North Africa Cloud Managed Services Market by Service Types (Business Services, Network Services, Security Services, Data Center Services, Mobility Services) - Global Forecast to 2015 - 2020

[132 Pages Report] The global North Africa Cloud Managed Services Market size was USD 1,353.4 Million in 2015 and is projected to reach USD 3,248.8 Million by 2020, growing at a Compound Annual Growth Rate (CAGR) of 19.1% during the forecast period.

Managed services mean that a company hands over a part or the entire management of its network infrastructure, applications, and security to networking experts. These experts might include service providers, systems integrators, or value-adding resellers. Organizations are focused on driving down operational costs, strengthening customer relationships, and improving financial management. Managed services and cloud services are a great combination of solutions for companies that want to concentrate on their core competencies and assign the technical growth and management to the technicians. Staffing levels can usually be reduced because there is no longer a need to have in-house teams responsible for IT or other auxiliary business processes. Once a company experiences the cost comparison, it may decide to purchase its applications, application platforms, computing needs, and storage as a service in a pay-per-use model. This is a cloud managed service in its true sense, which offers full benefits of the cloud to the business. As defined by the National Institute of Standards and Technologies (NIST), a cloud managed service is a pay-per-use model for enabling available, convenient, on-demand network access to a shared pool of configurable computing resources; for example, networks, servers, storage, applications, and services that can be rapidly provisioned and released with minimal management efforts or service provider interactions. Thus, the recent technology timelines have shown an increasing number of companies turning to as-a-service offers to manage their businesses.

The ICT spending in North Africa is on the rise and this could be attributed to the large-scale government, telecommunications, and banking infrastructure projects coming up in the countries of the region. Cloud managed services are being readily adopted in the region by organizations to reduce the rising costs and to standardize the business processes across the organization. Thus, the increase in digitization and mobility among the companies has led to the increased efforts by cloud managed services vendors to boost their revenues.

The North Africa cloud managed services market report analyzes the adoption trends, future growth potential, key drivers, restraints, opportunities, challenges, and best practices in the market. The report also examines growth potential, market sizes, and revenue forecasts across different countries. The major players profiled in the North Africa cloud managed services report include Cisco, Ericsson, IBM, NEC Corp., Huawei, Accenture, Alcatel Lucent, Fujitsu, HP, and Dimension Data.

Scope of the report:

North Africa cloud managed services market is a broad study of the regional market and forecasts the market sizes and trends in the following subsegments.

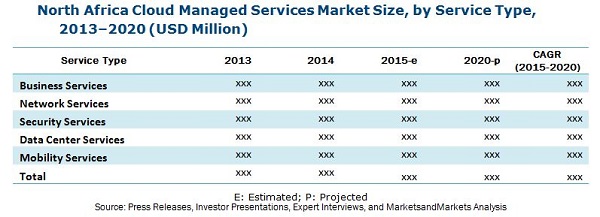

Cloud Managed Services market size by service type:

- Business Services

- Network Services

- Security Services

- Data Center Services

- Mobility Services

Cloud Managed Services market size by cloud deployment:

- Private Cloud

- Public Cloud

Cloud Managed Services market size by end user:

- SMB

- Enterprise

Cloud Managed Services market size by vertical:

- BFSI

- Telecom & IT

- Government & Public Services

- Energy & Utilities

- Retail

- Manufacturing

- Healthcare

- Others

Cloud Managed Services market size by country:

- Morocco

- Algeria

- Tunisia

- Rest of North Africa

Top corporate imperatives for executives are focused on driving down operational costs, strengthening customer relationships, and improving financial management. This is where organizations need to allow third-party service providers to perform routine business services for the organization. Managed services mean that a company hands over a part or all of the management of its network infrastructure, applications, and security to experts such as service providers, systems integrators, or value-adding resellers. Managed services and cloud services are a great combination of solutions for companies that want to concentrate on their core competency and leave the technical growth and management to the technicians.

The ICT spending in North Africa is on the rise and this could be attributed to the large-scale government, telecommunications, and banking infrastructure projects coming up in the countries of the region. The primary factors stipulating the growth in the cloud managed services market in North Africa are the increase in operational efficiency, reduced Capital Expenditure (CAPEX), secure environment, and the increasing adoption of Bring Your Own Device (BYOD). Thus, the increase in digitization and mobility among the companies has led to the increased efforts by cloud managed services vendors to boost their revenues.

The report includes an in-depth study of the market trends, market sizing, competitive mapping, and market dynamics of the market. The industry trends, drivers, and opportunities in the North Africa cloud managed services market distinctly indicate a noteworthy growth during the forecast period. It also provides premium insights that can help the solution vendors and system integrators identify the needs for managed services coupled with cloud technologies in the market.

The North Africa cloud managed services is segmented by countries into Morocco, Algeria, Tunisia and Rest of North Africa which includes Egypt & Libya. Morocco has the highest adoption rate in the market, while Algeria, Tunisia & Egypt offer a lot of opportunities for the vendors as these countries are yet to expansively adopt cloud managed services. Some of the major players in this market include Cisco, Ericsson, IBM, NEC Corp., Huawei, Accenture, Alcatel Lucent, Fujitsu, HP, and Dimension Data.

The table below highlights the North Africa cloud managed services market which is expected to grow from USD 1,353.4 Million in 2015 to 3,248.8 Million by 2020, at a CAGR of 19.1% during the forecast period of 20152020.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 North Africa Cloud Managed Services: By End-User

4.3 North Africa Cloud Managed Services Market

4.4 Lifecycle Analysis, 2015

5 North Africa Cloud Managed Services Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Service Type

5.3.2 By Deployment Type

5.3.3 By End-User

5.3.4 By Vertical

5.3.5 By Country

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increased ICT Spending and Growing Trends in Big Data and Analytics

5.4.1.2 Rising Adoption of Managed Services in the SMB Segment

5.4.1.3 Technological Imports and Proximity to the European Market

5.4.2 Restraints

5.4.2.1 Concerns Over Privacy and Security

5.4.2.2 Network Bandwidth Incapability and Soaring Internet Prices

5.4.3 Opportunities

5.4.3.1 Increased Need of Managed Services in North African Industrial Verticals

5.4.4 Challenges

5.4.4.1 Low Availability of ICT Skills

6 North Africa Cloud Managed Services Market : Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.4 Demand Overview

6.5 Porters Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Managed Services Concepts, Best Practises & Certifications

6.6.1 Introduction

6.6.2 Managed Services Concepts

6.6.2.1 Managed Service Provider (MSP)

6.6.2.2 Customer Premises Equipment (CPE)

6.6.3 Best Practises and Certifications

6.6.3.1 Information Technology Infrastructure Library (ITIL)

6.6.3.2 IT Service Management (ITSM)

6.6.3.3 IBM Tivoli Unified Process (ITUP)

6.6.3.4 Microsoft Operations Framework (MOF)

6.6.3.5 Enhanced Telecom Operations Map (ETOM)

6.6.3.6 Federal Information Processing Standards (FIPS)

6.6.3.7 Unified Certification Standard (UCS)

7 North Africa Cloud Managed Services Market Analysis, By Service Type (Page No. - 48)

7.1 Introduction

7.2 Managed Business Services

7.3 Managed Network Services

7.4 Managed Security Services

7.5 Managed Data Center Services

7.6 Managed Mobility Services

8 North Africa Cloud Managed Services Market Analysis, By Deployment Type (Page No. - 55)

8.1 Introduction

8.2 Private Cloud

8.3 Public Cloud

9 Market Analysis, By End-User (Page No. - 59)

9.1 Introduction

9.2 Small and Medium Businesses

9.3 Enterprises

10 Market Analysis, By Vertical (Page No. - 63)

10.1 Introduction

10.2 Banking, Financial Services and Insurance (BFSI)

10.3 Telecom and IT

10.4 Government and Public Sector

10.5 Energy and Utilities

10.6 Retail

10.7 Manufacturing

10.8 Healthcare

10.9 Others

11 North Africa Cloud Managed Services Market Analysis, By Country (Page No. - 79)

11.1 Introduction

11.2 Morocco

11.3 Algeria

11.4 Tunisia

11.5 Rest of North Africa

12 Competitive Landscape (Page No. - 88)

12.1 Overview

12.2 Supplier Overview

12.3 Competitive Situation and Trends

12.3.1 Mergers and Acquisitions

12.3.2 Agreements, Partnerships, and Collaborations

12.3.3 New Product/Service Developments

12.3.4 Research and Expansion

13 Company Profiles (Page No. - 95)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 Cisco Systems

13.3 Ericsson

13.4 IBM Corporation

13.5 NEC Corporation

13.6 Huawei Technologies

13.7 Accenture PLC

13.8 Alcatel-Lucent

13.9 Fujitsu

13.10 Hewlett-Packard Company

13.11 Dimension Data

14 Key Innovators (Page No. - 120)

14.1 Issal

14.2 Netissime Algeria

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 123)

15.1 Key Industry Insights

15.2 Discussion Guide

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (73 Tables)

Table 1 Assumptions of the Research Study

Table 2 Limitations of the Research Study

Table 3 Market: Analysis of Drivers

Table 4 Market: Analysis of Restraints

Table 5 Market: Analysis of Opportunities

Table 6 Market: Analysis of Challenges

Table 7 North Africa Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 8 Managed Business Services: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 9 Managed Business Services: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 10 Managed Network Services: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 11 Managed Network Services: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 12 Managed Security Services: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 13 Managed Security Services: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 14 Managed Data Center Services: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 15 Managed Data Center Services: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 16 Managed Mobility Services: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 17 Managed Mobility Services: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 18 North Africa Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 19 Private Cloud: Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 20 Public Cloud: Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 21 Market Size, By End-User, 20132020 (USD Million)

Table 22 SMB: Cloud Managed Services Market Size, By Vertical, 20132020 (USD Million)

Table 23 Enterprise: Cloud Managed Services Market Size, By Vertical, 20132020 (USD Million)

Table 24 North Africa Cloud Managed Services Market Size, By Vertical, 20132020 (USD Million)

Table 25 BFSI: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 26 BFSI: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 27 BFSI: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 28 BFSI: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 29 Telecom and IT: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 30 Telecom and IT: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 31 Telecom and IT: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 32 Telecom and IT: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 33 Government and Public Sector: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 34 Government and Public Sector: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 35 Government and Public Sector: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 36 Government and Public Sector: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 37 Energy and Utilities: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 38 Energy and Utilities: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 39 Energy and Utilities: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 40 Energy and Utilities: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 41 Retail: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 42 Retail: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 43 Retail: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 44 Retail: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 45 Manufacturing: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 46 Manufacturing: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 47 Manufacturing: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 48 Manufacturing: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 49 Healthcare: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 50 Healthcare: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 51 Healthcare: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 52 Healthcare: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 53 Others: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 54 Others: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 55 Others: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 56 Others: Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 57 North Africa Cloud Managed Services Market Size, By Country, 20132020 (USD Million)

Table 58 Morocco: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 59 Morocco: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 60 Morocco: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 61 Algeria: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 62 Algeria: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 63 Algeria: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 64 Tunisia: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 65 Tunisia: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 66 Tunisia: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 67 Rest of North Africa: Cloud Managed Services Market Size, By Service Type, 20132020 (USD Million)

Table 68 Rest of North Africa: Cloud Managed Services Market Size, By Deployment Type, 20132020 (USD Million)

Table 69 Rest of North Africa: Cloud Managed Services Market Size, By End-User, 20132020 (USD Million)

Table 70 Mergers and Acquisitions, 20132015

Table 71 Agreements, Partnerships, and Collaborations, 20132015

Table 72 New Product Developments, 20132015

Table 73 Research and Expansion, 20132015

List of Figures (47 Figures)

Figure 1 North Africa Cloud Managed Services Market

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 North Africa Cloud Managed Services Market is Expected to Grow Rapidly in the Near Future

Figure 7 Mobility Services are Expected to Gain Major Traction Due to Mobilizing Organizations

Figure 8 Market Snapshot (2015 vs 2020): Business Services Expected to Hold the Largest Market Share

Figure 9 Rising Foreign Businesses in North Africa Would Bring Attractive Market Opportunities

Figure 10 SMB Segment to Grow at the Highest Rate During the Forecast Period

Figure 11 BFSI is Estimated to Gain the Largest Market Share in 2015 Among Industry Verticals

Figure 12 The Morocco Cloud Managed Services Market is Expected to Be in the High Growth Phase in 2015

Figure 13 Cloud Managed Services Market Evolution

Figure 14 Market Segmentation: By Service Type

Figure 15 Market Segmentation: By Deployment Type

Figure 16 Market Segmentation: By End-User

Figure 17 Market Segmentation: By Vertical

Figure 18 Market Segmentation: By Country

Figure 19 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Cloud Managed Services Market: Value Chain Analysis

Figure 21 IBM Adopted All-Round Strategies for Cloud Managed Services

Figure 22 North Africa Cloud Managed Services: Porters Five Forces Analysis

Figure 23 Managed Security Services Gaining Traction Due to Increase in Cyber Threats

Figure 24 Public Cloud Adoption to Be Larger Due to Low Cost Factors Among End-Users

Figure 25 SMBS in North Africa Will Show Tremendous Increase in Adoption of Cloud Managed Services

Figure 26 Banking, Financial Services and Insurance Set to Dominate in the North Africa Cloud Managed Services Market

Figure 27 Increased ICT Spending Set to Be the Major Driver for the Market

Figure 28 Morocco Expected to Be Maturing Market Amongst the North African Countries

Figure 29 Companies Adopted Mergers and Acquisition as the Key Growth Strategy During the Period 20132015

Figure 30 IBM and Cisco Considered as Forerunners in Providing Comprehensive Cloud Managed Services

Figure 31 Market Evaluation Framework

Figure 32 Battle for Market Share: Mergers and Acquisitions Have Been the Key Strategy for Company Growth

Figure 33 Geographic Revenue Mix of 5 Market Players

Figure 34 Cisco Systems: Company Snapshot

Figure 35 Cisco Systems: SWOT Analysis

Figure 36 Ericsson: Company Snapshot

Figure 37 Ericsson: SWOT Analysis

Figure 38 IBM Corporation: Company Snapshot

Figure 39 IBM Corporation: SWOT Analysis

Figure 40 NEC Corporation: Company Snapshot

Figure 41 NEC Corporation: SWOT Analysis

Figure 42 Huawei Technologies: Company Snapshot

Figure 43 Huawei Technologies: SWOT Analysis

Figure 44 Accenture PLC: Company Snapshot

Figure 45 Alcatel-Lucent: Company Snapshot

Figure 46 Fujitsu: Company Snapshot

Figure 47 Hewlett-Packard: Company Snapshot

Growth opportunities and latent adjacency in North Africa Cloud Managed Services Market