AND 2028

- FIGURE 29 ONBOARD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 RETROFIT SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 31 REAL-TIME SEGMENT TO REGISTER HIGHER CAGR BETWEEN 2023 AND 2028

- FIGURE 32 STRUCTURE HEALTH MONITORING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 DIAGNOSTICS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 35 NORTH AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 36 EUROPE: AIRCRAFT HEALTH MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: AIRCRAFT HEALTH MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 38 MIDDLE EAST: AIRCRAFT HEALTH MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 39 LATIN AMERICA: AIRCRAFT HEALTH MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 40 AFRICA: AIRCRAFT HEALTH MONITORING SYSTEM SNAPSHOT

- FIGURE 41 RANKING ANALYSIS OF TOP FIVE PLAYERS: AIRCRAFT HEALTH MONITORING SYSTEM MARKET, 2022

- FIGURE 42 SHARE OF TOP PLAYERS IN AIRCRAFT HEALTH MONITORING SYSTEM MARKET, 2022 (%)

- FIGURE 43 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS IN AIRCRAFT HEALTH MONITORING SYSTEM MARKET

- FIGURE 44 AIRCRAFT HEALTH MONITORING SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- FIGURE 45 AIRCRAFT HEALTH MONITORING SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2022

- FIGURE 46 AIRBUS SE: COMPANY SNAPSHOT

- FIGURE 47 SAFRAN GROUP: COMPANY SNAPSHOT

- FIGURE 48 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 50 TELEDYNE CONTROLS LLC: COMPANY SNAPSHOT

- FIGURE 51 BOEING: COMPANY SNAPSHOT

- FIGURE 52 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 53 MEGGITT PLC: COMPANY SNAPSHOT

- FIGURE 54 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 55 FLYHT AEROSPACE SOLUTIONS LTD.: COMPANY SNAPSHOT

- FIGURE 56 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 AIR FRANCE KLM: COMPANY SNAPSHOT

- FIGURE 58 LUFTHANSA: COMPANY SNAPSHOT

- FIGURE 59 EMBRAER: COMPANY SNAPSHOT

- FIGURE 60 AMETEK, INC.: COMPANY SNAPSHOT

- FIGURE 61 TECH MAHINDRA LIMITED: COMPANY SNAPSHOT

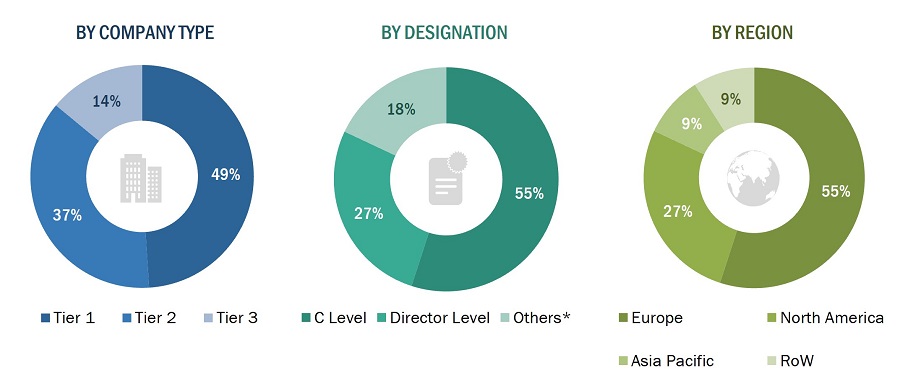

The study involved four major activities in estimating the current market size for the Aircraft Health Monitoring Systems market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with aircraft health monitoring industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, Dow Jones Factiva and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases. Secondary sources referred for this research study included General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

The Aircraft Health Monitoring Systems market comprises several stakeholders, such as raw material providers, Aircraft Health Monitoring Systems manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in sensors and wireless connected systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Health Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Aircraft Health Monitoring Systems market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the aircraft health monitoring industry and markets were identified through extensive secondary research.

- The aircraft health monitoring industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

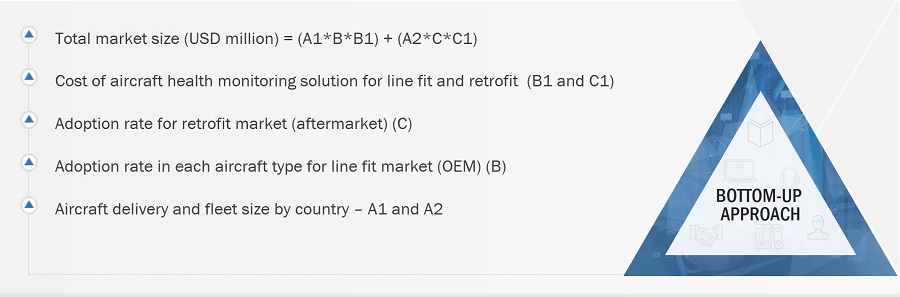

Aircraft Health Management Market size estimation methodology: Bottom-up Approach

The bottom-up approach was employed to arrive at the overall size of the Aircraft Health Monitoring Systems market from the demand for such systems and components by end users in each country, and the average cost of aircraft health monitoring systems, subsystems, and components was multiplied by the new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size. In the bottom-up approach, the size of the aircraft health monitoring market was arrived at by calculating the country-level data. In the top-down approach, the market size was derived by estimating the revenues of key companies operating in the market and validating the data acquired from primary research.

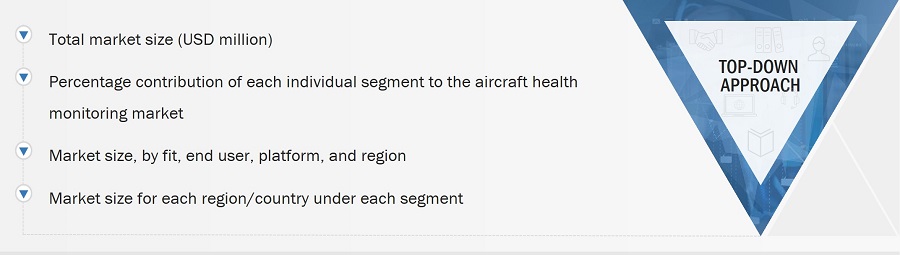

Aircraft Health Management Market size estimation methodology: Top-down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Aircraft Health Monitoring Systems market.

The Aircraft Health Monitoring Systems market report covers engine health monitoring, structural health monitoring, and component health monitoring systems, sub-systems and components, that are used in civil aviation, military aviation, and advanced air mobility (AAMs). AHMS has evolved into a necessary component of modern aircraft, helping airlines and aircraft manufacturers to increase safety, lower maintenance costs, and improve the passenger experience. A sensor network, data gathering units, communication systems, and data processing software are typical components of a system. Sensors are strategically located throughout the aircraft to monitor a variety of systems, including engines, avionics, structural, and other vital components. These sensors gather information on a variety of factors, including temperature, pressure, vibration, and other vital indications of system health. The data is subsequently sent to data acquisition units, which process and store the information. Depending on the system architecture, these devices can be deployed aboard the aircraft or on the ground. The data is transmitted via communication networks to ground-based maintenance and operations centres, where it is analysed using sophisticated software algorithms. These algorithms are capable of detecting trends, identifying anomalies, and forecasting future issues before they arise.

The AHMS software provides a comprehensive perspective of the aircraft's health and performance, allowing operators to make informed maintenance, repair, and operational decisions. The technology can also provide real-time notifications to ground-based maintenance and operations people, allowing them to respond to any problems as they develop.

Aircraft Manufacturers, AHMS component manufacturers, private and small enterprises, distributors/suppliers/retailers, and end users are the key stakeholders in the Aircraft Health Monitoring Systems market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries are major influencers in the market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Aircraft Health Monitoring Systems market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East and Rest of the World along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Health Monitoring Market

I am looking to put together a market view of the US aircraft health monitoring market, including overall market size and market share from the main competitors.