Insights-as-a-Service Market by Application (Revenue Cycle Management, Governance, Risk & Compliance, Customer Life Cycle Management), Type, Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2021

[127 Pages Report] The Insights-as-a-Service market size is estimated to grow from USD 1.16 billion in 2016 to USD 3.33 billion by 2021, at an estimated Compound Annual Growth Rate (CAGR) of 23.5%. The Insights-as-a-Service report aims at estimating the market size and future growth potential of the market across different segments, such as type, application, deployment model, organization size, industry vertical, and region. The primary objectives of the report is to provide a detailed analysis of the major factors influencing the growth of this market (drivers, restraints, opportunities, industry specific challenges, and burning issues) and analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders.

Market Dynamics

Drivers

- Increasing market competition

- Increased need for customer management

- Emergence of IoT

- Rising big data

Restraints

- Data security concern

Opportunities

- Specialized insights-as-a-service vendors

Challenges

- Difficulty in integrating the data

- Less skilled professionals

Increased need for customer management drives the global insights-as-a-service market

Customer management is emerging as a popular business strategy that encompasses all marketing activities directed towards establishing, developing, and maintaining customer relationships. It enables various industries to identify and target their most profitable customers. The effective customer management involves advance marketing strategies that depend on the understanding of various needs of customers at different phases. Cloud-based Customer Relationship Management (CRM) draws the relationship between perception & satisfaction, commitment & loyalty that underline the significance in various industries. Competition and globalizations are forcing the companies to focus strongly on CRM to be productive and profitable. Better customer response will help organizations to understand their requirement and come up with satisfied products and solutions. This has led to the increasing need for insights-as-a-service as it helps to collect data, refine & predict data, and eventually derive useful insights through it. Moreover, this can also help companies to improve customer experience in real-time and gain full visibility into customer cycle.

The following are the major objectives of the study.

- To describe and forecast the global insights-as-a-service market on the basis of type, application, industry vertical, deployment model, organization size, and region

- To forecast the market size of market segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide strategic profiles of the key players in the market to comprehensively analyze the core competencies1 and to draw competitive landscape for the market

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities in the market

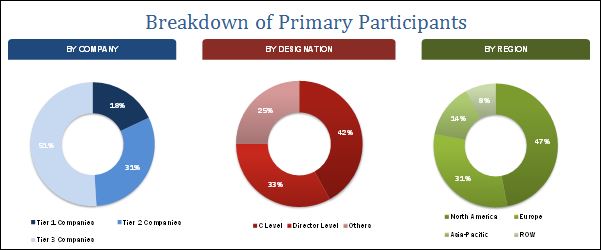

During this research study, major players operating in the insights-as-a-service market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The Insights-as-a-Service market comprises number of intermediaries involved in the ecosystem of this market space. It starts with service providers such as Oracle, Accenture Plc, IBM, Deloitte Touche Tohmatsu Limited, Capgemini, Dell EMC, NTT Data, GoodData, SmartFocus, and Zephyr Health. Other stakeholders of the Insights-as-a-Service include cloud vendors, cloud brokers, and analytics solution providers, Independent Software Vendors (ISVs), platform providers, consultancy firms/advisory firms, and training & education service providers.

Target Audience

- Consultancy firms/advisory firms

- Training and education service providers

- Cloud vendors

- Analytics solution providers

- Service providers

- Platform providers

“The research study answers several questions for the stakeholders, primarily which market segments to focus in during the next two to five years for prioritizing the efforts and investments”.

Scope of the Report

The research report categorizes the Insights-as-a-Service market to forecast the revenues and analyze the trends in each of the following sub-markets:

By Type

- Predictive Insights

- Descriptive Insights

- Prescriptive Insights

By Application

- Revenue Cycle Management

- Governance, Risk, and Compliance

- Branding and Marketing Management

- Customer Life Cycle Management

- Strategy Management

- Supply Chain Management

- Others

By Industry Vertical

- BFSI

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Energy and Utilities

- Manufacturing

- Telecommunication and IT

- Government and Public Sector

- Others

By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium Enterprise (SME)

- Large enterprise

By Region

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Vendor Comparison Analysis

- Vendor comparison analysis provides information about major players that offer insights-as-a-service solutions and outlines the findings and analysis on how well each insights-as-a-service market vendor performs within our criteria.

Geographic Analysis

- Further breakdown of the European Insights-as-a-Service market

- Further breakdown of the APAC Insights-as-a-Service market

- Further breakdown of the MEA Insights-as-a-Service market

- Further breakdown of the Latin American Insights-as-a-Service market

Company Information

- Detailed analysis and profiling of additional market players

The Insights-as-a-Service market is expected to grow from USD 1.16 billion in 2016 to USD 3.33 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 23.5% during the forecast period. The major drivers of this market include better business with new revenue streams, increasing focus on cloud deployment model, and rising need for understanding customer behavior to focus on marketing and sales activities.

Insights-as-a-service is defined as a type of cloud service, which is involved in providing useful information through raw data. It not only helps in providing insights to business corporations but also provides concrete steps required to leverage these insights for achieving business goals. The value of the data was much higher than the last few years and it can be weighed with the amount of efforts taken to analyze it and in converting it into actionable data. But the shift from data to insights became more prominent due to its effectiveness at penetrating new markets, developing new technology enabled revenue cycles and more efficient in their operations.

The Insights-as-a-Service market report has been broadly classified into types. Prescriptive insight market is expected to grow at the highest CAGR due to its ability to forecast the events as well as to provide solutions to tackle them, followed by predictive insights. large companies successfully implementing this approach to optimize production and scheduling in supply chain. The growing demand of Insights-as-a-Service is increasing the demand of these types widely.

The retail and consumer goods vertical has the highest growing CAGR during the forecast period. This vertical is expected to grow rapidly in the insights services adoption as this industry focus on customer experience. Enhancement in customer experience is an important factor to maintain competitiveness, which will provide emerging players in this sector an opportunity to grow faster.

APAC is expected to be growing at a higher rate in the near future owing to large investments being made in the data insights services in this region to make better customer experiences and streamline the business operations. Industry verticals across the region are fast maturing in their aptitudes to leverage the Insights-as-a-Service technology. Data driven industries such as BFSI, retail & consumer goods, media & communications, and services (including Internet companies) are leading in high adoption and capitalization of their data assets.

Insights-as-a-service applications streamlines and standardize BI processes and allows end users to make confident decisions

Revenue Cycle Management

Revenue Cycle Management (RCM) is the financial process used by healthcare and life sciences system, BFSI sector and by other industry verticals as well. RCM consolidates financial data and patient care chapters to provide insights into organization’s account receivables. RCM application in Insights-as-a- Service market provides advanced analytics with actionable plan that helps in effective business planning and accurate forecasting. Organizations across the globe are adopting RCM application to identify anomalies in the revenue cycle, reduce bad debt & understand its root causes, guide business strategy by identifying service line profitability, and to help improve customer onboarding.

Governance, Risk, and Compliance Management

Predictive, adaptive, and integrated Governance, Risk, and Compliance (GRC) management application within Insights-as-a-Service ecosystem maintains end-users’ current risk and compliance processes while improving overall efficiency and performance. Data integration & aggregation and actionable insights using advanced analytics are the two vital components of GRC application platform. Data integration and aggregation empowers the GRC platform with risk and compliance information from across the industry by automatically importing key data points and enables businesses to extend across unlimited entry points in a fully informed GRC environment. While actionable insights component maps a path towards opportunity with deep insights for enterprise-wide risk and compliance initiatives. Insights-as-a-Service also helps GRC management application in risk assessment & adjustment.

Customer lifecycle management

Customer lifecycle management focuses on elevating the customer’s experience with the brand from product/service evaluation such as purchasing, using, and maintaining loyalty to subscription renewal/upgrade. Business mode of operations and market competition has shifted overall economy from product-centric to customer-centric. Companies considering Insight-as-a-Service for customer lifecycle management stand a far greater chance of retaining them. With the growing demand for customer life cycle management in organizations, Insights-as-a- Service extract actionable insights from available data and embed it back into the organizational process.

Branding and marketing management

Branding and marketing management helps organizations in delivering the right customer acquisition, growth, retention & profitability initiatives and rate brands and channels across digital, social, and traditional media, to maximize Return on Marketing Investment (ROMI). Leveraging big data technology experience, Insight-as-a-Service offer comprehensive, integrated, and technology-enabled insights and embed it back on BI architecture to provide meaningful and actionable insights when it comes to branding and marketing management. Companies across the globe are implementing Insights-as-a-Service within their business function for market intelligence, branding management, loyalty management, and campaign analytics.

Strategy Management

With the increasing number of competitions among the enterprises, many enterprises are using big data and analytics to generate business intelligence with the help of analytical tools based on latest technologies to match the specific needs. Insights-as-a-Service offers an ever-increasing demand for information and analysis about the products and services of the enterprises. Large enterprises are focusing on data driven strategies because it generates high competitive differentiation among the enterprise about the products pricing and services. Enterprises are identifying, collecting, and managing multiple sources of data using advanced analytical models for predicting and optimizing the enterprise results. The Insights-as-a-Service helps to provides most critical business decisions such as deployment of the right technology architecture and capabilities through data and analytics. In addition, the Insights-as-a- Service market offers services that are reliable, accurate, and relevant to the enterprise and the market demand.

Supply Chain Management

The increasing number of competitions and globalization created challenges for the enterprises in terms of suppliers, manufacturing units, and distributions of the products. The strong growth of business opportunities and growing product variance specifically tailored for the scattered customers has generated complexities in supply chain. This complexity need to be monitored closely for the enhanced performance of supply chain management. These issues can be solved with the insights derived from the embedded analytics in the supply chain management. The Insights-as-a-Service provides optimization in supply chain functions and minimizes the gaps to help manage market pressures and offers financial performance to the enterprises. Insights-as-a-Service helps enterprises to make real-time business decisions to increase supply chain responsiveness and optimize cost.

The need for better business revenue cycle management and customer life cycle management are the driving factors in the market. Permission issues regarding data usage and privacy concern are some of the major restraints and challenges in the market. The key vendors in the Insights-as-a-Service market are IBM, Capgemini, Accenture Plc, Deloitte Touche Tohmatsu Limited and Oracle Corporation. These players have adopted various strategies, such as new product developments, acquisitions, and partnerships, to serve the Insights-as-a-Service market. Continuous technology innovation is an area of focus for these players in order to maintain its competitive position in the market and promote customer satisfaction.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for insights-as-a-service?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Report

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Global Insight-As-A-Service Market: Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Insights-As-A-Service Market

4.2 Deployment Model

4.3 Global Market Share of Top Five Applications and Regions

4.4 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Application

5.3.3 By Deployment Model

5.3.4 By Organization Size

5.3.5 By Industry Vertical

5.3.6 By Region

5.4 Insights-As-A-Service Market: By Business Function

5.4.1 Human Resource

5.4.2 Information Technology

5.4.3 Finance

5.4.4 Operation

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Increasing Market Competition

5.5.1.2 Increased Need for Customer Management

5.5.1.3 Emergence of Iot

5.5.1.4 Rising Big Data

5.5.2 Restraints

5.5.2.1 Data Security Concern

5.5.3 Opportunities

5.5.3.1 Specialized Insights-As-A-Service Vendors

5.5.4 Challenges

5.5.4.1 Difficulty in Integrating the Data

5.5.4.2 Less Skilled Professionals

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Demand Overview

6.4 Strategic Benchmarking

7 Insights-As-A-Service Market Analysis, By Type (Page No. - 42)

7.1 Introduction

7.2 Descriptive Insights

7.3 Predictive Insights

7.4 Prescriptive Insights

8 Market Analysis, By Application (Page No. - 47)

8.1 Introduction

8.2 Revenue Cycle Management

8.3 Governance, Risk, and Compliance Management

8.4 Customer Life-Cycle Management

8.5 Branding and Marketing Management

8.6 Strategy Management

8.7 Supply Chain Management

9 Insights-As-A-Service Market Analysis, By Deployment Model (Page No. - 54)

9.1 Introduction

9.2 Public Cloud

9.3 Private Cloud

9.4 Hybrid Cloud

10 Market Analysis, By Organization Size (Page No. - 58)

10.1 Introduction

10.2 Large Enterprise

10.3 Small and Medium Enterprise

11 Insights-As-A-Service Market Analysis, By Vertical (Page No. - 62)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance (BFSI)

11.3 Healthcare and Life Sciences

11.4 Retail and Consumer Goods

11.5 Energy and Utilities

11.6 Manufacturing

11.7 Telecommunication and IT

11.8 Government and Public Sector

11.9 Others

12 Geographic Analysis (Page No. - 70)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.4 Asia-Pacific (APAC)

12.5 Middle East and Africa (MEA)

12.6 Latin America

13 Competitive Landscape (Page No. - 91)

13.1 Overview

13.2 Competitive Situations and Trends

13.2.1 Partnerships

13.2.2 New Product Launches

13.2.3 Acquisitions

14 Company Profiles (Page No. - 95)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 International Business Machines Corporation

14.3 Capgemini

14.4 Accenture PLC

14.5 Oracle Corporation

14.6 Deloitte Touche Tohmatsu Limited

14.7 EMC Corporation (Acquired By Dell)

14.8 NTT Data Corporation

14.9 Good Data

14.10 Zephyr Health

14.11 Smartfocus

14.12 Key Innovators

15 Appendix (Page No. - 118)

15.1 Key Industry Insights

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (68 Tables)

Table 1 Insights-As-A-Service Market Size 2014–2021 (USD Million)

Table 2 Market Size, By Type, 2014-2021 (USD Million)

Table 3 Descriptive Insights: Market Size, By Region, 2014-2021 (USD Million)

Table 4 Predictive Insights: Market Size, By Region, 2014-2021 (USD Million)

Table 5 Prescriptive Insights: Market Size, By Region, 2014-2021 (USD Million)

Table 6 Market Size, By Application, 2014-2021 (USD Million)

Table 7 Revenue Cycle Management: Market Size, By Region, 2014-2021 (USD Million))

Table 8 Governance, Risk, and Compliance Management: Market Size, By Region, 2014-2021 (USD Million)

Table 9 Customer Life-Cycle Management: Market Size, By Region, 2014-2021 (USD Million)

Table 10 Branding and Marketing Management: Market Size, By Region, 2014-2021 (USD Million)

Table 11 Strategy Management: Market Size, By Region, 2014-2021 (USD Million)

Table 12 Supply Chain Management: Market Size, By Region, 2014-2021 (USD Million)

Table 13 Insights-As-A-Service Market Size, By Deployment Model, 2014-2021 (USD Million)

Table 14 Public Cloud: Market Size, By Region, 2014-2021 (USD Million)

Table 15 Private Cloud: Market Size, By Region, 2014-2021 (USD Million)

Table 16 Hybrid Cloud: Market Size, By Region, 2014-2021 (USD Million)

Table 17 Market Size, By Organization Size, 2014-2021 (USD Million)

Table 18 Large Enterprise: Market Size, By Region, 2014-2021 (USD Million)

Table 19 Small and Medium Enterprises: Market Size, By Region, 2014-2021 (USD Million)

Table 20 Insights-As-A-Service Market Size, By Vertical, 2014-2021 (USD Million)

Table 21 Banking, Financial Services, and Insurance: Market Size, By Region, 2014-2021 (USD Million)

Table 22 Healthcare and Life Sciences: Market Size, By Region, 2014-2021 (USD Million)

Table 23 Retail and Consumer Goods: Market Size, By Region, 2014-2021 (USD Million)

Table 24 Energy and Utilities: Market Size, By Region, 2014-2021 (USD Million)

Table 25 Manufacturing: Market Size, By Region, 2014-2021 (USD Million)

Table 26 Telecommunication and IT: Market Size, By Region, 2014-2021 (USD Million)

Table 27 Government and Public Sector: Market Size, By Region, 2014-2021 (USD Million)

Table 28 Others: Market Size, By Region, 2014-2021 (USD Million)

Table 29 Insights-As-A-Service Market Size, By Region, 2014-2021 (USD Million)

Table 30 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 31 North America: Market Size, By Type, 2014-2021 (USD Million)

Table 32 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 33 North America: Market Size, By Vertical, 2014-2021 (USD Million)

Table 34 North America: Market Size, By Deployment Model, 2014-2021 (USD Million)

Table 35 North America: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 36 United States: Insights-As-A-Service Market Size, By Type, 2014-2021 (USD Million)

Table 37 United States: Market Size, By Application, 2014-2021 (USD Million)

Table 38 United States: Market Size, By Vertical, 2014-2021 (USD Million)

Table 39 United States: Market Size, By Deployment Model 2014-2021 (USD Million)

Table 40 United States: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 41 Canada: Market Size, By Type, 2014-2021 (USD Million)

Table 42 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 43 Canada: Market Size, By Vertical, 2014-2021 (USD Million)

Table 44 Canada: Market Size, By Deployment Model 2014-2021 (USD Million)

Table 45 Canada: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 46 Europe: Insights-As-A-Service Market Size, By Type, 2014-2021 (USD Million)

Table 47 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 48 Europe: Market Size, By Vertical, 2014-2021 (USD Million)

Table 49 Europe: Market Size, By Deployment Model 2014-2021 (USD Million)

Table 50 Europe: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Type, 2014-2021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Application, 2014-2021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Vertical, 2014-2021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Deployment Model 2014-2021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 56 Middle East and Africa: Insights-As-A-Service Market Size, By Type, 2014-2021 (USD Million)

Table 57 Middle East and Africa: Market Size, By Application, 2014-2021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Vertical, 2014-2021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Deployment Model 2014-2021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 61 Latin America: Market Size, By Type, 2014-2021 (USD Million)

Table 62 Latin America: Market Size, By Application, 2014-2021 (USD Million)

Table 63 Latin America: Market Size, By Vertical, 2014-2021 (USD Million)

Table 64 Latin America: Market Size, By Deployment Model, 2014-2021 (USD Million)

Table 65 Latin America: Market Size, By Organization Size, 2014-2021 (USD Million)

Table 66 Partnerships, 2013–2016

Table 67 New Product Launches, 2013–2016

Table 68 Acquisitions, 2013–2016

List of Figures (48 Figures)

Figure 1 Global Insights-As-A-Service Market: Market Segmentation

Figure 2 Global Insight-As-A-Service Market: Research Design

Figure 3 Breakdown of Primary Interview: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 The Demand for Insights-As-A-Service is Increasing in SMES During the Forecast Period

Figure 8 Customer Lifecycle Management is Expected to Grow During the Forecast Period

Figure 9 Prescriptive Insights has High Demand for Insights-As-A-Service and is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 North America is Expected to Lead the Market Followed By Europe

Figure 11 Lucrative Growth Prospects in the Market

Figure 12 Hybrid Cloud Deployment Model is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 13 Revenue Cycle Management and North America By Region Holds the Largest Market Share in 2016

Figure 14 Market Regional Lifecycle: Asia-Pacific Exhibits Potential Growth During the Forecast Period

Figure 15 Insights-As-A-Service Market: Evolution

Figure 16 Market Segmentation By Type

Figure 17 Market Segmentation By Application

Figure 18 Market Segmentation By Deployment Model

Figure 19 Market Segmentation By Organization Size

Figure 20 Market Segmentation By Industry Vertical

Figure 21 Market Segmentation By Region

Figure 22 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Value Chain: Insights-As-A-Service Market

Figure 24 Strategic Benchmarking: Insights-As-A-Service

Figure 25 Data Insights Workflow

Figure 26 Descriptive Insights Service Type is Expected to Have the Largest Market Size in 2016

Figure 27 Revenue Cycle Management is Expected to Hold the Largest Market Size in 2016

Figure 28 Public Cloud Model is Expected to Hold the Largest Market Size in 2016

Figure 29 Large Enterprises Segment is Expected to Hold the Largest Market Size in 2016

Figure 30 Banking, Financial Services, and Insurance Vertical Expected to Hold the Largest Market Size in 2016

Figure 31 North America is Expected to Have the Largest Market Size in 2016

Figure 32 North America Market Snapshot

Figure 33 Asia-Pacific Market Snapshot

Figure 34 Companies Adopted the Strategy of Partnerships as the Key Growth Strategy From 2013 to 2016

Figure 35 Market Evaluation Framework

Figure 36 Battle for Market Share: Partnerships Was the Key Strategy Adopted By Key Players in Insights-As-A-Service Market During the Period 2013–2016

Figure 37 Geographic Revenue Mix of Top Market Players

Figure 38 International Business Machines Corporation: Company Snapshot

Figure 39 International Business Machines Corporation: SWOT Analysis

Figure 40 Capgemini: Company Snapshot

Figure 41 Capgemini: SWOT Analysis

Figure 42 Accenture PLC: Company Snapshot

Figure 43 Accenture PLC: SWOT Analysis

Figure 44 Oracle Corporation: Company Snapshot

Figure 45 Oracle Corporation: SWOT Analysis

Figure 46 Deloitte Touche Tohmatsu Limited: Company Snapshot

Figure 47 Deloitte Touche Tohmatsu Limited: SWOT Analysis

Figure 48 NTT Data Corporation: Company Snapshot

Growth opportunities and latent adjacency in Insights-as-a-Service Market

Interested in healthcare market in US

Interested in IaaS market in mining sector