Blockchain in Media, Advertising, and Entertainment Market by Provider, Application (Licensing & Rights Management, Digital Advertising, Smart Contracts, Content Security, Online Gaming, Payments), Enterprise Size, and Region - Global Forecast to 2023

[139 Pages Report] The increasing adoption of the blockchain technology for various applications in the media, advertising, and entertainment vertical and utilization of transparent and secure transactions are expected to drive the blockchain in media, advertising, and entertainment market. The global market size was USD 30.4 million in 2017 and is projected to reach USD 1,000.1 million by 2023, growing at a Compound Annual Growth Rate (CAGR) of 81.1% during the forecast period. The base year considered for the study is 2017 and the forecast period is 20182023.

The objective of the report is to define, describe, and forecast the size of the market by providers, applications, enterprise size, and regions. The report also aims at providing detailed information about the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

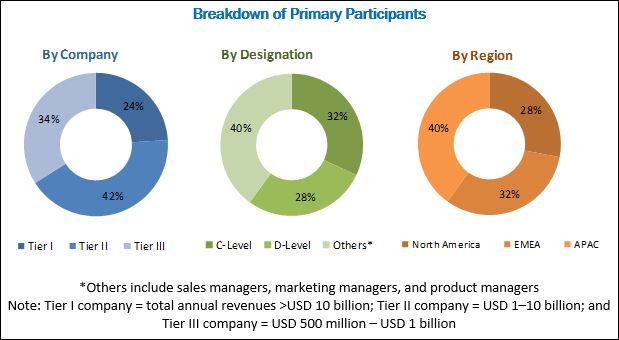

The research methodology used to estimate and forecast the global blockchain in media, advertising, and entertainment market size began with capturing data from key vendors revenue through secondary research, annual reports, government, publishing sources, the Institute of Electrical and Electronics Engineers (IEEE), Factiva, Bloomberg, and press releases. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall global market size from the revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The major vendors in the blockchain in media, advertising, and entertainment include IBM (US), Microsoft (US), SAP (Germany), Accenture (Ireland), AWS (US), Oracle (US), Digital Currency Group (US), Bitfury Group (US), Factom (US), Guardtime (Estonia), BRAINBOY (Germany), ARK (US), Auxesis (India), Synereo (Israel), NYIAX (US), MetaX (US), BTL (Canada), Voise (Canada), UJo (US), BigchainDb (Germany), Bloq (US), Clearcoin (US), iProdoos (US), Current (US), and Decent (Switzerland).

Key Target Audience For Blockchain in Media, Advertising, and Entertainment Market

- Government agencies

- Blockchain technology vendors

- Network solution providers

- Independent software vendors

- Payment gateway provider

- Blockchain security providers

- Infrastructure and protocol providers

- Value-added resellers

- Blockchain security providers

- Communication service providers

The study answers several questions for stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing their efforts and investments.

Scope of the Blockchain in Media, Advertising, and Entertainment Market Report

The market is segmented on the basis of providers, applications, enterprise size, and regions:

By Providers

- Application

- Middleware

- Infrastructure

Blockchain in Media, Advertising, and Entertainment Market By Application

- Licensing & Rights Management

- Digital Advertising

- Smart Contracts

- Content Security

- Online Gaming

- Payments

By Enterprise Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Blockchain in Media, Advertising, and Entertainment Market By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American blockchain in media, advertising, and entertainment market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global blockchain in media, advertising, and entertainment market to grow from USD 51.4 million in 2018 to USD 1,000.1 million by 2023, at a Compound Annual Growth Rate (CAGR) of 81.1% during the forecast period. The rising demand for eliminating intermediaries between content creators and end-users, increasing instances of data piracy in the media, entertainment, and advertising vertical, and the growing need for secure and faster transactions are expected to drive the market.

By providers, the blockchain in media, advertising, and entertainment market has been segmented into application providers, middleware providers, and infrastructure providers. The application providers segment is expected to grow at the highest CAGR during the forecast period. Application providers help media vendors to reduce the costs associated with contractual agreements and distribution of profits, eliminate intermediaries, and decrease manual processes.

Based on applications, the market is segmented into licensing and rights management, digital advertising, smart contracts, content security, online gaming, payments, and others (content distribution and dynamic pricing). The payments application is expected to have the largest market size during the forecast period. The blockchain technology provides real-time payments against assets with an immutable state and digital identity, thereby resulting in 4080% reduction in transaction costs. The technology helps in automating the payment processing activities, eliminating the need for intermediaries, and reducing the administrative costs and time for the providers and payers.

Among enterprises, the Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period. The increasing demand for the integration of the blockchain technology-powered solutions in the media, entertainment, and advertising vertical is expected to drive the SMEs segment in the market.

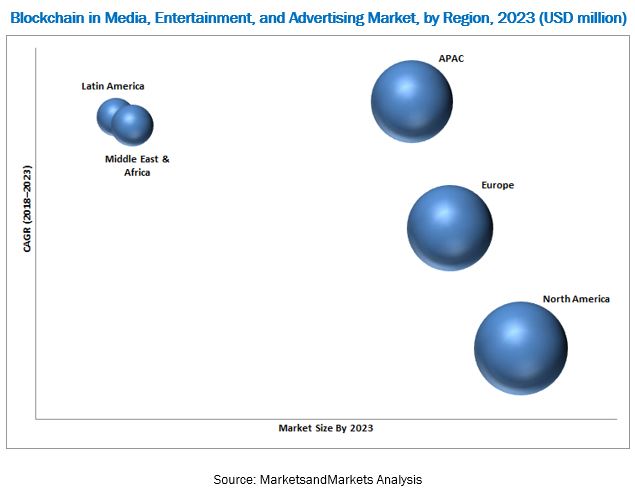

North America is expected to have the largest market size in the global blockchain in media, entertainment, and advertising market, while APAC is expected to grow at the highest CAGR during the forecast period. The North American region has witnessed increased investments in the blockchain in media, advertising, and entertainment market. In the region, the blockchain technologies are effectively used in media, entertainment, and advertising vertical for various applications, such as licensing and rights management, digital advertising, smart contracts, content security, online gaming, and payments.

Major vendors in the global blockchain in media, advertising, and entertainment market include IBM (US), Microsoft (US), SAP (Germany), Accenture (Ireland), AWS (US), Oracle (US), Digital Currency Group (US), Bitfury Group (US), Factom (US), Guardtime (Estonia), BRAINBOY (Germany), ARK (US), Auxesis (India), Synereo (Israel), NYIAX (US), MetaX (US), BTL (Canada), Voise (Canada), UJo (US), BigchainDb (Germany), Bloq (US), Clearcoin (US), iProdoos (US), Current (US), and Decent (Switzerland). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Blockchain in Media, Advertising, and Entertainment Market

4.2 Market Top 3 Applications

4.3 Market Share: By Provider and Top 3 Regions

4.4 Market By Region

4.5 Market By Enterprise Size

4.6 Market Share, By Region

4.7 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Eliminating Intermediaries Between Content Creators and End-Users

5.2.1.2 Increasing Instances of Data Piracy in the Media, Entertainment, and Advertising Sectors

5.2.1.3 Growing Need for Secure and Faster Transactions

5.2.2 Restraints

5.2.2.1 Lack of Standardization

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of the Blockchain Technology in Various Application Areas

5.2.4 Challenges

5.2.4.1 Limited Scalability

5.2.4.2 Integration With Legacy Systems

5.3 Market: Use Cases

5.3.1 Introduction

5.3.2 Use Case: Scenario 1

5.3.3 Use Case: Scenario 2

5.3.4 Use Case: Scenario 3

5.3.5 Use Case: Scenario 4

5.4 Industry Trends

5.4.1 Types of Blockchain Technology

5.4.1.1 Public Blockchain

5.4.1.2 Private Blockchain

5.4.1.3 Permissioned Blockchain

5.4.2 Blockchain Associations and Consortiums

5.4.2.1 CLS Group

5.4.2.2 R3CEV Blockchain Consortium

5.4.2.3 Hyperledger

5.4.2.4 Global Payments Steering Group (GPSG)

5.4.2.5 Financial Blockchain Shenzhen Consortium (FBSC)

5.4.2.6 CU Ledger

5.4.2.7 Blockchain Collaborative Consortium (BCCC)

5.4.2.8 Wall Street Blockchain Alliance (WSBA)

5.5 Market Evolution

6 Blockchain in Media, Advertising, and Entertainment Market By Provider (Page No. - 48)

6.1 Introduction

6.2 Application Providers

6.3 Middleware Providers

6.4 Infrastructure Providers

7 Market By Application (Page No. - 53)

7.1 Introduction

7.2 Licensing and Rights Management

7.3 Digital Advertising

7.4 Smart Contracts

7.5 Content Security

7.6 Online Gaming

7.7 Payments

7.8 Others

8 Blockchain in Media, Advertising, and Entertainment Market By Enterprise Size (Page No. - 61)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Market By Region (Page No. - 65)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 India

9.4.3 Australia and New Zealand

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 Brazil

9.5.2 Mexico

9.5.3 Rest of Latin America

9.6 Middle East and Africa

9.6.1 Middle East

9.6.2 Africa

10 Competitive Landscape (Page No. - 86)

10.1 Overview

10.2 Top Players in the Blockchain in Media, Advertising, and Entertainment Market

10.3 Competitive Scenario

10.3.1 New Product Launches and Product Upgradations

10.3.2 Partnerships and Collaborations

10.3.3 Business Expansions

11 Company Profiles (Page No. - 92)

11.1 Introduction

(Business Overview, Products Platforms, & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.2 IBM

11.3 Microsoft

11.4 SAP

11.5 Accenture

11.6 AWS

11.7 Oracle

11.8 Infosys

11.9 Bitfury

11.10 Factom

11.11 Guardtime

11.12 ARK

11.13 Auxesis Group

11.14 Nyiax

11.15 Metax

11.16 BTL

11.17 Voise

11.18 Bloq

11.19 Clearcoin

11.20 Decent

11.21 Krypc

11.22 Synereo

11.23 UJO

11.24 Brainbot Technologies

11.25 Bigchaindb

11.26 Iprodoos

*Details on Business Overview, Products, Platforms & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 132)

12.1 Industry Excerpts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (41 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Global Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 3 Blockchain in Media, Advertising, and Entertainment Market Size By Provider, 20162023 (USD Million)

Table 4 Application Providers: Market Size By Region, 20162023 (USD Million)

Table 5 Middleware Providers: Market Size By Region, 20162023 (USD Million)

Table 6 Infrastructure Providers: Market Size By Region, 20162023 (USD Million)

Table 7 Market Size By Application, 20162023 (USD Million)

Table 8 Licensing and Rights Management: Market Size By Region, 20162023 (USD Million)

Table 9 Digital Advertising: Market Size By Region, 20162023 (USD Million)

Table 10 Smart Contracts: Market Size By Region, 20162023 (USD Million)

Table 11 Content Security: Market Size By Region, 20162023 (USD Million)

Table 12 Online Gaming: Market Size By Region, 20162023 (USD Million)

Table 13 Payments: Market Size By Region, 20162023 (USD Million)

Table 14 Others: Market Size By Region, 20162023 (USD Million)

Table 15 Market Size By Enterprise Size, 20162023 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Market Size By Region, 20162023 (USD Million)

Table 17 Large Enterprises: Market Size By Region, 20162023 (USD Million)

Table 18 Blockchain in Media, Advertising, and Entertainment Market Size By Region, 20162023 (USD Million)

Table 19 North America: Market Size By Country, 20162023 (USD Million)

Table 20 North America: Market Size By Provider, 20162023 (USD Million)

Table 21 North America: Market Size By Application, 20162023 (USD Million)

Table 22 North America: Market Size By Enterprise Size, 20162023 (USD Million)

Table 23 Europe: Market Size By Country, 20162023 (USD Million)

Table 24 Europe: Market Size By Provider, 20162023 (USD Million)

Table 25 Europe: Market Size By Application, 20162023 (USD Million)

Table 26 Europe: Market Size By Enterprise Size, 20162023 (USD Million)

Table 27 Asia Pacific: Blockchain in Media, Advertising, and Entertainment Market Size By Country, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size By Provider, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size By Application, 20162023 (USD Million)

Table 30 Asia Pacific: Market Size By Enterprise Size, 20162023 (USD Million)

Table 31 Latin America: Market Size By Country, 20162023 (USD Million)

Table 32 Latin America: Market Size By Provider, 20162023 (USD Million)

Table 33 Latin America: Market Size By Application, 20162023 (USD Million)

Table 34 Latin America: Market Size By Enterprise Size, 20162023 (USD Million)

Table 35 Middle East and Africa: Blockchain in Media, Advertising, and Entertainment Market Size By Subregion, 20162023 (USD Million)

Table 36 Middle East and Africa: Market Size By Provider, 20162023 (USD Million)

Table 37 Middle East and Africa: Market Size By Application, 20162023 (USD Million)

Table 38 Middle East and Africa: Market Size By Enterprise Size, 20162023 (USD Million)

Table 39 New Product Launches and Product Upgradations, 20152018

Table 40 Partnerships and Collaborations, 20162018

Table 41 Business Expansions, 20172018

List of Figures (46 Figures)

Figure 1 Global Blockchain in Media, Advertising, and Entertainment Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Blockchain in Media, Advertising, and Entertainment Market: Assumptions

Figure 9 North America is Estimated to Have the Largest Market Share in 2018

Figure 10 Market Snapshot By Provider, 2017

Figure 11 Market Snapshot By Application, 2017

Figure 12 Market Snapshot By Enterprise Size, 2017

Figure 13 The Global Blockchain in Media, Advertising, and Entertainment Market is Expected to Witness Significant Growth During the Forecast Period

Figure 14 Payments Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Application Providers Segment and North America are Estimated to Have the Largest Market Shares in the Market in 2018

Figure 16 Asia Pacific is Expected to Register the Highest CAGR During the Forecast Period

Figure 17 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 18 North America is Estimated to Have the Largest Market Share in 2018

Figure 19 Asia Pacific is Expected to Be the Best Region for Investments During the Forecast Period

Figure 20 Market Drivers, Restraints, Opportunities, and Challenges

Figure 21 Evolution of the Blockchain Market

Figure 22 Application Providers Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Payments Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 North America is Estimated to Hold the Largest Market Size in 2018

Figure 26 Asia Pacific is Expected to Register the Fastest Growth During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Payments Application is Projected to Hold the Largest Market Size By 2023

Figure 29 Payments Application is Projected to Account for the Largest Market Size in Europe By 2023

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Payments Application is Projected to Account for the Largest Market Size in Asia Pacific By 2023

Figure 32 Payments Application is Estimated to Hold the Largest Market Size in Latin America in 2018

Figure 33 Payments Application is Estimated to Account for the Largest Market Size in Middle East and Africa in 2018

Figure 34 Key Developments By the Major Players in the Blockchain in Media, Advertising, and Entertainment Market, 20152018

Figure 35 IBM: Company Snapshot

Figure 36 IBM: SWOT Analysis

Figure 37 Microsoft: Company Snapshot

Figure 38 Microsoft: SWOT Analysis

Figure 39 SAP: Company Snapshot

Figure 40 SAP: SWOT Analysis

Figure 41 Accenture: Company Snapshot

Figure 42 Accenture: SWOT Analysis

Figure 43 AWS: Company Snapshot

Figure 44 AWS: SWOT Analysis

Figure 45 Oracle: Company Snapshot

Figure 46 Infosys: Company Snapshot

Growth opportunities and latent adjacency in Blockchain in Media, Advertising, and Entertainment Market