Healthcare Fabrics Market by Raw Material (Polypropylene, Cotton, Polyester, Viscose, Polyamide), Fabric Type (Non-woven, Woven, Knitted), Application (Hygiene, Dressing, Clothing, Curtains, Blanket & Bedding, Upholstery) - Global Forecast to 2025

Updated on : October 25, 2024

Healthcare Fabrics Market

The global healthcare fabrics market was valued at USD 16.8 billion in 2020 and is projected to reach USD 23.3 billion by 2025, growing at 6.7% cagr from 2020 to 2025. The major application of healthcare fabric is in hygiene products, clothing, blanket & bedding, privacy curtains, among others. Healthcare fabrics are specifically manufactured for different applications in the healthcare sector. These fabrics are designed and produced to be used in medical and hygiene applications. Healthcare fabrics can be produced using various fibers such as polypropylene, polyester, cotton, viscose, polyamide, and others. The fibers used in the healthcare industry should possess antimicrobial, fire-resistant, non-allergic, and non-carcinogenic properties. These fabrics are produced using technologies such as weaving, non-weaving, and knitting. This improved quality of healthcare fabrics and increasing consumer awareness will increase the demand for healthcare fabrics, which, in turn, will drive market growth.

Increasing awareness of hygiene products through promotions and advertising is primarily driving the healthcare fabrics market. For example, the manufacturers such as Procter & Gamble Co. (US), Johnson & Johnson (US), Unicharm Corporation (Japan), and Kimberly-Clark Corporation (US) are focusing on advertising and promotions to increase the awareness of baby diapers and other hygiene products among consumers.

Attractive Opportunities in the Healthcare Fabrics Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Fabrics Market Dynamics

Drivers: Improved quality of healthcare fabrics

The healthcare industry demands a hygienic and bacteria-free environment. Hence, high-quality fabrics are used in healthcare applications, including privacy curtains, dressing products, blankets & bedding, upholstery, and clothing and hygiene products. In this industry, anti-microbial textile is used in several application areas such as bed linen, surgical gowns & drapes, wound dressing & bandages, and curtains to prevent infections. Factors such as an increase in the number of healthcare services, rising prevalence of chronic diseases, and growing awareness of better healthcare practices have increased the need for antimicrobial textiles in the healthcare industry. This has encouraged many manufacturers to develop materials or products that can combat Healthcare-Associated Infections (HAIs) and reduce the risk of infection. The market players such as Designtex (US), Knoll, Inc. (US), and Maharam Fabric Corporation (US) are developing healthcare fabrics that are resistant to microbial contamination, fire, dirt, stain, and water. Hence, the increase in the development of high-quality healthcare fabrics is expected to drive the market.

Restraint Increased carbon-footprint due to use of female hygiene products

The increased use of sanitary napkins among females has led to a serious environmental concern. According to Menstrual Health Alliance India, one sanitary napkin can take around 500-800 years to decompose. Personal hygiene products such as diapers and sanitary napkins are produced from non-biodegradable materials. When these non-biodegradable materials are dumped in landfills, they release harmful gasses into the atmosphere, thus increasing the carbon footprint as well. Most of the sanitary napkins are 90% plastic. Each sanitary napkin is considered equivalent to 4 plastic bags. These personal hygiene products are made from polypropylene, which is non-biodegradable. The high use of sanitary napkins is raising environmental concerns.

Opportunities: Advancements in medical science and textile industry

The use of medical textile continues to grow at an astounding rate. With the improvement in health & hygiene facilities globally, the growth in medical textile technology is significantly growing. Big corporations are investing in R&D to develop fabrics with better quality and improved characteristics. Researchers are working hard to invent fabrics that have stability, elasticity, and porosity to fit various applications. Consumers are now more health-conscious, and with stringent government rules toward health and environment, companies are developing fabrics that are biocompatible, non-toxic, anti-allergic, and anti-bacterial during their life cycle usage. The development of medical textile has been successfully demonstrated in fibers, including cotton, polyester, and linen. This will provide high growth potential to the market in the future.

CHALLENGES :Counterfeited healthcare clothing in the market

The COVID-19 crisis has led to a surplus in demand for PPEs. Counterfeit PPEs by the grey marketers have multiplied with the supplies surfacing on the grey market, including isolation gowns, testing kits, swabs, and N95 masks. According to a recent media release, the US Customs and Border Protection has completed 18 seizures of counterfeited and unapproved COVID-19 protective equipment and medications since March 2020. A lot of fake documents and unauthorized sources have surfaced. Companies such as 3M and Honeywell International Inc. are fighting the COVID-19-related fraud. 3M has arranged hotlines in the US and around the world to keep customers informed of the authentic 3M respirators and ensure that the products are from 3M authorized distributors. They have also filed lawsuits in courts against the fraudsters and terminated 3M distributors for engaging in price gorging or violating the 3M policy.

Hygiene to be the largest application of healthcare fabrics

Hygiene is the largest application of the healthcare fabrics market. The growing importance of healthcare fabrics in the manufacturing of baby diapers and sanitary napkins drives the market in the hygiene products segment. The hygiene products segment is projected to register the highest CAGR between 2020 and 2025. Moreover, the rising awareness of feminine hygiene, growing disposable income, and increasing birth rate are expected to fuel the growth of the healthcare fabrics market in hygiene products

Non-woven to be the fastest-growing healthcare fabric type segment

Non-woven fabric is estimated to have accounted for the largest share of the healthcare fabrics market in 2019. These fabrics are used in various hygiene products ranging from baby diapers to adult incontinence products. Non-woven fabrics are used as an alternative to traditional textile owing to excellent absorption properties, softness, smoothness, strength, comfort and fit, stretchability, and cost-effectiveness. The fabric has various advantages over woven and knitted fabrics and, hence, is expected to register the highest CAGR during the forecast period.

Polypropylene to be the largest raw material segment for healthcare fabrics

Polypropylene is estimated to account for the largest share in the healthcare fabrics market in 2019. The segment is projected to continue its leadership during the forecast period owing to the high demand for hygiene products. Polypropylene is used to manufacture the top sheet of hygiene products; hence, the increasing demand for sanitary napkins and baby diapers is expected to drive the polypropylene segment during the forecast period. The polyester segment is projected to register the highest during the forecast period. This high growth is mainly attributed to its high performance at lower costs.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Europe to account for the largest share of the global healthcare fabrics market during the forecast period

Europe is the largest market for healthcare fabrics, followed by APAC and North America. The growth of this market in Europe is propelled by high expenditure on healthcare and increased purchasing power. Moreover, the increasing demand for eco-friendly hygiene products will drive the demand for healthcare fabrics that are used in sanitary napkins, baby diapers, and adult diapers. APAC is projected to register the highest CAGR during the forecast period. The rising awareness regarding health and hygiene drives the demand for feminine hygiene products, which will drive the demand for healthcare fabrics across APAC.

Healthcare Fabrics Market Ecosystem

Healthcare Fabrics Market Players

The key market players profiled in the report include as Kimberly-Clark Corporation (US), Berry Global Group Inc. (US), Freudenberg Group (Germany), Ahlstrom Munksjo OYJ (Finland), Asahi Kasei Corporation (Switzerland), Knoll Inc. (US), Eximus Corporation (India), Paramount Tech Fab Industries (India), Carnegie Fabrics LLC (US), Avgol Industries 1953 Ltd. (Israel) among others.

Kimberly-Clark Corporation is the largest player in the healthcare fabrics market. Kimberly-Clark Corporation is a leading company focused in essential products. The company is principally engaged in manufacturing and marketing of a wide range of products made from natural or synthetic fibers using advanced technologies in fibers, nonwovens, and absorbency.

Freudenberg Group is the second-largest player in the healthcare fabrics market. The Freudenberg Group is a leading German company which deals in housewares, cleaning products, automobile parts, textiles, building materials, and telecommunication. The company has its production facilities worldwide including Europe, Asia, and North and South America.

Healthcare Fabrics Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2025 |

|

Base Year considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments covered |

Raw Material, Fabric Type, Application, and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Kimberly-Clark Corporation (US), Berry Global Group Inc. (US), Freudenberg Group (Germany), Ahlstrom Munksjo OYJ (Finland), Asahi Kasei Corporation (Japan), Knoll Inc. (US), Eximus Corporation (India), Paramount Tech Fab Industries (India), Carnegie Fabrics LLC (US), Avgol Industries 1953 Ltd. (Israel) among others. Total 25 major players covered. |

This report categorizes the global healthcare fabrics market based on raw material, fabric type, application, and region.

On the basis of raw material, the healthcare fabrics market has been segmented as follows:

- Polypropylene

- Cotton

- Polyester

- Viscose

- Polyamide

-

Others

- Polyurethane

- Polyethylene

- Vinyl

On the basis of fabric type, the healthcare fabrics market has been segmented as follows:

- Non-woven

- Woven

- Knitted

- Others

On the basis of application, the healthcare fabrics market has been segmented as follows:

-

Hygiene Products

- Sanitary Napkins

- Baby Diapers

- Adult Diapers

- Dressing Products

- Clothing

- Blanket & Bedding

- Privacy Curtains

- Upholstery

- Others

On the basis of region, the healthcare fabrics market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments:

- May 2020, Freudenberg Group announced to start manufacturing mouth-nose masks for end-consumers. The company has combined its technical nonwoven expertise for the in-house mask production, addressing the global demands for face masks

- In February 2020, Asahi Kasei Corporation introduced “ECORISE.” It is a plan-based PLA, which has wide applications, including production of facemasks

Frequently Asked Questions (FAQ):

What are the high growth applications of healthcare fabrics?

Clothing are extensively used in the healthcare industry to protect the hospital staff from any kind of infection. The healthcare fabrics are used to produce clothing such as apparel, surgical gown, contamination suits, radiation suits, surgical masks, and caps. The medical professionals select the type of clothing based on the requirements. Globally, the demand for disposable clothing is high because of the ease of use, hygiene, and cost-effectiveness.

What are the major factors impacting market growth during the forecast period?

The market growth is primarily due to the growing awareness of hygiene products coupled with the availability of highly efficient and innovative products in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 HEALTHCARE FABRICS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 HEALTHCARE FABRIC: MARKET DEFINITION AND INCLUSIONS, BY RAW MATERIAL

1.2.3 HEALTHCARE FABRICS: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.2.4 HEALTHCARE FABRIC: MARKET DEFINITION AND INCLUSIONS, BY FABRIC TYPE

1.3 MARKET SCOPE

1.3.1 HEALTHCARE FABRICS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 52)

2.1 HEALTHCARE FABRICS MARKET: STUDY APPROACH

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH:1

2.1.3 DEMAND-SIDE APPROACH:2

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – Demand- and Supply-side

2.3.2.2 Key industry insights

2.3.2.3 Breakdown of primary interviews

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 1 HEALTHCARE FABRICS MARKET: DATA TRIANGULATION

2.6 FACTORS ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS ASSOCIATED WITH THE HEALTHCARE FABRICS MARKET

3 EXECUTIVE SUMMARY (Page No. - 62)

FIGURE 2 HYGIENE TO BE THE LARGEST APPLICATION OF HEALTHCARE FABRICS

FIGURE 3 NON-WOVEN TO BE THE FASTEST-GROWING HEALTHCARE FABRIC TYPE SEGMENT

FIGURE 4 POLYPROPYLENE TO BE THE LARGEST RAW MATERIAL SEGMENT FOR HEALTHCARE FABRICS

FIGURE 5 EUROPE ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 SIGNIFICANT OPPORTUNITIES IN THE HEALTHCARE FABRICS MARKET

FIGURE 6 RISING HEALTHCARE EXPENDITURE TO DRIVE THE HEALTHCARE FABRIC MARKET DURING THE FORECAST PERIOD

4.2 HEALTHCARE FABRICS MARKET SIZE, BY REGION

FIGURE 7 EUROPE TO BE LARGEST HEALTHCARE FABRIC MARKET DURING THE FORECAST PERIOD

4.3 EUROPE: HEALTHCARE FABRICS MARKET, BY FABRIC TYPE AND COUNTRY, 2019

FIGURE 8 RUSSIA ACCOUNTED FOR THE LARGEST SHARE

4.4 HEALTHCARE FABRIC MARKET SIZE, BY APPLICATION

FIGURE 9 HYGIENE TO BE THE LARGEST SEGMENT

4.5 HEALTHCARE FABRICS MARKET SIZE, BY RAW MATERIAL

FIGURE 10 POLYPROPYLENE TO BE THE LARGEST SEGMENT

4.6 HEALTHCARE FABRIC MARKET ATTRACTIVENESS

FIGURE 11 INDIA TO BE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE HEALTHCARE FABRICS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing consumer awareness regarding hygiene products

5.2.1.2 Improved quality of healthcare fabrics

5.2.1.3 Growing need for better and convenient wound dressing material

5.2.1.4 Increasing use of non-woven fabrics in the healthcare industry

5.2.2 RESTRAINTS

5.2.2.1 Increased carbon footprint due to the use of female hygiene products

5.2.2.2 Availability of alternative products

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in medical science and textile industry

5.2.3.2 Shift toward eco-friendly products

5.2.4 CHALLENGES

5.2.4.1 Counterfeited healthcare clothing in the market

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TECHNOLOGY ANALYSIS

5.4.1 LIST OF NEW TECHNOLOGIES IN HEALTHCARE FABRICS, BY APPLICATION

5.5 COVID-19 IMPACT

5.5.1 INTRODUCTION

5.5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 14 COUNTRY-WISE SPREAD OF COVID-19

5.5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 15 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5.3.1 COVID-19 Impact on the Economy—Scenario Assessment

FIGURE 16 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 17 SCENARIOS OF COVID-19 IMPACT

5.6 COVID-19 IMPACT ON THE MEDICAL & HEALTHCARE INDUSTRY

5.6.1 DISRUPTION IN THE HEALTHCARE INDUSTRY DUE TO COVID-19

5.6.2 IMPACT ON CUSTOMERS’ OUTPUT AND STRATEGIES TO IMPROVE PRODUCTION

TABLE 1 HEALTHCARE COMPANIES’ ANNOUNCEMENTS

6 INDUSTRY TRENDS (Page No. - 85)

6.1 VALUE CHAIN ANALYSIS

FIGURE 18 THE HEALTHCARE FABRICS VALUE CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURING

6.1.3 DISTRIBUTION TO THE END-USER

6.2 AVERAGE SELLING PRICE TREND

FIGURE 19 AVERAGE PRICE OF HEALTHCARE FABRICS, BY REGION, 2019

6.3 HEALTHCARE FABRICS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 20 MARKET SIZE IN TERMS OF REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

6.3.1 NON-COVID-19 SCENARIO

6.3.2 OPTIMISTIC SCENARIO

6.3.3 PESSIMISTIC SCENARIO

6.3.4 REALISTIC SCENARIO

6.4 PATENT ANALYSIS

6.4.1 APPROACH

6.4.2 DOCUMENT TYPE

FIGURE 21 PATENTS REGISTERED FOR HEALTHCARE FABRICS, 2015-2020

FIGURE 22 PATENTS PUBLICATION TRENDS FOR HEALTHCARE FABRICS, 2015-2020

6.4.3 JURISDICTION ANALYSIS

FIGURE 23 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

6.4.4 TOP APPLICANTS

FIGURE 24 WUHU BAOPING INTELLIGENT SERVICE OUTSOURCING CO. LTD. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2015 AND 2020

6.5 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

FIGURE 25 HEALTHCARE FABRICS MARKET: CHANGING REVENUE MIX

6.6 CONNECTED MARKETS: ECOSYSTEM

FIGURE 26 HEALTHCARE FABRIC MARKET: ECOSYSTEM

6.7 CASE STUDIES

6.8 REGULATORY LANDSCAPE

TABLE 2 REGULATIONS ON HEALTHCARE FABRICS

6.9 TRADE DATA STATISTICS

6.9.1 IMPORT OF HEALTHCARE FABRICS: US

6.9.2 IMPORT OF HEALTHCARE FABRICS: INDIA

6.9.3 IMPORT OF HEALTHCARE FABRICS: BRAZIL

6.9.4 EXPORT OF HEALTHCARE FABRICS: INDIA

7 HEALTHCARE FABRICS MARKET, BY RAW MATERIAL (Page No. - 105)

7.1 INTRODUCTION

FIGURE 27 POLYPROPYLENE TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

TABLE 3 HEALTHCARE FABRICS MARKET SIZE, BY RAW MATERIAL, 2016–2019 (USD MILLION)

TABLE 4 HEALTHCARE FABRIC MARKET SIZE, BY RAW MATERIAL, 2020–2025 (USD MILLION)

TABLE 5 HEALTHCARE FABRICS MARKET SIZE, BY RAW MATERIAL, 2016–2019 (KILOTON)

TABLE 6 HEALTHCARE FABRIC MARKET SIZE, BY RAW MATERIAL, 2020–2025 (KILOTON)

7.2 POLYPROPYLENE

7.2.1 LIGHTEST OF ALL THE FIBERS

FIGURE 28 POLYPROPYLENE APPLICATIONS IN HEALTHCARE FABRICS MARKET

7.3 COTTON

7.3.1 DEMAND FOR ACID-RESISTANT FIBERS TO DRIVE THE MARKET

FIGURE 29 COTTON APPLICATIONS IN HEALTHCARE FABRIC MARKET

7.4 POLYESTER

7.4.1 HIGH TENSILE STRENGTH TO INCREASE ITS USE

FIGURE 30 POLYESTER APPLICATION IN HEALTHCARE FABRICS MARKET

7.5 VISCOSE

7.5.1 DEMAND FROM DRESSING APPLICATION IS DRIVING THE MARKET

FIGURE 31 VISCOSE APPLICATIONS IN HEALTHCARE FABRIC MARKET

7.6 POLYAMIDE

7.6.1 HIGH ELASTICITY, ABRASION RESISTANCE, AND HIGH MELTING POINT TO DRIVE THE MARKET

FIGURE 32 POLYAMIDE APPLICATIONS IN HEALTHCARE FABRICS MARKET

7.7 OTHERS

7.7.1 POLYURETHANE

7.7.2 POLYETHYLENE

7.7.3 VINYL

8 HEALTHCARE FABRICS MARKET, BY FABRIC TYPE (Page No. - 112)

8.1 INTRODUCTION

FIGURE 33 NON-WOVEN TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

TABLE 7 HEALTHCARE FABRICS MARKET SIZE, BY FABRIC TYPE, 2016–2019 (USD MILLION)

TABLE 8 HEALTHCARE FABRIC MARKET SIZE, BY FABRIC TYPE, 2020–2025 (USD MILLION)

TABLE 9 HEALTHCARE FABRICS MARKET SIZE, BY FABRIC TYPE, 2016–2019 (KILOTON)

TABLE 10 HEALTHCARE FABRIC MARKET SIZE, BY FABRIC TYPE, 2020–2025 (KILOTON)

8.2 NON-WOVEN FABRIC

8.2.1 DEMAND FROM HYGIENE APPLICATIONS TO DRIVE THE MARKET

FIGURE 34 EUROPE TO BE THE LARGEST MARKET FOR HEALTHCARE FABRICS IN NON-WOVEN FABRICS

TABLE 11 HEALTHCARE FABRICS MARKET SIZE IN NON-WOVEN FABRICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 HEALTHCARE FABRIC MARKET SIZE IN NON-WOVEN FABRICS, BY REGION, 2020–2025 (USD MILLION)

TABLE 13 HEALTHCARE FABRICS MARKET SIZE IN NON-WOVEN FABRICS, BY REGION, 2016–2019 (KILOTON)

TABLE 14 HEALTHCARE FABRIC MARKET SIZE IN NON-WOVEN FABRICS, BY REGION, 2020–2025 (KILOTON)

8.3 WOVEN FABRICS

8.3.1 HIGH COST RESTRAINING MARKET GROWTH

FIGURE 35 APAC TO BE THE LARGEST MARKET IN WOVEN FABRICS SEGMENT

TABLE 15 HEALTHCARE FABRICS MARKET SIZE IN WOVEN FABRICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 HEALTHCARE FABRIC MARKET SIZE IN WOVEN FABRICS, BY REGION, 2020–2025 (USD MILLION)

TABLE 17 HEALTHCARE FABRICS MARKET SIZE IN WOVEN FABRICS, BY REGION, 2016–2019 (KILOTON)

TABLE 18 HEALTHCARE FABRIC MARKET SIZE IN WOVEN FABRICS, BY REGION, 2020–2025 (KILOTON)

8.4 KNITTED FABRICS

8.4.1 GROWING DEMAND FOR SURGICAL HOSIERY DRIVING THE MARKET

FIGURE 36 EUROPE TO BE THE SECOND-LARGEST MARKET IN KNITTED FABRICS

TABLE 19 HEALTHCARE FABRICS MARKET SIZE IN KNITTED FABRICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 HEALTHCARE FABRIC MARKET SIZE IN KNITTED FABRICS, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 HEALTHCARE FABRICS MARKET SIZE IN KNITTED FABRICS, BY REGION, 2016–2019 (KILOTON)

TABLE 22 HEALTHCARE FABRIC MARKET SIZE IN KNITTED FABRICS, BY REGION, 2020–2025 (KILOTON)

9 HEALTHCARE FABRICS MARKET, BY APPLICATION (Page No. - 121)

9.1 INTRODUCTION

FIGURE 37 HYGIENE PRODUCTS TO BE THE LARGEST SEGMENT DURING THE FORECAST PERIOD

TABLE 23 HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 24 HEALTHCARE FABRIC MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 25 HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 26 HEALTHCARE FABRIC MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

9.2 HYGIENE PRODUCTS

9.2.1 DEMAND FROM DEVELOPING COUNTRIES TO DRIVE THE MARKET

FIGURE 38 EUROPE TO BE THE LARGEST MARKET FOR HEALTHCARE FABRICS IN HYGIENE PRODUCTS

TABLE 27 HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY REGION, 2020–2025 (USD MILLION)

TABLE 29 HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY REGION, 2016–2019 (KILOTON)

TABLE 30 HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY REGION, 2020–2025 (KILOTON)

TABLE 31 HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 32 HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 33 HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 34 HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

9.2.2 SANITARY NAPKIN

TABLE 35 HEALTHCARE FABRICS MARKET SIZE IN SANITARY NAPKIN, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 HEALTHCARE FABRIC MARKET SIZE IN SANITARY NAPKIN, BY REGION, 2020–2025 (USD MILLION)

TABLE 37 HEALTHCARE FABRICS MARKET SIZE IN SANITARY NAPKIN, BY REGION, 2016–2019 (KILOTON)

TABLE 38 HEALTHCARE FABRIC MARKET SIZE IN SANITARY NAPKIN, BY REGION, 2020–2025 (KILOTON)

9.2.3 BABY DIAPER

TABLE 39 HEALTHCARE FABRICS MARKET SIZE IN BABY DIAPER, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 HEALTHCARE FABRIC MARKET SIZE IN BABY DIAPER, BY REGION, 2020–2025 (USD MILLION)

TABLE 41 HEALTHCARE FABRICS MARKET SIZE IN BABY DIAPER, BY REGION, 2016–2019 (KILOTON)

TABLE 42 HEALTHCARE FABRIC MARKET SIZE IN BABY DIAPER, BY REGION, 2020–2025 (KILOTON)

9.2.4 ADULT DIAPER

TABLE 43 HEALTHCARE FABRICS MARKET SIZE IN ADULT DIAPER, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 HEALTHCARE FABRIC MARKET SIZE IN ADULT DIAPER, BY REGION, 2020–2025 (USD MILLION)

TABLE 45 HEALTHCARE FABRICS MARKET SIZE IN ADULT DIAPER, BY REGION, 2016–2019 (KILOTON)

TABLE 46 HEALTHCARE FABRIC MARKET SIZE IN ADULT DIAPER, BY REGION, 2020–2025 (KILOTON)

9.3 DRESSING PRODUCTS

9.3.1 INCREASING AWARENESS ABOUT WOUND CARE PRODUCTS DRIVING THE MARKET

FIGURE 39 APAC TO BE THE LARGEST MARKET IN DRESSING PRODUCTS SEGMENT DURING THE FORECAST PERIOD

TABLE 47 HEALTHCARE FABRICS MARKET SIZE IN DRESSING PRODUCTS, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 HEALTHCARE FABRIC MARKET SIZE IN DRESSING PRODUCTS, BY REGION, 2020–2025 (USD MILLION)

TABLE 49 HEALTHCARE FABRICS MARKET SIZE IN DRESSING PRODUCTS, BY REGION, 2016–2019 (KILOTON)

TABLE 50 HEALTHCARE FABRIC MARKET SIZE IN DRESSING PRODUCTS, BY REGION, 2020–2025 (KILOTON)

9.4 CLOTHING

9.4.1 GROWING DEMAND FOR DISPOSABLES DRIVING THE MARKET

FIGURE 40 NORTH AMERICA TO BE THE SECOND-LARGEST MARKET IN CLOTHING SEGMENT DURING THE FORECAST PERIOD

TABLE 51 HEALTHCARE FABRICS MARKET SIZE IN CLOTHING, BY REGION, 2016–2019 (USD MILLION)

TABLE 52 HEALTHCARE FABRIC MARKET SIZE IN CLOTHING, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 HEALTHCARE FABRICS MARKET SIZE IN CLOTHING, BY REGION, 2016–2019 (KILOTON)

TABLE 54 HEALTHCARE FABRIC MARKET SIZE IN CLOTHING, BY REGION, 2020–2025 (KILOTON)

9.5 BLANKET & BEDDING

9.5.1 DEMAND FOR ANTI-MICROBIAL FABRIC TO DRIVE THE MARKET

FIGURE 41 APAC TO BE THE LARGEST MARKET IN BLANKET & BEDDING SEGMENT DURING THE FORECAST PERIOD

TABLE 55 HEALTHCARE FABRICS MARKET SIZE IN BLANKET & BEDDING, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 HEALTHCARE FABRIC MARKET SIZE IN BLANKET & BEDDING, BY REGION, 2020–2025 (USD MILLION)

TABLE 57 HEALTHCARE FABRICS MARKET SIZE IN BLANKET & BEDDING, BY REGION, 2016–2019 (KILOTON)

TABLE 58 HEALTHCARE FABRIC MARKET SIZE IN BLANKET & BEDDING, BY REGION, 2020–2025 (KILOTON)

9.6 PRIVACY CURTAIN

9.6.1 MOST WIDELY USED MATERIAL IN PRODUCING PRIVACY CURTAINS FOR HOSPITALS

FIGURE 42 NORTH AMERICA TO BE THE THIRD-LARGEST MARKET IN PRIVACY CURTAINS SEGMENT DURING THE FORECAST PERIOD

TABLE 59 HEALTHCARE FABRICS MARKET SIZE IN PRIVACY CURTAIN, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 HEALTHCARE FABRIC MARKET SIZE IN PRIVACY CURTAIN, BY REGION, 2020–2025 (USD MILLION)

TABLE 61 HEALTHCARE FABRICS MARKET SIZE IN PRIVACY CURTAIN, BY REGION, 2016–2019 (KILOTON)

TABLE 62 HEALTHCARE FABRIC MARKET SIZE IN PRIVACY CURTAIN, BY REGION, 2020–2025 (KILOTON)

9.7 UPHOLSTERY

9.7.1 POLYESTER AND VINYL ARE WIDELY USED FIBERS IN THIS APPLICATION

FIGURE 43 APAC TO BE THE LARGEST MARKET IN UPHOLSTERY SEGMENT DURING THE FORECAST PERIOD

TABLE 63 HEALTHCARE FABRICS MARKET SIZE IN UPHOLSTERY, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 HEALTHCARE FABRIC MARKET SIZE IN UPHOLSTERY, BY REGION, 2020–2025 (USD MILLION)

TABLE 65 HEALTHCARE FABRICS MARKET SIZE IN UPHOLSTERY, BY REGION, 2016–2019 (KILOTON)

TABLE 66 HEALTHCARE FABRIC MARKET SIZE IN UPHOLSTERY, BY REGION, 2020–2025 (KILOTON)

9.8 OTHERS

FIGURE 44 EUROPE TO BE THE LARGEST MARKET IN OTHER APPLICATIONS DURING THE FORECAST PERIOD

TABLE 67 HEALTHCARE FABRICS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 68 HEALTHCARE FABRIC MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 69 HEALTHCARE FABRICS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 70 HEALTHCARE FABRIC MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2025 (KILOTON)

10 HEALTHCARE FABRICS MARKET, BY REGION (Page No. - 145)

10.1 INTRODUCTION

FIGURE 45 APAC TO BE THE FASTEST-GROWING HEALTHCARE FABRICS MARKET

TABLE 71 HEALTHCARE FABRICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 HEALTHCARE FABRIC MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 73 HEALTHCARE FABRICS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 74 HEALTHCARE FABRIC MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

10.2 APAC

10.2.1 IMPACT OF COVID-19 ON APAC HEALTHCARE FABRICS MARKET

FIGURE 46 APAC: HEALTHCARE FABRICS MARKET SNAPSHOT

TABLE 75 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 APAC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 77 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 78 APAC: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 79 APAC: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (USD MILLION)

TABLE 80 APAC: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (USD MILLION)

TABLE 81 APAC: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (KILOTON)

TABLE 82 APAC: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (KILOTON)

TABLE 83 APAC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 84 APAC: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 85 APAC: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 86 APAC: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 87 APAC: MARKET SIZE IN HYGIENE, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 APAC: MARKET SIZE IN HYGIENE, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 89 APAC: MARKET SIZE, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 90 APAC: HEALTHCARE FABRIC MARKET SIZE, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.2.2 CHINA

10.2.2.1 Economic growth supporting the healthcare fabrics market

TABLE 91 CHINA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 92 CHINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 93 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 94 CHINA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 95 CHINA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 CHINA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 97 CHINA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 98 CHINA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.2.3 JAPAN

10.2.3.1 Growing technical textile industry to drive the market

TABLE 99 JAPAN: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 101 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 102 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 103 JAPAN: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 JAPAN: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 105 JAPAN: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 106 JAPAN: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.2.4 INDIA

10.2.4.1 Rising industrialization to propel the market

TABLE 107 INDIA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 INDIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 109 INDIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 110 INDIA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 111 INDIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 112 INDIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 113 INDIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2025 (KILOTON)

TABLE 114 INDIA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.2.5 SOUTH KOREA

10.2.5.1 Growing textile production propelling the market

TABLE 115 SOUTH KOREA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 116 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 117 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 118 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 119 SOUTH KOREA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 SOUTH KOREA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 121 SOUTH KOREA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 122 SOUTH KOREA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.2.6 AUSTRALIA

10.2.6.1 Growing healthcare industry propelling the market

TABLE 123 AUSTRALIA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 124 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 125 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 126 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 127 AUSTRALIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 128 AUSTRALIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 129 AUSTRALIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 130 AUSTRALIA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.2.7 INDONESIA

10.2.7.1 Increasing purchasing power propelling the market

TABLE 131 INDONESIA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 132 INDONESIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 133 INDONESIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 134 INDONESIA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 135 INDONESIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 136 INDONESIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 137 INDONESIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 138 INDONESIA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.3 NORTH AMERICA

10.3.1 IMPACT OF COVID-19 ON NORTH AMERICAN HEALTHCARE FABRIC MARKET

FIGURE 47 NORTH AMERICA: HEALTHCARE FABRICS MARKET SNAPSHOT

TABLE 139 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 140 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 142 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 143 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (USD MILLION)

TABLE 144 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (USD MILLION)

TABLE 145 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (KILOTON)

TABLE 146 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (KILOTON)

TABLE 147 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 151 NORTH AMERICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 152 NORTH AMERICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 153 NORTH AMERICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 154 NORTH AMERICA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.3.2 US

10.3.2.1 Awareness about hygiene to fuel market growth

TABLE 155 US: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 156 US: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 157 US: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 158 US: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 159 US: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 160 US: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 161 US: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 162 US: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.3.3 CANADA

10.3.3.1 Increasing demand for high-quality fabrics to drive the market

TABLE 163 CANADA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 164 CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 165 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 166 CANADA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 167 CANADA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 168 CANADA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 169 CANADA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 170 CANADA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.3.4 MEXICO

10.3.4.1 Rising textile industry to propel the market

TABLE 171 MEXICO: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 172 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 173 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 174 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 175 MEXICO: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 176 MEXICO: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 177 MEXICO: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 178 MEXICO: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.4 EUROPE

10.4.1 IMPACT OF COVID-19 ON EUROPEAN HEALTHCARE FABRICS MARKET

FIGURE 48 EUROPE: HEALTHCARE FABRIC MARKET SNAPSHOT

TABLE 179 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 180 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 181 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 182 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 183 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (USD MILLION)

TABLE 184 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (USD MILLION)

TABLE 185 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (KILOTON)

TABLE 186 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (KILOTON)

TABLE 187 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 188 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 189 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 190 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 191 EUROPE: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 192 EUROPE: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 193 EUROPE: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 194 EUROPE: HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.4.2 GERMANY

10.4.2.1 Rising government expenditure on healthcare sector to be an opportunity for the market

TABLE 195 GERMANY: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 196 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 197 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 198 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 199 GERMANY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 200 GERMANY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 201 GERMANY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 202 GERMANY: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.4.3 UK

10.4.3.1 UK is the fourth-largest producer of technical textile

TABLE 203 UK: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 204 UK: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 205 UK: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 206 UK: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 207 UK: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 208 UK: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 209 UK: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 210 UK: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.4.4 FRANCE

10.4.4.1 Economic growth leading to high demand for healthcare fabrics

TABLE 211 FRANCE: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 212 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 213 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 214 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 215 FRANCE: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 216 FRANCE: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 217 FRANCE: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 218 FRANCE: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.4.5 ITALY

10.4.5.1 Italy is the third-largest economy in the Euro-zone

TABLE 219 ITALY: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 220 ITALY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 221 ITALY: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 222 ITALY: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 223 ITALY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 224 ITALY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 225 ITALY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 226 ITALY: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020-2025 (KILOTON)

10.4.6 RUSSIA

10.4.6.1 High purchasing power to boost market growth

TABLE 227 RUSSIA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 228 RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 229 RUSSIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 230 RUSSIA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 231 RUSSIA: MARKET SIZE IN HYGIENE, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 232 RUSSIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 233 RUSSIA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 234 RUSSIA: HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.4.7 TURKEY

10.4.7.1 Well-established textile industry to augment demand for healthcare fabrics

TABLE 235 TURKEY: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 236 TURKEY: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 237 TURKEY: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 238 TURKEY: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 239 TURKEY: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 240 TURKEY: MARKET SIZE IN HYGIENE, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 241 TURKEY: MARKET SIZE IN HYGIENE, BY SUB- APPLICATION, 2016–2019 (KILOTON)

TABLE 242 TURKEY: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.5 MIDDLE EAST & AFRICA

10.5.1 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICAN HEALTHCARE

FABRICS MARKET 214

TABLE 243 MIDDLE EAST & AFRICA: HEALTHCARE FABRICS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 244 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 245 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 246 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 247 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (USD MILLION)

TABLE 248 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (USD MILLION)

TABLE 249 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (KILOTON)

TABLE 250 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (KILOTON)

TABLE 251 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 252 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 253 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 254 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 255 MIDDLE EAST & AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 256 MIDDLE EAST & AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 257 MIDDLE EAST & AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 258 MIDDLE EAST: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.5.2 SAUDI ARABIA

10.5.2.1 Initiatives by the government to drive the market

TABLE 259 SAUDI ARABIA: HEALTHCARE FABRIC MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 260 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 261 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 262 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 263 SAUDI ARABIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 264 SAUDI ARABIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 265 SAUDI ARABIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2025 (KILOTON)

TABLE 266 SAUDI ARABIA: HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.5.3 IRAN

10.5.3.1 Growth in the economy to drive the country’s market

TABLE 267 IRAN: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 268 IRAN: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 269 IRAN: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 270 IRAN: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 271 IRAN: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 272 IRAN: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 273 IRAN: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 274 IRAN: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.5.4 EGYPT

10.5.4.1 Striving to attract new investments in the textile upstream segment to increase competitiveness

TABLE 275 EGYPT: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 276 EGYPT: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 277 EGYPT: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 278 EGYPT: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 279 EGYPT: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 280 EGYPT: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 281 EGYPT: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 282 EGYPT: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.5.5 SOUTH AFRICA

10.5.5.1 Growing textile industry to support the healthcare fabrics market

TABLE 283 SOUTH AFRICA: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 284 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 285 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 286 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 287 SOUTH AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 288 SOUTH AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 289 SOUTH AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 290 SOUTH AFRICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.6 SOUTH AMERICA

10.6.1 IMPACT OF COVID-19 ON SOUTH AMERICAN HEALTHCARE FABRIC MARKET

TABLE 291 SOUTH AMERICA: HEALTHCARE FABRICS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 292 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 293 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 294 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 295 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (USD MILLION)

TABLE 296 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (USD MILLION)

TABLE 297 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2016–2019 (KILOTON)

TABLE 298 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2020–2025 (KILOTON)

TABLE 299 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 300 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 301 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 302 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 303 SOUTH AMERICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 304 SOUTH AMERICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 305 SOUTH AMERICA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 306 SOUTH AMERICA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.6.2 BRAZIL

10.6.2.1 Largest healthcare fabrics market in South America

TABLE 307 BRAZIL: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 308 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 309 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 310 BRAZIL: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 311 BRAZIL: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 312 BRAZIL: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 313 BRAZIL: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 314 BRAZIL: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.6.3 ARGENTINA

10.6.3.1 Rising trade activity likely to drive the market

TABLE 315 ARGENTINE: HEALTHCARE FABRICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 316 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 317 ARGENTINA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 318 ARGENTINA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 319 ARGENTINA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 320 ARGENTINA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 321 ARGENTINA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 322 ARGENTINA: HEALTHCARE FABRIC MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

10.6.4 COLOMBIA

10.6.4.1 Huge female population to drive the market

TABLE 323 COLOMBIA: HEALTHCARE FABRIC MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 324 COLOMBIA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 325 COLOMBIA: MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 326 COLOMBIA: MARKET SIZE, BY APPLICATION, 2020–2025 (KILOTON)

TABLE 327 COLOMBIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (USD MILLION)

TABLE 328 COLOMBIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

TABLE 329 COLOMBIA: MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2016–2019 (KILOTON)

TABLE 330 COLOMBIA: HEALTHCARE FABRICS MARKET SIZE IN HYGIENE PRODUCTS, BY SUB-APPLICATION, 2020–2025 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 247)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 49 HEALTHCARE FABRICS: MARKET EVALUATION FRAMEWORK, 2016-2020

11.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 50 RANKING ANALYSIS OF TOP 5 PLAYERS IN THE HEALTHCARE FABRICS MARKET, 2019 248

11.4 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 51 HEALTHCARE FABRIC MARKET: REVENUE OF KEY PLAYERS, 2015-2019

11.5 MARKET SHARE ANALYSIS

FIGURE 52 HEALTHCARE FABRICS MARKET SHARE, BY COMPANY, 2019

11.6 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

FIGURE 53 HEALTHCARE FABRIC MARKET: COMPANY EVALUATION MATRIX, 2019

11.7 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 54 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN HEALTHCARE FABRICS MARKET

11.8 BUSINESS STRATEGY EXCELLENCE

FIGURE 55 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN HEALTHCARE FABRIC MARKET

11.9 STARTUP AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

FIGURE 56 HEALTHCARE FABRICS MARKET: STARTUP AND SMES MATRIX, 2019

11.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 57 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN HEALTHCARE FABRIC MARKET

11.11 BUSINESS STRATEGY EXCELLENCE

FIGURE 58 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN HEALTHCARE FABRICS MARKET

11.12 COMPETITIVE SCENARIOS

11.12.1 NEW PRODUCT LAUNCH

TABLE 331 NEW PRODUCT LAUNCH, 2016–2020

11.12.2 EXPANSION

TABLE 332 EXPANSION, 2016–2020

11.12.3 COLLABORATION

TABLE 333 COLLABORATION, 2016–2020

11.12.4 ACQUISITION

TABLE 334 ACQUISITION, 2016–2020

12 COMPANY PROFILES (Page No. - 258)

(Business Overview, Products Offered, Recent Developments, winning imperatives, current focus and strategies, Threat from Competition, Right to Win)*

12.1 BERRY GLOBAL GROUP INC.

FIGURE 59 BERRY GLOBAL GROUP INC. : COMPANY SNAPSHOT

TABLE 335 BERRY GLOBAL GROUP INC.: PRODUCTS & DESCRIPTION

FIGURE 60 BERRY GLOBAL GROUP INC.: WINNING IMPERATIVES

12.2 FREUDENBERG GROUP

FIGURE 61 FREUDENBERG GROUP: COMPANY SNAPSHOT

TABLE 336 FREUDENBERG GROUP: PRODUCTS & DESCRIPTION

FIGURE 62 FREUDENBERG GROUP: WINNING IMPERATIVES

12.3 AHLSTROM MUNKSJO OYJ

FIGURE 63 AHLSTROM MUNKSJO OYJ: COMPANY SNAPSHOT

TABLE 337 AHLSTROM MUNKSJO OYJ: PRODUCTS & DESCRIPTION

FIGURE 64 AHLSTROM MUNKSJO OYJ: WINNING IMPERATIVES

12.4 ASAHI KASEI CORPORATION

FIGURE 65 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

TABLE 338 ASAHI KASEI CORPORATION: PRODUCTS & DESCRIPTION

FIGURE 66 ASAHI KASEI CORPORATION: WINNING IMPERATIVES

12.5 KNOLL, INC.

FIGURE 67 KNOLL, INC.: COMPANY SNAPSHOT

TABLE 339 KNOLL, INC.: PRODUCTS & DESCRIPTION

FIGURE 68 KNOLL, INC.: WINNING IMPERATIVES

12.6 KIMBERLY-CLARK CORPORATION

FIGURE 69 KIMBERLY-CLARK CORPORATION: COMPANY SNAPSHOT

TABLE 340 KIMBERLY-CLARK CORPORATION: PRODUCTS & DESCRIPTION

FIGURE 70 KIMBERLY-CLARK CORPORATION: WINNING IMPERATIVES

12.7 EXIMIUS INCORPORATION

TABLE 341 EXIMIUS INCORPORATION: PRODUCTS & DESCRIPTION

12.8 PARAMOUNT TECH FAB INDUSTRIES

TABLE 342 PARAMOUNT TECH FAB INDUSTRIES: PRODUCTS & DESCRIPTION

12.9 CARNEGIE FABRICS, LLC

TABLE 343 CARNEGIE FABRICS LLC: PRODUCTS & DESCRIPTION

12.10 AVGOL INDUSTRIES 1953 LTD

FIGURE 71 AVGOL INDUSTRIES 1953 LTD.: COMPANY SNAPSHOT

TABLE 344 AVGOL INDUSTRIES 1953 LTD: PRODUCTS & DESCRIPTION

12.11 OTHER KEY MARKET PLAYERS

12.11.1 DESIGNTEX

12.11.2 BRENTANO FABRICS

12.11.3 MAHARAM FABRIC CORPORATION

12.11.4 ARCHITEX INTERNATIONAL

12.11.5 SAAF ADVANCED FABRICS

12.11.6 SIDWIN FABRICS PVT LTD

12.11.7 WELSPUN INDIA LTD

12.11.8 GLOBAL NONWOVENS LIMITED

12.11.9 FABTEX

12.11.10 AGUA FABRICS

12.11.11 JADEN FABRICS, INC.

12.11.12 THE MITCHELL GROUP

12.11.13 BALTEX FABRICS

12.11.14 EASTEX PRODUCTS, INC.

12.11.15 FITESA

*Details on Business Overview, Products Offered, Recent Developments, winning imperatives, current focus and strategies, Threat from Competition, Right to Win might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 281)

13.1 INTRODUCTION

13.2 LIMITATION

13.3 NON-WOVEN FABRICS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 NON-WOVEN FABRICS MARKET, BY REGION

TABLE 345 NONWOVEN FABRICS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 346 NON-WOVEN FABRICS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

13.4.1 APAC

13.4.1.1 By Country

TABLE 347 APAC: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 348 APAC: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

13.4.1.2 By Application

TABLE 349 APAC: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 350 APAC: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

13.4.2 EUROPE

13.4.2.1 By Country

TABLE 351 EUROPE: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 352 EUROPE: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

13.4.2.2 By Application

TABLE 353 EUROPE: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 354 EUROPE: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

13.4.3 NORTH AMERICA

13.4.3.1 By Country

TABLE 355 NORTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 356 NORTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

13.4.3.2 By Application

TABLE 357 NORTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 358 NORTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

13.4.4 MIDDLE EAST & AFRICA

13.4.4.1 By Country

TABLE 359 MIDDLE EAST & AFRICA: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 360 MIDDLE EAST & AFRICA: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

13.4.4.2 By Application

TABLE 361 MIDDLE EAST & AFRICA: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 362 MIDDLE EAST & AFRICA: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

13.4.5 SOUTH AMERICA

13.4.5.1 By Country

TABLE 363 SOUTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 364 SOUTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

13.4.5.2 By Application

TABLE 365 SOUTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 366 SOUTH AMERICA: NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

14 APPENDIX (Page No. - 292)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the market size for the healthcare fabrics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

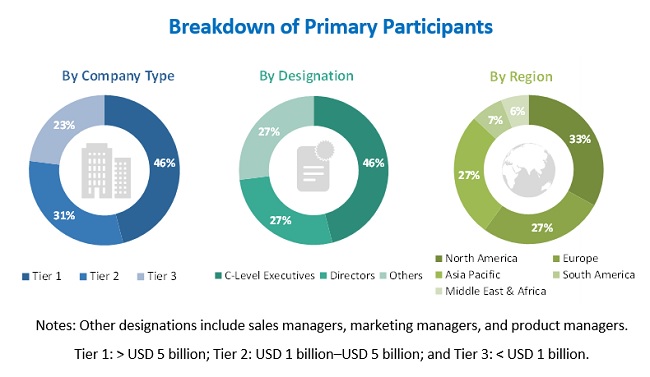

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The healthcare fabrics market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the hygiene & healthcare industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare fabrics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the healthcare industry.

Report Objectives

- To analyze and forecast the size of the healthcare fabrics market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the healthcare fabrics market based on rae material, fabric type, and application

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional raw material/application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Fabrics Market