Blockchain as a Service Market by Offering (Tools and Services), Application (Supply Chain Management, Smart Contracts, Identity Management, GRC Management), Organization Size, End User (FMCG, Healthcare), and Region - Global Forecast to 2026

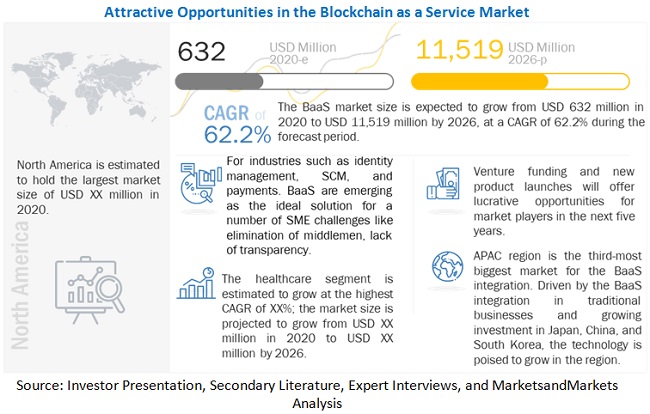

The global Blockchain as a Service Market anticipated to be valued at approximately $632 million in 2020 and is projected to hit a revenue of around $11,519 million by the end of 2026, projecting a CAGR of 62.2% between 2020 to 2026. An study of the market's industry trends makes up the new research report. The latest research report includes market buying trends, pricing analysis, patent analysis, conference and webinar materials, and important stakeholders. The major factors fueling the blockchain as a service market include increasing demand for blockchain as a service due to COVID-19 outbreak, growing need for supply chain transparency across verticals and need to reduce risk and complexities and increase in the efficiency of blockchain solutions. Moreover, Blockchain and the Internet of Things and rising government initiatives would provide lucrative opportunities for Blockchain as a service vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID 19 Impact

To ensure healthcare industry privacy post the outbreak of COVID-19, blockchain is expected to provide a number of security features, including decentralization, encryption, and cryptography. The COVID-19 pandemic has resulted in an increased demand for eCommerce. To successfully operate in pandemic technologies, such as AI, ML, and Blockchain are beginning to drive innovation strategies of the business which has further fueled the increase in the adoption of blockchain as a service solutions across SMEs. The adoption of fintech and blockchain technology, is enabling enterprises to streamline as well as modernize their operations after the outbreakm of COVID-19 pandemic. This may lead to firm growth in contactless transactions and redesigned financial services. Blockchain is expected to be a boon to the pharmaceutical industry. The technology is seen as a solution to the logistical challenges of delivering a COVID-19 vaccine. Blockchain is being used for proper distribution of COVID-19 vaccine to keep a proper track of maintenance as well as storage of vaccine for distribution.

Market Dynamics

Driver: Increasing demand for Blockchain as a Service due to COVID-19 outbreak

The COVID-19 emergency has caused significant interruptions across worldwide supply chains. Two factor plays a major role: numerous factories shut down due to safety and hygiene concerns, and the unparalleled demand for specific products, such as PPE kits and medical supplies. Various users are feeling pressured to secure supplies from unknown origins or quality due to the increased demand for these products. Lengthy supply chains cause excessive obscurity, making it hard to calculate and plan the entire supply process. Blockchain is the best option for supply chains as it can connect all stakeholders into one supply chain network universal source while maintaining transparency and being able to securely break down data silos. Therefore, huge numbers of blockchain arrangements exist in the supply chain process, which accelerated during the COVID-19 pandemic. Blockchain accelerates the validation procedure by expelling third-party delegates and innate delays in handling and processing operations. The advantages include quicker handling and processing time, reduced costs, lower operational risks, and faster settlements for all parties included.

Restraint:Uncertain regulatory status and standards

Regulations may hinder the adoption of the blockchain as a service technology across various regions. Governments are establishing various regulations to avoid fraudulent cross-border transactions. For instance, in February 2018, Japan formed a legislation to regulate bitcoin across the country, similarly, in the recent past, India has banned the cryptocurrency’s trade. Moreover, various countries are investing in research to get acquainted with blockchain and its usage. Some areas of blockchain implementation are highly contingent upon supportive regulations, including property records, legal contracts, and disintermediation of financial institutions. According to the BigBreak101, organizations can use Know Your Customer (KYC) to comply with the regulatory norms. Moreover, the blockchain as a service technology does not have clarity over regulatory compliances; hence, organizations are more careful while making international transactions through blockchain.

Opportunity: Blockchain and the Internet of Things

Blockchain technology can provide a secure and scalable framework for communication between IoT devices. While modern security protocols already appeared to be vulnerable when implemented to IoT devices, blockchain has already approved its high resistance to cyberattacks. Besides, the technology allows smart devices to make automated micro-transactions. Due to its distributed nature, blockchain will conduct transactions faster and cheaper. To enable the transfer of money or data, IoT devices leverage smart contracts, which will be considered as the agreement between the two parties.

Challenge: Lack of the technical knowledge

Blockchain technology is currently one of the hottest and most intriguing technologies in the blockchain as a service market. However, end users are still facing some challenges about the technical understanding of the blockchain technology and its concept, as it is in a nascent stage. Platforms for training and maintaining knowledge in the blockchain field would become a necessity, as the adoption and use cases of blockchain technology are expected to increase in the next few years. Blockchain technology uses cryptographic algorithms that run across a vast network of independent computers. Hence, knowledge of the related techniques is required to leverage the blockchain technology applications.

SMEs segment to grow at a higher CAGR during the forecast period

Rather than investing in on-premises networking solutions, SMEs prefer cloud-based solutions, which are more flexible and fall within the budget. The adoption of the pay-as-you-go model by SMEs to flexibly manage the IT infrastructure as per their requirements is projected to drive the adoption of blockchain as a service. Also, the need for efficient customer data protection and cost-cutting, as well as attaining a competitive advantage, enables quick response and timely decisions that are projected to drive the growth of the blockchain as a service market in SMEs. Also, factors such as the need for efficient customer data protection, cost-cutting, getting a competitive advantage, and quick response and timely decisions are projected to drive the growth of the blockchain as a service market in SMEs.

BFSI vertical to hold the largest market size during the forecast period

The increased need for transparency and accountability of transactions through GRC management tools, increased adoption of cross-border payments, digital ledger and consortium blockchain, and increased investment by banks in blockchain-based solutions drive the growth of the global blockchain in the BFSI industry. In addition, the increased demand from developing economies and high demand for increased scalability, transaction speed, smart contracts, and reduced processing costs are expected to create a number of opportunities in the blockchain in the BFSI industry in the near future.

To know about the assumptions considered for the study, download the pdf brochure

North America to hold the largest market size during the forecast period

Most of the companies in North America across BFSI, retail, healthcare, and manufacturing end users have started implementing blockchain technology across their businesses. Blockchain is already witnessing its use cases outside of the cryptocurrency end user and has been successfully used for food safety, voting, and shipping. The Federal Government of Canada is exploring blockchain technology to boost innovations in the economy, resulting in the creation of ample opportunities for blockchain as a service vendors and driving the blockchain as a service market. Increasing adoption of blockchain technology among various SMEs as well as big industries in order to streamline processes in fields such as medical data, supply chain, and administration is also expected to drive the demand for blockchain as a service in the region. The increasing adoption of blockchain among software development companies for building apps on it is also expected to fuel the demand for blockchain as a service. With the technological advancement and the rising focus on making supply chain functions, such as logistics, warehousing, fulfillment, production, and transportation management more efficient, the need for a blockchain as a service is being fueled in the region.

Asia Pacific to grow at the highest CAGR during the forecast period

In APAC region, presently, the blockchain as a service market is in the nascent phase of exploration and adoption. However, most of the technology and services providers are looking forward to the blockchain as a service technology as a lucrative opportunity. Moreover, growth in the financial sector is expected to complement the adoption of blockchain as a service tools and services. APAC countries are showing growth in cryptocurrency and blockchain technology startups. The region is analyzing the potential of blockchain technology to explore new opportunities and possible challenges to overcome. Supply chains in APAC are often significantly more difficult to manage as compared to other regions of the world. To reduce these complexities, the adoption of blockchain as a service in the region is increasing. With the rising penetration of the internet and smartphones, eCommerce became a strong driving force for APAC in 2020, which is further necessitating the demand for effective blockchain as a service tools and services in the region for optimizing as well as cost-effectively managing the supply chain. This is also fueling the need for blockchain as a service solutions and services in the region. Hence, the region is expected to grow at the highest CAGR during the forecast period.

Top Companies

Major vendors in the global blockchain as a service market include IBM (US), SAP SE (Germany), Oracle (US), R3 (US), and Microsoft (US).

Oracle is one of the leading providers of a wide array of technologies. The company operates in three business areas: cloud and license, hardware, and services. It offers middleware software, Oracle databases, cloud infrastructure, application software, and hardware systems, including networking products, computer servers, and storage-related services. It has a broad portfolio of SCM applications that enable organizations to improve outcomes for operational efficiency, while ensuring cost savings. Oracle offers a comprehensive and broad portfolio of cloud solutions for business functions, such as enterprise resource planning, human capital management, customer experience, and SCM. The Oracle SCM offerings enable organizations to efficiently organize and improve their supply chains. These offerings include Oracle product lifecycle management cloud, Oracle supply chain planning cloud, Oracle inventory management cloud, Oracle order management cloud, Oracle order manufacturing cloud, and Oracle logistics cloud. Oracle’s geographic operations are spread across Europe, the MEA, APAC, North America, and South America. Some of its notable subsidiaries include Oracle International Corporation (US), Oracle Global Holdings, Inc. (US), Oracle America, Inc. (US), Oracle Technology Company (Ireland), Oracle Systems Corporation (US), and OCAPAC Holding Company (Ireland).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 632 Million |

|

Market size value in 2026 |

USD 11,519 Million |

|

Growth rate |

CAGR of 62.2% |

|

Blockchain as a Service Market Drivers |

|

|

Blockchain as a Service Marke Opportunities |

|

|

Segments covered |

Offering (tools and Services), application, organization size, end user, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), SAP (Germany), AWS (US), Oracle (US), Huawei (China), R3 (US), HPE (US), Accenture (Dublin), Wipro (India), Infosys (India) and many more. |

This research report categorizes the blockchain as a service market to forecast revenues and analyze trends in each of the following subsegments:

Based on Offering:

- Tools

- Services

Based on Application:

- Supply Chain Management

- Smart Contracts

- Identity Management

- Payments

- Governance, Risk, and Compliance Management

- Others (Trade Finance and Data Storage)

Based on Organization Size:

- SMEs

- Large enterprises

Based on Verticals:

- BFSI

- FMCG

- Healthcare

- Manufacturing

- Retail and eCommerce

- Transportation and Logistics

- Government and Public Sector

- Energy and Utilities

- Media and Entertainment

- Others (telecom and IT, hospitality, real estate, and agriculture)

Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2019, MIMOS collaborated with Oracle to leverage blockchain technology for greater transparency and trust.

- In October 2018, Oracle Blockchain Applications Cloud was launched to help customers increase trust and provide agility in transactions across their business networks.

- In September 2018, in order to fight the growing problem of counterfeit drugs in India, NITI Aayog and Oracle signed a Statement of Intent (SoI) to pilot a real drug supply-chain using blockchain distributed ledger and IoT software.

Frequently Asked Questions (FAQ):

What is the blockchain as a service market growth?

The global market for blockchain as a service is projected to reach USD 11,519 million by 2026.

What is the estimated growth rate (CAGR) of the global blockchain as a service market for the next five years?

The global blockchain as a service market is projected to grow at a Compound Annual Growth Rate (CAGR) of 62.2% from 2020 to 2026.

What are the application in blockchain as a service market?

The application segment of the blockchain as a service market includes supply chain management, smart contracts, identity management, GRC management.

Who are the prominent companies in the blockchain as a service market?

IBM (US), Microsoft (US), SAP SE (Germany), Amazon Web Services (AWS) (US), R3 (US), Oracle (US), Huawei (China), HPE (US), Accenture (Ireland), Wipro (India), Infosys (India), BitFury (Netherlands), Factom (US), LeewayHertz (US), Altoros (US), VeChain Foundation (China), Salesforce (US), OpenXcell (US), Oodles Technologies (India), BLOCKO (South Korea), Dragonchain (US), Kaleido (US), Bloq (US), Chainstack (Singapore), Cryptowerk (US), Morpheus Labs (Singapore), Shipchain (South Carolina), Crypto APIs (Bulgaria) etc.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.4.1 MARKET DEFINITION

1.4.2 INCLUSIONS AND EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKET SEGMENTATION

1.5.2 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2020

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 BLOCKCHAIN AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY— APPROACH 1, SUPPLY SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY SIDE ANALYSIS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATIVE EXAMPLE OF AMAZON WEB SERVICES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP - SUPPLY SIDE: COLLECTIVE REVENUE FROM TOOLS AND SERVICES

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP DOWN - DEMAND SIDE ANALYSIS

2.4 IMPLICATION OF COVID-19 ON THE BLOCKCHAIN AS A SERVICE MARKET

2.4.1 IMPACT OF THE COVID-19 PANDEMIC

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 ASSUMPTIONS FOR THE STUDY

2.9 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 14 GLOBAL BLOCKCHAIN AS A SERVICE MARKET TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

FIGURE 15 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 16 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN THE BLOCKCHAIN AS A SERVICE MARKET

FIGURE 17 HIGH ADOPTION OF THE BLOCKCHAIN TECHNOLOGY ACROSS APPLICATION AREAS TO PROVIDE SIGNIFICANT OPPORTUNITIES FOR MARKET GROWTH

4.2 MARKET, BY OFFERING AND ORGANIZATION SIZE

FIGURE 18 TOOLS SEGMENT AND LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARES IN 2020

4.3 MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 20 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BLOCKCHAIN AS A SERVICE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for blockchain as a service due to COVID-19 outbreak

5.2.1.2 Growing need for supply chain transparency across verticals

5.2.1.3 Rising demand for enhanced security

5.2.1.4 Low cost of bandwidth, data storage, and computing

5.2.1.5 Need to reduce risk and complexities and increase the efficiency of blockchain solutions

5.2.2 RESTRAINTS

5.2.2.1 Uncertain regulatory status and standards

5.2.3 OPPORTUNITIES

5.2.3.1 Blockchain and the Internet of Things

5.2.3.2 Rising government initiatives

5.2.4 CHALLENGES

5.2.4.1 Managing the increasing data volume

5.2.4.2 Lack of the technical knowledge

5.3 COVID-19 DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 COVID-19 IMPACT: BLOCKCHAIN AS A SERVICE MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN: MARKET

5.5 ECOSYSTEM: MARKET

FIGURE 23 BLOCKCHAIN AS A SERVICE ECOSYSTEM

TABLE 4 ROLE OF COMPANIES IN THE ECOSYSTEM

5.6 AVERAGE SELLING PRICE/PRICING MODEL OF BLOCKCHAIN AS A SERVICE PLAYERS 2019-2020

FIGURE 24 2019-2020 AVERAGE SELLING PRICE MODEL OF MARKET

5.7 BLOCKCHAIN TECHNOLOGY ANALYSIS

5.7.1 BLOCKCHAIN AS A SERVICE MARKET: TOP TRENDS

5.7.1.1 Integration of blockchain technology with the Internet of Things

5.7.1.2 Smart contracts

5.8 USE CASES

5.8.1 DATA RECONCILIATION SERVICES FOR THE TRAVEL INDUSTRY, BY MICROSOFT

5.8.2 USE CASE 2: TO REDUCE THE WASTAGE OF FOOD BY IMPROVING FOOD SAFETY AND TRACEABILITY, AND TO HELP ITS ONLINE AND OFFLINE CONSUMERS ACROSS THE GLOBE, BY IBM

5.8.3 USE CASE 3: TO LEVERAGE INNOVATIVE TECHNOLOGIES SUCH AS BLOCKCHAIN, AI, AND IOT TO TRANSFORM SUPPLY CHAIN OPERATIONS IN THE SHIPPING INDUSTRY, BY ORACLE

5.8.4 USE CASE 4: BLOCKCHAIN HELPS RCS GLOBAL TRACE RESPONSIBLY PRODUCED RAW MATERIALS, BY IBM

5.9 REVENUE SHIFT – YC/YCC SHIFT FOR BLOCKCHAIN AS A SERVICE MARKET

FIGURE 25 YC/YCC SHIFT: BLOCKCHAIN AS SERVICE MARKET

5.10 PATENT ANALYSIS

FIGURE 26 BLOCKCHAIN PATENT APPLICATIONS PER YEAR

FIGURE 27 TOP BLOCKCHAIN APPLICATION AREAS

TABLE 5 BLOCKCHAIN PATENT ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTERS 5 FORCES IMPACT ON THE Blockchain As A Service MARKET

FIGURE 28 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.11.1 THREAT FROM NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITION RIVALRY

6 BLOCKCHAIN AS A SERVICE MARKET, BY OFFERING (Page No. - 73)

6.1 INTRODUCTION

6.1.1 OFFERING: MARKET DRIVERS

6.1.2 OFFERING: COVID-19 IMPACT

FIGURE 29 TOOLS SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

6.2 TOOLS

TABLE 9 TOOLS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 TOOLS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 SERVICES

TABLE 11 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 SERVICES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 BLOCKCHAIN AS A SERVICE MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

FIGURE 30 SMART CONTRACTS SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 14 BLOCKCHAIN AS SERVICE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 SUPPLY CHAIN MANAGEMENT

TABLE 15 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 SMART CONTRACTS

TABLE 17 SMART CONTRACTS: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 SMART CONTRACTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.4 IDENTITY MANAGEMENT

TABLE 19 IDENTITY MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 IDENTITY MANAGEMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.5 PAYMENTS

TABLE 21 PAYMENTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 PAYMENTS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.6 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT

TABLE 23 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT: MARKET SIZE, 2016–2019 (USD MILLION)

TABLE 24 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.7 OTHER APPLICATIONS

TABLE 25 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8 BLOCKCHAIN AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 31 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 27 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 28 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL-AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

8.2.2 SMALL- AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 SMALL AND MEDIUM-SIZED ENTERPRISES: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

8.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 31 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 BLOCKCHAIN AS A SERVICE MARKET, BY END USER (Page No. - 93)

9.1 INTRODUCTION

TABLE 33 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

FIGURE 32 BANKING, FINANCIAL SERVICES AND INSURANCE SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE IN 2020

9.2 BANKING, FINANCIAL SERVICES AND INSURANCE

9.2.1 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

9.2.2 BANKING, FINANCIAL SERVICES AND INSURANCE: COVID-19 IMPACT

TABLE 35 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 FAST-MOVING CONSUMER GOODS

9.3.1 FAST-MOVING CONSUMER GOODS: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

9.3.2 FAST-MOVING CONSUMER GOODS: COVID-19 IMPACT

TABLE 37 FAST-MOVING CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 FAST-MOVING CONSUMER GOODS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.4 HEALTHCARE

9.4.1 HEALTHCARE: MARKET DRIVERS

9.4.2 HEALTHCARE: COVID-19 IMPACT

TABLE 39 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 HEALTHCARE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.5 MANUFACTURING

9.5.1 MANUFACTURING: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

9.5.2 MANUFACTURING: COVID-19 IMPACT

TABLE 41 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.6 RETAIL AND ECOMMERCE

9.6.1 RETAIL AND ECOMMERCE: MARKET DRIVERS

9.6.2 RETAIL AND ECOMMERCE: COVID-19 IMPACT

TABLE 43 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.7 TRANSPORTATION AND LOGISTICS

9.7.1 TRANSPORTATION AND LOGISTICS: MARKET DRIVERS

9.7.2 TRANSPORTATION AND LOGISTICS: COVID-19 IMPACT

TABLE 45 TRANSPORTATION AND LOGISTICS: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.8 GOVERNMENT AND PUBLIC SECTOR

9.8.1 GOVERNMENT AND PUBLIC SECTOR: MARKET DRIVERS

9.8.2 GOVERNMENT AND PUBLIC SECTOR: COVID-19 IMPACT

TABLE 47 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.9 ENERGY AND UTILITIES

9.9.1 ENERGY AND UTILITIES: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

9.9.2 ENERGY AND UTILITIES: COVID-19 IMPACT

TABLE 49 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.10 MEDIA AND ENTERTAINMENT

9.10.1 MEDIA AND ENTERTAINMENT: MARKET DRIVERS

9.10.2 MEDIA AND ENTERTAINMENT: COVID-19 IMPACT

TABLE 51 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.11 OTHER END USERS

TABLE 53 OTHER END USERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 OTHER END USERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 BLOCKCHAIN AS A SERVICE MARKET, BY REGION (Page No. - 112)

10.1 INTRODUCTION

TABLE 55 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 57 NORTH AMERICA: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 67 UNITED STATES: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 68 UNITED STATES: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 69 UNITED STATES: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 70 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.2.5 CANADA

TABLE 75 CANADA: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: TARIFFS AND REGULATIONS

TABLE 83 EUROPE: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 93 UNITED KINGDOM: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 98 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 99 UNITED KINGDOM: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 100 UNITED KINGDOM: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.3.5 GERMANY

TABLE 101 GERMANY: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 102 GERMANY: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 103 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 106 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 107 GERMANY: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 108 GERMANY: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 109 REST OF EUROPE: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.4.4 CHINA

TABLE 127 CHINA: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 128 CHINA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 129 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 131 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 132 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 133 CHINA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 134 CHINA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.4.5 JAPAN

TABLE 135 JAPAN: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 136 JAPAN: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 137 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 138 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 139 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 140 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 141 JAPAN: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 142 JAPAN: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.4.6 INDIA

TABLE 143 INDIA: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 144 INDIA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 145 INDIA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 146 INDIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 147 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 148 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 149 INDIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 150 INDIA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 151 REST OF ASIA PACIFIC: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 155 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 156 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUBREGION, 2016–2019 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUBREGION, 2019–2026 (USD MILLION)

10.5.4 MIDDLE EAST

TABLE 169 MIDDLE EAST: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 170 MIDDLE EAST: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 171 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 173 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 174 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 175 MIDDLE EAST: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 176 MIDDLE EAST: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.5.5 AFRICA

TABLE 177 AFRICA: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 178 AFRICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 179 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 180 AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 181 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 182 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 183 AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 184 AFRICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: BLOCKCHAIN AS A SERVICE MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

TABLE 185 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

10.6.4 BRAZIL

TABLE 195 BRAZIL: BLOCKCHAIN AS A SERVICE MARKET SIZE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 196 BRAZIL: MARKET SIZE, BY OFFERING, 2019–2026 (USD MILLION)

TABLE 197 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 198 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 199 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 200 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2026 (USD MILLION)

TABLE 201 BRAZIL: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 202 BRAZIL: MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

10.6.5 MEXICO

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 185)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 BLOCKCHAIN AS A SERVICE: MARKET EVALUATION FRAMEWORK

11.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 36 BLOCKCHAIN AS A SERVICE MARKET: REVENUE ANALYSIS

11.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 203 MARKET: DEGREE OF COMPETITION

11.5 HISTORICAL REVENUE ANALYSIS

FIGURE 37 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

11.6 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 38 KEY PLAYERS RANKING, 2020

11.7 COMPANY EVALUATION MATRIX

11.7.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 204 EVALUATION CRITERIA

TABLE 205 COMPANY PRODUCT FOOTPRINT

11.7.2 STAR

11.7.3 PERVASIVE

11.7.4 EMERGING LEADERS

11.7.5 PARTICIPANTS

FIGURE 39 BLOCKCHAIN AS A SERVICE MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.8 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

11.9 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

11.1 STARTUP/SME EVALUATION MATRIX, 2020

11.10.1 PROGRESSIVE COMPANIES

11.10.2 RESPONSIVE COMPANIES

11.10.3 DYNAMIC COMPANIES

11.10.4 STARTING BLOCKS

FIGURE 42 BLOCKCHAIN AS A SERVICE MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 196)

12.1 MAJOR PLAYERS

12.1.1 IBM

(Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View)*

TABLE 206 IBM: BUSINESS OVERVIEW

FIGURE 43 IBM: COMPANY SNAPSHOT

TABLE 207 IBM: SOLUTIONS AND SERVICES OFFERED

TABLE 208 IBM: MARKET: PRODUCT LAUNCHES

TABLE 209 IBM: MARKET: DEALS

12.1.2 MICROSOFT

TABLE 210 MICROSOFT: BUSINESS OVERVIEW

FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

TABLE 211 MICROSOFT: SOLUTIONS AND SERVICES OFFERED

TABLE 212 MICROSOFT: BLOCKCHAIN AS A SERVICE MARKET: PRODUCT LAUNCHES

TABLE 213 MICROSOFT: MARKET: DEALS

12.1.3 SAP

TABLE 214 SAP: BUSINESS OVERVIEW

FIGURE 45 SAP: COMPANY SNAPSHOT

TABLE 215 SAP: SOLUTIONS AND SERVICES OFFERED

TABLE 216 SAP: MARKET: PRODUCT LAUNCHES

TABLE 217 SAP: MARKET: DEALS

12.1.4 AMAZON WEB SERVICES

TABLE 218 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 46 AMAZON WEB SERVICES: COMPANY SNAPSHOT

TABLE 219 AMAZON WEB SERVICES: SOLUTIONS AND SERVICES OFFERED

TABLE 220 AMAZON WEB SERVICES: BLOCKCHAIN AS A SERVICE MARKET: PRODUCT LAUNCHES

TABLE 221 AMAZON WEB SERVICES: MARKET: DEALS

12.1.5 R3

TABLE 222 R3: BUSINESS OVERVIEW

TABLE 223 R3: SOLUTIONS OFFERED

TABLE 224 R3: MARKET: PRODUCT LAUNCHES

TABLE 225 R3: MARKET: DEALS

12.1.6 ORACLE

TABLE 226 ORACLE: BUSINESS OVERVIEW

FIGURE 47 ORACLE: COMPANY SNAPSHOT

TABLE 227 ORACLE: SERVICES OFFERED

TABLE 228 ORACLE: BLOCKCHAIN AS A SERVICE MARKET: PRODUCT LAUNCHES

TABLE 229 ORACLE: MARKET: DEALS

TABLE 230 ORACLE: MARKET: OTHERS

12.1.7 HUAWEI

TABLE 231 HUAWEI: BUSINESS OVERVIEW

FIGURE 48 HUAWEI: COMPANY SNAPSHOT

TABLE 232 HUAWEI: SERVICES OFFERED

TABLE 233 HUAWEI: MARKET: PRODUCT LAUNCHES

12.1.8 HEWLETT PACKARD ENTERPRISE

TABLE 234 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 49 HEWLETT PACKARD ENTERPRISES: COMPANY SNAPSHOT

TABLE 235 HEWLETT PACKARD ENTERPRISE: PLATFORM OFFERED

TABLE 236 HEWLETT PACKARD ENTERPRISE: BLOCKCHAIN AS A SERVICE MARKET: DEALS

12.1.9 ACCENTURE

TABLE 237 ACCENTURE: BUSINESS OVERVIEW

FIGURE 50 ACCENTURE: COMPANY SNAPSHOT

TABLE 238 ACCENTURE: SERVICES OFFERED

TABLE 239 ACCENTURE: MARKET: PRODUCT LAUNCHES

TABLE 240 ACCENTURE: MARKET: DEALS

12.1.10 WIPRO

TABLE 241 WIPRO: BUSINESS OVERVIEW

FIGURE 51 WIPRO: COMPANY SNAPSHOT

TABLE 242 WIPRO: SOLUTIONS AND SERVICES OFFERED

TABLE 243 WIPRO: BLOCKCHAIN AS A SERVICE MARKET: DEALS

12.1.11 INFOSYS

TABLE 244 INFOSYS: BUSINESS OVERVIEW

FIGURE 52 INFOSYS: COMPANY SNAPSHOT

TABLE 245 INFOSYS: SOLUTIONS AND SERVICES OFFERED

TABLE 246 INFOSYS: MARKET: PRODUCT LAUNCHES

TABLE 247 INFOSYS: MARKET: DEALS

12.1.12 BITFURY

TABLE 248 BITFURY: BUSINESS OVERVIEW

TABLE 249 BITFURY: SOLUTIONS OFFERED

TABLE 250 BITFURY: BLOCKCHAIN AS A SERVICE MARKET: PRODUCT LAUNCHES

TABLE 251 BITFURY: MARKET: DEALS

TABLE 252 BITFURY: MARKET: OTHERS

12.1.13 FACTOM

12.1.14 LEEWAYHERTZ

12.1.15 ALTOROS

12.1.16 VECHAIN FOUNDATION

12.1.17 SALESFORCE

12.1.18 OPENXCELL

12.1.19 OODLES TECHNOLOGIES

12.1.20 BLOCKO

(Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View)*

12.2 RIGHT TO WIN

TABLE 253 RIGHT TO WIN

12.3 STARTUP COMPANY PROFILES

12.3.1 DRAGONCHAIN

12.3.2 KALEIDO

12.3.3 BLOQ

12.3.4 CHAINSTACK

12.3.5 CRYPTOWERK

12.3.6 MORPHEUS LABS

12.3.7 SHIPCHAIN

12.3.8 CRYPTO APIS

13 ADJACENT/RELATED MARKETS (Page No. - 259)

13.1 INTRODUCTION

13.2 BLOCKCHAIN SUPPLY CHAIN MARKET

13.2.1 MARKET DEFINITION

TABLE 254 BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 255 BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 256 PUBLIC: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 257 PUBLIC: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 258 PRIVATE: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 259 PRIVATE: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 260 HYBRID AND CONSORTIUM: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 261 HYBRID AND CONSORTIUM: BLOCKCHAIN SUPPLY CHAIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

13.3 BLOCKCHAIN IN INSURANCE MARKET

13.3.1 MARKET DEFINITION

TABLE 262 APPLICATION AND SOLUTION PROVIDER: BLOCKCHAIN IN INSURANCE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 263 MIDDLEWARE PROVIDER: BLOCKCHAIN IN INSURANCE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 264 INFRASTRUCTURE AND PROTOCOLS PROVIDER: BLOCKCHAIN IN INSURANCE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13.4 BLOCKCHAIN IDENTITY MANAGEMENT MARKET

13.4.1 MARKET DEFINITION

TABLE 265 BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

TABLE 266 LARGE ENTERPRISES: BLOCKCHAIN IDENTITY MANAGEMENT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 267 SMALL AND MEDIUM-SIZED ENTERPRISES: BLOCKCHAIN IDENTITY MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14 APPENDIX (Page No. - 265)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

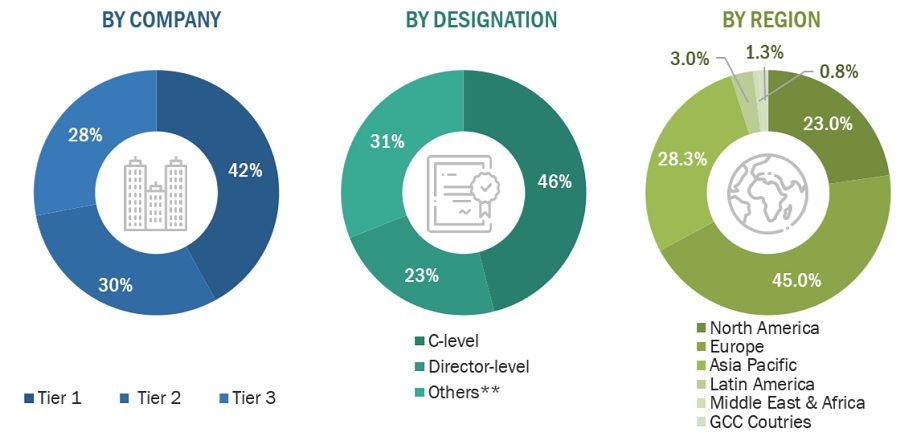

The study involved four major activities in estimating the current size of the sterilization equipment market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Pharmaceutical Companies, Hospitals & Clinics, Medical Device Companies, and Food & Beverage Companies) and supply sides (sterilization equipment manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the sterilization equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the sterilization equipment industry.

Report Objectives

- To define, describe, and forecast the sterilization equipment market by product & service, end user, and region

- To forecast the size of the market with respect to five main regional segments, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the major factors influencing the market growth (drivers, opportunities, challenges, and trends)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as collaborations, expansions, partnerships, acquisitions, and product launches in the sterilization equipment market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis:

- Further breakdown of the sterilization equipment market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, Rest of Latin America, and the Middle East & Africa.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blockchain as a Service Market