Cockpit Display Market for Land Vehicle by Vehicle Type (Commercial Automobile, Tactical, and Trains), Display Type (Driver-Assist Displays and Mission Displays), Display Size, and Geography - Analysis and Forecast (2014-2020)

A cockpit display is mostly used for the navigation and infotainment purposes in various types of land vehicles. Due to factors such as rapid developments for automotive infotainment systems and navigations systems; consumers demand for smartphone features in their cars; wide adoption of the concept of connected cars; and enhanced safety, situational awareness, and efficiency while driving, the Cockpit Display Market for Land Vehicle is growing significantly.

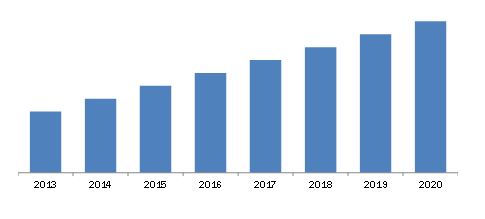

The cockpit display market for land vehicle is expected to reach $4,398.2 Million by 2020 at a CAGR of 2.5% from 2015 to 2020. Technological advancement and increase in the electronics content per vehicle has a positive impact on the Market.

This report is based on an in-depth research study of the Cockpit Display Market for Land Vehicle across different types of vehicles such as commercial automobiles, tactical vehicles, and trains. The report provides the profiles of the major active companies in the cockpit display for land vehicles market. The recent developments, contracts received by the OEMs, and the agreements to strengthen the growth of this market are also briefly discussed. The report also provides the competitive landscape of the key players, which indicates their growth strategies in terms of the Cockpit Display Market for Land Vehicle.

Additionally, the report presents the market dynamics such as the drivers, restraints, and opportunities. Apart from the in-depth view on market segmentation on the basis of vehicle type, display type, display size, and region, the report also includes the critical market data and qualitative information for each type, along with the qualitative analysis, such as the Porters five force analysis, value chain analysis, supply chain, and market breakdown analysis. The market covered under this report has been segmented as follows:

By Vehicle Type:

The Cockpit Display Market for Land Vehicle segmented on the basis of vehicle type includes commercial automobiles, tactical vehicles, and trains.

By Display Type:

The Cockpit Display Market for Land Vehicle segmented on the basis of display type includes driver-assist displays and mission displays.

By Display Size:

The Cockpit Display Market for Land Vehicle segmented on the basis of display size is divided into three different sizes; they are less than 5 inches, 5 inches to 10 inches, and greater than 10 inches.

By Geography:

The Cockpit Display Market for Land Vehicle segmented on the basis of region is divided into four major regions the Americas, Europe, Asia-Pacific (APAC), and Rest of the World (RoW).

Major players in this market include Alpine Electronics, Inc. (Japan), AU Optronics Corp. (Taiwan), Continental AG (Germany), Esterline technologies Corporation (U.S), Garmin Ltd. (Switzerland), General Dynamics Canada Ltd. (Canada), Innolux Corporation (Taiwan), Japan Display, Inc. (Japan), Rockwell Collins Inc. (U.S.), and Texas Instruments Inc. (U.S) among others.

A Cockpit Display Market for Land Vehicle is an emerging technology. It is highly appealing to land vehicle manufacturers. Land or ground vehicles include commercial vehicles, tactile vehicles, and trains. Earlier the cathode ray tube (CRT) displays were used in land vehicles. The advancements in the display technology towards capacitive touchscreen and use of thin-film transistor liquid-crystal displays (TFT- LCDs) have attracted the land vehicle industry and presently the cockpit display is becoming an integral part of vehicle electronics content. The basic idea of the cockpit display for land vehicle concept is to replace static controls and instruments with displays and create a modifiable and mode-based driving environment that adjusts the display information when needed.

The main factors driving the Cockpit Display Market for Land Vehicle are consumer demand for using their smartphone feature in the car dashboard; wide adoption of the concept of connected cars; growing demand of electric vehicles and their need for diagnostic displays; and last but not the least, the need for enhanced safety, situational awareness, and efficiency. At present, the display technology in land vehicles is getting shifted towards the use of organic light-emitting diode (OLED) displays in the cockpit because OLED panels are thinner, lighter, flexible, more durable, and safer than the old display technologies, thereby enhancing the user experience inside the cockpit of the vehicle.

Cockpit Display for Land Vehicle Market Size, by Value, 2013-2020 ($Million)

Source: MarketsandMarkets Analysis

The market size of the Cockpit Display Market for Land Vehicle is expected to grow at a CAGR of 2.5% in terms of value and 5.1% in terms of volume from 2015 to 2020. This report focuses on detailed segmentations of the market, combined with qualitative and quantitative analyses of each and every aspect of the classification on the basis of vehicle type, display type, display size, and region. All the numbers, at every level of detail, are forecasted till 2020 to give a glimpse of the potential market size in terms of value and volume in this market.

Major players in the Cockpit Display Market for Land Vehicle include Alpine Electronics, Inc. (Japan), AU Optronics Corp. (Taiwan), Continental AG (Germany), Esterline Technologies Corporation (U.S), Garmin Ltd. (Switzerland), General Dynamics Canada Ltd. (Canada), Innolux Corporation (Taiwan), Japan Display Inc. (Japan), Rockwell Collins Inc. (U.S.), Texas Instruments Inc. (U.S) among others.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Growth of the Electronic Content Per Vehicle

2.2.1.2 High Demand for Smartphones

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.3.3 Market Share Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Market Opportunities in the Globalcockpit Display for Land Vehicle Market

4.2 Cockpit Display for Land Vehicle Market, By Vehicle Type

4.3 Cockpit Display for Land Vehicle Market, By Vehicle Type and Geography

4.4 Cockpit Display for Land Vehicle Market, By Display Type

4.5 Cockpit Display for Land Vehicle Market, By Display Size

4.6 Cockpit Display for Land Vehicle Market, By Geography, 2014

4.7 Cockpit Display for Land Vehicle Market: Matured vs Emerging Markets

4.8 Lifecycle Cycle Analysis, By Geography

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Vehicle Type

5.3.2 By Display Type

5.3.3 By Display Size

5.3.4 By Geography

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Trend of Electric Vehicles (EVS)

5.4.1.2 Consumers Demand for Smartphone Features in Cars

5.4.1.3 Enhanced Safety, Situational Awareness, and Efficiency

5.4.1.4 Wide Adoption of the Concept of Connected Cars

5.4.2 Restraints

5.4.2.1 Increased Complexity for the Drivers

5.4.2.2 Providing Advanced Features at A Low Cost

5.4.3 Opportunities

5.4.3.1 Organic Light-Emitting Diode (OLED) Displays

5.4.4 Challenges

5.4.4.1 Lack of Enhanced In-Vehicle Hmi Solutions

5.4.5 Winning Imperatives

5.4.5.1 Advancement to Low-Cost, Technically Advanced Cockpit Display With Less Complexity

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porters Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Cockpit Display for Land Vehicle Market, By Vehicle Type (Page No. - 68)

7.1 Introduction

7.2 Commercial Automobiles

7.2.1 Two-Wheelers

7.2.2 Sub-Premium Cars

7.2.3 Premium Cars

7.2.4 Super-Premium Cars

7.2.5 Trucks & Buses

7.3 Tactical Vehicles

7.4 Trains

7.4.1 High-Speed Trains

7.4.2 Light Rails

7.4.3 Intercity Trains

7.4.4 Metro Trains

8 Cockpit Display for Land Vehicle Market, By Display Type (Page No. - 119)

8.1 Introduction

8.2 Driver-Assist Display

8.3 Mission Display

9 Cockpit Display for Land Vehicle Market, By Display Size (Page No. - 126)

9.1 Introduction

9.2 Less Than 5 Inches

9.3 5 Inches to 10 Inches

9.4 Greater Than 10 Inches

10 Geographic Analysis (Page No. - 137)

10.1 Introduction

10.2 Americas

10.3 Europe

10.4 Asia-Pacific

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 153)

11.1 Overview

11.2 Market Share Analysis, 2014

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Acquisitions, Partnerships, Collaborations, Agreements, and Contracts

11.3.3 Expansions

11.3.4 Others

12 Company Profile (Page No. - 160)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Continental AG

12.3 Garmin Ltd.

12.4 Innolux Corp.

12.5 AU Optronics Corp.

12.6 Japan Display Inc.

12.7 Alpine Electronics, Inc.

12.8 General Dynamics Canada Ltd.

12.9 Texas Instruments Inc.

12.10 Esterline Technologies Corp. (Also Featuring Barco N.V. Products)

12.11 Rockwell Collins, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 187)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (86 Tables)

Table 1 Analysis of Drivers

Table 2 Analysis of Restraints

Table 3 Analysis of Opportunities

Table 4 Advantages of OLED Over LCD and VFD

Table 5 Analysis of Challenges

Table 6 Porters Five Forces Analysis With Their Weightage Impact

Table 7 Cockpit Display for Land Vehicle Market Size, By Vehicle Type, 20132020 ($Million)

Table 8 Cockpit Display for Land Vehicle Market Size, By Vehicle Type, 20132020 (Thousand Units)

Table 9 Cockpit Display Market Size for Commercial Automobiles, By Type, 20132020 ($Million)

Table 10 Cockpit Display Market Size for Commercial Automobiles, By Type, 20132020 (Thousand Units)

Table 11 Cockpit Display Market Size for Commercial Automobiles, By Display Size, 20132020 ($Million)

Table 12 Cockpit Display Market Size for Commercial Automobiles, By Display Size, 20132020 (Thousand Units)

Table 13 Cockpit Display Market Size for Commercial Automobiles, By Region, 20132020 ($Million)

Table 14 Cockpit Display Units)

Table 15 Cockpit Display Market Size for Two-Wheelers, By Display Size, 20132020 ($Million)

Table 16 Cockpit Display Market Size for Two-Wheelers, By Display Size, 20132020 (Thousand Units)

Table 17 Cockpit Display Market Size for Two-Wheelers, By Region, 20132020 ($Million)

Table 18 Cockpit Display Market Size for Two-Wheelers, By Region, 20132020 (Thousand Units)

Table 19 Cockpit Display Market Size for Sub-Premium Cars, By Display Size, 20132020 ($Million)

Table 20 Cockpit Display Market Size for Sub-Premium Cars, By Display Size, 20132020 (Thousand Units)

Table 21 Cockpit Display Market Size for Sub-Premium Cars, By Region, 20132020 ($Million)

Table 22 Cockpit Display Market Size for Sub-Premium Cars, By Region, 20132020 (Thousand Units)

Table 23 Cockpit Display Market Size for Premium Cars, By Display Size, 20132020 ($Million)

Table 24 Market Size for Premium Cars, By Display Size, 20132020 (Thousand Units)

Table 25 Cockpit Display Market Size for Premium Cars, By Region, 20132020 ($Million)

Table 26 Cockpit Display Market Size for Premium Cars, By Region, 20132020 (Thousand Units)

Table 27 Cockpit Display Market Size for Super-Premium Cars, By Display Size, 20132020 ($Million)

Table 28 Cockpit Display Market Size for Super-Premium Cars, By Display Size, 20132020 (Thousand Units)

Table 29 Cockpit Display Market Size for Super-Premium Cars, By Region, 20132020 ($Million)

Table 30 Market Size for Super-Premium Cars, By Region, 20132020 (Thousand Units)

Table 31 Cockpit Display Market Size for Trucks & Buses, By Display Size, 20132020 ($Million)

Table 32 Market Size for Trucks & Buses, By Display Size, 20132020 (Thousand Units)

Table 33 Cockpit Display Market Size for Trucks & Buses, By Region, 20132020 ($Million)

Table 34 CockpiMarket Size for Trucks & Buses, By Region, 20132020 (Thousand Units)

Table 35 Cockpit Display Market Size for Tactical Vehicles, By Display Type, 20132020 ($Million)

Table 36 Cockpit Display Market Size for Tactical Vehicles, By Display Type, 20132020 (Thousand Units)

Table 37 Market Size for Tactical Vehicles, By Display Size, 20132020 ($Million)

Table 38 Market Size for Tactical Vehicles, By Display Size, 20132020 (Thousand Units)

Table 39 Cockpit Display Market Size for Tactical Vehicles, By Geography, 20132020 ($Million)

Table 40 Market Size for Tactical Vehicles, By Region, 20132020 (Thousand Units)

Table 41 Cockpit Display Market Size for Trains, By Display Size, 20132020 ($Million)

Table 42 Market Size for Trains, By Display Size, 20132020 (Thousand Units)

Table 43 Cockpit Display Market Size for Trains, By Region, 20132020 ($Million)

Table 44 Market Size for Trains, By Region, 20132020 (Thousand Units)

Table 45 Market Size for High-Speed Trains, By Display Size, 20132020 ($Million)

Table 46 Cockpit Display Market Size for High-Speed Trains, By Display Size, 20132020 (Thousand Units)

Table 47 Market Size for High-Speed Train, By Region, 20132020 ($Million)

Table 48 Market Size for High-Speed Train, By Region, 20132020 (Thousand Units)

Table 49 Market Size for Light Rails, By Display Size, 20132020 ($Million)

Table 50 Market Size for Light Rails, By Display Size, 20132020 (Thousand Units)

Table 51 Cockpit Display Market Size for Light Rails, By Region, 20132020 ($Million)

Table 52 Cockpit Display Market Size for Light Rails, By Region, 20132020 (Thousand Units)

Table 53 Market Size for Intercity Trains, By Display Size, 20132020 ($Million)

Table 54 Cockpit Display Market Size for Intercity Trains, By Display Size, 20132020 (Thousand Units)

Table 55 Cockpit Display Market Size for Intercity Trains, By Region, 20132020 ($Million)

Table 56 Market Size for Intercity Trains, By Region, 20132020 (Thousand Units)

Table 57 Cockpit Display Market Size for Metro Trains, By Display Size, 20132020 ($Million)

Table 58 Cockpit Display Market Size for Metro Trains, By Display Size, 20132020 (Thousand Units)

Table 59 Market Size for Metro Trains, By Region, 20132020 ($Million)

Table 60 Market Size for Metro Trains, By Region, 20132020 (Thousand Units)

Table 61 Cockpit Display for Land Vehicle Market Size, By Display Type, 20132020 ($Million)

Table 62 Cockpit Display of Land Vehicle Market Size, By Display Type, 20132020 (Thousand Units)

Table 63 Cockpit Display Market Size for Driver -Assist Displays, By Vehicle Type, 20132020 ($Million)

Table 64 Market Size for Driver-Assist Displays, By Vehicle Type, 20132020 (Thousand Units)

Table 65 Cockpit Display for Land Vehicle Market Size, By Display Size, 20132020 ($Million)

Table 66 Cockpit Display for Land Vehicle Market Size, By Display Size, 20132020 (Thousand Units)

Table 67 Market for the Display Size of Less Than 5 Inches, By Vehicle Type, 20132020 ($Million)

Table 68 Market for the Display Size of Less Than 5 Inches, By Vehicle Type, 20132020 (Thousand Units)

Table 69 Market for the Display Size of 5 Inches to 10 Inches, By Vehicle Type, 20132020 ($Million)

Table 70 Cockpit Display Market for the Display Size of 5 Inches to 10 Inches, By Vehicle Type, 20132020 (Thousand Units)

Table 71 Market for the Display Size of Greater Than 10 Inches, By Vehicle Type, 20132020 ($Million)

Table 72 Cockpit Display Market for the Display Size of Greater Than 10 Inches, By Vehicle Type, 20132020 (Thousand Units)

Table 73 Cockpit Display for Land Vehicle Market Size, By Region, 20132020 ($Million)

Table 74 Cockpit Display for Land Vehicle Market Size, By Region, 20132020 (Thousand Units)

Table 75 Cockpit Display Market Size for Americas, By Vehicle Type, 20132020 ($Million)

Table 76 Market Size for the Americas, By Vehicle Type, 20132020 (Thousand Units)

Table 77 Market Size for Europe, By Vehicle Type, 20132020 ($Million)

Table 78 Market Size for Europe, By Vehicle Type, 20132020 (Thousand Units)

Table 79 Cockpit Display Market Size for APAC, By Vehicle Type, 20132020 ($Million)

Table 80 Market Size for APAC, By Vehicle Type, 20132020 (Thousand Units)

Table 81 Market Size for RoW, By Vehicle Type, 20132020 ($Million)

Table 82 Market Size for RoW, By Vehicle Type, 20132020 (Thousand Units)

Table 83 Most Significant New Product Launches in the Cockpit Display for Land Vehicle Market

Table 84 Most Significant Acquisitions, Partnerships, Collaborations, Agreements, and Contracts in the Cockpit Display for Land Vehicle Market

Table 85 Recent Expansions of the Cockpit Display for Land Vehicle Market

Table 86 Other Recent Developments of the Cockpit Display for Land Vehicle Market

List of Figures (139 Figures)

Figure 1 Research Design

Figure 2 Average Semiconductor Content Per Vehicle, 20122017

Figure 3 Global Smartphone Shipment

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Limitations of the Research Study

Figure 9 Cockpit Display Market for Trains are Expected to Grow at the Highest Rate During the Forecast Period

Figure 10 Displays With the Size of 5 Inches to 10 Inches are Expected to Hold the Largest Market Size in 2015

Figure 11 The Rising Demand for Driver-Assist Displays in Commercial Automobiles and Trains Contributes to the Favorable Growth Pattern

Figure 12 Europe Held the Largest Market Share in 2014, Whereas APAC is Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 13 Geographic Expansion in Emerging Markets Offer Lucrative Opportunities

Figure 14 Commercial Automobiles are Expected to Hold the Largest Share in the Cockpit Display for Land Vehicle Market

Figure 15 Commercial Automobiles Hold the Largest Share in the Vehicle Type Segment

Figure 16 Driver-Assist Displays Held the Largest Share in the Cockpit Display for Land Vehicle Market in 2015

Figure 17 Cockpit Display Market for the Display Size of Greater Than 10 Inches is Expected to Grow at the Highest Rate From 2015 to 2020

Figure 18 Europe Accounted for the Largest Share in the Overall Cockpit Display for Land Vehicle Market in 2014

Figure 19 APAC Would Hold the Largest Share in the Overall Cdlv Market in 2015 and is Expected to Grow at the Highest Rate

Figure 20 Eupore and APAC Have Entered the Maturity Stage

Figure 21 Evolution of the Cockpit Display for Land Vehicle Market

Figure 22 Cockpit Display for Land Vehicle Market Segmentation

Figure 23 Market Segmentation: By Vehicle Type

Figure 24 Market Segmentation: By Display Type

Figure 25 Market Segmentation: By Display Size

Figure 26 Market Segmentation: By Region

Figure 27 Cockpit Display for Land Vehicles: Drivers, Restraints, Opportunities and Challenges

Figure 28 Global Unit Shipment of Electric Vehicles

Figure 29 Global Smartphone Shipment

Figure 30 Value Chain Analysis: Major Value is Added During R&D, Raw Material Supply, and Original Equipment Manufacturing Phase

Figure 31 Display Packagers/Avionics Manufacturers are the Most Essential Part of Cockpit Display for Land Vehicle Supply Chain

Figure 32 Porters Five Forces Analysis

Figure 33 Due to the Small Number of Existing Players, Suppliers Bargaining Power is Expected to Remain High From 2014 to 2020

Figure 34 The Impact of Threat of New Entrants is Currently High and Would Gradually Decrease to Medium By 2020

Figure 35 Technological Subsitute is the Key Factor Strengthening the Substitutes Market

Figure 36 Technology Factors and the Switching of Suppliers By Buyers are Highly Impacting Suppliers Power

Figure 37 Buyers Would Have A Limited Choice During Upgrades Due to Compatibility Issues

Figure 38 The Inensity of Competitive Rivalry is Expected to Remain High in the Forcasted Period

Figure 39 Trains are Expected to Grow at the Highest Rate From 2015 to 2020

Figure 40 Commercial Automobiles Consumed the Maximum Cockpit Displays in 2014

Figure 41 Commercial Automobiles, By Type, Market Size Comparison (2015 vs 2020)

Figure 42 Market Size of Driver-Assist Displays Used in Commercial Automobiles, in Terms of Value, 20132020 ($Million)

Figure 43 Market Size of Driver-Assist Displays Used in Commercial Automobiles, in Terms of Volume, 20132020 (Thousand Units)

Figure 44 Commercial Automobiles, By Display Size, Market Size Comparison, (2015 vs 2020)

Figure 45 Commercial Automobiles, By Region, Market Size Comparison (2015 vs 2020)

Figure 46 Market Size of Driver-Assist Displays Used in Two-Wheelers, in Terms of Value, 20132020 ($Million)

Figure 47 Market Size of Driver-Assist Displays Used in Two-Wheelers, in Terms of Volume, 20132020 (Thousand Units)

Figure 48 Cockpit Display Market Size for Two-Wheelers, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 49 Market Size for Two-Wheelers, By Region, Market Size Comparison, (2015 vs 2020)

Figure 50 Market Size of Driver-Assist Displays Used in Sub-Premium Cars, in Terms of Value, 20132020 ($Million)

Figure 51 Market Size of Driver-Assist Displays Used in Sub-Premium Cars, in Terms of Volume, 20132020 (Thousand Units)

Figure 52 Sub-Premium Cars, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 53 Sub-Premium Cars, By Region, Market Size Comparison (2015 vs 2020)

Figure 54 Market Size of Driver-Assist Displays Used in Premium Cars, in Terms of Value, 20132020 ($Million)

Figure 55 Market Size of Driver-Assist Displays Used in Premium Cars, in Terms of Volume, 20132020 (Thousand Units)

Figure 56 Premium Cars, By Display Size, Market Size Comparison (2014 vs 2020)

Figure 57 Premium Cars, By Region, Market Size Comparison (2015 vs 2020)

Figure 58 Market Size of Driver-Assist Displays Used in Super-Premium Cars, in Terms of Value, 20132020 ($Million)

Figure 59 Market Size of Driver-Assist Displays Used in Super-Premium Cars, in Terms of Volume, 20132020 (Thousand Units)

Figure 60 Super-Premium Cars, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 61 Super-Premium Cars, By Region, Market Size Comparison (2015 vs 2020)

Figure 62 Market Size of Driver-Assist Displays Used in Trucks & Buses, in Terms of Value, 20132020 ($Million)

Figure 63 Market Size of Driver-Assist Displays Used in Trucks & Buses, in Terms of Volume, 20132020 (Thousand Units)

Figure 64 Trucks & Buses, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 65 Trucks & Buses, By Geography, Market Size Comparison (2015 vs 2020)

Figure 66 Tactical Vehicles, By Display Type, Market Size Comparison (2015 vs 2020)

Figure 67 Tactical Vehicles, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 68 Tactical Vehicles, By Region, Market Size Comparison (2015 vs 2020)

Figure 69 Market Size of Driver-Assist Displays Used in Trains, in Terms of Value, 20132020 ($Million)

Figure 70 Market Size of Driver-Assist Displays Used in Trains, in Terms of Volume, 20132020 (Thousand Units)

Figure 71 Trains, By Display Size, Market Size Comparison, (2015 vs 2020)

Figure 72 Trains, By Region, Market Size Comparison, (2015 vs 2020)

Figure 73 Market Size of Driver-Assist Displays Used in High-Speed Trains, in Terms of Value, 20132020 ($Million)

Figure 74 Market Size of Driver-Assist Displays Used in High-Speed Trains, in Terms of Volume, 20132020 (Thousand Units)

Figure 75 High-Speed Trains, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 76 High-Speed Train, By Region, Market Size Comparison(2015 vs 2020)

Figure 77 Market Size of Driver-Assist Displays Used in Light Rails, in Terms of Value, 20132020 ($Million)

Figure 78 Market Size of Driver-Assist Displays Used in Light Rails, in Terms of Volume, 20132020 (Thousand Units)

Figure 79 Light Rails, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 80 Light Rails , By Region, Market Size Comparison In,(2015 vs 2020)

Figure 81 Market Size of Driver-Assist Displays Used in Intercity Trains, in Terms of Value, 20132020 ($Million)

Figure 82 Market Size of Driver-Assist Displays Used in Intercity Trains, in Terms of Volume, 20132020 (Thousand Units)

Figure 83 Intercity Trains, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 84 Intercity Trains, By Region, Market Size Comparison ,(2015 vs 2020)

Figure 85 Market Size of Driver-Assist Displays Used in Metro Trains, in Terms of Value, 20132020 ($Million)

Figure 86 Market Size of Driver-Assist Displays Used in Metro Trains, in Terms of Volume, 20132020 (Thousand Units)

Figure 87 Metro Trains, By Display Size, Market Size Comparison (2015 vs 2020)

Figure 88 Metro Trains, By Region, Market Size Comparison (2015 vs 2020)

Figure 89 Driver -Assist Displays Accounted for the Largest Share in the Overall Cockpit Display for Land Vehicle Market in 2015

Figure 90 Driver- Assist Displays Segment is Expected to Be the Fastest-Growing Segment During , 2015 2020

Figure 91 Driver-Assist Displays Market Size Comparison in Terms of Value, (2015 vs 2020)

Figure 92 Driver-Assist Displays Market Size Comparison in Terms of Volume, (2015 vs 2020)

Figure 93 Mission Display Market Size in Terms of Value, 20132020 ($Million)

Figure 94 Mission Display Market Size in Terms of Volume, 20132020 (Thousand Units)

Figure 95 Cockpit Displays With the Display Size of 5 Inches to 10 Inches Holds the Largest Market Size in 2015

Figure 96 Cockpit Display Market for the Display Size of Greater Than 10 Inches is Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 97 Less Than 5 Inches Display Market Size Comparison (2014 vs 2020)

Figure 98 Less Than 5 Inches Display Market Size Comparison (2014 vs 2020)

Figure 99 5 Inches to 10 Inches Display Market Size Comparison (2014 vs 2020)

Figure 100 5 Inches to 10 Inches Display Market Size Comparison (2014 vs 2020)

Figure 101 Greater Than 10 Inches Display Market Size Comparison

Figure 102 Greater Than 10 Inches Display Market Size Comparison (2014 vs 2020)

Figure 103 Regional Growth Rate, in Terms of Value, From 2015 to 2020

Figure 104 Europe Dominates the Cockpit Display for Land Vehicle Market in 2015

Figure 105 APAC is Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 106 Snapshot of the Cockpit Display for Land Vehicle Market in the Americas

Figure 107 Americas: Cockpit Display for Land Vehicle Market Size, Comparison, (2015 vs 2020)

Figure 108 Americas: Cockpit Display for Land Vehicle Market Size, Comparison, (2015 vs 2020 )

Figure 109 Snapshot of the Cockpit Display for Land Vehicle Market in Europe

Figure 110 Europe: Cockpit Display for Land Vehicle Market Size, By Comparison, (2015 vs 2020)

Figure 111 Europe: Cockpit Display for Land Vehicle Market Size, Comparison, (2015 vs 2020)

Figure 112 Snapshot of the Cockpit Display for Land Vehicle Market in APAC

Figure 113 APAC: Cockpit Display for Land Vehicle Market Size, Comparison (2015 vs 2020)

Figure 114 APAC: Cockpit Display for Land Vehicle Market Size, Comparison (2015 vs 2020)

Figure 115 Snapshot of the Cockpit Display for Land Vehicle Market in RoW

Figure 116 RoW: Cockpit Display for Land Vehicle Market Size, Comparison (2015 vs 2020)

Figure 117 RoW: Cockpit Display for Land Vehicle Market Size, Comparison, (2015 vs 2020)

Figure 118 Companies Adopted Product Innovation as the Key Growth Strategy From 2012 to 2015

Figure 119 Japan Display Inc. has Emerged as the Fastest-Growing Company

Figure 120 Market Share Analysis for the Cockpit Display for Land Vehicle Market in Terms of Value, 2014

Figure 121 Market Evaluation Framework

Figure 122 Battle for Market Share: New Product Launch is the Key Strategy

Figure 123 Geographic Revenue Mix of Top 5 Market Players

Figure 124 Competitive Benchmarking of the Key Players (20102015)

Figure 125 Continental AG: Company Snapshot

Figure 126 Continental AG: SWOT Analysis

Figure 127 Garmin Ltd.: Company Snapshot

Figure 128 Garmin Ltd.: SWOT Analysis

Figure 129 Innolux Corp.: Company Snapshot

Figure 130 Innolux Corp.: SWOT Analysis

Figure 131 AU Optronics Corp.: Company Snapshot

Figure 132 AU Optronics Corp.: SWOT Analysis

Figure 133 Japan Display Inc.: Company Snapshot

Figure 134 Japan Display Inc.: SWOT Analysis

Figure 135 Alpine Electronics, Inc.: Company Snapshot

Figure 136 General Dynamics Canada Ltd.: Company Snapshot

Figure 137 Texas Instruments Inc.: Company Snapshot

Figure 138 Esterline Technologies Corp.: Company Snapshot

Figure 139 Rockwell Collins, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Cockpit Display Market