Cloud Workload Protection Market by Solution (Monitoring and Logging, Policy and Compliance Management, Threat Detection Incident Response), Service, Deployment Model, Organizational Size, Vertical, and Region - Global Forecast to 2023

[127 Pages Report] The global cloud workload protection market accounted for USD 1.97 Billion in 2017 and is expected to reach to USD 6.70 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 24.4% during the forecast period. Several factors, such as the increase in the adoption of multi-cloud strategy among enterprises, dire need to fortify enterprise workloads against unauthorized strikes, and centralized policy enforcement are expected to drive the growth of the market across the globe. The base year considered for this study is 2017, and the forecast period under consideration is 20182023.

Objectives of the Study:

- To describe and forecast the global cloud workload protection market by component (solutions and services), deployment model, organization size, vertical, and region

- To forecast the market size of the main regional segments, including North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the market subsegments with respect to the individual growth trends, prospects, and contribution to the total market

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape to the major players

- To track and analyze competitive developments, such as acquisitions, new product developments, and partnerships and collaborations, in the market

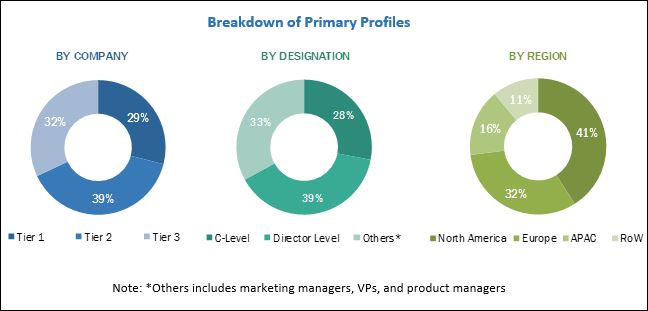

The research methodology used to estimate and forecast the cloud workload protection market began with capturing data on the key vendor revenues through secondary research sources, such as Cloud Computing Association, Association for Financial Professionals (AFP), and Information Systems Security Association (ISSA). Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. Post arrival at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of the primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key Target Audience of Cloud Workload Protection Market:

- Government agencies

- Cybersecurity vendors

- Network solution providers

- Independent software vendors

- Consulting firms

- System integrators

- Value-added Resellers (VARs)

- Cloud Service Providers (CSPs)

- Information Technology (IT) security agencies

- Managed Security Service Providers (MSSPs)

The research study answers several questions for stakeholders, primarily which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report:

|

Report Metrics |

Details |

|

Market size available for years |

20172023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component (Solutions and Services), Deployment Model, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Bracket (US), CloudPassage (US), Dome9 (US), Evident (US), GuardiCore (Israel), HyTrust (US), LogRhythm (US), McAfee (US), Sophos (UK), Symantec (US), Trend Micro (Japan), and Tripwire (US) |

The research report categorizes the cloud workload protection market to forecast the revenue and analyze the trends in each of the following submarkets:

Cloud Workload Protection Market By Solution:

- Monitoring and logging

- Policy and compliance management

- Vulnerability assessment

- Threat detection and incident response

- Others (encryption, tokenization, and key management)

By Service:

- Training, consulting, and integration

- Support and maintenance

- Managed services

By Deployment Model:

- Public cloud

- Private cloud

- Hybrid cloud

By Organizational Size:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and life sciences

- IT and telecommunications

- Retail and consumer goods

- Manufacturing

- Government and public sector

- Media and entertainment

- Energy and utilities

- Others (education, and transportation and logistics)

Cloud Workload Protection Market By Region:

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the company's specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North American Market

- Further country-level breakdown of the European Market

- Further country-level breakdown of the APAC Market

- Further country-level breakdown of the MEA Market

- Further country-level breakdown of the Latin American Market

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The cloud workload protection market size is expected to grow from USD 2.25 Billion in 2018 to USD 6.70 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 24.4% during the forecast period. The major drivers of this market include the growing adoption of the multi-cloud strategy, increasing need to fortify the enterprise network against unauthorized and unprecedented strikes, centralized policy management, and simplified installation for distributed enterprise networks.

The cloud workload protection market report has been broadly classified on the basis of solutions into monitoring and logging, policy and compliance management, vulnerability assessment, threat detection and incident response, and others (tokenization, encryption, and key management). On the basis of services, the market has been classified into training, consulting, and integration; support and maintenance; and managed services. By deployment model, the market has been categorized into public cloud, private cloud, and hybrid cloud. On the basis of verticals, the market has been divided into Banking, Financial Services, and Insurance (BFSI), healthcare and life sciences, IT and telecommunications, retail and consumer goods, manufacturing, government and public sector, media and entertainment, energy and utilities, others (education, and transportation and logistics). By region, the market has been segmented into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

The policy and compliance management segment is expected to grow at the fastest rate during the forecast period. The key reason for the high growth is an efficient policy management that enables the segmentation requirements for compliance with various regulations, including General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Health Insurance Portability and Accountability Act (HIPAA), and Revised Payment Services Directive (PSD2).

The public cloud segment is estimated to account for the largest market share in 2018 and is expected to grow at a significant rate during the forecast period. The major reason for the high adoption of the public cloud is its ease of access and faster deployment. This segment offers various benefits, such as scalability, reliability, flexibility, and remote location access to enterprises.

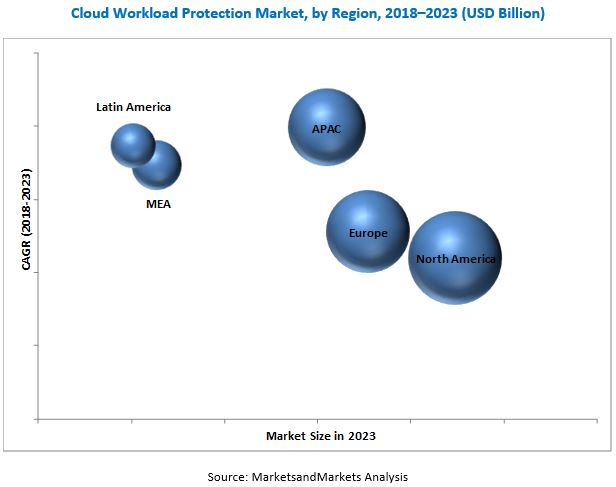

APAC is expected to witness the highest CAGR during the forecast period. The increasing adoption of cloud workload protection solutions and services, and advanced cybersecurity attacks are expected to be the major driving factors for the growth of the cloud workload protection market in this region. The increased Information and Communications Technology (ICT) expenditure in the government infrastructure, cloud protection initiatives, and the need to prevent unauthorized access to networks are some of the factors that have contributed to the growth of the market in the APAC region. The need to adhere to different regulatory compliances and lack of technical expertise among the enterprise staff are some of the major restraints and challenges in the market.

Some of the key vendors in the cloud workload protection market are Bracket (US), CloudPassage (US), Dome9 (US), Evident (US), GuardiCore (Israel), HyTrust (US), LogRhythm (US), McAfee (US), Sophos (UK), Symantec (US), Trend Micro (Japan), and Tripwire (US). These players have adopted various strategies, such as new product launches, acquisitions, and partnerships to cater to enterprises in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Cloud Workload Protection Market

4.2 Market Share of Top 3 Solutions and Regions, 2018

4.3 Market By Component, 2018

4.4 Market By Service, 2018

4.5 Market By Deployment Model, 2018

4.6 Market Top 3 Verticals, 20182023

4.7 Market Investment Scenario, 20182023

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of the Multi-Cloud Strategy Among Enterprises

5.2.1.2 Dire Need to Fortify Enterprise Workloads Against Unauthorized Strikes

5.2.1.3 Centralized Policy Enforcement and Simplified Installation of Distributed Enterprise Workloads

5.2.1.4 Seamless Scalability and Reduced Operational Costs

5.2.2 Restraints

5.2.2.1 Adherence to Multiple Regulatory Compliances

5.2.2.2 SMEs Budget Constraints in Adopting Advanced Cloud Security Solutions

5.2.3 Opportunities

5.2.3.1 Higher Adoption of Cloud Workload Protection Offerings in the BFSI Vertical

5.2.4 Challenges

5.2.4.1 Limited Technical Expertise to Handle Complex and Distributed Cloud Workloads

5.3 Regulatory Landscape

5.3.1 Payment Card Industry Data Security Standard (PCI DSS)

5.3.2 Health Insurance Portability and Accountability Act (HIPAA)

5.3.3 Federal Information Security Management Act (FISMA)

5.3.4 Gramm-Leach-Bliley Act (GLBA)

5.3.5 SarbanesOxley Act

5.3.6 International Organization for Standardization Standard 27001

5.3.7 General Data Protection Regulation (GDPR)

6 Cloud Workload Protection Market By Component (Page No. - 38)

6.1 Introduction

6.2 Solutions

6.3 Services

7 Cloud Workload Protection Market By Solution (Page No. - 42)

7.1 Introduction

7.2 Monitoring and Logging

7.3 Policy and Compliance Management

7.4 Vulnerability Assessment

7.5 Threat Detection and Incident Response

7.6 Others

8 Cloud Workload Protection Market By Service (Page No. - 47)

8.1 Introduction

8.2 Training, Consulting, and Integration

8.3 Managed Services

8.4 Support and Maintenance

9 Cloud Workload Protection Market By Deployment Model (Page No. - 51)

9.1 Introduction

9.2 Public Cloud

9.3 Private Cloud

9.4 Hybrid Cloud

10 Cloud Workload Protection Market By Organization Size (Page No. - 55)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Cloud Workload Protection Market By Vertical (Page No. - 59)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Retail and Consumer Goods

11.4 Healthcare and Life Sciences

11.5 Manufacturing

11.6 Media and Entertainment

11.7 IT and Telecommunications

11.8 Government and Public Sector

11.9 Energy and Utilities

11.10 Others

12 Cloud Workload Protection Market By Region (Page No. - 68)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.2 Australia and New Zealand

12.4.3 Japan

12.4.4 Singapore

12.4.5 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Middle East

12.5.2 Africa

12.6 Latin America

12.6.1 Mexico

12.6.2 Brazil

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 90)

13.1 Overview

13.2 Competitive Scenario

13.2.1 New Product Launches

13.2.2 Acquisitions

13.2.3 Partnerships

14 Company Profiles (Page No. - 93)

(Business Overview, Solutions Offered, Recent Developments, and MnM View)*

14.1 Bracket

14.2 Cloudpassage

14.3 Dome9

14.4 Evident

14.5 Guardicore

14.6 Hytrust

14.7 Logrhythm

14.8 Mcafee

14.9 Sophos

14.10 Symantec

14.11 Trend Micro

14.12 Tripwire

*Details on Business Overview, Solutions Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 119)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (69 Tables)

Table 1 Cloud Workload Protection Market Size, By Component, 20162023 (USD Million)

Table 2 Solutions: Market Size, By Region, 20162023 (USD Million)

Table 3 Services: Market Size, By Region, 20162023 (USD Million)

Table 4 Cloud Workload Protection Market Size By Solution, 20162023 (USD Million)

Table 5 Monitoring and Logging: Market Size, By Region, 20162023 (USD Million)

Table 6 Policy and Compliance Management: Market Size, By Region, 20162023 (USD Million)

Table 7 Vulnerability Assessment: Market Size, By Region, 20162023 (USD Million)

Table 8 Threat Detection and Incident Response: Market Size, By Region, 20162023 (USD Million)

Table 9 Others: Market Size, By Region, 20162023 (USD Million)

Table 10 Cloud Workload Protection Market Size, By Service, 20162023 (USD Million)

Table 11 Training, Consulting, and Integration: Market Size, By Region, 20162023 (USD Million)

Table 12 Managed Services: Market Size, By Region, 20162023 (USD Million)

Table 13 Support and Maintenance: Market Size, By Region, 20162023 (USD Million)

Table 14 Cloud Workload Protection Market Size By Deployment Model, 20162023 (USD Million)

Table 15 Public Cloud: Market Size, By Region, 20162023 (USD Million)

Table 16 Private Cloud: Market Size, By Region, 20162023 (USD Million)

Table 17 Hybrid Cloud: Market Size, By Region, 20162023 (USD Million)

Table 18 Cloud Workload Protection Market Size, By Organization Size, 20162023 (USD Million)

Table 19 Small and Medium-Sized Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 20 Large Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 21 Cloud Workload Protection Market Size By Vertical, 20162023 (USD Million)

Table 22 Banking, Financial Services, and Insurance: Market Size, By Region, 20162023 (USD Million)

Table 23 Retail and Consumer Goods: Market Size, By Region, 20162023 (USD Million)

Table 24 Healthcare and Life Sciences: Market Size, By Region, 20162023 (USD Million)

Table 25 Manufacturing: Market Size, By Region, 20162023 (USD Million)

Table 26 Media and Entertainment: Market Size, By Region, 20162023 (USD Million)

Table 27 IT and Telecommunications: Market Size, By Region, 20162023 (USD Million)

Table 28 Government and Public Sector: Market Size, By Region, 20162023 (USD Million)

Table 29 Energy and Utilities: Market Size, By Region, 20162023 (USD Million)

Table 30 Others: Market Size, By Region, 20162023 (USD Million)

Table 31 Cloud Workload Protection Market Size, By Region, 20162023 (USD Million)

Table 32 North America: Cloud Workload Protection Market Size, By Component, 20162023 (USD Million)

Table 33 North America: Market Size, By Solution, 20162023 (USD Million)

Table 34 North America: Market Size, By Service, 20162023 (USD Million)

Table 35 North America: Market Size, By Deployment Model, 20162023 (USD Million)

Table 36 North America: Market Size, By Organization Size, 20162023 (USD Million)

Table 37 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 38 North America: Market Size, By Country, 20162023 (USD Million)

Table 39 Europe: Cloud Workload Protection Market Size, By Component, 20162023 (USD Million)

Table 40 Europe: Market Size, By Solution, 20162023 (USD Million)

Table 41 Europe: Market Size, By Service, 20162023 (USD Million)

Table 42 Europe: Market Size, By Deployment Model, 20162023 (USD Million)

Table 43 Europe: Market Size, By Organization Size, 20162023 (USD Million)

Table 44 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 45 Europe: Market Size, By Country, 20162023 (USD Million)

Table 46 Asia Pacific: Cloud Workload Protection Market Size, By Component, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size, By Solution, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size, By Deployment Model, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size, By Organization Size, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 53 Middle East and Africa: Cloud Workload Protection Market Size, By Component, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size, By Solution, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size, By Deployment Model, 20162023 (USD Million)

Table 57 Middle East and Africa: Market Size, By Organization Size, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 59 Middle East and Africa: Market Size, By Sub-Region, 20162023 (USD Million)

Table 60 Latin America: Cloud Workload Protection Market Size, By Component, 20162023 (USD Million)

Table 61 Latin America: Market Size, By Solution, 20162023 (USD Million)

Table 62 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 63 Latin America: Market Size, By Deployment Model, 20162023 (USD Million)

Table 64 Latin America: Market Size, By Organization Size, 20162023 (USD Million)

Table 65 Latin America: Market Size, By Vertical, 20162023 (USD Million)

Table 66 Latin America: Cloud Workload Protection Market Size, By Country, 20162023 (USD Million)

Table 67 New Product Launches, 20162018

Table 68 Acquisitions, 2017

Table 69 Partnerships, 20152017

List of Figures (31 Figures)

Figure 1 Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Cloud Workload Protection Market: Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cloud Workload Protection Market Assumptions

Figure 8 Fastest Growing Segments in the Market 20182023

Figure 9 Global Cloud Workload Protection Market Size 20162023 (USD Million)

Figure 10 Cloud Workload Protection Market, By Region

Figure 11 Elimination of Upfront Investment Costs, Seamless Scalability, and Reduced Operational Costs are Expected to Drive the Growth of the Market During the Forecast Period

Figure 12 Monitoring and Logging Solution, and North American Region are Estimated to Have the Largest Market Shares in 2018

Figure 13 Solutions Segment is Estimated to Have the Larger Market Share in 2018

Figure 14 Training, Consulting, and Integration Segment is Estimated to Have the Largest Market Share in 2018

Figure 15 Public Cloud Deployment Model is Estimated to Have the Largest Share in 2018

Figure 16 Banking, Financial Services, and Insurance Vertical is Estimated to Have the Largest Share in 2018

Figure 17 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 18 Cloud Workload Protection Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Solutions Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 20 Monitoring and Logging Solution is Expected to Have the Largest Market Size in 2018

Figure 21 Training, Consulting, and Integration Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Public Cloud Deployment Model is Expected to Hold the Largest Market Size During the Forecast Period

Figure 23 Large Enterprises Segment is Expected to Hold the Larger Market Size During the Forecast Period

Figure 24 IT and Telecommunications Vertical is Projected to Have the Largest Market Size By 2023

Figure 25 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 26 North America: Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Key Developments By the Leading Players in the Cloud Workload Protection Market During 20142017

Figure 29 Sophos: Company Snapshot

Figure 30 Symantec: Company Snapshot

Figure 31 Trend Micro: Company Snapshot

Growth opportunities and latent adjacency in Cloud Workload Protection Market