Blockchain AI Market by Technology (ML & NLP), Component (Platform/Tools & Services), Deployment Mode, Organization Size, Application (Smart Contracts, Payments, & Asset Tracking), Vertical (BFSI, Automotive, & Media), and Region - Global Forecast to 2025

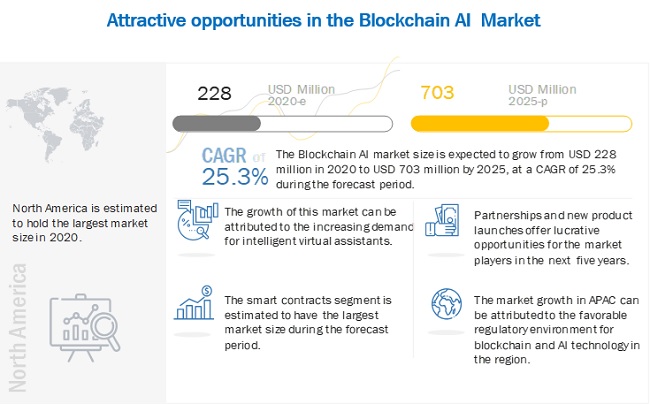

[220 Pages Report] The global blockchain AI market size is projected to grow from USD 228 million in 2020 to USD 703 million by 2025, at a Compound Annual Growth Rate (CAGR) of 25.3% during the forecast period. The increasing venture capital funding and growing investments in Blockchain AI technology to drive market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis on Blockchain AI Market

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. The internet ecosystem has been playing a pivotal role all over the globe. Due to the COVID-19 pandemic, the dependency on online businesses has increased significantly. BFSI, healthcare and life sciences, telecom & IT, manufacturing, automotive, and media & entertainment, among others, are leveraging the internet to provide necessary services to consumers.

Market Dynamics

Driver: Blockchain AI technologies enable data monetization

Data monetization would make both AI and advanced blockchain easily accessible to smaller companies. The developing and growing AI technology is costly for organizations, especially those that do not own data sets. A decentralized market would create space for such companies where it is otherwise too expensive. Therefore, Blockchain AI is the ultimate enabler of data monetization, which is expected to be one of the biggest driving factors for the blockchain AI market.

Restraint: Limited number of Blockchain AI experts

Blockchain AI is a complex system, and for developing, managing, and implementing Blockchain AI systems, companies require a workforce with certain skill sets. The Blockchain AI technology is in a nascent stage. This technology provides enormous benefits; however, even after a lot of Blockchain AI solution vendors have entered the market, the adoption of blockchain solutions is still not up to the mark. Enterprises adopting this technology need skilled staff that has in-depth knowledge of the blockchain AI applications.

Opportunity: Enhancement in the acceptance of cloud-based security solutions

Cloud-based security solutions offer great benefits, such as cost-effectiveness, easy deployment, security, and single management facility across all endpoint devices. Cloud-based solutions reduce upfront costs and eliminate concerns regarding the maintenance of servers. Thus, cloud-based Blockchain AI solutions are useful as they improve scalability and are cost-effective for SMEs and organizations that find on-premises solutions expensive. The increasing adoption of cloud-based technologies and the Internet of Things (IoT) is a great opportunity for AI solution providers, eliminating various concerns related to expenditure and installation expenses.

Challenge: Decentralization and data control to obstruct the violation of privacy

By eliminating the need for an intermediary when sharing data, decentralization puts the user completely in charge of their data. Therefore, rather than have multiple data sets held by different companies, users retain their data ownership and can determine who has access to the same. Blockchain AI gives a unique and perfect provenance trail of where the data comes from, who owns it, and if there is a problem with the data, how would one take it out of the analysis.

BFSI vertical to grow at the highest CAGR during the forecast period

The BFSI segment is focusing on significant technologies, which help secure transactions for customers. In addition, the technology shift from centralized infrastructure management to the distributed ecosystem is paving the way for new business models in payments, internet banking, and financial transaction technologies by leveraging the power of both AI and blockchain solutions. Blockchain and AI solve different financial issues as a standalone solution, but they can work together to improve many business processes in the financial industry to make it smarter and perform more effectively. Therefore, BFSI registers the highest growth rate during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

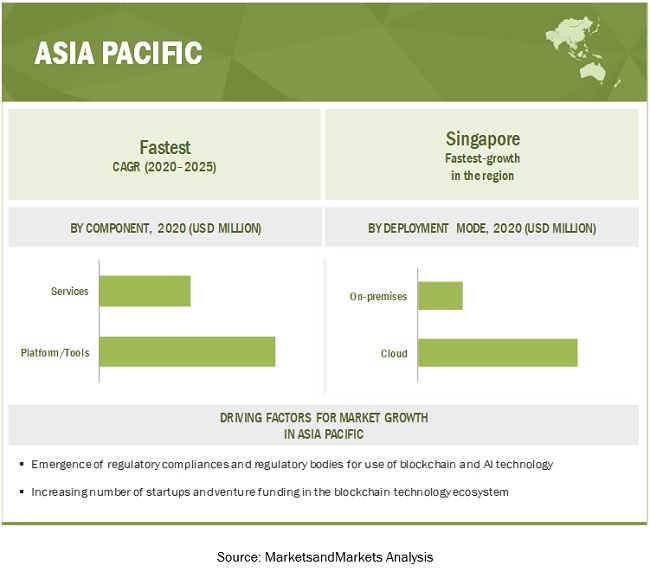

APAC to account for the highest CAGR during the forecast period

Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and is expected to record the highest CAGR in the global Blockchain AI market during the forecast period. APAC constitutes major economies, such as China, Japan, and Singapore, which are expected to register high growth rates in the Blockchain AI market. Industries such as financial institutions, financial institutions, healthcare & life sciences, telecom & IT, manufacturing, automotive, media, and entertainment are expected to adopt Blockchain AI solutions at the region's highest rate. Companies operating in APAC would benefit from flexible economic conditions, industrialization-motivated policies, political transformation, and the growing digitalization, which is expected to impact the business community significantly.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the Blockchain AI market include Figure Technologies (US), Cyware Labs (US), Core Scientific (US), NetObjex (US), Fetch.ai (UK), Ai-Blockchain (US), AlphaNetworks (US), Bext360 (US), Blackbird.AI (US), BurstIQ (US), Chainhaus (US), CoinGenius (US), Computable (US), Finalze (US), Gainfy (US), Hannah Systems (US), LiveEdu (UK), Mobs (US), Neurochain Tech (France), Numerai (US), SingularityNET (The Netherlands), Stowk (US), Synapse AI (US), Talla (US), Verisart (US), VIA (US), Vytalyx (US), Wealthblock.AI (US), and Workdone (US).

The study includes an in-depth competitive analysis of these key players in the Blockchain AI market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20182025 |

|

Base year considered |

2019 |

|

Forecast period |

20202025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology, Component, Application, Deployment Mode, Organization Size, Vertical, and Regions. |

|

Geographies covered |

North America, Europe, APAC, and RoW. |

|

Major companies covered |

Figure Technologies (US), Cyware Labs (US), Core Scientific (US), NetObjex (US), Fetch.ai (UK), Ai-Blockchain (US), AlphaNetworks (US), Bext360 (US), Blackbird.AI (US), BurstIQ (US), Chainhaus (US), CoinGenius (US), Computable (US), Finalze (US), Gainfy (US), Hannah Systems (US), LiveEdu (UK), Mobs (US), Neurochain Tech (France), Numerai (US), SingularityNET (The Netherlands), Stowk (US), Synapse AI (US), Talla (US), Verisart (US), VIA (US), Vytalyx (US), Wealthblock.AI (US), and Workdone (US). |

This research report categorizes the Blockchain AI to forecast revenues and analyze trends in each of the following submarkets:

Based on technology:

- ML

- NLP

- Context-Aware Computing

- Computer Vision

Based on the component:

- Platform/Tools

- Services

- Consulting

- System Integration and Deployment

- Support and Maintenance

Based on applications:

- Smart Contracts

- Payment and settlement

- Data Security

- Data Sharing/Communication

- Asset Tracking and Management

- Logistics and supply chain management

- Business process optimization

- Other applications*

Based on the deployment mode:

- Cloud

- On-premises

Based on organization size:

- Large Enterprises

- SMEs

Based on the vertical:

- BFSI

- Telecom and IT

- Healthcare and Life science

- Manufacturing

- Media and Entertainment

- Automotive

- Other verticals**

Based on the region:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- Rest of Europe (EU and Non-EU countries)

- APAC

- China

- Japan

- Singapore

- Rest of APAC (Indonesia, Taiwan, and South Korea)

- ROW

- Middle East & Africa (MEA)

- Latin America

Recent Developments:

- In September 2020, BurstIQ partnered with Tech Mahindra. The partnership is offering both solutions to Tech Mahindras extensive network of clients. In addition to solving critical high-cost needs in the area of data integrity and data exchange, both solutions provide a foundation on which Tech Mahindras clients can support a broad array of connected services: B2B data exchange, consumer engagement, dynamic consent, and more.

- In September 2020, Cyware partnered with Cofense Intelligence, the integration will allow users to incorporate high-fidelity, human-verified phishing threat intelligence data from Cofense into Cyware's threat intelligence platform, CTIX.

- In August 2020, BurstIQ launched a full developer toolset for blockchain-enabled applications and services.

- In August 2020, Fetch.ai partnered with Waves. The partnership aimed to conduct joint R & D to bring increased multi-chain capabilities to Fetch.ais system of Autonomous Economic Agents (AEAs).

- In February 2020, BurstIQ expanded its partnership with Ehave to bring Ehave's dashboard compliant with HIPAA and GDPR standards using blockchain technology.

- In January 2020, Bext360 partnered with fashion giants to make organic cotton traceable.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Blockchain AI market?

The global Blockchain AI market size is expected to grow from USD 228 million in 2020 to USD 703 million by 2025, at a Compound Annual Growth Rate (CAGR) of 25.3% during the forecast period.

Which region has the highest market share in the Blockchain AI market?

North America followed is expected to hold the largest market share in the Blockchain AI market.

Which application segment is expected to witness a higher adoption rate in the coming years?

The data security segment is expected to hold the highest growth rate during the forecast period. Merging AI with blockchain can not only increase operational efficiency but also ensures a more secure environment. AI helps users understand and analyze the voluminous data; however, there are chances of data hacking or leakage. The AI technology powered by blockchain provides a decentralized database that protects data related to AI, which results in enhanced security and quick and transparent operations. The rapid advancements in technologies have given organizations challenges that are related to data security. Hence, there is significant adoption of data security applications across the globe.

Who are the major vendors in the Blockchain AI market?

Key and innovative vendors in the Blockchain AI market include Figure Technologies (US), Cyware Labs (US), Core Scientific (US), NetObjex (US), Fetch.ai (UK), Ai-Blockchain (US), AlphaNetworks (US), Bext360 (US), Blackbird.AI (US), BurstIQ (US), Chainhaus (US), CoinGenius (US), Computable (US), Finalze (US), Gainfy (US), Hannah Systems (US), LiveEdu (UK), Mobs (US), Neurochain Tech (France), Numerai (US), SingularityNET (The Netherlands), Stowk (US), Synapse AI (US), Talla (US), Verisart (US), VIA (US), Vytalyx (US), Wealthblock.AI (US), and Workdone (US).

Which vertical segment is expected to grow at the highest CAGR during the forecast period?

The BFSI segment is focusing on significant technologies, which help secure transactions for customers. In addition, the technology shift from centralized infrastructure management to the distributed ecosystem is paving the way for new business models in payments, internet banking, and financial transaction technologies by leveraging the power of both AI and blockchain solutions. Blockchain and AI solve different financial issues as a standalone solution. Still, they can work together to improve many business processes in the financial industry to make it smarter and perform more effectively. Therefore, BFSI registers the highest growth rate during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20182020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 6 BLOCKCHAIN AI MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 1 (SUPPLY SIDE): REVENUE FROM PLATFORM/TOOLS AND SERVICES OF BLOCKCHAIN AI VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGYAPPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL PLATFORM/TOOLS AND SERVICES OF BLOCKCHAIN AI VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 3 TOP DOWN (DEMAND SIDE): SHARE OF BLOCKCHAIN AI IN THE OVERALL INFORMATION TECHNOLOGY MARKET

2.4 IMPLICATION OF COVID-19 ON THE BLOCKCHAIN AI MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 BLOCKCHAIN AI MARKET

2.4.1 IMPACT OF COVID-19 PANDEMIC

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 11 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 3 BLOCKCHAIN AI APPLICATIONS

FIGURE 12 GLOBAL BLOCKCHAIN AI MARKET TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

FIGURE 13 MARKET TO WITNESS MODERATE GROWTH DURING THE COVID-19 PERIOD

FIGURE 14 SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

FIGURE 15 MARKET: REGIONAL SNAPSHOT

FIGURE 16 GEOGRAPHIC DISTRIBUTION OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN BLOCKCHAIN AI MARKET

FIGURE 17 INCREASING DEMAND FOR INTELLIGENT VIRTUAL ASSISTANTS TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY TECHNOLOGY, 2020 VS. 2025

FIGURE 18 MACHINE LEARNING SEGMENT TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY COMPONENT, 2020 VS. 2025

FIGURE 19 PLATFORM/TOOLS SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY SERVICE, 2020 VS. 2025

FIGURE 20 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 BLOCKCHAIN AI MARKET, BY DEPLOYMENT MODE, 2020 VS. 2025

FIGURE 21 CLOUD DEPLOYMENT MODE TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY ORGANIZATION SIZE, 2020 VS. 2025

FIGURE 22 LARGE ENTERPRISES SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.7 MARKET, BY APPLICATION, 2020 VS. 2025

FIGURE 23 SMART CONTRACTS SEGMENT TO GROW AT THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

4.8 MARKET, BY VERTICAL, 20202025

FIGURE 24 BANKING, FINANCIAL SERVICES AND INSURANCE SEGMENT TO HOLD THE HIGHEST SHARE DURING THE FORECAST PERIOD

4.9 MARKET INVESTMENT SCENARIO

FIGURE 25 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 MARKET DYNAMICS

FIGURE 26 BLOCKCHAIN AI MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 blockchain AI technologies enable data monetization

5.1.1.2 Increasing demand for intelligent virtual assistants

5.1.1.3 Simplification of processes along with transparency, responsibility, and immutability

5.1.2 RESTRAINTS

5.1.2.1 Limited number of blockchain AI experts

5.1.2.2 Uncertain regulatory and compliance environment

5.1.3 OPPORTUNITIES

5.1.3.1 Enhancement in the acceptance of cloud-based security solutions

5.1.3.2 Increasing demand for real-time data analysis, enhanced visibility, and proactive maintenance

5.1.3.3 Growing number of partnerships and acquisitions in the market

5.1.4 CHALLENGES

5.1.4.1 Decentralization and data control to obstruct the violation of privacy

5.1.4.2 Improving operational efficiency in the manufacturing industry

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.3 INDUSTRY TRENDS

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: BLOCKCHAIN AI MARKET

5.5 BLOCKCHAIN AI ECOSYSTEM

FIGURE 28 BLOCKCHAIN PROVIDER ECOSYSTEM

5.6 BLOCKCHAIN ASSOCIATIONS AND CONSORTIUMS

5.6.1 ENTERPRISE ETHEREUM ALLIANCE

5.6.2 HYPERLEDGER CONSORTIUM

5.6.3 GLOBAL BLOCKCHAIN BUSINESS COUNCIL

5.6.4 BLOCKCHAIN COLLABORATIVE CONSORTIUM

5.6.5 R3CEV BLOCKCHAIN CONSORTIUM

5.6.6 CONTINUOUS LINKED SETTLEMENT GROUP

5.6.7 GLOBAL PAYMENTS STEERING GROUP

5.6.8 FINANCIAL BLOCKCHAIN SHENZHEN CONSORTIUM

5.6.9 CULEDGER

5.6.10 WALL STREET BLOCKCHAIN ALLIANCE

5.6.11 OTHER BLOCKCHAIN ASSOCIATIONS

5.7 STEPS INVOLVED IN THE IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY

FIGURE 29 STEPS INVOLVED IN THE IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY

5.8 TECHNOLOGY ANALYSIS

5.8.1 BIG DATA ANALYTICS

5.8.2 INTERNET OF THINGS

5.8.3 CLOUD

5.8.4 OTHER TECHNOLOGIES

5.9 PATENT ANALYSIS

FIGURE 30 COUNTRY-SPECIFIC TECHNOLOGY PATENTS, 2019

FIGURE 31 TECHNOLOGY PATENTS, BY COUNTRY, 2018 VS. 2019

FIGURE 32 TECHNOLOGY PATENTS, BY TOP APPLICANT, 2019

5.9.1 BLOCKCHAIN AI PATENTS

FIGURE 33 BLOCKCHAIN PATENTS, BY APPLICANT, 2008-2019

FIGURE 34 AI PATENTS, BY APPLICANT, 2008-2019

5.10 USE CASES

TABLE 4 BLOCKCHAIN AI MARKET: USE CASES

5.11 ADJACENT MARKETS

6 BLOCKCHAIN AI MARKET, BY TECHNOLOGY (Page No. - 83)

6.1 INTRODUCTION

FIGURE 35 COMPUTER VISION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 5 TECHNOLOGY: MARKET SIZE, 20182025 (USD MILLION)

TABLE 6 TECHNOLOGY: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.2 MACHINE LEARNING

6.2.1 MACHINE LEARNING: MARKET DRIVERS

TABLE 7 MACHINE LEARNING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.2.2 DEEP LEARNING

6.2.3 SUPERVISED LEARNING

6.2.4 UNSUPERVISED LEARNING

6.2.5 REINFORCEMENT LEARNING

6.2.6 GENERATIVE ADVERSARIAL NETWORKS

6.2.7 OTHER MACHINE LEARNING TECHNOLOGIES

6.3 NATURAL LANGUAGE PROCESSING

6.3.1 NATURAL LANGUAGE PROCESSING: BLOCKCHAIN AI MARKET DRIVERS

TABLE 8 NATURAL LANGUAGE PROCESSING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.4 CONTEXT-AWARE COMPUTING

6.4.1 CONTEXT AWARE COMPUTING: MARKET DRIVERS

TABLE 9 CONTEXT-AWARE COMPUTING: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

6.5 COMPUTER VISION

6.5.1 COMPUTER VISION: MARKET DRIVERS

TABLE 10 COMPUTER VISION: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

7 BLOCKCHAIN AI MARKET, BY COMPONENT (Page No. - 91)

7.1 INTRODUCTION

FIGURE 36 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 COMPONENT: MARKET SIZE, 20182025 (USD MILLION)

TABLE 12 COMPONENT: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

7.2 PLATFORM/TOOLS

7.2.1 PLATFORM/TOOLS: MARKET DRIVERS

TABLE 13 PLATFORM/TOOLS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

7.3 SERVICES

7.3.1 SERVICES: MARKET DRIVERS

FIGURE 37 SUPPORT AND MAINTENANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 SERVICES: BLOCKCHAIN AI MARKET SIZE, 20182025 (USD MILLION)

TABLE 15 SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

7.3.2 CONSULTING

TABLE 16 CONSULTING: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

7.3.3 SYSTEM INTEGRATION AND DEPLOYMENT

TABLE 17 SYSTEM INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

7.3.4 SUPPORT AND MAINTENANCE

TABLE 18 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

8 BLOCKCHAIN AI MARKET, BY DEPLOYMENT MODE (Page No. - 98)

8.1 INTRODUCTION

FIGURE 38 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 19 DEPLOYMENT MODE: MARKET SIZE, 20182025 (USD MILLION)

TABLE 20 DEPLOYMENT MODE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.2 CLOUD

8.2.1 CLOUD: MARKET DRIVERS

TABLE 21 CLOUD: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.3 ON-PREMISES

8.3.1 ON-PREMISES: MARKET DRIVERS

TABLE 22 ON-PREMISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9 BLOCKCHAIN AI MARKET, BY ORGANIZATION SIZE (Page No. - 102)

9.1 INTRODUCTION

FIGURE 39 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 23 ORGANIZATION SIZE: MARKET SIZE, 20182025 (USD MILLION)

TABLE 24 ORGANIZATION SIZE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 25 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 26 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10 BLOCKCHAIN AI MARKET, BY APPLICATION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 40 DATA SECURITY SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 27 APPLICATION: MARKET SIZE, 20182025 (USD MILLION)

TABLE 28 APPLICATION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10.2 SMART CONTRACTS

10.2.1 SMART CONTRACTS: MARKET DRIVERS

TABLE 29 SMART CONTRACTS: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

10.3 PAYMENT AND SETTLEMENT

10.3.1 PAYMENTS AND SETTLEMENT: MARKET DRIVERS

TABLE 30 PAYMENT AND SETTLEMENT: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10.4 DATA SECURITY

10.4.1 DATA SECURITY: BLOCKCHAIN AI MARKET DRIVERS

TABLE 31 DATA SECURITY: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10.5 DATA SHARING/COMMUNICATION

10.5.1 DATA SHARING/COMMUNICATION: MARKET DRIVERS

TABLE 32 DATA SHARING/COMMUNICATION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10.6 ASSET TRACKING AND MANAGEMENT

10.6.1 ASSET TRACKING AND MANAGEMENT: MARKET DRIVERS

TABLE 33 ASSET TRACKING AND MANAGEMENT: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10.7 LOGISTICS AND SUPPLY CHAIN MANAGEMENT

10.7.1 LOGISTICS AND SUPPLY CHAIN MANAGEMENT: MARKET DRIVERS

TABLE 34 LOGISTICS AND SUPPLY CHAIN MANAGEMENT: BLOCKCHAIN AI MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

10.8 BUSINESS PROCESS OPTIMIZATION

10.8.1 BUSINESS PROCESS OPTIMIZATION: MARKET DRIVERS

TABLE 35 BUSINESS PROCESS OPTIMIZATION: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

10.9 OTHER APPLICATIONS

TABLE 36 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

11 BLOCKCHAIN AI MARKET, BY VERTICAL (Page No. - 115)

11.1 INTRODUCTION

FIGURE 41 TELECOM AND IT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 37 VERTICAL: MARKET SIZE, 20182025 (USD MILLION)

TABLE 38 VERTICAL: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

TABLE 39 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

11.3 TELECOMMUNICATIONS AND IT

11.3.1 TELECOMMUNICATIONS AND IT: MARKET DRIVERS

TABLE 40 TELECOMMUNICATIONS AND IT: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

11.4 HEALTHCARE AND LIFE SCIENCES

11.4.1 HEALTHCARE AND LIFESCIENCES: BLOCKCHAIN AI MARKET DRIVERS

TABLE 41 HEALTHCARE AND LIFE SCIENCE: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

11.5 MANUFACTURING

11.5.1 MANUFACTURING: MARKET DRIVERS

TABLE 42 MANUFACTURING: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

11.6 MEDIA AND ENTERTAINMENT

11.6.1 MEDIA AND ENTERTAINMENT: MARKET DRIVERS

TABLE 43 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

11.7 AUTOMOTIVE

11.7.1 AUTOMOTIVE: MARKET DRIVERS

TABLE 44 AUTOMOTIVE: MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

11.8 OTHER VERTICALS

TABLE 45 OTHER VERTICALS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

12 BLOCKCHAIN AI MARKET BY REGION (Page No. - 123)

12.1 INTRODUCTION

FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 43 SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 44 ASIA PACIFIC TO BE THE HOTSPOT FOR INVESTORS DURING THE FORECAST PERIOD

FIGURE 45 NORTH AMERICA TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY REGION, 20182025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: BLOCKCHAIN AI MARKET DRIVERS

12.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 47 COMPUTER VISION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN NORTH AMERICA

TABLE 47 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

FIGURE 48 NORTH AMERICA: COUNTRY-WISE ANALYSIS

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

12.2.3 UNITED STATES

12.2.4 CANADA

12.3 EUROPE

12.3.1 EUROPE: BLOCKCHAIN AI MARKET DRIVERS

12.3.2 EUROPE: REGULATORY LANDSCAPE

FIGURE 49 NATURAL LANGUAGE PROCESSING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN EUROPE

TABLE 55 EUROPE: MARKET SIZE, BY TECHNOLOGY, 20182025 (USD THOUSAND)

TABLE 56 EUROPE: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY SERVICE, 20182025 (USD THOUSAND)

TABLE 58 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY APPLICATION, 20182025 (USD THOUSAND)

TABLE 61 EUROPE: MARKET SIZE, BY VERTICAL, 20182025 (USD THOUSAND)

FIGURE 50 EUROPE: COUNTRY-WISE ANALYSIS

TABLE 62 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.4 GERMANY

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: BLOCKCHAIN AI MARKET DRIVERS

12.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 52 THE CONTEXT-AWARE COMPUTING SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN ASIA PACIFIC

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 20182025 (USD THOUSAND)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20182025 (USD THOUSAND)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20182025 (USD THOUSAND)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20182025 (USD THOUSAND)

FIGURE 53 ASIA PACIFIC: COUNTRY-WISE ANALYSIS

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

12.4.3 CHINA

12.4.4 JAPAN

12.4.5 SINGAPORE

12.4.6 REST OF ASIA PACIFIC

12.5 REST OF THE WORLD

12.5.1 REST OF THE WORLD: BLOCKCHAIN AI MARKET DRIVERS

12.5.2 REST OF THE WORLD: REGULATORY LANDSCAPE

FIGURE 54 CONTEXT-AWARE COMPUTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD IN THE REST OF THE WORLD

TABLE 71 REST OF THE WORLD: MARKET SIZE, BY TECHNOLOGY, 20182025 (USD THOUSAND)

TABLE 72 REST OF THE WORLD: MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 73 REST OF THE WORLD: MARKET SIZE, BY SERVICE, 20182025 (USD THOUSAND)

TABLE 74 REST OF THE WORLD: MARKET SIZE, BY DEPLOYMENT MODE, 20182025 (USD MILLION)

TABLE 75 REST OF THE WORLD: MARKET SIZE, BY ORGANIZATION SIZE, 20182025 (USD MILLION)

TABLE 76 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 20182025 (USD THOUSAND)

TABLE 77 REST OF THE WORLD: MARKET SIZE, BY VERTICAL, 20182025 (USD THOUSAND)

TABLE 78 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

12.5.3 MIDDLE EAST AND AFRICA

12.5.4 LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 151)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 55 MARKET EVALUATION FRAMEWORK

13.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

13.3.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY BLOCKCHAIN AI VENDORS

13.4 STARTUP/SME EVALUATION MATRIX, 2020

13.4.1 PROGRESSIVE COMPANIES

13.4.2 RESPONSIVE COMPANIES

13.4.3 DYNAMIC COMPANIES

13.4.4 STARTING BLOCKS

FIGURE 56 BLOCKCHAIN AI MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

13.5 RANKING OF KEY STARTUPS IN THE BLOCKCHAIN AI MARKET, 2020

FIGURE 57 RANKING OF KEY STARTUPS, 2020

14 COMPANY PROFILES (Page No. - 155)

14.1 INTRODUCTION

(Business Overview, Products Offered, and Recent Developments)*

14.2 AI-BLOCKCHAIN

14.3 ALPHANETWORKS

14.4 BEXT360

14.5 BURSTIQ

14.6 COINGENIUS

14.7 CORE SCIENTIFIC

14.8 CYWARE LABS

14.9 FETCH.AI

14.10 FIGURE

14.11 FINALZE

14.12 NETOBJEX

14.13 NEUROCHAIN TECH

14.14 SINGULARITYNET

14.15 SYNAPSE AI

14.16 VIA

14.17 WEALTHBLOCK.AI

14.18 BLACKBIRD.AI

14.19 CHAINHAUS

14.20 COMPUTABLE

14.21 LIVEEDU

14.22 GAINFY

14.23 HANNAH SYSTEMS

14.24 MOBS

14.25 NUMERAI

14.26 STOWK

14.27 TALLA

14.28 VERISART

14.29 VYTALYX

14.30 WORKDONE

*Details on Business Overview, Products Offered, and Recent Developments might not be captured in case of unlisted companies.

15 ADJACENT MARKET (Page No. - 194)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 BLOCKCHAIN MARKET

15.3.1 INTRODUCTION

15.3.2 MARKET ESTIMATES AND FORECAST, BY COMPONENT

FIGURE 58 BLOCKCHAIN SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 79 BLOCKCHAIN MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

15.3.3 MARKET ESTIMATES AND FORECAST, BY APPLICATION AREA

FIGURE 59 BANKING AND FINANCIAL SERVICES SEGMENT TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 80 BLOCKCHAIN MARKET SIZE, BY APPLICATION AREA, 20182025 (USD MILLION)

TABLE 81 APPLICATION: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.1 Transportation and Logistics

TABLE 82 TRANSPORTATION AND LOGISTICS: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.1.1 Applications in Transportation and Logistics

TABLE 83 TRANSPORTATION AND LOGISTICS: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.2 Agriculture and Food

TABLE 84 AGRICULTURE AND FOOD: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.2.1 Applications in Agriculture and Food

TABLE 85 AGRICULTURE AND FOOD: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.3 Manufacturing

TABLE 86 MANUFACTURING: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.3.1 Applications in Manufacturing

TABLE 87 MANUFACTURING: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.4 Energy and Utilities

TABLE 88 ENERGY AND UTILITIES: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.4.1 Applications in Energy and Utilities

TABLE 89 ENERGY AND UTILITIES: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.5 Healthcare and Life Sciences

TABLE 90 HEALTHCARE AND LIFE SCIENCES: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD THOUSAND)

15.3.3.5.1 Applications in Healthcare and Life Sciences

TABLE 91 HEALTHCARE AND LIFE SCIENCES: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.6 Media, Advertising, and Entertainment

TABLE 92 MEDIA, ADVERTISING, AND ENTERTAINMENT: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.6.1 Applications in Media, Advertising, and Entertainment

TABLE 93 MEDIA, ADVERTISING, AND ENTERTAINMENT: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.7 Banking and Financial Services

TABLE 94 BANKING AND FINANCIAL SERVICES: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.7.1 Applications in Banking and Financial Services

TABLE 95 BANKING AND FINANCIAL SERVICES: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.8 Insurance

TABLE 96 INSURANCE: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.8.1 Applications in Insurance

TABLE 97 INSURANCE: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.9 IT and Telecom

TABLE 98 IT AND TELECOM: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.9.1 Applications in IT and Telecom

TABLE 99 IT AND TELECOM: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.10 Retail and eCommerce

TABLE 100 RETAIL AND ECOMMERCE: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.10.1 Applications in Retail and eCommerce

TABLE 101 RETAIL AND ECOMMERCE: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.11 Government

TABLE 102 GOVERNMENT: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.3.3.11.1 Applications in Government

TABLE 103 GOVERNMENT: BLOCKCHAIN MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.3.3.12 Other application Areas

TABLE 104 OTHER APPLICATION AREAS: BLOCKCHAIN MARKET SIZE, BY REGION, 20182025 (USD MILLION)

15.4 ARTIFICIAL INTELLIGENCE MARKET

15.4.1 INTRODUCTION

15.4.2 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING

FIGURE 60 ARTIFICIAL INTELLIGENCE MARKET FOR SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 105 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 20152025 (USD BILLION)

TABLE 106 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 20152025 (USD BILLION)

15.4.3 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY

FIGURE 61 ARTIFICIAL INTELLIGENCE MARKET FOR COMPUTER VISION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 107 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 20152025 (USD BILLION)

15.5 COGNITIVE COMPUTING MARKET

15.5.1 INTRODUCTION

15.5.2 COGNITIVE COMPUTING MARKET, BY COMPONENT

FIGURE 62 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 108 COGNITIVE COMPUTING MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

15.5.3 COGNITIVE COMPUTING MARKET, BY APPLICATION

FIGURE 63 BEHAVIORAL ANALYSIS SEGMENT TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 109 COGNITIVE COMPUTING MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

15.5.4 COGNITIVE COMPUTING MARKET, BY REGION

FIGURE 64 ASIA PACIFIC TO HOLD THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 110 COGNITIVE COMPUTING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

16 APPENDIX (Page No. - 213)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

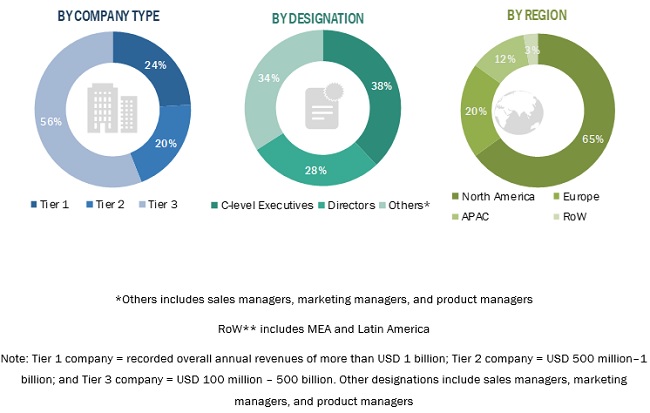

The study involved four major activities in estimating the current size of the Blockchain AI. Exhaustive secondary research was done to collect information on the Blockchain AI. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, such as North America Blockchain Association (NABA), Blockchain Association of Canada, European Blockchain Association (EBA), European Blockchain Observatory and Forum, International Blockchain Association, APAC Blockchain Development Association, National Blockchain and Distributed Ledger Technology Standardization Technical Committee (China), Blockchain Association of Africa (BAA),

Primary Research

The Blockchain AI comprises several stakeholders, Blockchain AI specialists, Blockchain AI and service providers, business analysts, business intelligence tools, enterprise users, telecommunication providers, technology consultants, and System Integrators (SIs). The market demand side consists of financial institutions, retail, healthcare, manufacturing, and others. The supply side includes Blockchain AI and service providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Blockchain AI. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industrys supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at each market segment's exact statistics and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Blockchain AI by technology, component, application, deployment mode, organization size, vertical, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the market segments' size with respect to five main regions: North America, Europe, Asia Pacific (APAC), and RoW.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Blockchain AI

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Blockchain AI

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the European market, which includes the rest of Europe countries, such as the EU and Non-EU countries

- Further breakup of the APAC market, which includes the rest of APAC countries, such as Indonesia, Taiwan, and South Korea

- Further breakup of the RoW, which includes MEA and Latin America

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Blockchain AI Market