Bacteriological Testing Market Size, Growth, Analysis

Bacteriological Testing Market by Bacterium (Coliform, Salmonella, Campylobacter, Listeria, Legionella, Other Bacteria), End-Use Industry (Food & Beverage, Water, Pharmaceutical, Cosmetics & Personal Care, Other End-Use Industries), Technology (Traditional, Rapid), Component (Instruments, Test Kits, Reagents & Consumables), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The bacteriological testing market is estimated to be valued at USD 25.83 billion in 2025. It is projected to reach USD 37.26 billion by 2030 at a CAGR of 7.6%. The bacteriological testing equipment market is estimated to be valued at USD 15.95 billion in 2025. It is projected to reach USD 22.48 billion by 2030, growing at a CAGR of 7.1% during the forecast period. The bacteriological testing market is being driven by a combination of public health concerns, regulatory pressures, and technological advancements. Rising incidence of foodborne illnesses, water contamination, and hospital-acquired infections has heightened the need for reliable and routine bacteriological testing across industries, such as food & beverage, water, pharmaceutical, healthcare, personal care & cosmetics. Stringent safety regulations in regions like Europe and North America mandate frequent microbiological testing to ensure compliance and protect consumers, further boosting demand.

KEY TAKEAWAYS

- Europe is expected to account for a 34.9% share of the bacteriological testing market in 2025, while North America is projected to register the highest CAGR of 8.9% during the forecast period.

- By bacterium, the coliform segment is expected to register the highest CAGR of 9.6% in the bacteriological testing market.

- By technology, the rapid technology segment is projected to grow at the fastest rate from 2025 to 2030.

- By component, the reagents & consumables segment is expected to dominate the bacteriological testing market.

- By end-use industry, the pharmaceuticals segment will grow at the fastest rate in the bacteriological testing market during the forecast period.

- By mode of use, the laboratory-based systems segment is expected to dominate the bacteriological testing market from 2025 to 2030.

- Key players in the bacteriological testing market include Eurofins Scientific, SGS Société Générale de Surveillance SA, ALS, Intertek Group plc, and TÜV SÜD due to their specialization in advanced microbiological testing, food safety analysis, pathogen detection, and quality assurance.

- Key startups in the bacteriological testing market include FoodChain ID, AGQ Labs, Tentamus, and Vimta Labs due to their expertise in rapid microbiological testing, pathogen detection, and high-precision analytical services.

The competitive landscape of the bacteriological testing market is driven by innovation across bacteria types, technologies, industries, components, and modes of use. Companies focus on expanding pathogen coverage, developing multi-pathogen detection kits, and enhancing sensitivity and specificity to meet stringent food, water, and pharmaceutical safety regulations. In technology, players are rapidly shifting from traditional culture methods to advanced rapid diagnostics such as PCR, ELISA, and convenience-based kits, with strategies emphasizing automation, AI integration, and user-friendly platforms. End-use industry targeting is another core approach, with tailored solutions for high-risk categories like meat, dairy, and drinking water, supported by compliance with global certifications. On the equipment side, firms adopt bundled offerings that combine instruments, test kits, and consumables to ensure recurring revenue, often through subscription models. Finally, in terms of mode of use, companies balance innovations in portable, field-ready devices with the scaling of high-throughput laboratory systems, focusing on miniaturization, affordability for developing markets, and acquisitions to broaden product portfolios.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The bacteriological testing market is undergoing rapid change, shaped by both evolving trends and disruptive forces. Key trends include the industry-wide shift from traditional culture methods to rapid diagnostics such as PCR, ELISA, and multiplex kits, along with growing adoption of automation, AI, and cloud integration to deliver faster, more accurate results. Portable and point-of-care devices are gaining traction for on-site food, water, and environmental testing, while customization of solutions for specific industries such as meat, dairy, and beverages is becoming standard to meet stricter regulatory demands. Sustainability is also emerging, with greener reagents and reduced consumables. Disruption comes from next-gen technologies like whole genome sequencing and metagenomics, which enable strain-level detection and advanced outbreak tracing, as well as AI-driven predictive microbiology that can anticipate risks before contamination occurs. Decentralization of testing, driven by the need for rapid decisions in supply chains and developing markets, further challenges the dominance of centralized labs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of foodborne and waterborne illnesses

-

Expansion of pharmaceutical & cosmetics industries

Level

-

•High cost of advanced rapid testing

-

•Lack of skilled personnel in developing regions

Level

-

•Advancements in rapid, portable, and automated testing solutions

-

•AI & predictive microbiology integration

Level

-

•Lack of harmonized global regulations

-

•Supply chain issues for reagents & consumables

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of foodborne and waterborne illnesses

The growing incidence of foodborne and waterborne illnesses is pivotal in driving the expansion of the global bacteriological testing market. Across the world, there is a notable rise in outbreaks caused by harmful pathogens, such as Salmonella, E. coli, Listeria, and Campylobacter. These outbreaks pose severe threats to public health and result in significant economic losses for businesses and governments alike. In response to this trend, governments and regulatory bodies are implementing more stringent microbiological testing requirements to protect consumers from potential health hazards. Food and beverage manufacturers, in particular, face increasing pressure to adopt comprehensive bacteriological testing practices throughout the entire production process. From testing raw materials to monitoring finished products, companies are expected to maintain high levels of safety and quality. This is especially critical for compliance with established safety frameworks, such as the Hazard Analysis and Critical Control Point (HACCP) standards, which are designed to prevent contamination and ensure consumer safety. Failure to adhere to such standards can result in costly product recalls, legal repercussions, and damaged brand reputation. Other end-use industries, such as water utilities and healthcare, also heighten their reliance on bacteriological testing solutions. Water utilities must conduct routine tests to ensure drinking water remains safe and free from microbial contamination, safeguarding public health. Meanwhile, the healthcare industry depends on these tests to prevent hospital-acquired infections and maintain sterile environments.

Restraint: High cost of advanced rapid testing

One of the key factors limiting the expansion of the market is the high cost associated with advanced rapid testing technologies. Cutting-edge techniques such as polymerase chain reaction (PCR), immunoassays, and next-generation sequencing (NGS) provide significant advantages over traditional culture-based methods. These technologies deliver faster results, greater sensitivity, and more accurate detection of pathogens, which are critical in preventing outbreaks and ensuring safety in food, water, and healthcare applications. However, the implementation of these advanced systems comes with considerable financial challenges. The high initial capital investment needed to purchase specialized equipment, coupled with ongoing costs for maintenance, calibration, and the procurement of expensive consumables, poses a significant burden for many laboratories. These technologies also demand highly skilled personnel to effectively operate and interpret the results, increasing operational expenses. This cost barrier makes it difficult for small and medium-sized laboratories to adopt rapid testing methods, especially in developing and cost-sensitive regions. As a result, many businesses and testing facilities in such regions continue to rely heavily on traditional culture-based techniques. Although slower and sometimes less sensitive, these methods remain more affordable, easier to implement, and widely recognized by regulatory agencies. The high cost and complexity of advanced rapid testing technologies slow their adoption rate, creating a technological divide between developed and developing regions. This divide ultimately restrains the overall growth potential of the global bacteriological testing market, particularly where the need for efficient pathogen detection is rising the fastest.

Opportunity: Advancements in rapid, portable, and automated testing solutions

Despite the challenges related to high costs and infrastructure needs, the bacteriological testing market is well-positioned for robust growth, fueled by ongoing technological advancements in rapid, portable, and automated testing solutions. Innovations such as handheld diagnostic devices, lab-on-a-chip platforms, and AI-integrated systems are revolutionizing how pathogens are detected, enabling faster, point-of-care testing outside traditional laboratory environments. These developments are particularly impactful across multiple industries, including food, water, pharmaceuticals, cosmetics, and personal care, where the need for rapid and accurate microbial detection is critical to ensuring product safety, regulatory compliance, and consumer protection. In the food industry, quick detection of pathogens helps prevent contamination and large-scale recalls, ensuring food safety from raw materials to finished goods. Water utilities benefit from on-site testing devices that provide immediate results, safeguard drinking water, and minimize public health risks. In the pharmaceutical sector, accurate and timely bacteriological testing is essential for preventing contamination during drug development and manufacturing processes. Similarly, rapidly detecting microbial contamination in the cosmetics & personal care industry is crucial to maintaining product integrity and consumer trust. Automation and digitalization further enhance the market by reducing human error, improving result accuracy, and increasing sample throughput, making testing processes more efficient and scalable. For emerging markets, portable and affordable devices help bridge infrastructure gaps, enabling broader access to bacteriological testing where laboratory facilities are scarce. Collectively, these innovations are expanding the market’s reach and driving its long-term growth across diverse industries worldwide.

Challenge: Lack of harmonized global regulations

A significant and persistent challenge facing the bacteriological testing market is the absence of harmonized global regulations. In regions such as Europe and North America, regulatory authorities have established stringent microbiological quality and safety standards that must be met by industries, ensuring high levels of consumer protection. However, in many developing regions, regulatory frameworks tend to be less strict, fragmented, or inconsistent, with each country imposing unique requirements. This wide variation in regulatory standards creates significant compliance challenges, particularly for multinational companies that operate in multiple regions and markets. These companies are often required to perform different types of bacteriological tests, follow different protocols, and meet varying limits depending on the local regulations of each country. The situation is further complicated by frequent revisions and updates to regulatory guidelines, which force businesses to continuously adjust their testing methods, invest in new technologies, and retrain personnel to stay compliant. Such constant changes lead to increased operational complexity and higher costs, particularly in terms of equipment investments, training, and validation processes. Moreover, the lack of standardization in global regulations generates significant uncertainty in international trade. Products that successfully pass microbiological testing and receive clearance in one country may face unexpected barriers or rejections in another due to differing testing requirements or accepted methods. This situation not only slows down the time-to-market process but can also impact the profitability and competitiveness of businesses in the bacteriological testing space. Until a more harmonized regulatory framework is established globally, these challenges will likely continue restraining market growth and operational efficiency.

bacteriological testing market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Automated bacteriological analyzers and PCR-based systems for food, pharma, and clinical labs | High throughput, accurate detection; supports regulatory compliance across multiple industries |

|

Rapid microbiology test kits and petrifilm plates for food safety testing | Easy-to-use, cost-effective; enables faster quality checks for manufacturers |

|

Reagents, consumables, and filtration systems for water and pharmaceutical bacteriological testing | Strong reliability; ensures sterility in pharma; trusted partner for water utilities |

|

Molecular bacteriological testing platforms (qPCR, sequencing tools) | High precision; supports advanced R&D and clinical diagnostics |

|

Chromatography and molecular testing solutions for bacteriological applications | Broad application range; innovation-driven testing; supports pharma and biotech labs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The bacteriological testing market ecosystem includes key juice testing companies, key food & beverage manufacturers, regulatory bodies & associations, and research & academic institutions. Some prominent companies in this market have been operational for over a decade and have diversified portfolios, latest technologies, and excellent global sales and marketing networks. These include Eurofins Scientific (Luxembourg), SGS Société Générale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), and Mérieux NutriSciences Corporation (France).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Bacteriological testing market, by end-use industry

By end-use industry, the pharmaceutical segment is projected to experience the highest growth rate throughout the forecast period. This strong momentum is primarily driven by the rapid expansion of biologics, vaccines, and sterile injectable products, all of which require exceptionally stringent microbial safety standards. As the pharmaceutical industry evolves, developing complex drugs and advanced therapies increasingly relies on robust bacteriological testing to ensure product safety and efficacy. The growing global concern over antimicrobial resistance significantly contributes to this trend. This has underscored the critical need for thorough microbial monitoring during pharmaceutical research and development and throughout production processes. Regulatory bodies such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have tightened sterility assurance, endotoxin testing, and overall microbial contamination control requirements. These intensified regulations are compelling pharmaceutical manufacturers to adopt more advanced and precise bacteriological testing methods to comply with regulatory standards and avoid costly compliance failures. In addition, the post-pandemic surge in vaccine development and the increasing focus on personalized medicine have amplified the demand for highly reliable, rapid, and automated testing solutions that can support complex workflows while ensuring uncompromised quality. Regulatory pressures, technological advancements, and industry trends are positioning the pharmaceutical sector as the most dynamic and fastest-growing contributor to the overall expansion of the bacteriological testing market. As the industry continues to innovate and expand, the need for advanced bacteriological testing solutions will only intensify, driving long-term growth in this segment.

Bacteriological testing market, by technology

By technology, the market for rapid testing technologies is witnessing significant growth in adoption and is projected to lead the bacteriological testing market throughout the forecast period. This shift is driving a fundamental transformation in industry practices, moving away from conventional culture-based methods that typically require several days to produce results. In contrast, advanced rapid testing solutions—such as polymerase chain reaction (PCR), immunoassays, biosensors, and next-generation sequencing technologies—can deliver highly accurate results within a few hours. The ability to obtain fast and reliable outcomes is especially crucial in industries like food & beverages, pharmaceuticals, water treatment, and cosmetics & personal care, where even minor delays in detecting microbial contamination can result in serious safety hazards, regulatory non-compliance, or costly product recalls. Moreover, ongoing technological advancements are accelerating the adoption of rapid testing solutions. Innovations in automation and miniaturization, coupled with the integration of AI-driven analytics, are making these rapid methods faster, more scalable, and highly precise. These improvements are helping reduce manual errors and optimize workflows, thereby increasing overall operational efficiency. Over time, the cost-efficiency of these solutions is improving as economies of scale are realized, making them more accessible even to mid-sized laboratories and emerging market players. As industries increasingly prioritize real-time monitoring, regulatory compliance, and operational efficiency, rapid testing technologies are expected to remain at the forefront of the bacteriological testing market’s technological growth, redefining how microbial safety is managed across various sectors.

Bacteriological testing equipment market, by component

By component, the test kits segment is projected to experience the highest growth rate during the forecast period. This strong growth is primarily driven by the inherent versatility and ease of use of test kits, especially compared to larger, more complex analytical instruments. Unlike bulky laboratory equipment that typically requires a centralized lab setup and highly trained personnel, test kits allow for rapid, on-the-spot detection of pathogens, enabling industries to take immediate preventive or corrective actions. Their portability and affordability make them an ideal solution for small and medium-scale operations, particularly in food processing, water treatment, pharmaceuticals, cosmetics, personal care, etc. Test kits are increasingly adopted in environments where field-level usability is critical, allowing for fast and efficient microbial testing without the need for extensive infrastructure. This advantage is significant for decentralized testing applications, such as point-of-care diagnostics in clinical settings and environmental monitoring in food and water safety programs. The rising focus on real-time monitoring and rapid decision-making has driven the demand for convenient, easy-to-use testing solutions that do not compromise accuracy or reliability. Furthermore, regulatory trends favoring more frequent testing and stricter microbial safety standards encourage businesses to implement simple, cost-effective testing strategies. As industries continue emphasizing efficiency, flexibility, and faster turnaround times, test kits are poised to gain significant traction and emerge as a key driver of market growth in the bacteriological testing sector.

REGION

Europe is estimated to be the largest market during the forecast period.

Europe holds the largest share of the bacteriological testing market, driven by stringent food and water safety regulations, well-established healthcare infrastructure, and a strong emphasis on quality control across industries. The European Food Safety Authority (EFSA) and strict EU directives mandate rigorous testing standards, encouraging wide adoption of advanced bacteriological testing equipment in food, beverages, pharmaceuticals, and environmental monitoring. Additionally, the region’s growing focus on preventive healthcare, rising cases of foodborne illness, and investments in rapid and automated testing technologies further support market expansion. With continuous innovation and high compliance requirements, Europe is expected to remain the leading region in this market.

bacteriological testing market: COMPANY EVALUATION MATRIX

Eurofins Scientific leads with a strong market share and an extensive testing portfolio, driven by its advanced laboratory network, broad range of food, water, pharmaceutical, and environmental testing services, and strong regulatory expertise across global markets. SGS (Emerging Leader) is gaining visibility with its expanding service capabilities, robust compliance-focused offerings, and strategic partnerships with food and beverage manufacturers, strengthening its position through quality assurance and regional expansion. While Eurofins dominates through scale, global presence, and diversified services, both SGS and other emerging service providers show significant potential to move toward the leaders’ quadrant as demand for rapid, reliable, and accredited bacteriological testing continues to grow across industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Eurofins Scientific (Luxembourg)

- SGS Société Générale de Surveillance SA (Switzerland)

- ALS (Australia)

- Intertek Group plc (UK)

- Mérieux NutriSciences Corporation (France)

- Certified Group (US)

- TÜV SÜD (Germany)

- Symbio Labs (Australia)

- Alfa Chemistry (US)

- FoodChain ID (US)

- AGQ Labs (Spain)

- Tentamus (Germany)

- LAUDA DR. R. WOBSER GMBH & CO. KG (Germany)

- Centre Testing International (China)

- Vimta Labs (India)

- Company Name - Bacteriological Testing Equipment Market

- Thermo Fisher Scientific (US)

- BioMérieux (France)

- Merck KGaA (Germany)

- 3M Food Safety (US)

- BD – Becton, Dickinson and Company (US)

- Neogen Corporation (US)

- HiMedia Laboratories (India)

- Hardy Diagnostics (US)

- Bio-Rad Laboratories (US)

- Agilent Technologies, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 25.83 Billion |

| Market Forecast in 2030 | USD 37.26 Billion |

| Growth Rate | CAGR of 7.6% during 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (No. of Tests), Volume (Tons), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

WHAT IS IN IT FOR YOU: bacteriological testing market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food & Beverage Manufacturer |

|

|

| Water Utility / Environmental Agency |

|

|

| Pharmaceutical & Cosmetics Company |

|

|

| Testing Equipment Manufacturer |

|

|

RECENT DEVELOPMENTS

- February 2025 : Intertek launched its regional headquarters in Riyadh, further localizing ATIC services for beverage manufacturers and driving Saudi Arabia’s diversified industrial expansion with quicker compliance and testing solutions.

- February 2025 : Mérieux NutriSciences purchased Bureau Veritas’ food testing activities in several regions, expanding the global network of laboratories and reinforcing bacteriological testing with increased infrastructure and regulatory compliance services.

- October 2024 : SGS inaugurated a new food and nutraceutical testing laboratory in Fairfield, New Jersey, upgrading its North American bacteriological testing capability and compliance assistance for FSMA regulations.

- August 2024 : ALS launched InviRapid Lateral Flow Test Strips for quick on-site detection of allergens, complementing HACCP programs and increasing allergen safety in juice and beverage processing facilities.

- June 2024 : Eurofins introduced a quick acetic acid bacteria count test in Milwaukee to enhance juice spoilage detection according to European Brewers’ Association standards for improved shelf-life guarantee.

Table of Contents

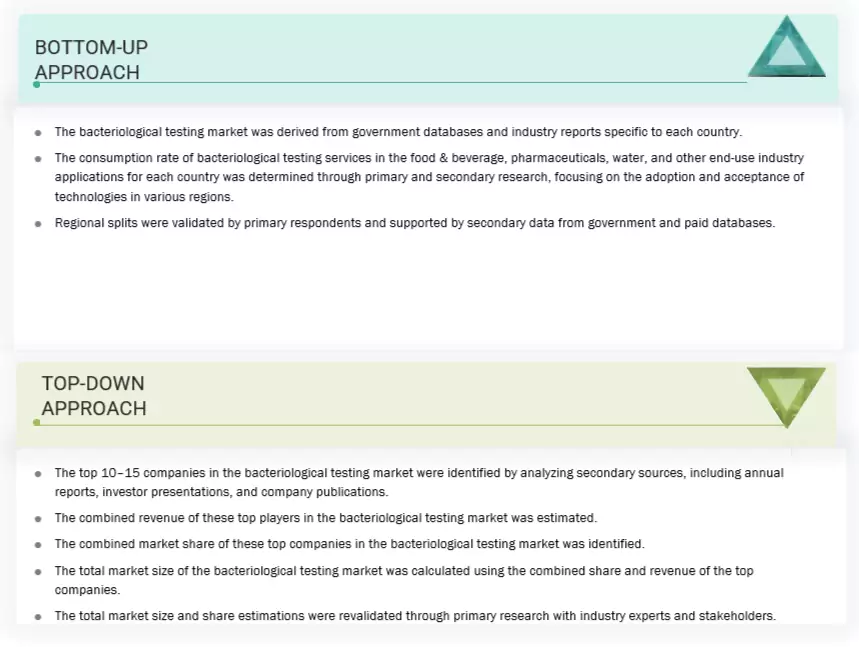

Methodology

The study involved two major approaches in estimating the current size of the bacteriological food safety testing market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved extensive secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial market study. In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information. Additionally, secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation per the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the bacteriological food safety testing market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephone interviews. Additionally, primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary sources from the supply side included Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, research, and development teams; and key opinion leaders.

Primary research helped understand the various trends related to bacteriological food safety testing market segments by bacterium, end-use industry, technology, component, and region. Demand-side stakeholders, such as research institutions, universities, and third-party vendors, were interviewed to understand the buyer’s perspective on the service, their current usage of bacteriological testing services, and their business outlook, which will affect the overall market.

Notes: Others include Executives and Associates.

The three tiers of companies are defined based on their total revenue in 2023 or 2024, as per the availability of financial data. Here’s the bifurcation of tiers:

Tier 1: Revenue > USD 1 billion; tier 2: USD 100 million = Revenue = USD 1 billion; tier 3: Revenue < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the bacteriological testing market. These approaches were used extensively to determine the size of various subsegments in the market.

The research methodology used to estimate the market size included the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Bacteriological Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall bacteriological testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

The bacteriological testing market is focused on detecting, identifying, and quantifying harmful and indicator bacteria across the food & beverage, water, pharmaceutical, cosmetics & personal care industries. It encompasses a range of technologies—including traditional culture-based methods and rapid techniques like PCR, immunoassays, and next-generation sequencing—along with associated consumables, instruments, and test kits. The market is driven by the need to ensure safety, quality, and regulatory compliance in products and processes, while minimizing risks associated with bacterial contamination and outbreaks.

Stakeholders

- Manufacturers of food products and beverages

- Importers and exporters of food & beverages, pharmaceuticals, and cosmetics & personal care products

- Testing laboratories

- Government and research organizations

- Associations and industrial bodies

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies

-

Regulatory bodies:

- US Food and Drug Administration (FDA)

- Health Canada/Canadian Food Inspection Agency (CFIA)

- United States Department of Agriculture (USDA)

- Food Safety and Standards Authority of India (FSSAI)

- European Food Safety Authority (EFSA)

- Food and Agriculture Organization (FAO)

- Food Standards Australia New Zealand (FSANZ)

- World Health Organization (WHO)

Report Objectives

- To determine and project the size of the bacteriological testing market by bacterium (Coliform, Salmonella, Campylobacter, Listeria, Legionella, Other bacteria), end-use industry (Food & Beverage, Water, Pharmaceutical, Cosmetics & Personal Care, Other End-Use Industries), technology (Traditional, Rapid), component (Instruments, Test Kits, Consumables & Reagents), and Region

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the bacteriological testing market

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakdown of the Rest of European bacteriological testing market into key countries

- Further breakdown of the Rest of Asia Pacific bacteriological testing market into key countries

- Further breakdown of the Rest of South American bacteriological testing market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the bacteriological testing market?

The bacteriological testing market is estimated to be valued at USD 25.83 billion in 2025. It is projected to reach USD 37.26 billion by 2030, growing at a CAGR of 7.6% during the forecast period. Rising food safety concerns, stricter regulatory standards, and increasing demand from the pharmaceutical and water testing industries fuel the market’s growth.

Who are the key players in the bacteriological testing equipment market, and how competitive is the landscape?

The key players in the bacteriological testing equipment market are bioMérieux (France), Thermo Fisher Scientific (US), Merck KGaA (Germany), 3M (US), Neogen Corporation (US), and Agilent Technologies (US). The market is highly competitive, driven by technological innovation, frequent product launches, and mergers & acquisitions aimed at expanding global reach and testing capabilities.

Which region is projected to account for the largest share of the bacteriological testing market during the forecast period?

Europe is projected to account for the largest market share during the forecast period. Robust food safety regulations, advanced healthcare infrastructure, and the presence of key market players support the position of Europe. North America follows closely, while Asia Pacific is projected to witness the highest growth due to rapid industrialization, stricter regulatory reforms, and rising awareness about foodborne and waterborne diseases.

What type of information is provided in the company profiles section of the report?

The section covers business overview, product portfolios, key technologies, financial performance, geographic presence, strategic developments, and revenue breakdown by segment. It highlights recent innovations, partnerships, and expert insights that help stakeholders evaluate market positioning and growth opportunities.

What are the major factors driving the bacteriological testing market?

Key factors driving growth are as follows:

- Increasing incidence of foodborne and waterborne illnesses

- Stringent regulatory standards for food, pharma, and water quality testing

- Expansion of pharmaceutical and biotechnology sectors

- Rising adoption of rapid, portable, and automated testing technologies

- Growing demand for point-of-care and on-site testing solutions

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Bacteriological Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Bacteriological Testing Market