Food Blenders and Mixers Market by Type (High Shear, Shaft, Ribbon Mixer, Double Cone, Planetary Mixer, Screw Mixers & Blenders), Application (Bakery, Dairy, Beverages, Confectionery), Technology, Mode of Operation and Region - Global Forecast to 2027

Food Blenders and Mixers Market Overview

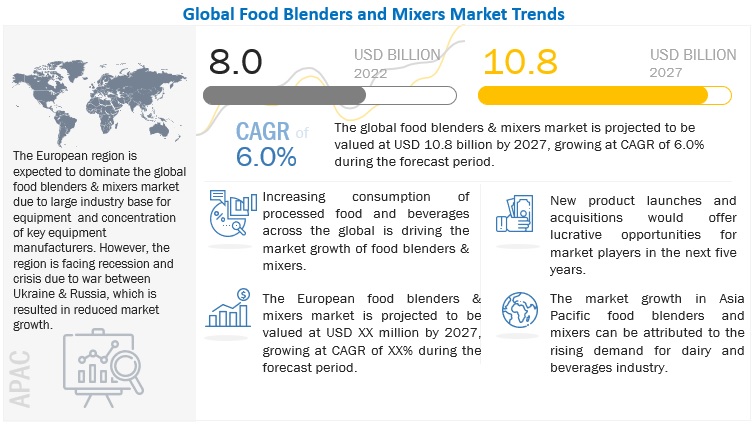

The global food blenders and mixers market is expected to grow from USD 8.2 billion in 2022 to USD 10.8 billion by 2027, registering a CAGR of 6.0% during the forecast period. The primary factor anticipated to propel market growth for food blenders and mixers over the long run is the expanding food processing industry along with rising consumption of bread and dairy food products in developing nations.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Blenders and Mixers Market Dynamics

Driver: Changing consumer expectations have propelled the food processing industry

Food & beverage processing converts raw materials and various ingredients, by physical or chemical means, into food or other forms. Earlier, food & beverage industry manufacturers used traditional techniques and extensive human labor to process and manufacture food & beverage products. However, these traditional processing practices have the potential to deliver only a limited amount of output, which involves high costs, owing to the number of human resources involved, costs of wastages & spillovers, and the relatively long time taken to produce the required output. Mixing is the primary operation required in transforming raw ingredients into food for human consumption. To overcome such challenges, there have been multiple advancements in the food & beverage processing industry, including the adoption of food blenders & mixers equipment that helps in processing various food & beverage products belonging to the bakery, dairy, confectionery, and other industries. Their use and application are determined by the phases being mixed (liquid-liquid, solid-liquid, or solid-solid) as well as the physical characteristics of the end product (such as viscosity and density). Thus, the blenders & mixers industry has a positive outlook due to high food & beverage processing growth.

Rising per capita income and the increasing trend of snacking between meals are accelerating the demand for R.T.E products, nutrition bars, extruded snacks, bakery products, batter-coated products, and soups & sauces. Consumer preferences in emerging economies, such as China, India, Brazil, and the Middle East, have gradually transitioned from traditional homemade breakfasts and snacking meals to ready-to-eat products over the last couple of decades. To cater to the rising demands of end consumers, the companies have been increasingly investing and focusing on increasing their production volumes. Thus, they have adapted to modern mixing and blending techniques to help them eliminate the excess time required, human capital expenditure, and wastage. This, in turn, delivers better-finished products at relatively lower costs, thereby leading to better sustainability. Recent advances in food processing and packaging are not just to meet the productivity demands but to adopt sophisticated automation, control, and monitoring methods and techniques. A majority of global players have upgraded their old production facilities with multifunctional equipment, thereby propelling the food processing equipment industry and ultimately accelerating the demand for blending & mixing equipment as well.

Restraint: Increase in the cost of power and energy

Manufacturing of food & beverage products consumes a tremendous amount of energy and power, especially where large and automated equipment is involved. The entire manufacturing of food & beverage products is concluded in the following stages: agriculture, processing, handling, and transporting. The handling and processing stages involve various types of machinery and technology, which consume massive energy and power.

Food blending and mixing is the initial stage in food processing and involves automated and semi-automated machinery for carrying out the processing of food & beverage products. Rising costs of power and energy required for the operation of mixing & blending equipment is the key restraint for the food blenders and mixers market for food & beverages. Large and established companies can afford to incur such heavy costs for operating this machinery. The high cost of running this equipment and the scarcity of non-renewable energy sources prevents small food manufacturers from installing these systems. Energy efficiency is the major attribute food processors are looking at when choosing blending & mixing equipment. As blending and mixing are vital parts of food processing, installing such systems is mandatory for a smooth and large-scale process. However, blenders & mixers are high-power-consuming equipment, making it difficult for the food processing companies to cope with rising energy costs.

Opportunity: Increase in demand for innovative blenders & mixers for special ingredients

Blenders & mixers are used to mix almost every ingredient in the food & beverage industry. However, certain ingredients are difficult to mix with water. For instance, xanthan gum is commonly used for its thickening and stabilizing effect on emulsions and suspensions. However, xanthan gum forms a gel structure in water, which is shear thinning and can be used in combination with other rheology modifiers, such as guar gum, as the two provide better effects. However, xanthan gum has certain difficulties in terms of mixing. When mixed with water, the powder has a strong tendency to form lumps. Several dispersion and hydration methods are used to overcome this. Thus, an advanced high-shear mixer can be a solution for this, as it can produce an agglomerate-free dispersion and fully hydrate Xanthan gum in a fraction of the time compared to conventional methods. This type of advanced blender & mixer equipment provides opportunities for manufacturers to function in niche markets.

Challenge: Increasing competition in the global market due to competitive pricing

Companies producing and marketing equipment exist in the market, which established global players dominate. However, in recent years, the market has seen the entry of local companies or SMEs designing, producing, and offering an array of food blenders and mixers in the respective local markets at a relatively lower price. This leads to market disruptions, resulting in competitive pricing, as the SMEs do not incur higher costs of manufacturing these equipment types due to limited product offerings and operations, which ultimately helps them offer their product portfolio at lower price points. But these companies might fail to offer after-sales service and assistance due to limited expertise or human resources, possibly leading to reducing the impact of these players as a challenger in the global food blenders and mixers market.

By technology, the batch mixer subsegment is estimated to account for the largest share of the market.

The use of batch technology gives precise control of mix quality, batch traceability, the flexibility of production, and easy pre-mixing of minor ingredients. These factors are contributing to the growth of the segment.

By type, the high-shear mixer segment is projected to achieve the highest CAGR in the food blenders and mixers market during the forecast period.

As high-shear mixers are widely used as fluid-based product mixing, the growing beverage industry is ultimately driving the growth of high-shear mixers.

The automatic mode of operation segment is projected to grow at the highest rate in the food blenders and mixers market.

Fully automated mixers & blenders contribute to accurate mixing & blending, quick and reliable production processes, optimum time utilization, reduced labor costs, and controlled operations. These factors have impacted the growth of automatic food blenders and mixers.

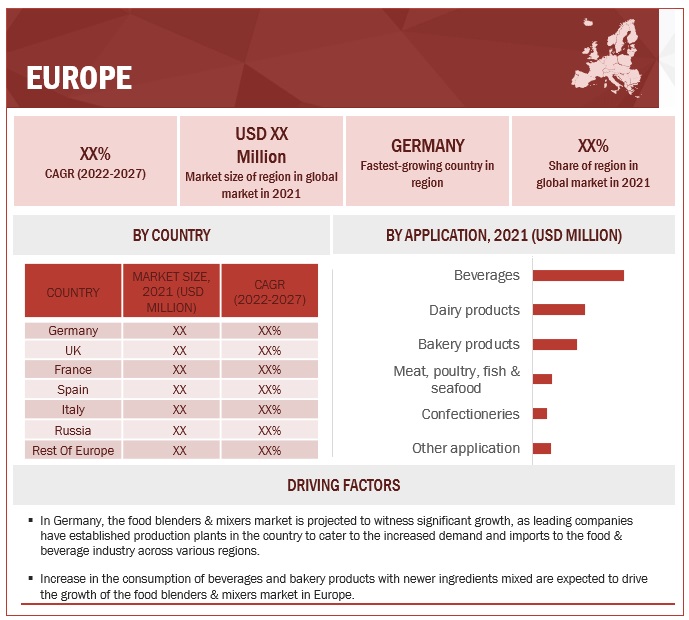

Europe is projected to account for the largest market share of the market during the forecast period.

Food manufacturers are adopting advanced food processing machinery that helps to reduce processing time and enhance the efficiency of manufacturing operations. The food processing sectors in this region are also witnessing automation transformation, which is further providing opportunities for the food blender & mixer manufacturers. Also, the food processing sector in this region is growing exponentially every year, thus creating more business opportunities for food blender and mixer manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Leading Food Blenders and Mixers Manufacturers

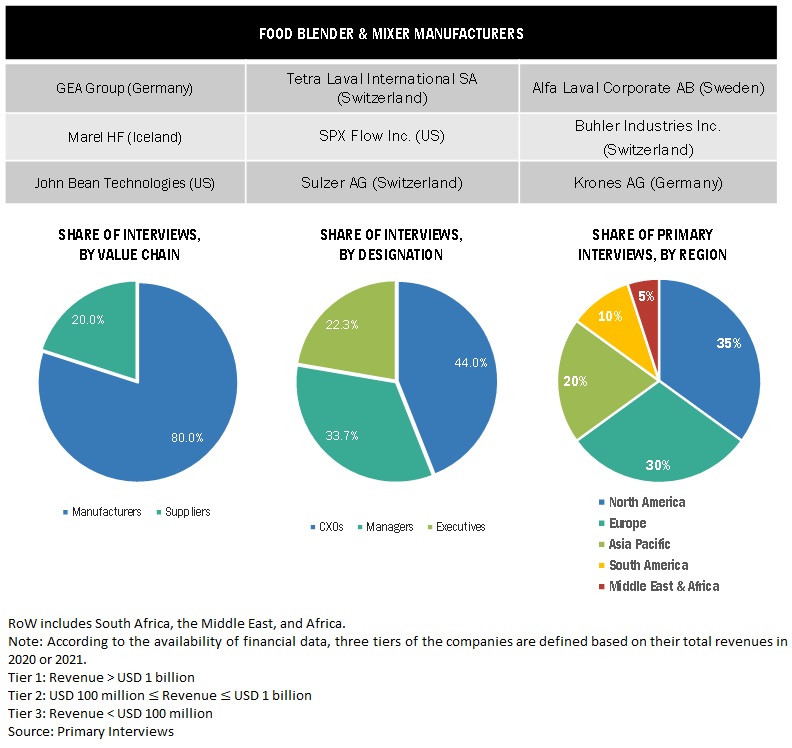

The key players in this market include GEA Group (Germany), Tetra Laval (Switzerland), SPX Flow (US), Alfa Laval (Sweden), Marel (Iceland), Krones AG (Germany), Sulzer Ltd (Switzerland), Buhler (Switzerland), JBT (US), KHS Group (Germany), Hosokawa Micron Group (Japan), Amixon GmbH (Germany), Technosilos AP (Italy), Admix Inc. (US), and Nano Pharm Technology Machinery Equipment Co. Ltd. (China). To strengthen their market position in the global food blenders and mixers market, these players focus on strategies such as recent developments, acquisitions, collaborations, and partnerships.

Food Blenders and Mixers Market Report Scope

|

Report Metric |

Details |

| Food Blenders and Mixers Market Estimated Size (2022) | USD 8.0 Billion |

| Projected Market Valuation (2027) | USD 10.8 Billion |

| Value-based CAGR (2022-2027) | 6.0% |

|

Number of Pages |

351 Pages Report |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

Type, Application, Technology, Mode of Operation and Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

The major market players include GEA Group (Germany), Tetra Laval (Switzerland), SPX Flow (US), Alfa Laval (Sweden), Marel (Iceland), Krones AG (Germany), Sulzer Ltd (Switzerland), Buhler (Switzerland), JBT (US), KHS Group (Germany), Hosokawa Micron Group (Japan), Amixon GmbH (Germany), Technosilos AP (Italy), Admix Inc. (US), and Nano Pharm Technology Machinery Equipment Co. Ltd. (China) |

Recent Developments

- In January 2020, Tetra Pak unveiled the food and beverage (F&B) industry’s first full-scale virtual marketplace. The new platform, created using Mirakl SaaS Marketplace solutions, will bring convenience and ease to the food and beverage industry players by making purchasing products faster, more convenient, and simpler for producers, which will initially include over 300,000 spare parts & consumables and over 200,000 products for maintenance, repairs, and operations.

- The company acquired other mixing technology companies, such as Philadelphia Mixing Solutions (US) in April 2021 and UTG Mixing Group (Germany) in December 2020, as a strategic move to expand its businesses geographically.

- In October 2020, the company opened its new application & innovation center in Denmark to accelerate the development of new product innovations within the hygienic fluid handling technology (including pumps, valves, cleaning and mixing equipment). This center will allow customers to experience Alfa Laval equipment under actual operating conditions. The 1,600-square-metre center located at Alfa Laval’s site in Kolding will also be a global test facility for food and pharmaceutical application equipment. This expansion will allow the company to interact with more customers and increase sales.

- In April 2021, Marel opened a new office and demo center in Brazil. As a part of the expansion and upgrade decision, the company relocated its corporate office from Piracicaba to Campinas. The company is also opening a new Progress Point demonstration and training center at the same location, which will help the company to connect with its clients and strengthen its ability to support Latin American food processors.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the food blender and mixers market, and how intense is the competition?

The key players in this market include GEA Group (Germany), Tetra Laval (Switzerland), SPX Flow (US), Alfa Laval (Sweden), Marel (Iceland), Krones AG (Germany), Sulzer Ltd (Switzerland), Buhler (Switzerland), JBT (US), KHS Group (Germany), Hosokawa Micron Group (Japan), Amixon GmbH (Germany), Technosilos AP (Italy), Admix Inc. (US), and Nano Pharm Technology Machinery Equipment Co. Ltd. (China). These players have a strong presence in North America, Asia Pacific, and Europe and focus on increasing their presence through agreements and collaborations. They also have manufacturing facilities across these regions.

What kind of stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders in the food blenders and mixers market would include,

- Raw material suppliers

- Manufacturers, dealers, and suppliers of food blenders & mixers market

- Government bodies

- Food & beverage manufacturers

- Food importers and exporters

- Associations and NGOs

- Logistics providers & transporters

- Regulatory bodies & institutions

- Association of the Beverage Machinery Industry (ABMI)

What are the potential challenges to the food blenders and mixers market?

Food blenders and mixing equipment are large machineries. It uses sophisticated technologies and has multiple parts, such as vessels, inlets, outlets, and blades required for mixing or blending motors and other important parts used to design and produce food blenders & mixers. The machinery involves high capital investments by food & beverage industry manufacturers. In addition, the installation, transportation, and maintenance costs of such blenders and mixers are high and may add to the capital or production costs. This factor is expected to challenge the growth of the food blenders and mixers market in the coming years.

What key development strategies do the players in the food blenders and mixers market undertake?

Some of the strategies undertaken by players include product launches, investments, expansions and developments, and research initiatives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

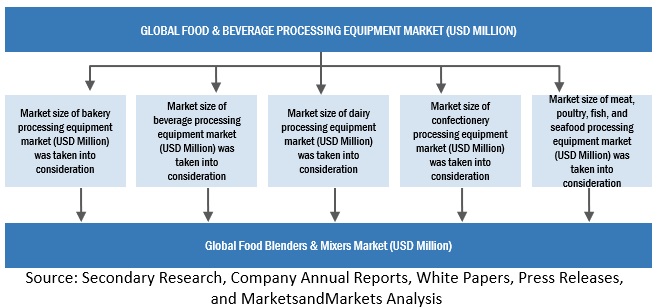

The study involved four major steps in estimating the size of the food blenders and mixers market. Exhaustive secondary research was done to collect information on the market and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as the International Safety Equipment Association (ISEA) and the Association of Equipment Manufacturers, were referred to, to identify and collect information for this study. It also includes clinical studies and journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers and food blender & mixer manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include food blender & mixer manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end-users.

The primary interviewees from the supply side include food blender and mixer manufacturers. The primary sources from the demand side include distributors, importers, exporters, and end-use sectors.

To know about the assumptions considered for the study, download the pdf brochure

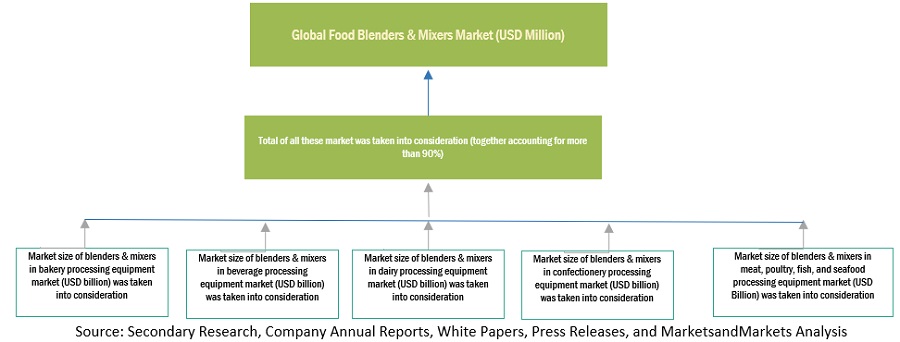

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the food blender and mixers market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The food blenders and mixers value chain and market size in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food blender and mixers market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Bottom-up

- With the bottom-up approach, food blenders and mixers for technology, application, type, mode of operation, and region were added to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the food blender and mixers market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and data validation through primaries, the exact values of the overall parent and each market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down

In the top-down approach, the overall market size was used to estimate the size of individual markets (technology, application, type, mode of operation, and region) through percentage splits from secondary and primary research. The most appropriate and immediate parent market size was used to calculate each specific market segment to implement the top-down approach. The data obtained was further validated by conducting primary interviews with industry experts, key suppliers, and manufacturers of food blenders and mixers.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to estimate the overall food blenders & mixers market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Also, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives:

Market Intelligence

- Determining and projecting the size of the food blenders and mixers market with respect to target technology, application, type, mode of operation, and region, over five years, ranging from 2022 to 2027

-

Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key market players in the food blenders and mixers market

- Determining the market share of key players operating in the food blender and mixers market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Service offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Providing insights on the trade scenario

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Segment Analysis

- A further breakdown of food blenders and mixers by type.

Geographic Analysis

- Further breakdown and customization are available for the South American food blender and mixers market by key countries, such as Colombia, Venezuela, and Peru.

- Further analysis of the South American market can be included in the market analysis for food blenders and mixers.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Blenders and Mixers Market