Cockpit Electronics Market for Automotive by Product (HUD, Information Display, Infotainment & Navigation, Instrument Cluster, and Telematics), Type (Basic and Advanced), End Market, Fuel Type (BEV, ICE and Others), and Region - Global Forecast to 2022

The cockpit electronics market for automotive is estimated to be USD 34.12 Billion in 2017 and is projected to grow at a CAGR of 8.60% during the forecast period. The base year for the report is 2016 and the forecast period is 2017 to 2022. The market for cockpit electronics is primarily driven by the rising consumer demand for enhanced user experience and convenience features. Additionally, the market is also influenced by the growth in the connected vehicles and integration of smartphones with vehicles. Earlier, the share of electronics system in a vehicle was merely 1 to 2% of the total vehicle cost. However, due to the rising demand for enhanced user experience and convenience features, the share of such systems has increased to 8 to 12% of the total vehicle cost.

Objectives of the Report

- To define, segment, and forecast the automotive cockpit market (2017–2022), in terms of volume (‘000 units) and value (USD million)

- To provide a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To segment the automotive cockpit market and forecast its size, by product, type, end market, fuel type, and level of autonomous driving, based on regions, namely, Asia-Pacific, Europe, North America, and Rest of the World

- To segment the automotive cockpit market and forecast the market size, by volume and value, based on the products, type of electronics, end market, fuel type, and level of automation

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of interior cockpit electronic components. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs, among others. The analysis has been discussed and validated by primary respondents, which include experts from the automotive electronics industry, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

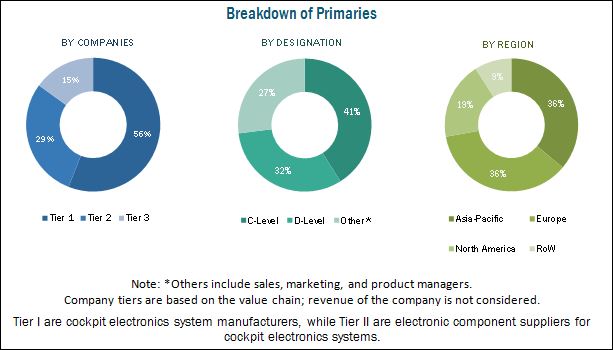

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive cockpit electronics market consists of automotive electronics system manufacturers and service providers such as Robert Bosch GmbH (Germany), Continental AG (Germany), Harman International (U.S), Visteon Corporation (U.S), and Delphi Automotive PLC (U.K). These systems and technologies are supplied to automotive OEMs such as Volkswagen AG (Germany), General Motors (U.S.), Daimler AG (Germany), and others.

Target Audience

- Cockpit electronics system manufacturers and component suppliers

- Infotainment and Telematics service providers

- Automotive OEMs

- Industry associations and other driver assistance systems manufacturers

- The automobile industry and related end-user industries

Scope of the Report

-

Market, By Product

- Head-up Display

- Information Display

- Infotainment & Navigation

- Instrument Cluster

- Telematics

- Others

-

Market, By Type

-

Advanced Cockpit Electronics

- Advanced Instrument Cluster

- Advanced Telematics

- High-End Information Display

- Mid/High-end Infotainment Unit

- Windshield HUD

- Others

-

Basic Cockpit Electronics

- Basic Infotainment Unit

- Basic Instrument Cluster

- Combiner HUD

- Entry Level Information Display

- Tethered Telematics

- Others

-

Advanced Cockpit Electronics

-

Market, By End Market

- Economic Passenger Car

- Luxury Passenger Car

- Mid-Priced Passenger Car

-

Market, By Fuel Type

- Battery Electric Vehicle (BEV)

- Internal Combustion Engine (ICE)

- Others (Hybrid Vehicles)

-

Market, By Level of Autonomous Driving

- Conventional

- Semi-Autonomous

-

Market, By Region

- Asia-Oceania (China, Japan, South Korea, and India)

- Europe (Germany, France, Italy, and the U.K.)

- North America (U.S., Mexico, and Canada)

- Rest of the World (Brazil, Russia, and South Africa)

Available Customizations

-

Cockpit market, By Fuel Type & Country

(Countries include China, Japan, South Korea, India, Germany, France, U.K., U.S., Mexico, Canada, Brazil, Russia, and Turkey

Fuel Type includes battery electric vehicle (BEV), internal combustion engine (ICE), and Others (Hybrid))

- Asia-Oceania

- Europe

- North America

- Rest of the World

The cockpit electronics market for automotive is projected to grow at a CAGR of 8.60% from 2017 to 2022, to reach a market size of USD 51.54 Billion by 2022. The key drivers of this market are rising consumer demand for enhanced user experience and convenience features, growth in the connected vehicles, and integration of smartphones with vehicles.

Head-up displays are estimated to be the fastest growing product segment globally, in terms of volume and value. The growth of this segment can be attributed to increasing demand for premium and luxury passenger cars as head-up displays are majorly featured in these vehicles. Also, increasing awareness about safety features among consumers is driving the head-up display market. The infotainment and navigation segment is estimated to be the largest market, in terms of value. The growth of this segment is due to the increasing adoption of integrated infotainment and navigation systems by OEMs. Advanced cockpit is estimated to be the largest as well as the fastest growing market. Advanced cockpit electronics features such as windshield head-up display, high-end information display, and advanced telematics are estimated to grow at a higher CAGR as compared to the components in the basic cockpit electronics.

Luxury passenger cars are estimated to be the fastest growing segment of the automotive cockpit market, by end market. Luxury passenger cars are feature rich in terms of electronic systems. Several OEMs are including high-end infotainment and windshield head-up display in their luxury passenger cars. The global market for battery electric vehicles (BEV) is estimated to be the fastest growing market in the fuel type segment. This growth is due to the increased production of electric vehicles. The largest market in the segment is the internal combustion engine (ICE) vehicles, and it is expected to remain an attractive market in the near future due to its production and sales.

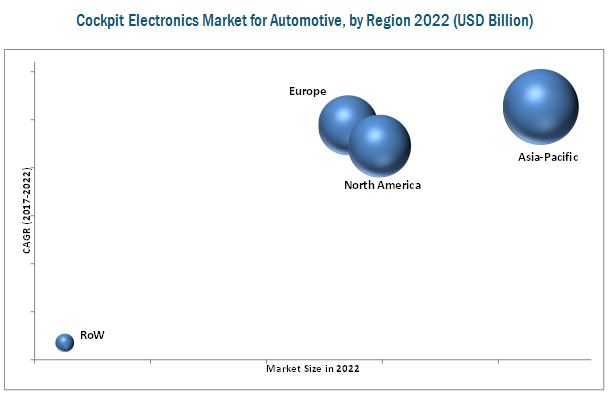

Asia-Oceania is estimated to dominate the market, by volume as well as value. The region comprises countries such as China and India, which are major automotive hubs in terms of vehicle production as well as sales. The demand for cockpit electronics is directly linked to the vehicle production and consumer demand in this region. Hence, with the shift of automobile manufacturing plants to developing countries, the companies engaged in manufacturing cockpit and their components have started focusing on these markets.

A key factor restraining the growth of the cockpit electronics market is the high cost of advanced cockpit electronics systems. Advanced electronic systems involve high development cost. This means that the companies have to invest heavily in research and development for developing and testing advanced electronic systems. The high costs involved are restraining the adoption of the automotive cockpit electronics by OEMs. The market is dominated by a few global players. Some of the key manufacturers operating in the market are Robert Bosch GmbH (Germany), Continental AG (Germany), Harman International (U.S), Visteon Corporation (U.S), and Delphi Automotive PLC (U.K).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Data

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Increase in Demand for HEV & PHEV Vehicles

2.5.2.2 Growing Information and Telecommunication Infrastructure is Increasing the Demand for Automotive Telematics

2.5.2.3 Growth in Luxury Vehicle Sales

2.5.3 Supply Side Analysis

2.5.3.1 OEMS Focus on Convenience and Comfort Systems in Vehicle

2.5.3.2 Technological Advancements in Automotive Industry

2.6 Market Size Estimation

2.7 Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in the Automotive Cockpit Electronics Market

4.2 Market, By Region

4.3 Market, By Country

4.4 Market, By Level of Autonomous Driving

4.5 Market, By End Market

4.6 Market, By Fuel Type

4.7 Market, By Product Type

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Product

5.2.2 Market, By Type

5.2.3 Market, By Fuel Type

5.2.4 Market, By Level of Autonomous Driving

5.2.5 Market, By End Market

5.2.6 Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in Connected Vehicles

5.3.1.2 Rising Demand for Enhanced User Experience and Convenience Features

5.3.1.3 Increased Adoption By OEMS

5.3.1.4 Government Regulations Pertaining to Telematics

5.3.1.5 Integration of Smartphones With Vehicles

5.3.2 Restraints

5.3.2.1 High Cost of Advanced Cockpit Electronic Systems

5.3.2.2 High Power Consumption

5.3.2.3 Cyber Security Threat Due to Vehicle Telematics

5.3.3 Opportunities

5.3.3.1 Advent of Concept Cars and Electric Vehicles in the Automotive Industry

5.3.3.2 Growth of Mobility Services

5.3.3.3 Integration of Multiple Technologies (Adaptive & Holistic HMI)

5.3.3.4 Increase in Demand for Autonomous Vehicles

5.3.4 Challenges

5.3.4.1 Long Production Cycle of Automotive Vehicle

5.3.4.2 Luxurious Interior at Lower Price

5.3.4.3 Distraction of Driver

5.4 Porter’s Five Forces Analysis

5.4.1 Global Market

5.4.1.1 Intensity of Competitive Rivalry

5.4.1.2 Threat of Substitutes

5.4.1.3 Bargaining Power of Buyers

5.4.1.4 Bargaining Power of Suppliers

5.4.1.5 Threat of New Entrants

6 Technological Overview (Page No. - 66)

6.1 Introduction

6.2 Current Technologies in Automotive Cockpit Market

6.2.1 Instrument Cluster

6.2.2 Infotainment Unit

6.2.3 Head-Up Display

6.2.4 Telematics

6.2.5 Information Display

6.2.6 Audio System

7 Global Market, By Product (Page No. - 69)

7.1 Introduction

7.2 Market, By Product Type

7.2.1 Head-Up Display (Hud) Market, By Region

7.2.2 Information Display Market, By Region

7.2.3 Infotainment & Navigation Market, By Region

7.2.4 Instrument Clusters Market, By Region

7.2.5 Telematics Market, By Region

7.2.6 Others Market, By Region

8 Global Market, By Type (Page No. - 80)

8.1 Introduction

8.2 Market, By Type

8.2.1 Asia-Pacific: Market, By Type

8.2.2 Europe: Market, By Type

8.2.3 North America: Market, By Type

8.2.4 Rest of the World: Market, By Type

*The Market, By Type Include Basic Cockpit Electronics and Advanced Electronics. the Basic Cockpit Electronics Consists of Basic Instrument Cluster, Entry Level Information Display, Basic Infotainment Unit, Combiner Hud, and Basic Telematics. the Advanced Cockpit Electronics Involves Advanced Instrument Cluster, High-End Information Display, Mid/High End Infotainment Unit, Windshield Hud, and Advanced Telematics.

9 Global Market, By Fuel Type (Page No. - 92)

9.1 Introduction

9.2 Market, By Fuel Type

9.2.1 Battery Electric Vehicle (BEV) Market, By Region

9.2.2 Internal Combustion Engine (ICE) Market, By Region

9.2.3 Others (Hybrid Vehicles) Market, By Region

10 Global Market, By End Market (Page No. - 99)

10.1 Introduction

10.2 Market, By End Market

10.2.1 Economic Passenger Car Market, By Region

10.2.2 Luxury Passenger Car Market, By Region

10.2.3 Mid-Price Passenger Car Market, By Region

11 Global Market, By Level of Autonomous Driving

11.1 Introduction

11.2 Market, By Level of Autonomous Driving

11.2.1 Conventional, By Region

11.2.2 Semi-autonomous, By Region

12 Global Market, By Region (Page No. - 105)

12.1 Introduction

12.2 Market, By Region and Level of Autonomous Driving

12.2.1 Asia-Pacific

12.2.1.1 China

12.2.1.2 India

12.2.1.3 Japan

12.2.1.4 South Korea

12.2.1.5 Rest of Asia-Pacific

12.2.2 Europe

12.2.2.1 France

12.2.2.2 Germany

12.2.2.3 Italy

12.2.2.4 U.K.

12.2.2.5 Rest of Europe

12.2.3 North America

12.2.3.1 Canada

12.2.3.2 Mexico

12.2.3.3 U.S.

12.2.4 Rest of the World

12.2.4.1 Brazil

12.2.4.2 Russia

12.2.4.3 South Africa

13 Competitive Landscape (Page No. - 138)

13.1 Introduction

13.1.1 Visionary Leaders

13.1.2 Innovators

13.1.3 Dynamic Differentiators

13.1.4 Emerging Companies

13.2 Product Offerings

13.3 Business Strategy

*Top 25 Companies Analyzed for This Study are - Continental Ag, Robert Bosch GmbH, Delphi Automotive LLP, Denso Corporation, Visteon Corporation, Harman International Industries, Panasonic Corporation, Magneti Marelli S.P.A., Yazaki Corporation, Nippon Seiki Co., Ltd., Clarion Co.,Ltd., Tomtom International BV, Alpine Electronics, Inc, Pioneer Corporation, Garmin International, Inc, Jvckenwood Corporation, Innolux Corporation, Valeo Sa, At&T Inc., Mix Telematics, Fujitsu Ten Ltd., Renesas Electronics Corporation, Flex Ltd., Faurecia, Iav Automotive Engineering

13.4 Automotive Cockpit Market: Market Ranking

14 Company Profiles (Page No. - 143)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

14.1 Continental AG

14.2 Robert Bosch GmbH

14.3 Delphi Automotive PLC

14.4 Denso Corporation

14.5 Visteon Corporation

14.6 Harman International

14.7 Panasonic Corporation

14.8 Magneti Marelli S.P.A

14.9 Yazaki Corporation

14.10 Nippon-Seiki Co. Ltd.

14.11 Clarion Co., Ltd.

14.12 Tomtom International BV

14.13 Alpine Electronics

14.14 Garmin Ltd.

14.15 Pioneer Corporation

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 201)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing Rt: Real Time Market Intelligence

15.5 Available Customizations

15.5.1 Global Market, By Fuel Type & Country

15.5.2 Company Information

15.5.2.1 Detailed Analysis and Profiling of Additional Market Players (Up to 5)

15.6 Related Reports

15.7 Author Details

List of Tables (100 Tables)

Table 1 Average U.S. Dollar Exchange Rates (Per 1 USD)

Table 2 Government Incentives for Electric Vehicles

Table 3 Market: By Product

Table 4 Market, By Fuel Type

Table 5 Market, By Level of Autonomous Driving

Table 6 Market, By End Market

Table 7 Market: Key Adoptions By Oem

Table 8 Porters Five Forces Analysis

Table 9 Global Market, By Product, 2015–2022 (‘000 Units)

Table 10 Global Market, By Product, 2015–2022 (USD Million)

Table 11 Head-Up Display: Market, By Region, 2015–2022 (‘000 Units)

Table 12 Head-Up Display: Market, By Region, 2015–2022 (USD Million)

Table 13 Information Display: Market, By Region, 2015–2022 (‘000 Units)

Table 14 Information Display: Market, By Region, 2015–2022 (USD Million)

Table 15 Infotainment & Navigation: Market, By Region, 2015–2022 (‘000 Units)

Table 16 Infotainment & Navigation: Market, By Region, 2015–2022 (USD Million)

Table 17 Instrument Cluster: Market, By Region, 2015–2022 (‘000 Units)

Table 18 Instrument Cluster: Market, By Region, 2015–2022 (USD Million)

Table 19 Telematics: Market, By Region, 2015–2022 (‘000 Units)

Table 20 Telematics: Market, By Region, 2015–2022 (USD Million)

Table 21 Others: Market, By Region, 2015–2022 (‘000 Units)

Table 22 Others: Market, By Region, 2015–2022 (USD Million)

Table 23 Global Market, By Type, 2015–2022 (‘000 Units)

Table 24 Global Market, By Type, 2015–2022 (USD Million)

Table 25 Asia-Pacific: Market, By Type, 2015–2022 (‘000 Units)

Table 26 Asia-Pacific: Market, By Type, 2015–2022 (USD Million)

Table 27 Europe: Market, By Type, 2015–2022 (‘000 Units)

Table 28 Europe: Market, By Type, 2015–2022 (USD Million)

Table 29 North America: Market, By Type, 2015–2022 (‘000 Units)

Table 30 North America: Market, By Type, 2015–2022 (USD Million)

Table 31 Rest of the World: Automotive Cockpit Market Size, By Type, 2015–2022 (‘000 Units)

Table 32 Rest of the World: Automotive Cockpit Market, By Type, 2015–2022 (USD Million)

Table 33 Global Market, By Fuel Type, 2015–2022 (‘000 Units)

Table 34 Global Market, By Fuel Type, 2015–2022 (USD Million)

Table 35 Battery Electric Vehicle (BEV): Cockpit Market, By Region, 2015–2022 (‘000 Units)

Table 36 Battery Electric Vehicle (BEV): Cockpit Market, By Region, 2015–2022 (USD Million)

Table 37 Internal Combustion Engine (ICE): Cockpit Market, By Region, 2015–2022 (‘000 Units)

Table 38 Internal Combustion Engine (ICE): Cockpit Market, By Region, 2015–2022 (USD Million)

Table 39 Others (Hybrid): Cockpit Market, By Region, 2015–2022 (‘000 Units)

Table 40 Others (Hybrid): Cockpit Market, By Region, 2015–2022 (USD Million)

Table 41 Global Market , By End Market, 2015–2022 (‘000 Units)

Table 42 Global Market, By End Market, 2015–2022 (USD Million)

Table 43 Economic Passenger Car: Cockpit Market, By End Market, 2015–2022 (‘000 Units)

Table 44 Economic Passenger Car: Cockpit Market, By Region, 2015–2022 (USD Million)

Table 45 Luxury Passenger Car: Cockpit Market, By Region, 2015–2022 (‘000 Units)

Table 46 Luxury Passenger Car: Cockpit Market, By Region, 2015–2022 (USD Million)

Table 47 Mid-Priced Passenger Car: Cockpit Market, By Region, 2015–2022 (‘000 Units)

Table 48 Mid-Priced Passenger Car: Cockpit Market, By Region, 2015–2022 (USD Million)

Table 49 Cockpit Market, By Region, 2015–2022 (000’ Units)

Table 50 Cockpit Market, By Region, 2015–2022 (USD Million)

Table 51 Global Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 52 Global Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 53 Asia-Pacific: Market, By Country, 2015–2022 (‘000 Units)

Table 54 Asia-Pacific: Market, By Country, 2015–2022 (USD Million)

Table 55 Asia-Pacific: Market, By Level of Autonomous Driving, 2015–2022 (000’ Units)

Table 56 Asia-Pacific: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 57 China: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 58 China: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 59 India: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 60 India: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 61 Japan: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 62 Japan: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 63 South Korea: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 64 South Korea: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 65 Rest of Asia-Pacific: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 66 Rest of Asia-Pacific: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 67 Europe: Market, By Country, 2015–2022 (‘000 Units)

Table 68 Europe: Market, By Country, 2015–2022 (USD Million)

Table 69 Europe: Market, By Level of Autonomous Driving, 2015–2022 (000’ Units)

Table 70 Europe: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 71 France: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 72 France: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 73 Germany: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 74 Germany: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 75 Italy: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 76 Italy: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 77 U.K.: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 78 U.K.: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 79 Rest of Europe: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 80 Rest of Europe: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 81 North America: Market, By Country, 2015–2022 (‘000 Units)

Table 82 North America: Market, By Country, 2015–2022 (USD Million)

Table 83 North America: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 84 North America: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 85 Canada: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 86 Canada: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 87 Mexico: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 88 Mexico: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 89 U.S.: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 90 U.S.: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 91 RoW: Market, By Country, 2015–2022 (‘000 Units)

Table 92 RoW: Market, By Country, 2015–2022 (USD Million)

Table 93 RoW: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 94 RoW: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 95 Brazil: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 96 Brazil: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 97 Russia: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 98 Russia: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

Table 99 South Africa: Market, By Level of Autonomous Driving, 2015–2022 (‘000 Units)

Table 100 South Africa: Market, By Level of Autonomous Driving, 2015–2022 (USD Million)

List of Figures (66 Figures)

Figure 1 Global Market : Segmentations Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 HEV & PHEV Sales Data (2016 vs 2021)

Figure 6 Global Luxury Vehicle Y-O-Y Sales Growth (2011–2015)

Figure 7 Global Market , By End Market: Bottom-Up Approach

Figure 8 Global Market, By Type: Top-Down Approach

Figure 9 Infotainment & Navigation Segment to Drive the Growth of Automotive Cockpit Market, 2017 vs 2022 (USD Billion)

Figure 10 ICE Vehicle Segment to Be the Largest Contributor to the Market, 2017 vs 2022 (USD Billion)

Figure 11 Advanced Cockpit Segment to Be the Largest Contributor to Global Market, 2017 vs 2022 (USD Billion)

Figure 12 Advanced vs Basic Market, 2017 vs 2022 (USD Billion)

Figure 13 Luxury Passenger Cars to Be the Largest Contributor to Global Market, 2017 vs 2022 (USD Billion)

Figure 14 Asia-Pacific to Hold the Largest Share in the Market, By Region, 2017 vs 2022 (USD Billion)

Figure 15 Increasing Adoption of Advanced Cockpit By OEMS to Drive the Market in the Next Five Years

Figure 16 Asia-Pacific to Be the Largest Market in the Market, 2017 (Value)

Figure 17 China to Grow at the Highest CAGR During the Forecast Period, (Value)

Figure 18 Semi-Autonomous Vehicles to Register the Highest Growth During the Forecast Period, 2017 vs 2022 (Value)

Figure 19 Luxury Passenger Cars to Hold the Largest Market Share, 2017 vs 2022 (Value)

Figure 20 ICE Vehicles Expected to Lead the Market, 2017 vs 2022 (Value)

Figure 21 Advanced Cockpit to Have the Largest Market Size, 2017 vs 2022 (Value)

Figure 22 Global Market Segmentation

Figure 23 Market, By Product

Figure 24 Market, By Type

Figure 25 Market, By Fuel Type

Figure 26 Market, By Level of Autonomous Driving

Figure 27 Market, By End Market

Figure 28 Market, By Region

Figure 29 Market Dynamics

Figure 30 Connected Cars Market Size, 2014–2016 (USD Billion)

Figure 31 Growth of Mobility Services

Figure 32 Holistic Cockpit Electronics Layouts

Figure 33 Passenger Death Rate in Road Accidents Per 1,00,000 People, By Country

Figure 34 Porter’s Five Forces Analysis

Figure 35 Competitive Rivalry is High in Global Market

Figure 36 New Product Launch and Innovation in Market Lead to A High Competition in the Global Market

Figure 37 Limited Availability of Substitutes Makes the Threat of Substitutes Medium

Figure 38 Buyer Concentration and Buyer Volume Leverage Make the Buyer’s Bargaining Power to Be High

Figure 39 Technology Factor and Importance of Volume to Supplier Make the Bargaining Power of Suppliers Low

Figure 40 Established Firms and High Initial Cost Make the Threat of New Entrants Medium

Figure 41 Technological Evolution of Cockpit Electronics

Figure 42 Market, By Product, 2017 vs 2022

Figure 43 Market Split (By Fuel Type): Internal Combustion Engine (ICE) Vehicles to Constitute the Largest Market Size By Volume, 2017–2022

Figure 44 Market, By End Market, 2017 vs 2022

Figure 45 Market Outlook, By Region, 2017 vs 2022 (USD Million)

Figure 46 Asia-Pacific: Market Snapshot

Figure 47 Europe: Market, By Country, 2017 vs 2022 (USD Million)

Figure 48 North America: Market Snapshot

Figure 49 RoW: Market, By Country, 2017–2022 (‘000 Units)

Figure 50 Competitive Leadership Mapping: 2017

Figure 51 Market Ranking, 2017

Figure 52 Continental AG: Company Snapshot

Figure 53 Robert Bosch GmbH: Company Snapshot

Figure 54 Delphi Automotive PLC: Company Snapshot

Figure 55 Denso Corporation: Company Snapshot

Figure 56 Visteon Corporation: Company Snapshot

Figure 57 Harman International: Company Snapshot

Figure 58 Panasonic Corporation: Company Snapshot

Figure 59 Magneti Marelli S.P.A: Company Snapshot

Figure 60 Yazaki Corporation: Company Snapshot

Figure 61 Nippon-Seiki Co. Ltd: Company Snapshot

Figure 62 Clarion Co., Ltd. : Company Snapshot

Figure 63 Tomtom International BV: Company Snapshot

Figure 64 Alpine Electronics: Company Snapshot

Figure 65 Garmin Ltd.: Company Snapshot

Figure 66 Pioneer Corporation: Company Snapshot

Growth opportunities and latent adjacency in Cockpit Electronics Market