Fruit and Vegetable Processing Market by Product Type (Fresh, Fresh-cut, Canned, Frozen, Dried & Dehydrated, Convenience), Equipment Type, Operation (Automatic, Semi-automatic), Processing Systems & Region – Global Forecast to 2027

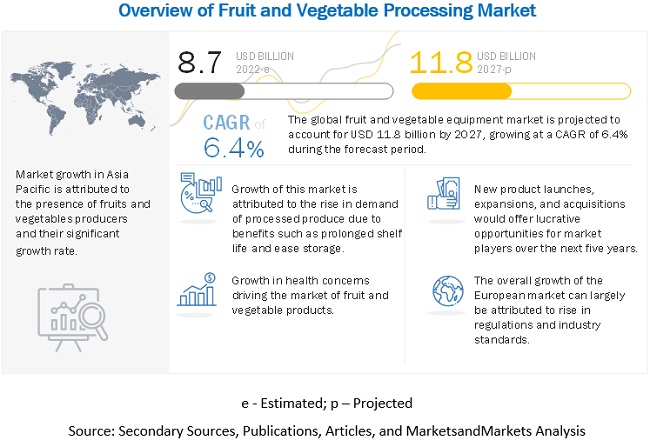

The fruit and Vegetable Processing Market is projected to reach a value of nearly USD 11.8 billion by 2027, growing at a CAGR of 6.4% from 2022. It is estimated to account for nearly USD 8.7 billion in 2022. In the 21st century, globalization has led to an increase in trade and resulted in aggressive R&D initiatives by several food & beverage manufacturers. Advanced technologies for food ingredients and food processing include membrane technology, super-critical fluid technology, and molecular techniques such as Polymerase Chain Reaction (PCR) and High-Pressure Processing (HPP) technology. Other new processing technologies use non-thermal preservation techniques such as pulsed electric fields, ultrasound, pulsed light, and hurdle systems to maintain the texture and freshness of the food products. Development of new machinery and enhancement of the existing ones are the key strategies adopted by many players in the fruit and vegetable processing market. In addition, increasing focus on the expansion of facilities, marketing schemes, and information exchange programs to create awareness and enhance the applications of fruit and vegetable processing is projected to contribute to the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Fruit and Vegetable Processing Market Dynamics

Drivers: Growth in the demand for convenience food products

The processed food market is driven by the increase in the need for convenience due to the busy customer lifestyles. Further, growth in per-capita income has resulted in greater demand for ready-to-eat and on-the-go food items. This, in turn, has led to an increase in demand for processed fruit and vegetable products. The outlook on the growth of fruit and vegetable processing market is projected to remain positive due to the high growth in the fruit and vegetable processing industry.

Consumers are also benefited by the purchase of processed food products, as it is easy for them to use, consume, and store for a longer period. Consumer preferences in developing countries, such as China, India, Brazil, have witnessed a gradual transition from traditional homemade breakfasts and snacking meals to ready-to-eat products over the last couple of decades. Amid Covid-19, according to a “Food Processing” article of December 2020, the sales of the pantry and other home staples soared. Canned soup sales were up 200% year over year in March, and frozen food sales were up 40%. The demand especially surged for comfort foods such as fruit juices. This has been contributing to the growth of the fruit & vegetable processing market.

Restraints: Incidences of food recalls

Contamination of food products due to a failure or gap in the supply chain leads to food recalls. The Food Standards Australia New Zealand (FSANZ) defines a food recall as: “Action taken to remove unsafe food from sale, distribution and consumption, which may pose a safety risk to consumers.”

A food recall is initiated as a result of a report or complaint about the quality of the product. The complaint can be filed by the person(s) associated with the product, including manufacturers, wholesalers, retailers, government agencies, and consumers. Recalls are carried out to ensure that potentially hazardous or unsafe foods are not consumed. Any incidence of food recall hampers the reputation of the manufacturing company. This may lead to a decrease in sales of other products offered by the company. Also, the threat of consuming contaminated food products at high prices prevents consumers from buying processed food and relying on unprocessed food products.

Opportunities: Growing demand for Vegan food products

Over the last few years, there has been growing interest in the development and production of plant-based alternatives to meat. The global market for plant-based substitutes is projected to reach USD 85 million by 2030. Also, in the US, the demand for beef and dairy products is expected to shrink by 80–90% by 2035. Manufacturers of plant-based foods are capitalizing on the use of fruits & vegetables, legumes, and pulses; they are also mulling over fruit-based products because of their nutritional composition and superior functionality, which can bring upon textural and flavor enhancements.

Challenges: Physiological deterioration and infections

The fresh produce value chain is a basic and monumental aspect of agricultural production. Among many other factors, it affects the quality of products for consumers, profit margins for farmers, and export conditions and consequences for a country. There can be an increased risk in the rate of loss because of normal physiological changes caused by conditions that increase the rate of natural deterioration, such as high temperature, low atmospheric humidity, and physical injury. Fresh produce, when subjected to extremes of temperature, atmospheric modification, or contamination, abnormal physiological deterioration is often observed. This may cause unpalatable flavors, failure to ripen, or other changes in the living processes of the produce, making it unfit for use.

The fruit segment is estimated to grow at the highest CAGR during the forecast period

By fruit and vegetable type, the fruit segment is estimated to grow at the highest CAGR during the forecast period. The fruit segment is projected to witness significant growth due to the increasing preference for healthy food such as organic, ready to eat fruits. As customers are becoming more health-conscious, they are encouraged to opt for fruit products that are readily available and much tastier like fruit juices.

The fresh fruits and vegetables segment is estimated to account for the largest share in the fruit and vegetable market

The fresh segment includes minimally processed agricultural produce. Fruits and vegetables are treated to be preserved and packaged to prevent wastage or spoilage(by microbial contaminants) during transport. Various government initiatives and food policy councils have been created to increase the consumption of fruits and vegetables which in turn increased the demand for fresh fruits and vegetables

To know about the assumptions considered for the study, download the pdf brochure

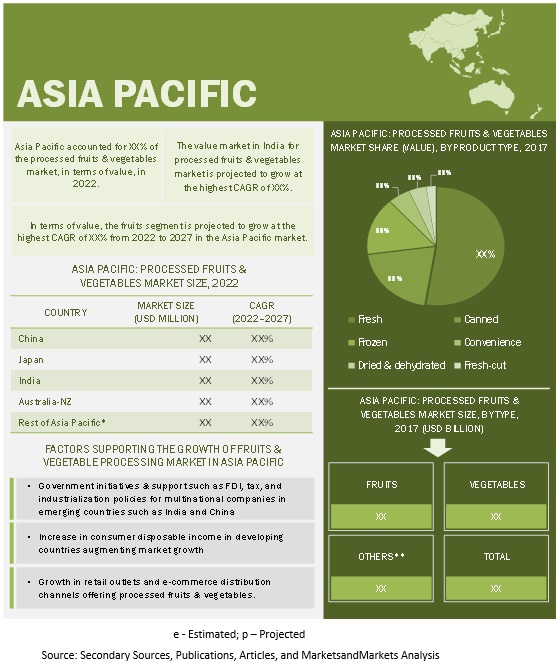

The Asia Pacific market is projected to have the second highest market share by value during the forecast period

Between 2000 and 2018, global fruit and vegetable production increased by roughly half. Asia, particularly East Asia, saw the greatest absolute increase (where China has been the largest producer). The greatest increases were seen in Central Asia, in relative terms (where production of both fruits and vegetables more than tripled). There are enough fruits and vegetables in Asia and upper middle-income countries to meet the FAO/WHO recommendation of 400/gram per day.

Leading Fruit and Vegetable Processing Companies:

Key players in this market include GEA Group AG (Germany), Bühler (Switzerland), Alfa Laval (Sweden), JBT Corporation (US), Syntegon Technology GmbH(Germany), Krones AG (Germany), Marel (Iceland), Bigtem Makine A.S.(Turkey), FENCO Food Machinery S.R. L.(Italy), ANKO FOOD MACHINE CO.LTD (Taiwan), Heat and Control, Inc. (Sweden), Finis (Netherlands), Conagra Brands (US), Greencore Group (Ireland), Nestlé S.A (Switzerland), Olam International (Singapore), The Kraft Heinz Company (US), PepsiCo Inc. (US), AGRANA Group (Austria), Bonduelle (France), Dole Food (US), SVZ International B.V. (US), Sahyadri Farms (India) and Diana Group S.A.S.(France)

Target Audience:

- Government organizations

- Service providing company officials

- Government and research organizations

- Research officers

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the market

- Manufacturing and marketing companies

Scope of the report

|

Report Metric |

Details |

|

Market demand in 2022 |

USD 8.7 billion |

|

Revenue Forecast in 2027 |

USD 11.8 billion |

|

Progress Rate |

CAGR of 6.4% from 2022 to 2027 |

|

Market size available for years |

2022-2027 |

|

Base year for estimation |

2021 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

Asia Pacific |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Key Industry Participants Presented |

|

This research report categorizes the fruit and vegetable processing market based on fruit and vegetable type, product type, equipment type, mode of operation, processing system and region.

By Fruit and Vegetable Type

- Fruits

- Vegetables

- Others*

*Others include jams, pickles, and preserved produce.

By Product Type

- Fresh

- Fresh-cut

- Canned

- Frozen

- Dried & dehydrated

- Convenience

By Equipment type

- Pre-processing

- Peeling/Inspection/slicing

- Washing & dewatering

- Fillers

- Packaging & handling

- Seasoning systems

- Others**

**Others include control & information systems, metal detectors, and fryer & oven systems, homogenizers, and weighers

By Mode of Operation

- Automatic

- Semi-automatic

By Processing System

- Small Scale

- Intermediate Scale

By Region

- North America

- Europe

- Asia Pacific

-

Rest of the World (RoW)

- South America

- Middle East

- Africa

Fruit & Vegetable Processing Market Recent Developments

- In September 2021, The Kraft Heinz Company entered into an agreement to acquire “Hemmer,” a Brazilian company focused on condiments and sauces. The acquisition is designed to expand consumers’ taste options in Brazil, while supporting Kraft Heinz’s strategy of growing its International Taste Elevation product platform and its presence in emerging markets

- In June 2021, the Kraft Heinz Company announced today that it has reached an agreement to purchase Assan Foods. Assan Foods manufactures and sells a wide range of products, including those that appeal to a variety of international cuisines and are sold under brands including Colorado.

- In January 2021 Bühler and DIL Deutsches Institut für Lebensmitteltechnik e. V.research institute (Germany) teamed up to develop new production technologies for healthy and sustainable food products.

- In March 2021, the Austrian food company Agrana has expanded its presence in the Asian market with the acquisition of fruit preparations business from Japan-based Taiyo Kagaku Co. Under the deal, Agrana also acquires Taiyo Kagaku’s fruit preparation plant in Yokkaichi, southern Japan.

- In June 2021, Bonduelle USA, Inc., a French, family-run company involved in the processing and commercialization of canned and frozen vegetables in the United States, has announced plans to invest at least $5 million to expand canned and frozen vegetable operations at its facility in Lebanon, Pennsylvania.

Key Benefits of this report for you:

- Define, segment, and project the global market size for fruit and vegetable processing market

- Understand the structure of the fruit and vegetable processing market by identifying its various subsegments

- Provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- Project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- Profile the key players and comprehensively analyze their core competencies

- Understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- Analyze competitive developments such as expansions & investments, new product launches, mergers & acquisitions, collaborations, and agreements

Frequently Asked Questions (FAQ):

Who are the major market players in the fruit and vegetable market?

Key players in this market include GEA Group AG (Germany), Bühler (Switzerland), Alfa Laval (Sweden), JBT Corporation (US), Syntegon Technology GmbH(Germany), Krones AG (Germany), Marel (Iceland), Bigtem Makine A.S.(Turkey), FENCO Food Machinery S.R. L.(Italy), ANKO FOOD MACHINE CO.LTD (Taiwan), Heat and Control, Inc. (Sweden), Finis (Netherlands), Conagra Brands (US), Greencore Group (Ireland), Nestlé S.A (Switzerland), Olam International (Singapore), The Kraft Heinz Company (US), PepsiCo Inc. (US), AGRANA Group (Austria), Bonduelle (France), Dole Food (US), SVZ International B.V. (US), Sahyadri Farms (India) and Diana Group S.A.S.(France).

What is the fruit and vegetable processing market?

The fruit and vegetable processing market refers to the industry that processes raw fruits and vegetables into various forms such as canned, frozen, dried, and pureed products.

Which are the key regions that are projected to witness significant growth in the fruit and vegetable processing equipment market?

Asia Pacific is the key region that is projected to witness significant growth with a CAGR of 7.7% in 2027, in the fruit and vegetable processing equipment market. Asia Pacific dominated the fruit and vegetable processing for the packaging and handling segments in 2021.

What are the main drivers of the fruit and vegetable processing market?

The main drivers of the fruit and vegetable processing market include an increasing demand for convenient and ready-to-eat food products, a growing population, and increasing disposable income.

What is the current size of the global processed fruit and vegetable market?

The global processed fruit and vegetable market size is estimated at USD 337.4 billion in 2022 and its projected to grow at a CAGR of 7.4% to reach USD 481.2 billion by 2027 .

What are the key trends in the fruit and vegetable processing market?

Some key trends in the fruit and vegetable processing market include increasing demand for organic and natural products, growing popularity of plant-based diets, and the increasing use of advanced technologies such as automation and robotics in the processing of fruits and vegetables.

What are the future opportunities in the fruit and vegetable processing market?

The future opportunities in the fruit and vegetable processing market include the increasing demand for processed fruits and vegetables in developing countries, increasing use of e-commerce channels to sell processed fruits and vegetables, and growing demand for functional ingredients and fortified products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 54)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

FIGURE 1 FRUIT & VEGETABLE PROCESSING MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.6 VOLUME UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 60)

2.1 RESEARCH DATA

FIGURE 2 FRUIT & VEGETABLE PROCESSING MARKET: RESEARCH METHODOLOGY

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

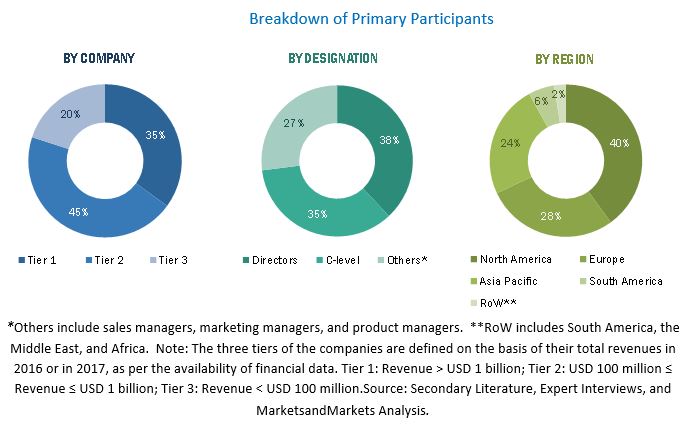

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 PROCESSED FRUITS & VEGETABLES MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 PROCESSED FRUITS & VEGETABLES MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 77)

FIGURE 13 PROCESSED VEGETABLES SEGMENT TO DOMINATE THE MARKET (USD MILLION)

FIGURE 14 PROCESSED FRUITS & VEGETABLES MARKET, BY PRODUCT TYPE, 2017 VS. 2022 (USD MILLION)

FIGURE 15 PROCESSED FRUITS & VEGETABLES MARKET SHARE (VALUE): GEOGRAPHICAL OVERVIEW, 2021

FIGURE 16 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 82)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET

FIGURE 17 EMERGING ECONOMIES OFFER OPPORTUNITIES FOR MARKET GROWTH

4.2 NORTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET, BY EQUIPMENT TYPE & COUNTRY

FIGURE 18 FILLERS FORMED THE EQUIPMENT TYPE AND NORTH AMERICA WAS THE LARGEST FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET

4.3 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET, BY OPERATION TYPE

FIGURE 19 AUTOMATIC EQUIPMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD (USD MILLION)

4.4 PROCESSED FRUITS & VEGETABLES MARKET, BY PRODUCT TYPE & REGION

FIGURE 20 NORTH AMERICA TO LEAD THE PROCESSED FRUITS & VEGETABLES MARKET SHARE (VALUE)

4.5 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET, BY EQUIPMENT TYPE

FIGURE 21 FILLERS TO DOMINATE DURING THE FORECAST PERIOD (USD MILLION)

4.6 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET, BY REGION

FIGURE 22 THE US ACCOUNTED FOR THE LARGEST SHARE (VALUE) OF THE GLOBAL FRUIT & VEGETABLE PROCESSING EQUIPMENT IN 2021

5 MARKET OVERVIEW (Page No. - 87)

5.1 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET

5.1.1 INTRODUCTION

5.1.2 MARKET DYNAMICS

FIGURE 23 MARKET DYNAMICS: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET

5.1.2.1 Drivers

5.1.2.1.1 Increase in fruit & vegetable processing and QSRs in the Indian foodservice industry

FIGURE 24 EXPENDITURE FOR FOOD AT HOME AND AWAY FROM HOME, 2011–2020 (USD BILLION)

5.1.2.1.2 Rise in demand for health and innovations leads to the advancement of fruit & vegetable processing machinery

5.1.2.1.3 Rise in focus on production and operational efficiency demand new technologies for fruit & vegetable processing

5.1.2.1.4 Demand for hygienic food packaging is on rise

5.1.2.1.5 Automation and robotics in processing equipment

5.1.2.2 Restraints

5.1.2.2.1 Increase in cost of production due to rise in energy, labor and maintenance costs

5.1.2.2.2 Stringent government regulations in Europe

5.1.2.3 Opportunities

5.1.2.3.1 Government initiatives and investments to expand the processed food sector in developing regions

5.1.2.3.2 Post-sales service contracts

5.1.2.4 Challenges

5.1.2.4.1 Lack of Infrastructural support in developing countries

5.2 PROCESSED FRUITS & VEGETABLES MARKET

5.2.1 INTRODUCTION

5.2.2 MARKET DYNAMICS

FIGURE 25 MARKET DYNAMICS: PROCESSED FRUITS AND VEGETABLES MARKET

5.2.2.1 Drivers

5.2.2.1.1 Growth in demand for exotic fruits and vegetables due to a boom in the hospitality industry

FIGURE 26 IMPORT VALUE OF FRUITS AND VEGETABLES IN KEY COUNTRIES, 2020 (USD THOUSAND)

5.2.2.1.2 Growth in demand for convenience food products

FIGURE 27 SALES OF CONVENIENCE FOODS, 2020 (CHANGE IN SALES)

5.2.2.1.3 Increased presence of modern retail outlets

5.2.2.1.4 Higher prevalence of chronic diseases

FIGURE 28 LEADING GLOBAL CAUSES OF DEATH

5.2.2.2 Restraints

5.2.2.2.1 Incidences of food recall

TABLE 2 FOOD RECALL INCIDENCES FOR PROCESSED FRUITS & VEGETABLES, 2022

5.2.2.2.2 Complex supply chain and high inventory carrying cost

5.2.2.3 Opportunities

5.2.2.3.1 Growth in demand for vegan food products

5.2.2.3.2 International trade of crops impacting food safety standards

FIGURE 29 KEY GLOBAL IMPORTER SHARE (VALUE), BY PRODUCE TYPE, 2020

5.2.2.3.3 Development of emerging economies

FIGURE 30 ASIA: GDP GROWTH RATE, BY KEY COUNTRY, 2020–2021

5.2.2.4 Challenges

5.2.2.4.1 Physiological deterioration and infections

5.2.2.4.2 Volatility in market prices of fresh produce

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 COVID-19 NEGATIVELY IMPACTED SUPPLY CHAIN DYNAMICS OF THE FRUIT & VEGETABLE PROCESSING MARKET

6 INDUSTRY TRENDS (Page No. - 103)

6.1 FRUIT AND VEGETABLE EQUIPMENT MARKET

6.1.1 INTRODUCTION

6.1.2 VALUE CHAIN ANALYSIS

FIGURE 31 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

6.1.2.1 Raw material providers/suppliers

6.1.2.2 Component manufacturers

6.1.2.3 Fruit & vegetable processing equipment manufacturers/assemblers

6.1.2.4 Distributors (buyers)/end users and post-sales services

6.1.3 SUPPLY CHAIN

FIGURE 32 ENSURING PROPER HANDLING OF MACHINERY IS AN IMPORTANT ASPECT OF THE SUPPLY CHAIN

6.1.4 TECHNOLOGY ANALYSIS

6.1.5 PATENT ANALYSIS

FIGURE 33 FRUIT & VEGETABLE PROCESSING EQUIPMENT PATENTS, BY REGION, 2011–2021

TABLE 3 LIST OF IMPORTANT PATENTS FOR FRUIT & VEGETABLE PROCESSING EQUIPMENT, 2021

6.1.6 MARKET MAP

FIGURE 34 FRUIT & VEGETABLE PROCESSING MARKET: MARKET MAP

TABLE 4 FRUIT & VEGETABLE PROCESSING MARKET: ECOSYSTEM

6.1.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 FRUIT & VEGETABLE PROCESSING QUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.1.7.1 Threat of new entrants

6.1.7.2 Threat of substitutes

6.1.7.3 Bargaining power of suppliers

6.1.7.4 Bargaining power of buyers

6.1.7.5 Intensity of competitive rivalry

6.1.8 KEY EXPORT-IMPORT MARKETS

FIGURE 35 IMPORT VALUE OF MACHINERY USED IN FRUIT & VEGETABLE PROCESSING, 2016–2020 (USD THOUSAND)

FIGURE 36 EXPORT VALUE OF MACHINERY USED IN FRUIT & VEGETABLE PROCESSING, 2016–2020 (USD THOUSAND)

6.1.9 KEY CONFERENCES & EVENTS

TABLE 6 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.1.10 TARIFF & REGULATORY LANDSCAPE

6.1.10.1 Regulatory bodies, government agencies, and other organizations

TABLE 7 US: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS: EUROPE

TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS: ASIA PACIFIC

TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS: ROW

6.1.11 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FRUIT & VEGETABLE PROCESSING EQUIPMENT MANUFACTURERS

FIGURE 37 REVENUE SHIFT FOR FRUIT & VEGETABLE PROCESSING EQUIPMENT

6.1.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.1.12.1 Key stakeholders in buying process

TABLE 11 INFLUENCE OF STAKEHOLDERS ON THE BUYING PROCESS FOR THE TOP 3 TYPES

6.1.12.2 Buying criteria

FIGURE 38 KEY BUYING CRITERIA FOR TOP 3 PRODUCT TYPES

TABLE 12 KEY BUYING CRITERIA FOR TOP 3 PRODUCT TYPES

6.1.13 CASE STUDY ANALYSIS

6.1.13.1 Optimal maintenance costs and higher juice production reliability

TABLE 13 GROWING DEMAND FOR QUALITY WITHIN THE PRODUCTION LINE OF AN AFRICAN PRODUCER OF JUICES, NECTAR, AND STILL DRINKS

6.1.13.2 High-quality produce reaches grocery store shelves

TABLE 14 TO AVOID LOSSES DUE TO FALSE INSPECTION, MATROX IMAGING LIBRARY FOUND A SOLUTION USING AUTOMATIC MACHINERY

6.1.13.3 Compact potato flakes production line

TABLE 15 KIRON FOOD PROCESSING TECHNOLOGIES CATERED TO A GROWING DEMAND FOR POTATO FLAKES BECAUSE OF WIDE APPLICATION IN THE FOOD INDUSTRY

6.2 PROCESSED FRUITS & VEGETABLES MARKET

6.2.1 INTRODUCTION

6.2.2 VALUE CHAIN ANALYSIS

FIGURE 39 PROCESSED FRUITS & VEGETABLES MARKET: VALUE CHAIN ANALYSIS

6.2.3 MARKET ECOSYSTEM & SUPPLY CHAIN

FIGURE 40 PROCESSED FRUIT AND VEGETABLES: SUPPLY CHAIN ANALYSIS

6.2.3.1 Research & development

6.2.3.2 Inputs

6.2.3.3 Production

6.2.3.4 Logistics & distribution

6.2.3.5 Marketing & sales

6.2.3.6 End-user industry

TABLE 16 PROCESSED FRUIT & VEGETABLE MARKET: SUPPLY CHAIN (ECOSYSTEM)

FIGURE 41 PROCESSED FRUIT & VEGETABLE PRODUCTS: MARKET MAP

6.2.4 PRICING ANALYSIS: PROCESSED FRUITS & VEGETABLES MARKET

TABLE 17 PRICING RANGE OF PROCESSED FRUITS & VEGETABLES, 2017–2022 (USD/KG)

FIGURE 42 PRICING TREND OF PROCESSED FRUIT & VEGETABLES, 2017–2022 (USD/KG)

6.2.5 TECHNOLOGY ANALYSIS

6.2.6 PATENT ANALYSIS

FIGURE 43 PATENTS GRANTED FOR PROCESSED FRUIT & VEGETABLES MARKET, 2011–2021

FIGURE 44 REGIONAL ANALYSIS OF PATENT GRANTED FOR PROCESSED FRUITS & VEGETABLES, 2011–2021

TABLE 18 LIST OF IMPORTANT PATENTS FOR PROCESSED FRUITS & VEGETABLES, 2021

6.2.7 MARKET MAP

FIGURE 45 PROCESSED FRUIT & VEGETABLE MARKET: MARKET MAP

TABLE 19 PROCESSED FRUIT & VEGETABLE MARKET: ECOSYSTEM

6.2.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 20 PROCESSED FRUITS & VEGETABLES MARKET: PORTER’S FIVE FORCES ANALYSIS

6.2.8.1 Threat of new entrants

6.2.8.2 Threat of substitutes

6.2.8.3 Bargaining power of suppliers

6.2.8.4 Bargaining power of buyers

6.2.8.5 Intensity of competitive rivalry

6.2.9 KEY EXPORT-IMPORT MARKETS

FIGURE 46 VEGETABLE IMPORT VALUE, BY KEY COUNTRY, 2O16–2020 (USD THOUSAND)

FIGURE 47 VEGETABLE EXPORT VALUE, BY KEY COUNTRY, 2O16–2020 (USD THOUSAND)

FIGURE 48 FRUIT IMPORT VALUE, BY KEY COUNTRY, 2O16–2020 (USD THOUSAND)

FIGURE 49 FRUIT EXPORT VALUE, BY KEY COUNTRY, 2O16–2020 (USD THOUSAND)

6.2.10 TARIFF AND REGULATORY LANDSCAPE

6.2.10.1 Regulatory bodies, government agencies, and other organizations

TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.2.11 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PROCESSED FRUIT & VEGETABLE MANUFACTURERS

FIGURE 50 REVENUE SHIFT FOR PROCESSED FRUIT & VEGETABLE MANUFACTURERS

6.2.12 CASE STUDY ANALYSIS

TABLE 25 PROCESSED FRUIT & VEGETABLE MARKET: CASE STUDY ANALYSIS

7 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET, BY EQUIPMENT TYPE (Page No. - 141)

7.1 INTRODUCTION

TABLE 26 KEY OPERATIONS CONDUCTED IN PROCESSING PLANTS

FIGURE 51 FILLERS ARE PROJECTED TO DOMINATE THE PROCESSING EQUIPMENT MARKET THROUGH 2027 (USD MILLION)

TABLE 27 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 28 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

7.2 COVID-19 IMPACT ON THE FRUIT & VEGETABLE PROCESSING MARKET, BY TYPE

TABLE 29 OPTIMISTIC SCENARIO: FRUIT & VEGETABLE EQUIPMENT PROCESSING MARKET SIZE, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 30 REALISTIC SCENARIO: FRUIT & VEGETABLE EQUIPMENT PROCESSING MARKET SIZE, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

TABLE 31 PESSIMISTIC SCENARIO: FRUIT & VEGETABLE EQUIPMENT PROCESSING MARKET SIZE, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

7.3 PRE-PROCESSING EQUIPMENT

7.3.1 INCREASE IN USAGE OF SORTING AND GRADING EQUIPMENT TO MAINTAIN QUALITY STANDARDS AND SAVE TIME

TABLE 32 FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 36 EUROPE: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 37 EUROPE: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 39 ASIA PACIFIC: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 40 SOUTH AMERICA: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 41 SOUTH AMERICA: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 42 ROW: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 ROW: FRUIT & VEGETABLE PRE-PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 PEELING/INSPECTION/SLICING

7.4.1 YIELD OPTIMIZATION AND WASTE ELIMINATION FOR PROFIT MAXIMIZATION TO DRIVE SEGMENT GROWTH

TABLE 44 FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 47 NORTH AMERICA: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 48 EUROPE: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 49 EUROPE: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 51 ASIA PACIFIC: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 52 SOUTH AMERICA: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 53 SOUTH AMERICA: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 54 ROW: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 ROW: FRUIT & VEGETABLE PEELING/INSPECTION/SLICING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 WASHING & DEWATERING

7.5.1 RISING FOOD SAFETY CONCERNS INCREASE IMPORTANCE OF WASHERS

TABLE 56 FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 60 EUROPE: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 61 EUROPE: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 62 ASIA PACIFIC: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 63 ASIA PACIFIC: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 64 SOUTH AMERICA: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 65 SOUTH AMERICA: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 ROW: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 67 ROW: FRUIT & VEGETABLE WASHING & DEWATERING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 FILLERS

7.6.1 RISE IN PROCESSED FOOD CONSUMPTION TO DRIVE SEGMENT GROWTH

TABLE 68 TYPES OF FILLING EQUIPMENT

TABLE 69 FRUIT & VEGETABLE FILLERS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 70 FRUIT & VEGETABLE FILLERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 73 EUROPE: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 74 EUROPE: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 ASIA PACIFIC: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 76 ASIA PACIFIC: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 77 SOUTH AMERICA: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 78 SOUTH AMERICA: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 79 ROW: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 80 ROW: FRUIT & VEGETABLE FILLERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.7 SEASONING SYSTEMS

7.7.1 INNOVATIONS IN SEASONING FOR MULTIPLE PRODUCT OPTIONS TO ALSO IMPROVE SHELF LIFE OF FRESH PRODUCE

TABLE 81 FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 82 FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 86 EUROPE: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 88 ASIA PACIFIC: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 89 SOUTH AMERICA: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 90 SOUTH AMERICA: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 ROW: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 92 ROW: FRUIT & VEGETABLE SEASONING SYSTEMS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.8 PACKAGING & HANDLING

7.8.1 STEEP GROWTH IN URBANIZATION AND INCREASING QSRS TO DRIVE SEGMENT GROWTH

TABLE 93 FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 94 FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 98 EUROPE: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 101 SOUTH AMERICA: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 102 SOUTH AMERICA: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 103 ROW: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 104 ROW: FRUIT & VEGETABLE PACKAGING & HANDLING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.9 OTHER EQUIPMENT

TABLE 105 OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 106 OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 110 EUROPE: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 113 SOUTH AMERICA: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 114 SOUTH AMERICA: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 ROW: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 116 ROW: OTHER FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET, BY OPERATION TYPE (Page No. - 183)

8.1 INTRODUCTION

FIGURE 52 AUTOMATIC EQUIPMENT IS PROJECTED TO GROW AT A HIGHER CAGR BETWEEN 2022 & 2027 (USD MILLION)

TABLE 117 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2017–2021 (USD MILLION)

TABLE 118 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2022–2027 (USD MILLION)

8.2 COVID-19 IMPACT ON THE FRUIT & VEGETABLE PROCESSING MARKET, BY OPERATION TYPE

TABLE 119 OPTIMISTIC SCENARIO: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2018–2021 (USD MILLION)

TABLE 120 REALISTIC SCENARIO: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2018–2021 (USD MILLION)

TABLE 121 PESSIMISTIC SCENARIO: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2018–2021 (USD MILLION)

8.3 AUTOMATIC

8.3.1 ACCURACY, TIME-SAVING, AND EFFICIENCY TO DRIVE AUTOMATION

TABLE 122 AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 123 AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 124 AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 125 AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 SEMI-AUTOMATIC

8.4.1 LOWER INSTALLATION AND MAINTENANCE COSTS FUEL THE MARKET IN DEVELOPING COUNTRIES

TABLE 126 SEMI-AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 127 SEMI-AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

TABLE 128 SEMI-AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 129 SEMI-AUTOMATIC FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 PROCESSED FRUITS & VEGETABLES MARKET, BY TYPE (Page No. - 191)

9.1 INTRODUCTION

FIGURE 53 PROCESSED VEGETABLES ARE PROJECTED TO DOMINATE THE MARKET THROUGH 2027 (USD MILLION)

TABLE 130 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 131 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 132 PROCESSED FRUITS MARKET SIZE, BY SUBTYPE, 2017–2021 (USD MILLION)

TABLE 133 PROCESSED FRUITS MARKET SIZE, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 134 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (MT)

TABLE 135 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (MT)

9.2 COVID-19 IMPACT ON THE PROCESSED FRUITS & VEGETABLES MARKET, BY TYPE

TABLE 136 OPTIMISTIC SCENARIO: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 137 REALISTIC SCENARIO: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 138 PESSIMISTIC SCENARIO: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

9.3 FRUITS

9.3.1 HEALTH BENEFITS AND COMPETITIVE PRICES OF PROCESSED PRODUCTS TO BE KEY MARKET INFLUENCERS

TABLE 139 PROCESSED FRUITS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 140 PROCESSED FRUITS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 141 PROCESSED FRUITS MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 142 PROCESSED FRUITS MARKET SIZE, BY REGION, 2022–2027 (MT)

9.3.2 BERRIES

9.3.2.1 Versatility of use ranging from salads to convenience food keeps berries in demand

TABLE 143 PROCESSED BERRIES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 144 PROCESSED BERRIES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.3 PITS

9.3.3.1 Increase in parental preference for pits as healthy snacking option for kids

TABLE 145 PROCESSED PITS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 146 PROCESSED PITS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.4 CORE FRUITS

9.3.4.1 Asia Pacific to drive demand for core fruits in the future

TABLE 147 PROCESSED CORE FRUITS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 148 PROCESSED CORE FRUITS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.5 CITRUS

9.3.5.1 Increased demand for vitamin C-rich fruits due to COVID-19

TABLE 149 PROCESSED CITRUS FRUITS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 150 PROCESSED CITRUS FRUITS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.6 MELONS

9.3.6.1 Year-round availability and added health benefits to drive segment

TABLE 151 PROCESSED MELONS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 152 PROCESSED MELONS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.7 TROPICAL FRUITS

9.3.7.1 Immunity-building fruits in demand after COVID-19 outbreak

TABLE 153 PROCESSED TROPICAL FRUITS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 154 PROCESSED TROPICAL FRUITS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 VEGETABLES

9.4.1 HEALTH CONSCIOUSNESS & GROWING VEGAN POPULATION DRIVE VEGETABLE DEMAND

TABLE 155 PROCESSED VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 156 PROCESSED VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 157 PROCESSED VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 158 PROCESSED VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

9.5 OTHER TYPES

TABLE 159 OTHER PROCESSED FRUIT & VEGETABLE TYPES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 160 OTHER PROCESSED FRUIT & VEGETABLE TYPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 161 OTHER PROCESSED FRUIT & VEGETABLE TYPES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 162 OTHER PROCESSED FRUIT & VEGETABLE TYPES MARKET SIZE, BY REGION, 2022–2027 (MT)

10 PROCESSED FRUITS & VEGETABLES MARKET, BY PRODUCT TYPE (Page No. - 209)

10.1 INTRODUCTION

FIGURE 54 FRESH FRUITS & VEGETABLES TO DOMINATE THE PROCESSED MARKET THROUGH 2027 (USD MILLION)

TABLE 163 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 164 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 165 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (MT)

TABLE 166 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MT)

10.2 COVID-19 IMPACT ON THE PROCESSED FRUITS & VEGETABLES MARKET, BY PRODUCT TYPE

TABLE 167 OPTIMISTIC SCENARIO: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

TABLE 168 REALISTIC SCENARIO: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

TABLE 169 PESSIMISTIC SCENARIO: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

10.3 FRESH

10.3.1 INCREASED CONSUMPTION OF FRESH PRODUCE DUE TO DIETARY CHANGES INDUCED BY COVID-19

TABLE 170 FRESH FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 171 FRESH FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 172 FRESH FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 173 FRESH FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

10.4 FRESH-CUT

10.4.1 SINGLE-SERVE FRESH-CUT PRODUCE TO BE PREFERRED MORE

TABLE 174 FRESH-CUT FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 175 FRESH-CUT FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 176 FRESH-CUT FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 177 FRESH-CUT FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

10.5 CANNED

10.5.1 CANNED FRUITS DIPPED IN NATURAL JUICE INSTEAD OF SUGAR SYRUP TO GAIN CONSUMER PREFERENCE

TABLE 178 CANNED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 179 CANNED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 180 CANNED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 181 CANNED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

10.6 FROZEN

10.6.1 ALL-SEASON AVAILABILITY AND LACK OF PRESERVATIVE USE TO INCREASE DEMAND FOR FROZEN FOODS

TABLE 182 FROZEN FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 183 FROZEN FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 184 FROZEN FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 185 FROZEN FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

10.7 DRIED & DEHYDRATED

10.7.1 NEED FOR BETTER SHELF-LIFE WILL INCREASE DEMAND IN DEVELOPING COUNTRIES

TABLE 186 DRIED & DEHYDRATED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 187 DRIED & DEHYDRATED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 188 DRIED & DEHYDRATED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 189 DRIED & DEHYDRATED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

10.8 CONVENIENCE

10.8.1 BUSY CONSUMER LIFESTYLE AND GROWTH IN PER CAPITA INCOME TO DRIVE DEMAND FOR CONVENIENCE FOODS

TABLE 190 CONVENIENCE FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 191 CONVENIENCE FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 192 CONVENIENCE FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 193 CONVENIENCE FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

11 PROCESSED FRUITS & VEGETABLES MARKET, BY PROCESSING SYSTEM (Page No. - 225)

11.1 INTRODUCTION

11.2 SMALL-SCALE

11.2.1 GOVERNMENT INITIATIVES AND INVESTMENTS BOOST THE GROWTH OF SMALL-SCALE PROCESSING UNITS

11.3 INTERMEDIATE-SCALE

11.3.1 ADOPTION OF NOVEL TECHNOLOGIES IN THE MARKET FOR INTERMEDIATE-SCALE PROCESSING SYSTEMS

11.4 LARGE-SCALE

11.4.1 TO ACQUIRE A MAJOR MARKET, LARGE INVESTMENTS AND LARGE SCALE ARE NECESSITIES

12 FRUIT & VEGETABLE PROCESSING MARKET, BY REGION (Page No. - 227)

12.1 INTRODUCTION

TABLE 194 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 195 FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 196 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 197 PROCESSED FRUIT & VEGETABLES MARKET SIZE, BY REGION 2022–2027 (USD MILLION)

TABLE 198 PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 199 PROCESSED FRUIT & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

12.2 COVID-19 IMPACT ON THE FRUITS & VEGETABLE PROCESSING EQUIPMENT MARKET, BY REGION

TABLE 200 OPTIMISTIC SCENARIO: FRUITS & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

TABLE 201 REALISTIC SCENARIO: FRUITS & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 202 PESSIMISTIC SCENARIO: FRUITS & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

12.3 NORTH AMERICA

12.3.1 GROWING NUMBER OF DISTRIBUTION CHANNELS IN NORTH AMERICA

FIGURE 55 NORTH AMERICA: MARKET SNAPSHOT

TABLE 203 NORTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 204 NORTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 205 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 206 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 207 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2017–2021 (MT)

TABLE 208 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2022–2027 (MT)

TABLE 209 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 210 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 211 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (MT)

TABLE 212 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MT)

TABLE 213 NORTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 214 NORTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027(USD MILLION)

TABLE 215 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 216 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027(USD MILLION)

TABLE 217 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (MT)

TABLE 218 NORTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (MT)

TABLE 219 NORTH AMERICA: FRUITS & VEGETABLES PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2017–2021 (USD MILLION)

TABLE 220 NORTH AMERICA: FRUITS & VEGETABLES PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2022–2027 (USD MILLION)

12.3.2 US

12.3.2.1 Growth in vegan population and continuous innovation boost the convenience food market in the US

TABLE 221 US: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 222 US: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.3.3 CANADA

12.3.3.1 Shift from heavily processed food to healthy products fueled by an aging Canadian population

TABLE 223 CANADA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 224 CANADA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.3.4 MEXICO

12.3.4.1 Increased demand for vitamin-C-rich fresh products drives market in Mexico

TABLE 225 MEXICO: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 226 MEXICO: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4 EUROPE

FIGURE 56 EUROPE: MARKET SNAPSHOT

TABLE 227 EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 228 EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 229 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 230 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 231 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2017–2021 (MT)

TABLE 232 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2022–2027 (MT)

TABLE 233 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 234 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 235 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (MT)

TABLE 236 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MT)

TABLE 237 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 238 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 239 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (MT)

TABLE 240 EUROPE: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (MT)

TABLE 241 EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2017–2021(USD MILLION)

TABLE 242 EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2022–2027 (USD MILLION)

12.4.1 EUROPE: FRUIT & VEGETABLE PROCESSING MARKET, BY EQUIPMENT TYPE

TABLE 243 EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 244 EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.2 GERMANY

12.4.2.1 Growing aging population and continuous innovation boost the market in Germany

TABLE 245 GERMANY: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 246 GERMANY: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.3 UK

12.4.3.1 High-quality food products rich in protein, vitamins, and minerals experience demand surge in the UK

TABLE 247 UK: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 248 UK: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.4 FRANCE

12.4.4.1 Young consumers shifting to value-priced ready-to-eat functional foods in France

TABLE 249 FRANCE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 250 FRANCE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.5 ITALY

12.4.5.1 Changes in demographics and working patterns drive demand for ready-to-eat foods in Italy

TABLE 251 ITALY: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 252 ITALY: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.6 SPAIN

12.4.6.1 Taste, freshness, and internal fruit quality are important characteristics for Spanish consumers

TABLE 253 SPAIN: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 254 SPAIN: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.7 NETHERLANDS

12.4.7.1 Tropical fruits and vegetables experience increased demand in the Netherlands

TABLE 255 NETHERLANDS: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 256 NETHERLANDS: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.4.8 REST OF EUROPE

TABLE 257 REST OF EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 258 REST OF EUROPE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5 ASIA PACIFIC

FIGURE 57 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 259 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 260 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 261 REST OF ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 262 REST OF ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 263 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (USD MILLION)

TABLE 264 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 265 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY/REGION, 2017–2021 (MT)

TABLE 266 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY/REGION, 2022–2027 (MT)

TABLE 267 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 268 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 269 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (MT)

TABLE 270 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MT)

TABLE 271 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 272 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 273 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (MT)

TABLE 274 ASIA PACIFIC: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (MT)

TABLE 275 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2017–2021 (USD MILLION)

TABLE 276 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2022–2027 (USD MILLION)

12.5.1 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING MARKET, BY EQUIPMENT TYPE

TABLE 277 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 278 ASIA PACIFIC: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.2 CHINA

12.5.2.1 China is the key market for fruit & vegetable processing players

TABLE 279 CHINA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 280 CHINA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.3 JAPAN

12.5.3.1 Improvement in product quality and safety to drive Japanese industry expansion

TABLE 281 JAPAN: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 282 JAPAN: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.4 INDIA

12.5.4.1 Government schemes and incentives to further expand the Indian processed fruits & vegetables market

TABLE 283 INDIA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 284 INDIA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.5 AUSTRALIA & NEW ZEALAND

12.5.5.1 Need for health and uniqueness driving innovations in Australia & New Zealand

FIGURE 58 NEW ZEALAND: HORTICULTURAL PRODUCE EXPORTS (FRESH, FROZEN AND OTHER PROCESSES), 2019–2020 (USD MILLION)

TABLE 285 AUSTRALIA & NEW ZEALAND: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 286 AUSTRALIA & NEW ZEALAND: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.6 REST OF ASIA PACIFIC

12.5.6.1 Vietnam

12.5.6.1.1 Government schemes and foreign investment will help Vietnamese market growth

TABLE 287 VIETNAM: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 288 VIETNAM: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.6.2 Malaysia

12.5.6.2.1 Variety of options and added health benefits drive the Malaysian convenience food market growth

TABLE 289 MALAYSIA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 290 MALAYSIA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.6.3 Singapore

12.5.6.3.1 Affordability and convenience with added health benefits drive market growth in Singapore

TABLE 291 SINGAPORE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 292 SINGAPORE: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.5.6.4 Other countries

TABLE 293 OTHER COUNTRIES: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 294 OTHER COUNTRIES: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.6 SOUTH AMERICA

FIGURE 59 SOUTH AMERICA: MARKET SNAPSHOT

TABLE 295 SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 296 SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 297 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 298 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 299 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2017–2021 (MT)

TABLE 300 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY COUNTRY, 2022–2027 (MT)

TABLE 301 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 302 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 303 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (MT)

TABLE 304 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MT)

TABLE 305 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 306 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 307 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (MT)

TABLE 308 SOUTH AMERICA: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (MT)

TABLE 309 SOUTH AMERICA: FRUITS & VEGETABLES PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2017–2021 (USD MILLION)

TABLE 310 SOUTH AMERICA: FRUITS & VEGETABLES PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2022–2027 (MT)

12.6.1 SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET BY EQUIPMENT TYPE

TABLE 311 SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 312 SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Expansion in export opportunities to drive Brazilian industry growth

TABLE 313 BRAZIL: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 314 BRAZIL: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.6.3 ARGENTINA

12.6.3.1 The Healthy Eating movement by the Argentinian government drives consumption of fruits and vegetables

TABLE 315 ARGENTINA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 316 ARGENTINA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.6.4 REST OF SOUTH AMERICA

TABLE 317 REST OF SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 318 REST OF SOUTH AMERICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.7 REST OF THE WORLD (ROW)

TABLE 319 ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 320 ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 321 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

TABLE 322 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 323 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2017–2021 (MT)

TABLE 324 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (MT)

TABLE 325 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (USD MILLION)

TABLE 326 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 327 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2017–2021 (MT)

TABLE 328 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY PRODUCT TYPE, 2022–2027 (MT)

TABLE 329 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

TABLE 330 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 331 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2017–2021 (MT)

TABLE 332 ROW: PROCESSED FRUITS & VEGETABLES MARKET SIZE, BY TYPE, 2022–2027 (MT)

TABLE 333 ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY OPERATION TYPE, 2017–2021 (USD MILLION)

TABLE 334 ROW: FRUITS & VEGETABLES PROCESSING EQUIPMENT SIZE, BY OPERATION TYPE, 2022–2027(USD MILLION)

12.7.1 ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET BY EQUIPMENT TYPE

TABLE 335 ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 336 ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.7.2 MIDDLE EAST

12.7.2.1 Establishment of High Standard Cold Storage Infrastructure drives the frozen fruits & vegetables market in the Middle East

TABLE 337 MIDDLE EAST: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 338 MIDDLE EAST: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.7.3 AFRICA

12.7.3.1 Rising middle-class population and increased spending power drives the shift to convenience foods

TABLE 339 AFRICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 340 AFRICA: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

12.7.4 OTHERS IN ROW

TABLE 341 OTHERS IN ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2017–2021 (USD MILLION)

TABLE 342 OTHERS IN ROW: FRUIT & VEGETABLE PROCESSING EQUIPMENT MARKET SIZE, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 316)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS

TABLE 343 FRUIT & VEGETABLE PROCESSING MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

13.3 KEY PLAYER STRATEGIES

13.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 60 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

13.5 COVID-19-SPECIFIC COMPANY RESPONSE

13.5.1 GEA GROUP (GERMANY)

13.5.2 ALFA LAVAL (SWEDEN)

13.5.3 JBT CORPORATION (US)

13.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 61 FRUIT & VEGETABLE PROCESSING INDUSTRY MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

13.7 PRODUCT FOOTPRINT

TABLE 344 COMPANY EQUIPMENT TYPE FOOTPRINT

TABLE 345 COMPANY OPERATION TYPE FOOTPRINT

TABLE 346 COMPANY REGIONAL FOOTPRINT

TABLE 347 OVERALL COMPANY FOOTPRINT

13.8 FRUIT & VEGETABLE PROCESSING INDUSTRY MARKET, START-UP/SME EVALUATION QUADRANT

13.8.1 PROGRESSIVE COMPANIES

13.8.2 STARTING BLOCKS

13.8.3 RESPONSIVE COMPANIES

13.8.4 DYNAMIC COMPANIES

TABLE 348 FRUIT & VEGETABLE PROCESSING MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 349 FRUIT & VEGETABLE PROCESSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

FIGURE 62 FRUIT & VEGETABLE PROCESSING INDUSTRY MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UPS/SMES)

13.9 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

13.9.1 PRODUCT LAUNCHES

TABLE 350 PRODUCT LAUNCHES, 2019–2021

13.9.2 DEALS

TABLE 351 DEALS, 2018–2022

13.9.3 OTHERS

TABLE 352 OTHERS, 2020–2022

14 COMPANY PROFILES (Page No. - 338)

14.1 FRUIT & VEGETABLE PROCESSING EQUIPMENT COMPANIES

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

14.1.1 GEA GROUP

TABLE 353 GEA GROUP: BUSINESS OVERVIEW

FIGURE 63 GEA GROUP: COMPANY SNAPSHOT

TABLE 354 GEA GROUP: PRODUCTS OFFERED

TABLE 355 GEA GROUP: DEALS

TABLE 356 GEA GROUP: PRODUCT LAUNCHES

14.1.2 BÜHLER GROUP

TABLE 357 BÜHLER GROUP: BUSINESS OVERVIEW

FIGURE 64 BÜHLER GROUP: COMPANY SNAPSHOT

TABLE 358 BÜHLER GROUP: PRODUCTS OFFERED

TABLE 359 BÜHLER GROUP: DEALS

TABLE 360 BÜHLER GROUP: PRODUCT LAUNCHES

TABLE 361 BÜHLER GROUP: OTHERS

14.1.3 ALFA LAVAL

TABLE 362 ALFA LAVAL: BUSINESS OVERVIEW

FIGURE 65 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 363 ALFA LAVAL: PRODUCTS OFFERED

TABLE 364 ALFA LAVAL: DEAL

TABLE 365 ALFA LAVAL: PRODUCT LAUNCHES

TABLE 366 ALFA LAVAL: OTHERS

14.1.4 JBT CORPORATION

TABLE 367 JBT CORPORATION: BUSINESS OVERVIEW

FIGURE 66 JBT CORPORATION: COMPANY SNAPSHOT

TABLE 368 JBT CORPORATION: PRODUCTS OFFERED

TABLE 369 JBT CORPORATION: DEALS

14.1.5 SYNTEGON TECHNOLOGY GMBH

TABLE 370 SYNTEGON TECHNOLOGY: BUSINESS OVERVIEW

TABLE 371 SYNTEGON TECHNOLOGY: PRODUCTS OFFERED

TABLE 372 SYNTEGON TECHNOLOGY: PRODUCT LAUNCHES

14.1.6 KRONES AG

TABLE 373 KRONES AG: BUSINESS OVERVIEW

FIGURE 67 KRONES AG: COMPANY SNAPSHOT

TABLE 374 KRONES AG: PRODUCTS OFFERED

TABLE 375 KRONES AG: DEALS

14.1.7 MAREL

TABLE 376 MAREL: BUSINESS OVERVIEW

FIGURE 68 MAREL: COMPANY SNAPSHOT

TABLE 377 MAREL: PRODUCTS OFFERED

14.1.8 BIGTEM MAKINE A.S.

TABLE 378 BIGTEM MAKINE A.S.: BUSINESS OVERVIEW

TABLE 379 BIGTEM MAKINE A.S.: PRODUCTS OFFERED

TABLE 380 BIGTEM MAKINE A.S.: DEALS

14.1.9 FENCO FOOD MACHINERY S.R.L

TABLE 381 FENCO FOOD MACHINERY S.R. L.: BUSINESS OVERVIEW

TABLE 382 FENCO FOOD MACHINERY S.R. L.: PRODUCTS OFFERED

14.1.10 ANKO FOOD MACHINE CO., LTD

TABLE 383 ANKO FOOD MACHINE CO.LTD.: BUSINESS OVERVIEW

TABLE 384 ANKO FOOD MACHINE CO.LTD.: PRODUCTS OFFERED

14.1.11 HEAT AND CONTROL, INC.

TABLE 385 HEAT AND CONTROL, INC.: BUSINESS OVERVIEW

TABLE 386 HEAT AND CONTROL, INC.: PRODUCTS OFFERED

TABLE 387 HEAT AND CONTROL, INC.: OTHERS

14.1.12 FINIS

TABLE 388 FINIS: BUSINESS OVERVIEW

TABLE 389 FINIS: PRODUCTS OFFERED

14.2 PROCESSED FRUIT & VEGETABLE COMPANIES

14.2.1 CONAGRA BRANDS

TABLE 390 CONAGRA: BUSINESS OVERVIEW

FIGURE 69 CONAGRA: COMPANY SNAPSHOT

TABLE 391 CONAGRA: PRODUCTS OFFERED

TABLE 392 CONAGRA: PRODUCT LAUNCHES

14.2.2 GREENCORE GROUP

TABLE 393 GREENCORE GROUP: BUSINESS OVERVIEW

FIGURE 70 GREENCORE GROUP: COMPANY SNAPSHOT

TABLE 394 GREENCORE GROUP: PRODUCTS OFFERED

TABLE 395 GREENCORE GROUP: DEALS

14.2.3 NESTLÉ

TABLE 396 NESTLÉ: BUSINESS OVERVIEW

FIGURE 71 NESTLÉ: COMPANY SNAPSHOT

TABLE 397 NESTLÉ: PRODUCTS OFFERED

TABLE 398 NESTLÉ: DEALS

14.2.4 OLAM INTERNATIONAL

TABLE 399 OLAM INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 72 OLAM INTERNATIONAL COMPANY SNAPSHOT

TABLE 400 OLAM INTERNATIONAL: PRODUCTS OFFERED

TABLE 401 OLAM INTERNATIONAL: DEALS, 2018

14.2.5 THE KRAFT HEINZ COMPANY

TABLE 402 THE KRAFT HEINZ COMPANY: BUSINESS OVERVIEW

TABLE 403 THE KRAFT HEINZ COMPANY: PRODUCTS OFFERED

TABLE 404 THE KRAFT HEINZ COMPANY: DEALS

TABLE 405 THE KRAFT HEINZ COMPANY: PRODUCT LAUNCHES

14.2.6 PEPSICO INC.

TABLE 406 PEPSICO INC: BUSINESS OVERVIEW

FIGURE 73 PEPSICO INC.: COMPANY SNAPSHOT

TABLE 407 PEPSICO INC.: PRODUCTS OFFERED

TABLE 408 PEPSICO INC.: DEALS

14.2.7 AGRANA BETEILIGUNGS-AG

TABLE 409 AGRANA BETEILIGUNGS AG: BUSINESS OVERVIEW

FIGURE 74 AGRANA BETEILIGUNGS AG: SNAPSHOT

TABLE 410 AGRANA BETEILIGUNGS AG: PRODUCTS OFFERED

TABLE 411 AGRANA BETEILIGUNGS AG: DEALS

TABLE 412 AGRANA BETEILIGUNGS AG: OTHERS

14.2.8 BONDUELLE

TABLE 413 BONDUELLE: BUSINESS OVERVIEW

FIGURE 75 BONDUELLE: COMPANY SNAPSHOT

TABLE 414 BONDUELLE: PRODUCTS OFFERED

TABLE 415 BONDUELLE: DEALS

TABLE 416 BONDUELLE: PRODUCT LAUNCHES

TABLE 417 BONDUELLE: OTHERS

14.2.9 DOLE FOOD

TABLE 418 DOLE FOOD: BUSINESS OVERVIEW

TABLE 419 DOLE FOODS: PRODUCTS OFFERED

TABLE 420 DOLE FOOD: DEALS

14.2.10 SVZ INTERNATIONAL B.V.

TABLE 421 SVZ INTERNATIONAL B.V.: BUSINESS OVERVIEW

TABLE 422 SVZ INTERNATIONAL B.V.: PRODUCTS OFFERED

TABLE 423 SVZ INTERNATIONAL B.V.: PRODUCT LAUNCHES

14.2.11 SAHYADRI FARMS

TABLE 424 SAHYADRI FARMS: BUSINESS OVERVIEW

TABLE 425 SAHYADRI FARMS: PRODUCTS OFFERED

14.2.12 DIANA GROUP S.A.S.

TABLE 426 DIANA GROUP S.A.S.: BUSINESS OVERVIEW

TABLE 427 DIANA GROUP S.A.S.: PRODUCTS OFFERED

TABLE 428 DIANA GROUP S.A.S.: PRODUCT LAUNCHES

14.2.13 RAJE AGRO FOOD

TABLE 429 RAJE AGRO FOOD: BUSINESS OVERVIEW

TABLE 430 RAJE AGRO FOOD: PRODUCTS OFFERED

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

14.3 OTHER PLAYERS

14.3.1 KRONITECK-FOOD PROCESSING MACHINES

14.3.2 SEALTECH ENGINEERS

14.3.3 NEOLOGIC ENGINEERS PRIVATE LIMITED

14.3.4 SHIVA ENGINEERS

14.3.5 BK ENGINEERS

14.3.6 HARSHAD FOOD EQUIPMENTS

14.3.7 FOODCONS GMBH & CO. KG

14.3.8 WOOTZANO LTD.

14.3.9 OCTOFROST

14.3.10 JUICING DOT SYSTEMS INC.

15 ADJACENT AND RELATED MARKETS (Page No. - 429)

15.1 INTRODUCTION

TABLE 431 ADJACENT MARKETS TO THE FOOD PROCESSING & HANDLING EQUIPMENT MARKET

15.2 LIMITATIONS

15.3 FRUITS & VEGETABLE PROCESSING ENZYME MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 432 FRUIT & VEGETABLE PROCESSING ENZYMES MARKET SIZE, BY TYPE, 2014–2022 (USD MILLION)

15.4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 433 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 434 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

15.5 ASEPTIC PROCESSING MARKET

15.5.1 MARKET DEFINITION

15.5.2 MARKET OVERVIEW

TABLE 435 PACKAGING MARKET SIZE, BY TYPE, 2015–2022 (USD BILLION)

16 APPENDIX (Page No. - 434)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS