Marketing Cloud Platform Market by Component (Platforms and Services), Deployment Mode (Public Cloud and Private Cloud), Marketing Functions, Organization Size, Vertical and Region - Global Forecast to 2027

Marketing Cloud Platform Market Size & Industry Growth

The marketing cloud platform market size is projected to grow at a CAGR of 8.7 % during the forecast period to reach USD 17.8 billion by 2027 from an estimated USD 11.7 billion in 2022. A marketing cloud platform is referred to as a technology a business uses to manage client contacts and record important data created during customers engagement. To help marketers reach out to customers for the proper causes and via the appropriate channels, information such as the customer's name, email, phone number, communication preferences, as well as interaction and purchase history, can be made available.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

In all marketplaces, the client is the primary focus for businesses. As a result, the businesses will benefit from the relationships marketers have developed over time with their clients during the COVID-19 pandemic. Organizations may evaluate customer interactions throughout the lifecycle of a product or consumer because of the marketing cloud platform. Due to the limitations placed on interactions with both current and potential customers, the COVID-19 has had a significant influence on the company's competitiveness. The pandemic has forced businesses to rely more heavily on marketing cloud platforms to reimagine corporate procedures, client connections, and marketing plans.

Marketing Cloud Platform Market Dynamics

Driver: Increased customer data platform to improve experience across marketing

Customer data platform (CDP) enables markers to deliver consistent user experiences across websites, social media, email, advertising, mobile, and offline channels. Marketers can keep customers interested and moving forward in their journeys by providing a unified, personalized omnichannel experience. A platform with extensibility can expand and evolve to meet the needs of the market without needing to be totally rebuilt. To adapt to shifting demands across many platforms, a flexible platform makes it simple to integrate new services and products. Additionally, it makes upgrades and bug fixes simpler, which improves client retention and satisfaction. A mobile-first strategy is predicated on having a mobile app, a responsive interface, and mobile marketing initiatives. Companies must put the customer experience and customer engagement at the center of their strategies if they want to properly take use of a mobile phone's capabilities. Hand-held devices provide marketing automation engines with significantly more signals for a more tailored experience. The mobile environment is persistent and always on. Users always have their hand-held devices with them, which enables marketers to stay in touch with customers. Social media platforms are used by people to maintain relationships with their friends, families, and communities. More than 51% of marketers cited increased sales as a benefit of spending time cultivating relationships with customers. The more favorable an impression company provide a visitor, the more probable it is that they will consider their company the next time they require company's goods or services.

Restraint: Increase of Vendors lock-in

Customers that bind themselves to a single service provider make it nearly impossible to switch, which is known as vendor lock-in. As a result, the client depends more on the service provider. A problem with marketing cloud platform is lock-in. This dependence develops as a result of the work required to transfer providers, which may make it an undesirable choice or seem unattainable. Vendor lock-in occurs when a single vendor controls the technology, effectively tying the consumer to that company. Single vendor lock-in has many advantages, including decreased complexity, a single data source, a consistent user experience, a single point of contact, and increased effectiveness. However, excessive reliance on a single vendor raises subscription costs and places restrictions on the usage of third-party plugins and tools. Vendors place a strong focus on using their own internal tools, which could not produce the same outcome as cheaper third-party solutions

Opportunity: Digital Engagement through Virtual Reality (VR) and Augmented Reality

Virtual Reality (VR) and Augmented Reality (AR) have been highly adopted in the gaming industry, and nowadays these cutting-edge technologies are being implemented in digital marketing to boost up the business. Industry verticals, such as media, entertainment, and gaming; retail; and education, are strategically investing and integrating VR and AR technologies to deliver improved customer experiences. VR refers to complete digital world, whereas AR is a combination of the real and digital world, superimposing digitally generated layer to the existing environment. Campaigns created using AR and VR technologies give a better feel of products and services to the audience, thereby creating a long-lasting effect. The goal of personalized marketing is to provide a better user experience (UX) by presenting pertinent material or focusing critical messages at the right points in the funnel based on company customers' e-commerce actions and behavior. Retailers can use personalized marketing to cultivate customer relationships during the customer experience (CX), which increase sales through digital marketing, and nurture leads. Personalization is something that customers demand, not simply want. It's important to get it right since customer and product loyalty is becoming increasingly elusive.

Challenge: Complying with privacy and data-sharing regulations

Customer expectations are any group of behaviors or actions that people anticipate while interacting with a company, even if data privacy laws change. Customers have traditionally anticipated the fundamentals, such as good service and reasonable prices, but modern consumers have considerably greater expectations, such as proactive service, individualized encounters, and integrated digital experiences. Any group of behaviors or activities that people anticipate while interacting with a corporation are referred to as customer expectations, which are altering because of data privacy. Customers have traditionally anticipated the bare minimum in terms of good service and reasonable prices, but current consumers have considerably greater expectations in terms of proactive service, personalized interactions, and integrated experiences across digital channels. It is the responsibility of advertisers to ensure that their first-party data and the sources of their inventory are compliant with privacy and data-sharing laws. Compliance demands a high level of cooperation and communication throughout the ecosystem by its very nature.

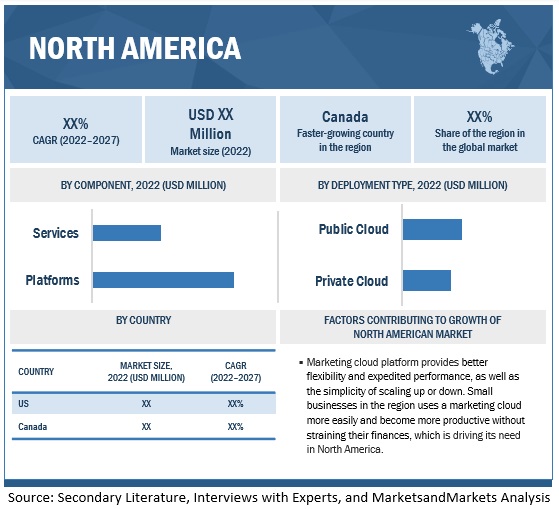

North America to account for the largest market size during the forecast period

The geographic analysis of the marketing cloud platform market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2022, North America has captured most of the share, as the US and Canada are rapidly adopting marketing cloud platform. North America has the presence of top vendors, including Adobe, Salesforce, Oracle, Pegasystems, and HubSpot. The region is experiencing significant innovations in technologies.

To know about the assumptions considered for the study, download the pdf brochure

As per organization size, large enterprises segment to hold the largest market size during the forecast period

The marketing cloud platform market organization size segment is sub segmented into SMEs and large enterprises. As per organization size, large enterprises segment to hold largest market size during the forecast period. Large Enterprises are having the financial means to make investments in international marketplaces. As a result, companies are free to create subsidiaries abroad and increase their market share without depending on the domestic market to fuel their growth possibilities. Many companies are big and well-known enough to have a solid reputation for their brands and a strong brand image owing to marketing cloud platform. Since customers are more inclined to stick with a company and its products due to the perception of respect & value for money, and better branding boosts customer loyalty.

Key Market Players

Some of the major marketing cloud platform market vendors are Adobe (US), Salesforce (US), Oracle (US), Pegasystems (US), HubSpot (US), SAP (Germany), SAS (US), Redpoint Global (US), Cheetah Digital (US), and Acoustic (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 11.7 billion |

|

Revenue forecast for 2027 |

USD 17.8 billion |

|

Growth Rate |

8.7% CAGR |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

Components, Marketing Functions, Organization Sizes, Deployment Modes, Verticals, and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Adobe (US), Salesforce (US), Oracle (US), Pegasystems (US), HubSpot (US), SAP (Germany), SAS (US), Redpoint Global (US), Cheetah Digital (US), Acoustic (US), Braze (US), Acquia (US), Cision (US), Insider (US), Sitecore (US), Resulticks (US), Fico (US), Selligent (Belgium), Zeta Global (US), Algonomy (US). Platformly (British Virgin Islands), Mapp (US), ConvertLab (China), SocialPilot (US), OneSignal (US), Bluecore (US), CleverTap (US), Optimove (US), MoEngage (US), and Iterable (US) |

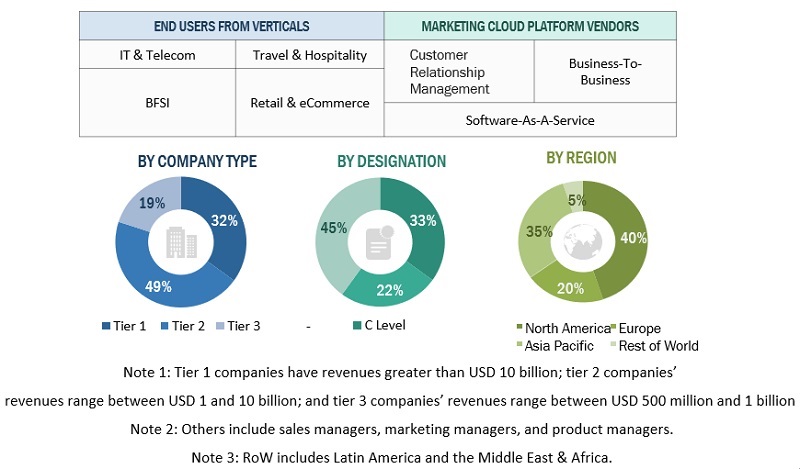

This research report categorizes the Marketing Cloud Platform Market based on components, organization sizes, marketing functions, deployment modes, verticals, and regions.

By Component:

-

Platforms

- Customer Relationship Management

- Software-as-a-Service

- Business-to-Business

-

Services

- Managed Services

- Professional Services

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Mode:

- Public Cloud

- Private Cloud

By Marketing Function:

- Advertising

- Designing

- Sales Channel

- Branding

- Communications

- Customer Support

By Vertical:

- Retail & eCommerce

- Banking, Financial Services, & Insurance (BFSI)

- IT & Telecom

- Education

- Travel & Hospitality

- Media, Entertainment, & Gaming

- Healthcare & Life Sciences

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2022, To better understand regional needs and create value in each area, the 2022 HubSpot Partner Advisory Council (HPAC) will be organized into five groups: North America, Latin America, EMEA, Australia and New Zealand, and Southeast and South Asia. Each regional PAC group will add a unique viewpoint to HubSpot's Solutions Partner Program and give the business invaluable advice as the program develops.

- In June 2022, Global CRM giant Salesforce has revealed that UK big four retailer Asda is starting a top-tier retail IT transformation project. Asda will use Salesforce technology to deliver a 360-degree perspective of its customers, giving customized and individualized experiences that will transform the grocery shopping experience for consumers.

- In April 2022, The largest provider of IT infrastructure services in the world, Kyndryl, recently announced an expanded strategic partnership with SAP aimed at creating innovative solutions to assist clients in overcoming their most difficult digital business transformation issues. In order to speed and facilitate a customer-friendly journey to the cloud, the expanded cooperation will make use of Kyndryl's strong expertise in artificial intelligence (AI), data, and cyber resiliency services as well as SAP's Business Technology Platform (SAP BTP).

- In February 2021, Fusion Marketing, the first fully automated solution for lead generation and qualification, is announced by Oracle. Fusion Marketing gives advertisers the ability to automatically generate and qualify leads from campaigns that transcend conventional marketing and advertising channels.

- In May 2022, Pegasystems and Google Cloud have partnered strategically to help joint clients accelerate their digital transformations using Google Cloud's highly scalable cloud services and Pega's low-code enterprise applications. Pega will make Pega Cloud apps on Google Cloud available as a fully hosted and managed as-a-service offering as part of the agreement. Pega and Google Cloud will also work together to solve new use cases that are industry-specific, engage in cooperative go-to-market initiatives, and introduce Pega Infinity applications to the Google Cloud Marketplace.

Frequently Asked Questions (FAQ):

What is marketing cloud platform?

According to Acquia, A marketing cloud platform is a collection of marketing technologies that can be accessed online by marketers rather than ones that are set up on-premise. In order to maximize marketing efforts, a marketing cloud platform will often include tools for managing campaigns, creating content, automating tasks, interacting with customers on social media, and managing analytics and reports.

According to Acoustic, The Marketing Cloud is an easy-to-use platform that gives marketers access to a wealth of information about their customers' behavior, both at scale and on a more individualized level, so marketers can use that information to develop campaigns that connect with target audiences, grow a loyal following, and increase sales.

Which regions are early adopter of marketing cloud platform?

North America and Europe are at the initial stage towards adoption of Marketing Cloud Platform.

Which are key verticals adopting remote workplace services?

Key verticals adopting marketing cloud platform include: -

- Retail & Consumer Goods

- Banking, Financial Services, & Insurance

- IT & Telecom

- Education

- Travel & Hospitality

- Media & Entertainment

- Healthcare & Life Sciences

- Other Verticals

Which are the key vendors exploring marketing cloud platform?

The key vendors exploring marketing cloud platform includes Adobe (US), Salesforce (US), Oracle (US), Pegasystems (US), HubSpot (US), SAP (Germany), SAS (US), Redpoint Global (US), Cheetah Digital (US), Acoustic (US), Braze (US), Acquia (US), Cision (US), Insider (US), Sitecore (US), Resulticks (US), Fico (US), Selligent (Belgium), Zeta Global (US), Algonomy (US), and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 1 MARKETING CLOUD PLATFORM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

TABLE 2 PRIMARY CONTACTED: MARKET

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 MARKETING CLOUD PLATFORM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING MARKETING CLOUD PLATFORM SOLUTIONS AND SERVICES

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM VERTICALS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF MARKETING CLOUD PLATFORM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): CAGR PROJECTIONS FROM SUPPLY-SIDE

2.4 RESEARCH ASSUMPTIONS

TABLE 3 ASSUMPTIONS FOR STUDY

2.5 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 7 MARKETING CLOUD PLATFORM MARKET SNAPSHOT, 2020–2027

FIGURE 8 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

FIGURE 9 PLATFORMS TO HOLD LARGER MARKET SHARE THAN SERVICES DURING FORECAST PERIOD

FIGURE 10 LARGE ENTERPRISES TO BE LARGER MARKET DURING FORECAST PERIOD

FIGURE 11 PUBLIC CLOUD TO BE LARGER THAN PRIVATE CLOUD DURING FORECAST PERIOD

FIGURE 12 TOP VERTICALS IN MARKET, 2022–2027 (USD MILLION)

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR KEY PLAYERS IN MARKETING CLOUD PLATFORM MARKET

FIGURE 14 GROWING ADOPTION OF CONTENT MARKETING SOFTWARE FOR PERSONALIZED MARKETING AND CUSTOMER ENGAGEMENT TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT (2022 VS. 2027)

FIGURE 15 PLATFORMS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE (2022 VS. 2027)

FIGURE 16 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE (2022 VS. 2027)

FIGURE 17 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL (2021 VS. 2027)

FIGURE 18 TELECOMMUNICATIONS TO CAPTURE HIGHER MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increase in customer data management platforms to improve experiences across marketing

5.2.1.2 Rise of hand-held devices to increase mobile marketing cloud platforms

FIGURE 21 MOBILE DEVICE USERS: 2020–2025

5.2.1.3 Social media platforms to allow higher conversion rates

FIGURE 22 SOCIAL MEDIA USERS: JULY 2022

5.2.2 RESTRAINTS

5.2.2.1 Increase in vendor lock-ins

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in personalized marketing for better user experience (UX)

5.2.3.2 Digital engagement through virtual reality (VR) and augmented reality (AR)

5.2.4 CHALLENGES

5.2.4.1 Compliance with privacy and data-sharing regulations

5.3 CASE STUDY ANALYSIS

5.3.1 ACHIEVING VISIBILITY GOALS FOR PLADIS WITH CISION COMMS CLOUD AND CISION INSIGHTS

5.3.2 LULULEMON USED ACQUIA TO COMBINE AND PROCESS INFORMATION FROM ALL ITS CLIENT TOUCHPOINTS

5.3.3 JBC REAPS BENEFITS FROM SELLIGENT AI-POWERED MARKETING AND AUTOMATED LIFECYCLE CAMPAIGNS

5.4 PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS PUBLISHED, 2011–2021

FIGURE 24 TOP TEN PATENT APPLICANTS (GLOBAL) IN 2021

TABLE 4 TOP PATENT OWNERS

5.5 ECOSYSTEM ANALYSIS

FIGURE 25 ECOSYSTEM: MARKETING CLOUD PLATFORM MARKET

TABLE 5 MARKETING CLOUD PLATFORM: ECOSYSTEM

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 26 SUPPLY CHAIN: MARKET

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY SOLUTION

TABLE 6 MARKET: PRICING LEVELS

5.7.2 AVERAGE SELLING PRICE TRENDS

TABLE 7 MARKET: AVERAGE PRICING LEVELS (USD)

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS: MARKET

TABLE 8 PORTER’S FIVE FORCES ANALYSIS: MARKETING CLOUD PLATFORM MARKET

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE

5.9.2 CYBERSECURITY

5.9.3 BLOCKCHAIN

5.9.4 DATA ANALYTICS

5.9.5 MACHINE LEARNING

5.9.6 BIG DATA

5.10 REGULATORY ANALYSIS

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.10.3 GENERAL DATA PROTECTION REGULATION

5.10.4 SEC RULE 17A-4

5.10.5 ISO/IEC 27001

5.10.6 SYSTEM AND ORGANIZATION CONTROLS 2 (SOC 2) TYPE II COMPLIANCE

5.10.7 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.10.8 FREEDOM OF INFORMATION ACT

5.10.9 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT PLAY

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP VERTICALS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP VERTICALS

5.11.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 14 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 30 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 MARKETING CLOUD PLATFORM MARKET, BY COMPONENT (Page No. - 92)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

FIGURE 31 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 16 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 PLATFORMS

TABLE 17 PLATFORMS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 PLATFORMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 CUSTOMER RELATIONSHIP MANAGEMENT (CRM) MARKETING CLOUD PLATFORMS

6.2.1.1 CRM offers real-time visibility into customer behavior for next best action

6.2.2 SOFTWARE-AS-A-SERVICE (SAAS) MARKETING CLOUD PLATFORMS

6.2.2.1 SaaS platforms enable cost-cutting by providing pay-as-you-go models

6.2.3 BUSINESS-TO-BUSINESS (B2B) MARKETING CLOUD PLATFORMS

6.2.3.1 B2B marketing cloud platforms help create targeted and cross-channel marketing campaigns

6.3 SERVICES

FIGURE 32 MANAGED SERVICES TO GROW AT HIGHER CAGR THAN PROFESSIONAL SERVICES DURING FORECAST PERIOD

TABLE 19 MARKETING CLOUD PLATFORM MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 20 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 21 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 MANAGED SERVICES

6.3.1.1 Managed services deliver round-the-clock technical support

TABLE 23 MANAGED SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

FIGURE 33 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 25 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 28 MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

6.3.2.1 Consulting

6.3.2.1.1 Need to decrease complexity and risks for better ROI

TABLE 29 CONSULTING: MARKETING CLOUD PLATFORM MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2.2 Integration and implementation services

6.3.2.2.1 Need for compliance with standards and policies to fuel system integration and deployment market

TABLE 31 INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2.3 Training, support, and maintenance

6.3.2.3.1 Training, support, and maintenance services enable hassle-free implementation of marketing cloud platforms

TABLE 33 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 34 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE (Page No. - 105)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET

FIGURE 34 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 35 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 36 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

7.2.1 SMES IMPLEMENTING MARKETING CLOUD PLATFORMS TO STREAMLINE AND AUTOMATE CONSUMER OUTREACH AND COMMUNICATIONS

TABLE 37 SMES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 SMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LARGE ENTERPRISES

7.3.1 FUNCTIONAL PRODUCTIVITY GAINS TO GENERATE DEMAND FOR MARKETING CLOUD PLATFORMS

TABLE 39 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MARKETING CLOUD PLATFORM MARKET, BY DEPLOYMENT MODE (Page No. - 110)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 35 PRIVATE CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 41 MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 42 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 PRIVATE CLOUD

8.2.1 NEED TO SECURE CUSTOMER DATA FROM MALWARE DRIVING DEMAND FOR PRIVATE CLOUD

TABLE 43 PRIVATE CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 PRIVATE CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PUBLIC CLOUD

8.3.1 PUBLIC CLOUD MAY BE OFFERED FREE OF COST, DRIVING ITS ADOPTION

TABLE 45 PUBLIC CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 PUBLIC CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MARKETING CLOUD PLATFORM MARKET, BY MARKETING FUNCTION (Page No. - 115)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: MARKET DRIVERS

FIGURE 36 SALES CHANNELS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 47 MARKET, BY MARKETING FUNCTION, 2017–2021 (USD MILLION)

TABLE 48 MARKET, BY MARKETING FUNCTION, 2022–2027 (USD MILLION)

9.2 ADVERTISING

9.2.1 HELPS RE-ENGAGE INACTIVE USERS AND ACQUIRE AUDIENCES FROM PRECISELY DEFINED CUSTOMER SEGMENTS

TABLE 49 ADVERTISING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 ADVERTISING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 BRANDING

9.3.1 HELPS DEVELOP BRAND IDENTITY USING MARKETING CLOUD PLATFORMS

TABLE 51 BRANDING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 BRANDING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 DESIGNING

9.4.1 FOCUS ON DESIGNING HELPS BUILD GREAT USER EXPERIENCE

TABLE 53 DESIGNING: MARKETING CLOUD PLATFORM MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 DESIGNING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 SALES CHANNELS

9.5.1 NEED TO ALIGN SALES CHANNELS IN AN OMNICHANNEL WORLD

TABLE 55 SALES CHANNELS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 SALES CHANNELS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 COMMUNICATIONS

9.6.1 COMMUNICATIONS HELP TRACK COMPONENTS THAT MAKE A SUCCESSFUL MARKETING CAMPAIGN

TABLE 57 COMMUNICATIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 COMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 CUSTOMER SUPPORT

9.7.1 MAINTAINING POSITIVE CLIENT EXPERIENCE INCREASES REVENUE STABILITY

TABLE 59 CUSTOMER SUPPORT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 CUSTOMER SUPPORT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MARKETING CLOUD PLATFORM MARKET, BY VERTICAL (Page No. - 124)

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

FIGURE 37 MEDIA, ENTERTAINMENT, AND GAMING VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 61 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 62 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 RETAIL AND ECOMMERCE

10.2.1 BUILDING CUSTOMER LOYALTY PROGRAMS CREATE DEMAND FOR MARKETING CLOUD PLATFORMS

TABLE 63 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 64 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 TRAVEL AND HOSPITALITY

10.3.1 ENHANCED MOBILE MARKETING STRATEGIES TO PROPEL GROWTH OF MARKETING CLOUD PLATFORMS

TABLE 65 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 TRAVEL AND HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.4.1 BFSI IMPROVED CUSTOMER EXPERIENCE BY OFFERING ANYTIME, ANYWHERE ACCESS TO BANKING SERVICES

TABLE 67 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKETING CLOUD PLATFORM MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 IT AND TELECOM

10.5.1 MARKETING CLOUD PLATFORMS HELP CUSTOMERS USE BETTER ANALYTICS AND ENHANCE MARKETING STRATEGY

TABLE 69 IT AND TELECOM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 IT AND TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 MEDIA, ENTERTAINMENT, AND GAMING

10.6.1 MARKETING CLOUD PLATFORMS SEND PERSONALIZED CONTENT TO ATTRACT PROSPECTS AND ENGAGE LARGER AUDIENCES

TABLE 71 MEDIA, ENTERTAINMENT, AND GAMING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 72 MEDIA, ENTERTAINMENT, AND GAMING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 HEALTHCARE AND LIFE SCIENCES

10.7.1 USES MARKETING CLOUD INTERACTION PLATFORM TO TRACK PATIENTS' VISITS TO THEIR WEBSITES

TABLE 73 HEALTHCARE AND LIFE SCIENCES: MARKETING CLOUD PLATFORM MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 74 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 EDUCATION

10.8.1 INCREASED UTILIZATION OF MARKETING CLOUD PLATFORMS FOR LONG-LASTING RELATIONSHIPS

TABLE 75 EDUCATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 76 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 OTHER VERTICALS

TABLE 77 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 78 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 MARKETING CLOUD PLATFORM MARKET, BY REGION (Page No. - 137)

11.1 INTRODUCTION

FIGURE 38 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: MARKETING CLOUD PLATFORM MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY MARKETING FUNCTION, 2017–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY MARKETING FUNCTION, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Huge investments in personalized marketing to increase demand for marketing cloud platforms

TABLE 95 US: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 96 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 97 US: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 98 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Rapid technological advancements in retail and consumer goods and media and entertainment industry to drive market

TABLE 99 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 100 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 101 CANADA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 102 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARKETING CLOUD PLATFORM MARKET DRIVERS

TABLE 103 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY MARKETING FUNCTION, 2017–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY MARKETING FUNCTION, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Better brand loyalty and complete omnichannel view of customers to propel market growth

TABLE 119 UK: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 120 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 121 UK: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 122 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Rising investments in advanced technologies for robust marketing campaigns

TABLE 123 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 124 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 125 GERMANY: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 126 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Cloud-based services from large IT corporations to offer numerous opportunities for expansion

TABLE 127 FRANCE: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 128 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 130 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 131 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 132 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 134 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 135 ASIA PACIFIC: MARKETING CLOUD PLATFORM MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY MARKETING FUNCTION, 2017–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY MARKETING FUNCTION, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Increasing awareness about promotional strategies, internet penetration, and hand-held devices to boost market

TABLE 151 CHINA: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 152 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 153 CHINA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 154 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Continuous upgrading of company’s IT infrastructure and applications helps drive market

TABLE 155 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 156 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 158 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Presence of large number of SMEs and attractive kick-start packages to drive adoption of marketing cloud platforms

TABLE 159 INDIA: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 160 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 161 INDIA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 162 INDIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: MARKETING CLOUD PLATFORM MARKET DRIVERS

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY MARKETING FUNCTION, 2017–2021 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY MARKETING FUNCTION, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 KINGDOM OF SAUDI ARABIA

11.5.2.1 Cloud adoption initiatives help Kingdom of Saudi Arabia enterprises better customer experience and improve relationships

TABLE 183 KINGDOM OF SAUDI ARABIA: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 184 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 185 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 186 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.5.3 SOUTH AFRICA

11.5.3.1 High potential for adoption of cutting-edge technologies

TABLE 187 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 188 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 189 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 190 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.5.4 UAE

11.5.4.1 UAE to adopt Account-Based Marketing (ABM) to create personalized campaigns that engage in real-time

TABLE 191 UAE: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 192 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 193 UAE: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 194 UAE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 195 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 196 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 197 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 198 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKETING CLOUD PLATFORM MARKET DRIVERS

TABLE 199 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY MARKETING FUNCTION, 2017–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY MARKETING FUNCTION, 2022–2027 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Generating high number of leads and understanding consumer behavior to drive adoption of marketing cloud platforms

TABLE 215 BRAZIL: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 216 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 217 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 218 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Increased awareness about online marketing activities to drive growth for marketing cloud platform vendors

TABLE 219 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 220 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 221 MEXICO: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 222 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

11.6.4 REST OF LATIN AMERICA

TABLE 223 REST OF LATIN AMERICA: MARKETING CLOUD PLATFORM MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 224 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 225 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 226 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 191)

12.1 INTRODUCTION

FIGURE 41 MARKET EVALUATION FRAMEWORK, 2019–2022

12.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

TABLE 227 OVERVIEW OF STRATEGIES BY KEY MARKETING AUTOMATION VENDORS

12.3 MARKET SHARE OF TOP VENDORS

FIGURE 42 MARKETING AUTOMATION MARKET: VENDOR SHARE ANALYSIS

12.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 43 HISTORICAL REVENUE ANALYSIS, 2017–2021 (USD MILLION)

12.5 KEY COMPANY EVALUATION QUADRANT

FIGURE 44 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 45 MARKETING CLOUD PLATFORM MARKET: KEY COMPANY EVALUATION QUADRANT

12.5.5 KEY PLAYER COMPETITIVE BENCHMARKING

TABLE 228 COMPANY COMPONENT FOOTPRINT

TABLE 229 COMPANY REGION FOOTPRINT

TABLE 230 COMPANY FOOTPRINT

12.6 START-UP/SME EVALUATION QUADRANT

FIGURE 46 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

12.6.1 RESPONSIVE VENDORS

12.6.2 PROGRESSIVE VENDORS

12.6.3 DYNAMIC VENDORS

12.6.4 STARTING BLOCKS

FIGURE 47 MARKET: STARTUP/SME EVALUATION QUADRANT

TABLE 231 COMPANY COMPONENT FOOTPRINT (SMES)

TABLE 232 COMPANY REGION FOOTPRINT (SMES)

TABLE 233 COMPANY FOOTPRINT (SMES)

12.6.5 START-UP/SME COMPETITIVE BENCHMARKING

TABLE 234 MARKET: DETAILED LIST OF KEY START-UPS/SMES

12.7 COMPETITIVE SCENARIO

TABLE 235 MARKET: NEW LAUNCHES, 2019–2022

TABLE 236 MARKETING CLOUD PLATFORM MARKET: DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 217)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 KEY PLAYERS

13.1.1 ADOBE

TABLE 237 ADOBE: BUSINESS OVERVIEW

FIGURE 48 ADOBE: COMPANY SNAPSHOT

TABLE 238 ADOBE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 239 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 240 ADOBE: DEALS

13.1.2 SALESFORCE

TABLE 241 SALESFORCE: BUSINESS OVERVIEW

FIGURE 49 SALESFORCE: COMPANY SNAPSHOT

TABLE 242 SALESFORCE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 243 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 244 SALESFORCE: DEALS

13.1.3 ORACLE

TABLE 245 ORACLE: BUSINESS OVERVIEW

FIGURE 50 ORACLE: COMPANY SNAPSHOT

TABLE 246 ORACLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 247 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 248 ORACLE: DEALS

13.1.4 PEGASYSTEMS

TABLE 249 PEGASYSTEMS: BUSINESS OVERVIEW

FIGURE 51 PEGASYSTEMS: COMPANY SNAPSHOT

TABLE 250 PEGASYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 251 PEGASYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 PEGASYSTEMS: DEALS

13.1.5 HUBSPOT

TABLE 253 HUBSPOT: BUSINESS OVERVIEW

FIGURE 52 HUBSPOT: COMPANY SNAPSHOT

TABLE 254 HUBSPOT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 255 HUBSPOT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 256 HUBSPOT: DEALS

13.1.6 SAP

TABLE 257 SAP: BUSINESS OVERVIEW

FIGURE 53 SAP: COMPANY SNAPSHOT

TABLE 258 SAP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 259 SAP: PRODUCT LAUNCHES & ENHANCEMENT

TABLE 260 SAP: DEALS

13.1.7 SAS

TABLE 261 SAS: BUSINESS OVERVIEW

FIGURE 54 SAS: COMPANY SNAPSHOT

TABLE 262 SAS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 263 SAS: SERVICE LAUNCHES & BUSINESS EXPANSIONS

TABLE 264 SAS: DEALS

13.1.8 REDPOINT GLOBAL

TABLE 265 REDPOINT GLOBAL: BUSINESS OVERVIEW

TABLE 266 REDPOINT GLOBAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 267 REDPOINT GLOBAL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 268 REDPOINT GLOBAL: DEALS

13.1.9 CHEETAH DIGITAL

TABLE 269 CHEETAH DIGITAL: BUSINESS OVERVIEW

TABLE 270 CHEETAH DIGITAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 271 CHEETAH DIGITAL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 272 CHEETAH DIGITAL: DEALS

13.1.10 ACOUSTIC

TABLE 273 ACOUSTIC: BUSINESS OVERVIEW

TABLE 274 ACOUSTIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 275 ACOUSTIC: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 276 ACOUSTIC: DEALS

13.2 OTHER PLAYERS

13.2.1 BRAZE

13.2.2 ACQUIA

13.2.3 CISION

13.2.4 INSIDER

13.2.5 SITECORE

13.2.6 RESULTICKS

13.2.7 FICO

13.2.8 SELLIGENT

13.2.9 ZETA GLOBAL

13.2.10 ALGONOMY

13.3 START-UPS/SMES

13.3.1 PLATFORMLY

13.3.2 MAPP

13.3.3 CONVERTLAB

13.3.4 SOCIALPILOT

13.3.5 ONESIGNAL

13.3.6 BLUECORE

13.3.7 CLEVERTAP

13.3.8 OPTIMOVE

13.3.9 MOENGAGE

13.3.10 ITERABLE

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT/RELATED MARKETS (Page No. - 279)

14.1 INTRODUCTION

14.1.1 RELATED MARKET

14.1.2 ADJACENT/RELATED MARKET LIMITATIONS

14.2 MARKETING AUTOMATION MARKET

TABLE 277 MARKETING AUTOMATION MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 278 MARKETING AUTOMATION MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 279 MARKETING AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2017–2020 (USD MILLION)

TABLE 280 MARKETING AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 281 MARKETING AUTOMATION MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 282 MARKETING AUTOMATION MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 283 MARKETING AUTOMATION MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 284 MARKETING AUTOMATION MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 285 MARKETING AUTOMATION MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 286 MARKETING AUTOMATION MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

14.3 CUSTOMER EXPERIENCE MANAGEMENT MARKET

TABLE 287 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 288 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 289 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2015–2020 (USD MILLION)

TABLE 290 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

TABLE 291 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 292 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 293 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 294 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 286)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the marketing cloud platform market size. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, whitepapers; certified publications; and articles from recognized associations.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the marketing cloud platform market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing remote workplace services offerings; associated service providers; and SIs operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the marketing cloud platform market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the BFSI, healthcare & life sciences, IT & telecom, education, retail & eCommerce, media, entertainment and gaming, travel & hospitality, and other verticals. Others include manufacturing, transportation & logistics, and the public sector.

Report Objectives

- To describe and forecast the marketing cloud platform market based on components (platforms and services), deployment modes, marketing functions, organization sizes, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

- To comprehensively analyze the core competencies of the key players in the market

- To assess the impact of COVID-19 on the marketing cloud platform market

- To track and analyze the competitive developments, such as product/solution launches and enhancements, business expansions, acquisitions, partnerships, contracts, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

- Further breakup of the European digital map market

- Further breakup of the Asia Pacific digital map market

- Further breakup of the Latin American digital map market

- Further breakup of the Middle East & Africa digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marketing Cloud Platform Market