Blockchain In Insurance Market by Provider, Application (GRC Management, Death & Claims Management, Identity Management & Fraud Detection, Payments, and Smart Contracts), Organization Size (Large Enterprises and SMEs), and Region - Global Forecast to 2023

[131 Pages Report] The blockchain technology in insurance is a decentralized and shared digital distributed ledger that records and provides the history of an individual’s transactions, including claims, thus helping insurers prevent, detect, and counter frauds. The blockchain technology offers smart contracts for insurers and customers for managing claims transparently and responsively. Insurance companies have begun testing and proving out new models based on blockchain technology, starting with the low-risk, internal prototypes, and the pilot projects within their infrastructure.

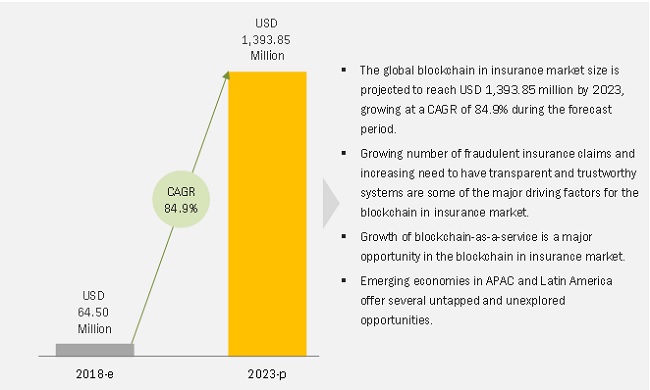

The blockchain in insurance market size was valued at USD 64.50 million in 2018 and projected to reach USD 1,393.8 million by 2023, at a Compound Annual Growth Rate (CAGR) of 84.9%. The major growth drivers of the market include the emerging need to have transparent and trustworthy systems, and the overall trends witnessed in the insurance sector related to increase in claims-related frauds. The base year considered for this report is 2017, and the market forecast period is 2018–2023.

Application and solution provider segment is expected to grow at the highest CAGR during the forecast period

The blockchain technology is a decentralized ledger that is distributed across a business network that permanently records business transactions. The blockchain technology decentralizes the ownership of credentials, thereby offering a universal protocol for verifying users’ records in an immutable data chain. The blockchain technology has the potential to deliver disruptive outcomes and reshape digital businesses. Market vendors provide various solutions, including digital identity verification, money transfers, exchanges, documentation, capital markets, and trading. These vendors offer blockchain technologies that are more likely to deliver value to businesses by reducing the duplication of transactional data and providing periodic reconciliation and authentication for commercial and regulatory reasons.

Payments application is expected to grow at the highest CAGR during the forecast period

The blockchain technology provides real-time payments against assets, thereby resulting in substantial cost savings. One of the recent trends witnessed is the use of blockchain technology for payment applications. Companies operating in the market are coming up with innovative blockchain technologies to revolutionize payments. The deployment of blockchain for payments assists in reducing risks and improving efficiency and transparency in payment systems across the insurance sector. Several banks across the globe, including Banco Masventas (Argentina), MUFG, and Taipei Fubon Commercial Bank, are building payment networks based on blockchain.

North America to dominate the blockchain in insurance market during the forecast period

North America is expected to dominate the technology adoption in the blockchain in the insurance market. The financial sector, which encompasses banking, financial services, and insurance, is focusing on the blockchain technology for its various benefits. For instance, all the major banks in North America, such as JPMorgan, Royal Bank of Canada, and Bank of America, are investing in the blockchain technology. Moreover, the high growth of the blockchain technology can also be ascertained after a survey done by Accenture, which states that 9 out of 10 banks in North America are deploying the blockchain technology for their payment applications.

Market Dynamics

Driver: Growing number of fraudulent insurance claims

The insurance industry is one of the most vulnerable sectors subject to various frauds and data thefts. Implementing blockchain in insurance is one of the novel ways to reduce fraud, minimize risks, and increase customer satisfaction. Fraudulent activities in the insurance industry are increasing. Hence, it makes a compelling reason to adopt the blockchain technology in its processes. As a result, insurance companies have to replace their inefficient legacy systems integrated in the insurance systems with better systems for efficient prevention of fraudulent claims. Blockchain offers decentralized public ledger across multiple untrusted parties. Thus it could be used to eliminate errors and identify fraudulent activities. Validation is at the core of the blockchain technology, which can be used to verify the authenticity of insurance customers’ policies by providing a complete historical record of a policy holder’s past transactions. Hence, blockchain technology offers improved efficiency in detecting and preventing fraud.

Restraint: Uncertain regulatory status and lack of common standards

Regulatory authorities find it difficult to cope with advancements in technologies. With such technological advancements, regulatory bodies need to understand what the current regulations lack and how the rules can impact the overall technology applications. Uncertainties in regulations remain a concern in the blockchain in the insurance market. At present, the lack of regulations is likely to restrain the adoption of blockchain technology in most application areas, such as financial services, telecom, government, and retail. The adoption of blockchain technology in the insurance vertical is affected by uncertain regulations and the lack of common standards for drafting the transactions of cryptocurrencies on the blockchain technology. Significant blockchain associations and consortiums, including Hyperledger, R3CEV Blockchain Consortium, CU Ledger, and Global Payments Steering Group (GPSG), have their own sets of standards and codes.

Opportunity: Growth of BaaS

Blockchain is poised to grow at a very rapid pace, especially in the BFSI vertical. The growth of the technology is expected to provide unprecedented opportunities to blockchain service providers to customize their solutions and offer to such banks. Witnessing the extraordinary growth of BaaS, several IT giants, such as IBM, Oracle, and Microsoft, have started offering BaaS modules to their cloud-computing platform. Moreover, the report also estimated that the BFSI vertical would hold the lion’s share in the global BaaS market in 2018.

Challenge: Lack of awareness about the blockchain technology

Blockchain technology is still in its nascent stage, with few applications getting traction among the industry verticals. Although the insurance industry has shown a positive trend in the adoption of technology, a lot needs to be done in terms of spreading awareness about the DLT and its diverse application areas in the insurance industry. The lack of awareness is one of the foremost challenges. Hence, it needs to be addressed swiftly. Blockchain use cases with its successful implementation stories could potentially build up the momentum of adoption by the insurance industry. Insurance companies are grappling with frauds, risk, compliance, and security issues, which could be addressed through the successful implementation of blockchain technology. Thus, creating awareness could drive the growth of blockchain technology adoption.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

USD million/billion (Value) |

|

Segments covered |

Provider, Application, Organization Size, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA) |

|

Companies covered |

Applied Blockchain (UK), Algorythmix (India), Auxesis Group (India), AWS (US), Bitfury (US), BitPay (US), BlockCypher (US), BTL Group (Canada), Cambridge Blockchain (US), ChainThat (UK), Circle (US), ConsenSys (US), Digital Asset Holdings (US), Earthport (UK), Everledger (UK), Factom (US), Guardtime (Estonia), IBM (US), iXLedger (UK), Microsoft (US), Oracle (US) |

The research report categorizes the Blockchain in Insurance Market to forecast the revenues and analyze trends in each of the following sub-segments:

By Provider

- Application and solution provider

- Middleware provider

- Infrastructure and protocols provider

By Application

- GRC management

- Death and claims management

- Identity management and fraud detection

- Payments

- Smart contracts

- Others (content storage management and customer communication)

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- Singapore

- Australia and New Zealand (ANZ)

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- Middle East

- Africa

Key Market Players

Applied Blockchain (UK), Algorythmix (India), Auxesis Group (India), AWS (US), Bitfury (US)

Recent Developments

- In May 2018, Microsoft launched Azure Blockchain Workbench, a set of new tools to build apps quickly in minimum time.

- In April 2018, BTL announced the launch of its proprietary blockchain platform Interbit and made it available for testing and feedback. The company plans to make Interbit fully commercial through regular software releases. Interbit can be licensed by developers and businesses who can build and share their applications in a trusted ecosystem.

- In March 2018, AWS partnered with Luxoft Holding, a technology consulting firm, to offer blockchain solutions certified to run on AWS. Luxoft Holding implemented a digital ledger solution using the Hyperledger Fabric network. This solution runs on AWS and had developed the digital interfaces to link the legacy systems to each member in the insurance claims process, which is specifically used in the healthcare industry.

- In November 2017, SAP partnered with SophiaTX to introduce an open-source platform to primarily integrate SAP with the blockchain technology and enhance the business operations. This partnership would create a product that would be suitable for business users while providing superior functionalities and features.

- In October 2017, IBM launched a new blockchain banking solution that helps financial institutions expedite global payments. This solution uses IBM’s blockchain technology and collaborates with technology partners, such as Stellar.org and KlickEx Group, to enhance speed so that the financial institutions can settle payment transactions in real-time on a single network.

Key questions addressed in the report

- Which regions are likely to grow at the highest CAGR?

- What are the recent trends affecting the blockchain in the insurance market?

- Who are the key players in the market, and how intense is the competition?

- What are the key implementation areas of blockchain insurance?

- What are the challenges hindering the adoption of blockchain insurance services?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Blockchain in Insurance Market

4.2 Market Share Across Various Regions

4.3 Market Top 4 Applications and Regions

5 Market Overview (Page No. - 34)

5.1 Market Overview

5.1.1 Drivers

5.1.1.1 Growing Number of Fraudulent Insurance Claims

5.1.1.2 Increasing Need to Have Transparent and Trustworthy Systems

5.1.1.3 Focus on Reducing the Total Cost of Ownership

5.1.2 Restraints

5.1.2.1 Uncertain Regulatory Status and Lack of Common Standards

5.1.3 Opportunities

5.1.3.1 Growth of Baas

5.1.3.2 Growth of Iot

5.1.4 Challenges

5.1.4.1 Lack of Awareness About the Blockchain Technology

5.1.4.2 Lack of Understanding of Blockchain Concept, Skill Sets, and Technical Knowledge

5.2 Industry Trends

5.2.1 Types of Blockchain Technology

5.2.1.1 Private Blockchain

5.2.1.2 Public Blockchain

5.2.2 Blockchain Associations and Consortiums

5.2.2.1 Blockchain Insurance Industry Initiative

5.2.2.2 R3cev Blockchain Consortium

5.2.2.3 Cash Settlement Providers Group

5.2.2.4 Financial Blockchain Shenzhen Consortium (FBSC)

5.2.2.5 CU Ledger

5.2.2.6 Blockchain Collaborative Consortium (BCCC)

5.2.2.7 Wall Street Blockchain Alliance (WSBA)

5.2.2.8 Financial Conduct Authority (FCA)

5.2.2.9 Hyperledger

5.2.2.10 Global Payments Steering Group (GPSG)

5.3 Blockchain in Insurance Market: Use Cases

5.3.1 Use Case #1: Minimized Settlement Time has Reduced the Cost of Completing Global Payments

5.3.2 Use Case #2: Revolutionizing the KYC Process for the Insurance Industry

6 Market By Provider (Page No. - 42)

6.1 Introduction

6.2 Application and Solution Provider

6.3 Middleware Provider

6.4 Infrastructure and Protocols Provider

7 Blockchain in Insurance Market, By Application (Page No. - 47)

7.1 Introduction

7.2 GRC Management

7.3 Death and Claims Management

7.4 Payments

7.5 Identity Management and Fraud Detection

7.6 Smart Contracts

7.7 Others

8 Market By Organization Size (Page No. - 54)

8.1 Introduction

8.2 Large Enterprises

8.3 Small and Medium-Sized Enterprises

9 Blockchain in Insurance Market, By Region (Page No. - 58)

9.1 Introduction

9.2 North America

9.2.1 By Provider

9.2.2 By Application

9.2.3 By Organization Size

9.2.4 By Country

9.2.4.1 United States

9.2.4.2 Canada

9.3 Europe

9.3.1 By Provider

9.3.2 By Application

9.3.3 By Organization Size

9.3.4 By Country

9.3.4.1 United Kingdom

9.3.4.2 Germany

9.3.4.3 France

9.3.4.4 Rest of Europe

9.4 Asia Pacific

9.4.1 By Provider

9.4.2 By Application

9.4.3 By Organization Size

9.4.4 By Country

9.4.4.1 China

9.4.4.2 Japan

9.4.4.3 Singapore

9.4.4.4 Australia and New Zealand

9.4.4.5 Rest of Asia Pacific

9.5 Latin America

9.5.1 By Provider

9.5.2 By Application

9.5.3 By Organization Size

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.2 Mexico

9.5.4.3 Rest of Latin America

9.6 Middle East and Africa

9.6.1 By Provider

9.6.2 By Application

9.6.3 By Organization Size

9.6.4 By Subregion

9.6.4.1 Middle East

9.6.4.2 Africa

10 Competitive Landscape (Page No. - 77)

10.1 Overview

10.2 Prominent Players in the Blockchain in Insurance Market

10.3 Competitive Scenario

10.3.1 New Product Launches and Product Upgradations

10.3.2 Partnerships, Collaborations, and Agreements

11 Company Profiles (Page No. - 81)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.1 IBM

11.2 Oracle

11.3 Microsoft

11.4 AWS

11.5 SAP

11.6 Earthport

11.7 BTL Group

11.8 Bitfury

11.9 Digital Asset Holdings

11.10 Factom

11.11 Auxesis Group

11.12 Bitpay

11.13 Circle

11.14 Cambridge Blockchain

11.15 Chainthat Limited

11.16 Blockcypher

11.17 Safeshare Global

11.18 Everledger

11.19 Consensys

11.20 Guardtime

11.21 Symbiont

11.22 Recordskeeper

11.23 Applied Blockchain

11.24 Algorythmix

11.25 Ixledger

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 123)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (38 Tables)

Table 1 Global Blockchain in Insurance Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Market Size By Provider, 2016–2023 (USD Million)

Table 3 Application and Solution Provider: Market Size By Region, 2016–2023 (USD Million)

Table 4 Middleware Provider: Market Size By Region, 2016–2023 (USD Million)

Table 5 Infrastructure and Protocols Provider: Market Size By Region, 2016–2023 (USD Million)

Table 6 Blockchain in Insurance Market Size, By Application, 2016–2023 (USD Million)

Table 7 GRC Management: Market Size By Region, 2016–2023 (USD Million)

Table 8 Death and Claims Management: Market Size By Region, 2016–2023 (USD Million)

Table 9 Payments: Market Size, By Region, 2016–2023 (USD Million)

Table 10 Identity Management and Fraud Detection: Market Size By Region, 2016–2023 (USD Million)

Table 11 Smart Contracts: Market Size By Region, 2016–2023 (USD Million)

Table 12 Others: Market Size By Region, 2016–2023 (USD Million)

Table 13 Market Size By Organization Size, 2016–2023 (USD Million)

Table 14 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 15 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 16 Blockchain in Insurance Market Size, By Region, 2016–2023 (USD Million)

Table 17 North America: Market Size By Provider, 2016–2023 (USD Million)

Table 18 North America: Market Size By Application, 2016–2023 (USD Million)

Table 19 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 20 North America: Market Size By Country, 2016–2023 (USD Million)

Table 21 Europe: Blockchain in Insurance Market Size, By Provider, 2016–2023 (USD Million)

Table 22 Europe: Market Size By Application, 2016–2023 (USD Million)

Table 23 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 24 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 25 Asia Pacific: Market Size By Provider, 2016–2023 (USD Million)

Table 26 Asia Pacific: Market Size By Application, 2016–2023 (USD Million)

Table 27 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 28 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 29 Latin America: Blockchain in Insurance Market Size, By Provider, 2016–2023 (USD Million)

Table 30 Latin America: Market Size By Application, 2016–2023 (USD Million)

Table 31 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 32 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 33 Middle East and Africa: Market Size By Provider, 2016–2023 (USD Million)

Table 34 Middle East and Africa: Market Size By Application, 2016–2023 (USD Million)

Table 35 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 36 Middle East and Africa: Market Size By Subregion, 2016–2023 (USD Million)

Table 37 New Product Launches and Product Upgradations, 2016–2018

Table 38 Partnerships, Collaborations, and Agreements, 2017–2018

List of Figures (37 Figures)

Figure 1 Blockchain in Insurance Market Segmentation

Figure 2 Market Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Blockchain in Insurance Market: Assumptions

Figure 9 Blockchain: Block Diagram

Figure 10 Global Market is Expected to Witness Significant Growth During the Forecast Period (USD Million)

Figure 11 Global Market Snapshot, By Provider, 2018–2023

Figure 12 Global Market Snapshot, By Application, 2018–2023

Figure 13 Global Market Snapshot, By Organization Size, 2018–2023

Figure 14 Growing Number of Fraudulent Insurance Claims Would Provide Lucrative Market Prospects in the Blockchain in Insurance Market

Figure 15 North America is Estimated to Hold the Largest Market Size in 2018

Figure 16 Smart Contract Applications Segment and North America are Estimated to Hold the Largest Market Sizes in 2018

Figure 17 Asia Pacific is Expected to Enter the Exponential Growth Phase During the Forecast Period

Figure 18 Blockchain in Insurance Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Application and Solution Provider Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Payments Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the Blockchain in Insurance Market During 2014–2018

Figure 26 IBM: Company Snapshot

Figure 27 IBM: SWOT Analysis

Figure 28 Oracle: Company Snapshot

Figure 29 Oracle: SWOT Analysis

Figure 30 Microsoft: Company Snapshot

Figure 31 Microsoft: SWOT Analysis

Figure 32 AWS: Company Snapshot

Figure 33 AWS: SWOT Analysis

Figure 34 SAP: Company Snapshot

Figure 35 SAP: SWOT Analysis

Figure 36 Earthport: Company Snapshot

Figure 37 BTL Group: Company Snapshot

Growth opportunities and latent adjacency in Blockchain In Insurance Market