Enterprise AI Market by Component (Solution & Services), Technology, Application Area (Security & Risk, Marketing, Customer Support & Experience, HR & Recruitment, Process Automation), Deployment, Organization Size, Industry, & Region - Forecast to 2022

[139 Pages Report] The rising demand for Artificial Intelligence (AI)-based solutions and platforms, and the need to analyze large and complex data sets are expected to drive the growth of the enterprise AI market. MarketsandMarkets expects the global market to grow from USD 625.0 Million in 2016 to USD 6,141.5 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 48.7% during the forecast period. The base year considered for the study is 2016 and the forecast period is 20172022.

The objective of the report is to define, describe, and forecast the size of the enterprise AI market on the basis of components, technologies, services, application areas, deployment type, organization sizes, industries, and regions. The report also aims at providing detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

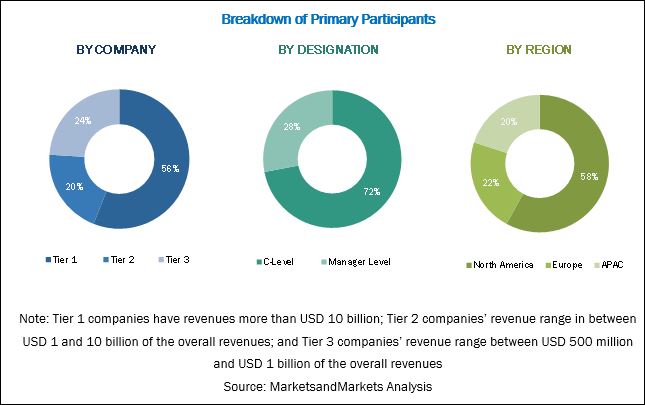

The research methodology used to estimate and forecast the global market size began with capturing the data from the key vendor revenues through secondary research, annual reports, government publishing sources, IEEE, Factiva, Bloomberg, and press releases. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall global enterprise AI market size from the revenues of the key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary participants has been depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The enterprise AI market includes various enterprise AI vendors, such as IBM (US), Microsoft (US), AWS (US), Intel (US), Google (US), SAP (Germany), Sentient Technologies (US), Oracle (US), HPE (US), and Wipro (India).

The Target Audience of the Enterprise AI Market report is given below:

- Government agencies

- Enterprise AI solution/service vendors

- Application developers

- System integrators

- Application end-users

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Enterprise AI Market Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Solution, Services, Technology, Application Area, Deployment, Organization Size, Industry, & Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA) |

|

Companies covered |

IBM (US), Microsoft (US), AWS (US), Intel (US), Google (US), SAP (Germany), Sentient Technologies (US), Oracle (US), HPE (US), and Wipro (India) |

The enterprise AI market is segmented on the basis of technologies, services, application areas, components (solution and services), deployment type, organization sizes, industries, and regions:

Enterprise AI Market By Component

- Solution

- Services

- Professional services

- Managed services

Market By Technology

- Machine learning and deep learning

- Natural Language Processing (NLP)

Enterprise AI Market By Application Area

- Security and risk management

- Marketing management

- Customer support and experience

- Human resource and recruitment management

- Analytics application

- Process automation

Market By Deployment Type

- Cloud

- On-premises

Enterprise AI Market By Organization Size

- Small and Medium-sized Businesses (SMBs)

- Large enterprises

Enterprise AI Market By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American enterprise AI market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets expects the global enterprise Artificial Intelligence (AI) market to grow from USD 845.4 Million in 2017 to USD 6,141.5 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 48.7% during the forecast period. The rising demand for AI-based solutions and platforms, and the need to analyze large and complex data sets are expected to drive the growth of the enterprise AI market.

The component segment has been further segmented into solution and services. The services segment is expected to grow at a higher CAGR during the forecast period. The services in the enterprise AI market play a vital role in the efficient and effective functioning of Natural Language Processing (NLP) and machine learning applications. Services are required to effectively integrate AI technologies with business modules and link them with the existing working environment.

Among technologies, the NLP segment is expected to grow at a higher CAGR during the forecast period. Due to the growing use of personal devices and smartphones, and the rising rate of internet usage, the need for human-to-machine level interaction has increased significantly in enterprises. With the growing demand for Machine-to-Machine (M2M) translation, the use of NLP is expected to grow. Many enterprises are deploying AI solutions to gain benefits from them.

The enterprise AI market is also segmented on the basis of application areas. The analytics application segment is expected to have the largest market size during the forecast period. The analytics application is a data discovery application that reviews information with the help of AI to save time for decision-making. AI is proving to be a very supportive tool for aligning an enterprises business objectives with the AI technologies supporting those objectives.

Among services, the managed services segment is expected to grow at a higher CAGR during the forecast period. Managed services are extremely substantial, as they are directly linked to delivering the best customer experience. As every business is dependent on its customers and cannot afford negotiations on this aspect, enterprises opt for managed services. These services provide the required technical skills and expertise for maintaining the deployed solutions and keeping them up to date.

On the basis of deployment type, the cloud deployment type is expected to grow at a higher CAGR during the forecast period. This deployment type is simple and cost-effective for use in applications, such as customer analytics, virtual assistance, and self-diagnostics.

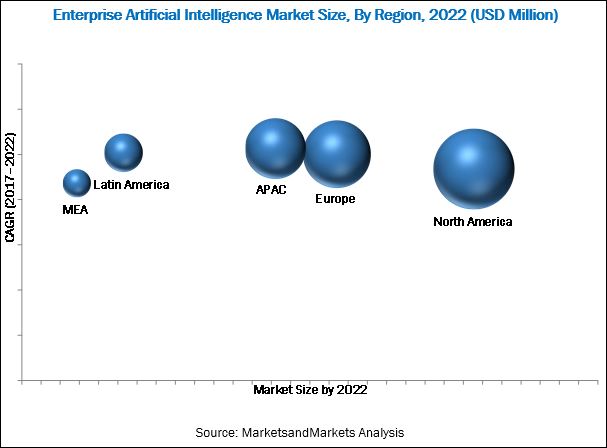

North America is expected to have the largest market size in the enterprise AI market, while Asia Pacific (APAC) is projected to grow at the highest CAGR during the forecast period. The North American region has shown increased investments in the enterprise AI market, and several vendors have evolved to cater to the rapidly growing market. A considerable growth is expected in the region during the forecast period. In North America, the enterprise AI technology is effectively used for various business applications, such as security and risk management, marketing management, customer support and experience, and process automation.

The enterprise AI market faces many challenges; for instance, incompatibility concerns and lack of skilled employees to use AI in enterprises.

The major vendors that offer enterprise AI solutions across the globe include IBM (US), Microsoft (US), AWS (US), Intel (US), Google (US), SAP (Germany), Sentient Technologies (US), Oracle (US), HPE (US), and Wipro (India). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the enterprise AI market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Enterprise AI Market

4.2 Market Top 3 Industries and Regions

4.3 Growth Rate of Industry During the Forecast Period

5 Enterprise AI Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for AI-Based Solutions and Platforms

5.2.1.2 Need for Analyzing Large and Complex Data Sets

5.2.2 Restraints

5.2.2.1 Slow Digitalization Rate

5.2.3 Opportunities

5.2.3.1 Growing Demand for Enhancing Business Functions

5.2.3.2 Emerging Innovations Across Industries

5.2.4 Challenges

5.2.4.1 Lack of Skilled Personnel

5.2.4.2 Concerns About Data Privacy

5.3 Regulatory Implications

5.3.1 Introduction

5.3.2 Federal Trade Commission (FTC)

5.3.3 Health Insurance Portability and Accountability Act (HIPAA)

5.3.4 Food and Drug Administration (FDA)

5.3.5 International Organization for Standardization (ISO)

5.4 Use Cases

5.4.1 Use Case: 1

5.4.2 Use Case: 2

5.4.3 Use Case: 3

6 Enterprise AI Market By Component (Page No. - 36)

6.1 Introduction

6.2 Solution

6.3 Services

6.3.1 Professional Services

6.3.2 Managed Services

7 Market By Technology (Page No. - 42)

7.1 Introduction

7.2 Machine Learning and Deep Learning

7.3 Natural Language Processing

8 Enterprise AI Market By Application Area (Page No. - 47)

8.1 Introduction

8.2 Security and Risk Management

8.3 Marketing Management

8.4 Customer Support and Experience

8.5 Human Resources and Recruitment Management

8.6 Analytics Application

8.7 Process Automation

9 Enterprise AI Market By Deployment Type (Page No. - 55)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Market By Organization Size (Page No. - 59)

10.1 Introduction

10.2 Small and Medium-Sized Businesses

10.3 Large Enterprises

11 Enterprise AI Market By Industry (Page No. - 63)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Advertising, Media, and Entertainment

11.4 Retail and Ecommerce

11.5 Healthcare and Life Sciences

11.6 Government and Defense

11.7 Transportation

11.8 Agriculture

11.9 Manufacturing

11.10 It and Telecommunication

11.11 Others

12 Enterprise AI Market By Region (Page No. - 73)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 99)

13.1 Overview

13.2 Key Players in the Enterprise Artificial Intelligence Market

13.3 Competitive Scenario

13.3.1 New Product Launches

13.3.2 Agreements, Partnerships, and Collaborations

13.3.3 Mergers and Acquisitions

14 Company Profiles (Page No. - 105)

(Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 IBM

14.2 Microsoft

14.3 AWS

14.4 Intel

14.5 Google

14.6 SAP

14.7 Sentient Technologies

14.8 Oracle

14.9 HPE

14.10 Wipro

*Details on Business Overview, Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 130)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Related Reports

15.6 Author Details

List of Tables (71 Tables)

Table 1 Enterprise AI Market Size, By Component, 20152022 (USD Million)

Table 2 Solution: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 3 Enterprise Artificial Intelligence Market Size, By Service, 20152022 (USD Million)

Table 4 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 5 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 6 Enterprise AI Market Size, By Technology, 20152022 (USD Million)

Table 7 Machine Learning and Deep Learning: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 8 Natural Language Processing: Enterprise AI Market Size, By Region, 20152022 (USD Million)

Table 9 Enterprise AI Market Size, By Application Area, 20152022 (USD Million)

Table 10 Security and Risk Management: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 11 Marketing Management: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 12 Customer Support and Experience: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 13 Human Resource and Recruitment Management: Enterprise AI Market Size, By Region, 20152022 (USD Million)

Table 14 Analytics Application: Enterprise AI Market Size, By Region, 20152022 (USD Million)

Table 15 Process Automation: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 16 Enterprise Artificial Intelligence Market Size, By Deployment Type, 20152022 (USD Million)

Table 17 Cloud: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 18 On-Premises: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 19 Market Size By Organization Size, 20152022 (USD Million)

Table 20 Small and Medium-Sized Businesses: Enterprise AI Market Size, By Region, 20152022 (USD Million)

Table 21 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 22 Enterprise AI Market Size, By Industry, 20152022 (USD Million)

Table 23 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 24 Advertising, Media, and Entertainment: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 25 Retail and Ecommerce: Market Size, By Region, 20172022 (USD Million)

Table 26 Healthcare and Life Sciences: Enterprise AI Market Size, By Region, 20152022 (USD Million)

Table 27 Government and Defense: Market Size, By Region, 20152022 (USD Million)

Table 28 Transportation: Market Size By Region, 20152022 (USD Million)

Table 29 Agriculture: Enterprise AI Market Size, By Region, 20152022 (USD Million)

Table 30 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 31 It and Telecommunication: Market Size, By Region, 20152022 (USD Million)

Table 32 Others: Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 33 Enterprise Artificial Intelligence Market Size, By Region, 20152022 (USD Million)

Table 34 North America: Enterprise AI Market Size, By Component, 20152022 (USD Million)

Table 35 North America: Market Size, By Service, 20152022 (USD Million)

Table 36 North America: Market Size, By Technology, 20152022 (USD Million)

Table 37 North America: Market Size, By Application Area, 20152022 (USD Million)

Table 38 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 39 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 40 North America: Enterprise Artificial Intelligence Market Size, By Industry, 20152022 (USD Million)

Table 41 Europe: Enterprise AI Market Size, By Component, 20152022 (USD Million)

Table 42 Europe: Market Size, By Service, 20152022 (USD Million)

Table 43 Europe: Market Size, By Technology, 20152022 (USD Million)

Table 44 Europe: Market Size, By Application Area, 20152022 (USD Million)

Table 45 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 46 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 47 Europe: Enterprise Artificial Intelligence Market Size, By Industry, 20152022 (USD Million)

Table 48 Asia Pacific: Enterprise AI Market Size, By Component, 20152022 (USD Million)

Table 49 Asia Pacific: Enterprise Artificial Intelligence Market Size, By Technology, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Application Area, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 54 Asia Pacific: Enterprise Artificial Intelligence Market Size, By Industry, 20152022 (USD Million)

Table 55 Middle East and Africa: Enterprise AI Market Size, By Component, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Technology, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Application Area, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 59 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 60 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 61 Middle East and Africa: Enterprise Artificial Intelligence Market Size, By Industry, 20152022 (USD Million)

Table 62 Latin America: Enterprise AI Market Size, By Component, 20152022 (USD Million)

Table 63 Latin America: Market Size, By Technology, 20152022 (USD Million)

Table 64 Latin America: Market Size, By Application Area, 20152022 (USD Million)

Table 65 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 66 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 67 Latin America: Enterprise Artificial Intelligence Market Size, By Service, 20152022 (USD Million)

Table 68 Latin America: Enterprise AI Market Size, By Industry, 20152022 (USD Million)

Table 69 New Product Launches, 20152017

Table 70 Agreements, Partnerships, and Collaborations, 20162017

Table 71 Mergers and Acquisitions, 20162017

List of Figures (48 Figures)

Figure 1 Global Enterprise AI Market Segmentation

Figure 2 Global Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Share Snapshot, By Component (2017)

Figure 7 Market Share Snapshot, By Technology (2017)

Figure 8 Market Share Snapshot, By Service (2017)

Figure 9 Enterprise AI Market Share Snapshot, By Application Area (2017)

Figure 10 Market Share Snapshot, By Deployment Type (2017)

Figure 11 Market Share Snapshot, By Organization Size (2017)

Figure 12 Market Snapshot, By Industry (2017)

Figure 13 Enterprise AI Market Snapshot, By Region

Figure 14 Proliferation of Data and Increase in Awareness have Propelled the Adoption of Enterprise Artificial Intelligence

Figure 15 Advertising, Media, and Entertainment Industry and North American Region are Estimated to Have the Largest Market Shares in 2017

Figure 16 Healthcare and Life Sciences Industry is Expected to Create Market Opportunities During the Forecast Period

Figure 17 Enterprise AI Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Natural Learning Processing Technology is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Analytics Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Small and Medium-Sized Businesses Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Healthcare and Life Sciences Industry is Expected to Have the Highest Growth Rate During the Forecast Period

Figure 25 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Asia Pacific is Expected to Be the Emerging Region in the Enterprise AI Market

Figure 27 North America: Market Snapshot

Figure 28 North America: Analytics Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Europe: Analytics Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Asia Pacific: Enterprise AI Market Snapshot

Figure 31 Asia Pacific: Analytics Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Middle East and Africa: Analytics Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Latin America: Analytics Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 Companies Adopted New Product Launches as the Key Growth Strategy From 2015 to 2017

Figure 35 IBM: Company Snapshot

Figure 36 IBM: SWOT Analysis

Figure 37 Microsoft: Company Snapshot

Figure 38 Microsoft: SWOT Analysis

Figure 39 AWS: Company Snapshot

Figure 40 AWS: SWOT Analysis

Figure 41 Intel: Company Snapshot

Figure 42 Intel: SWOT Analysis

Figure 43 Google: Company Snapshot

Figure 44 Google: SWOT Analysis

Figure 45 SAP: Company Snapshot

Figure 46 Oracle: Company Snapshot

Figure 47 HPE: Company Snapshot

Figure 48 Wipro: Company Snapshot

Growth opportunities and latent adjacency in Enterprise AI Market